TIDMDEVO

RNS Number : 7203V

Devolver Digital, Inc.

11 April 2023

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with

the Company's obligations under Article 17 of MAR

11 April 2023

Devolver Digital, Inc.

("Devolver Digital", "Devolver" or the "Company", and the

Company together with all of its subsidiary undertakings "the

Devolver Group", or "Group")

Unaudited preliminary results for the year ended 31 December

2022

Resolution of operational issues; strong second half

recovery

Devolver Digital, an award-winning digital publisher and

developer of independent ("indie") video games, announces its

preliminary unaudited results for the financial year ended 31

December 2022 ("FY2022") (1) . All figures relate to this period

unless otherwise stated.

Strategic highlights

o Identified and fixed operational issues which impacted first

half performance and resulted in impairments of cancelled games,

principally at subsidiary Good Shepherd.

o Strong recovery in the second half driven by the success of

Cult of the Lamb and Return to Monkey Island, boosted by the return

to face-to-face interaction.

o Drive to improve quality, sales and customer reach to sustain

long-term growth - supported by resumption of game-play testing,

studio visits, game conferences and investment in talent.

o Co-founder Graeme Struthers appointed as Group COO to oversee

operational improvements.

o 12 new titles released in 2022 (2021: 9) re-establishing our

track record for quality.

o 5 new titles with 80+ Metacritic scores (2021: 5), record high

2022 average score of 78 (2021: 77).

o Back catalogue of 109 titles supports reliance of model in

current consumer environment.

o Back catalogue sales rose 15% versus 2021 (excluding Fall

Guys), comprising 45% of total sales (2021: 64%, excluding Fall

Guys).

o Weaker performance of 1H 2022 games expected to reduce

back-catalogue momentum in 2023.

Financial highlights

o Revenues rose 37.1% year-on-year to US$134.6 million (2021:

US$98.2 million).

o Normalised Gross Profit (2) increased 18.1% to US$46.3 million

(2021: US$39.2 million).

o N ormalised Adjusted EBITDA (3) in 2022, including US$9.3

million of one-time, non-cash impairments for under-performing

games, was US$13.9m (2021: US$25.7 million), reflecting

underperformance of 1H released games relative to their cost, and

increased administrative and headcount expenses.

o Excluding the above one-off impairment , Normalised Adjusted

EBITDA was US$23.2 million, down 9.7% from 2021's US$25.7

million.

o In total, US$92.8 million of non-recurring, non-cash

impairments were taken in 2022, relating to the under-performance

of publishing subsidiary Good Shepherd, under-performing released

titles, cancelled unreleased games, and a write-down of acquired IP

and goodwill from acquisitions.

o Statutory net loss for 2022 was US$91.5 million (2021: US$30.6

million profit), mainly driven by the non-cash impairments and

US$19.6 million of non-cash share-based payments.

o Cash of US$79.5 million supports investment in organic growth,

and strategic acquisitions.

o The Company intends to utilise up to US$10.0 million of

Company capital to purchase Devolver shares in 2023 through the EBT

or by direct purchase subject to relevant shareholder

approvals.

Current trading and outlook

o On-track to release 10-12 new games in 2023 across the Group,

weighted to 2H 2023.

o Recent release Terra Nil will be followed by Wizard with a

Gun, The Plucky Squire and other major titles.

o Solid growth in Normalised Adjusted EBITDA expected in 2023

over 2022's Normalised Adjusted EBITDA result of US$13.9 million,

followed by a steady step-up in earnings expected in 2024 and 2025

.

o Addition of Oregon-based Doinksoft team and IP takes Devolver

first-party IP to 11 titles.

o 2024 - 2026 titles: There are currently over 30 titles in the

Group pipeline up to 2026 with several exciting new titles to be

announced during 2023.

Harry Miller, Executive Chairman of Devolver, said:

"Devolver's revenues grew by 37% year-over-year, despite a

challenging first half, underlining the resilience of our proven

model. From the game release perspective, we saw a stronger second

half with the stand-out success of Cult of the Lamb and Return to

Monkey Island. Our 2H 2022 EBITDA, pre impairments, was the highest

ever six-month performance for Devolver, excluding 2020's Fall

Guys. At the same time, we underwent a group-wide, title-by-title

assessment of commercial viability, carrying value and future

prospects. We cancelled some titles, restructured Good Shepherd,

and made impairments to IP and Goodwill, reflecting the current

lower sector valuations compared to the highs of 2021. With this

reset completed we look forward to building for growth in 2024 and

2025."

Douglas Morin, Chief Executive Officer of Devolver, said:

"The return of face-to-face interaction and gaming conferences

is helping to unleash the full potential of Devolver's unique

culture and experienced team of talented people. We saw this with

the success of Cult of The Lamb, which beat all Devolver records

for first day and first week unit sales on all platforms, excluding

2020's Fall Guys. Return to Monkey Island has also generated great

excitement since release in September 2022. Together they

contributed to a record average 78 Metacritic score for released

games in 2022 . We have absorbed valuable lessons during the last

year and are eager to move forward from this challenging period. We

have tightened management oversight across the Group and welcome

Devolver co-founder Graeme Struthers taking the role as Group Chief

Operating Officer to drive this process. We have a clear strategy

and a strong pipeline for the next three years that will continue

to diversify and grow our revenues across titles, developers,

platforms and geography."

Enquiries :

Devolver Digital, Inc. ir@devolverdigital.com

Harry Miller, Executive Chairman

Douglas Morin, Chief Executive Officer

Daniel Widdicombe, Chief Financial Officer

Zeus (Nominated Adviser and Sole Broker) +44 (0)20 3829 5000

Nick Cowles, Jamie Peel, Matt Hogg (Investment Banking)

Ben Robertson (Equity Capital Markets)

FTI Consulting devolver@fticonsulting.com

Jamie Ricketts / Dwight Burden / Valerija Cymbal / Usama Ali +44 (0)20 3727 1000

Devolver Digital overview

Devolver Digital is an award-winning video games publisher in

the indie games space with a balanced portfolio of third-party and

own-IP. The Company has an emphasis on premium games and has a back

catalogue of over 100 titles, with more than 30 new titles in the

pipeline. Through acquisitions, Devolver now has its own-IP

franchises, in-house studios developing first-party IP and two

publishing brands. The Company is registered in Wilmington,

Delaware, USA.

OPERATING REVIEW

Second half performance stronger after a challenging first

half

Devolver released 12 new titles in 2022, including Shadow

Warrior 3, Weird West, Tentacular and Trek to Yomi in the first

half, and Cult of the Lamb, Return to Monkey Island and Reigns:

Three Kingdoms in the second half. Year-on-year revenue growth

accelerated into the second half, due to the stand-out success of

Cult of the Lamb, reaching 37.1% for the full year versus 2021.

This was offset by a substantial step-up in amortisation costs

expensed upon release of new games, largely related to three of the

more heavily invested titles from 1H 2022, as well as increases in

general operating expenses due to inflation, headcount increases

and greater marketing expenditure.

The second quarter of 2022 saw the relaxation of Covid

restrictions and a normalisation in travel, allowing face-to-face

communication with our colleagues, partners and game-developers,

gamers, influencers, and everyone involved in the complex

game-production ecosystem. This has contributed enormously in terms

of ensuring the quality and the positioning of our games, as

evidenced by a record high Metacritic average score of 78 for the

whole year, and an 80 average for the second half of the year.

This resumption of normal activities released great pent-up

enthusiasm for Devolver's games, as demonstrated in 2H sales.

During the Steam Next Fest week in June, Cult of the Lamb was the

number 1 wish-listed game of all demos featured, while future

release Anger Foot and recently released Terra Nil were also

featured in the Top 10 most wish-listed games. Overall, 2H

Normalised Adjusted EBITDA, adding back non-recurring non-cash

impairments for released games, was higher than any six-month

period in Devolver Group's history.

2021 hit releases supported back catalogue, but year-end sales

were below our expectations

Devolver's back catalogue includes all titles released in or

prior to the last financial year. As of 31 December 2022, the back

catalogue consists of 109 titles, including numerous indie cult

classics, supporting diversified revenues and reducing reliance on

any one new title release. Back catalogue revenue accounted for 45%

in 2022, lower than the 64% of 2021 (excluding Fall Guys revenues),

primarily due to the outperformance of smash hit Cult of the Lamb,

which increased new-release revenues.

An encouraging trend through the first half of 2022 was the

strong performance of titles launched in 2021 that, categorised as

back catalogue in 2022, continue to deliver sales like

newly-released titles in 2022, including Inscryption, Loop Hero and

Death's Door. However, whilst these titles continued to deliver

through the end of 2022, broad sales of other back catalogue titles

were flat in the last few months of the year, below original

expectations of annual growth in Q4 2022, a trend that was

noticeable across the sector.

Investing for long-term growth

At IPO, Devolver outlined its strategic plan to broaden and

deepen its in-house capabilities by adding talent across the group

in several essential areas, from production, quality assurance,

marketing, finance, legal to business development. We have nearly

completed the planned team expansion which will drive our future

performance.

New releases are increasingly complex, often involving same

day-date releases across multiple platforms. This allows Devolver

to capitalise on the synergies generated through a single launch

campaign across multiple platforms, demographics and territories.

Additional talent enables us to raise the level of 'polish' we

provide to the new titles we release and drive unit sales across

multiple platforms and geographies.

Strengthening our bench of talent has a knock-on positive effect

on medium term cost control, as we are able to bring key expertise

in-house, generating cost savings, delivering better products and

reducing third-party payments such as professional fees. As part of

this, we continue to build a management oversight team for quality

assurance testing, while also strengthening our in-house finance

and legal capabilities.

The Group currently has operating subsidiaries in the United

Kingdom, the Netherlands, Croatia, Poland and the United States.

Total Group headcount at year-end 2022 was 235 (2021: 210).

FINANCIAL REVIEW

Unaudited preliminary full year 2022 results

The unaudited financial results included in this announcement

cover the Group's combined activities for the full year ended

31(st) December 2022 (prepared in accordance with applicable

International Financial Reporting Standards, "IFRS").

Normalised Adjusted results

The following refers to Normalised Adjusted results, as

presented in the financial statements contained within this

release. Normalised Adjusted results exclude any one-time

exceptional items during the respective periods.

Sustained revenue momentum

Devolver's 2022 revenue performance was in line with updated

expectations set in the trading update dated January 9, 2023 (4)

rising 37.1% year-on-year to US$134.6 million. Revenue growth was

driven by 12 new title releases in 2022, including Shadow Warrior

3, Weird West, Tentacular and Trek to Yomi, supported by steady

back catalogue sales including with sales from bundled special

deals, and then accelerated by the outperformance of Cult of the

Lamb in 2H 2022.

Normalised Gross Profit increased 18.1% to US$46.3 million

year-on-year. However, normalised gross margins contracted to

34.4%, down from 40.0% in 2021, primarily due to: a) the

significant step-up of amortisation expense from new releases in 1H

2022 that were not offset by commensurate revenue increases, and;

b) increased marketing costs following the release of three more

heavily-invested titles.

Adjusted EBITDA and Normalised Adjusted EBITDA

Adjusted EBITDA and Normalised Adjusted EBITDA results are

non-IFRS measures that are not intended to replace statutory

results and are prepared to provide a more comparable indication of

the Group's core business performance by removing the impact of

certain items including exceptional items (material and

non-recurring), and other, non-trading, items that are reported

separately. These results have been presented to provide users with

additional information and analysis of the Group's performance,

consistent with how the Directors monitor results.

The statutory results for the prior year 2021 include the gain

from the sale of publishing rights to the Fall Guys game; a gain

which is excluded from normalised comparative numbers. Further

details of adjustments are given in Notes 3 and 4 to the condensed

financial statements contained within this annual results

release.

EBITDA margins

Normalised Adjusted EBITDA margins, pre impairments, were 17.2%

for full year 2022, compared to 26.2% the previous year. However,

2H 2022 Normalised Adjusted EBITDA margin, pre impairments, reached

20.1% versus a trough of 12.9% in 1H 2022. Overall, the growth in

revenues was insufficient to offset the significant step-up in

amortisation expense recorded in cost of sales. In addition,

operating expenses increased due to: 1) higher payroll costs

(excluding 1H 2021 Fall Guys-related bonus), reflecting the 12%

increase in headcount versus 2021; 2) increases in professional

fees for various work streams including audit, accounting, tax and

legal fees, and; 3) listed company-related costs (Directors' fees,

NOMAD fees and D&O insurance, among others).

Impairments of capitalised development costs, IP and

Goodwill

At the end of 2022 the Group made a number of impairments, as

summarised in the table below, and described separately in the

following paragraphs:

Non-cash, non-recurring impairments

(5)

Impairments of under-performing, US$9. 3 million

released games

Impairments of cancelled, unreleased US$13.5 million

games

Impairment of acquired IP US$22.3 million

Impairments of goodwill from acquisitions US$47.7 million

Impairments to carrying value of already-released games (5)

At year-end 2022 the Group assessed the balance sheet carrying

value of capitalised development costs of five titles published in

2022, three of which were released in the first half of the year.

It was determined that there was a need to impair their carrying

value based on continued low unit sales through to year end 2022

and reduced future projections. The total non-cash charge of US$

9.3 million as a write-down for impairment in their carrying value

will reduce 2022 Normalised Adjusted EBITDA to US$13.9 million.

Impairments for cancelled, unreleased games (5)

In 1H 2022 Devolver wrote-down the entire investment into a

discontinued game at a cost of US$0.7 million, reflected in

additional amortisation expense in cost of sales. This expense was

adjusted out to derive Normalised Gross profit. Similarly, at 2022

year-end the Group has cancelled a further four unreleased titles,

and two prototypes in early development, and will write-down

existing capitalised development amounts for those titles. In

total, a US$ 13.5 million non-cash write-down has been recorded,

for impairment in the carrying value of cancelled titles that are

no longer considered commercially viable.

These cancellations occurred for several reasons. A title in

development was cancelled because the external studio was no longer

able to complete its work on personal grounds. The remaining three

titles and two prototypes had been scheduled for publication by

Good Shepherd Entertainment ("Good Shepherd", or "GSE"), our

publishing subsidiary. However, these titles were cancelled due to

certain issues identified at GSE, which has subsequently undergone

a major restructuring (discussed in further detail below). The

one-time nature of these cancellations results in these impairments

being reflected below t he Normalised Adjusted EBITDA line.

The estimated US$ 15 million in future spending earmarked for

the cancelled titles will be redirected to investment into games

which Devolver considers have stronger potential.

Impairments to carrying values of IP and Goodwill (5)

The challenging global macro conditions and substantial

reduction in technology company valuations throughout the course of

2022 resulted in the need to reassess the Group's carrying value on

the balance sheet of acquired IP and goodwill for the subsidiaries

in the Group acquired over the last two years. This assessment

concluded that in many cases the 2022 performance and current

outlook for the subsidiaries' games were not considered sufficient

to support the carrying values held on the Group balance sheet.

As a result, US$22.3 million in non-cash impairments, with no

impact on year-end 2022 cash balances, have been made to the

carrying value of IP below t he Normalised Adjusted EBITDA line. As

part of the same group-wide review, US$ 47.7 million of non-cash

impairments were made to the carrying value on the balance sheet of

goodwill recorded upon acquisition of subsidiaries, again reflected

below the Normalised Adjusted EBITDA line.

Restructuring of Good Shepherd - Now completed

Following identification of development risks at GSE, the Group

undertook a full review of GSE's pipeline titles and determined

that three titles would not meet the varied challenging technical

requirements required for release, and two prototypes did not have

adequate potential, leading to their cancellation. The Group has

subsequently undertaken a restructuring of GSE, with the

appointment of a new General Manager, a significant reduction in

overall team size, and a re-focusing of its business direction

towards publishing licensed IP.

Employee Benefit Trust (EBT)

Devolver established an Employee Benefit Trust (EBT) in May 2022

to facilitate off-market and on-market stock option exercise by

employees and contractors who were awarded 2017 Stock Option plan

stock options and certain of the 2022 LTIP grants. The EBT is an

independent Jersey-incorporated Trust enabling option exercise and

share settlement off-market without impacting market liquidity.

Share purchases by the EBT are funded by way of a loan from

Devolver. The Company can request settlement of the loan at any

time in future. The shares held by the EBT are disclosed as

Treasury Shares within the Group's Capital Redemption Reserve.

During 2022 there were 1,789,811 options exercised and shares

granted for a net paid consideration by Devolver of US$1.7 million.

At the end of 2022 there were 37,028,480 options still outstanding

with a weighted average exercise price of US$0.42 per option.

Long Term Incentive Plan (LTIP)

In December 2022 Devolver published the details of a long-term

incentive plan for its senior leadership and Group employees

charged with delivering the Group's strategic objectives for the

period 1 January 2022 to 31 December 2024 (the "2022 LTIP"). This

follows the outcome of a Special Meeting held on December 12, 2022

where shareholders voted in favour of the two resolutions within

the Shareholder Circular, which was distributed to all shareholders

of record. The resolutions approved the adoption of the LTIP plan

and rules, as well as grants to be made in 2022 under the plan.

The 2022 LTIP was designed to reward employees at all levels of

the Company for performance that delivers value for shareholders,

through the award of long-term incentive shares ("LTIP Shares").

The Remuneration Committee, made up entirely of Independent

Non-Executive Directors, worked with independent consultants

Alvarez and Marsal throughout the development of the LTIP.

All LTIP Shares awarded to management are subject to a

three-year cliff vesting period from the date of award, with a

two-year cliff vesting period for all other employees. The LTIP

Shares are made up of Performance Stock Units ("PSUs"), award of

which are, amongst other things, subject to achieving ambitious

financial targets, and Restricted Stock Units ("RSUs"), award of

which are, amongst other things, subject to certain performance

criteria for management and senior employees.

The Remuneration Committee recommended 2022 awards granted under

the 2022 LTIP plan that amounted to 7,913,563 shares in aggregate

(on the assumption that all vest), representing 1.8% of the issued

and outstanding share capital. Total dilution from the outstanding

options (i.e. excluding options previously exercised within the

EBT) and these initial grants would therefore amount to 10.1% of

the issued and outstanding share capital.

It should be noted that the co-founders of Devolver who are

fully employed at the Company, including Executive Chairman Harry

Miller, without exception, declined to receive any share awards

under the 2022 LTIP. Further information regarding the LTIP Shares

and the Group's remuneration framework will be set out in the

Group's annual report for the year ended 31 December 2022.

Cash Balances

Cash holdings at end December 2022 were US$ 79.5 million, a

reduction of US$6.7 million compared to year end 2021's level of

US$86.2 million, but US$5.3 million higher compared to period end

June 2022, as a result of the stronger 2H result. The reduction in

cash balances during the period was primarily due to: 1) EBITDA

generation during the year being lower than the US$32.6 million

investment in game development during the period; 2) US$2.5 million

spent on settlement of exercised options and net-cash settled share

grants through the EBT, and; 3) Taxes paid.

POST BALANCE SHEET EVENTS

Acquisition of Doinksoft

In January 2023 Devolver acquired the IP, assets and development

team of Doinksoft, a small development studio based in Oregon,

United States. Doinksoft created Gato Roboto, which was published

by Devolver in 2019. Devolver will also publish Doinksoft's new

title, Gunbrella later this year. The acquisition takes Devolver's

first-party IP count to 11 titles.

CURRENT TRADING AND OUTLOOK

Devolver Group continues to nurture a healthy and diverse

pipeline in terms of titles, developers, platforms and geography.

Our total pipeline for 2023 and beyond comprises an exciting

line-up of over 30 titles, with a balanced mix of third-party IP

and own-IP over a range of investment values.

The Board expects revenues and gross profit contribution to be

weighted towards 2H 2023, with only one major title release - Terra

Nil - in 1H 2023. Five more major titles are due for release in 2H

2023 and will participate in some or all of the 4Q sales season

from Halloween through to the New Year, which has historically been

the strongest quarter of the year.

Devolver Digital still enjoys a strong balance sheet with cash

holdings of nearly US$80 million. The Directors consider that the

shares offer significant value at current levels and have approved

the purchase of up to US$10.0 million in shares in 2023, at the

discretion of the Company. Share purchases may be made entirely by

the EBT, or by the Company directly (if suitable shareholder

resolutions are passed at the Company's AGM or a separate GM).

Our momentum, extensive pipeline and contribution from an

impressive back catalogue all support our confidence of further

progress in 2023 and in the future. We have a proven strategy that

has delivered success for the last 13 years. The Board believes

that we are well positioned for future success, and we look forward

to reporting on our progress in the year ahead.

"Second half EBITDA was significantly higher than the first

half, although the overall 2022 performance was constrained by

three underperforming titles and difficult market conditions in

November and December, as well as impairments and write-downs. The

second half featured the successes of Cult of the Lamb, Return to

Monkey Island and other titles, which have re-established our

record of releasing high quality and popular Indie games.

Metacritic scores rose to a historical high in 2022 on the back of

the strong slate of releases, which demonstrates that our core

model of publishing quality indie games remains robust.

While we have successfully grown revenues in 2022 by 37%, the

substantial changes in global valuations worldwide, and ongoing

recessionary and inflationary pressures have greatly altered the

current and near-term outlook. We expect the negative global

economic outlook and reduction in consumer spending to continue

into 2023, which may affect sales volumes. Market conditions will

likely remain difficult for our industry in 2023, and profitability

will again be heavily weighted towards the second half of the year,

reflecting the release schedule of new titles in 2023. We therefore

expect financial performance in 2023 to see steady growth on the

2022 Normalised Adjusted EBITDA level of US$13.3 million. We will

continue to build the pipeline for 2024 and 2025 with the

expectation of higher growth as the macro environment improves and

larger titles are released.

Despite this, we consider the year-end 2022 write-downs and

impairments in carrying values to be sensible and conservative.

With this reset of our balance sheet we can move forward with

confidence as we consolidate in the next few years on the greater

scale platform we have established."

Harry Miller

Chairman

11 April 2023

Notes

1. Financial numbers contained in this release are based on

preliminary unaudited 2022 results.

2. Normalised Gross Profit: adds back the impairment of

under-performing released games and cancelled unreleased games.

3. Normalised Adjusted EBITDA: EBITDA is normalised to exclude

the 2021 contribution from the Fall Guys title which was sold in

April 2021. The following adjustments are then applied: it excludes

1) stock compensation (share-based payment) expenses and

revaluation of contingent consideration; 2) one-time expenses and

other non-recurring items; 3) amortisation of IP (but does not

exclude amortisation of capitalised software development costs); 4)

The gain on the sale of Fall Guys publishing rights in 2021, and;

5) impairments of goodwill, acquired IP and cancelled, unreleased

games. Normalised Adjusted EBITDA does include impairments of

capitalised software development costs of underperforming released

games.

4. January 9, 2023 guidance was for US$130-140 million of

revenues and US$20-22 million of Normalised Adjusted EBITDA.

5. The above impairments are based on preliminary unaudited

results and could change based on the completion of the 2022 audit.

Devolver Digital will provide further details in its 2022 annual

report, which is expected to be released in early May 2023.

Consolidated Statement of Profit or Loss

Unaudited

Year ended Year ended

31-Dec-21 31-Dec-22

US$'000 US$'000

REVENUES

Revenues 98,152 134,565

-------------------- -----------

TOTAL REVENUES 98,152 134,565

COST OF SALES

Royalty expense (46,573) (61,448)

Development expense (4,384) (4,520)

Marketing (4,275) (9,148)

Amortisation of intangible

assets (3,688) (14,124)

Impairment of software

development costs - (22,822)

TOTAL COST OF SALES (58,920) (112,062)

GROSS PROFIT 39,232 22,503

-------------------- -----------

ADMINISTRATIVE EXPENSES

Payroll (14,468) (14,254)

Stock compensation expense (55,150) (19,621)

Professional fees (9,455) (6,257)

Travel and entertainment (271) (806)

Office (342) (875)

Insurance (202) (876)

Administration and other

costs (19,544) (2,291)

Foreign exchange movements (212) (673)

Amortisation of intellectual

property and depreciation

of PPE (5,651) (5,456)

Impairment of goodwill

and IP - (69,973)

TOTAL ADMINISTRATIVE

EXPENSES (105,295) (121,082)

Other income/(loss) 116,080 (549)

-----------

OPERATING PROFIT/(LOSS) 50,017 (99,128)

-------------------- -----------

Interest receivable

income 10 364

-------------------- -----------

PRE-TAX PROFIT/(LOSS) 50,027 (98,764)

Income tax expense (19,400) 7,265

-------------------- -----------

PROFIT/(LOSS) FOR THE

PERIOD 30,627 (91,499)

Equity holders of the

parent 30,550 (91,474)

Non-controlling interests 77 (25)

------- ---------

PROFIT/(LOSS) FOR THE

PERIOD 30,627 (91,499)

------- ---------

Basic earnings per share

($) 0.081 (0.206)

Diluted earnings per

share ($) 0.075 (0.206)

Year ended Year ended

31-Dec-21 31-Dec-22

US$'000 US$'000

Non-IFRS measures

Adjusted EBITDA 110,818 (73,378)

Normalised Adjusted

EBITDA 25,729 23,210

Normalised Adjusted

EBITDA after performance-related

impairments 25,729 13,914

Consolidated Statement of Comprehensive Income

Unaudited

Year ended Year ended

31-Dec-21 31-Dec-22

US$'000 US$'000

Profit/(Loss) for the

period 30,627 (91,499)

Other comprehensive

income: Items that may

be reclassified

subsequently to profit

or loss

Exchange differences

on translation of foreign

operations (986) (477)

Total comprehensive

income for the period 29,641 (91,976)

Total comprehensive

income is attributable

to:

Equity holders of the

parent 29,564 (91,951)

Non-controlling interests 77 (25)

----------- -----------

29,641 (91,976)

Consolidated Statement of Financial Position

Unaudited

As of As of

31-Dec-21 31-Dec-22

US$'000 US$'000

NON-CURRENT ASSETS

Goodwill 66,820 19,153

Intellectual property 53,381 25,783

Capitalised development

costs 44,441 40,136

---------- ----------

Total intangibles 164,642 85,072

Tangible assets 226 174

Deferred tax assets 2,413 10,088

---------- ----------

TOTAL NON-CURRENT ASSETS 167,281 95,334

---------- ----------

CURRENT ASSETS

Accounts receivable 17,811 15,402

Prepaid and other current

assets 1,544 2,406

Cash at bank and in hand 86,239 79,493

Prepaid income tax 8,512 2,186

---------- ----------

TOTAL CURRENT ASSETS 114,106 99,487

---------- ----------

TOTAL ASSETS 281,387 194,821

---------- ----------

CURRENT LIABILITIES

Trade, other payables &

accrued expenses 17,835 16,917

Deferred revenue 4,482 2,091

Current tax payable 1,434 692

Contingent consideration - 1,802

Total trade and other

payables 23,751 21,502

TOTAL CURRENT LIABILITIES 23,751 21,502

---------- ----------

NON-CURRENT LIABILITIES

Deferred tax liabilities 9,316 1,046

Contingent consideration 1,567 -

---------- ----------

TOTAL NON-CURRENT LIABILITIES 10,883 1,046

---------- ----------

TOTAL LIABILITIES 34,634 22,548

---------- ----------

CAPITAL AND RESERVES

Share capital 44 45

Share premium 121,588 147,674

Retained earnings 126,184 56,260

Foreign currency translation

reserve (986) (2,267)

Capital redemption reserve - (29,337)

---------- ----------

CAPITAL AND RESERVES TO

OWNERS 246,830 172,375

---------- ----------

Non-controlling interest (77) (102)

---------- ----------

TOTAL EQUITY 246,753 172,273

---------- ----------

TOTAL EQUITY AND LIABILITIES 281,387 194,821

---------- ----------

Consolidated Statement of Changes in Equity

Share Capital Share Translation Retained Subtotal Non-controlling Total

capital redemption premium reserve earnings equity interests equity

reserve

US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000

Balance at

31 December

2020 1 - - - 71,512 71,513 - 71,513

--------- ------------ --------- ------------ ---------- --------- ---------------- ---------

Profit for

the period 30,627 30,627 (77) 30,550

Currency

translation

differences (986) (986) (986)

Transactions

with owners

in their

capacity

as owners

Dividends (30,000) (30,000) (30,000)

Issue of shares 43 119,230 3 119,276 119,276

Exercise of

share options

Other 2,358 (1,108) 1,250 1,250

Share-based

payments 55,150 55,150 55,150

Total

transactions

with owners 43 - 121,588 - 24,045 145,676 - 145,676

--------- ------------ --------- ------------ ---------- --------- ---------------- ---------

Balance at

31 December

2021 44 - 121,588 (986) 126,184 246,830 (77) 246,753

--------- ------------ --------- ------------ ---------- --------- ---------------- ---------

Loss for the

period (91,474) (91,474) (25) (91,499)

Currency

translation

differences (1,281) (1,281) (1,281)

Business - -

combinations

with common

control

Transactions -

with owners

in their

capacity

as owners

Issue of shares 165 165 165

Exercise of

share options 1 630 631 631

Share-based

payments 19,621 19,621 19,622

Share buyback

transactions (29,337) 29,337 - -

Transfers (1,929) 1,929 - -

Other movements (2,117) (2,117) (2,117)

Total

transactions

with owners 1 (29,337) 26,086 - 21,551 18,301 - 18,301

--------- ------------ --------- ------------ ---------- --------- ---------------- ---------

Balance at

31 December

2022 45 (29,337) 147,674 (2,267) 56,260 172,375 (102) 172,273

--------- ------------ --------- ------------ ---------- --------- ---------------- ---------

Consolidated Condensed Statement of Cash Flows

Unaudited

Year ended Year ended

31-Dec-21 31-Dec-22

US$'000 US$'000

Operating activities

Profit/(loss) for the period 30,627 (91,499)

Amortisation, depreciation

& impairments 9,338 112,376

Gain on sale of publishing (115,576) -

rights & IP

Share based payments 55,150 19,621

Working capital movement 3,991 (10,209)

----------- -----------

Cashflow from operating activities (16,470) 30,289

Investing activities

Investment in software development

intangibles (31,734) (32,641)

Proceeds from the sale of 127,500 -

publishing rights & IP

Purchase of PPE (223) (66)

Acquisitions (net of cash (34,083) -

acquired)

----------- -----------

Cashflow from investing activities 61,460 (32,707)

Financing activities

Legal fees on share issue/IPO (68) -

Proceeds on issue of share

capital including option exercise 49,362 795

Share buyback transactions - (2,514)

Repayment of shareholder loan (20,837) -

Dividends paid (30,000) -

----------- -----------

Cashflow from financing activities (1,543) (1,719)

Cash and cash equivalents

Cashflow in the period 43,447 (4,137)

At 1 January 43,529 86,239

Foreign exchange movements (737) (2,609)

----------- -----------

At 31 December 86,239 79,493

Note 1: Basis of preparation and consolidation

These consolidated financial statements have been prepared in

accordance with the recognition and measurement requirements of

International Financial Reporting Standards ("IFRS"). In the

opinion of management, all adjustments considered necessary for

fair presentation have been included.

The Directors are confident that the Group will remain cash

positive and will have sufficient funds to continue to meet its

liabilities as they fall due for a period of at least 12 months

from the date of this full year 2022 announcement and have

therefore prepared this unaudited announcement on a going concern

basis.

The financial presentation in this release should be read in

conjunction with the notes to the consolidated financial statements

as at and for the full year ended 31 December 2022, as contained

within this release.

In May 2022 Devolver established an Employee Benefit Trust (EBT)

to facilitate settlement of employee stock options granted under

the 2017 Stock Option Plan. The EBT is a Jersey-based Trust and the

Trustees act to the benefit of the employees. The accounting

treatment determined that Devolver controls the EBT and must

consolidate the EBT in its consolidated financial statements. Most

transactions eliminate upon consolidation, with the exception of

the purchase by the EBT of Devolver shares from employees. These

are recognised at cost as Treasury Shares (Issued shares held

within the Group). These shares are a separate reserve within

equity but may be presented in aggregation with other reserves. The

Devolver shares held by the EBT are not revalued. When the EBT

sells the shares to a third party, any gains or losses are

recognised directly in equity.

These preliminary unaudited financial statements were approved

by the Board of Directors on April 9, 2023.

Note 2: Earnings Per Share

Year ended Year ended

31-Dec-21 31-Dec-22

US$'000 US$'000

Profit/(loss) attributable to

the owners of the company 30,550 (91,474)

Weighted average number of shares 376,034,064 443,090,183

Basic earnings per share ($) 0.081 (0.206)

Profit/(loss) attributable to

the owners of the company 30,550 (91,474)

Weighted average number of shares 376,034,064 443,090,183

Dilutive effect of share options 32,367,003 -

------------ ------------

Weighted average number of diluted

shares 408,401,067 443,090,183

Diluted earnings per share ($) 0.075 (0.206)

Note 3: Normalised Adjusted Results

Year ended Year ended

31-Dec-21 31-Dec-22

US$'000 US$'000

Revenue

Reported Revenue 98,152 134,565

Reported Revenue growth (53.9%) 37.1%

Normalised Revenue 98,152 134,565

Normalised Revenue growth 38.0% 37.1%

Gross Profit (5)

Reported Gross Profit 39,232 22,503

Reported Gross Profit margin 40.0% 16.7%

Normalised Gross Profit adjustment - 23,829

Normalised Gross Profit 39,232 46,332

Normalised Gross Profit margin 40.0% 34.4%

Adjusted EBITDA

Reported Adjusted EBITDA 110,818 (73,378)

Reported Adjusted EBITDA margin 112.9% (54.5%)

Normalised Adjusted EBITDA adjustment (85,089) 87,292

Normalised Adjusted EBITDA 25,729 13,914

Impairment of non-performing

games - 9,296

Normalised Adjusted EBITDA

pre-impairment 25,729 23,210

Normalised Adjusted EBITDA margin

pre-impairment 26.2% 17.2%

Note 4: Reconciliations to Adjusted EBITDA

Year ended Year ended

31-Dec-21 31-Dec-22

US$'000 US$'000

Operating profit/(loss) 50,017 (99,128)

Share-based payment expenses 55,150 19,621

Amortisation of purchased

intellectual property 5,504 5,292

Depreciation of property,

plant and equipment 147 164

Foreign exchange movements - 673

----------- -----------

Adjusted EBITDA 110,818 (73,378)

Year ended Year ended

31-Dec-21 31-Dec-22

US$'000 US$'000

Adjusted EBITDA 110,818 (73,378)

Net exceptional income from

IP disposal & sale of publishing

rights (113,166) (214)

Non-recurring, one-time expenses

related to IPO & others 7,857 1,616

Exceptional bonus payment 5,164 -

relating to sale of publishing

rights

Change in fair value of contingent

consideration 15,056 763

Impairment of IP and goodwill - 69,973

Impairment of capitalised

development cost - 22,822

Costs accrued for cancelled

titles - 1,007

IPO-related Employer Social

Security - 621

Normalised Adjusted EBITDA

pre-impairments 25,729 23,210

----------- -----------

Impairment of non-performing

games - (9,296)

----------- -----------

Normalised Adjusted EBITDA 25,729 13,914

----------- -----------

Note 5: Intangible Assets

Goodwill Intellectual Royalty Software Total

property rights development

costs

US$'000 US$'000 US$'000 US$'000 US$'000

Cost

As at 31 December

2020 159 24,184 2 44,064 68,409

--------- ------------- -------- ------------- ---------

Additions - business

combinations 66,661 35,633 - 102,294

Additions - - - 31,735 31,735

Disposals - - - (14,403) (14,403)

--------- ------------- -------- ------------- ---------

As at 31 December

2021 66,820 59,817 2 61,396 188,035

--------- ------------- -------- ------------- ---------

Additions - - - 32,641 32,641

As at 31 December

2022 66,820 59,817 2 94,037 220,676

--------- ------------- -------- ------------- ---------

Amortisation and impairment

As at 31 December

2020 - 931 - 15,746 16,677

Amortisation charge

for the period - 5,504 2 3,688 9,194

Disposal - - - (2,479) (2,479)

--------- ------------- -------- ------------- ---------

As at 31 December

2021 - 6,435 2 16,955 23,392

Amortisation charge

for the period - 5,292 - 14,124 19,416

Impairment 47,666 22,307 - 22,822 92,796

--------- ------------- -------- ------------- ---------

As at 31 December

2022 47,666 34,034 2 53,901 135,604

Carrying amount

As at 31 December 2020 159 23,253 2 28,318 51,732

As at 31 December 2021 66,820 53,382 0 44,441 164,643

As at 31 December 2022 19,154 25,782 0 40,136 85,072

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR BBLLFXZLZBBD

(END) Dow Jones Newswires

April 11, 2023 02:00 ET (06:00 GMT)

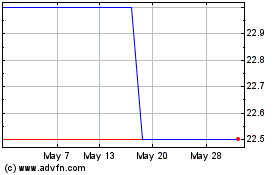

Devolver Digital (LSE:DEVO)

Historical Stock Chart

From Oct 2024 to Nov 2024

Devolver Digital (LSE:DEVO)

Historical Stock Chart

From Nov 2023 to Nov 2024