TIDMCRS

7 March 2019

Crystal Amber Fund Limited

Interim results for the period ended 31 December 2018

The Company announces its interim results for the six months ended 31 December

2018.

Highlights

* Net Asset Value ("NAV")(1) per share fell by 9.4% over the period or 7.4%

after adjusting for dividends paid.

* Over the 2018 calendar year, NAV per share grew by 18.8%, after adjusting

for the dividends paid. Over the same period, the Numis Small Cap Index

fell by 11.0%.

* NAV per share of 221.67 pence at 31 December 2018 (244.62 pence at 30 June

2018, 190.69 pence at 31 December 2017).

* In the first half of the year, the Fund realised gains in Hurricane Energy

plc, NCC Group plc, Boku Inc and Woodford Patient Capital Trust.

* Share price discount to NAV averaged 8.4 per cent throughout the period as

the Fund continued its buy-back programme.

Christopher Waldron, Chairman of the Fund, commented: "Despite difficult equity

markets, I am pleased to report a creditable performance over the six-month

period, and an excellent performance for 2018. We continue to engage with

management teams of our main holdings and remain confident of making additional

progress in 2019."

For further enquiries please contact:

Crystal Amber Fund Limited

Christopher Waldron (Chairman) Tel: 01481 742 742

Allenby Capital Limited - Nominated Adviser

David Worlidge/Liz Kirchner Tel: 020 3328 5656

Winterflood Investment Trusts - Broker

Joe Winkley/Neil Langford Tel: 020 3100 0160

Crystal Amber Advisers (UK) LLP - Investment Adviser

Richard Bernstein Tel: 020 7478 9080

(1) All capitalised terms are defined in the Glossary of Capitalised Defined

Terms unless separately defined.

Chairman's Statement

I am pleased to present the unaudited interim results of Crystal Amber Fund

Limited ("the Fund"), for the six-month period to 31 December 2018 ("the

period").

Against a background of generally weaker equity markets, Net Asset Value

("NAV") fell from GBP238.1 million (244.62 pence per share) at 30 June 2018 to an

unaudited NAV of GBP213.8 million (221.67 pence per share) at 31 December 2018.

After adjusting for dividends, the Fund's fall in NAV of 7.4% compares to an

11.1% fall by the Numis Small Cap Index. The Fund is making good activist

progress with several of its largest positions and this is discussed further in

the Investment Manager's Report.

The fourth quarter of 2018 saw significant falls in US equities, as the pace of

monetary tightening by the Federal Reserve prompted investors to rebalance

portfolios away from relatively expensive growth stocks. This weakness spread

quickly to all major markets, but UK investors also had to contend with the

tortuous Brexit process. At the time of writing, we are no closer to

understanding what Brexit will mean. All we currently have is a negotiated deal

that has so far failed to win parliamentary approval and while leaving the EU

with "no deal" seems an incredible prospect, it will happen on 29 March 2019

unless a new deal or a deferral of Brexit is agreed.

This uncertainty has eroded business confidence in the UK as investment

decisions are deferred. Forecasts of economic growth have been downgraded and

the Bank of England's first steps to increase interest rates have been placed

on hold. This is a matter of concern for investors as uncertainty over outcomes

deters investment and increases market volatility. The protracted nature of the

process is likely to damage future growth. Although domestic UK equities are by

many measures relatively cheap, a policy mistake could still result in a market

sell-off.

As markets weakened, the Fund continued its proactive and accretive discount

management policy of share buy-backs; during the period 995,000 shares were

acquired at an average price of 214.48 pence per share. The Fund's shares

traded at an average discount of 8.4% over the period.

During the period under review, the Fund issued and donated 125,000 ordinary

shares of GBP0.01 each ("Ordinary shares") to five different charities. Today,

the Board has resolved to issue 25,000 Ordinary shares each to the following

five charitable organisations: Royal Marsden Cancer Charity, Royal British

Legion, Royal Irish Academy of Music, Spread a Smile and Eleanor Foundation.

The par value of these 125,000 shares has been paid by Richard Bernstein.

Today's combined donation of over GBP250,000 in value of Ordinary shares brings

the total value of shares gifted since March 2018 to more than GBP750,000. The

Fund is delighted to support such worthy causes.

Overall, I am happy to report a solid performance of the Fund over a difficult

period and excellent returns for 2018. Whilst mindful of increased political

risks, we are confident that we will make further progress in 2019.

Christopher Waldron

Chairman

6 March 2019

Investment Manager's Report

Strategy and performance

During the period the Fund maintained close engagement with the management

teams of its major holdings, initiated new investments and took profits from

holdings as they reached the Fund's target price.

At 31 December 2018, equity investments in 18 companies represented 88.9% of

NAV. The Fund also held other investments in those companies, including

warrants, loan notes and convertible investments that accounted for 8.1% of the

NAV. The Fund's net cash and accruals position was GBP6.3 million, net of GBP2.4

million accrued for the 2.5 pence per share dividend paid in January 2019.

During the period, the Fund reduced its position in Hurricane by 22% as it sold

into market demand and booked a profit of GBP11.3 million. GBP5.8 million was

received from a capital redemption out of Leaf Clean Energy Company ("Leaf"),

as explained in the Fund's previous Annual Report. The positions in NCC Group

plc and Woodford Patient Capital Trust were sold outright, realising gains of GBP

2.5 million and GBP1.0 million respectively. Cash realised from those holdings

was used principally to increase the De la Rue holding by GBP11.5 million and add

to investments forming part of the Fund's top ten positions.

After adjusting for dividends paid, the Fund's fall in value of 7.4% compares

to an 11.1% fall by the Numis Small Cap index. Over the 2018 calendar year NAV

grew by 18.8%, after adjusting for the dividends paid. The Numis Small Cap

index fell by 11.0% over the same period.

The table below lists top holdings as at 31 December 2018, showing the

performance contribution of each company during the six-month period. In

addition to these, trading in FTSE100 put options contributed 0.2% to the NAV.

Portfolio

Top ten shareholdings Pence per Percentage of Total return Contribution

share investee over the to NAV

equity held period performance

(1)

Hurricane Energy plc 45.0 5.1% (7.0%) (0.3%)

Fair FX Group plc 38.7 20.2% 4.4% 0.8%

Northgate plc 32.7 6.4% (2.5%) (0.7%)

STV Group plc 27.7 19.7% (19.4%) (2.7%)

De La Rue plc 24.3 5.4% (20.0%) (2.3%)

Board Intelligence Ltd 4.8 * 25.4% 0.4%

GI Dynamics Inc. 4.6 48.4% (53.5%) (0.7%)

Sutton Harbour Holdings 3.1 10.0% (19.7%) (0.3%)

plc

Cenkos plc 2.8 6.9% (28.9%) (0.5%)

Leaf Clean Energy Co. 2.8 30.0% (3.0%) (0.1%)

Total of ten largest 186.5

shareholdings

Other investments 28.6

Cash and accruals 6.6

Total NAV 221.7

(1) Percentage contribution stated for equity holdings only.

*Board Intelligence Ltd is a private company and its shares are not listed on a

stock exchange. Therefore, the percentage held is not disclosed.

Investee companies

Our comments on a number of our principal investments are as follows:

Hurricane Energy plc ("Hurricane")

Over the period, Hurricane reported continued good progress with its Lancaster

Early Production System ("Lancaster EPS") and announced Spirit Energy's

("Spirit") farm-in to 50% of the Greater Warwick Area ("Warwick").

Hurricane's Lancaster EPS remains on time and on budget for first oil in the

first quarter of 2019. Well completion operations concluded in July, the

mooring system was installed in August and the subsea infrastructure was

completed in September. The infrastructure is now ready to connect with the

Aoka Mizu, the floating production storage and offloading vessel. The EPS's

Floating Production and Storage Vessel ("FPSO") Aoka Mizu sailed from Dubai in

October after completing a programme of repair, upgrade and life extension. The

FPSO is now at the port of Cromarty, near Inverness, awaiting a favourable

weather window to hook up with the buoy and initiate commissioning.

We believe that the deal with Spirit is transformational for Hurricane. As

Warwick had only been drilled once by Hurricane in 2016, it was behind

Lancaster in the appraisal and development process. Spirit's commitment of $387

million to a detailed three-year work programme aims to rectify this. It

targets an initial development of 500 million barrels of reserves. To achieve

this goal, rig contracts have been signed to drill three horizontal wells in

2019, fully funded by Spirit. Long lead items have been ordered so that in 2020

one of those wells will be tied back to the FPSO for production appraisal. As

with the Lancaster EPS, this step will enable collection of additional

reservoir data ahead of full field development. It is expected to leverage

Hurricane's Lancaster EPS infrastructure, and so generate incremental revenues

at little additional cost.

The Fund is pleased that Spirit's commitments validate Hurricane's belief that

Warwick is analogous to Lancaster, and also contains significant reserves of

oil. With this deal, the cash expected to be generated by the Lancaster EPS

will be available to further the appraisal of the Greater Lancaster Area, in

which Hurricane retains a 100% interest.

Over the period, the Fund reduced its holding in Hurricane by 22% and realised

GBP11.3 million. This reduction takes into account the subsequent reinvestment of

GBP3 million in the company at the end of the period, following share price

weakness.

In 2019, the Fund looks forward to the commissioning of the EPS in addition to

the three wells that will be drilled by Hurricane and Spirit.

FairFX Group plc ("FairFX")

In December, FairFX announced an agreement with Metropolitan Commercial Bank to

offer its services to the US market. The agreement is subject to additional due

diligence and will cover FairFX's corporate expense platform as well as its

international payments service. Both are expected to go live in the first half

of 2019.

The company has continued to rationalise its supply chain, extracting synergies

from its acquisitions of CardOne Banking in 2017 and City Forex in 2018.

Northgate plc ("Northgate")

At Northgate's annual general meeting on 18 September, shareholders rejected

the directors' remuneration report, with 58% of votes cast against. More than

10% of votes cast opposed the re-election of the chairman and three of

Northgate's other non-executive directors. The Fund voted against the

remuneration report and the re-election of the chairman and the senior

independent director.

We believe that the board should be held accountable for this heightened

shareholder discontent, and particularly the chairman Andrew Page for his lack

of strategic leadership and failure to take responsibility for the

underperformance of the company during his tenure, both operationally and for

shareholders. Despite enjoying the tailwind of a growth market, Northgate's

number of vehicles on hire in the UK and Ireland is lower in organic terms than

in autumn 2015, when Mr Page was appointed chairman. The company's total

shareholder return over this period has been -13%, whilst UK equities have

delivered over 25%.

With the announcement of Northgate's interim results on 4 December, the

company's prior overly-conservative guidance for UK and Ireland growth was

upgraded. However, this was accompanied by a downgrade to margin guidance. We

are increasingly concerned that Northgate is expanding its fleet with

insufficient regard to margins and return on capital.

The value of Northgate's substantial Spanish business remains unrecognised by

the UK equity market, despite repeated evidence of strong trading and financial

performance. The Fund continues to press Northgate's board to realise some of

this value at a time of high investor interest in Spanish businesses and

assets. During the period, a significant flexible rental competitor of

Northgate's completed a successful IPO on the Spanish market, at a material

premium to net asset value. If Northgate was to achieve a comparable rating for

its Spanish division, we believe its UK division would be implicitly valued at

just one third of book value. For more than a year, the Fund has repeatedly

requested that Northgate seriously assesses this path as a means of releasing

shareholder value.

During the period, Northgate reached out to Crystal Amber on several occasions.

Regrettably and tellingly, this engagement was limited to the company lobbying

for its remuneration report and following the shareholder vote against, how

best to resurrect it. It is evidential where the board's focus lies. The Fund

has been contacted by several institutional shareholders in Northgate who

independently share the Fund's concerns regarding lack of strategic leadership

and engagement, and the company's financial performance.

STV Group plc ("STV")

Over the period, STV completed the hiring for its new divisional structure and

announced deals with two retransmission partners, Virgin TV and Sky.

In July, STV announced Richard Williams as the managing director of its newly

formed digital division. Williams will focus on driving the growth of STV's

player by improving consumer experience and maximising the digital value of

STV's content. In September, STV announced David Mortimer as managing director

of STV Productions. Both divisions have since announced new partnerships in

support of STV's growth strategy.

In December, STV announced the launch of its player on the Virgin TV platform.

In January, STV announced that its player would become available on the Sky

platform in the second half of 2019. The increased availability of STV's own

player product on additional platforms will give the company more digital video

advertising inventory to sell. This inventory has achieved and sustained

premium rates relative to other digital channels.

Board Intelligence Ltd ("Board Intelligence")

Board Intelligence is a private British company with a mission to improve the

quality of board decision-making.

Based on their consulting experience to company boards, the Board Intelligence

founders launched a software tool in 2013. This encompasses workflow management

for drafting meeting packs and structured communication templates to improve

the effectiveness of meetings. The primary audience is boards of directors, but

the tool can also be used for other committees. The company fills a gap in an

attractive niche market.

Board Intelligence continued its record of strong revenue growth in 2018. The

business has an impressive client list and has received emphatic public

testimonials from leading large-cap companies.

The Fund invested in Board Intelligence in March 2018 and carried the

investment in this private company at cost. The holding was revalued at the end

of December resulting in an increase in its value as discussed in the Interim

Financial Statements. This reflects the growth acceleration seen in the

business. As activist investors, we are keen to support improvements in UK

corporate governance.

GI Dynamics Inc ("GI Dynamics")

Over the period, the company took its first steps to rebuild its strategy by

securing a US FDA pivotal trial, appointing a new CE Mark notified body and

reaching an agreement with Apollo Sugar for a trial in India.

In August, the US FDA approved a pivotal trial for the EndoBarrier, GI

Dynamics's medical device for the treatment of type 2 diabetes and obesity. The

company expects to complete the first phase enrolment during the first half of

2019, with a primary endpoint of reduced blood sugar levels one-year

post-implant. The Fund participated in a preliminary $5 million capital raising

and the company expects to raise funding for the remainder of the trial costs

over the coming months.

In October, GI Dynamics appointed Intertek as its European notified body and

expects to achieve a CE Mark for the EndoBarrier in H2 2019.

In November, the company announced its agreement with Apollo Sugar, a joint

venture between India's largest hospital system Apollo and Sanofi. The

agreement covers a clinical trial that would enable commercialisation of the

EndoBarrier in India.

Sutton Harbour Holdings plc ("Sutton")

In November, Sutton Harbour received planning approval for its Sugar Quay

project. Interim results reported 37.4 pence NAV per share versus a then share

price of 28.5 pence. The company launched a GBP3 million open offer to fund post

planning pre-construction phase project costs, capital maintenance project

costs and to provide cash headroom. The Fund took its full entitlement and has

continued to grow this position.

Further comments on the operations of investments previously disclosed can be

found in the Fund's 2018 Annual Report (available at www.crystalamber.com).

Hedging activity

During the period, the Fund purchased put options on the FTSE100 index as

insurance against a significant market sell-off and to protect unrealised gains

in the portfolio. As the market sold off, puts were sold, and profits were

realised. Due to the increased market volatility and costs of the puts, the

Fund closed the period unhedged. FTSE100 puts contributed 0.2% to NAV growth.

Activist investment process

The Fund originates ideas mainly from its screening processes and its network

of contacts, including its institutional shareholders. Companies are valued

with focus on their replacement value, cash generation ability and balance

sheet strength. In the process, the Fund's goal is to examine the company both

'as it is' and also under the lens of 'as it could be' to maximise shareholder

value.

Investments are typically made after an initial engagement, which in some cases

may have been preceded by the purchase of a modest position in the company.

This position allows us to meet the company as a shareholder. Engagement

includes dialogue with the company chairman and management, and normally also

several non-executive directors, as we build a network of knowledge around our

holdings. Site visits are undertaken to deepen our research and where

appropriate, independent research is commissioned. We attend investee company

annual general meetings to maintain close contact with the board and other

stakeholders.

For all companies in the portfolio, the Fund strives to develop an activist

angle and aims to contribute to each company's strategy with the goal of

maximising shareholder value. Where value is hidden or trapped, the Fund looks

for ways to realise it. Throughout the period, most of the Fund's activism has

taken place in private, but the Fund remains willing to make its concerns

public when appropriate. The responses of management and boards to our

suggestions have generally been encouraging. We remain determined to ensure

that our investments deliver their full potential for all shareholders, and are

committed to engage to the degree required to achieve this.

Realisations

Over the period, the Fund realised profits of GBP11.2 million from Hurricane, GBP

2.5 million from NCC Group Plc, GBP2.3 million from Boku Inc, GBP1.9 million from

FairFX and GBP1.0 million from Woodford Patient Capital Trust. A loss of GBP0.8

million was incurred as part of the capital redemption of Leaf. The Fund

remains confident on the outlook for additional profitable returns from Leaf,

as discussed in our 2018 Annual Report.

Outlook

Whilst at the period end, equity markets were in 'risk off' mode, in recent

weeks, the cocktail of the volte-face from the US Federal Reserve and its new

found patience regarding the pace of interest rate rises and normalisation of

its balance sheet, hopes of a trade deal between the US and China and increased

share buybacks has seen US equity markets rally sharply. The Dow Jones

Industrial Average has risen by 20% since Christmas. Whilst the broader S&P 500

Index currently trades above its June 2017 levels, UK equity indices remain

well below levels at that time, as Brexit uncertainties have prevailed. UK

equity markets would also be susceptible to downside risk from a resumption of

global macro-economic or political concerns.

UK political uncertainty has depressed the willingness of companies to invest.

Whilst the trading performances of several of the Fund's holdings are

inevitably affected by this lack of clarity, we believe that the Fund is both

defensively and securely positioned, with its focus on special situation and

strategic holdings, which are ultimately less dependent upon macroeconomic

developments and more upon a combination of self-help and active engagement.

Crystal Amber Asset Management (Guernsey) Limited

6 March 2019

Condensed Statement of Profit or Loss and Other Comprehensive Income

(Unaudited)

For the six months ended 31 December 2018

Six months ended 31 December Six months ended 31 December

2018 2017

(Unaudited) (Unaudited)

Revenue Capital Total Revenue Capital Total

Notes GBP GBP GBP GBP GBP GBP

Income

Dividend income from 3,048,961 - 3,048,961 1,980,590 - 1,980,590

listed equity

investments

Interest income from - - - 99,072 - 99,072

listed debt

instruments

Arrangement fee - - - 46,531 - 46,531

received from debt

instruments

Interest received 2,172 - 2,172 - - -

3,051,133 - 3,051,133 2,126,193 - 2,126,193

Net losses on

financial assets

designated at FVTPL

and derivatives held

for trading

Equities

Net realised gains 4 - 18,567,453 18,567,453 - 202,555 202,555

Movement in unrealised 4 - (36,142,677) (36,142,677) - (4,348,174) (4,348,174)

losses

Debt instruments

Movement in unrealised 4 - 564,244 564,244 - 381,233 381,233

gains

Derivative financial

instruments

Realised losses 4 - (2,426,731) (2,426,731) - (3,045,990) (3,045,990)

Movement in unrealised 4 - 1,553,631 1,553,631 - (227,407) (227,407)

gains/(losses)

- (17,884,080) (17,884,080) - (7,037,783) (7,037,783)

Total income/(loss) 3,051,133 (17,884,080) (14,832,947) 2,126,193 (7,037,783) (4,911,590)

Expenses

Transaction costs - 271,340 271,340 - 119,851 119,851

Exchange movements on (214,674) 118,654 (96,020) - 518,127 518,127

revaluation of

investments and

working capital

Management fees 9 1,816,362 - 1,816,362 1,649,074 - 1,649,074

Performance fees 9 - - - - 983,800 983,800

Directors' 72,500 - 72,500 81,232 - 81,232

remuneration

Administration fees 144,159 - 144,159 106,441 - 106,441

Custodian fees 61,036 - 61,036 45,091 - 45,091

Audit fees 12,702 - 12,702 12,320 - 12,320

Other expenses 169,881 - 169,881 154,426 - 154,426

2,061,966 389,994 2,451,960 2,048,584 1,621,778 3,670,362

Return/(Loss) for the 989,167 (18,274,074) (17,284,907) 77,609 (8,659,561) (8,581,952)

period

Basic and diluted 2 1.02 (18.82) (17.80) 0.08 (8.83) (8.75)

earnings/(loss) per

share (pence)

All items in the above statement derive from continuing operations.

The total column of this statement represents the Company's Statement of Profit

or Loss and Other Comprehensive Income prepared in accordance with IFRS. The

supplementary information on the allocation between revenue return and capital

return is presented under guidance published by the AIC.

The Notes to the Unaudited Condensed Financial Statements form an integral part

of these Interim Financial Statements.

Condensed Statement of Financial Position (Unaudited)

As at 31 December 2018

As at As at As at

31 December 30 June 31 December

2018 2018 2017

(Unaudited) (Audited) (Unaudited)

Assets Notes GBP GBP GBP

Cash and cash equivalents 8,916,616 1,168,729 835,330

Trade and other receivables 985,834 57,873 448,599

Financial assets designated at FVTPL 4 207,465,843 249,009,853 187,669,649

and derivatives held for trading

Total assets 217,368,293 250,236,455 188,953,578

Liabilities

Trade and other payables 3,555,118 12,158,971 2,623,425

Total liabilities 3,555,118 12,158,971 2,623,425

Equity

Capital and reserves attributable to

the Company's equity shareholders

Share capital 6 992,498 991,248 989,998

Treasury shares reserve 7 (5,346,498) (3,212,448) (2,182,262)

Distributable reserve 95,309,557 100,156,159 100,156,159

Retained earnings 122,857,618 140,142,525 87,366,258

Total equity 213,813,175 238,077,484 186,330,153

Total liabilities and equity 217,368,293 250,236,455 188,953,578

NAV per share (pence) 3 221.67 244.62 190.69

The Interim Financial Statements were approved by the Board of Directors and

authorised for issue on 6 March 2019.

Christopher Waldron Jane Le

Maitre

Chairman

Director

6 March 2019

6 March 2019

Condensed Statement of Changes in Equity (Unaudited)

For the six months ended 31 December 2018

Share Treasury Distributable Retained earnings Total

shares

Notes capital reserve reserve Capital Revenue Total equity

GBP GBP GBP GBP GBP GBP GBP

Opening balance 991,248 (3,212,448) 100,156,159 143,277,348 (3,134,823) 140,142,525 238,077,484

at 1 July 2018

Issue of Ordinary 6 1,250 - - - - - 1,250

shares

Purchase of 7 - (2,134,050) - - - - (2,134,050)

Ordinary shares

into Treasury

Dividends paid in 8 - - (4,846,602) - - - (4,846,602)

the period

(Loss)/Return for - - - (18,274,074) 989,167 (17,284,907) (17,284,907)

the period

Balance at 31 992,498 (5,346,498) 95,309,557 125,003,274 (2,145,656) 122,857,618 213,813,175

December 2018

For the six months ended 31 December 2017

Share Treasury Distributable Retained earnings Total

shares

Notes capital reserve reserve Capital Revenue Total capital

GBP GBP GBP GBP GBP GBP GBP

Opening balance at 989,998 (972,800) 105,058,397 98,217,020 (2,268,810) 95,948,210 201,023,805

1 July 2017

Purchase of 7 - (1,209,462) - - - - (1,209,462)

Ordinary shares

into Treasury

Dividends paid in 8 - - (4,902,238) - - - (4,902,238)

the period

(Loss)/Return for - - - (8,659,561) 77,609 (8,581,952) (8,581,952)

the period

Balance at 31 989,998 (2,182,262) 100,156,159 89,557,459 (2,191,201) 87,366,258 186,330,153

December 2017

Condensed Statement of Cash Flows (Unaudited)

For the six months ended 31 December 2018

Six months Six months

ended ended

31 December 31 December

2018 2017

(Unaudited) (Unaudited)

GBP GBP

Cash flows from operating activities

Dividend income received from listed equity 2,116,794 1,584,253

investments

Interest income received from listed debt - 99,072

instruments

Arrangement fee received from debt instruments - 46,531

Bank interest received 4,498 -

Management fees paid (1,816,362) (1,649,074)

Performance fee paid (10,964,740) (3,338,552)

Directors' fees paid (72,500) (73,834)

Other expenses paid (369,144) (374,690)

Net cash outflow from operating activities (11,101,454) (3,706,294)

Cash flows from investing activities

Purchase of equity investments (34,694,153) (9,957,618)

Sale of equity investments 56,988,813 20,359,191

Purchase of debt instruments (69,032) (6,178,430)

Purchase of derivative financial instruments (6,250,850) (3,869,720)

Sale of derivative financial instruments 7,712,140 -

Transaction charges on purchase and sale of (271,632) (127,550)

investments

Net cash inflow from investing activities 23,415,286 225,873

Cash flows from financing activities

Proceeds from issue of Company Shares 1,250 -

Purchase of Ordinary shares into Treasury (2,134,050) (1,185,573)

Dividends paid (2,433,145) (2,456,619)

Net cash outflow from financing activities (4,565,945) (3,642,192)

Net increase/(decrease) in cash and cash equivalents 7,747,887 (7,122,613)

during the period

Cash and cash equivalents at beginning of period 1,168,729 7,957,943

Cash and cash equivalents at end of period 8,916,616 835,330

Notes to the Unaudited Condensed Financial Statements

For the six months ended 31 December 2018

General Information

Crystal Amber Fund Limited (the "Company") was incorporated and registered in

Guernsey on 22 June 2007 and is governed in accordance with the provisions of

the Companies Law. The registered office address is Heritage Hall, Le Marchant

Street, St. Peter Port, Guernsey, GYI 4HY. The Company was established to

provide shareholders with an attractive total return which is expected to

comprise primarily capital growth with the potential for distributions of up to

5 pence per share per annum following consideration of the accumulated retained

earnings as well as the unrealised gains and losses at that time. The Company

seeks to achieve this through investment in a concentrated portfolio of

undervalued companies which are expected to be predominantly, but not

exclusively, listed or quoted on UK markets and which have a typical market

capitalisation of between GBP100 million and GBP1,000 million.

The Company's Ordinary shares were listed and admitted to trading on AIM, on 17

June 2008. The Company is also a member of the AIC.

All capitalised terms are defined in the Glossary of Capitalised Defined Terms

unless separately defined.

1. SIGNIFICANT ACCOUNTING POLICIES

The principal accounting policies applied in the preparation of these Interim

Financial Statements are set out below. These policies have been consistently

applied to those balances considered material to the Interim Financial

Statements throughout the current period, unless otherwise stated.

Basis of preparation

The Interim Financial Statements have been prepared in accordance with IAS 34,

Interim Financial Reporting.

The Interim Financial Statements do not include all the information and

disclosures required in the Annual Financial Statements and should be read in

conjunction with the Company's Annual Financial Statements for the year to 30

June 2018. The Annual Financial Statements have been prepared in accordance

with IFRS.

The same accounting policies and methods of computation are followed in the

Interim Financial Statements as in the Annual Financial Statements for the year

ended 30 June 2018.

The presentation of the Interim Financial Statements is consistent with the

Annual Financial Statements. Where presentational guidance set out in the SORP

"Financial Statements of Investment Trust Companies and Venture Capital

Trusts", issued by the AIC in November 2014 and updated in January 2017, is

consistent with the requirements of IFRS, the Directors have sought to prepare

the Interim Financial Statements on a basis compliant with the recommendations

of the SORP. In particular, supplementary information which analyses the

Statement of Profit or Loss and Other Comprehensive Income between items of a

revenue and capital nature has been presented alongside the total Statement of

Profit or Loss and Comprehensive Income.

The Company does not operate in an industry where significant or cyclical

variations as a result of seasonal activity are experienced during the

financial year. Income and dividends from investments will vary according to

the construction of the portfolio from time to time.

Going concern

The Directors are confident that the Company has adequate resources to continue

in operational existence for the foreseeable future and do not consider there

to be any threat to the going concern status of the Company.

Continuation vote

The Directors have specifically considered the implications of the continuation

vote scheduled to occur every two years on the application of the going concern

basis. The next continuation vote will be proposed at the 2019 AGM.

Segmental reporting

Operating segments are reported in a manner consistent with internal reporting

provided to the chief operating decision maker. The chief operating decision

maker, who is responsible for allocating resources and assessing performance of

the operating segments, has been identified as the Board as a whole. The key

measure of performance used by the Board to assess the Company's performance

and to allocate resources is the total return on the Company's NAV, as

calculated under IFRS, and therefore no reconciliation is required between the

measure of profit or loss used by the Board and that contained in these Interim

Financial Statements.

For management purposes, the Company is domiciled in Guernsey and is engaged in

a single segment of business mainly in one geographical area, being investment

in UK equity instruments, and therefore the Company has only one operating

segment.

2. BASIC AND DILUTED LOSS PER SHARE

Loss per share is based on the following data:

Six months Six months

ended ended

31 December 31 December

2018 2017

(Unaudited) (Unaudited)

Loss for the period (GBP17,284,907) (GBP8,581,952)

Weighted average number of issued Ordinary shares 97,085,658 98,071,325

Basic and diluted loss per share (pence) (17.80) (8.75)

3. NAV PER SHARE

NAV per share is based on the following data:

As at As at As at

31 December 30 June 31 December

2018 2018 2017

(Unaudited) (Audited) (Unaudited)

NAV per Condensed Statement of Financial GBP186,330,153

Position 213,813,175 238,077,484

Weighted average number of issued Ordinary 97,712,280

shares (excluding Treasury shares) 96,455,780 97,325,780

NAV per share (pence) 190.69

221.67 244.62

4. FINANCIAL ASSETS DESIGNATED AT FAIR VALUE THROUGH PROFIT OR LOSS

AND DERIVATIVES HELD FOR TRADING

1 July 1 July 1 July

2018 to 2017 to 2017 to

31 December 30 June 31 December

2018 2018 2017

(Unaudited) (Audited) (Unaudited)

GBP GBP GBP

Equity investments 190,087,261 229,682,729 170,344,729

Debt instruments 5,706,034 5,320,186 10,292,085

Financial assets designated at FVTPL 195,793,295 235,002,915 180,636,814

Derivative financial instruments held 11,672,548 14,006,938 7,032,835

for trading

Total financial assets designated at 207,465,843 249,009,853 187,669,649

FVTPL and derivatives held for

trading

Equity investments

Cost brought forward 172,761,740 156,798,987 156,798,987

Purchases 34,694,153 69,198,617 8,539,686

Sales (56,988,813) (73,610,743) (20,359,191)

Net realised gains 18,567,453 20,374,879 202,555

Cost carried forward 169,034,533 172,761,740 145,182,037

Unrealised gains brought forward 57,316,659 29,708,411 29,708,411

Movement in unrealised (losses)/ (36,142,677) 27,608,248 (4,348,174)

gains

Unrealised gains carried forward 21,173,982 57,316,659 25,360,237

Effect of exchange rate movements on (121,254) (395,670) (197,545)

revaluation

Fair value of equity investments 170,344,729

190,087,261 229,682,729

Debt instruments

Cost brought forward 5,547,350 9,318,984 9,318,984

Purchases - 2,066,642 804,530

Sales - (6,755,428) -

Net realised gains - 917,152 -

Cost carried forward 5,547,350 5,547,350 10,123,514

Unrealised gains brought forward 203,233 290,017 290,017

Movement in unrealised gains/(losses) 564,244 (86,784) 381,233

Unrealised gains carried forward 767,477 203,233 671,250

Effect of exchange rate movements on (608,793) (430,397) (502,679)

revaluation

Fair value of debt instruments 5,706,034 5,320,186 10,292,085

Total financial assets designated at 195,793,295 235,002,915 180,636,814

FVTPL

Derivative financial instruments held

for trading

Cost brought forward 3,888,021 360,001 360,001

Purchases 6,250,850 18,079,220 3,869,720

Sales (7,712,140) (19,953,704) -

Net realised (losses)/gains (2,426,731) 5,402,504 (3,045,990)

Cost carried forward - 3,888,021 1,183,731

Unrealised gains brought forward 10,118,917 6,076,511 6,076,511

Movement in unrealised gains/(losses) 1,553,631 4,042,406 (227,407)

Unrealised gains carried forward 11,672,548 10,118,917 5,849,104

Fair value of derivatives held for 7,032,835

trading 11,672,548 14,006,938

Total derivative financial 7,032,835

instruments held for trading 11,672,548 14,006,938

Total financial assets designated at 207,465,843 249,009,853 187,669,649

FVTPL and derivatives held for

trading

At the reporting date, the warrant instruments in FairFX, GI Dynamics and

Hurricane were valued using a Black Scholes valuation technique.

The following table details the Company's positions in derivative financial

instruments:

Nominal amount Value

(Unaudited) (Unaudited)

31 December 2018 GBP

Derivative financial instruments

FairFX warrant instrument 6,000,000 5,523,840

Hurricane warrant instrument 23,333,333 5,589,873

GI Dynamics warrant instrument 97,222,200 558,835

126,555,533 11,672,548

Nominal amount Value

(Audited) (Audited)

30 June 2018 GBP

Derivative financial instruments

Puts on FTSE100 Index 7200 (expiry: July 2,000 180,000

2018)

Puts on FTSE 100 Index 7400 (expiry: July 4,000 900,000

2018)

FairFX warrant instrument 6,000,000 5,259,942

Hurricane warrant instrument 23,333,333 6,511,213

GI Dynamics warrant instrument 97,222,200 1,155,783

126,561,533 14,006,938

5. FINANCIAL INSTRUMENTS

Fair value measurements

The Company measures fair values using the following fair value hierarchy that

prioritises the inputs to valuation techniques used to measure fair value. The

hierarchy gives the highest priority to unadjusted quoted prices in active

markets for identical assets or liabilities (Level 1 measurements) and the

lowest priority to unobservable inputs (Level 3 measurements). The three levels

of the fair value hierarchy under IFRS 13 are as follows:

Level 1: Quoted price (unadjusted) in an active market for an identical

instrument.

Level 2: Valuation techniques based on observable inputs, either

directly (i.e. as prices) or indirectly (i.e. derived from prices). This

category includes instruments valued using: quoted prices in active markets for

similar instruments; quoted prices for identical or similar instruments in

markets that are considered less than active; or other valuation techniques for

which all significant inputs are directly or indirectly observable from market

data.

Level 3: Valuation techniques using significant unobservable inputs.

This category includes all instruments for which the valuation technique

includes inputs that are not based on observable data, and the unobservable

inputs have a significant effect on the instrument's valuation. This category

includes instruments that are valued based on quoted prices for similar

instruments for which significant unobservable adjustments or assumptions are

required to reflect differences between the instruments.

The level in the fair value hierarchy within which the fair value measurement

is categorised in its entirety is determined on the basis of the lowest level

input that is significant to the fair value measurement. For this purpose, the

significance of an input is assessed against the fair value measurement in its

entirety. If a fair value measurement uses observable inputs that require

significant adjustment based on unobservable inputs, that measurement is a

Level 3 measurement. Assessing the significance of a particular input to the

fair value measurement in its entirety requires judgement, considering factors

specific to the asset or liability.

The determination of what constitutes 'observable' requires significant

judgement by the Company. The Company considers observable data to be that

market data that is readily available, regularly distributed or updated,

reliable and verifiable, not proprietary, and provided by independent sources

that are actively involved in the relevant market.

The objective of the valuation techniques used is to arrive at a fair value

measurement that reflects the price that would be received if an asset was sold

or a liability transferred in an orderly transaction between market

participants at the measurement date.

The following tables analyse, within the fair value hierarchy, the Company's

financial assets measured at fair value at 31 December 2018 and 30 June 2018:

Level 1 Level 2 Level 3 Total

(Unaudited) (Unaudited) (Unaudited) (Unaudited)

31 December 2018 GBP GBP GBP GBP

Financial assets designated at

FVTPL and derivatives held for

trading:

Equities - listed equity 185,441,237 - - 185,441,237

investments

Equities - unlisted equity - - 4,646,024 4,646,024

investments

Debt - loan notes - - 5,706,034 5,706,034

Derivatives - warrant instruments - 11,672,548 - 11,672,548

185,441,237 11,672,548 10,352,058 207,465,843

Level 1 Level 2 Level 3 Total

(Audited) (Audited) (Audited) (Audited)

30 June 2018 GBP GBP GBP GBP

Financial assets designated at

FVTPL and derivatives held for

trading:

Equities - listed equity 225,976,612 - - 225,976,612

investments

Equities - unlisted equity - - 3,706,117 3,706,117

investments

Debt - loan notes - - 5,320,186 5,320,186

Derivatives - listed derivative 1,080,000 - - 1,080,000

instruments

Derivatives - warrant instruments - 12,926,938 - 12,926,938

227,056,612 12,926,938 9,026,303 249,009,853

The Level 1 equity investments were valued by reference to the closing bid

prices in each investee company on the reporting date.

The Level 2 derivative investments were valued using a Black Scholes valuation

technique.

The Level 3 equity investment in Board Intelligence was valued with reference

to the valuation multiples of publicly-listed cloud software companies, after

applying a discount equivalent to that which prevailed at the time of

investment in March 2018. The loan notes were classified as Level 3 debt

instruments as there was no observable market data. The Board has concluded

that fair value is approximate to the share market price had the loan notes

been converted to equity and valued at the closing bid price on the reporting

date.

For financial instruments not measured at FVTPL, the carrying amount is

approximate to their fair value.

Fair value hierarchy - Level 3

The following table shows a reconciliation from the opening balances to the

closing balances for fair value measurements in Level 3 of the fair value

hierarchy:

Six months Six months

ended ended

31 December 31 December

2018 2017

(Unaudited) (Unaudited)

GBP GBP

Opening balance at 1 July 9,026,303 3,846,387

Purchases - 744,491

Movement in unrealised gain 1,504,151 119,834

Effect of exchange rate movements (178,396) (143,556)

Closing balance at 31 December 10,352,058 4,567,156

The Company recognises transfers between levels of the fair value hierarchy on

the date of the event of change in circumstances that caused the transfer.

There have been no transfers between levels during the period ended 31 December

2018.

At the period end and assuming all other variables are held constant:

* If unobservable inputs in Level 3 investments had been 5 per cent higher/

lower (2017: 5 per cent higher/lower), the Company's return and net assets

for the six months ended 31 December 2018 would have increased/decreased by

GBP517,603 (2017: GBP228,358); and

* There would have been no impact on the other equity reserves.

6. SHARE CAPITAL AND RESERVES

The authorised share capital of the Company is GBP3,000,000 divided into 300

million Ordinary shares of GBP0.01 each.

The issued share capital of the Company is comprised as follows:

31 December 2018 30 June 2018

(Unaudited) (Audited)

Number GBP Number GBP

Issued, called up and fully paid 99,249,762 992,498 99,124,762 991,248

Ordinary shares of GBP0.01 each

During the period, the Company issued 125,000 Ordinary shares of GBP0.01 divided

equally amongst five charitable organisations, the nominal value of which has

been paid by Richard Bernstein, who is a shareholder of the Company, a director

and shareholder of the Investment Manager and a member of the Investment

Adviser.

7. TREASURY SHARES RESERVE

Six months ended Year ended

31 December 2018 30 June 2018

(Unaudited) (Audited)

Number GBP Number GBP

Opening balance (1,798,982) (3,212,448) (635,000) (972,800)

Treasury shares purchased (995,000) (2,134,050) (1,163,982) (2,239,648)

during the period/year

Closing balance (2,793,982) (5,346,498) (1,798,982) (3,212,448)

During the period ended 31 December 2018: 995,000 (2017: 652,482) Treasury

shares were purchased at an average price of 214.48 pence per share (2017:

185.4 pence per share), representing an average discount to NAV at the time of

purchase of 11.9 per cent (2017: 5.2 per cent). During the period ended 31

December 2018, Nil (2017: Nil) Treasury shares were sold.

8. DIVIDS

On 6 July 2018, the Company declared an interim dividend of GBP2,433,145,

equating to 2.5 pence per Ordinary share, which was paid on 17 August 2018 to

shareholders on the register on 20 July 2018.

On 13 December 2018, the Company declared an interim dividend of GBP2,413,457,

equating to 2.5 pence per Ordinary share, which was paid on 18 January 2018 to

shareholders on the register on 21 December 2018.

9. RELATED PARTIES

Richard Bernstein is a director and a member of the Investment Manager, a

member of the Investment Adviser and a holder of 10,000 (30 June 2018: 10,000)

Ordinary shares in the Company, representing 0.01 per cent (30 June 2018: 0.01

per cent) of the voting share capital of the Company at 31 December 2018.

During the period, the Company incurred management fees of GBP1,816,362 (2017: GBP

1,649,074) none of which was outstanding at 31 December 2018 (30 June 2018: GBP

Nil). The Company also accrued performance fees of GBPNil (2017: GBPNil) none of

which was outstanding or included in trade and other payables as at 31 December

2018 (30 June 2018: GBP10,964,740 was outstanding and included in trade and other

payables).

Under the terms of the IMA, the Investment Manager is entitled to a performance

fee in certain circumstances. This fee is calculated by reference to the

increase in NAV per Ordinary share over the course of each performance period.

Payment of the performance fee is subject to:

1. the achievement of a performance hurdle condition: the NAV per Ordinary

share at the end of the relevant performance period must exceed an amount equal

to the placing price, increased at a rate of; (i) 7% per annum on an annual

compounding basis in respect of that part of the performance period which falls

from (and including) the date of Admission up to (but not including) the date

of the 2013 Admission; (ii) 8% per annum on an annual compounding basis in

respect of that part of the performance period which falls from (and including)

the date of the 2013 Admission up to (but not including) the date of the 2015

Admission; and (iii) 10% per annum on an annual compounding basis in respect of

that part of the performance period which falls from (and including) the date

of the 2015 Admission up to the end of the relevant performance period with all

dividends and other distributions paid in respect of all outstanding Ordinary

shares (on a per share basis) during any performance period being deducted on

their respective payment dates (and after compounding the distribution amount

per share at the relevant annual rate or rates for the period from and

including the payment date to the end of the performance period) ("the Basic

Performance Hurdle"). Such Basic Performance Hurdle at the end of a performance

period is compounded at the relevant annual rate to calculate the initial per

share hurdle level for the next performance period, which will subsequently be

adjusted for any dividends or other distributions paid in respect of all

outstanding Ordinary shares during that performance period; and

2. the achievement of a "high watermark": the NAV per Ordinary share at the

end of the relevant performance period must be higher than the highest

previously reported NAV per Ordinary share at the end of a performance period

in relation to which a performance fee, if any, was last earned (less any

dividends or other distributions in respect of all outstanding Ordinary shares

declared (on a per share basis) since the end of the performance period in

relation to which a performance fee was last earned).

As the NAV per share at 31 December 2018 did not exceed the high watermark of

239.62 pence per share at that date, a performance fee has not been accrued in

the Interim Financial Statements. In the event that, on 30 June 2019, the NAV

per share exceeds both the performance hurdle and the high watermark, the

performance fee will be an amount equal to 20 per cent of the excess of the NAV

per share at that date over the higher of these hurdles multiplied by the time

weighted average number of Ordinary shares in issue during the year ending 30

June 2019. Depending on whether the Ordinary shares are trading at a discount

or a premium to the Company's NAV per share at 30 June 2019, the performance

fee will be either payable in cash (subject to the Investment Manager being

required to use the cash payment to purchase Ordinary shares in the market) or

satisfied by the sale of Ordinary shares out of Treasury or by the issue of new

fully paid Ordinary shares at the closing mid-market closing price on 30 June

2019, respectively.

As at 31 December 2018, the Investment Manager held 6,203,326 Ordinary shares

(30 June 2018: 3,530,930) of the Company, representing 6.40 per cent (30 June

2018: 3.63 per cent) of the voting share capital. Subsequent to the period end,

the Investment Manager purchased 10,000 Ordinary shares of the Company on 5

February 2019 and now holds 6,213,326 Ordinary shares of the Company.

The interests of the Directors in the share capital of the Company at the

period/year end, and as at the date of this report, are as follows:

31 December 2018 30 June 2018

Number of Total Number of Total

Ordinary shares voting Ordinary voting

rights shares rights

Christopher Waldron(1) 15,000 0.02% 10,000 0.01%

Jane Le Maitre(2) 6,000 0.01% N/A N/A

Total 21,000 0.03% 10,000 0.01%

(1) Chairman of the Company

(2) Ordinary Shares held indirectly

All related party transactions are carried out on an arm's length basis.

10. POST BALANCE SHEET EVENTS

The Company purchased 73,800 of its own Ordinary Shares during the period

between 1 January 2019 and 10 January 2019, which were held as Treasury shares.

Following these purchases, the total number of Ordinary Shares held as Treasury

shares by the Company is 2,867,782.

On 5 February 2019, the Investment Manager purchased 10,000 Ordinary shares of

the Company and now holds 6,213,326 Ordinary shares of the Company.

On 11 February 2019, the Company reported that its unaudited NAV at 31 January

2019 was 216.96 pence per share.

11. AVAILABILITY OF INTERIM REPORT

Copies of the Interim Report will be available to download from the Company's

website www.crystalamber.com.

Glossary of Capitalised Defined Terms

"AGM" means the annual general meeting of the Company;

"AIC" means the Association of Investment Companies;

"AIM" means the Alternative Investment Market of the London Stock Exchange;

"Annual Financial Statements" means the audited annual financial statements of

the Company, including the Statement of Profit or Loss and Other Comprehensive

Income, the Statement of Financial Position, the Statement of Changes in

Equity, the Statement of Cash Flows and associated notes;

"Annual Report" means the annual publication of the Company to the shareholders

to describe their operations and financial conditions, together with the

Company's financial statements;

"Black Scholes" means the Black Scholes model, a mathematical model of a

financial market containing derivative instruments;

"Board" or "Directors" or "Board of Directors" means the directors of the

Company;

"Brexit" means the departure of the UK from the European Union;

"Company" or "Fund" means Crystal Amber Fund Limited;

"Companies Law" means the Companies (Guernsey) Law, 2008, (as amended);

"Dow Jones Industrial Average" means a stock market index that indicates the

value of thirty large publicly owned companies based in the US;

"EGM" or "Extraordinary General Meeting" means an extraordinary general meeting

of the Company;

"FDA" means food and drug administration;

"FPSO" means floating production storage and offloading vessel;

"FTSE" means Financial Times Stock Exchange;

"FVTPL" means Fair Value Through Profit or Loss;

"IAS" means international accounting standards as issued by the Board of the

International Accounting Standards Committee;

"IFRS" means the International Financial Reporting Standards, being the

principles-based accounting standards, interpretations and the framework by

that name issued by the International Accounting Standards Board, as adopted by

the European Union;

"IMA" means the investment management agreement between the Company and the

Investment Manager, dated 16 June 2008, as amended on 21 August 2013, further

amended on 27 January 2015 and further amended on 12 June 2018;

"Interim Financial Statements" means the unaudited condensed interim financial

statements of the Company, including the Condensed Statement of Profit or Loss

and Other Comprehensive Income, the Condensed Statement of Financial Position,

the Condensed Statement of Changes in Equity, the Condensed Statement of Cash

Flows and associated notes;

"Interim Report" means the Company's interim report and unaudited condensed

financial statements for the period ended 31 December;

"IPO" means initial public offering;

"Lancaster EPS" means Lancaster Early Production System;

"NAV" or "Net Asset Value" means the value of the assets of the Company less

its liabilities as calculated in accordance with the Company's valuation

policies and expressed in Pounds Sterling;

"NAV per share" means the Net Asset Value per Ordinary share of the Company and

is expressed in pence;

"Small Cap Index" means an index of small market capitalisation companies;

"Ordinary share" means an allotted, called up and fully paid Ordinary share of

the Company of GBP0.01 each;

"S&P 500 Index" means a US stock market index based on the market

capitalisations of 500 large companies having common stock listed;

"SORP" means Statement of Recommended Practice;

"Treasury" means the reserve of Ordinary shares that have been repurchased by

the Company;

"Treasury shares" means Ordinary shares in the Company that have been

repurchased by the Company and are held as Treasury shares;

"UK" or "United Kingdom" means the United Kingdom of Great Britain and Northern

Ireland;

"US" means the means the United States of America, its territories and

possessions, any state of the United States and the District of Columbia;

"US$" means United States dollars; and

"GBP" or "Pounds Sterling" or "Sterling" means British pound sterling and "pence"

means British pence.

Directors and General Information

Directors Registered Office

Christopher Waldron (Chairman) Heritage Hall

Fred Hervouet Le Marchant Street

Jane Le Maitre (Chairman of Audit St. Peter Port

Committee) Guernsey GY1 4HY

Nigel Ward (Chairman of Remuneration and

Management Engagement Committee) Investment Manager

Crystal Amber Asset Management (Guernsey)

Investment Adviser Limited

Crystal Amber Advisers (UK) LLP Heritage Hall

17c Curzon Street Le Marchant Street

London W1J 5HU St. Peter Port

United Kingdom Guernsey GY1 4HY

Administrator and Secretary Nominated Adviser

Estera International Fund Managers Allenby Capital Limited

(Guernsey) Limited 5 St. Helen's Place

Heritage Hall London EC3A 6AB

Le Marchant Street United Kingdom

St. Peter Port

Guernsey GY1 4HY Legal Advisers to the Company

As to English Law

Broker Norton Rose Fulbright LLP

Winterflood Investment Trusts 3 More London Riverside

The Atrium Building London SE1 2AQ

Cannon Bridge House United Kingdom

25 Dowgate Hill

London EC4R 2GA As to Guernsey Law

United Kingdom Carey Olsen

PO Box 98

Independent Auditor Carey House

KPMG Channel Islands Limited Les Banques

Glategny Court St. Peter Port

Glategny Esplanade Guernsey GY1 4BZ

St. Peter Port

Guernsey GY1 1WR Custodian

ABN AMRO (Guernsey) Limited

Identifiers PO Box 253

ISIN: GG00B1Z2SL48 Martello Court

Sedol: B1Z2SL4 Admiral Park

Ticker: CRS St. Peter Port

Website: crystalamber.com Guernsey GY1 3QJ

LEI: 213800662E2XKP9JD811

Registrar

Link Asset Services

65 Gresham Street

London

EC2V 7NQ

United Kingdom

END

(END) Dow Jones Newswires

March 07, 2019 02:00 ET (07:00 GMT)

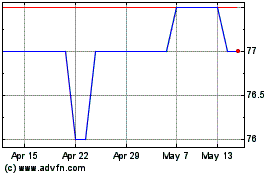

Crystal Amber (LSE:CRS)

Historical Stock Chart

From Jun 2024 to Jul 2024

Crystal Amber (LSE:CRS)

Historical Stock Chart

From Jul 2023 to Jul 2024