TIDMCLIG

RNS Number : 9927O

City of London Investment Group PLC

15 February 2016

15th February 2016

CITY OF LONDON INVESTMENT GROUP PLC

("City of London", "the Group" or "the Company")

HALF YEAR RESULTS TO 31ST DECEMBER 2015

City of London (LSE:CLIG) announces half year results for the

six months to 31st December 2015.

SUMMARY

-- Funds under Management ("FuM") of US$3.8 billion (GBP2.6

billion) at 31st December 2015. This compares with US$4.2 billion

(GBP2.7 billion) at the beginning of this financial year on 1st

July 2015 and US$4.0 billion (GBP2.6 billion) at 31st December

2014

-- FuM at 31st January 2016 of US$3.5 billion (GBP2.5

billion)

-- Revenues representing the Group's management charges on FuM,

were GBP11.8 million (2014: GBP12.2 million)

Profit before tax of GBP3.6 million (2014: GBP4.3 million)

-- Maintained interim dividend of 8p per share payable on 11th

March 2016 to shareholders on the register on 26th February

2016

-- Cash and cash equivalents at the period end of GBP8.4 million

(2014: GBP8.1 million)

This release includes forward-looking statements, which may

differ from actual results. Any forward-looking statements are

based on certain factors and assumptions, which may prove

incorrect, and are subject to risks, uncertainties and assumptions

relating to future events, the Group's operations, results of

operations, growth strategy and liquidity.

For further information, please visit www.citlon.co.uk or

contact:

Barry Olliff (CEO)

City of London Investment Group PLC

Tel: +1 215 313 3774

Roger Lambert

Canaccord Genuity Limited

Financial Adviser and Broker

Tel: +44 (0)20 7523 8000

CHAIRMAN'S STATEMENT

The expression "May you live in interesting times" is often

erroneously attributed to the Chinese. There can be little

question, however, that the immediate trigger for the current

"interesting times" is attributable to the Chinese but we should

not forget that in giving the global economy a very extended diet

of highly intoxicating free money, Western governments are surely

to blame for the inevitable huge underlying debt fuelled problems

that the global economy now faces. I know that some people hold

that the best cure for a hangover is another drink, but when it

comes to the global economy I would have hoped that the world's

economists could have come up with a better solution.

At City of London Investment Group we have certainly not been

immune from these problems. With markets falling across both the

developed and emerging economies we have at least been fortunate to

record, if only on a relative basis, a strong performance. As a

consequence we have been favoured by contrarian investors awarding

us new mandates including asset allocations for our diversification

products.

At end December 2015 total Funds under Management (FuM) were

US$3.8 billion (GBP2.6 billion), down from US$4.2 billion (GBP2.7

billion) at the 30th June 2015 year end. The new mandates noted

above combined with good relative performance reduced the actual

decline in FuM to 11% against a fall in the MSCI Emerging Markets

index of 17%.

Results - unaudited

Unaudited profit before taxation for the period was GBP3.6

million which compares to GBP4.3 million for the six months to end

December 2014. In a falling market these results were exacerbated

by losses incurred on our seed investments. No let up could be

afforded in our ongoing programme of cost controls.

Gross revenue for the period fell back to GBP11.8 million (2014:

GBP12.2 million), whilst commissions payable to our ex-third party

marketing consultant continued to reduce amounting to GBP0.8

million (2014: GBP1.2 million). Custody fees relating to the

safekeeping and administration of the assets of our commingled

funds were unchanged at GBP0.4 million (2014: GBP0.4 million).

Administrative expenses were GBP6.9 million (2014: GBP6.4

million). The largest components of which were staff costs

(essentially salaries, benefits and related employment taxes) of

GBP3.3 million (2014: GBP3.0 million) and profit-share, including

related employment taxes, of GBP1.8 million (2014: GBP1.9

million).

Basic earnings per share, after a 27% tax charge of GBP1.0

million (2014: GBP1.2 million also representing 27% of profit

before tax), were 10.6p (2014: 12.7p). Diluted earnings per share

were 10.4p (2014: 12.5p).

Dividends

As I have previously noted, it is recognised by your Board that

for many of our shareholders a strong and consistent dividend is

particularly important. For this reason we have endeavoured over

the recent more difficult years to at least maintain the dividend,

whilst always ensuring that our finances have remained sound. In

view of your Company's strong balance sheet and cash reserves (cash

and cash equivalents at end December 2015 were GBP8.4 million up

from GBP8.1 million at end December 2014), your Board has agreed to

maintain the 8p interim dividend payable on 11th March 2016 to

shareholders on the register on 26th February 2016. Whilst it

remains your Board's policy that over a rolling five year period

the intention is to achieve an average dividend cover of circa 1.2

times, in the light of current trading some flexibility in this

policy may be advisable. No decision on the final dividend will be

taken until both the results for the full year are known and the

outlook for 2017 is much clearer.

Your Board

Following the 2015 AGM we have welcomed two new directors, Mark

Dwyer, CIO Emerging Markets and Tracy Rodrigues, Finance Director

to the CLIG Board. Their contribution has been greatly appreciated

particularly at a time of Carlos Yuste's departure after 15 years

at CLIG. The handover of Carlos's broadly based business

development and client responsibilities has gone well with clear

benefits in terms of staff motivation in taking on the new roles

that became available. Achieving success over the longer term in

fund management is very dependent on staff continuity and as a firm

we are constantly looking for ways to improve on our already

impressive level of key staff retention. We hope in 2016 to be able

to ensure staff further identify their interests with those of

shareholders by enabling a higher level of equity ownership

throughout the firm whilst avoiding shareholder dilution.

Outlook

Notwithstanding our demonstrated success in attracting new

mandates and the early success of our diversification strategies,

it remains the case that our fortunes are closely tied to those of

the emerging markets. The benchmark index for our core emerging

markets product (MSCI Emerging Markets index) has, at the time of

writing, given up over 10 years of gains. Whether this is now a buy

opportunity is not for me to opine - I leave that up to individual

investors - however if markets do turn, and they are often in the

habit of overshooting, then I am confident that our well

established investment process will ensure that we provide icing on

any positive cake.

Finally, it is worth noting, in his CEO report Barry Olliff

again sets out a template whereby shareholders and interested

investors can work out on the basis of given assumptions the likely

level of profitability. The template is self explanatory however I

draw shareholders' attention to the importance of the US$ to GBP

Sterling exchange rate. A weak pound vs the US$ has a very

beneficial effect on profits.

Post-tax profit: Illustration of US$/GBP rate effect

FUM US$bn: 3.0 3.5 4.0 4.5 5.0

----------- ---------- ---- ---- ---- -----

US$/GBP Post-tax,

GBPm

----------- ---------- ---- ---- ---- -----

1.35 4.3 5.9 7.5 9.2 10.8

----------- ---------- ---- ---- ---- -----

1.40 4.1 5.6 7.2 8.7 10.3

----------- ---------- ---- ---- ---- -----

1.45 3.9 5.4 6.9 8.4 9.9

----------- ---------- ---- ---- ---- -----

1.50 3.7 5.1 6.6 8.0 9.5

----------- ---------- ---- ---- ---- -----

1.55 3.5 4.9 6.3 7.7 9.1

----------- ---------- ---- ---- ---- -----

Assumes:

Average net fee 0.85%

Annual operating costs GBP4.0m plus $7m plus S$1m (GBP1 =

S$2)

Profit-share 30% of operating profit

Average tax rate 27%

Note: The above table is intended to illustrate the approximate

impact of movement in US$/GBP, given an assumed set of trading

conditions. It is not intended to be interpreted or used as a

profit forecast.

In conclusion I am confident that we will continue to make the

best of very uncertain markets and that we will again weather the

storms just as we have in previous downturns.

David Cardale

Chairman

12th February 2016

CHIEF EXECUTIVE OFFICER'S REVIEW

Funds under management (FuM) at the Group's half year end on

31st December 2015 were US$3.8 billion (GBP2.6 billion). This

compares with US$4.2 billion (GBP2.7 billion) at the year-end on

30th June 2015.

The fall in underlying FuM (US$) of 11% compares with a fall of

17% in the MSCI Emerging Markets TR Index (NDUEEGF).

The first six months of our financial year have continued with

net inflows and also outperformance aiding both FuM and the

P&L. Unfortunately the index that we use to measure the

environment in which we work has not been so accommodating.

As shareholders will be aware this has been a difficult time for

fund managers who invest in emerging markets. It is only fund

managers who are outperforming, providing clients with useful

solutions and managing their businesses efficiently that will

survive and prosper.

We believe that it is as a result of the Size Weighted Average

Discount (SWAD) being so wide that there is at present such

significant interest in emerging markets via closed-end funds.

With confirmed additional net inflows of just under US$200

million in the next 3-6 months, we are in a good place both within

our peer group and also from a client stability perspective.

(MORE TO FOLLOW) Dow Jones Newswires

February 15, 2016 02:00 ET (07:00 GMT)

While subsequent to 31st December the emerging markets have

continued to fall, we have continued to notice the return of some

risk taking with recent allocations being to Global Tactical Asset

Allocation, Frontier, EM and three specialist China mandates. This

level of asset allocation diversity is not something that we have

experienced in the past. In addition our book of potential

business, at well in excess of US$500 million, is as large as we

have experienced in the recent past. As usual, shareholders and

other interested parties will be kept up to date with our progress

in this regard on a monthly basis via our web site

www.citlon.co.uk.

Since the end of our financial year in June, the MSCI Emerging

Markets TR Index has fallen significantly but because we were

aggressive in terms of cost reductions in July and August and with

the effects of this now coming through to the P&L, we have come

out of the recent downturn in much better condition than if we had

not acted.

Opportunities have been taken to switch resources so that more

responsibilities are automated, or put another way we have placed

additional resources in Operations which we see as the engine room

for creating additional technology related efficiencies.

As a result of the afore referenced increase in risk appetite,

shareholders and other interested parties should note that in our

dividend cover template we have increased the amount of new

emerging markets FuM from US$250 million to US$500 million for next

financial year, 2016/2017. We have maintained the diversification

products figure at US$250 million.

The template shows the quarterly estimated cost of a maintained

dividend over a three year period against actual post-tax profits

and assumed post-tax profit based upon some key assumptions.

Given these assumptions it should be possible for shareholders

and other interested parties to construct models projecting our

profitability based upon their own opinions while taking into

account changing market circumstances.

The updated template can be viewed on our website

www.citlon.co.uk/shareholders/announcement.php.

Over the next few months we intend to put in place an improved

incentive scheme for staff as the present scheme that was put

together prior to listing has become out-dated in many

respects.

Barry Olliff

Chief Executive Officer

12th February 2016

For further information please see the most recent presentation

to CLIG shareholders. This is on our website www.citlon.co.uk

CONSOLIDATED INCOME STATEMENT

FOR THE SIX MONTHS ENDED 31ST DECEMBER 2015

Six months

Six months ended

ended 31st Dec 30th June

Note 31st 2014 2015 (audited)

Dec 2015 (restated) GBP

(unaudited) (unaudited)

GBP GBP

--------------------- ------ ------------- ------------ ----------------

Revenue

Gross fee income 2 11,761,261 12,203,702 25,356,009

Commissions payable (823,557) (1,191,994) (2,274,745)

Custody fees

payable (361,730) (365,916) (737,513)

--------------------- ------ ------------- ------------ ----------------

Net fee income 10,575,974 10,645,792 22,343,751

--------------------- ------ ------------- ------------ ----------------

Administrative

expenses

Staff costs 5,114,846 4,937,907 10,418,571

Other administrative

expenses 1,696,006 1,415,564 3,027,637

Depreciation

and amortisation 75,806 77,049 170,852

--------------------- ------ ------------- ------------ ----------------

(6,886,658) (6,430,520) (13,617,060)

Operating profit 3,689,316 4,215,272 8,726,691

Interest receivable

and similar gains 3 (112,506) 81,227 204,979

--------------------- ------ ------------- ------------ ----------------

Profit before

tax 3,576,810 4,296,499 8,931,670

Income tax expense (982,495) (1,151,471) (2,318,004)

--------------------- ------ ------------- ------------ ----------------

Profit for the

period 2,594,315 3,145,028 6,613,666

--------------------- ------ ------------- ------------ ----------------

Profit attributable

to:

Equity shareholders

of the parent 2,632,839 3,161,769 6,577,845

Non-controlling

interest (38,524) (16,741) 35,821

--------------------- ------ ------------- ------------ ----------------

Basic earnings

per share 4 10.6p 12.7p 26.4p

--------------------- ------ ------------- ------------ ----------------

Diluted earnings

per share 4 10.4p 12.5p 26.0p

--------------------- ------ ------------- ------------ ----------------

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE SIX MONTHS ENDED 31ST DECEMBER 2015

Six months Six

ended months

ended

31st Dec 31st

2015 (unaudited) Dec

2014

GBP (unaudited) 30th

June

2015

(audited)

GBP GBP

---------------------------- ------------------ ------------- -----------

Profit for the period 2,594,315 3,145,028 6,613,666

---------------------------- ------------------ ------------- -----------

Fair value (losses)/gains

on available-for-sale

investments*

Release of fair value

gains on disposal

of available-for-sale (1,971) 353 2,117

investments*

Foreign currency movements - - 40

in foreign operations 96,018 - -

Foreign exchange gains

on non-monetary assets 28,245 55,981 50,988

---------------------------- ------------------ ------------- -----------

Other comprehensive

income 122,292 56,334 53,145

---------------------------- ------------------ ------------- -----------

Total comprehensive

income for the period 2,716,607 3,201,362 6,666,811

---------------------------- ------------------ ------------- -----------

Attributable to:

Equity holders of

the parent 2,755,131 3,218,103 6,630,990

Non-controlling interest (38,524) (16,741) 35,821

*Net of deferred tax

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

31ST DECEMBER 2015

31st

Dec 2014

31st (restated) 30th

Dec 2015 (unaudited) June

(unaudited) 2015

(audited)

Note GBP GBP GBP

-------------------------- ----- ------------- ------------- -----------

Non-current assets

Property and equipment 398,916 393,132 384,083

Intangible assets 205,816 219,072 196,343

Other financial

assets 2,073,625 1,940,006 2,075,954

Deferred tax asset 451,013 415,249 395,354

-------------------------- ----- ------------- ------------- -----------

3,129,370 2,967,459 3,051,734

-------------------------- ----- ------------- ------------- -----------

Current assets

Trade and other

receivables 4,082,052 4,230,870 4,509,184

Other financial

assets - 58,798 -

Cash and cash equivalents 8,382,280 8,129,359 10,226,705

-------------------------- ----- ------------- ------------- -----------

12,464,332 12,419,027 14,735,889

-------------------------- ----- ------------- ------------- -----------

Current liabilities

Trade and other

payables (2,012,317) (2,084,998) (2,609,944)

Current tax payable (686,771) (600,822) (814,638)

-------------------------- ----- ------------- ------------- -----------

Creditors, amounts

falling due within

one year (2,699,088) (2,685,820) (3,424,582)

-------------------------- ----- ------------- ------------- -----------

Net current assets 9,765,244 9,733,207 11,311,307

-------------------------- ----- ------------- ------------- -----------

Total assets less

current liabilities 12,894,614 12,700,666 14,363,041

(MORE TO FOLLOW) Dow Jones Newswires

February 15, 2016 02:00 ET (07:00 GMT)

-------------------------- ----- ------------- ------------- -----------

Non-current liabilities

Deferred tax liability (102,865) (99,624) (115,525)

-------------------------- ----- ------------- ------------- -----------

Net assets 12,791,749 12,601,042 14,247,516

-------------------------- ----- ------------- ------------- -----------

Capital and reserves

Share capital 267,973 269,123 269,123

Share premium account 2,117,888 2,117,888 2,117,888

Investment in own

shares 5 (5,607,771) (5,854,471) (5,692,430)

Fair value reserve 6,648 6,815 8,619

Foreign exchange

reserve 116,612 (2,658) (7,651)

Share option reserve 854,417 816,205 807,106

Capital redemption

reserve 22,747 21,597 21,597

Retained earnings 14,416,559 14,678,883 16,127,877

-------------------------- ----- ------------- ------------- -----------

Total equity 12,195,073 12,053,382 13,652,129

Non-controlling

interest 596,676 547,660 595,387

-------------------------- ----- ------------- ------------- -----------

Total equity 12,791,749 12,601,042 14,247,516

-------------------------- ----- ------------- ------------- -----------

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE SIX MONTHS ENDED 31ST DECEMBER 2015

Total

attributable

Share Investment Fair Foreign Share Capital to

Share premium in own value exchange option redemption Retained share-

capital account shares reserve reserve reserve reserve earnings holders NCI Total

GBP GBP GBP GBP GBP GBP GBP GBP GBP GBP GBP

-------------- --------- ----------- ------------- --------- --------- --------- ----------- ------------- ------------- ---------- -------------

At 1st

July 2015 269,123 2,117,888 (5,692,430) 8,619 (7,651) 807,106 21,597 16,127,877 13,652,129 595,387 14,247,516

Profit

for the

period - - - - - - 2,632,839 2,632,839 (38,524) 2,594,315

Comprehensive

income - - - (1,971) 124,263 - - - 122,292 - 122,292

-------------- --------- ----------- ------------- --------- --------- --------- ----------- ------------- ------------- ---------- -------------

Total

comprehensive

income - - - (1,971) 124,263 - - 2,632,839 2,755,131 (38,524) 2,716,607

Transactions

with owners

Forex movement

on NCI

investment - - - - - - - - - 39,813 39,813

Share option

exercise - - 84,659 - - (13,746) - 13,746 84,659 - 84,659

Share

cancellation (1,150) - - - - - 1,150 (375,502) (375,502) - (375,502)

Share-based

payment - - - - - 9,479 - - 9,479 - 9,479

Deferred

tax - - - - - 51,578 - 100 51,678 - 51,678

Current

tax share

opts - - - - - - - 2,516 2,516 - 2,516

Dividends

paid - - - - - - - (3,985,017) (3,985,017) - (3,985,017)

-------------- --------- ----------- ------------- --------- --------- --------- ----------- ------------- ------------- ---------- -------------

Total

transactions

with owners (1,150) - 84,659 - - 47,311 1,150 (4,344,157) (4,212,187) 39,813 (4,172,374)

-------------- --------- ----------- ------------- --------- --------- --------- ----------- ------------- ------------- ---------- -------------

As at

31st December

2015 267,973 2,117,888 (5,607,771) 6,648 116,612 854,417 22,747 14,416,559 12,195,073 596,676 12,791,749

-------------- --------- ----------- ------------- --------- --------- --------- ----------- ------------- ------------- ---------- -------------

Total

attributable

Share Investment Fair Foreign Share Capital to

Share premium in own value exchange option redemption Retained share-

capital account shares reserve reserve reserve reserve earnings holders NCI Total

GBP GBP GBP GBP GBP GBP GBP GBP GBP GBP GBP

-------------- --------- ----------- ------------- -------- --------- --------- ----------- ------------- ------------- ---------- -------------

At 1st

July 2014 269,727 2,060,809 (4,884,025) 6,462 (58,639) 732,651 20,582 15,759,107 13,906,674 518,494 14,425,168

Profit

for the

period - - - - - - 3,161,769 3,161,769 (16,741) 3,145,028

Comprehensive

income - - - 353 55,981 - - - 56,334 - 56,334

-------------- --------- ----------- ------------- -------- --------- --------- ----------- ------------- ------------- ---------- -------------

Total

comprehensive

income - - - 353 55,981 - - 3,161,769 3,218,103 (16,741) 3,201,362

Transactions

with owners

Forex movement

on NCI

investment - - - - - - - - - 45,907 45,907

Share option

exercise 411 57,079 26,495 - - (13,550) - 13,550 83,985 - 83,985

Share

cancellation (1,015) - - - - - 1,015 (325,054) (325,054) - (325,054)

Purchase

of own

shares - - (996,941) - - - - - (996,941) - (996,941)

Share-based

payment - - - - - (19,308) - - (19,308) - (19,308)

Deferred

tax - - - - - 116,412 - 15,471 131,883 - 131,883

Current

tax share

opts options - - - - - - - 28,828 28,828 - 28,828

Dividends

paid - - - - - - - (3,974,788) (3,974,788) - (3,974,788)

-------------- --------- ----------- ------------- -------- --------- --------- ----------- ------------- ------------- ---------- -------------

Total

transactions

with owners (604) 57,079 (970,446) - - 83,554 1,015 (4,241,993) (5,071,395) 45,907 (5,025,488)

-------------- --------- ----------- ------------- -------- --------- --------- ----------- ------------- ------------- ---------- -------------

As at

31st December

2014 269,123 2,117,888 (5,854,471) 6,815 (2,658) 816,205 21,597 14,678,883 12,053,382 547,660 12,601,042

-------------- --------- ----------- ------------- -------- --------- --------- ----------- ------------- ------------- ---------- -------------

Total

attributable

Share Investment Fair Foreign Share Capital to

(MORE TO FOLLOW) Dow Jones Newswires

February 15, 2016 02:00 ET (07:00 GMT)

Share premium in own value exchange option redemption Retained share-

capital account shares reserve reserve reserve reserve earnings holders NCI Total

GBP GBP GBP GBP GBP GBP GBP GBP GBP GBP GBP

-------------- --------- ----------- ------------- -------- --------- --------- ----------- ------------- ------------- --------- -------------

At 1st

July 2014 269,727 2,060,809 (4,884,025) 6,462 (58,639) 732,651 20,582 15,759,107 13,906,674 518,494 14,425,168

Profit

for the

period - - - - - - - 6,577,845 6,577,845 35,821 6,613,666

Comprehensive

income - - - 2,157 50,988 - - - 53,145 - 53,145

-------------- --------- ----------- ------------- -------- --------- --------- ----------- ------------- ------------- --------- -------------

Total

comprehensive

income - - - 2,157 50,988 - - 6,577,845 6,630,990 35,821 6,666,811

Transactions

with owners

Forex movement

on NCI

investment - - - - - - - - - 41,072 41,072

Share option

exercise 411 57,079 188,536 - - (36,358) - 36,358 246,026 - 246,026

Share

cancellation (1,015) - - - - - 1,015 (325,054) (325,054) - (325,054)

Purchase

of own

shares - - (996,941) - - - - - (996,941) - (996,941)

Share-based

payment - - - - - 10,037 - - 10,037 - 10,037

Deferred

tax - - - - - 100,776 - 8,737 109,513 - 109,513

Current

tax share

opts options - - - - - - - 30,711 30,711 - 30,711

Dividends

paid - - - - - - - (5,959,827) (5,959,827) - (5,959,827)

-------------- --------- ----------- ------------- -------- --------- --------- ----------- ------------- ------------- --------- -------------

Total

transactions

with owners (604) 57,079 (808,405) - - 74,455 1,015 (6,209,075) (6,885,535) 41,072 (6,844,463)

-------------- --------- ----------- ------------- -------- --------- --------- ----------- ------------- ------------- --------- -------------

As at

30th June

2015 269,123 2,117,888 (5,692,430) 8,619 (7,651) 807,106 21,597 16,127,877 13,652,129 595,387 14,247,516

-------------- --------- ----------- ------------- -------- --------- --------- ----------- ------------- ------------- --------- -------------

CONSOLIDATED CASH FLOW STATEMENT

FOR THE SIX MONTHS ENDED 31ST DECEMBER 2015

Six months Six months

ended ended

31st Dec 31st Dec 30th June

2015 (unaudited) 2014 2015 (audited)

GBP (unaudited) GBP

GBP

--------------------------- ------------------ ------------ ----------------

Cash flow from operating

activities

Operating profit 3,689,316 4,215,272 8,726,691

Adjustments for:

Depreciation charges 51,028 54,319 125,392

Amortisation of intangible

assets 24,778 22,730 45,460

Share-based payment

charge 9,479 (19,308) 10,037

Translation adjustments (79,804) (147,946) (154,153)

(Profit) on disposal

of fixed assets (50) - -

Cash generated from

operations before

changes

in working capital 3,694,747 4,125,067 8,753,427

Decrease/(increase)

in trade and other

receivables 427,132 (592,765) (873,707)

(Decrease)/increase

in trade and other

payables (597,627) 787,914 1,315,488

Cash generated from

operations 3,524,252 4,320,216 9,195,208

Interest received 22,246 34,072 57,482

Interest paid - - -

Taxation paid (1,123,995) (1,281,553) (2,219,304)

--------------------------- ------------------ ------------ ----------------

Net cash generated

from operating activities 2,422,503 3,072,735 7,033,386

--------------------------- ------------------ ------------ ----------------

Cash flow from investing

activities

Purchase of property

and equipment (72,042) (41,118) (108,136)

Proceeds from sale

of property and equipment 225 - -

Purchase of non-current - - -

financial assets

Proceeds from sale

of non-current financial

assets - - 5,960

Purchase of current

financial assets - (332,088) (328,962)

Proceeds from sale

of current financial

assets - 322,676 329,382

--------------------------- ------------------ ------------ ----------------

Net cash used in

investing activities (71,817) (50,530) (101,756)

--------------------------- ------------------ ------------ ----------------

Cash flow from financing

activities

Proceeds from issue

of ordinary shares - 57,491 57,490

Ordinary dividends

paid (3,985,017) (3,974,788) (5,959,827)

Purchase and cancellation

of own shares (375,502) (325,054) (325,054)

Purchase of own shares

by employee share

option trust - (996,941) (996,941)

Proceeds from sale

of own shares by

employee

share option trust 84,659 26,495 188,536

--------------------------- ------------------ ------------ ----------------

Net cash used in

financing activities (4,275,860) (5,212,797) (7,035,796)

--------------------------- ------------------ ------------ ----------------

Net decrease in cash

and cash equivalents (1,925,174) (2,190,592) (104,166)

--------------------------- ------------------ ------------ ----------------

Cash and cash equivalents

at start of period 10,226,705 10,242,906 10,242,906

Effect of exchange

rate changes 80,749 77,045 87,965

--------------------------- ------------------ ------------ ----------------

Cash and cash equivalents

at end of period 8,382,280 8,129,359 10,226,705

--------------------------- ------------------ ------------ ----------------

NOTES

1 BASIS OF PREPARATION AND SIGNIFICANT ACCOUNTING POLICIES

The financial information contained herein is unaudited and does

not comprise statutory financial information within the meaning of

section 434 of the Companies Act 2006. The information for the year

ended 30th June 2015 has been extracted from the latest published

audited accounts. The report of the independent auditor on those

financial statements contained no qualification or statement under

s498(2) or (3) of the Companies Act 2006.

These interim financial statements have been prepared in

accordance with the Disclosure and Transparency Rules of the

Financial Conduct Authority and IAS 34 "Interim Financial

Reporting" as adopted by the European Union. The accounting

policies are consistent with those set out and applied in the

statutory accounts of the Group for the period ended 30th June

2015, which were prepared in accordance with IFRSs as adopted by

the European Union. In line with current accounting policies the

six months ended 31st December 2014 have been restated to account

for the effects of adopting IFRS10.

2 SEGMENTAL ANALYSIS

(MORE TO FOLLOW) Dow Jones Newswires

February 15, 2016 02:00 ET (07:00 GMT)

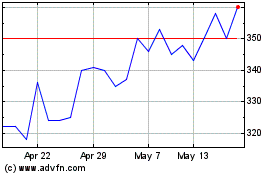

City Of London Investment (LSE:CLIG)

Historical Stock Chart

From Oct 2024 to Nov 2024

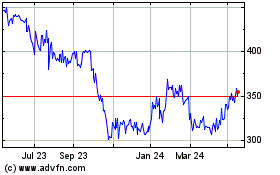

City Of London Investment (LSE:CLIG)

Historical Stock Chart

From Nov 2023 to Nov 2024