TIDMCBOX

RNS Number : 4073I

Cake Box Holdings PLC

26 November 2018

Cake Box Holdings plc

("Cake Box", "the Company" or "the Group")

Unaudited Half Year Results for the six months ended 30

September 2018

Maiden results announced with growth in sales, profits and

dividend

Cake Box Holdings plc, the specialist retailer of fresh cream

cakes, today announces its half year results for the six months

ended 30 September 2018.

Financial Highlights

Half year Half year Change

ended ended

30 September 30 September

18 17

------------- -------

Revenue GBP8.28m GBP5.75m +44%

------------- ------------- -------

Gross profit GBP3.67m GBP2.50m +47%

------------- ------------- -------

EBITDA* GBP2.18m GBP1.63m +34%

------------- ------------- -------

Pre-tax profit GBP1.37m GBP1.47m -7%

------------- ------------- -------

Adjusted Pre-tax profit** GBP1.97m GBP1.47m +34%

------------- ------------- -------

Net cash GBP2.40m GBP1.46m +64%

------------- ------------- -------

Earnings per share 2.85p 3.19p -11%

------------- ------------- -------

Adjusted Earnings per

share** 4.35p 3.19p +36%

------------- ------------- -------

Interim dividend declared 1.20p 1.03p +17%

------------- ------------- -------

* EBITDA is calculated as operating profit before

depreciation

**Calculated after adjusting for AIM listing costs of

GBP599k

-- Group revenue up 44.0% to GBP8.3m (H1 FY18: GBP5.8m)

-- Gross margin improved to 44.3% (H1 FY18: 43.4%)

-- Underling operating cash flow** of GBP1.62 million (H1 FY18: GBP1.33 million)

-- Strong balance sheet with GBP2.40 million cash (H1 FY18: GBP1.46 million)

Operational highlights

-- IPO on AIM successfully completed in June 2018

-- 15 new franchise stores added in the period (H1 FY18: 10 new stores)

-- 101 franchise stores in operation at 30 September 2018

-- Successful launch of new product ranges

Our Franchisee Store highlights

-- Franchisee total turnover up by 29% to GBP14.1 million (H1 FY18: GBP10.9 million)

-- Franchisee online sales up 86% to GBP1.99 million (H1 FY18: GBP1.07 million)

-- Like-for-like sales growth of 4.4% in franchise stores (H1 FY18: 9.0%)

Neil Sachdev, Non-executive Chairman commented:

"I am pleased to report a strong performance since our IPO on

AIM in the summer. These results reflect the robust growth

opportunity presented by our franchisee store roll-out strategy. I

look forward to further progress in the remainder of our financial

year. We celebrate 10 years of Cake Box with our staff and

franchisees in 2019."

Sukh Chamdal, Chief Executive Officer, added:

"It's very exciting to be announcing our first set of results as

a public company. The Cake Box brand has continued to go from

strength to strength and we have made good progress since

floatation with our strategic priorities of growing our store

estate, investing further in our new products and developing our

digital marketing.

Our performance during the first eight weeks of the second half

has been encouraging and we have already opened four new stores.

The Group is well placed for further progress and the Board remains

confident of another successful year of growth."

For further information, please contact:

Cake Box Holdings plc

Sukh Chamdal, CEO

Pardip Dass, CFO +44 (0) 20 8443 1113

Shore Capital (NOMAD and Broker)

Stephane Auton

Patrick Castle

James Thomas +44 (0) 20 7408 4090

MHP Communications (Financial PR)

Oliver Hughes

Simon Hockridge

Charlie Barker

Pete Lambie +44 (0) 20 3128 8570

Operational Review

Results overview

We have delivered a strong trading performance for the half

year, during which we successfully completed our IPO in June. We

continue to build momentum with a record number of new franchise

store openings and an increase in average sales per store.

This has led to significant financial progress for the Group.

Revenue grew by 44% and underlying EBITDA rose by 34%, meaning that

adjusted profit before tax also increased by 34% to GBP1.9m, ahead

of our previous expectations. This was partly a result of an

increase in our gross margin to 44.3% (H1 FY18: 43.4%), driven by

better yield obtained from the new ovens which were installed

earlier this year.

These results demonstrate the continuing appeal of the Cake Box

brand and unique customer offer, combined with the financial

strength of the Group and the strong cash generative nature of our

business model. We have achieved impressive growth in revenues and

profits despite the hot weather which adversely impacted high

street footfall and therefore the like- for-like sales growth of

many stores during the summer months. Despite this impact, our

franchisees achieved like-for-like sales of +4.4% with franchisee

total turnover rising to GBP14.1m for the half year.

Store openings

15 new franchise stores were added during the period, bringing

the total number of stores to 101 at the half year end. Recent

store openings included Bletchley, Northampton and Derby. Our new

stores continue to deliver strong returns and we were particularly

pleased with our 100(th) store in Bletchley near Milton Keynes

which recorded the highest ever first week of sales for a new

store.

This performance further demonstrates our successful business

model through which new stores typically reach a break-even or

profitable contribution to the Group within the first day of trade.

We have a strong pipeline of new franchise stores for the second

half of the year and are on track to open a similar number to that

seen during the first half.

Online

During the year we saw strong growth in franchisee online sales

which were up 86% to GBP1.99 million (H1 FY18: GBP1.07 million).

Online sales are processed centrally through the Group's website

with orders fulfilled through our franchise estate. Franchise

revenue from online sales is included in franchisee turnover

totaling GBP14.1 million (H1 FY18: GBP10.9 million).

Products

We have successfully launched a number of new products to our

range during the period. Of these, the introduction of our caramel

and chocolate cheesecake products have been particularly

well-received by customers. These are individually and expertly

decorated by our in-store designers which create a real buzz with

our customers who are excited by our evolving product range.

New Warehouse

We hope to complete soon on an additional warehouse and

distribution Centre in the north of England which we anticipate

will be in operation in the first half of 2019. As well as acting

as a distribution centre, the intention would be to install some

sponge production capability at the new site which would enable us

to reduce our existing distribution costs and provide a back up to

our production facility in Enfield. It is expected that the entire

funding required for the new warehouse will be generated through

the sale of our investment property, which we hope to complete

during the next few months.

Balance Sheet and Cashflow

We have a strong balance sheet with GBP2.40 million cash as at

30 September 2018 (H1 FY18: GBP1.46 million).

Net cash as at 30 September 2018 was GBP0.8m (H1 FY18: Net debt

GBP0.4m).

Underlying operating cash flow for the period (excluding IPO

costs of GBP599k) was GBP1.62 million dup from GBP1.33 million in

the same period in 2017 despite early payment of 2017/18

corporation tax of GBP400k.

Dividend

As outlined at the time of IPO, the Company has adopted a

progressive dividend policy to reflect the cash flow generation and

earnings of the Group.

Today we are declaring an interim dividend of 1.2 pence per

share. The Company intends that the total dividend for the year

(and future years) will split by one third for the first six months

of the year to two thirds for the year end respectively. The

interim dividend will be paid on 20 December 2018 to those

shareholders on the register at the close of business on 7 December

2018. The ex-dividend date is therefore 6 December 2018.

Outlook

Our performance during the first eight weeks of the second half

has been encouraging and we have already opened four new stores.

The Group is well placed for further progress and the Board remains

confident of another successful year of growth.

Unaudited Consolidated Statement Of Comprehensive Income

For The Six Months Ended 30 September 2018

6 months to 6 months to 12 months to

30 September 30 September 31 March

2018 2017 2018

(unaudited) (unaudited) (audited)

Note GBP GBP GBP

Revenue 8,283,338 5,753,628 12,833,659

Cost of sales (4,616,474) (3,254,911) (7,263,209)

-------------- -------------- -------------

Gross profit 3,666,864 2,498,717 5,570,450

Administrative expenses (1,680,671) (1,087,629) (2,273,128)

Other operating income - 84,000 84,000

-------------- -------------- -------------

Operating profit 1,986,193 1,495,088 3,381,322

Exceptional items 5 (598,645) - -

Net finance costs (18,919) (22,879) (45,672)

-------------- -------------- -------------

Profit before income tax 1,368,629 1,472,209 3,335,650

Income tax expense (228,613) (208,032) (568,053)

-------------- -------------- -------------

PROFIT AFTER INCOME TAX 1,140,016 1,264,177 2,767,597

OTHER COMPREHENSIVE INCOME

FOR THE PERIOD

Movement of deferred tax on

the revaluation of tangible

fixed assets - 12,691 16,790

-------------- -------------- -------------

TOTAL COMPREHENSIVE PROFIT

FOR THE PERIOD 1,140,016 1,276,868 2,784,567

============== ============== =============

EARNINGS PER SHARE

Basic & diluted 6 2.85p 3.19p 6.96p

Unaudited Consolidated Statement Of Financial Position

As At 30 September 2018

30 September 30 September 31 March

2018 2017

(Unaudited) (Unaudited) 2018

(audited)

Note GBP GBP GBP

ASSETS

Non-current assets

Investment property 342,629 342,629 342,629

Property, plant and equipment 3,620,035 3,413,528 3,340,520

Trade and other receivables 130,112 281,565 259,459

------------- ------------- -----------

4,092,776 4,037,722 3,942,608

------------- ------------- -----------

Current assets

Inventories 800,866 663,524 709,212

Trade and other receivables 1,649,810 1,261,327 1,300,636

Cash and cash equivalents 2,401,318 1,459,918 2,505,657

4,851,994 3,384,769 4,515,505

------------- ------------- -----------

TOTAL ASSETS 8,944,770 7,422,491 8,458,113

============= ============= ===========

EQUITY AND LIABILITIES

Share capital and reserves

Issued share capital 6 400,000 160 160

Capital redemption reserve 40 40 40

Revaluation reserve 455,422 451,143 455,422

Retained earnings 4,385,512 3,223,742 4,205,336

------------- ------------- -----------

TOTAL EQUITY 5,240,974 3,675,085 4,660,958

------------- ------------- -----------

Current liabilities

Trade and other payables 1,646,620 1,239,790 1,493,348

Short-term borrowings 176,544 178,095 185,594

Current tax payable 339,591 500,243 519,523

------------- ------------- -----------

2,162,755 1,918,128 2,198,465

Non-current liabilities

Borrowings 1,399,728 1,667,099 1,457,377

Deferred tax liabilities 141,313 162,179 141,313

------------- ------------- -----------

1,541,041 1,829,278 1,598,690

TOTAL LIABILITES 3,703,796 3,747,406 3,797,155

------------- ------------- -----------

TOTAL EQUITY & LIABILITIES 8,944,770 7,422,491 8,458,113

============= ============= ===========

Unaudited Consolidated Statement Of Changes In Equity

For The Six Months Ended 30 September 2018

Share Capital Revaluation Retained Total

capital redemption reserve earnings

reserve

GBP GBP GBP GBP GBP

Balance at 1 April

2017 160 40 438,452 1,959,565 2,398,217

Total comprehensive

income - - - 1,264,177 1,264,177

Deferred tax on revalued

property, plant and

equipment - - 12,691 - 12,691

-------- ----------- ----------- --------- ---------

Balance at 30 September

2017 160 40 451,143 3,223,742 3,675,085

-------- ----------- ----------- --------- ---------

Total comprehensive

income - - - 1,503,420 1,503,420

Deferred tax on revalued

property, plant and

equipment - - 4,279 - 4,279

Dividends paid - - - (521,826) (521,826)

-------- ----------- ----------- --------- ---------

Balance at 31 March

2018 160 40 455,422 4,205,336 4,660,958

-------- ----------- ----------- --------- ---------

Total comprehensive

income - - - 1,140,016 1,140,016

Share bonus issue 399,840 - - (399,840) -

Dividends paid - - - (560,000) (560,000)

-------- ----------- ----------- --------- ---------

Balance at 30 September

2018 400,000 40 455,422 4,385,512 5,240,974

======== =========== =========== ========= =========

Unaudited Consolidated Cash Flow Statement

For The Six Months Ended 30 September 2018

6 months to 6 months to 12 months

to

30 September 30 September 31 March

2018 2017 2018

(unaudited) (unaudited) (audited)

GBP GBP GBP

Cash from operating activities:

Profit before income tax 1,368,629 1,472,209 3,335,650

Adjusted for:

Depreciation 198,381 132,796 318,548

Profit on Disposal - - (5,181)

(Increase)/ decrease in inventories (91,654) (108,126) (153,814)

(Increase)/ decrease in trade

and other receivables (220,134) (347,272) (364,269)

(Decrease)/ increase in trade

and other payables 153,579 167,291 402,110

Finance income (2,542) (51) (1,114)

------------------------- ------------------------- ----------------------

Cash generated by operations 1,406,259 1,316,847 3,531,930

Finance costs 21,461 22,930 46,786

Taxation paid (408,545) (5,214) (362,542)

Net cash inflow

from operating

activities 1,019,175 1,334,563 3,216,174

------------------------- ------------------------- ----------------------

Cash flows from investing activities

Sale of investment properties - - 190,000

Purchase of property, plant

and equipment (477,896) (233,124) (530,688)

Interest received 2,542 51 1,114

Net cash flows

used in

investing

activities (475,354) (233,073) (339,574)

------------------------- ------------------------- ----------------------

Cash flows from financing activities:

Repayment of borrowings (52,606) (61,716) (249,847)

Repayment of finance leases (14,093) (32,627) (28,185)

Dividends paid (560,000) - (521,826)

Interest paid (21,461) (22,930) (46,786)

------------------------- ------------------------- ----------------------

Net cash flows used in financing

activities (648,160) (117,273) (846,644)

Net (decrease)/increase in cash

and cash equivalents (104,339) 984,217 2,029,956

Cash and cash equivalents brought

forward 2,505,657 475,701 475,701

------------------------- ------------------------- ----------------------

Cash and cash equivalents carried

forward 2,401,318 1,459,918 2,505,657

========================= ========================= ======================

For the purposes of the cash flow statement, cash and cash

equivalents comprise the following:

Cash at bank and in hand 2,401,318 1,459,918 2,505,657

Bank overdraft - - -

2,401,318 1,459,918 2,505,657

============== ============ ==========

1. Notes to the Interim Report

Basis of preparation

The consolidated half-yearly financial statements, do not

constitute statutory accounts within the meaning of Section 434 of

the Companies Act 2006. The statutory accounts for the year ended

31 March 2018 have been filed with the Registrar of Companies at

Companies House. The auditor's report on the statutory accounts for

the year ended 31 March 2018 was unqualified and did not contain

any statements under Section 498 (2) or (3) of the Companies Act

2006.

The published financial statements for the year ended 31 March

2018 were prepared in accordance with UK GAAP Financial Reporting

Standard 102. The financial statements for the year ended 31 March

2018 were converted to International Financial Reporting Standards

as adopted for use in the EU ("IFRS") and this conversion of the

historical financial information was included in the AIM Admission

document. There was no material effect from conversion. The

comparative information for the year ended 31 March 2018 presented

in these half-year financial statements has been extracted from the

historical financial information, which was published in the AIM

admission document

The consolidated annual financial statements of Cake Box

Holdings Plc for the year ended 31 March 2019 will be prepared in

accordance with IFRS. Accordingly, these interim financial

statements have been prepared using accounting policies consistent

with those which will be adopted by the Group in the financial

statements for the year ended 31 March 2019 and which were used in

the preparation of the historic financial information for the year

ended 31 March 2018 included in the AIM admission document.

None of the standards, interpretations and amendments effective

for the first time from 1 January 2018, including IFRS 9 and IFRS

15, have had a material effect on the historical financial

information. None of the standards, interpretations and amendments

which are effective for periods beginning after 1 January 2019 and

which have not been adopted early, are expected to have a material

effect on the historical financial information.

The financial information contained in this interim report

should be read in conjunction with the historical financial

information included in the AIM Admission document.

On 27 June 2018, Cake Box Holdings Plc was admitted to the AIM

market of London Stock Exchange Plc.

The consolidated half-yearly financial statements for the six

months to 30 September 2018 have not been audited or reviewed by

auditors, pursuant to the Auditing Practices Board guidance on

Review of Interim Financial Information.

The consolidated half-yearly financial statements have been

prepared under the going concern assumption and historical cost

convention as modified by fair value for investment property and

property, plant and equipment.

Basis of consolidation

The Group consolidated half-yearly financial statements

consolidates the company and its subsidiaries. All intra-group

transactions, balances, income and expenses are eliminated on

consolidation.

2. Changes in accounting policies and disclosures

IFRS 15 'Revenue from Contracts with Customers'

The Group has applied this accounting standard from 1 April 2018

and has adopted the modified retrospective approach to its adoption

which would result in any adjustments for contracts in progress at

1 April 2018 being made to opening retained earnings at that

date.

The Group has considered how franchise fees are recognised in

accordance with IFRS 15 using the 5 step approach set out in that

standard. In undertaking this exercise the Group has not identified

any material changes in how revenue would be recognised for the

contracts in progress at 31 March 2018 nor with those that have

been undertaken in the six months to 30 September 2018.

IFRS 9 'Financial Instruments'

The Group has applied this standard from 1 January 2018 but it

has had no material effect on the Group's financial statements.

IFRS 16 'Leases'

The Group has considered how leases are accounted for in

accordance with IFRS 16 'Leases', including consideration of

transition method. The standard is expected to only affect the

Group in respect of leases that it has in place that are currently

treated as operating leases in accordance with current

standards.

The Group acts as a lessee and lessor but will not be required

to recognise operating leases on the balance sheet when the new

standard is implemented. The leases are expected to fall under the

definition of exemption criteria. Early adoption of this standard

has not been taken.

3. Segment reporting

Components reported to the chief operating decision maker, the

board of directors, are not separately identifiable. The group

makes varied sales to its customers but none are a separately

identifiable component. The following information is disclosed:

6 months 6 months to 12 months

to to

30 September 30 September 31 March

2018

(unaudited) 2017 2018

(unaudited) (audited)

GBP GBP GBP

Sale of goods 6,687,900 4,875,831 10,490,687

Sale of services 1,535,038 833,212 2,248,797

Rental of properties 60,400 44,585 94,175

--------------- --------------- -----------

8,283,338 5,753,628 12,833,659

--------------- --------------- -----------

4. Dividends

6 months 6 months 12 months to

to to 31 March

30 September 30 September 2018

2018 2017

(unaudited) (unaudited) (audited)

GBP GBP GBP

Dividends paid 560,000 - 521,826

============== ============== ===================

5. Exceptional items

6 months 6 months 12 months to

to to 31 March

30 September 30 September 2018

2018 2017

(unaudited) (unaudited) (audited)

GBP GBP GBP

AIM listing costs 598,645 - -

============== ============== ===================

6. Share Capital

6 months 6 months 12 months to

to to 31 March

30 September 30 September 2018

2018 2017

(unaudited) (unaudited) (audited)

GBP GBP GBP

40,000,000 Ordinary shares 400,000 - -

of GBP0.01 each

40,000,000 Ordinary shares

of GBP0.000004 each - 160 160

=============== ============== =============

On 4 June 2018 a bonus issue was made in the proportion of 2,500

shares for every 1 existing Ordinary share held. Immediately after

the bonus issue the 100 billion GBP0.000004 Ordinary shares in

issue were consolidated into 40,000,000 ordinary shares of GBP0.01

each. No amendment to the rights and restrictions as set out in the

Company's articles of association were made.

Earnings per share

The basic earnings per share is calculated by dividing the

earnings attributable to equity shareholders by the weighted

average number of shares in issue. In calculating the diluted

earnings per share, share options outstanding have been taken into

account where the impact of these is dilutive.

6 months 6 months 12 months to

to to 31 March

30 September 30 September 2018

2018 2017

(unaudited) (unaudited) (audited)

GBP GBP GBP

Basic earnings per share 2.85p 3.19p 6.96p

Diluted earnings per share 2.85p 3.19p 6.96p

-------------- -------------- -------------

Excluding exceptional AIM listing costs

Basic earnings per share 4.35p 3.19p 6.96p

Diluted earnings per share 4.35p 3.19p 6.96p

------ ------ ------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR LLFLFLFLEFIT

(END) Dow Jones Newswires

November 26, 2018 02:00 ET (07:00 GMT)

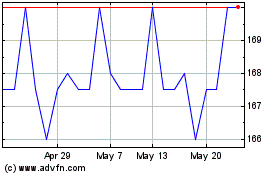

Cake Box (LSE:CBOX)

Historical Stock Chart

From Jun 2024 to Jul 2024

Cake Box (LSE:CBOX)

Historical Stock Chart

From Jul 2023 to Jul 2024