ARCONTECH GROUP

PLC

("Arcontech" or the "Group")

INTERIM RESULTS FOR THE SIX

MONTHS ENDED 31 DECEMBER 2024

Arcontech (AIM: ARC), the provider

of products and services for real-time financial market data

processing and trading, reports

its unaudited results for the six months ended 31

December 2024.

Overview:

- Revenue increased by 4.3% to £1,511,346 (H1 2023:

£1,448,804)

- Recurring revenues represented 97%

of total revenues for the period (H1 2023: 100%)

- Adjusted EBITDA* decreased by 12.1% to £446,513 (H1

2023: £507,668) reflecting the expected increase in staff

costs

(* adjusted ebitda is

defined as operating profit before depreciation, amortisation,

share base payments and releases of historic accruals relating to

administrative expenses)

- Profit before tax decreased by 3.8% to £518,166 (H1

2023: £538,790)

- Our preferred measure of adjusted

profit before tax, which excludes the release of accruals unrelated

to the underlying business, decreased by 7.5% to £494,360 (H1 2023:

£534,775)

- Net

cash of £7,166,839 at 31 December 2024, up 24.9% (H1 2023: £5,734,226). The

period under review saw the return to a normal billing cycle for

one of our large customers, and a record dividend payment of

£501,479 on 1 November 2024

- Trading in line with full year market expectations and

confident in the full year outturn

Geoff Wicks, Chairman of Arcontech, said:

"The improvements to market

conditions we mentioned in our Preliminary Statement last year have

continued and the growth has materialised. We remain cautious as

customers are careful about increasing their costs and lead times

remain long. However, our pipeline is strong and we are confident

about our future and the full year outturn."

Enquiries:

|

Arcontech Group plc

|

020 7256 2300

|

|

Geoff Wicks, Chairman and

Non-Executive Director

|

|

|

Matthew Jeffs, Chief

Executive

|

|

|

|

|

|

Cavendish Capital Markets Ltd (Nomad &

Broker)

|

020 7220 0500

|

|

Carl Holmes/Rory Sale (Corporate Finance)

Harriet Ward (Corporate

Broking)

|

|

|

|

|

To

access more information on the Group please visit:

www.arcontech.com

The interim report will only be

available to view online enabling the Group to communicate in a

more environmentally friendly and cost-effective manner.

Chairman's Statement

Arcontech has seen continued growth

and although market conditions have improved many customers are

cautious about embarking on new projects and increasing their cost

base. As a result our pipeline has improved but lead times remain

long. Our continued focus on our core market has ensured we

continue to build the potential for future growth.

Our expected growth is likely to be

tempered by some downsizing at larger customers as technology and

markets change, however we are confident that new business will

continue to work its way through the pipeline. With the complexity

of markets changing, we have started to see some one-off contracts

for work to change and embed our products into our customers'

systems. It remains a small part of our business.

Revenue was £1.51 million, up 4.3%

on the same period last year, Profit before tax ("PBT") was £0.51

million, down 3.8% on the same period last year. Adjusted profit

before tax, which is PBT before the release of accruals for

administrative costs in respect of prior years was £0.50 million,

down 7.5% on the previous year.

Financing

Our balance sheet remains robust

with net cash of £7.1 million, £1.2 million higher than at 31

December 2023. The cash generation profile for the period

normalised with a return to regular timing of the billing cycle for

a large customer. This cash position allows for continued

investment in sales and products and for us to remain alert to

opportunities to acquire small complementary businesses.

Dividend

No interim dividend is proposed to

be paid in respect of the half year. The Board expects to continue

its policy of paying a dividend following the announcement of its

full year results.

Outlook

The improvements to market

conditions we mentioned in our Preliminary Statement last year have

continued and the growth has materialised. We remain cautious as

customers are careful about increasing their costs and lead times

remain long. However, our pipeline is strong and we are confident

about our future and the full year outturn.

Geoff Wicks

Chairman and Non-Executive Director

GROUP INCOME STATEMENT AND STATEMENT OF COMPREHENSIVE

INCOME

|

|

|

Note

|

Six months ended

31

December

|

|

Six months

ended 31

December

|

|

Year

ended

30

June

|

|

|

|

|

2024

|

|

2023

|

|

2024

|

|

|

|

|

(unaudited)

£

|

|

(unaudited)

£

|

|

(audited)

£

|

|

|

|

|

|

|

|

|

|

|

Revenue

|

|

|

1,511,346

|

|

1,448,804

|

|

2,910,232

|

|

|

|

|

|

|

|

|

|

|

Administrative costs

|

|

|

(1,109,882)

|

|

(1,039,456)

|

|

(2,040,541)

|

|

|

|

|

|

|

|

|

|

|

Operating profit

|

|

4

|

401,464

|

|

409,348

|

|

869,691

|

|

|

|

|

|

|

|

|

|

|

Finance income

|

|

|

139,066

|

|

126,055

|

|

247,903

|

|

|

|

|

|

|

|

|

|

|

Finance costs

|

|

12

|

(22,364)

|

|

3,387

|

|

(18,635)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Profit before taxation

|

|

|

518,166

|

|

538,790

|

|

1,098,959

|

|

|

|

|

|

|

|

|

|

|

Taxation

|

|

6

|

-

|

|

-

|

|

(31,302)

|

|

Profit for the period after tax

|

|

|

518,166

|

|

538,790

|

|

1,067,657

|

|

|

|

|

|

|

|

|

|

|

Total comprehensive income

|

|

|

518,166

|

|

538,790

|

|

1,067,657

|

|

|

|

|

|

|

|

|

|

|

Profit per share (basic)

|

|

|

3.87p

|

|

4.03p

|

|

7.98p

|

|

|

|

|

|

|

|

|

|

|

Adjusted* Profit per share (basic)

|

|

|

3.70p

|

|

4.00p

|

|

7.80p

|

|

|

|

|

|

|

|

|

|

|

Profit per share (diluted)

|

|

|

3.85p

|

|

4.02p

|

|

7.96p

|

|

|

|

|

|

|

|

|

|

|

Adjusted* Profit per share (diluted)

|

|

|

3.68p

|

|

3.99p

|

|

7.78p

|

All of the results relate to

continuing operations and there was no other comprehensive income

in the period.

* Before release of accruals for

administrative costs in respect of prior years.

GROUP BALANCE SHEET

|

|

Note

|

31

December 2024

|

|

31

December 2023

|

|

30

June

2024

|

|

|

|

(unaudited)

£

|

|

(unaudited)

£

|

|

(audited)

£

|

|

Non-current assets

|

|

|

|

|

|

|

|

Goodwill

|

|

1,715,153

|

|

1,715,153

|

|

1,715,153

|

|

Property, plant and

equipment

|

|

10,220

|

|

6,325

|

|

5,404

|

|

Right of use asset

|

12

|

447,279

|

|

559,098

|

|

503,190

|

|

Deferred tax asset

|

|

358,000

|

|

328,000

|

|

358,000

|

|

Trade and other

receivables

|

9

|

141,750

|

|

141,750

|

|

141,750

|

|

|

|

|

|

|

|

|

|

Total non-current assets

|

|

2,672,402

|

|

2,750,326

|

|

2,723,497

|

|

|

|

|

|

|

|

|

|

Current assets

|

|

|

|

|

|

|

|

Trade and other

receivables

|

9

|

821,336

|

|

1,335,408

|

|

677,069

|

|

Cash and cash equivalents

|

|

7,166,839

|

|

5,734,226

|

|

7,160,177

|

|

|

|

|

|

|

|

|

|

Total current assets

|

|

7,988,175

|

|

7,069,634

|

|

7,837,246

|

|

|

|

|

|

|

|

|

|

Current liabilities

|

|

|

|

|

|

|

|

Trade and other payables

|

10

|

(594,088)

|

|

(473,512)

|

|

(595,190)

|

|

Deferred income

|

|

(1,221,194)

|

|

(1,013,405)

|

|

(1,092,835)

|

|

Lease liabilities

|

12

|

(114,893)

|

|

(68,869)

|

|

(110,308)

|

|

Provisions

|

|

-

|

|

(50,000)

|

|

-

|

|

|

|

|

|

|

|

|

|

Total current liabilities

|

|

(1,930,175)

|

|

(1,605,786)

|

|

(1,798,333)

|

|

|

|

|

|

|

|

|

|

Non-current liabilities

|

|

|

|

|

|

|

|

Lease liabilities

|

12

|

(368,748)

|

|

(483,641)

|

|

(427,365)

|

|

Provisions

|

|

(70,000)

|

|

(20,000)

|

|

(70,000)

|

|

|

|

|

|

|

|

|

|

Total non-current

liabilities

|

|

(438,748)

|

|

(503,641)

|

|

(497,365)

|

|

|

|

|

|

|

|

|

|

Net

current assets

|

|

6,058,000

|

|

5,463,848

|

|

6,038,913

|

|

|

|

|

|

|

|

|

|

Net

assets

|

|

8,291,654

|

|

7,710,533

|

|

8,265,045

|

|

Equity

|

|

|

|

|

|

|

|

Share capital

|

|

1,671,601

|

|

1,671,601

|

|

1,671,601

|

|

Share premium account

|

|

115,761

|

|

115,761

|

|

115,761

|

|

Share option reserve

|

|

340,668

|

|

305,101

|

|

330,746

|

|

Retained earnings

|

|

6,163,624

|

|

5,618,070

|

|

6,146,937

|

|

|

|

|

|

|

|

|

|

|

|

8,291,654

|

|

7,710,533

|

|

8,265,045

|

GROUP CASH FLOW

STATEMENT

|

|

|

Note

|

Six months ended

31

December

|

|

Six months

ended 31

December

|

|

Year

ended

30

June

|

|

|

|

|

2024

|

|

2023

|

|

2024

|

|

|

|

|

(unaudited)

£

|

|

(unaudited)

£

|

|

(audited)

£

|

|

Cash

generated from / (used in) operating activities

|

|

11

|

432,237

|

|

(296,937)

|

|

1,051,177

|

|

|

|

|

|

|

|

|

|

|

Tax paid

|

|

6

|

-

|

|

-

|

|

(15,586)

|

|

|

|

|

|

|

|

|

|

|

Net

cash generated from / (used in) operating

activities

|

|

|

432,237

|

|

(296,937)

|

|

1,035,591

|

|

|

|

|

|

|

|

|

|

|

Investing activities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest received

|

|

|

137,775

|

|

126,055

|

|

247,903

|

|

|

|

|

|

|

|

|

|

|

Proceeds on disposal of fixed

assets

|

|

|

-

|

|

417

|

|

417

|

|

Purchases of plant and

equipment

|

|

|

(7,840)

|

|

(3,471)

|

|

(12,055)

|

|

|

|

|

|

|

|

|

|

|

Net

cash generated from investing activities

|

|

|

129,935

|

|

123,001

|

|

236,265

|

|

|

|

|

|

|

|

|

|

|

Financing activities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dividends paid

|

|

|

(501,479)

|

|

(468,048)

|

|

(468,048)

|

|

|

|

|

|

|

|

|

|

|

Payment of lease

liabilities

|

|

|

(54,031)

|

|

(35,031)

|

|

(54,872)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net

cash used in financing activities

|

|

|

(555,510)

|

|

(503,079)

|

|

(522,920)

|

|

Net

increase / (decrease) in cash and cash

equivalents

|

|

|

6,662

|

|

(677,015)

|

|

748,936

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents at

beginning of period

|

|

|

7,160,177

|

|

6,411,241

|

|

6,411,241

|

|

|

|

|

|

|

|

|

|

|

Cash

and cash equivalents at end of period

|

|

|

7,166,839

|

|

5,734,266

|

|

7,160,177

|

GROUP STATEMENT OF CHANGES IN EQUITY

|

|

Share

capital

|

Share

premium

|

Share-option

reserve

|

Retained

earnings

|

Total

|

|

|

£

|

£

|

£

|

£

|

£

|

|

At

1 July 2023

|

1,671,601

|

115,761

|

279,455

|

5,547,328

|

7,614,145

|

|

Profit for the period

|

-

|

-

|

-

|

538,790

|

538,790

|

|

Total comprehensive income for the

period

|

-

|

-

|

-

|

538,790

|

538,790

|

|

Dividends paid

|

-

|

-

|

-

|

(468,048)

|

(468,048)

|

|

Share-based payments

|

-

|

-

|

25,646

|

-

|

25,646

|

|

Total transactions with

owners

|

-

|

-

|

25,646

|

(468,048)

|

(442,402)

|

|

At

31 December 2023

|

1,671,601

|

115,761

|

305,101

|

5,618,070

|

7,710,533

|

|

Profit for the period

|

-

|

-

|

-

|

528,867

|

528,867

|

|

Total comprehensive income for the

period

|

-

|

-

|

-

|

528,867

|

528,867

|

|

Share-based payments

|

-

|

-

|

25,645

|

-

|

25,645

|

|

Total transactions with

owners

|

-

|

-

|

25,645

|

-

|

25,645

|

|

At

30 June 2024

|

1,671,601

|

115,761

|

330,746

|

6,146,937

|

8,265,045

|

|

Profit for the period

|

-

|

-

|

-

|

518,166

|

518,166

|

|

Total comprehensive income for the

period

|

-

|

-

|

-

|

518,166

|

518,166

|

|

Dividends paid

|

-

|

-

|

-

|

(501,479)

|

(501,479)

|

|

Share-based payments

|

-

|

-

|

9,922

|

-

|

9,922

|

|

Total transactions with

owners

|

-

|

-

|

9,922

|

(501,479)

|

(491,557)

|

|

At

31 December 2024

|

1,671,601

|

115,761

|

340,668

|

6,163,624

|

8,291,654

|

NOTES TO THE FINANCIAL INFORMATION

1. The figures for

the six months ended 31 December 2024 and 31 December

2023 are unaudited

and do not constitute statutory accounts. The accounting policies adopted are consistent with those

applied by the Group in the preparation of the annual consolidated

financial statements for the year ended 30 June

2024. The Group has

not early adopted any standard, interpretation or amendment that

has been issued but is not yet effective. Several amendments and

interpretations apply for the first time in the 2025 financial

year, but these do not have a material impact on the interim

condensed consolidated financial statements of the Group.

2. The financial

information for the year ended 30 June 2024 set out in this interim report does

not comprise the Group's statutory accounts as defined in section

434 of the Companies Act 2006. The statutory accounts for the year

ended 30 June 2024,

which were prepared in accordance with

UK-adopted international accounting standards, have been delivered to the Registrar of Companies. The

auditors reported on those accounts; their report was unqualified

and did not contain a statement under either Section 498(2) or

Section 498(3) of the Companies Act 2006 and did not include

references to any matters to which the auditor drew attention by

way of emphasis.

3. Copies of this statement

are available from the Company Secretary at the Company's

registered office at 1st Floor 11-21 Paul Street,

London, EC2A 4JU or from the Company's website at

www.arcontech.com.

4. Operating profit is

stated after release of accruals for administrative expenses in

respect of prior years of £23,806 (31 December

2023:

£4,014; 30 June

2024:

£24,603).

5. Earnings per share

have been calculated based on the profit after tax and the weighted

average number of shares in issue during the half year ended 31

December 2024 of

13,372,811 (31 December 2023: 13,372,811 30 June

2024:

13,372,811).

The number of dilutive shares under

option at 31 December 2024

was 76,017 (31 December 2023: 26,988; 30 June 2024: 31,620). The calculation of

diluted

earnings

per share assumes conversion

of all potentially

dilutive ordinary shares, all of which

arise from share

options. A

calculation is done to determine the number of shares that could

have been acquired at the average market price during the period,

based upon the issue price of the outstanding share options

including future charges to be recognised under the share-based

payment arrangements.

6. Taxation is based on

the unaudited results and provision has been estimated at the rate

applicable to the Company at the time of this statement and

expected to be applied to the total annual earnings. No corporation

tax has been charged in the period as any liability has been offset

against tax losses brought forward from prior years. The tax paid

represents the cash payment of tax liability from the preceding

income tax year.

7. A final dividend in

respect of the year ended 30 June 2024 of 3.75 pence per share

(2023:

3.50 pence per share) was

paid on 1 November 2024.

8. The Directors have

elected not to apply IAS 34 Interim financial reporting.

9. Trade and other receivables

|

|

31 December

2024

£

(unaudited)

|

|

31

December

2023

£

(unaudited)

|

|

30

June

2024

£

(audited)

|

|

Due

within one year:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Trade and other

receivables

|

628,762

|

|

1,137,648

|

|

458,227

|

|

|

|

|

|

|

|

|

Prepayments and accrued

income

|

192,575

|

|

197,760

|

|

218,842

|

|

|

|

|

|

|

|

|

Other receivables

|

-

|

|

-

|

|

-

|

|

|

821,336

|

|

1,335,408

|

|

677,069

|

|

|

31 December

2024

£

(unaudited)

|

|

31

December

2023

£

(unaudited)

|

|

30

June

2024

£

(audited)

|

|

Due

after more than one year:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other receivables

|

141,750

|

|

141,750

|

|

141,750

|

|

|

141,750

|

|

141,750

|

|

141,750

|

The long term trade receivable of

£141,750 is the rental agreement deposit for the Group's Paul

Street office.

10. Trade

and other payables

|

|

31 December

2024

£

(unaudited)

|

|

31

December

2023

£

(unaudited)

|

|

30

June

2024

£

(audited)

|

|

|

|

|

|

|

|

|

Trade payables

|

88,874

|

|

27,055

|

|

61,328

|

|

|

|

|

|

|

|

|

Other tax and social security

payable

|

169,864

|

|

69,714

|

|

106,899

|

|

|

|

|

|

|

|

|

Other payables and

accruals

|

335,350

|

|

376,743

|

|

426,963

|

|

|

594,088

|

|

473,512

|

|

595,190

|

11. Cash generated from

operations

|

|

|

Six months ended

31

December

|

|

Six months

ended 31

December

|

|

Year

ended

30

June

|

|

|

|

|

|

2024

|

|

2023

|

|

2024

|

|

|

|

|

|

(unaudited)

£

|

|

(unaudited)

£

|

|

(audited)

£

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating profit

|

|

401,464

|

|

409,348

|

|

869,691

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation charge

|

|

58,933

|

|

76,688

|

|

134,518

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-cash share option

charges

|

|

9,922

|

|

25,646

|

|

51,291

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Lease interest charge

|

|

(21,569)

|

|

(476)

|

|

(18,435)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other interest charge

|

|

(795)

|

|

(1,141)

|

|

(200)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Profit on disposal of fixed

assets

|

|

-

|

|

(152)

|

|

(151)

|

|

|

|

Increase in trade and other

receivables

|

|

(133,039)

|

|

(990,910)

|

|

(318,958)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Increase in trade and other

payables

|

|

117,321

|

|

184,060

|

|

333,421

|

|

|

|

Cash

generated from / (used in) operations

|

|

432,237

|

|

(296,937)

|

|

1,051,177

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12. Leases

As a lessee, under IFRS 16 the Group

recognises right-of-use assets and lease liabilities for all leases

on its balance sheet. The only lease applicable under IFRS 16 is

the Group's office.

The key impacts on the Statement of

Comprehensive Income and the Statement of Financial Position are as

follows:

|

|

Right of

use asset

£

|

|

Lease

liability

£

|

|

Income

statement

£

|

|

As at 1 July 2024

|

503,190

|

|

(537,672)

|

|

-

|

|

|

|

|

|

|

|

|

Depreciation

|

(55,911)

|

|

-

|

|

(55,910)

|

|

Interest

|

-

|

|

(21,569)

|

|

(21,569)

|

|

Lease payments

|

-

|

|

75,600

|

|

-

|

|

Carrying value at 31 December 2024

|

447,279

|

|

(483,641)

|

|

(77,479)

|

|

|

Right of

use asset

£

|

|

Lease

liability

£

|

|

Income

statement

£

|

|

As at 1 July 2023

|

73,152

|

|

(40,324)

|

|

-

|

|

|

|

|

|

|

|

|

Recognition of new lease under IFRS

16

|

559,803

|

|

(552,220)

|

|

-

|

|

Depreciation

|

(73,857)

|

|

-

|

|

(73,857)

|

|

Liability write-back at

expiry

|

-

|

|

5,293

|

|

5,293

|

|

Interest

|

-

|

|

(765)

|

|

(765)

|

|

Lease payments

|

-

|

|

35,506

|

|

-

|

|

Carrying value at 31 December 2023

|

559,098

|

|

(552,510)

|

|

(69,329)

|

Contractual maturity analysis of lease liabilities as at 31

December 2024

|

|

Less than

3 months

£

|

3 - 12

months

£

|

1 - 5

Years

£

|

Longer

than 5 Years

£

|

Total

£

|

|

Lease liabilities

|

37,800

|

113,400

|

332,441

|

-

|

483,641

|

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact

rns@lseg.com or visit

www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our

Privacy

Policy.

END

IR FIFSAFSIVFIE

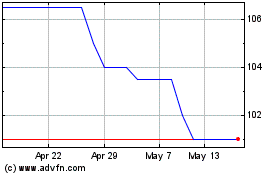

Arcontech (LSE:ARC)

Historical Stock Chart

From Jan 2025 to Feb 2025

Arcontech (LSE:ARC)

Historical Stock Chart

From Feb 2024 to Feb 2025