AEW UK REIT PLC Sale of two industrial assets for GBP16.1m (7976D)

June 26 2023 - 2:00AM

UK Regulatory

TIDMAEWU

RNS Number : 7976D

AEW UK REIT PLC

26 June 2023

26 June 2023

AEW UK REIT Plc

Sale of two industrial assets for GBP16.1m

AEW UK REIT plc (LSE: AEWU) ("AEWU" or the "Company") is pleased

to announce that it has completed on the sale of two industrial

assets, being Euroway Trading Estate, Bradford and Lockwood Court,

Leeds, for combined proceeds of GBP16,100,000. This reflects a

blended net initial yield (NIY) of 6.2% and a weighted average

premium to acquisition price of 31.2%. The prices achieved for the

individual assets are GBP6,450,000 for Euroway Trading Estate,

reflecting a 6.8% NIY, and GBP9,650,000 for Lockwood Court,

reflecting a 5.9% NIY.

Euroway Trading Estate was acquired in November 2016 for

GBP4,950,000, reflecting an 8.1% NIY. At acquisition, the property

benefitted from a new eight-year term certain to Advanced Supply

Chain (BFD) Ltd. In December 2019, the Company completed a rent

review which resulted in a 9.1% annual rental uplift.

Lockwood Court was acquired in February 2019 for GBP7,320,000,

reflecting a 7.7% NIY. The property was acquired with the benefit

of a new 10-year lease to L.W.S. (Yorkshire) Ltd ("L.W.S."),

guaranteed by Harrogate Spring Water. In December 2019, AEWU

secured a new 10-year lease to Harrogate Spring Water, following

L.W.S. entering into liquidation.

Both sales realise significant profit for AEWU's shareholders.

For Euroway Trading Estate and Lockwood Court respectively, their

sales prices exceeded the most recent valuation prior to going

under offer by 17.3% and 9.7%, as well as their acquisition prices

by 30.3% and 31.8%. Reinvestment of the sales proceeds into

comparatively higher yielding pipeline assets will be accretive to

the Company's earnings.

Laura Elkin, Portfolio Manager, AEW UK REIT plc, commented:

"Both Euroway Trading Estate and Lockwood Court have performed

well, delivering strong returns to AEWU shareholders since

acquisition. The value creation through strong performance of the

Yorkshire industrial markets, coupled with our successful asset

management initiatives, presented an opportunity to crystallise

capital growth and reinvest the sales proceeds into higher yielding

opportunities. As such, we expect to make further purchase

announcements in the coming months."

ENDS

Enquiries

AEW UK

Laura Elkin laura.elkin@eu.aew.com

+44(0) 7917 058 337

Henry Butt henry.butt@eu.aew.com

+44(0) 7920 499 076

Nicki Gladstone nicki.gladstone-ext@eu.aew.com

+44(0) 7711 401 021

Company Secretary

Link Company Matters Limited aewu.cosec@linkgroup.co.uk

+44(0) 1392 477 500

TB Cardew AEW@tbcardew.com

Ed Orlebar +44 (0) 7738 724 630

Tania Wild +44 (0) 7425 536 903

Henry Crane +44 (0)7918 207157

Liberum Capital

Darren Vickers / Owen Matthews +44 (0) 20 3100 2000

Notes to Editors

About AEW UK REIT

AEW UK REIT plc (LSE: AEWU) aims to deliver an attractive total

return to shareholders by investing predominantly in smaller

commercial properties (typically less than GBP15 million), on

shorter occupational leases in strong commercial locations across

the United Kingdom. The Company is currently invested in office,

retail, industrial and leisure assets, with a focus on active asset

management, repositioning the properties and improving the quality

of income streams. AEWU is currently paying an annualised dividend

of 8p per share.

The Company was listed on the Official List of the Financial

Conduct Authority and admitted to trading on the Main Market of the

London Stock Exchange on 12 May 2015. www.aewukreit.com

LEI: 21380073LDXHV2LP5K50

About AEW UK Investment Management LLP

AEW is one of the world's largest real estate asset managers,

with EUR84.3bn of assets under management as at 31 March 2023. AEW

has over 880 employees, with its main offices located in Boston,

London, Paris and Hong Kong and offers a wide range of real estate

investment products including comingled funds, separate accounts

and securities mandates across the full spectrum of investment

strategies. AEW represents the real estate asset management

platform of Natixis Investment Managers, one of the largest asset

managers in the world.

As at 31 March 2023, AEW managed EUR39.2bn of real estate assets

in Europe on behalf of a number of funds and separate accounts. AEW

has over 480 employees based in 12 locations across Europe and has

a long track record of successfully implementing core, value-add

and opportunistic investment strategies on behalf of its clients.

In the last five years, AEW has invested and divested a total

volume of over EUR22bn of real estate across European markets.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DISBLGDLUBDDGXX

(END) Dow Jones Newswires

June 26, 2023 02:00 ET (06:00 GMT)

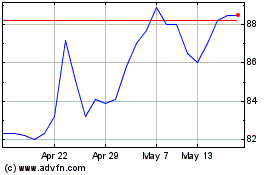

Aew Uk Reit (LSE:AEWU)

Historical Stock Chart

From Jan 2025 to Feb 2025

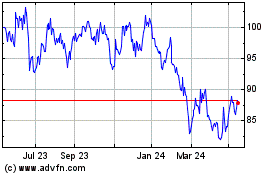

Aew Uk Reit (LSE:AEWU)

Historical Stock Chart

From Feb 2024 to Feb 2025