Music Streamer Pitches An IPO After a Pause -- WSJ

December 04 2018 - 3:02AM

Dow Jones News

By Maureen Farrell and Allison Prang

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (December 4, 2018).

After a two-month pause for market volatility, Tencent Music

Entertainment Group is hitting play again on its plans for an

initial public offering in the U.S.

The China-based music-streaming company, which is poised for one

of the largest U.S.-listed technology IPOs on record by market

valuation, has kicked off its roadshow to sell shares to investors,

according to people familiar with the matter.

In a securities filing Monday, Tencent Music said it would aim

to price its American depositary shares in a range of $13 to $15.

At the midpoint of that range, Tencent Music would be valued at

$22.9 billion on a fully diluted basis, according to Dealogic. That

would make it the largest IPO by market cap to file in the U.S.

since Alibaba Group Holding Ltd. went public in 2014.

Still, Tencent Music's potential valuation is below the $25

billion to $30 billion range it was initially targeting, according

to a person familiar with the deal. Recent market volatility and a

drop in technology stocks led the China-based music-streaming

company to temporarily shelve its IPO, The Wall Street Journal

reported in October. It has now scaled back its ambitions, both in

its valuation and how much stock the company and its shareholders

would sell.

The lower valuation comes as other, similar companies have also

taken a hit. The tech-heavy Nasdaq Composite Index is down 8.2%

over the past three months, and shares of Spotify Technology SA,

another streaming service, have declined 26% over the same time

frame.

Tencent Music's IPO would raise about $1.15 billion at the

midpoint of its range, excluding an underwriters' allotment,

according to the regulatory filing. Based on that midpoint, the

company expects to reap about $544 million in proceeds, and the

rest would go to the selling shareholders.

Still, people familiar with the offering said the company's

overall strength is allowing it to still go public in a market

where many companies have opted to wait.

U.S.-listed IPOs are currently up 9% from their offering price

this year and U.S-listed tech IPOs are up 11%, outperforming

broader market indexes, but IPO performance is still far below

highs from earlier this year. U.S.-listed Chinese IPOs, by

contrast, have struggled and are down 8% this year, according to

Dealogic data.

Tencent Music is offering about 41 million ADS, according to its

filing, and selling shareholders will offer an additional 41

million for which the company won't get proceeds. It filed in

October to go public in the U.S.

The music service was created in mid-2016 after Tencent Holdings

Ltd. bought a controlling stake in China Music Corp. and combined

it with Tencent's existing streaming business. Tencent Music

operates several popular apps, including QQ Music and an online

karaoke platform.

Tencent Music said that in the third quarter of this year it had

more than 800 million unique monthly active users. Its filing

touted its "tremendous growth potential," citing a report that

per-capita spending in China on recorded music is expected to more

than quadruple from 2017 to 2023.

Write to Maureen Farrell at maureen.farrell@wsj.com and Allison

Prang at allison.prang@wsj.com

(END) Dow Jones Newswires

December 04, 2018 02:47 ET (07:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

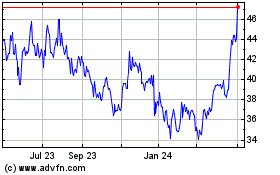

Tencent (PK) (USOTC:TCEHY)

Historical Stock Chart

From Jun 2024 to Jul 2024

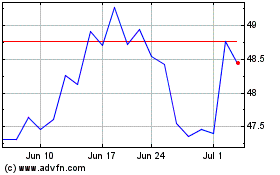

Tencent (PK) (USOTC:TCEHY)

Historical Stock Chart

From Jul 2023 to Jul 2024