false

0000318299

0000318299

2024-02-21

2024-02-21

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20544

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): February 21, 2024

SPARTA

COMMERCIAL SERVICES, INC.

(Exact

name of Company as specified in its charter)

| Nevada |

|

000-09483 |

|

30-0298178 |

| (State

or other jurisdiction |

|

(Commission

|

|

(IRS

Employer |

| of

Incorporation) |

|

File

Number) |

|

Identification

Number) |

555

Fifth Avenue, 14th Floor

New

York, New York 10017

(Address

of principal executive offices)

(212)

239-2666

(Registrant’s

Telephone Number)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (See General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol |

|

Name

of each exchange on which registered |

| Common

stock, $0.01 par value |

|

SRCO |

|

Pink

Open Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ☐

ITEM

3.02 UNREGISTERED SALES OF EQUITY SECURITIES

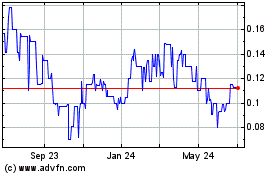

On

February 21, 2024, Sparta Commercial Services, Inc. (the “Company”) granted its CEO, Anthony L Havens and Vice President

of Operations, Sandra L Ahman, five year options to purchase an aggregate of 2,000,000 shares of the Company’s common stock at

$0.14 per share. The options vest in three equal tranches over three years.

On

February 21, 2024, the Company granted to each of its two independent Directors five year options to purchase 200,000 shares of the Company’s

common stock at $0.14 per share. The options vest in three equal tranches over three years. These options represent compensation for

past service on the board.

On

February 21, 2024, five year non-qualified stock options in an aggregate of 290,000 shares of the Company’s common stock

at $0.14 per share were issued by the Company to employees and consultants. The options vest in three equal tranches over three years.

The

stock options granted pursuant to the Stock Option Agreements have five year terms, vest in three equal tranches over three years, and

have an exercise price of $0.14 which was 110% of the closing price of the Company’s common stock for the thirty consecutive trading

days immediately preceding the date of the option (for a day to be included in the calculation, there must have been at least 100 shares

traded on that day). The sales of the above securities were deemed to be exempt from registration under the Securities Act in reliance

on Section 4(a)(2) of the Securities Act as transactions by an issuer not involving any public offering. The recipients of the securities

in each of these transactions represented their intentions to acquire the securities for investment only and not with a view to, or for

sale in connection with, any distribution thereof. All recipients had adequate access, through their relationships with the Company,

to information about the Company.

The

foregoing disclosure of the Stock Option Agreements set forth in this Section 3.02 does not purport to be complete and is qualified in

its entirety by reference to the Stock Option Agreements, which are filed as Exhibits 4.1, 4.2, 4.3, and 4.4 of this Current Report and

incorporated by reference herein.

ITEM

9.01 FINANCIAL STATEMENTS AND EXHIBITS

Pursuant

to the requirements of the Securities Exchange Act of 1934, as amended, the Company has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

| |

|

SPARTA

COMMERCIAL SERVICES, INC. |

| |

|

|

| |

Dated:

February 23, 2024 |

/s/

Anthony L. Havens |

| |

|

Anthony

L. Havens |

| |

|

Chief

Executive Officer |

Exhibit

4.1

SPARTA

COMMERCIAL SERVICES, INC.

STOCK OPTION AGREEMENT

FOR

Anthony

L. Havens

Agreement

1.

Grant of Option. Sparta Commercial Services, Inc., a Nevada corporation (the “Company”), hereby grants, as

of the effective date of this Agreement specified on Schedule I hereof beside the caption “Date of Grant” (“Date

of Grant”), to Anthony L. Havens (the “Optionee”) an option (the “Option”) to purchase an aggregate number of

shares set forth on Schedule I hereof beside the caption “Number of Optioned Shares” (such number being subject to

adjustment as provided below) of the Company’s common stock, $0.001 par value per share (the “Shares”), at an exercise

price per share set forth on Schedule I hereof beside the caption “Exercise Price” (such exercise price being subject

to adjustment as provided below) (the “Exercise Price”). The Option shall be subject to the terms and conditions set forth

herein. This Option is designated on Schedule I as either an Incentive Stock Option or a Non-Qualified Stock Option.

2.

Definitions.

(a)

“Affiliate” means a corporation or

other entity that, directly or through one or more intermediaries, controls, is controlled by or is under common control with, the Company.

(b)

“Applicable Laws” means the requirements

related to or implicated by the applicable state corporate law, United States federal and state securities laws, the Code, any stock

exchange or quotation system on which the shares of Common Stock are listed or quoted, and the applicable laws of any foreign country

or jurisdiction where Awards are granted under.

(c)

“Award” means any right granted under

this Agreement, including an Incentive Stock Option or a Non-qualified Stock Option.

(d)

“Beneficial Owner” has the meaning

assigned to such term in Rule 13d-3 and Rule 13d-5 under the Exchange Act, except that in calculating the beneficial ownership of any

particular Person, such Person shall be deemed to have beneficial ownership of all securities that such Person has the right to acquire

by conversion or exercise of other securities, whether such right is currently exercisable or is exercisable only after the passage of

time. The terms “Beneficially Owns” and “Beneficially Owned” have a corresponding meaning.

(e)

“Board” means the Board of Directors

of the Company, as constituted at any time.

(f)

“Change in Control” means:

(i)

the direct or indirect sale, transfer, conveyance or

other disposition (other than by way of merger or consolidation), in one or a series of related transactions, of all or substantially

all of the properties or assets of the Company and its subsidiaries, taken as a whole, to any Person that is not a subsidiary of the

Company;

(ii)

a majority of the members of the Board are replaced

during any twelve-month period by directors whose appointment or election is not endorsed by a majority of the Board before the date

of appointment or election;

(iii)

the date which is 10 business days prior to the consummation

of a complete liquidation or dissolution of the Company;

(iv)

the acquisition by any Person of Beneficial Ownership

of 50% or more (on a fully diluted basis) of either (a) the then outstanding shares of Common Stock of the Company, taking into account

as outstanding for this purpose such Common Stock issuable upon the exercise of options or warrants, the conversion of convertible stock

or debt, and the exercise of any similar right to acquire such Common Stock (the “Outstanding Company Common Stock”) or (b)

the combined voting power of the then outstanding voting securities of the Company entitled to vote generally in the election of directors

(the “Outstanding Company Voting Securities”); provided, however, that for purposes of this Agreement, the

following acquisitions shall not constitute a Change in Control: (1) any acquisition by the Company or any Affiliate, (2) any acquisition

by any employee benefit plan sponsored or maintained by the Company or any subsidiary, (3) any acquisition which complies with clauses,

(a), (b) and (c) of subsection (v) of this definition or (4) in respect of an Award held by a particular Participant, any acquisition

by the Participant or any group of persons including the Participant (or any entity controlled by the Participant or any group of persons

including the Participant); or

(v)

the consummation of a reorganization, merger, consolidation,

statutory share exchange or similar form of corporate transaction involving the Company that requires the approval of the Company’s

shareholders, whether for such transaction or the issuance of securities in the transaction (a “Business Combination”), unless

immediately following such Business Combination: (a) more than 50% of the total voting power of (A) the entity resulting from such Business

Combination (the “Surviving Company”), or (B) if applicable, the ultimate parent entity that directly or indirectly has beneficial

ownership of sufficient voting securities eligible to elect a majority of the members of the board of directors (or the analogous governing

body) of the Surviving Company (the “Parent Company”), is represented by the Outstanding Company Voting Securities that were

outstanding immediately prior to such Business Combination (or, if applicable, is represented by shares into which the Outstanding Company

Voting Securities were converted pursuant to such Business Combination), and such voting power among the holders thereof is in substantially

the same proportion as the voting power of the Outstanding Company Voting Securities among the holders thereof immediately prior to the

Business Combination; (b) no Person (other than any employee benefit plan sponsored or maintained by the Surviving Company or the Parent

Company) is or becomes the Beneficial Owner, directly or indirectly, of 50% or more of the total voting power of the outstanding voting

securities eligible to elect members of the board of directors of the Parent Company (or the analogous governing body) (or, if there

is no Parent Company, the Surviving Company); and (c) at least a majority of the members of the board of directors (or the analogous

governing body) of the Parent Company (or, if there is no Parent Company, the Surviving Company) following the consummation of the Business

Combination were Board members at the time of the Board’s approval of the execution of the initial agreement providing for such

Business Combination.

(g)

“Code” means the Internal Revenue

Code of 1986, as it may be amended from time to time. Any reference to a section of the Code shall be deemed to include a reference to

any regulations promulgated thereunder.

(h)

“Common Stock” means common stock,

$0.001 par value per share, of the Company, or such other securities of the Company as may be designated by the Company from time to

time in substitution thereof.

(i)

“Consultant” means any individual

or entity which performs bona fide services to the Company or an Affiliate, other than as an Employee or Director, and who may be offered

securities registrable pursuant to a registration statement on Form S-8 under the Securities Act.

(j)

“Continuous Service” means that the

Participant’s service with the Company or an Affiliate, whether as an Employee, consultant or Director, is not interrupted or terminated.

The Participant’s Continuous Service shall not be deemed to have terminated merely because of a change in the capacity in which

the Participant renders service to the Company or an Affiliate as an Employee, Consultant or Director or a change in the entity for which

the Participant renders such service, provided that there is no interruption or termination of the Participant’s Continuous

Service; provided further that if any Award is subject to Section 409A of the Code, this sentence shall only be given effect to

the extent consistent with Section 409A of the Code. For example, a change in status from an Employee of the Company to a Director of

an Affiliate will not constitute an interruption of Continuous Service. The Company or its delegate, in its sole discretion, may determine

whether Continuous Service shall be considered interrupted in the case of any leave of absence approved by that party, including sick

leave, military leave or any other personal or family leave of absence. The Company or its delegate, in its sole discretion, may determine

whether a Company transaction, such as a sale or spin-off of a division or subsidiary that employs a Participant, shall be deemed to

result in a termination of Continuous Service for purposes of affected Awards, and such decision shall be final, conclusive and binding.

(k)

“Director” means a member of the

Board.

(l)

“Effective Date” shall mean the date

as of which this Agreement is adopted by the Board.

(m)

“Employee” means any person, including

an Officer or Director, employed by the Company or an Affiliate; provided that for purposes of determining eligibility to receive

Incentive Stock Options, an Employee shall mean an employee of the Company or a parent or subsidiary corporation within the meaning of

Section 424 of the Code. Mere service as a Director or payment of a Director’s fee by the Company or an Affiliate shall not be

sufficient to constitute “employment” by the Company or an Affiliate.

(n)

“Exchange Act” means the Securities

Exchange Act of 1934, as amended.

(o)

“Disability” means that the Participant

is unable to engage in any substantial gainful activity by reason of any medically determinable physical or mental impairment; provided,

however, for purposes of determining the term of an Incentive Stock Option, the term Disability shall have the meaning ascribed to

it under Section 22(e)(3) of the Code. The determination of whether an individual has a Disability shall be determined under procedures

established by the Company. Except in situations where the Company is determining Disability for purposes of the term of an Incentive

Stock Option within the meaning of Section 22(e)(3) of the Code, the Company may rely on any determination that a Participant is disabled

for purposes of benefits under any long-term disability plan maintained by the Company or any Affiliate in which a Participant participates.

(p)

“Fair Market Value” means, as of

any date, the value of the Common Stock as determined below. If the Common Stock is listed on any established stock exchange or a national

market, including without limitation, the New York Stock Exchange or the Nasdaq Stock Market, the Fair Market Value shall be the weighted

average closing price as quoted on such exchange or system for the thirty consecutive trading days immediately preceding the date of

the option (for a day to be included in the calculation, there must have been at least 100 shares traded on that day). In the absence

of an established market for the Common Stock, the Fair Market Value shall be determined in good faith by the Company and such determination

shall be conclusive and binding on all persons.

(q)

“Incentive Stock Option” means an

Option that is designated by the Company as an incentive stock option within the meaning of Section 422 of the Code and that meets the

requirements set out in this Agreement, if applicable.

(r)

“Incumbent Directors” means individuals

who, on the Effective Date, constitute the Board; provided that any individual becoming a Director subsequent to the Effective

Date whose election or nomination for election to the Board was approved by a vote of at least two-thirds of the Incumbent Directors

then on the Board (either by a specific vote or by approval of the proxy statement of the Company in which such person is named as a

nominee for Director without objection to such nomination) shall be an Incumbent Director. No individual initially elected or nominated

as a director of the Company as a result of an actual or threatened election contest with respect to Directors or as a result of any

other actual or threatened solicitation of proxies by or on behalf of any person other than the Board shall be an Incumbent Director.

(s)

“Non-employee Director” means a Director

who is a “non-employee director” within meaning of Rule 16b-3.

(t)

“Non-qualified Stock Option” means

an Option that by its terms does not qualify or is not intended to qualify as an Incentive Stock Option.

(u)

“Officer” means a person who is an

officer of the Company within the meaning of Section 16 of the Exchange Act and the rules and regulations promulgated thereunder.

(v)

“Participant” means an eligible person

to whom an Award is granted pursuant to this Agreement or, if applicable, such other person who holds an outstanding Award.

(w)

“Person” means a person defined in

Section 13(d)(3) of the Exchange Act.

(x)

“Rule 16b-3” means Rule 16b-3 promulgated

under the Exchange Act or any successor to Rule 16b-3, as in effect from time to time.

(y)

“Securities Act” means the Securities

Act of 1933, as amended.

3.

Exercise Schedule. Except as otherwise provided in Sections 6 or 10 of this Agreement, the Option is exercisable

in installments as specified on Schedule I hereof beside the caption “Vesting”, which shall be cumulative. To the

extent that the Option has become exercisable with respect to a percentage of Shares as provided on Schedule I hereof beside the

caption “Vesting” on each date (each date being, a “Vesting Date”) upon which the Optionee shall be entitled

to exercise the Option with respect to the percentage of Shares granted as indicated for each Vesting Date (provided that the Continuous

Service of the Optionee continues through and on the applicable Vesting Date), the Option may thereafter be exercised by the Optionee,

in whole or in part, at any time or from time to time prior to the expiration of the Option as provided herein. Except as otherwise specifically

provided herein, there shall be no proportionate or partial vesting in the periods prior to each Vesting Date, and all vesting shall

occur only on the appropriate Vesting Date. Upon the termination of the Optionee’ s Continuous Service, any unvested portion of

the Option shall terminate and be null and void.

4.

Method of Exercise. The vested portion of this Option shall be exercisable in whole or in part, in accordance with the

Vesting of such Options provided in Schedule I and as set forth in Section 3 hereof, by written notice which shall state

the election to exercise the Option, the number of Shares in respect of which the Option is being exercised, and such other representations

and agreements as to the holder’s investment intent with respect to such Shares as may be required by the Company pursuant to the

provisions of this Agreement. Such written notice shall be signed by the Optionee or if someone other than the Optionee exercises the

Option, by such other person who provides documentation acceptable to the Company, or Committee, verifying that such person has the legal

right to exercise such Option, and shall be delivered in person or by certified mail to the Secretary of the Company. The written notice

shall be accompanied by payment of the Exercise Price. This Option shall be deemed to be exercised after both (a) receipt by the Company

of such written notice accompanied by the Exercise Price and (b) arrangements that are satisfactory to the Committee, in its sole discretion,

have been made for Optionee’ s payment to the Company of the amount, if any, that is necessary to be withheld in accordance with

applicable Federal or state withholding requirements. No Shares shall be issued pursuant to the Option unless and until such issuance

and such exercise shall comply with all relevant provisions of applicable law, including the requirements of any stock exchange upon

which the Shares then may be traded.

5.

Method of Payment. Payment of the Exercise Price shall be by any of the following, or a combination thereof, at the election

of the Optionee:

(a)

in cash or by certified or bank check at the time the

Option is exercised;

(b)

to the extent permitted by the Committee, or as provided

on Schedule I hereof beside the caption “Permission to Pay with Shares”, and if there is a public market available

for the Shares at the time of such exercise: (i) with Shares owned by the Optionee, duly endorsed for transfer to the Company, with a

fair market value on the date of delivery equal to the Exercise Price (or portion thereof) due for the number of shares being acquired;

(ii) by withholding or reducing the number of Shares otherwise deliverable to the Optionee upon exercise of such Option by a number of

Shares with an aggregate fair market value equal to the aggregate Exercise Price at the time of exercise; or (iii) pursuant to a “cashless

exercise” procedure established with a broker; provided that such payment by this method requires delivery of a properly

executed exercise notice together with such other documentation, and subject to such guidelines, as the Committee or Company shall require

to effect an exercise of the Option and delivery to the Company by a licensed broker acceptable to the Company of proceeds from the sale

of Shares sufficient to pay the Exercise Price and any applicable income or employment taxes; provided further that the Optionee

shall provide irrevocable written instructions (x) to such designated brokerage firm to effect the immediate sale of a portion of the

purchased Shares and remit to the Company, out of the sale proceeds available on the settlement date, an amount sufficient to cover the

aggregate Exercise Price payable for the purchased Shares plus all applicable state and federal income and employment taxes required

to be withheld by the Company by reason of such purchase and/or sale and (y) to the Company to deliver the certificates for the purchase

Shares directly to such brokerage firm to effect the sale transaction; or

(c)

in any other consideration or in such other manner as

may be determined by the Committee, in its absolute discretion.

Notwithstanding

anything contained herein to the contrary, no exercise shall become effective until the Company determines that the issuance and delivery

of the Shares pursuant to such exercise is in compliance with all applicable laws, regulations and requirements of any securities exchange

on which the Shares may be traded.

6.

Termination of Option

(a)

General. Any unexercised portion of the

Option shall automatically and without notice terminate and become null and void at the fifth anniversary of the date as of which the

Option is granted (or, if a different date is shown on Schedule I hereof beside the caption “Termination Date”, such

date).

(b)

Cancellation. To the extent not previously

exercised:

(i)

the Option shall terminate immediately in the event

of (a) the liquidation or dissolution of the Company, or (b) any reorganization, merger, consolidation or other form of corporate transaction

in which the Company does not survive or the Shares are exchanged for or converted into securities issued by another entity, or an affiliate

of such successor or acquiring entity, unless the successor or acquiring entity, or an Affiliate thereof, assumes the Option or substitutes

an equivalent option or right; and

(ii)

the Committee in its sole discretion may by written

notice cancel (“cancellation notice”), effective upon the consummation of any transaction that constitutes a Change in Control,

the Option (or portion thereof) that remains unexercised on such date.

The

Committee shall give written notice of any proposed transaction referred to in this Section 6(b) a reasonable period of time prior

to the closing date for such transaction (which notice may be given either before or after approval of such transaction), in order that

the Optionee may have a reasonable period of time prior to the closing date of such transaction within which to exercise the Option if

and to the extent that it then is exercisable (including any portion of the Option that may become exercisable upon the closing date

of such transaction). The Optionee may condition their exercise of the Option upon the consummation of a transaction referred to in this

Section 6(b).

7.

Transferability. Unless (i) transfers are expressly permitted in the language appearing beside the caption “Expanded

Rights to Transfer Option” on Schedule I hereof or (ii) otherwise determined by the Company or Committee, the Option granted

hereby is not transferable otherwise than by will or under the applicable laws of descent and distribution, and during the lifetime of

the Optionee the Option shall be exercisable only by the Optionee, or the Optionee’ s guardian or legal representative. In addition,

the Option shall not be assigned, negotiated, pledged or hypothecated in any way (whether by operation of law or otherwise), and the

Option shall not be subject to execution, attachment or similar process. Upon any attempt to transfer, assign, negotiate, pledge or hypothecate

the Option, or in the event of any levy upon the Option by reason of any execution, attachment or similar process contrary to the provisions

hereof, the Option shall immediately become null and void. The terms of this Option shall be binding upon the executors, administrators,

heirs, successors and assigns of the Optionee.

8.

No Rights of Stockholders. Neither the Optionee nor any personal representative (or beneficiary) shall be, or shall have

any of the rights and privileges of, a stockholder of the Company with respect to any Shares purchasable or issuable upon the exercise

of the Option, in whole or in part, prior to the date on which the Shares are issued.

9.

Acceleration of Exercisability of Option.

(a)

Acceleration Upon Certain Terminations or Cancellations

of Option. This Option shall become immediately fully exercisable in the event that, prior to the termination of the Option pursuant

to Section 6 hereof, (i) the Option is terminated pursuant to Section 6(b)(i) hereof, or (ii) the Company exercises its

discretion to provide a cancellation notice with respect to the Option pursuant to Section 6(b)(ii) hereof.

(b)

Acceleration Upon Change in Control. This Option

shall become immediately fully exercisable in the event that, prior to the termination of the Option pursuant to Section 6 hereof,

and during the Optionee’ s Continuous Service, there is a Change in Control.

10.

No Right to Continuous Service. Neither the Option nor this Agreement shall confer upon the Optionee any right to Continuous

Service with the Company or any Affiliate in the capacity in effect at the time the Award was granted or shall affect the right of the

Company or an Affiliate to terminate (a) the employment of an Employee with or without notice and with or without Cause or (b) the service

of a Director pursuant to the By-laws of the Company or an Affiliate, and any applicable provisions of the corporate law of the state

in which the Company or the Affiliate is incorporated, as the case may be.

11.

Information Confidential. As partial consideration for the granting of the Option, the Optionee agrees with the Company

to keep confidential all information and knowledge that the Optionee has relating to the manner and amount of the Optionee’ s participation;

provided, however, that such information may be disclosed as required by law and may be given in confidence to the Optionee’

s spouse, the Optionee’ s tax and financial advisors, or financial institutions to the extent that such information is necessary

to secure a loan.

12.

Notices. All notices, requests, demands, and other communications hereunder shall be in writing and shall be personally

delivered, delivered by facsimile or courier service, or mailed, certified with first class postage prepaid to the address specified

by the person who is to receive the same. Each such notice, request, demand, or other communication hereunder shall be deemed to have

been given (whether actually received or not) on the date of actual delivery thereof, if personally delivered or delivered by facsimile

transmission (if receipt is confirmed at the time of such transmission by telephone or facsimile-machine-generated confirmation), or

on the third day following the date of mailing, if mailed in accordance with this Section, or on the day specified for delivery to the

courier service (if such day is one on which the courier service will give normal assurances that such specified delivery will be made).

Any notice, request, demand, or other communication given otherwise than in accordance with this Section shall be deemed to have been

given on the date actually received. Each such notice, request, demand, or other communication hereunder shall be addressed, in the case

of the Company, to the Company’s Secretary at Sparta Commercial Services, Inc. 555 Fifth Avenue, 14th Floor, New York,

NY 10017, or if the Company should move its principal office, to such principal office, and, in the case of the Optionee, to the Optionee’

s last permanent address as shown on the Company’s records, subject to the right of either party to designate some other address

at any time hereafter in a notice satisfying the requirements of this Section. Any person entitled to any notice, request, demand, or

other communication hereunder may waive the notice, request, demand, or other communication.

13.

Section 409A.

(a)

It is intended that the Option awarded pursuant to this

Agreement be exempt from Section 409A of the Code (“Section 409A”) because it is believed that (i) the Exercise Price may

never be less than the Fair Market Value of a Share on the Date of Grant and the number of Shares subject to the Option is fixed on the

original Date of Grant, (ii) the transfer or exercise of the Option is subject to taxation under Section 83 of the Code and Treas. Reg.

1.83-7, and (iii) the Option does not include any feature for the deferral of compensation other than the deferral of recognition of

income until the exercise of the Option. The provisions of this Agreement shall be interpreted in a manner consistent with this intention,

and the provisions of this Agreement may not be amended, adjusted, assumed or substituted for, converted or otherwise modified without

the Optionee’ s prior written consent if and to the extent that the Company believes or reasonably should believe that such amendment,

adjustment, assumption or substitution, conversion or modification would cause the Award to violate the requirements of Section 409A.

In the event that either the Company or the Optionee believes, at any time, that any benefit or right under this Agreement is subject

to Section 409A, then the Committee may (acting alone and without any required consent of the Optionee) amend this Agreement in such

manner as the Committee deems necessary or appropriate to be exempt from or otherwise comply with the requirements of Section 409A (including

without limitation, amending the Agreement to increase the Exercise Price to such amount as may be required in order for the Option to

be exempt from Section 409A).

(b)

Notwithstanding the foregoing, the Company does not

make any representation to the Optionee that the Option awarded pursuant to this Agreement is exempt from, or satisfies, the requirements

of Section 409A, and the Company shall have no liability or other obligation to indemnify or hold harmless the Optionee or any Beneficiary

for any tax, additional tax, interest or penalties that the Optionee or any Beneficiary may incur in the event that any provision of

this Agreement, or any amendment or modification thereof or any other action taken with respect thereto, that either is consented to

by the Optionee or that the Company reasonably believes should not result in a violation of Section 409A, is deemed to violate any of

the requirements of Section 409A.

14.

Incentive Stock Option Treatment. If designated on Schedule I hereof as an Incentive Stock Option: (a) the terms

of this Option shall be interpreted in a manner consistent with the intent of the Company and the Optionee that the Option qualify as

an Incentive Stock Option under Section 422 of the Code; (b) if any provision of the this Agreement shall be impermissible in order for

the Option to qualify as an Incentive Stock Option, then the Option shall be construed and enforced as if such provision had never been

included in the Option; and (c) if and to the extent that the number of Options granted pursuant to this Agreement exceeds the limitations

contained in Section 422 of the Code on the value of Shares with respect to which this Option may qualify as an Incentive Stock Option,

this Option shall be a Non-Qualified Stock Option. If designated on Schedule I hereof as an Incentive Stock Option, this Option

is intended to qualify as an Incentive Stock Option as defined in Section 422 of the Code, and this Agreement shall be interpreted accordingly.

Notwithstanding the foregoing, the Company shall have no liability to the Optionee, any Option Holder or any other person if the Option

designated as an Incentive Stock Option fails to qualify as such at any time or if an Option is determined to constitute “nonqualified

deferred compensation” within the meaning of Section 409A of the Code and the terms of such Option do not satisfy the requirements

of Section 409A of the Code.

15.

Optionee Representations.

(a)

Entirely for Own Account. This Agreement is made

with the Optionee in reliance upon the Optionee’ s representation to the Company, which by the Optionee’ s execution of this

Agreement, the Optionee hereby confirms, that the Common Stock to be acquired by the Optionee will be acquired for investment for the

Optionee’ s own account, not as a nominee or agent, and not with a view to the resale or distribution of any part thereof, and

that the Optionee has no present intention of selling, granting any participation in, or otherwise distributing the same. By executing

this Agreement, the Optionee further represents that the Optionee does not presently have any contract, undertaking, agreement or arrangement

with any Person to sell, transfer or grant participations to such Person or to any third Person, with respect to any of the Shares. The

Optionee has not been formed for the specific purpose of acquiring the Shares.

(b) Disclosure

of Information. The Optionee has had an opportunity to discuss the Company’s business, management, financial affairs and the

terms and conditions of the issuance of the shares with the Company’s management and has had an opportunity to review the Company’s

facilities.

(d)

Legends. The Optionee understands that the Shares

and any securities issued in respect of or exchange for the Shares, may be notated with any legend required by the securities laws of

any state to the extent such laws are applicable to the Shares represented by the certificate, instrument, or book entry so legended.

(e)

Accredited Investors. The Optionee is an accredited

investor as defined in Rule 501(a) of Regulation D promulgated under the Securities Act.

(f)

Foreign Investors. If the Optionee is not a United

States person (as defined by Section 7701(a)(30) of the Code), the Optionee hereby represents that it has satisfied itself as to the

full observance of the laws of its jurisdiction in connection with any invitation to subscribe for the Shares or any use of this Agreement,

including (i) the legal requirements within its jurisdiction for the purchase of the Shares, (ii) any foreign exchange restrictions applicable

to such purchase, (iii) any governmental or other consents that may need to be obtained, and (iv) the income tax and other tax consequences,

if any, that may be relevant to the purchase, holding, redemption, sale, or transfer of the Shares. The Optionee’ s subscription

and payment for and continued beneficial ownership of the Shares will not violate any applicable securities or other laws of the Optionee’

s jurisdiction.

16.

Section Headings. The Section headings contained in this Agreement are for reference purposes only and shall not affect

in any way the meaning or interpretation of this Agreement.

17.

Use of Proceeds from Stock. Proceeds from the sale of Common Stock pursuant to Awards, or upon exercise thereof, shall

constitute general funds of the Company.

18.

Adjustments Upon Changes in Stock. In the event of changes in the outstanding Common Stock or in the capital structure

of the Company by reason of any stock or extraordinary cash dividend, stock split, reverse stock split, an extraordinary corporate transaction

such as any recapitalization, reorganization, merger, consolidation, combination, exchange, or other relevant change in capitalization

occurring after the Grant Date of any Award, Awards granted under the any Award Agreements, the exercise price of Options, the maximum

number of shares of Common Stock subject to all Awards will be equitably adjusted or substituted, as to the number, price or kind of

a share of Common Stock or other consideration subject to such Awards to the extent necessary to preserve the economic intent of such

Award. In the case of adjustments made pursuant to this Section 19, unless the Company or Committee, as applicable, specifically

determines that such adjustment is in the best interests of the Company or its Affiliates, the Company or Committee, as applicable, shall,

in the case of Incentive Stock Options, ensure that any adjustments under this Section 19 will not constitute a modification,

extension or renewal of the Incentive Stock Options within the meaning of Section 424(h)(3) of the Code and in the case of Non-qualified

Stock Options, ensure that any adjustments under this Section 19 will not constitute a modification of such Non-qualified Stock

Options within the meaning of Section 409A of the Code. Any adjustments made under this Section 19 shall be made in a manner which

does not adversely affect the exemption provided pursuant to Rule 16b-3 under the Exchange Act. The Company shall give each Participant

notice of an adjustment hereunder and, upon notice, such adjustment shall be conclusive and binding for all purposes.

19.

No Fractional Shares. No fractional shares of Common Stock shall be issued or delivered pursuant to this Agreement. The

Company or Committee, as applicable, shall determine whether cash, additional Awards or other securities or property shall be issued

or paid in lieu of fractional shares of Common Stock or whether any fractional shares should be rounded, forfeited or otherwise eliminated.

20.

Governing Law and Venue. THIS AGREEMENT SHALL AND CONSTRUED IN ACCORDANCE WITH THE LAWS OF THE STATE OF NEW YORK WITHOUT

GIVING EFFECT TO ANY CHOICE OR CONFLICT OF LAW PROVISION OR RULE (WHETHER OF THE STATE OF NEVADA OR ANY OTHER JURISDICTION) THAT WOULD

CAUSE THE APPLICATION OF THE LAWS OF ANY JURISDICTION OTHER THAN THE STATE OF NEW YORK. EACH PARTY HEREBY IRREVOCABLY SUBMITS TO THE

PERSONAL JURISDICTION OF THE COURTS LOCATED IN THE STATE OF NEW YORK AND AGREES THAT ANY LITIGATION BETWEEN THE PARTIES WILL BE FILED

IN COURTS LOCATED IN NEW YORK, NEW YORK.

21.

Arbitration. By execution hereof, the parties hereto expressly agree that upon the request of any party, whether made before

or after the institution of any legal proceeding, any action, dispute, claim or controversy of any kind, whether in contract or in tort,

statutory or common law, legal or equitable, arising between the parties in any way arising out of any of the provisions contained in

this Agreement shall be resolved by binding arbitration administered by the American Arbitration Association (the “AAA”)

and in New York, NY. Such arbitration shall be conducted in accordance with the Commercial Arbitration Rules of the AAA and, to the maximum

extent applicable, the Federal Arbitration Act (Title 9 of the United States Code) except as otherwise specified herein. Judgment upon

the award rendered by the arbitrator may be entered in any court having competent jurisdiction. The arbitrator shall resolve all disputes

in accordance with the applicable substantive law. A single arbitrator shall be chosen and shall decide the dispute, unless the amount

sought in the dispute exceeds $100,000, in which case a panel of three arbitrators shall decide the dispute. In all arbitration proceedings

in which the amount of any award exceeds $100,000, in the aggregate, the arbitrator(s) shall make specific, written findings of fact

and conclusions of law. In all arbitration proceedings in which the amount of any award exceeds $100,000, in the aggregate, the parties

shall have, in addition to the limited statutory right to seek a vacation or modification of an award pursuant to applicable law, the

right to vacation or modification of any award that is based, in whole or in part, on an incorrect or erroneous ruling of law by appeal

to an appropriate court having jurisdiction; provided, however, that any such application for a vacation or modification

of such an award based on an incorrect ruling of law must be filed in a court having jurisdiction over the dispute within 15 days from

the date the award is rendered. The findings of fact of the arbitrator(s) shall be binding on all parties and shall not be subject to

further review except as otherwise allowed by applicable law. No provision of this Agreement nor the exercise of any rights hereunder

shall limit the right of any party, and any party shall have the right during any dispute, to seek, use, and employ ancillary or preliminary

remedies, such as injunctive relief (including, without limitation, specific performance), from a court having jurisdiction before, during,

or after the pendency of any arbitration. The institution and maintenance of any action for judicial relief or pursuit of provisional

or ancillary remedies shall not constitute a waiver of the right of any party to submit any dispute to arbitration nor render inapplicable

the compulsory arbitration provisions hereof.

22.

Attorney’s Fees. If any action is brought to enforce or interpret the terms of this Agreement (including through

arbitration), the prevailing party shall be entitled to reasonable attorneys’ fees, costs, and necessary disbursements in addition

to any other relief to which such party may be entitled.

23.

Counterparts. This Agreement may be executed in any number of counterparts and shall be effective when each party hereto

has executed at least one counterpart, with the same effect as if all signing parties had signed the same document. All counterparts

will be construed together and evidence only one agreement, which, notwithstanding the actual date of execution of any counterpart, shall

be deemed to be dated the day and year first written above. In making proof of this Agreement, it shall not be necessary to account for

a counterpart executed by any party other than the party against whom enforcement is sought or to account for more than one counterpart

executed by the party against whom enforcement is sought.

24.

Execution by Facsimile. The manual signature of any party hereto that is transmitted to any other party by facsimile or

in portable document format (PDF) shall be deemed for all purposes to be an original signature.

Remainder

of page intentionally left blank; signature page follows.

IN

WITNESS WHEREOF, the undersigned have executed this Agreement as of the 21st day of February, 2024.

| |

COMPANY: |

| |

|

|

| |

Sparta

Commercial Services, Inc. |

| |

|

|

| |

By: |

|

| |

Name: |

Sandra

L. Ahman |

| |

Title: |

Vice

President, Operations |

The

Optionee acknowledges receipt of a copy of the Agreement and represents that he or she has reviewed the provisions of this Agreement

in their entirety, is familiar with and understands their terms and provisions, and hereby accepts this Option subject to all of the

terms and provisions of this Agreement. The Optionee further represents that he or she has had an opportunity to obtain the advice of

counsel prior to executing this Agreement.

| Dated: |

February 21, 2024 |

|

OPTIONEE: |

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

Name: |

Anthony

L. Havens |

| |

|

|

|

|

| |

|

|

Address: |

|

[Signature

Page to Option Agreement]

SCHEDULE

I

| NAME

OF OPTIONEE: |

Anthony

L. Havens |

| |

|

| DATE

OF GRANT: |

February

21, 2024 |

| |

|

| TYPE

OF OPTION: |

Incentive

Stock Option No |

| |

|

| |

Non-Qualified

Stock Option Yes |

| |

|

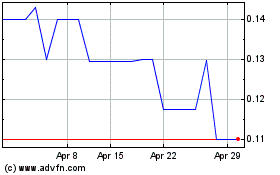

| NUMBER

OF OPTIONED SHARES: |

1,400,000 |

| |

|

| OPTION

PRICE: |

$0.12

per Share |

| |

|

| EXERCISE

PRICE: |

$0.14

per Share |

| |

|

| TERMINATION

DATE: |

Fifth

year anniversary of Date of Grant, subject to the other terms of the Option. |

| |

|

| VESTING: |

Vesting

shall take place as follows: (1) 466,667 options vest immediately; (2) 466,667 options vest one year from the date of grant; and

(3) 466,666 options vest two years from the date of grant. |

| |

|

| PERMISSION

TO PAY WITH SHARES: |

X

Granted ____Denied |

| |

|

| EXPANDED

RIGHTS TO TRANSFER OPTION: |

None |

[Schedule

I to Option Agreement]

Exhibit

4.2

SPARTA

COMMERCIAL SERVICES, INC.

STOCK OPTION AGREEMENT

FOR

Sandra

L. Ahman

Agreement

1.

Grant of Option. Sparta Commercial Services, Inc., a Nevada corporation (the “Company”), hereby grants, as

of the effective date of this Agreement specified on Schedule I hereof beside the caption “Date of Grant” (“Date

of Grant”), to Sandra L. Ahman (the “Optionee”) an option (the “Option”) to purchase an aggregate number of

shares set forth on Schedule I hereof beside the caption “Number of Optioned Shares” (such number being subject to

adjustment as provided below) of the Company’s common stock, $0.001 par value per share (the “Shares”), at an exercise

price per share set forth on Schedule I hereof beside the caption “Exercise Price” (such exercise price being subject

to adjustment as provided below) (the “Exercise Price”). The Option shall be subject to the terms and conditions set forth

herein. This Option is designated on Schedule I as either an Incentive Stock Option or a Non-Qualified Stock Option.

2.

Definitions.

(a)

“Affiliate” means a corporation or

other entity that, directly or through one or more intermediaries, controls, is controlled by or is under common control with, the Company.

(b)

“Applicable Laws” means the requirements

related to or implicated by the applicable state corporate law, United States federal and state securities laws, the Code, any stock

exchange or quotation system on which the shares of Common Stock are listed or quoted, and the applicable laws of any foreign country

or jurisdiction where Awards are granted under.

(c)

“Award” means any right granted under

this Agreement, including an Incentive Stock Option or a Non-qualified Stock Option.

(d)

“Beneficial Owner” has the meaning

assigned to such term in Rule 13d-3 and Rule 13d-5 under the Exchange Act, except that in calculating the beneficial ownership of any

particular Person, such Person shall be deemed to have beneficial ownership of all securities that such Person has the right to acquire

by conversion or exercise of other securities, whether such right is currently exercisable or is exercisable only after the passage of

time. The terms “Beneficially Owns” and “Beneficially Owned” have a corresponding meaning.

(e)

“Board” means the Board of Directors

of the Company, as constituted at any time.

(f)

“Change in Control” means:

(i)

the direct or indirect sale, transfer, conveyance or

other disposition (other than by way of merger or consolidation), in one or a series of related transactions, of all or substantially

all of the properties or assets of the Company and its subsidiaries, taken as a whole, to any Person that is not a subsidiary of the

Company;

(ii)

a majority of the members of the Board are replaced

during any twelve-month period by directors whose appointment or election is not endorsed by a majority of the Board before the date

of appointment or election;

(iii)

the date which is 10 business days prior to the consummation

of a complete liquidation or dissolution of the Company;

(iv)

the acquisition by any Person of Beneficial Ownership

of 50% or more (on a fully diluted basis) of either (a) the then outstanding shares of Common Stock of the Company, taking into account

as outstanding for this purpose such Common Stock issuable upon the exercise of options or warrants, the conversion of convertible stock

or debt, and the exercise of any similar right to acquire such Common Stock (the “Outstanding Company Common Stock”) or (b)

the combined voting power of the then outstanding voting securities of the Company entitled to vote generally in the election of directors

(the “Outstanding Company Voting Securities”); provided, however, that for purposes of this Agreement, the

following acquisitions shall not constitute a Change in Control: (1) any acquisition by the Company or any Affiliate, (2) any acquisition

by any employee benefit plan sponsored or maintained by the Company or any subsidiary, (3) any acquisition which complies with clauses,

(a), (b) and (c) of subsection (v) of this definition or (4) in respect of an Award held by a particular Participant, any acquisition

by the Participant or any group of persons including the Participant (or any entity controlled by the Participant or any group of persons

including the Participant); or

(v)

the consummation of a reorganization, merger, consolidation,

statutory share exchange or similar form of corporate transaction involving the Company that requires the approval of the Company’s

shareholders, whether for such transaction or the issuance of securities in the transaction (a “Business Combination”), unless

immediately following such Business Combination: (a) more than 50% of the total voting power of (A) the entity resulting from such Business

Combination (the “Surviving Company”), or (B) if applicable, the ultimate parent entity that directly or indirectly has beneficial

ownership of sufficient voting securities eligible to elect a majority of the members of the board of directors (or the analogous governing

body) of the Surviving Company (the “Parent Company”), is represented by the Outstanding Company Voting Securities that were

outstanding immediately prior to such Business Combination (or, if applicable, is represented by shares into which the Outstanding Company

Voting Securities were converted pursuant to such Business Combination), and such voting power among the holders thereof is in substantially

the same proportion as the voting power of the Outstanding Company Voting Securities among the holders thereof immediately prior to the

Business Combination; (b) no Person (other than any employee benefit plan sponsored or maintained by the Surviving Company or the Parent

Company) is or becomes the Beneficial Owner, directly or indirectly, of 50% or more of the total voting power of the outstanding voting

securities eligible to elect members of the board of directors of the Parent Company (or the analogous governing body) (or, if there

is no Parent Company, the Surviving Company); and (c) at least a majority of the members of the board of directors (or the analogous

governing body) of the Parent Company (or, if there is no Parent Company, the Surviving Company) following the consummation of the Business

Combination were Board members at the time of the Board’s approval of the execution of the initial agreement providing for such

Business Combination.

(g)

“Code” means the Internal Revenue

Code of 1986, as it may be amended from time to time. Any reference to a section of the Code shall be deemed to include a reference to

any regulations promulgated thereunder.

(h)

“Common Stock” means common stock,

$0.001 par value per share, of the Company, or such other securities of the Company as may be designated by the Company from time to

time in substitution thereof.

(i)

“Consultant” means any individual

or entity which performs bona fide services to the Company or an Affiliate, other than as an Employee or Director, and who may be offered

securities registrable pursuant to a registration statement on Form S-8 under the Securities Act.

(j)

“Continuous Service” means that the

Participant’s service with the Company or an Affiliate, whether as an Employee, consultant or Director, is not interrupted or terminated.

The Participant’s Continuous Service shall not be deemed to have terminated merely because of a change in the capacity in which

the Participant renders service to the Company or an Affiliate as an Employee, Consultant or Director or a change in the entity for which

the Participant renders such service, provided that there is no interruption or termination of the Participant’s Continuous

Service; provided further that if any Award is subject to Section 409A of the Code, this sentence shall only be given effect to

the extent consistent with Section 409A of the Code. For example, a change in status from an Employee of the Company to a Director of

an Affiliate will not constitute an interruption of Continuous Service. The Company or its delegate, in its sole discretion, may determine

whether Continuous Service shall be considered interrupted in the case of any leave of absence approved by that party, including sick

leave, military leave or any other personal or family leave of absence. The Company or its delegate, in its sole discretion, may determine

whether a Company transaction, such as a sale or spin-off of a division or subsidiary that employs a Participant, shall be deemed to

result in a termination of Continuous Service for purposes of affected Awards, and such decision shall be final, conclusive and binding.

(k)

“Director” means a member of the

Board.

(l)

“Effective Date” shall mean the date

as of which this Agreement is adopted by the Board.

(m)

“Employee” means any person, including

an Officer or Director, employed by the Company or an Affiliate; provided that for purposes of determining eligibility to receive

Incentive Stock Options, an Employee shall mean an employee of the Company or a parent or subsidiary corporation within the meaning of

Section 424 of the Code. Mere service as a Director or payment of a Director’s fee by the Company or an Affiliate shall not be

sufficient to constitute “employment” by the Company or an Affiliate.

(n)

“Exchange Act” means the Securities

Exchange Act of 1934, as amended.

(o)

“Disability” means that the Participant

is unable to engage in any substantial gainful activity by reason of any medically determinable physical or mental impairment; provided,

however, for purposes of determining the term of an Incentive Stock Option, the term Disability shall have the meaning ascribed to

it under Section 22(e)(3) of the Code. The determination of whether an individual has a Disability shall be determined under procedures

established by the Company. Except in situations where the Company is determining Disability for purposes of the term of an Incentive

Stock Option within the meaning of Section 22(e)(3) of the Code, the Company may rely on any determination that a Participant is disabled

for purposes of benefits under any long-term disability plan maintained by the Company or any Affiliate in which a Participant participates.

(p)

“Fair Market Value” means, as of

any date, the value of the Common Stock as determined below. If the Common Stock is listed on any established stock exchange or a national

market, including without limitation, the New York Stock Exchange or the Nasdaq Stock Market, the Fair Market Value shall be the weighted

average closing price as quoted on such exchange or system for the thirty consecutive trading days immediately preceding the date of

the option (for a day to be included in the calculation, there must have been at least 100 shares traded on that day). In the absence

of an established market for the Common Stock, the Fair Market Value shall be determined in good faith by the Company and such determination

shall be conclusive and binding on all persons.

(q)

“Incentive Stock Option” means an

Option that is designated by the Company as an incentive stock option within the meaning of Section 422 of the Code and that meets the

requirements set out in this Agreement, if applicable.

(r)

“Incumbent Directors” means individuals

who, on the Effective Date, constitute the Board; provided that any individual becoming a Director subsequent to the Effective

Date whose election or nomination for election to the Board was approved by a vote of at least two-thirds of the Incumbent Directors

then on the Board (either by a specific vote or by approval of the proxy statement of the Company in which such person is named as a

nominee for Director without objection to such nomination) shall be an Incumbent Director. No individual initially elected or nominated

as a director of the Company as a result of an actual or threatened election contest with respect to Directors or as a result of any

other actual or threatened solicitation of proxies by or on behalf of any person other than the Board shall be an Incumbent Director.

(s)

“Non-employee Director” means a Director

who is a “non-employee director” within meaning of Rule 16b-3.

(t)

“Non-qualified Stock Option” means

an Option that by its terms does not qualify or is not intended to qualify as an Incentive Stock Option.

(u)

“Officer” means a person who is an

officer of the Company within the meaning of Section 16 of the Exchange Act and the rules and regulations promulgated thereunder.

(v)

“Participant” means an eligible person

to whom an Award is granted pursuant to this Agreement or, if applicable, such other person who holds an outstanding Award.

(w)

“Person” means a person defined in

Section 13(d)(3) of the Exchange Act.

(x)

“Rule 16b-3” means Rule 16b-3 promulgated

under the Exchange Act or any successor to Rule 16b-3, as in effect from time to time.

(y)

“Securities Act” means the Securities

Act of 1933, as amended.

3.

Exercise Schedule. Except as otherwise provided in Sections 6 or 10 of this Agreement, the Option is exercisable

in installments as specified on Schedule I hereof beside the caption “Vesting”, which shall be cumulative. To the

extent that the Option has become exercisable with respect to a percentage of Shares as provided on Schedule I hereof beside the

caption “Vesting” on each date (each date being, a “Vesting Date”) upon which the Optionee shall be entitled

to exercise the Option with respect to the percentage of Shares granted as indicated for each Vesting Date (provided that the Continuous

Service of the Optionee continues through and on the applicable Vesting Date), the Option may thereafter be exercised by the Optionee,

in whole or in part, at any time or from time to time prior to the expiration of the Option as provided herein. Except as otherwise specifically

provided herein, there shall be no proportionate or partial vesting in the periods prior to each Vesting Date, and all vesting shall

occur only on the appropriate Vesting Date. Upon the termination of the Optionee’ s Continuous Service, any unvested portion of

the Option shall terminate and be null and void.

4.

Method of Exercise. The vested portion of this Option shall be exercisable in whole or in part, in accordance with the

Vesting of such Options provided in Schedule I and as set forth in Section 3 hereof, by written notice which shall state

the election to exercise the Option, the number of Shares in respect of which the Option is being exercised, and such other representations

and agreements as to the holder’s investment intent with respect to such Shares as may be required by the Company pursuant to the

provisions of this Agreement. Such written notice shall be signed by the Optionee or if someone other than the Optionee exercises the

Option, by such other person who provides documentation acceptable to the Company, or Committee, verifying that such person has the legal

right to exercise such Option, and shall be delivered in person or by certified mail to the Secretary of the Company. The written notice

shall be accompanied by payment of the Exercise Price. This Option shall be deemed to be exercised after both (a) receipt by the Company

of such written notice accompanied by the Exercise Price and (b) arrangements that are satisfactory to the Committee, in its sole discretion,

have been made for Optionee’ s payment to the Company of the amount, if any, that is necessary to be withheld in accordance with

applicable Federal or state withholding requirements. No Shares shall be issued pursuant to the Option unless and until such issuance

and such exercise shall comply with all relevant provisions of applicable law, including the requirements of any stock exchange upon

which the Shares then may be traded.

5.

Method of Payment. Payment of the Exercise Price shall be by any of the following, or a combination thereof, at the election

of the Optionee:

(a)

in cash or by certified or bank check at the time the

Option is exercised;

(b)

to the extent permitted by the Committee, or as provided

on Schedule I hereof beside the caption “Permission to Pay with Shares”, and if there is a public market available

for the Shares at the time of such exercise: (i) with Shares owned by the Optionee, duly endorsed for transfer to the Company, with a

fair market value on the date of delivery equal to the Exercise Price (or portion thereof) due for the number of shares being acquired;

(ii) by withholding or reducing the number of Shares otherwise deliverable to the Optionee upon exercise of such Option by a number of

Shares with an aggregate fair market value equal to the aggregate Exercise Price at the time of exercise; or (iii) pursuant to a “cashless

exercise” procedure established with a broker; provided that such payment by this method requires delivery of a properly

executed exercise notice together with such other documentation, and subject to such guidelines, as the Committee or Company shall require

to effect an exercise of the Option and delivery to the Company by a licensed broker acceptable to the Company of proceeds from the sale

of Shares sufficient to pay the Exercise Price and any applicable income or employment taxes; provided further that the Optionee

shall provide irrevocable written instructions (x) to such designated brokerage firm to effect the immediate sale of a portion of the

purchased Shares and remit to the Company, out of the sale proceeds available on the settlement date, an amount sufficient to cover the

aggregate Exercise Price payable for the purchased Shares plus all applicable state and federal income and employment taxes required

to be withheld by the Company by reason of such purchase and/or sale and (y) to the Company to deliver the certificates for the purchase

Shares directly to such brokerage firm to effect the sale transaction; or

(c)

in any other consideration or in such other manner as

may be determined by the Committee, in its absolute discretion.

Notwithstanding

anything contained herein to the contrary, no exercise shall become effective until the Company determines that the issuance and delivery

of the Shares pursuant to such exercise is in compliance with all applicable laws, regulations and requirements of any securities exchange

on which the Shares may be traded.

6.

Termination of Option

(a)

General. Any unexercised portion of the

Option shall automatically and without notice terminate and become null and void at the fifth anniversary of the date as of which the

Option is granted (or, if a different date is shown on Schedule I hereof beside the caption “Termination Date”, such

date).

(b)

Cancellation. To the extent not previously

exercised:

(i)

the Option shall terminate immediately in the event

of (a) the liquidation or dissolution of the Company, or (b) any reorganization, merger, consolidation or other form of corporate transaction

in which the Company does not survive or the Shares are exchanged for or converted into securities issued by another entity, or an affiliate

of such successor or acquiring entity, unless the successor or acquiring entity, or an Affiliate thereof, assumes the Option or substitutes

an equivalent option or right; and

(ii)

the Committee in its sole discretion may by written

notice cancel (“cancellation notice”), effective upon the consummation of any transaction that constitutes a Change in Control,

the Option (or portion thereof) that remains unexercised on such date.

The

Committee shall give written notice of any proposed transaction referred to in this Section 6(b) a reasonable period of time prior

to the closing date for such transaction (which notice may be given either before or after approval of such transaction), in order that

the Optionee may have a reasonable period of time prior to the closing date of such transaction within which to exercise the Option if

and to the extent that it then is exercisable (including any portion of the Option that may become exercisable upon the closing date

of such transaction). The Optionee may condition their exercise of the Option upon the consummation of a transaction referred to in this

Section 6(b).

7.

Transferability. Unless (i) transfers are expressly permitted in the language appearing beside the caption “Expanded

Rights to Transfer Option” on Schedule I hereof or (ii) otherwise determined by the Company or Committee, the Option granted

hereby is not transferable otherwise than by will or under the applicable laws of descent and distribution, and during the lifetime of

the Optionee the Option shall be exercisable only by the Optionee, or the Optionee’ s guardian or legal representative. In addition,

the Option shall not be assigned, negotiated, pledged or hypothecated in any way (whether by operation of law or otherwise), and the

Option shall not be subject to execution, attachment or similar process. Upon any attempt to transfer, assign, negotiate, pledge or hypothecate

the Option, or in the event of any levy upon the Option by reason of any execution, attachment or similar process contrary to the provisions

hereof, the Option shall immediately become null and void. The terms of this Option shall be binding upon the executors, administrators,

heirs, successors and assigns of the Optionee.

8.

No Rights of Stockholders. Neither the Optionee nor any personal representative (or beneficiary) shall be, or shall have

any of the rights and privileges of, a stockholder of the Company with respect to any Shares purchasable or issuable upon the exercise

of the Option, in whole or in part, prior to the date on which the Shares are issued.

9.

Acceleration of Exercisability of Option.

(a)

Acceleration Upon Certain Terminations or Cancellations

of Option. This Option shall become immediately fully exercisable in the event that, prior to the termination of the Option pursuant

to Section 6 hereof, (i) the Option is terminated pursuant to Section 6(b)(i) hereof, or (ii) the Company exercises its

discretion to provide a cancellation notice with respect to the Option pursuant to Section 6(b)(ii) hereof.

(b)

Acceleration Upon Change in Control. This Option

shall become immediately fully exercisable in the event that, prior to the termination of the Option pursuant to Section 6 hereof,

and during the Optionee’ s Continuous Service, there is a Change in Control.

10.

No Right to Continuous Service. Neither the Option nor this Agreement shall confer upon the Optionee any right to Continuous

Service with the Company or any Affiliate in the capacity in effect at the time the Award was granted or shall affect the right of the

Company or an Affiliate to terminate (a) the employment of an Employee with or without notice and with or without Cause or (b) the service

of a Director pursuant to the By-laws of the Company or an Affiliate, and any applicable provisions of the corporate law of the state

in which the Company or the Affiliate is incorporated, as the case may be.

11.

Information Confidential. As partial consideration for the granting of the Option, the Optionee agrees with the Company

to keep confidential all information and knowledge that the Optionee has relating to the manner and amount of the Optionee’ s participation;

provided, however, that such information may be disclosed as required by law and may be given in confidence to the Optionee’

s spouse, the Optionee’ s tax and financial advisors, or financial institutions to the extent that such information is necessary

to secure a loan.

12.

Notices. All notices, requests, demands, and other communications hereunder shall be in writing and shall be personally

delivered, delivered by facsimile or courier service, or mailed, certified with first class postage prepaid to the address specified

by the person who is to receive the same. Each such notice, request, demand, or other communication hereunder shall be deemed to have

been given (whether actually received or not) on the date of actual delivery thereof, if personally delivered or delivered by facsimile

transmission (if receipt is confirmed at the time of such transmission by telephone or facsimile-machine-generated confirmation), or

on the third day following the date of mailing, if mailed in accordance with this Section, or on the day specified for delivery to the

courier service (if such day is one on which the courier service will give normal assurances that such specified delivery will be made).

Any notice, request, demand, or other communication given otherwise than in accordance with this Section shall be deemed to have been

given on the date actually received. Each such notice, request, demand, or other communication hereunder shall be addressed, in the case

of the Company, to the Company’s Secretary at Sparta Commercial Services, Inc. 555 Fifth Avenue, 14th Floor, New York,

NY 10017, or if the Company should move its principal office, to such principal office, and, in the case of the Optionee, to the Optionee’

s last permanent address as shown on the Company’s records, subject to the right of either party to designate some other address

at any time hereafter in a notice satisfying the requirements of this Section. Any person entitled to any notice, request, demand, or

other communication hereunder may waive the notice, request, demand, or other communication.

13.

Section 409A.

(a)

It is intended that the Option awarded pursuant to this

Agreement be exempt from Section 409A of the Code (“Section 409A”) because it is believed that (i) the Exercise Price may

never be less than the Fair Market Value of a Share on the Date of Grant and the number of Shares subject to the Option is fixed on the

original Date of Grant, (ii) the transfer or exercise of the Option is subject to taxation under Section 83 of the Code and Treas. Reg.

1.83-7, and (iii) the Option does not include any feature for the deferral of compensation other than the deferral of recognition of

income until the exercise of the Option. The provisions of this Agreement shall be interpreted in a manner consistent with this intention,

and the provisions of this Agreement may not be amended, adjusted, assumed or substituted for, converted or otherwise modified without

the Optionee’ s prior written consent if and to the extent that the Company believes or reasonably should believe that such amendment,

adjustment, assumption or substitution, conversion or modification would cause the Award to violate the requirements of Section 409A.

In the event that either the Company or the Optionee believes, at any time, that any benefit or right under this Agreement is subject

to Section 409A, then the Committee may (acting alone and without any required consent of the Optionee) amend this Agreement in such

manner as the Committee deems necessary or appropriate to be exempt from or otherwise comply with the requirements of Section 409A (including

without limitation, amending the Agreement to increase the Exercise Price to such amount as may be required in order for the Option to

be exempt from Section 409A).

(b)

Notwithstanding the foregoing, the Company does not

make any representation to the Optionee that the Option awarded pursuant to this Agreement is exempt from, or satisfies, the requirements

of Section 409A, and the Company shall have no liability or other obligation to indemnify or hold harmless the Optionee or any Beneficiary

for any tax, additional tax, interest or penalties that the Optionee or any Beneficiary may incur in the event that any provision of

this Agreement, or any amendment or modification thereof or any other action taken with respect thereto, that either is consented to

by the Optionee or that the Company reasonably believes should not result in a violation of Section 409A, is deemed to violate any of

the requirements of Section 409A.

14.

Incentive Stock Option Treatment. If designated on Schedule I hereof as an Incentive Stock Option: (a) the terms

of this Option shall be interpreted in a manner consistent with the intent of the Company and the Optionee that the Option qualify as