Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

October 07 2020 - 3:44PM

Edgar (US Regulatory)

|

Free Writing Prospectus dated October 7, 2020

|

Filed pursuant to Rule 433

|

|

(to Prospectus dated October 2, 2020 and

|

Registration Statement No. 333-249255

|

|

Preliminary Prospectus Supplement dated October 7, 2020)

|

|

$1,000,000,000 2.032% Notes due 2030

(the “Notes”)

Final Term Sheet

October 7, 2020

|

Issuer:

|

Smith & Nephew plc (the “Issuer”)

|

|

Security Description:

|

Senior Notes

|

|

Trade Date:

|

October 7, 2020

|

|

Settlement Date*:

|

October 14, 2020 (T+4)

|

|

Maturity Date:

|

October 14, 2030

|

|

Aggregate Principal Amount:

|

$1,000,000,000 (the “Aggregate Principal Amount”)

|

|

Price to Public:

|

100.000% of the Aggregate Principal Amount

|

|

Coupon:

|

2.032%

|

|

Interest Payment Dates:

|

April 14 and October 14, commencing April 14, 2021

|

|

Benchmark Treasury:

|

0.625% due August 15, 2030

|

|

Benchmark Treasury Price and Yield:

|

98-16+, 0.782%

|

|

Spread to Benchmark Treasury:

|

125 basis points

|

|

Yield to Maturity:

|

2.032%

|

|

Make Whole Call:

|

At any time prior to July 14, 2030 at a discount rate of Treasury rate plus 20 bps

|

|

Par Call:

|

On or after July 14, 2030, 100%

|

|

Tax Redemption:

|

100%

|

|

Change of Control Repurchase Event:

|

Put at 101%

|

|

Gross Proceeds to Issuer:

|

$1,000,000,000

|

|

Underwriting Discount:

|

0.450% of the Aggregate Principal Amount

|

|

Net Proceeds to Issuer (before expenses):

|

$995,500,000

|

|

Day Count Fraction:

|

30/360 (following, unadjusted)

|

|

Business Days:

|

New York and London

|

|

Governing Law:

|

New York

|

|

Listing:

|

Application will be made for the Notes to be listed on the New York Stock Exchange.

|

|

CUSIP:

|

83192P AA6

|

|

ISIN:

|

US83192PAA66

|

|

Denominations/Multiple:

|

Minimum denominations of $2,000 and integral

multiples of $1,000 in excess thereof.

|

|

Ratings**:

|

Baa2 (Moody’s)

BBB+ (S&P)

|

|

Joint Book-Running Managers:

|

BofA Securities, Inc.

J.P. Morgan Securities

LLC

|

|

Bookrunners:

|

Bank of China Limited,

London Branch

HSBC Securities (USA)

Inc.

Mizuho Securities USA

LLC

SG Americas Securities,

LLC

SMBC Nikko Securities

America, Inc.

Wells Fargo Securities,

LLC

|

* Pursuant to Rule 15c6-1 under the

Securities Exchange Act of 1934, as amended, trades in the secondary market are generally required to settle in two business days,

unless the parties to any such trade expressly agree otherwise. Accordingly, purchasers who wish to trade the Notes prior to the

delivery of the Notes will be required to specify alternative settlement arrangements to prevent a failed settlement. Such purchasers

should consult their own advisors.

**A securities rating is not a recommendation

to buy, sell or hold securities and may be subject to revision or withdrawal at any time.

____________________

The Issuer has filed a registration

statement (including the Prospectus) with the U.S. Securities and Exchange Commission (the “SEC”) for this

offering. Before you invest, you should read the Preliminary Prospectus Supplement and the Prospectus in that registration statement,

and other documents the Issuer has filed with the SEC for more complete information about the Issuer and this offering. You may

get these documents for free by searching the SEC online database (EDGAR®) at www.sec.gov.

Alternatively, you may obtain a copy of the Prospectus and Preliminary Prospectus Supplement from BofA Securities, Inc. by calling

toll free +1-800-294-1322 or J.P. Morgan Securities LLC by calling collect +1-212-834-4533.

If this document has been distributed

by electronic transmission, such as e-mail, then such transmission cannot be guaranteed to be secure or error-free as information

could be intercepted, corrupted, lost, destroyed, arrive late or incomplete, or contain viruses. The sender therefore does not

accept liability for any errors or omissions in the contents of this document, which may arise as a result of electronic transmission.

MiFID II product governance / Professional

investors and ECPs only target market: Solely for the purposes of the manufacturer’s product approval process, the target

market assessment in respect of the Notes has led to the conclusion that: (i) the target market for the Notes is eligible counterparties

and professional clients only, each as defined in Directive 2014/65/EU, as amended (“MiFID II”); and (ii) all

channels for distribution of the Notes to eligible counterparties and professional clients are appropriate. Any person subsequently

offering, selling or recommending the Notes (a “distributor”) should take into consideration the manufacturer’s

target market assessment; however, a distributor subject to MiFID II is responsible for undertaking its own target market assessment

in respect of the Notes (by either adopting or refining the manufacturer’s target market assessment) and determining appropriate

distribution channels.

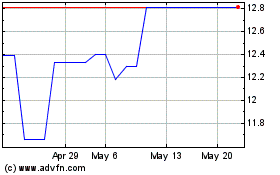

Smith and Nephew (PK) (USOTC:SNNUF)

Historical Stock Chart

From Jun 2024 to Jul 2024

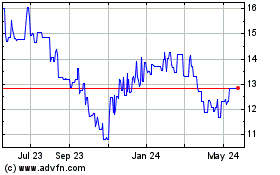

Smith and Nephew (PK) (USOTC:SNNUF)

Historical Stock Chart

From Jul 2023 to Jul 2024