Prospectus Filed Pursuant to Rule 424(b)(5) (424b5)

October 07 2020 - 8:47AM

Edgar (US Regulatory)

Filed pursuant to Rule 424b(5)

File Number 333-249255

The information in

this preliminary prospectus supplement is not complete and may be changed. A shelf registration statement relating to these

securities has become effective upon filing with the Securities and Exchange Commission. We are not using this preliminary

prospectus supplement or the accompanying prospectus to offer to sell these securities or to solicit offers to buy these

securities in any state or other jurisdiction where the offer or sale is not permitted.

Subject to Completion. Dated

October 7, 2020

PRELIMINARY PROSPECTUS SUPPLEMENT

(To Prospectus dated October 2, 2020)

Smith & Nephew plc

$

$

% Notes due 2030

____________________

This prospectus supplement relates to an offering of $ %

Notes due 2030 (the “Notes”). Smith & Nephew plc (the “Company”, “we”, “our”,

“us” or “Smith+Nephew”) will pay interest on the Notes on

and of each year, beginning on ,

2021. The Notes will mature on , 2030.

We may redeem the Notes, in whole or in part, at the times or

during the periods and at the applicable redemption prices described herein. We may also redeem the Notes, in whole but not in

part, at any time at 100% of their principal amount plus accrued interest upon the occurrence of certain tax events described herein.

If a “Change of Control Repurchase Event” (as defined in “Description of Notes—Repurchase upon

Change of Control Repurchase Event”) occurs, we will be required to offer to repurchase the Notes at a repurchase price

equal to 101% of their principal amount, plus accrued and unpaid interest to the date of repurchase unless the Notes have been

previously redeemed or called for redemption.

The Notes will constitute unsecured and unsubordinated indebtedness

of the Company and will rank equally with all other unsecured and unsubordinated indebtedness of the Company from time to time

outstanding.

There is currently no public market for the Notes. Application

will be made to list the Notes on the New York Stock Exchange.

See “Risk Factors” on page S-11 of

this prospectus supplement and “Risk Factors” on page 2 of the accompanying prospectus for a discussion of

certain factors you should consider before investing in the Notes.

Neither the Securities and Exchange Commission nor any state

securities commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy

or adequacy of this prospectus supplement or the accompanying prospectus. Any representation to the contrary is a criminal offense.

____________________

|

|

Price

to Public(1)

|

Underwriting

Discount

|

Proceeds

to

us (before

expenses)

|

|

Per Note

|

%

|

%

|

%

|

|

Total for the Notes

|

$

|

$

|

$

|

____________________

|

|

(1)

|

Plus accrued interest, if any, from , 2020 if settlement occurs after that date.

|

The underwriters expect to deliver the Notes in book-entry form

through the facilities of The Depository Trust Company (“DTC”), for the benefit of its direct and indirect participants,

including Euroclear Bank S.A./N.V. (“Euroclear”) and Clearstream Banking, société anonyme (“Clearstream,

Luxembourg”), against payment in New York, New York on or about , 2020.

____________________

Joint Bookrunning Managers

|

BofA Securities

|

J.P. Morgan

|

|

Bookrunners

|

|

Bank

of China

|

HSBC

|

Mizuho Securities

|

|

SOCIETE GENERALE

|

SMBC

Nikko

|

Wells Fargo Securities

|

|

|

|

|

|

The date of this prospectus supplement is ,

2020.

table

of Contents

____________________

Prospectus Supplement

Page

Prospectus

____________________

We have not, and the underwriters have not,

authorized any other person to provide you with any information other than the information contained in this prospectus supplement,

the accompanying prospectus and the documents incorporated by reference herein and therein. Neither we nor the underwriters take

responsibility for, or provide any assurance as to the reliability of, any different or additional information. Neither we nor

the underwriters are making an offer to sell the Notes in any jurisdiction where the offer or sale of such Notes is not permitted.

You should assume the information appearing in this prospectus supplement, the accompanying prospectus and the documents incorporated

by reference herein and therein are accurate only as of their respective dates. Our business, financial condition, results of

operations and prospects may have changed since those dates.

MiFID II product governance / Professional investors and

ECPs only target market – Solely for the purposes of the manufacturer’s product approval process, the target market

assessment in respect of the Notes has led to the conclusion that: (i) the target market for the Notes is eligible counterparties

and professional clients only, each as defined in Directive 2014/65/EU, as amended (“MiFID II”); and (ii) all channels

for distribution of the Notes to eligible counterparties and professional clients are appropriate. Any person subsequently offering,

selling or recommending the Notes (a “distributor”) should take into consideration the manufacturer’s target

market assessment; however, a distributor subject to MiFID II is responsible for undertaking its own target market assessment in

respect of the Notes (by either adopting or refining the manufacturer’s target market assessment) and determining appropriate

distribution channels.

In connection with the issue of the Notes, BofA Securities,

Inc. (the “Stabilization Manager”) (or persons acting on behalf of any Stabilization Manager(s)) may over allot Notes

or effect transactions with a view to supporting the market price of the Notes at a level higher than that which might otherwise

prevail. However, stabilization may not necessarily occur. Any stabilization action may begin on or after the date on which adequate

public disclosure of the terms of the offer of the Notes is made and, if begun, may cease at any time, but it must end no later

than the earlier of 30 days after the issue date of the Notes and 60 days after the date of the allotment of the Notes. Any stabilization

action or over allotment must be conducted by the relevant Stabilization Manager(s) (or person(s) acting on behalf of any Stabilization

Manager(s)) in accordance with all applicable laws and rules.

About This

Document

This document is in two parts. The first part

is the prospectus supplement, which describes the specific terms of the Notes we are offering and certain other matters relating

to us and our results of operations and financial condition. The second part, the accompanying prospectus, gives more general information

about securities we may offer from time to time, some of which does not apply to the Notes we are offering. Generally, when we

refer to the prospectus, we are referring to both parts of this document combined. If the description of the Notes in the prospectus

supplement differs from the description in the accompanying prospectus, the description in the prospectus supplement supersedes

the description in the accompanying prospectus.

Forward-Looking

Statements

The reports of Smith & Nephew plc and its subsidiaries (the

“Group”) filed with, or furnished to, the Securities and Exchange Commission (“SEC”), including this prospectus

supplement, the accompanying prospectus and written information released, or oral statements made, to the public in the future

by or on behalf of the Group, may contain ‘forward-looking statements’ within the meaning of the U.S. Private Securities

Litigation Reform Act of 1995, that may or may not prove accurate. For example, statements regarding expected revenue growth, trading

profit margins, market trends and our product pipeline are forward-looking statements. Phrases such as ‘aim’, ‘plan’,

‘intend’, ‘anticipate’, ‘well-placed’, ‘believe’, ‘estimate’, ‘expect’,

‘target’, ‘consider’ and similar expressions are generally intended to identify forward-looking statements,

but are not the exclusive means of identifying such statements. Forward-looking statements involve known and unknown risks, uncertainties

and other important factors that could cause actual results to differ materially from what is expressed or implied by the statements.

Accordingly, you should not unduly rely on any forward-looking statements.

Factors that may cause future results and

outcomes to differ for us include:

|

|

·

|

risks related to the impact of the COVID-19 pandemic, such as the depth and longevity of its impact, government actions and

other restrictive measures taken in response, material delays and cancellations of elective procedures, reduced procedure capacity

at medical facilities, restricted access for sales representatives to medical facilities, or our ability to execute business continuity

plans as a result of the COVID-19 pandemic;

|

|

|

·

|

economic and financial conditions in the markets we serve, especially those affecting healthcare providers, payers and customers

(including, without limitation, as a result of the COVID-19 pandemic);

|

|

|

·

|

price levels for established and innovative medical devices;

|

|

|

·

|

developments in medical technology;

|

|

|

·

|

regulatory approvals, reimbursement decisions or other government actions;

|

|

|

·

|

product defects or recalls or other problems with quality management systems or failure to comply with related regulations;

|

|

|

·

|

litigation relating to patent or other claims;

|

|

|

·

|

legal compliance risks and related investigative, remedial or enforcement actions;

|

|

|

·

|

disruption to our supply chain or operations or those of our suppliers (including, without limitation, as a result of the COVID-19

pandemic);

|

|

|

·

|

competition for qualified personnel;

|

|

|

·

|

strategic actions, including acquisitions and dispositions and our success in performing due diligence, valuing and integrating

acquired businesses;

|

|

|

·

|

disruption that may result from transactions or other changes we make in our business plans or organization to adapt to market

developments;

|

|

|

·

|

relationships with healthcare professionals;

|

|

|

·

|

reliance on information technology and cybersecurity;

|

|

|

·

|

numerous other matters that affect us or our markets, including those of a political, economic, business, competitive or reputational

nature; and

|

|

|

·

|

other factors

discussed under “Risk Factors” and elsewhere in this document (including

the documents incorporated by reference herein).

|

Other factors could also adversely affect

our results or the accuracy of forward-looking statements in this prospectus supplement, and you should not consider the factors

discussed here or in the accompanying prospectus, our annual report on Form 20-F for the year ended December 31, 2019, or other

documents incorporated by reference herein, to be a complete set of all potential risks or uncertainties.

The forward-looking statements made in this

prospectus supplement speak only as of the date of this prospectus supplement. We do not undertake any obligation to update or

revise any forward-looking statement to reflect any change in circumstances or expectations. You should, however, consult any further

disclosures we make in other documents filed with the SEC that are incorporated by reference into this prospectus supplement. This

discussion is provided as permitted by the U.S. Private Securities Litigation Reform Act of 1995.

Incorporation

of Documents by Reference

The SEC allows us to “incorporate by

reference” the information we file with or furnish to them, which means that we can disclose important information to you

by referring you to those documents. The information incorporated by reference is considered to be part of this prospectus supplement

and the accompanying prospectus and later information that we file with the SEC will automatically update or supersede this information.

We incorporate by reference the documents listed below and any of our future filings made with the SEC under Sections 13(a), 13(c)

and 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), until such time as all of the securities

covered by this prospectus supplement have been sold:

|

|

·

|

Our Annual Report on Form 20-F for the year ended December 31, 2019 filed with the SEC on March 2, 2020 (File No. 001-14978).

|

|

|

·

|

Our Report on Form 6-K furnished to the SEC on July 29, 2020, which includes our interim consolidated results for the six month

period ended June 27, 2020 (File No. 001-14978).

|

|

|

·

|

Amendment No. 1 to our Annual Report on Form 20-F for the year ended December 31, 2019, filed with the SEC on September 25,

2020 (File No. 001-14978).

|

|

|

·

|

All other documents we file pursuant to Section 13(a), 13(c), or 15(d) of the Exchange Act after the date of this prospectus

supplement and prior to the termination of the offering of the Notes and, to the extent designated therein, reports furnished to

the SEC on Form 6-K, in each case with effect from the date that such document or report is so filed or furnished.

|

We will provide without charge to each person,

including any beneficial owner, to whom this prospectus supplement is delivered, upon his or her written or oral request, a copy

of any or all documents referred to above which have been or may be incorporated by reference into this prospectus supplement other

than exhibits which are not specifically incorporated by reference into those documents. You can request those documents from the

below:

Smith & Nephew plc

Building 5, Croxley Park

Hatters Lane, Watford

Hertfordshire WD18 8YE

United Kingdom

Tel.: +44(0)1923 477 100

Summary

The following summary contains basic information about this

offering. It may not contain all the information that is important to you. The “Description of Notes” section of this

prospectus supplement and the “Description of Debt Securities” section of the accompanying prospectus contain more

detailed information regarding the terms and conditions of the Notes. The following summary is qualified in its entirety by reference

to the detailed information appearing elsewhere or incorporated by reference in this prospectus supplement and in the accompanying

prospectus. You should base your investment decision on a consideration of this prospectus supplement, the accompanying prospectus

and the documents incorporated by reference therein, as a whole.

Overview

We are a leading portfolio medical technology company operating

through three global franchises: Orthopaedics, Sports Medicine & ENT (Ear, Nose and Throat) and Advanced Wound Management.

Orthopaedics offers an innovative range of hip and knee implants used to replace diseased, damaged or worn joints, robotics-assisted

enabling technologies that empower surgeons, and trauma products used to stabilize severe fractures and correct bone deformities.

Our Sports Medicine & ENT businesses offer advanced products and instruments that enable surgeons to perform minimally invasive

surgery of the joints, and which are used to repair or remove soft tissue. Our Advanced Wound Management portfolio offers an extensive

set of products to meet broad and complex clinical needs, and help healthcare professionals reduce the human and economic consequences

of wounds. We operate on a worldwide basis and have distribution channels in over 100 countries.

Our history dates back more than 160 years. As of December 31,

2019, we employed approximately 17,500 employees supporting customers in over 100 countries. Our principal executive office is

located at Building 5, Croxley Park, Hatters Lane, Watford, Hertfordshire WD18 8YE and our telephone number is +44-(0)1923-477-100.

As part of our current strategy, we will continue to focus on

accelerating organic performance, acquiring and developing enabling technologies for procedures, and expanding in high-growth segments.

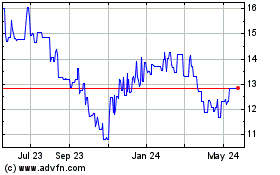

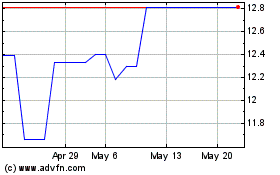

Our American Depositary Shares, representing our ordinary shares,

are listed on the New York Stock Exchange under the symbol “SNN”. Our ordinary shares are admitted to trading on the

London Stock Exchange under the symbol “SN”.

Strategic Initiatives

Our medium term value creation plan is founded upon the following

five strategic initiatives:

|

|

·

|

Achieve the full potential of our portfolio. This

strategic imperative is focused on improving commercial execution to accelerate organic performance. At the start of 2019, we

introduced a new commercial model organized around our three global franchises. This model provides greater insight into our customers’

needs, and allows us to combine all of our resources across our franchises to meet our customers’ needs. Our research

and development (“R&D”) team has benefitted from greater investment, and launched multiple new platforms

and products, supporting improved performance at a franchise level, such as in Arthroscopic Enabling Technologies. This, coupled

with a renewed focus on driving excellence across our Quality and Regulatory Affairs team, is allowing us to bring new products

to market faster across the globe.

|

For example, we completed the requirements to CE Mark

(i.e. a mark given to those products that conform with health, safety and environmental protection standards within the European

Economic Area) our NOVOSTITCH◊ PRO Meniscal Repair System and REGENETEN◊ Bioinductive Implant and

completed the first patient cases in Europe.

|

|

·

|

Transform the business through enabling technologies.

This strategic imperative focuses on acquiring and developing leading enabling technologies to transform procedures. We are

developing a unique approach to create enabling platforms that are both multi-procedural and multi-franchise. In 2019, we

announced our strategy to combine advanced technologies in robotics, digital surgery, and machine learning as well as augmented

reality to empower surgeons to improve clinical outcomes. Another important initiative in 2019 was the purchase of Brainlab’s

Orthopaedic Joint Reconstruction (“OJR”) business, which enables us to bring hip navigation to our robotics customers.

We now have a R&D partnership with Brainlab. We also announced a new robotics R&D center in Pittsburgh, United

States, which opened on March 7, 2020. In 2019, we created a Biologics and Regenerative Medicine R&D team in 2019 dedicated

to development of innovative orthobiologic products (i.e. substances that orthopaedic surgeons use to help injuries heal more

quickly). The Brainlab OJR business and Atracsys acquisitions brought core enabling technologies that we have been integrating

into our next generation robotics-assisted surgical platforms.

|

In the six months ended June 27, 2020, we delivered

a number of further innovations. In Orthopaedics this was led by a new handheld robotics platform, the CORI◊ Surgical

System (“CORI”), available for both unicompartmental knee arthroplasty and total knee arthroplasty. CORI is the lead

of our Real Intelligence digital ecosystem which, following applicable regulatory clearance and approvals, will include patient

engagement, pre-operative planning, digital and robotic surgery, post-operative assessment and outcomes measurement solutions.

We also launched the JOURNEY◊ II Unicompartmental Knee System, building on the heritage of our partial knees paired

with proprietary OXINIUM◊ Technology. In Sports Medicine, we introduced the INTELLIO◊ Connected Tower

Solution, which wirelessly connects and remotely controls multiple Sports Medicine systems from outside the sterile field, an ideal

solution for both hospitals and Ambulatory Surgery Centers (ASCs) where space is at a premium.

|

|

·

|

Expansion in high-growth segments. This strategic imperative focuses on accelerating portfolio growth, strengthening

our established leadership positions, and driving meaningful synergies. We strategically acquire valuable technologies that strengthen

our portfolio today, and strengthen our R&D expertise and programs. Our M&A strategy is to pursue growth enhancing acquisitions,

both in the segments we already operate in, and in related segments, which are a good strategic fit and where there is attractive

growth. Our largest recent acquisition was Osiris Therapeutics, Inc. (“Osiris”) for $660 million, which completed

in April 2019. Osiris is a fast-growing company delivering regenerative medicine products, including skin, bone-graft and articular

cartilage substitutes. The Osiris portfolio has improved our overall growth outlook for Advanced Wound Bioactives. Other significant

acquisitions included Ceterix Orthopaedics, Inc., enhancing our leading position in meniscal repair, and the LEAF◊

Patient Monitoring System, supporting our pressure injury prevention strategy.

|

In ENT, we announced the market introduction and first

commercial procedure of the Tula◊ System, an in-office solution for placement of tympanostomy tubes (commonly known as ear

tubes), following our acquisition of Tusker Medical, Inc. in January 2020.

We are also investing in developing a turnkey service

to support healthcare providers seeking to move orthopaedic cases into ambulatory surgery centers (“ASCs”) and other

outpatient settings. We believe we are well positioned to assist healthcare providers make the transition as our Sports

Medicine franchise has been supporting ASC-based procedures since their inception coupled with our leadership position in

orthopaedic implants and enabling technologies, including robotics. The LENS 4K Surgical Imaging System, a new surgical video platform

we launched in 2019, is designed for use in ASC and multi-surgery settings.

We are seeing an increase in the proportion of joint

replacement procedures taking place in ASCs and believe that part of the U.S. healthcare system’s response to the COVID-19

pandemic has been to accelerate the shift. We believe we are well positioned to benefit from this trend through our Positive Connections

service offering, and with our enabling technology including the launch of CORI.

|

|

·

|

Strengthen talent and capabilities. This strategic

imperative focuses on developing a winning culture to improve retention and attract talent. In late 2018, we introduced a new

corporate purpose ‘Life Unlimited’ and new culture pillars of care, collaboration and courage. Our culture pillars

are grounded in the service of patients and practitioners and guide employees to work together and encourage continuous learning

and improvement. These define who we are as a company and as employees, and create an environment that sets us up for collective

success. A new visual brand identity, launched in 2019, both emphasized and underpinned these changes. In 2019, we introduced

‘Winning Behaviours’, a new behavioral competency framework directly linked to the culture pillars to help employees

understand how they can demonstrate our culture on a daily basis. We strive to create a working environment that is inclusive

and welcomes diversity. New initiatives in 2019 included delivering inclusion training to our top 100 leaders and embedding

inclusion in all our leadership development programs. We believe that a strong and consistent culture engages and motivates employees.

2019 was the first year that we used the Gallup Global Engagement Survey to measure progress, and we were pleased

that 84% of employees participated. In May 2020, we retook the Gallup survey, achieving a response rate of 89% and recording

a significant improvement across every element of the survey.

|

|

|

·

|

Become the best owner. This strategic imperative

focuses on driving operational transformation through improved agility, and organization simplification to deliver profitable

growth. In February 2020, we began the construction of a new high-technology manufacturing facility in Penang, Malaysia. The 250,000

square-foot facility will primarily support our Orthopaedics franchise, which has been growing strongly in the Asia-Pacific region,

creating up to 800 new local jobs over the next five years.

|

We strive to deliver products of the highest quality

at the right price whilst maintaining high standards in ethics and compliance. Whilst we are proud of our track record, we consistently

seek to improve our performance in these areas.

Recent Developments

Third Quarter Trading

On October 1, 2020, we announced that revenue for the third

quarter ended September 26, 2020 declined by 4% (on both a reported and underlying basis) compared to the third quarter ended September

28, 2019. All three global franchises, Orthopaedics, Sports Medicine & ENT and Advanced Wound Management, showed significant

recovery following an overall revenue decline of 29.8% on a reported basis (and 29.3% on an underlying basis) for the second quarter

ended June 27, 2020 compared to the second quarter ended June 29, 2019. The improvement was strongest in our Orthopaedics franchise,

as global levels of elective surgery continued to recover. Monthly Group growth rates were broadly stable through the quarter,

with some seasonality and monthly variation across both franchises and regions, reflecting the continuing impact of COVID-19.

Despite the current challenging environment, we continue to

serve our customers, maintain R&D, pursue acquisitions, and launch new products. We are also managing our cost base while at

the same time seeking to protect employees and their jobs.

Acquisition

On September 29, 2020, we announced that we had agreed the acquisition

of the Extremity Orthopaedics business of Integra LifeSciences Holdings Corporation for $240 million, which will be financed from

existing cash and debt facilities. The acquisition supports Smith+Nephew’s strategy to invest in higher-growth segments.

This acquisition will significantly strengthen Smith+Nephew’s

extremities business by adding a combination of a focused sales channel, complementary shoulder replacement and upper and lower

extremities portfolio, and a new product pipeline.

The focused extremities commercial channel includes a specialized

sales force and distributors, predominantly in the United States as well as Canada and Europe.

The portfolio is highly complementary to Smith+Nephew’s

existing orthopaedics offering, in particular providing entry into the shoulder replacement and foot and ankle segments. The full

portfolio includes devices, implants, and instruments which provide for shoulder replacement as well as reconstruction of bone

in the hand, wrist and elbow (Upper Extremity) and foot and ankle (Lower Extremity). The Extremity Orthopaedics R&D pipeline

includes a next-generation shoulder replacement system.

The acquisition is expected to complete around the end of 2020,

subject to the satisfaction of customary conditions including consultation with employee representative bodies.

For further discussion on the impact of the COVID-19 pandemic

on our business and the risks associated with acquisitions, see “Risk Factors—Risks Relating to the Group—The

COVID-19 pandemic” and “Risk Factors—Risks Relating to the Group—Failure to make successful acquisitions,”

as applicable.

The Offering

|

Issuer

|

Smith & Nephew plc.

|

|

Notes

|

$ aggregate principal amount of % Notes due 2030.

|

|

|

The Notes will be issued under an indenture to be dated on or about , 2020 (the “Indenture”) among us, The Bank of New York Mellon, London Branch, as trustee, and The Bank of New York Mellon, as security registrar, and the terms of the securities will be set forth in an Officer’s Certificate to be dated , 2020.

|

|

Ranking

|

The Notes will constitute unsecured and unsubordinated indebtedness of Smith & Nephew plc and will rank equally with all of its other unsecured and unsubordinated indebtedness from time to time outstanding.

|

|

Issue Date

|

, 2020.

|

|

Maturity Date

|

,

2030.

|

|

Business Day

|

Any day which is not, in London, England or New York, New York, United States of America, or the place of payment of amounts payable in respect of the Notes, a Saturday, a Sunday, a legal holiday or a day on which banking institutions are authorized or obligated by law, regulation or executive order to close.

|

|

Interest Rate

|

The Notes will bear interest at a rate of % per annum.

|

|

Interest Payment Dates

|

Interest on the Notes will be payable semi-annually in arrears on and of each year, commencing on , 2021.

|

|

Day Count

|

30/360, Following, Unadjusted.

|

|

Optional Redemption

|

We may redeem the Notes, in whole or in part, at any

time and from time to time as follows: (i) prior to the Par Call Date (as defined in “Description of Notes—Redemption—Optional

Redemption”), at a redemption price equal to the greater of (A) 100% of the principal amount of the Notes to be redeemed,

and (B) as determined by the Quotation Agent (as defined in “Description of Notes—Redemption—Optional Redemption”),

the sum of the present values of the remaining scheduled payments of principal and interest on the Notes to be redeemed (assuming

for this purpose that such Notes matured on the Par Call Date and not including any portion of such payments of interest accrued

as of the date of redemption) discounted to the date of redemption on a semiannual basis (assuming a 360-day year consisting of

twelve 30-day months) at the Treasury Rate (as defined in “Description of Notes—Redemption—Optional Redemption”)

plus the Make-Whole Spread (as defined in “Description of Notes—Redemption—Optional Redemption”)

and (ii) on or after the Par Call Date, at a redemption price equal to 100% of the principal amount of the Notes to be redeemed, plus, in each case, accrued interest thereon to but excluding the date of redemption.

For more information, see “Description of Notes—Redemption—Optional Redemption.”

|

|

Optional Tax Redemption

|

In the event of various tax law changes and other

limited circumstances that require us to pay additional amounts (as described in “Description of Notes—Payment of

Additional Amounts”), we may redeem all, but not less than all, of the Notes at a price equal to 100% of the principal

amount of the Notes plus accrued interest thereon to but excluding the date of redemption.

For more information, see “Description of

Notes—Redemption—Optional Tax Redemption.”

|

|

Repurchase upon Change of Control Repurchase Event

|

If a “Change of Control Repurchase Event”

(as defined in “Description of Notes—Repurchase upon Change of Control Repurchase Event”) occurs, unless

we have exercised our right to redeem all of the Notes as described under “Description of Notes— Redemption—Optional

Redemption,” we will make an offer to repurchase the Notes at a repurchase price equal to 101% of their principal amount,

plus accrued and unpaid interest, if any, to, but not including, the date of repurchase unless the Notes have been previously redeemed

or called for redemption.

For more information, see “Description of

Notes—Repurchase upon Change of Control Repurchase Event.”

|

|

Certain Covenants

|

The Indenture governing the Notes contains certain

restrictions, including restrictions on our ability to: (i) create or permit to exist any lien (other than permitted liens) on

any of our property or assets, (ii) consolidate or merge with another entity and (iii) enter into certain sale and leaseback transactions.

These restrictions are subject to a number of exceptions.

For more information, see “Description of

Notes—Certain Covenants.”

|

|

Regular Record Dates for Interest

|

The close of business on the 15th calendar day preceding each applicable interest payment date, whether or not such day is a Business Day.

|

Book-Entry Issuance, Clearance and

Settlement

|

Book-entry interests in the Notes will be issued in

minimum denominations of $2,000 and in integral multiples of $1,000 in excess thereof.

We will issue the Notes in fully registered form. The

Notes will be represented by one or more global securities registered in the name of Cede & Co, as nominee of DTC. You will

hold beneficial interests in the Notes through DTC and its direct and indirect participants, including Euroclear

|

|

|

and Clearstream Luxembourg in book-entry form. We will not issue certificated Notes except in limited circumstances that we explain under “Legal Ownership—Global Securities—Special situations when the global security will be terminated” in the accompanying prospectus. Settlement of the Notes will occur through DTC in same day funds. For information on DTC’s book-entry system, see “Clearance and Settlement—The Clearing Systems—DTC” in the accompanying prospectus.

|

|

Use of Proceeds

|

We expect to receive approximately $ from the sale

of the Notes, after deducting the underwriting discount and other expenses related to this offering.

We intend to use the net proceeds from the sale of

the Notes for general corporate purposes. See “Use of Proceeds.”

|

|

Trustee

|

The Bank of New York Mellon, London Branch, as trustee under the Indenture.

|

|

Security Registrar

|

The Bank of New York Mellon, as security registrar under the Indenture.

|

|

Further Issues

|

We may, without the consent of the holders the Notes, issue additional notes having the same ranking and same interest rate, maturity date, redemption terms and other terms as the Notes described in this prospectus supplement except for the price to the public, issue date and, in certain circumstances, the first interest payment date. Any such additional notes, together with the Notes offered by this prospectus supplement, will constitute a single series of securities under the Indenture relating to the Notes; provided that, if the additional notes are not fungible for U.S. federal income tax purposes with the Notes offered hereby, the additional notes will have a separate CUSIP or other identifying number. There is no limitation on the amount of notes or other debt securities that we may issue under that Indenture.

|

|

Risk Factors

|

You should carefully consider all of the

information in this prospectus supplement and the accompanying prospectus, which includes information incorporated by

reference. In particular, you should evaluate the specific factors under “Risk Factors” beginning on page

S-11 of this prospectus supplement and beginning on page 2 of the accompanying prospectus, as well as those disclosed under

the heading “Risk Factors” in our Annual Report on Form 20-F for the year ended December 31, 2019, which

is incorporated by reference in this prospectus supplement, for risks involved with an investment in the Notes.

|

|

Listing

|

Application will be made for the Notes to be listed on the New York Stock Exchange.

|

|

Governing Law

|

The Notes and the Indenture will be governed by the laws of the State of New York.

|

Risk Factors

Prospective investors should consider carefully the risk

factors incorporated by reference into this prospectus supplement and the accompanying prospectus as well as set out below in addition

to the other information set out elsewhere in this prospectus supplement and the accompanying prospectus and reach their own views

prior to making any investment decision with respect to the Notes. In particular, prospective investors should evaluate the specific

factors under “Risk Factors” beginning on page 2 of the accompanying prospectus, as well as those discussed under the

heading “Risk Factors” in our Annual Report on Form 20-F for the year ended December 31, 2019, which is incorporated

by reference in this prospectus supplement and the accompanying prospectus, for risks involved with an investment in the Notes.

If any of these risks actually occur, our business, financial condition and results of operations could suffer, and the trading

price and liquidity of the Notes could decline, in which case you may lose all or part of your investment.

Risks Relating to the Group

The COVID-19 pandemic

Widespread outbreaks of infectious diseases, such as the COVID-19

pandemic, create uncertainty and challenges for the Group. The challenges created by the COVID-19 pandemic include, but are not

limited to, declines in and cancellations of elective procedures at medical facilities and the resulting increase in commercial

execution risk, disruptions at manufacturing facilities, and disruptions in supply and other commercial activities due to travel

restrictions and government restrictions on exports. The length, severity and geographical variation of the outbreak and pace of

recovery are not clear and there could be an increased impact on us depending on these factors.

Revenue for the six months ended June 27, 2020 decreased 18.1%

on a reported basis (18.7% on an underlying basis) relative to the first six months of 2019 as the COVID-19 pandemic impacted our

major markets. By franchise, the impact of the COVID-19 pandemic was most pronounced on our Orthopaedics and Sports Medicine &

ENT businesses. The negative impact on these businesses were principally driven by lower levels of elective surgery (including

a significant reduction in knee and hip implant procedures in Orthopaedics and nose and throat procedures in ENT). Our Advanced

Wound Management franchise was also significantly negatively affected, with the negative impact principally due to deferrals of

elective surgery, temporary closures of wound clinics and falling numbers in long-term care facilities, many of which were closed

to new residents as a result of the COVID-19 pandemic.

Our expected credit loss allowance increased from $59 million

as of December 31, 2019 to $70 million as of June 27, 2020 due to the effects of the COVID-19 pandemic and macroeconomic factors

such as government support. As a result of decreased sales demand and increased inventory levels, of which the COVID-19 pandemic

was a significant contributing factor, the provision for excess and obsolete inventory has increased from $308 million as of December

31, 2019 to $354 million as of June 27, 2020.

The impact of the COVID-19 pandemic on our businesses worldwide

has been strongly correlated with lockdown restrictions and the easing thereof. Despite rebounds in some markets, including China,

sales volumes have continued to lag in others, such as the United Kingdom, which accounted for 4% of our global sales for the six

months ended June 27, 2020, and Eastern Europe.

Any additional restrictions placed on elective procedures would

have an adverse impact on the Group’s revenue growth and operating and trading profit margins. The extent of the impact would

depend on the length, severity and geographical variation of restrictions on elective procedures. The impacts of the COVID-19 pandemic

and related response measures worldwide, including the impacts described above, have had and may continue to have an adverse effect

on global economic conditions, as well as on our business, results of operations, cash flows and financial condition and the COVID-19

pandemic may also have the effect of heightening many of the risks described in this prospectus supplement.

Highly competitive markets

The Group competes across a diverse range of geographic and

product markets. Each market in which the Group operates contains a number of different competitors, including specialized and

international corporations. Significant product innovations, technical advances or the intensification of price competition by

competitors could adversely affect the Group’s operating results. Some of these competitors may have greater financial, marketing

and other resources than Smith+Nephew. These competitors may be able to initiate technological advances in the field, deliver products

on more attractive terms, more aggressively market their products or invest larger amounts of capital and R&D into their businesses.

There is a possibility of further consolidation of competitors, which could adversely affect the Group’s ability to compete

with larger companies due to insufficient financial resources. If any of the Group’s businesses were to lose market share

or achieve lower than expected revenue growth, there could be a disproportionate adverse impact on the Group’s share price

and its strategic options. Competition exists among healthcare providers to gain patients on the basis of quality, service and

price. There has been some consolidation in the Group’s customer base and this trend is expected to continue. Some customers

have joined group purchasing organizations or introduced other cost containment measures that could lead to downward pressure on

prices or limit the number of suppliers in certain business areas, which could adversely affect Smith+Nephew’s results of

operations and hinder its growth potential.

Continual development and introduction of new products

The medical devices industry has a rapid rate of new product

introduction. In order to remain competitive, the Group must continue to develop innovative products that satisfy customer needs

and preferences or provide cost or other advantages. Developing new products is a costly, lengthy and uncertain process. The Group

may fail to innovate due to low R&D investment, a R&D skills gap or poor product development. A potential product may not

be brought to market or not succeed in the market for any number of reasons, including failure to work optimally, failure to receive

regulatory approval, failure to be cost-competitive, infringement of patents or other intellectual property rights and changes

in consumer demand. The Group’s products and technologies are also subject to marketing attack by competitors. Furthermore,

new products that are developed and marketed by the Group’s competitors may affect price levels in the various markets in

which the Group operates. If the Group’s new products do not remain competitive with those of competitors, the Group’s

revenue could decline.

The Group maintains reserves for excess and obsolete inventory

resulting from the potential inability to sell its products at prices in excess of current carrying costs. Marketplace changes

resulting from the introduction of new products or surgical procedures may cause some of the Group’s products to become obsolete.

The Group makes estimates regarding the future recoverability of the costs of these products and records a provision for excess

and obsolete inventories based on historical experience, expiration of sterilization dates and expected future trends. If actual

product life cycles, product demand or acceptance of new product introductions are less favorable than projected by management,

additional inventory write-downs may be required.

Proprietary rights and patents

Due to the technological nature of medical devices and the Group’s

emphasis on serving its customers with innovative products, the Group has been subject to patent infringement claims and is subject

to the potential for additional claims. Claims asserted by third parties regarding infringement of their intellectual property

rights, if successful, could require the Group to expend time and significant resources to pay damages, develop non-infringing

products or obtain licenses to the products which are the subject of such litigation, thereby affecting the Group’s growth

and profitability. Smith+Nephew attempts to protect its intellectual property and regularly opposes third party patents and trademarks

where appropriate in those areas that might conflict with the Group’s business interests. If Smith+Nephew fails to protect

and enforce its intellectual property rights successfully, its competitive position could suffer, which could harm its results

of operations. In addition, intellectual property rights may not be protectable to the same extent in all countries in which the

Group operates.

Dependence on government and other funding

In most markets throughout the world, expenditure on medical

devices is ultimately controlled to a large extent by governments. Funds may be made available or withdrawn from healthcare budgets

depending on government policy. The Group is therefore largely dependent on future governments providing increased funds commensurate

with the increased demand arising from demographic trends.

Pricing of the Group’s products is largely governed in

most markets by governmental reimbursement authorities. Initiatives sponsored by government agencies, legislative bodies and the

private sector to limit the growth of healthcare costs, including price regulation, excise taxes and competitive pricing, are ongoing

in markets where the Group has operations. This control may be exercised by determining prices for an individual product or for

an entire procedure. The Group is exposed to government policies favoring locally sourced products. The Group is also exposed to

changes in reimbursement policy, tax policy and pricing, including as a result of financial pressure on governments and hospitals

caused by the COVID-19 pandemic, which may have an adverse impact on revenue and operating profit. Provisions in U.S. healthcare

legislation which previously imposed significant taxes on medical device manufacturers were permanently repealed effective January

1, 2020. There may be an increased risk of adverse changes to government funding policies arising from deterioration in macro-economic

conditions from time to time in the Group’s markets.

The Group must adhere to the rules laid down by government agencies

that fund or regulate healthcare, including extensive and complex rules in the United States. Failure to do so could result in

fines or loss of future funding.

World economic conditions

Demand for the Group’s products is driven by demographic

trends, including the aging population and the incidence of osteoporosis and obesity. Supply of, use of and payment for the Group’s

products are also influenced by world economic conditions which could place increased pressure on demand and pricing, adversely

impacting the Group’s ability to deliver revenue and margin growth. The conditions could favor larger, better capitalized

groups, with higher market shares and margins. As a consequence, the Group’s prosperity is linked to general economic conditions

and there is a risk of deterioration of the Group’s performance and finances during adverse macro-economic conditions.

Economic conditions worldwide continue to create several challenges

for the Group, including the U.S. government’s approach to trade policy, heightened pricing pressure, significant declines

in capital equipment expenditures at hospitals and increased uncertainty over the collectability of government debt, particularly

those in the emerging markets. These factors could have an increased impact on growth in the future.

Political uncertainties, including Brexit

The Group operates on a worldwide basis and has distribution

channels, purchasing agents and buying entities in over 100 countries. Political upheaval in some of those countries or in surrounding

regions may impact the Group’s results of operations. Political changes in a country could prevent the Group from receiving

remittances of profit from a member of the Group located in that country or from selling its products or investments in that country.

Furthermore, changes in government policy regarding preference for local suppliers, import quotas, taxation or other matters could

adversely affect the Group’s revenue and operating profit. War, economic sanctions, terrorist activities or other conflict

could also adversely impact the Group. These risks may be greater in emerging markets, which account for an increasing portion

of the Group’s business.

There remain heightened levels of political and regulatory uncertainty

in the United Kingdom following the result of the referendum in June 2016 to leave the European Union. As of the date of this prospectus

supplement, there remains uncertainty as to the United Kingdom’s future trade and regulatory relationship with the European

Union. This may adversely impact trading performance across the sector. Regulatory uncertainty forms the most significant risk

presently; the ability for us to continue to manufacture and register our products in a compliant manner for global distribution

is key. Smith+Nephew has taken steps to prepare for Brexit, including moving certain of its product certifications from UK-based

notified bodies to notified bodies based in the European Union. The United Kingdom accounts for approximately 4% of global Group

revenue and the majority of our manufacturing takes place outside the United Kingdom and European Union. There is also uncertainty

around U.S.-China trade relations, which has resulted in tariffs on some medical devices being exported between the two countries.

The upcoming U.S. elections in November 2020 may also result in changes that have an adverse impact on the Group.

Currency fluctuations

Smith+Nephew’s results of operations are affected by transactional

exchange rate movements in that they are subject to exposures arising from revenue in a currency different from the related costs

and expenses. The Group’s manufacturing cost base is situated principally in the United States, the United Kingdom, China,

Costa Rica and Switzerland, from which finished products are exported to the Group’s selling operations worldwide. Thus,

the Group is exposed to fluctuations in exchange rates between the U.S. Dollar, Sterling and Swiss Franc and the currency of the

Group’s selling operations, particularly the Euro, Chinese Yuan, Australian Dollar and Japanese Yen. If the U.S. Dollar,

Sterling or Swiss Franc should strengthen against the Euro, Australian Dollar and the Japanese Yen, the Group’s trading margin

could be adversely affected. The Group manages the impact of exchange rate movements on operating profit by a policy of transacting

forward foreign currency contracts when firm commitments exist. In addition, the Group’s policy is for forecast transactions

to be covered between 50% and 90% for up to one year. However, the Group is still exposed to medium to long-term adverse movements

in the strength of currencies compared to the U.S. Dollar. The Group uses the U.S. Dollar as its reporting currency. The U.S. Dollar

is the functional currency of Smith & Nephew plc. The Group’s revenues, profits and earnings are also affected by exchange

rate movements on the translation of results of operations in foreign subsidiaries for financial reporting purposes.

Manufacturing and supply

The Group’s manufacturing production is concentrated at

main facilities in Memphis, Mansfield, Columbia and Oklahoma City in the United States, Hull and Warwick in the United Kingdom,

Aarau in Switzerland, Tuttlingen in Germany, Suzhou and Beijing in China, and Alajuela in Costa Rica. Disruptions which have taken

place at these sites as a result of the COVID-19 pandemic have had and may continue to have an adverse effect on the results of

operations.

Physical loss and consequential loss insurance is carried to

cover major physical disruption to these sites but is subject to limits and deductibles, generally does not cover COVID-19 related

disruptions and may not be sufficient to cover catastrophic loss. Management of orthopaedic inventory is complex, particularly

forecasting and production planning. There is a risk that failures in operational execution could lead to excess inventory or individual

product shortages.

The Group is reliant on certain key suppliers of raw materials,

components, finished products and packaging materials or in some cases on a single supplier. Disruptions in the supply chains and

operations of our suppliers as a result of the COVID-19 pandemic could result in an increase in our costs of production and distribution.

These suppliers must also provide materials in compliance with

legal requirements and perform activities to the Group’s standard of quality requirements. A supplier’s failure to

comply with legal requirements or otherwise meet expected quality standards could create liability for the Group and adversely

affect sales of the Group’s related products. The Group may be forced to pay higher prices to obtain raw materials, which

it may not be able to pass on to its customers in the form of increased prices for its finished products.

In addition, some of the raw materials used may become unavailable,

and there can be no assurance that the Group will be able to obtain suitable and cost effective substitutes. Interruptions of supply

caused by these or other factors have had and may continue to have a negative impact on Smith+Nephew’s revenue and operating

profit.

The Group will, from time to time including as part of the Accelerating

Performance and Execution (APEX) program, outsource or insource the manufacture of components and finished products to or from

third parties and will periodically relocate the manufacture of product and/or processes between existing and/or new facilities.

While these are planned activities, with these transfers there is a risk of disruption to supply.

Natural disasters can also lead to manufacturing and supply

delays, product shortages, excess inventory, unanticipated costs, lost revenues and damage to reputation. In addition, new environmental

regulation or more aggressive enforcement of existing regulations can impact the Group’s ability to manufacture, sterilize

and supply product. In addition, our physical assets and supply chains

are vulnerable to weather and climate change (e.g. sea level rise, increased frequency and severity of extreme weather events,

and stress on water resources).

Requirements of global regulatory agencies have become more

stringent in recent years and we expect them to continue to do so. The Group’s Quality and Regulatory Affairs team is leading

a major Group-wide program to prepare for implementation of the EU Medical Devices Regulation (“MDR”), which came into

force in May 2017 with an initial expected three-year transition period until May 2020. Due to the COVID-19 pandemic, the European

Commission published a formal proposal in early April, announcing the delay to the implementation by 12 months to May 26, 2021.

The regulation includes new requirements for the manufacture, supply and sale of all CE marked products sold in Europe (i.e. those

products that conform with health, safety and environmental protection standards within the European Economic Area) and requires

the reregistration of all medical devices, regardless of where they are manufactured. Smith+Nephew expects there will be significant

capacity constraints under the new European system, given the small number of notified bodies certified under MDR to date. This

could cause delays for medical device approvals for the industry more broadly and may result in delays for patients.

Other critical features of the system are also far from completion

and many of the major implementing acts remain to be completed. The European Commission has taken some important steps to aid implementation,

including delaying the EU database (EUDAMED) and passing a Corrigendum to give a longer implementation timeline for certain Class

1R devices (i.e. reusable surgical instruments), which helps address certain of the capacity constraint concerns.

The Group operates with a global remit and the speed of technological

change in an already complex manufacturing process leads to greater potential for disruption. Additional risks to supply include

inadequate sales and operational planning and inadequate supply chain capacity to support customer demand and growth.

Attracting and retaining key personnel

The Group’s continued development depends on its ability

to hire and retain highly-skilled personnel with particular expertise. This is critical, particularly in general management, research,

new product development and in the sales forces. If Smith+Nephew is unable to retain key personnel in general management, research

and new product development or if its largest sales forces suffer disruption or upheaval, its revenue and operating profit would

be adversely affected. Additionally, if the Group is unable to recruit, hire, develop and retain a talented, competitive workforce,

it may not be able to meet its strategic business objectives.

Product liability claims and loss of reputation

The development, manufacture and sale of medical devices entail

risk of product liability claims or recalls. Design and manufacturing defects with respect to products sold by the Group or by

companies it has acquired could damage, or impair the repair of, body functions. The Group may become subject to liability, which

could be substantial, because of actual or alleged defects in its products. In addition, product defects could lead to the need

to recall from the market existing products, which may be costly and harmful to the Group’s reputation. There can be no assurance

that customers, particularly in the United States, the Group’s largest geographical market, will not bring product liability

or related claims that would have a material adverse effect on the Group’s financial position or results of operations in

the future, or that the Group will be able to resolve such claims within insurance limits. As of December 31, 2019, a provision

of $315 million has been recognized relating to the present value of the estimated costs to resolve all unsettled known and anticipated

metal-on-metal hip implant claims globally.

Regulatory standards and compliance in the healthcare

industry

Business practices in the healthcare industry are subject to

regulation and review by various government authorities. In general, the trend in many countries in which the Group does business

is towards higher expectations and increased enforcement activity by governmental authorities. While the Group is committed to

doing business with integrity and welcomes the trend to higher standards in the healthcare industry, the Group and other companies

in the industry have been subject to investigations and other enforcement activity that have incurred and may continue to incur significant expense. Under certain circumstances, if

the Group were found to have violated the law, its ability to sell its products to certain customers could be restricted.

International regulation

The Group operates across the world and is subject to extensive

legislation, including anti-bribery and corruption and data protection, in each country in which the Group operates. Our international

operations are governed by the UK Bribery Act and the U.S. Foreign Corrupt Practices Act which prohibit us or our representatives

from making or offering improper payments to government officials and other persons or accepting payments for the purpose of obtaining

or maintaining business. Our international operations in the emerging markets which operate through distributors increase our Group

exposure to these risks. In this regard, the Group is investigating allegations of possible violations of anti-corruption laws

in India and responding to related requests for information from the SEC. It is not possible to predict the nature, scope or outcome

of the investigations, including the extent to which, if at all, this could result in any liability to the Group.

The Group is also required to comply with the requirements of

the EU General Data Protection Regulation (“GDPR”), which imposes additional obligations on companies regarding the

handling of personal data and provides certain individual privacy rights to persons whose data is stored and became effective on

May 25, 2018. As privacy and data protection have become more sensitive issues for regulators and consumers, new privacy and data

protection laws, such as the GDPR and the recent invalidation of the EU-U.S. Privacy Shield by the EU high court, continue to develop

in ways we cannot predict. Ensuring compliance with evolving privacy and data protection laws and regulations on a global basis

may require us to change or develop our current business models and practices and may increase our cost of doing business. Despite

those efforts, there is a risk that we may be subject to fines and penalties, litigation, and reputational harm in connection with

our European activities as enforcement of such legislation has increased in recent years on companies and individuals where breaches

are found to have occurred. Failure to comply with the requirements of privacy and data protection laws, including GDPR, could

adversely affect our business, financial condition or results of operations.

Operating in multiple jurisdictions also subjects the Group

to local laws and regulations related to tax, pricing, reimbursement, regulatory requirements, trade policy and varying levels

of protection of intellectual property. This exposes the Group to additional risks and potential costs.

Regulatory approval

The international medical device industry is highly regulated.

Regulatory requirements are a major factor in determining whether substances and materials can be developed into marketable products

and the amount of time and expense that should be allotted to such development.

National regulatory authorities administer and enforce a complex

series of laws and regulations that govern the design, development, approval, manufacture, labelling, marketing and sale of healthcare

products. They also review data supporting the safety and efficacy of such products. Of particular importance is the requirement

in many countries that products be authorized or registered prior to manufacture, marketing or sale and that such authorization

or registration be subsequently maintained. The major regulatory agencies for Smith+Nephew’s products include the Food and

Drug Administration (“FDA”) in the United States, the Medicines and Healthcare products Regulatory Agency in the United

Kingdom, the Ministry of Health, Labor and Welfare in Japan, the State Food and Drug Administration in China and the Australian

Therapeutic Goods Administration. At any time, the Group is awaiting a number of regulatory approvals which, if not received, could

adversely affect results of operations. In 2017, the European Union reached agreement on a new set of Medical Device Regulations

which entered into force on May 25, 2017 with an initial expected three-year transition period until May 2020. Due to the COVID-19

pandemic, the European Commission published a formal proposal in early April, announcing the delay to the implementation by 12

months to May 26, 2021.

The trend is towards more stringent regulation and higher standards

of technical appraisal. Such controls have become increasingly demanding to comply with and management believes that this trend

will continue. Privacy laws (including Health Insurance Portability and Accountability Act of 1996 in the United States and GDPR

in the United Kingdom) and environmental regulations have also become more stringent. Regulatory requirements may also entail

inspections for compliance with appropriate standards, including

those relating to Quality Management Systems or Good Manufacturing Practices regulations. All manufacturing and other significant

facilities within the Group are subject to regular internal and external audit for compliance with national medical device regulation

and Group policies. Payment for medical devices may be governed by reimbursement tariff agencies in a number of countries. Reimbursement

rates may be set in response to perceived economic value of the devices, based on clinical and other data relating to cost, patient

outcomes and comparative effectiveness. They may also be affected by overall government budgetary considerations. The Group believes

that its emphasis on innovative products and services should contribute to success in this environment. Failure to comply with

these regulatory requirements could have a number of adverse consequences, including withdrawal of approval to sell a product in

a country, temporary closure of a manufacturing facility, fines and potential damage to Company reputation.

Failure to make successful acquisitions

A key element of the Group’s strategy for continued growth

is to make acquisitions or alliances to complement its existing business. Failure to identify appropriate acquisition targets or

failure to conduct adequate due diligence or to integrate them successfully would have an adverse impact on the Group’s competitive

position and profitability. This could result from the diversion of management resources from the acquisition or integration process,

challenges of integrating organizations of different geographic, cultural and ethical backgrounds, as well as the prospect of taking

on unexpected or unknown liabilities. In addition, the availability of global capital may make financing less attainable or more

expensive and could result in the Group failing in its strategic aim of growth by acquisition or alliance.

Relationships with healthcare professionals

The Group seeks to maintain effective and ethical working relationships

with physicians and medical personnel who assist in the R&D of new products or improvements to our existing product range or

in product training and medical education. If we are unable to maintain these relationships our ability to meet the demands of

our customers could be diminished and our revenue and profit could be materially adversely affected.

Reliance on sophisticated information technology and cybersecurity

The Group uses a wide variety of information systems, programs

and technology to manage our business. The Group also develops and sells certain products that are or will be digitally enabled

including connection to networks and/or the internet. Our systems and the systems of the entities we acquire are vulnerable to

a cyber attack, theft of intellectual property, malicious intrusion, loss of data privacy or other significant disruption. Our

systems have been and will continue to be the target of such threats, including as a result of increased levels of remote working

due to the COVID-19 pandemic. Cybersecurity is a multifaceted discipline covering people, process and technology. It is also an

area where more can always be done; it is a continually evolving practice. We have a layered security approach in place to prevent,

detect and respond, in order to minimize the risk and disruption of these intrusions and to monitor our systems on an ongoing basis

for current or potential threats. There can be no assurance that these measures will prove effective in protecting Smith+Nephew

from future interruptions and as a result the performance of the Group could be materially adversely affected.

Financial reporting, compliance and control

Our financial results depend on our ability to comply with financial

reporting and disclosure requirements, comply with tax laws, appropriately manage treasury activities and avoid significant transactional

errors and customer defaults. Failure to comply with our financial reporting requirements or relevant tax laws can lead to litigation

and regulatory activity and ultimately to material loss to the Group. Potential risks include failure to report accurate financial

information in compliance with accounting standards and applicable legislation, failure to comply with current tax laws, failure

to manage treasury risk effectively and failure to operate adequate financial controls over business operations.

Other risk factors

Smith+Nephew is subject to a number of other risks, which are

common to most global medical technology groups and are reviewed as part of the Group’s Risk Management process.

Risks Relating to the Notes

We may not be able to repurchase the notes upon a Change

of Control Repurchase Event

If a “Change of Control Repurchase Event” (as defined

in “Description of Notes—Repurchase upon Change of Control Repurchase Event”) occurs, we will be required

to offer to repurchase the Notes at a repurchase price equal to 101% of their principal amount, plus accrued and unpaid interest,

if any, to the date of repurchase unless the Notes have been previously redeemed or called for redemption. If a “Change of

Control Repurchase Event” occurs, there can be no assurance that we would have sufficient financial resources available to

satisfy our obligations to repurchase the notes or that the terms of other indebtedness will not preclude us from doing so. Our

failure to repurchase the Notes as required under the Indenture governing such notes would result in a default under the Indenture,

which could result in other defaults under our and our subsidiaries’ various debt agreements and other arrangements and have

material adverse consequences for us and the holders of the notes. For more information, see “Description of Notes—Repurchase

upon Change of Control Repurchase Event.”

Additionally, you should read “Risk Factors—Risks Relating to the Debt Securities” in the accompanying prospectus.

Selected

Financial Information

The selected consolidated financial data for the Group set forth

below as of and for the years ended December 31, 2019, 2018, 2017, 2016 and 2015 is derived from our audited consolidated financial

statements, which can be found in our Annual Report on Form 20-F for the year ended December 31, 2019 and are incorporated by reference

herein, and has been prepared in accordance with International Financial Reporting Standards (“IFRS”) as adopted by

the EU and as issued by the International Accounting Standards Board (“IASB”). IFRS as adopted by the EU differs in

certain respects from IFRS as issued by the IASB. However, the differences have no impact for the periods presented below. The

selected consolidated financial data set forth below as of and for the six month periods ended June 27, 2020 and June 29, 2019

is derived from our unaudited consolidated financial statements for the six month period ended June 27, 2020 contained in our Report

on Form 6-K dated July 29, 2020, incorporated by reference herein. The unaudited consolidated financial statements include all

adjustments which we consider necessary for a fair statement of our financial position and results of operations for those periods

in accordance with IFRS. The results for the six month period ended June 27, 2020 are not necessarily indicative of the results

that might be expected for the entire year ending December 31, 2020 or any other period. The selected consolidated financial information

set forth below should be read in conjunction with our consolidated financial statements, the notes related thereto and the financial

and operating data incorporated by reference into this prospectus supplement and the accompanying prospectus.

The Group applied IFRS 16 Leases (“IFRS 16”)

for the first time on January 1, 2019. IFRS 16 primarily affected the accounting for operating leases except for short-term and

low value leases. Almost all leases are recognized on the balance sheet as an asset (the right to use the leased item) and a financial

liability to pay the rentals. The cumulative effect of initially adopting IFRS 16 on January 1, 2019 was recognized as an adjustment

for additional right-of-use assets of $159 million, a rent-free period accrual of $5 million and lease liabilities of $164 million.

The Group adopted IFRS 16 in accordance with the modified retrospective approach, under which prior year figures were not restated.

Accordingly, the selected consolidated financial data for the Group set forth below as of and for the years ended December 31,

2018, 2017, 2016 and 2015 differ from, and are not directly comparable to, the selected consolidated financial data for subsequent

periods and have not been restated in this prospectus supplement to adjust for the impact of IFRS 16. For further information please

refer to our Annual Report on Form 20-F for the year ended December 31, 2019, incorporated by reference herein.

|

|

|

For the Six Months

Ended

|

|

For the Year Ended December 31,

|

|

|

|

June 27,

2020

|

|

June 29,

2019

|

|

2019

|

|

2018

|

|

2017

|

|

2016

|

|

2015

|

|

|

|

(in $ millions)

|

|

Income Statement Data(1)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue

|

|

|

2,035

|

|

|

|

2,485

|

|

|

|

5,138

|

|

|

|

4,904

|

|

|

|

4,765

|

|

|

|

4,669

|

|

|

|

4,634

|

|

|

Cost of goods sold

|

|

|

(646

|

)

|

|

|

(648

|

)

|

|

|

(1,338

|

)

|

|

|

(1,298

|

)

|

|

|

(1,248

|

)

|

|

|

(1,272

|

)

|

|

|

(1,143

|

)

|

|

Gross profit

|

|

|

1,389

|

|

|

|

1,837

|

|

|

|

3,800

|

|

|

|

3,606

|

|

|

|

3,517

|

|

|

|

3,397

|

|

|

|

3,491

|

|

|

Selling, general and administrative expenses

|

|

|

(1,246

|

)

|

|

|

(1,279

|

)

|

|

|

(2,693

|

)

|

|

|

(2,497

|

)

|

|

|

(2,360

|

)

|

|

|

(2,366

|

)

|

|

|