Rolls-Royce Share Price Dives on Dividend Warning, Weaker Outlook -- 3rd Update

November 12 2015 - 8:27AM

Dow Jones News

By Robert Wall

LONDON-- Rolls-Royce Holdings PLC on Thursday suffered its

sharpest share drop in more than 15 years after the British engine

maker said it may cut its dividend and warned that its earnings

outlook for this year and next had weakened.

The company said that earnings this year would be at the low end

of its guidance and that profit next year would be GBP650 million

($988.8 million) lower than it expected, without stating its

projection.

The maker of aircraft engines for Boeing Co. 787 Dreamliners and

Airbus Group SE A380 superjumbos said full-year underlying pretax

profit, a measure that excludes some costs, is now expected to be

at the low end of its GBP1.33 billion and GBP1.48 billion

range.

"The outlook for 2016 is very challenging. The speed and

magnitude of change in some of our markets, which have historically

performed well, has been significant and shows how sensitive parts

of our business are to market conditions in the short-term," Chief

Executive Warren East said.

Shares in Rolls-Royce fell more than 23% in midday London

trading.

Agency Partners analyst Nick Cunningham said there are

"existential risks" at Rolls-Royce and that the share price had

further to fall.

It is the second profit warning for Mr. East, who issued his

first only two days into taking the top job in July. The latest was

widely expected as Mr. East reset investor expectations. The

company has been struggling with costs in its aerospace business

and a weaker market for its marine engine business amid lower oil

prices.

The company said demand for engines in the corporate-jet market

and regional planes had slowed. Use of some older long-range planes

is coming down, affecting Rolls-Royce's services sales.

Rolls-Royce said it would review its dividend plans. The review

should be completed by the time the company reports full-year

results in February.

The company's balance sheet and liquidity were strong, Mr. East

said, but the cost impact of planned changes to the business made

it prudent to review dividend plans.

The company also suspended its medium-term guidance.

Mr. East was named chief executive after the company suffered a

series of profit warnings under his predecessor, John Rishton,

drawing investor ire. Shares in Rolls-Royce have retreated more

than 57% since its series of profit warnings began in February

2014.

In July, Rolls-Royce activist investor ValueAct Capital

Management LP raised its stake in the company to more than 5%. It

also is seeking board representation, Mr. East said. "They have

some very good questions, " he said, without discussing details of

the discussions between management and the investor.

Rolls-Royce also announced Thursday initial findings of an

operational review that Mr. East has been conducting. The review

was aimed at finding ways to boost Rolls-Royce's returns, though

shies away from major shifts in strategy.

"As a business, we carry too much fixed cost and are inflexible

in managing this in response to changes in market conditions. This

is unacceptable in a world-class business that, as I've said

before, needs to be more resilient and sustainable," Mr. East

said.

The company said the savings measures, including streamlining

senior management and reductions in costs should yield incremental

gross cost savings of GBP150 million to GBP200 million a year from

2017. Rolls-Royce plans to spell out full details on these measures

in a Nov. 24 investor day.

Rolls-Royce said a previous cost-savings program was on track to

deliver the promised GBP115 million in on-year savings in the

aerospace and marine businesses next year. The company has

announced big job cuts in both areas.

"The next few years are going to be important in laying the

foundations for our long-term profitable growth," Mr. East said.

Long-term prospects remain positive, he said.

Chief Financial Officer David Smith said the business should see

strong growth over the next five years "that will produce

significant improvement in the results result of the business."

Write to Robert Wall at robert.wall@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 12, 2015 08:12 ET (13:12 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

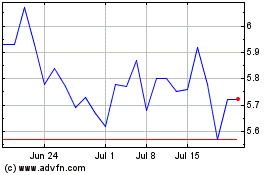

Rolls Royce (PK) (USOTC:RYCEY)

Historical Stock Chart

From Jun 2024 to Jul 2024

Rolls Royce (PK) (USOTC:RYCEY)

Historical Stock Chart

From Jul 2023 to Jul 2024