false

2023

FY

Yes

--11-30

false

0001627469

0001627469

2022-12-01

2023-11-30

0001627469

2023-05-31

0001627469

2024-03-08

0001627469

2023-11-30

0001627469

2022-11-30

0001627469

2021-12-01

2022-11-30

0001627469

us-gaap:CommonStockMember

2021-11-30

0001627469

us-gaap:AdditionalPaidInCapitalMember

2021-11-30

0001627469

us-gaap:RetainedEarningsMember

2021-11-30

0001627469

us-gaap:AccumulatedOtherComprehensiveIncomeLossDerivativeQualifyingAsHedgeExcludedComponentIncludingPortionAttributableToNoncontrollingInterestMember

2021-11-30

0001627469

2021-11-30

0001627469

us-gaap:CommonStockMember

2022-11-30

0001627469

us-gaap:AdditionalPaidInCapitalMember

2022-11-30

0001627469

us-gaap:RetainedEarningsMember

2022-11-30

0001627469

us-gaap:AccumulatedOtherComprehensiveIncomeLossDerivativeQualifyingAsHedgeExcludedComponentIncludingPortionAttributableToNoncontrollingInterestMember

2022-11-30

0001627469

us-gaap:CommonStockMember

2021-12-01

2022-11-30

0001627469

us-gaap:AdditionalPaidInCapitalMember

2021-12-01

2022-11-30

0001627469

us-gaap:RetainedEarningsMember

2021-12-01

2022-11-30

0001627469

us-gaap:AccumulatedOtherComprehensiveIncomeLossDerivativeQualifyingAsHedgeExcludedComponentIncludingPortionAttributableToNoncontrollingInterestMember

2021-12-01

2022-11-30

0001627469

us-gaap:CommonStockMember

2022-12-01

2023-11-30

0001627469

us-gaap:AdditionalPaidInCapitalMember

2022-12-01

2023-11-30

0001627469

us-gaap:RetainedEarningsMember

2022-12-01

2023-11-30

0001627469

us-gaap:AccumulatedOtherComprehensiveIncomeLossDerivativeQualifyingAsHedgeExcludedComponentIncludingPortionAttributableToNoncontrollingInterestMember

2022-12-01

2023-11-30

0001627469

us-gaap:CommonStockMember

2023-11-30

0001627469

us-gaap:AdditionalPaidInCapitalMember

2023-11-30

0001627469

us-gaap:RetainedEarningsMember

2023-11-30

0001627469

us-gaap:AccumulatedOtherComprehensiveIncomeLossDerivativeQualifyingAsHedgeExcludedComponentIncludingPortionAttributableToNoncontrollingInterestMember

2023-11-30

0001627469

2020-07-02

0001627469

2023-12-01

2024-03-08

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| [X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934. |

FOR THE

FISCAL YEAR ENDED NOVEMBER 30, 2023

OR

| [ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

COMMISSION FILE NUMBER: 000-55806

PHOTOZOU

HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

| |

Delaware |

90-1260322 |

|

| |

(State or other jurisdiction

of incorporation or organization) |

(I.R.S. Employer Identification No.) |

|

| |

|

|

|

| |

4-30-4F, Yotsuya Shinjuku-ku,

Tokyo, Japan |

160-0004 |

|

| |

(Address of Principal Executive Offices) |

(Zip Code) |

|

Securities to be registered under Section 12(b) of

the Act: None

Securities to be registered under Section 12(g) of

the Exchange Act:

| |

Title of each class |

|

Name of each exchange on which

registered |

|

| |

Common Stock, $0.0001 |

|

N/A |

|

Indicate by check mark if the registrant is a well-known

seasoned issuer, as defined in Rule 405 of the Securities Act.

[ ] Yes [X] No

Indicate by check mark if the registrant is not required

to file reports pursuant to Section 13 or Section 15(d) of the Act.

[ ] Yes [X] No

Indicate by check mark whether the registrant (1)

has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months

(or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements

for the past 90 days.

[X] Yes [ ] No

Indicate by check mark whether the registrant has

submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted

pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that

the registrant was required to submit and post such files).

[X] Yes [ ] No

Indicate by check mark if disclosure of delinquent

filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to

the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this

Form 10-K or any amendment to this Form 10-K.

[ ]

Indicate by check mark whether the registrant is a

large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See

the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and

“emerging growth company” in Rule 12b-2 of the Exchange Act:

Large accelerated filer [ ] Accelerated filer [ ]

Non-accelerated filer [X] Smaller reporting company [X] Emerging growth company [ ]

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. [ ]

Indicate by check mark whether the registrant is a

shell company (as defined in Rule 12b-2 of the Exchange Act).

[ ] Yes [X] No

As of May 31, 2023, the aggregate market value of the voting common

stock held by non-affiliates of the Registrant (without admitting that any person whose shares are not included in such calculation is

an affiliate) was approximately $197. This was calculated using the par value $0.0001.

As of March 8, 2024, there were 8,000,000 shares of the Registrant's common stock, par value $0.0001 per share, issued and outstanding.

- 1 -

Table of Contents

TABLE OF CONTENTS

PHOTOZOU

HOLDINGS, INC.

-

2 -

Table

of Contents

PART

I

Item 1. Business

Corporate

History

Photozou

Holdings, Inc., ("Photozou Holdings," or the "Company"), was incorporated in the State of Delaware on September 29,

2014, with the purposes to engage in any lawful act or activity for which corporations may be

organized under the General Corporation Law of Delaware (the "DGCL").

The Company was formed by Thomas DeNunzio, our former

sole officer and director, for the purpose of creating a corporation which could be used to consummate a merger or acquisition.

On January 13, 2017, Thomas DeNunzio sold 8,000,000

shares of our restricted common stock, which represented all of our issued and outstanding shares at the time, to Photozou Co.,

Ltd., a Japan corporation.

Photozou

Co., Ltd. is and was controlled by Koichi Ishizuka, a Japanese citizen. The aforementioned shares were sold pursuant to Regulation S

of the Securities Act of 1933, as amended ("Regulation S"). No directed selling efforts were made in the United States.

On January 13, 2017, Mr. Thomas DeNunzio resigned

as our Chief Executive Officer, Chief Financial Officer, President, Director, Secretary, and Treasurer.

On January 13, 2017, Mr. Koichi Ishizuka was appointed

as Chief Executive Officer, Chief Financial Officer, President, Director, Secretary, and Treasurer.

On January 18, 2017, we changed our name from Exquisite

Acquisition, Inc. to Photozou Holdings, Inc.

Pursuant to our Registration Statement deemed effective

on June 20, 2017, we, “the Company,” sold a total of 3,037,300 shares of our common stock. The proceeds totaled $75,933. These

shares were sold pursuant to Rule 419.

On May 8, 2018, the Company conducted a stock cancellation

of the above 3,037,300 shares and the total funds of $75,933 were returned to investors. The cancellation of the shares and return of

funds was due to the fact that we did not make an acquisition in the allotted time granted by Rule 419.

On May 31, 2018, the Company entered into and consummated

a Stock Purchase Agreement with Koichi Ishizuka, our President, CEO, and Director. At the closing of the Stock Purchase Agreement, Koichi

Ishizuka transferred to the Company, 10,000 shares of common stock of Photozou Koukoku Co., Ltd., a Japan corporation (“Photozou

Koukoku”), which represented all of its issued and outstanding shares, in consideration of 1,000,000 JPY ($9,190 USD as of the exchange

rate May 31, 2018). The Company has since gained a 100% interest in the issued and outstanding shares of Photozou Koukoku’s common

stock and Photozou Koukoku became a wholly owned subsidiary of the Company. The Company and Photozou Koukoku were under common control

at the time of the acquisition.

Photozou Koukoku Co., Ltd. was incorporated

under the laws of Japan on March 14, 2017. Currently, Photozou Koukoku is headquartered in Tokyo, Japan. The Company primarily

engages in online advertising through its photo sharing platforms, provides photo session services, and specializes in the resale of

cameras.

On September 21, 2020, Photozou Co., Ltd our

principal controlling shareholder, entered into a Stock Purchase Agreement with Koichi Ishizuka, our Sole Officer and Director.

Pursuant to the closing of the Agreement on September 21, 2020, Photozou Co., Ltd. transferred to Koichi Ishizuka 4,553,200 shares

of our common stock, which represented, at the time, approximately 56.9% of our issued and outstanding common stock, in

consideration of JPY 6,657,917 (approximately $60,500). Following the closing of the share purchase transaction, Koichi Ishizuka

owned approximately 66.7% interest in the issued and outstanding shares of our common stock. Photozou Co., Ltd. was and remains

owned and controlled entirely by Koichi Ishizuka, we do not believe that this transaction is deemed to be a change in control of the

Company.

Overview

Our principal executive offices are located at 4-30-4F,

Yotsuya, Shinjuku-ku, Tokyo, 160-0004, Japan.

The Company has elected November 30th as

its fiscal year end.

Currently, we operate through our wholly owned subsidiary,

Photozou Koukoku Co., Ltd., “Photozou Koukoku”, which is engaged in advertising services, photo session services, and selling

used cameras.

Photozou Koukoku was incorporated under the laws of

Japan on March 14, 2017.

Currently, Photozou Koukoku is headquartered at 4-30-4F,

Yotsuya, Shinjuku-ku, Tokyo, 160-0004, Japan. Photozou Koukoku’s office space is provided rent free by our Chief Executive Officer,

Koichi Ishizuka.

Photozou Koukoku Co., Ltd.’s business operations

are primarily focused around the sale of used cameras sold through Amazon USA, photo session services held in Tokyo and Kansai, and online

advertising through various channels. On April 17, 2017, Photozou Koukoku obtained a license to operate as a used goods merchant in Japan.

On July 31, 2023, the Company acquired a website

(https://photozou.jp/) in consideration of JPY 1 (nil in USD) from a related party, Photozou Co. Ltd., a company controlled by Koichi

Ishizuka, CEO, which resulted in the transaction being considered a transfer between entities under common control. The website https://photozou.jp/

is designed for free photo sharing, and may, in addition to other features, offer users the option to store pictures on the website for

a nominal fee.

Background of Operations - Sale of Cameras

Photozou Koukoku resells used cameras as its primary

business, which include mainly high-class digital single lens reflex cameras produced by well-known Japanese camera makers, e.g. Canon,

Nikon, Fujifilm, etc.

The camera industry in Japan is a multi-billion-dollar

industry and cameras made in Japan have worldwide appeal and recognition. This is due to the fact that common household name camera manufacturers

such as Canon, Nikon, Sony and several others, are headquartered in Japan and sell high end, digital cameras, generally associated with

high quality.

The Company believes that due to the high quality

of cameras created by Japanese camera makers that these will be the most appealing products to offer to the USA and Japanese market.

However, should market trends shift and the demand

for cameras of other companies see a surge in popularity then Photozou Koukoku may consider the possibility of acquiring and reselling

cameras by other manufacturers. It may also consider the possibility of selling electronics that serve other purposes other than taking

photographs, but have a camera embedded in them, such as camera phones. At this time however, the focus is to sell used high-class digital

single lens reflex cameras.

Purchasing

Photozou Koukoku primarily purchases used cameras

from used camera dealers and individual consumers in Japan. Photozou Koukoku’s supporting website at http://photozou.jp/kaitori/top/

can be used by interested parties to access pertinent information relating to selling their cameras. For example, there is a section

of the website which discloses a price list by product. Through the website they can also request an estimate, review Photozou Koukoku’s

procedure for purchasing cameras and fill out an application to sell their camera. Currently, Photozou Koukoku has hired, as an independent

contractor, Mr. Takaharu Ogami to handle the entirety of all purchasing and selling activities of Photozou Koukoku’s camera business.

Relating to his services to Photozou Koukoku, Mr. Takaharu is paid a monthly fee in amount of JPY 450,000 ($3,060). Mr. Ogami is responsible

for the sale and shipping of the cameras at the expense of Photozou Koukoku. Photozou Koukoku is the legal owner of the camera(s) until

the point of sale to the purchaser or purchaser(s).

- 3 -

Table of Contents

Inventory

The Company consigns its operations regarding the

sale of cameras to Mr. Ogami. Inventory, however, remains under legal ownership of the Company.

As of November 30, 2023, and 2022, the Company held

inventory comprised solely of used cameras in the amount of $68,466 and $58,780, respectively. The aforementioned amounts were presented

net of allowance for inventory obsolescence as of November 30, 2023 and 2022 totaling $7,089 and $11,900, respectively.

Selling

Photozou Koukoku sells its used cameras through Amazon

USA and Japan. Cameras are then shipped to the purchaser for a fee that is determined at the time of sale, and may differ on a case-by-case

basis depending on the type of camera and method of delivery.

Advertising Services

At present, Photozou Koukoku conducts a single type

of advertising service. The Company utilizes web advertising services specifically geared toward advertisements that are placed on https://photozou.jp/,

which is a website for photo sharing.

Photozou Koukoku develops banner ads for third party

companies and subsequently assists those clients with having those advertisements placed on https://photozou.jp/. Fees are determined

on a case-by-case basis and vary depending on whether or not Photozou Co., Ltd contracts Photozou Koukoku to work with a pre-existing

client, or if Photozou Koukoku obtains the client on its own accord.

It is possible that the Company will expand into offering

additional online advertising services and will create advertisements in forms other than banner ads, but no such plans have been fully

developed at this point in time.

Photo Contests

The Company has suspended its involvement with online photo contests, posted

on https://photozou.jp/, indefinitely. This decision came about as a result of the closure of the photo magazine “Photo Technic

Digital”, which was our collaborative partner in regard to photo contests, social networking and magazine collaboration. We are

of the understanding that the closure of Photo Technic Digital was the result of impacts the magazine suffered resulting from the Covid-19

pandemic.

Instead of hosting photo contests on https://photozou.jp/, the Photozou SNS (Social Networking Service) commenced operations in October

2023 via https://photozou.com/. The Photozou SNS is a social networking website, primarily for photo sharing, with a particular emphasis

placed on photography of models and promotion of the Primavera Photo Sessions (described in more detail below). Recently, we have initiated

hosting photo contests on the Photozou SNS with the aim of boosting user engagement on the website.

Photo session services

Starting in April 2021, Photozou Koukoku began providing

commercial photo session services to customers. The customers sign up for a photo session and Photozou Koukoku organizes the session in

which customers can take photos of models provided by Photozou Koukoku for the customer. The rights to any images or video taken by the

customer are retained by the Company, models, and model’s office, not the customer. The photo sessions are intended to be a skill

building activity as the Company believes many customers in Japan are interested in improving their photographic skills. Photographers

shall not publish images or videos taken at the photo sessions without the consent of both the Company and the model whose pictures are

taken. These photo sessions are held every weekend in Osaka and Tokyo since April, 2021 and February, 2022, respectively.

Approximately, 19 models are associated with the photo

session services provided in Osaka (https://www.primavera-photo-session.com/). Approximately, 11 models are part of Photozou Koukoku photo

sessions conducted in Tokyo (https://www.pps-tokyo.jp/). It is our intention to increase the number of models available for photo sessions,

through the assistance of a third-party contractor who began, in December of 2023, to manage the photo session services on our behalf

for a fee of approximately 200,000 JPY per month. It's important to clarify that the photo session services offered under the name 'Primavera

Photo Sessions' are not operated as a separate legal entity from Photozou Koukoku. Rather, 'Primavera Photo Sessions' is the branding

used by Photozou Koukoku to deliver these services.

Previously, the Company had engaged Blossom Report

Co., Ltd., to provide assistance with contacting and interviewing prospective models, but this arrangement was terminated around August

of 2023.

Customers pay an all-inclusive fee directly to Photozou

Koukoku, who in turn pays any associated costs or other expenses, including the amounts paid to the models.

Promotional activity

We believe there to be a clear synergy between the

operations of Photozou Koukoku and https://photozou.jp/, as https://photozou.jp/ is a website where users can upload and share pictures

taken with their cameras. It is our belief that many individuals who are sharing, browsing, and evaluating photographs online will have

an interest in purchasing cameras for personal use and potentially to upload more photos on the website.

Affiliate Program

Periodically, the company may enter into agreements with unrelated

third parties to serve as affiliates. Under such agreements, the affiliate would be granted authorization to establish a sub-page linked

to https://photozou.jp/ for promotional endeavors. In return, affiliates would commit to sharing a portion of the revenue generated from

such web pages with the company. The precise terms and revenue shares would be determined on a case-by-case basis.

Concentrations

Concentration of Purchases

Net purchase from suppliers accounting for 10% or

more of total purchases are as follows:

For the year ended November 30, 2023, 100% of the

inventory of cameras were purchased from one supplier, “eSakura Market”. For the year ended November 30, 2023, 100% of the

purchases of inventory of cameras was handled by Mr. Takaharu Ogami whom the Company has a service agreement with to buy and sell used

cameras on behalf of the Company.

For the year ended November 30, 2022, 93.8% of the

inventory of cameras were purchased from one supplier, “eSakura Market”. For the year ended November 30, 2022, 100% of the

purchases of inventory of cameras was handled by Mr. Takaharu Ogami whom the Company has a service agreement with to buy and sell used

cameras on behalf of the Company.

Concentration of Revenues

Gross revenues from customers accounting for 10%

or more of total revenues are as follows:

For the year ended November 30, 2023, 92% and 8%

of the revenue from the sale of cameras was generated through Amazon USA and Yahoo Japan, respectively.

For

the year ended November 30, 2022, 100% of the revenue from the sale of cameras was generated through Amazon USA.

For the year ended November 30, 2023 and November

30, 2022, 100% of the revenue from the sale of cameras was handled by Mr. Takaharu Ogami whom the Company has a service agreement with

to sell and buy used cameras on behalf of the Company.

For the year ended November 30, 2023and November

30, 2022, no customer accounted for 10% or more of service revenue.

Item 1A. Risk Factors.

As a smaller reporting company, as defined in Rule

12b-2 of the Exchange Act, we are not required to provide the information called for by this Item.

Item 1B. Unresolved Staff Comments.

None.

Item 2. Properties.

We neither rent nor own any properties. We utilize

the office space and equipment of our management at no cost. Management estimates such amounts to be immaterial.

Item 3. Legal Proceedings.

From time to time, we may become party to litigation

or other legal proceedings that we consider to be a part of the ordinary course of our business. We are not currently involved in legal

proceedings that could reasonably be expected to have a material adverse effect on our business, prospects, financial condition or results

of operations. We may become involved in material legal proceedings in the future.

Item 4. Mine Safety Disclosures.

Not applicable.

- 4 -

Table of Contents

PART II

Item 5. Market for Registrant’s Common Equity,

Related Stockholder Matters and Issuer Purchases of Equity Securities.

Market Information

Our common stock is quoted on the Pink® Open Market, “OTC

Pink”, operated by OTC Markets Group (“OTCM”). There is currently a limited trading market in the shares of our

common stock. Typically, our common stock experiences minimal trading volume, if any, on a daily basis. This limited activity

can result in significant fluctuations in the share price of our common stock.

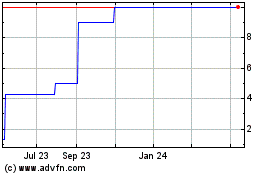

Set forth below are the

range of high and low bid closing bid prices for the periods indicated as reported by the OTCM. The market quotations reflect inter-dealer

prices, without retail mark-up, mark-down, or commissions and may not necessarily represent actual transactions.

| Quarter

Ended |

High

Bid |

|

Low

Bid |

| February

29, 2024 |

$10.00 |

|

$10.00 |

| November

30, 2023 |

$10.00 |

|

$5.00 |

| August

31, 2023 |

$5.00 |

|

$3.99 |

| May

31, 2023 |

$4.50 |

|

$1.32 |

| February

28, 2023 |

$4.50 |

|

$0.5606 |

| November 30, 2022 |

$2.48 |

|

$0.20 |

| August 31, 2022 |

$0.20 |

|

$0.20 |

| May 31, 2022 |

$0.20 |

|

$0.20 |

| February

28, 2022 |

$0.20 |

|

$0.20 |

Holders

As

of November 30, 2023, and March 8, 2024, there were 125 shareholders of record of our common stock and 8,000,000 shares of common

stock issued and outstanding.

Dividends

and Share Repurchases

We have not paid any dividends to our shareholders.

There are no restrictions which would limit our ability to pay dividends on common equity or that are likely to do so in the future.

Issuer Purchases of Equity Securities

None.

Equity Compensation Plan Information

Not applicable.

Recent Sales of

Unregistered Securities; Uses of Proceeds from Registered Securities

None.

- 5 -

Table of Contents

Item 6. Selected Financial Data.

Not applicable because the Company is a smaller reporting

company.

Item 7. Management’s Discussion and Analysis

of Financial Condition and Results of Operations.

Forward-Looking Statements

Certain statements, other than purely historical information,

including estimates, projections, statements relating to our business plans, objectives, and expected operating results, and the assumptions

upon which those statements are based, are “forward-looking statements.”

These forward-looking statements generally are identified

by the words “believes,” “project,” “expects,” “anticipates,” “estimates,”

“intends,” “strategy,” “plan,” “may,” “will,” “would,” “will

be,” “will continue,” “will likely result,” and similar expressions.

Forward-looking statements are based on current expectations

and assumptions that are subject to risks and uncertainties which may cause actual results to differ materially from the forward-looking

statements. Our ability to predict results or the actual effect of future plans or strategies is inherently uncertain. Factors which

could have a material adverse effect on our operations and future prospects on a consolidated basis include, but are not limited to:

changes in economic conditions, legislative/regulatory changes, availability of capital, interest rates, competition, and generally accepted

accounting principles. These risks and uncertainties should also be considered in evaluating forward-looking statements and undue reliance

should not be placed on such statements.

Liquidity

and Capital Resources

As of November 30, 2023, and 2022, we had cash

and cash equivalents in the amount of $11,562 and $19,104, respectively. Currently, our cash balance is not sufficient to fund our

operations and our revenues cannot cover our cost and expenses for any substantive period of time. We have been utilizing and may

continue to utilize funds from Photozou Co., Ltd., and White Knight Co., Ltd owned and managed by Koichi Ishizuka, our CEO. Photozou

Holdings., Inc, and Koichi Ishizuka, and affiliated entities of Koichi Ishizuka, have no formal commitment, arrangement or legal

obligation to advance or loan funds to the company. In order to implement our plan of operations for the next twelve-month period,

we require further funding. Being a start-up stage company, we have very limited operating history. After a twelve-month period we

may need additional financing but currently do not have any arrangements for such financing.

If we need additional cash and cannot raise it, we

will either have to suspend operations until we do raise the cash we need, or cease operations entirely.

For the years ended November 30, 2023, the

Company borrowed $105,987 from Photozou Co., Ltd., a company controlled by Koichi Ishizuka, CEO, $101,340 of which was comprised of

expenses paid on behalf of the Company by the related party, and the remaining $4,647 was comprised of cash borrowing received by

the Company directly through its bank account from the related party. During the years ended November 30, 2023, the Company

furnished repayments in an amount of $7,410 to Photozou Co., Ltd.

For the years ended November 30, 2023, the

Company borrowed $71,492 from White Knight Co., Ltd. a company controlled by Koichi Ishizuka, CEO, all of which was comprised of cash

borrowing received by the Company directly through its bank account from the related party. For the years ended November 30, 2023,

the Company had $167 of accrued interest payable due to the related party. The payable due to White Knight Co., Ltd. is unsecured,

bears an annual interest rate of 0.8%, and is due on July 31, 2024.

Revenues

For

the years ended November 30, 2023, and 2022, we generated revenues in the amount of $57,436 and $139,974, respectively, from the

sale of used cameras, and $16,465 and $46,017, respectively, primarily from photo sessions and advertising services related to the

company’s websites. It is the company’s belief that the decreased revenue for the fiscal year ended November 30, 2023,

when compared to the fiscal year ended November 30, 2022, was the result of decreased demand for used cameras during the November

30, 2023 fiscal year.

For the years ended November 30, 2023 and 2022, used camera revenue generated from the US market is 92.1% and 100% of used camera revenue,

respectively. For the years ended November 30, 2023 and 2022, used camera revenue generated from the Japan market is 7.9% and 0% of used

camera revenue, respectively.

Net

Loss

We

recorded a net loss of $263,837 and $155,286 for the years ended November 30, 2023 and 2022, respectively. The greater net loss for

the year ended November 30, 2023, as opposed to the year ended November 30, 2022, was attributed to the increase in expenses

and the decrease in revenue during the November 30, 2023 fiscal year.

We

believe that we realized a net loss for the years ended November 30, 2023, and November 30, 2022, because our, and our subsidiary’s,

collective operating expenses outweighed our gross profits.

Through the current date, our gross profit ratio

has been, in our opinion, low. To improve upon our margins, going forward, we intend to make an attempt to purchase cameras at lower

prices by better negotiating purchases in our favor, and or buying in bulk at cheaper prices. We do not believe a small increase in our

pricing will deter buyers from purchasing our cameras, therefore we are also exploring the possibility of increasing our prices slightly.

Cash flow

For the years ended November 30, 2023, and 2022,

we had negative cash flows from operating activities in the amount of $141,999 and $3,323, respectively. We believe the variance

between periods to be attributable to a significantly larger net loss incurred during the fiscal year ended November 30, 2023.

For the years ended November 30, 2023, and 2022,

we had cash flows from financing activities in the amount of $133,369 and negative $37,900, respectively. We believe the variance between

periods to be attributable to significantly greater proceeds from a related party during the fiscal year ended November 30, 2023.

Working capital

As of November 30, 2023, and 2022, we had a working

deficit of $716,702 and $563,519, respectively.

Going Concern

The accompanying consolidated financial statements

are prepared on a basis of accounting assuming that the Company is a going concern that contemplates realization of assets and satisfaction

of liabilities in the normal course of business. The Company is in the early stage of operations and has reoccurring net losses and working

capital deficit. These factors raise substantial doubt about the Company’s ability to continue as a going concern. The Company

will offer noncash consideration and seek equity lines as a means of financing its operations. If the Company is unable to obtain revenue-producing

contracts or financing or if the revenue or financing it does obtain is insufficient to cover any operating losses it may incur, it may

substantially curtail or terminate its operations or seek other business opportunities through strategic alliances, acquisitions or other

arrangements that may dilute the interests of existing stockholders. However, management cannot provide any assurances that the Company

will be successful in accomplishing any of its plans. The accompanying financial statements do not include any adjustments that might

result from the outcome of this uncertainty.

Item 7A. Quantitative and Qualitative Disclosures

about Market Risk.

As a “smaller reporting company”, we are

not required to provide the information required by this Item.

- 6 -

Table of Contents

Item 8. Financial Statements and Supplementary

Data.

| |

|

Pages |

| |

|

|

| |

|

|

| Report

of Independent Registered Public Accounting Firm (PCAOB ID 5041) |

|

F2 |

| |

|

|

| Report

of Independent Registered Public Accounting Firm (PCAOB ID 206) |

|

F3 |

| |

|

|

| Consolidated

Balance Sheets |

|

F4 |

| |

|

|

| Consolidated

Statements of Operations and Comprehensive Loss |

|

F5 |

| |

|

|

| Consolidated

Statements of Changes in Stockholders’ Deficit |

|

F6 |

| |

|

|

| Consolidated

Statements of Cash Flows |

|

F7 |

| |

|

|

| Notes

to Consolidated Financial Statements |

|

F8-F9 |

- F1 -

Table of Contents

Report

of Independent Registered Public Accounting Firm

To the shareholders and the board of directors

of Photozou Holdings, Inc.

Opinion on the Financial Statements

We have audited the accompanying consolidated

balance sheet of Photozou Holdings, Inc. (the "Company") as of November 30, 2023, the related statement of operations, stockholders'

equity (deficit), and cash flows for the year then ended, and the related notes (collectively referred to as the "financial statements").

In our opinion, the financial statements present fairly, in all material respects, the financial position of the Company as of November

30, 2023, and the results of its operations and its cash flows for the year then ended, in conformity with accounting principles generally

accepted in the United States.

Substantial Doubt about the Company’s

Ability to Continue as a Going Concern

The accompanying financial statements have

been prepared assuming that the Company will continue as a going concern. As discussed in Note 3 to the financial statements, the Company’s

significant operating losses raise substantial doubt about its ability to continue as a going concern. The financial statements do not

include any adjustments that might result from the outcome of this uncertainty.

Basis for Opinion

These financial statements are the responsibility

of the Company's management. Our responsibility is to express an opinion on the Company's financial statements based on our audit. We

are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) ("PCAOB") and are

required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and

regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audit in accordance with

the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the

financial statements are free of material misstatement, whether due to error or fraud. The Company is not required to have, nor were we

engaged to perform, an audit of its internal control over financial reporting. As part of our audits we are required to obtain an understanding

of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Company’s

internal control over financial reporting. Accordingly, we express no such opinion.

Our audit included performing procedures

to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that

respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial

statements. Our audit also included evaluating the accounting principles used and significant estimates made by management, as well as

evaluating the overall presentation of the financial statements. We believe that our audit provides a reasonable basis for our opinion.

/s

BF Borgers CPA PC

BF

Borgers CPA PC (PCAOB ID 5041)

We

have served as the Company's auditor since 2023

Lakewood,

CO

March

8, 2024

- F2 -

Table of Contents

REPORT OF INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

To the Shareholders and Board of Directors of

Photozou Holdings, Inc.

Opinion on the Financial Statements

We have audited the accompanying consolidated

balance sheet of Photozou Holdings, Inc. and its subsidiary (collectively, the “Company”) as of November 30, 2022, and the

related consolidated statements of operations and comprehensive loss, changes in stockholders’ deficit, and cash flows for the year

then ended, and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial

statements present fairly, in all material respects, the financial position of the Company as of November 30, 2022, and the results of

their operations and their cash flows for the year then ended, in conformity with accounting principles generally accepted in the United

States of America.

Going Concern Matter

The accompanying financial statements have

been prepared assuming that the Company will continue as a going concern. As discussed in Note 3 to the financial statements, the Company

has suffered recurring losses from operations and has a net capital deficiency that raises substantial doubt about its ability to continue

as a going concern. Management's plans in regard to these matters are also described in Note 3. The financial statements do not include

any adjustments that might result from the outcome of this uncertainty.

Basis for Opinion

These financial statements are the responsibility

of the Company’s management. Our responsibility is to express an opinion on the Company’s financial statements based on our

audit. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) ("PCAOB")

and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable

rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audit in accordance with

the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the

financial statements are free of material misstatement, whether due to error or fraud. The Company is not required to have, nor were we

engaged to perform, an audit of its internal control over financial reporting. As part of our audit we are required to obtain an understanding

of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Company's internal

control over financial reporting. Accordingly, we express no such opinion.

Our audit included performing procedures

to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that

respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial

statements. Our audit also included evaluating the accounting principles used and significant estimates made by management, as well as

evaluating the overall presentation of the financial statements. We believe that our audit provides a reasonable basis for our opinion.

/s/ MaloneBailey, LLP

www.malonebailey.com

We have served as the Company's auditor

from 2017 through 2023.

Houston, Texas

March 17, 2023

- F3 -

Table of Contents

PHOTOZOU HOLDINGS, INC.

CONSOLIDATED BALANCE SHEETS

| |

|

November

30, 2023 |

|

November

30, 2022 |

| |

|

|

|

|

| ASSETS |

|

|

|

|

| Current

Assets |

|

|

|

|

| Cash

and cash equivalents |

$ |

11,562 |

$ |

19,104 |

| Accounts

receivable |

|

4,594 |

|

7,981 |

| Prepaid

and other current assets |

|

1,709 |

|

2,657 |

| Sales

tax recoverable |

|

14,771 |

|

10,978 |

| Inventories,

net |

|

68,466 |

|

58,780 |

| |

|

|

|

|

| TOTAL

CURRENT ASSETS |

|

101,102 |

|

99,500 |

| |

|

|

|

|

| NON-CURRENT

ASSETS |

|

|

|

|

| Website

and software, net |

|

55,311 |

|

5,401 |

| Advance

payments |

|

- |

|

25,084 |

| |

|

|

|

|

| TOTAL

ASSETS |

|

156,413 |

|

129,985 |

| |

|

|

|

|

| LIABILITIES

AND STOCKHOLDERS’ DEFICIT |

|

|

|

|

| CURRENT

LIABILITIES: |

|

|

|

|

| Accrued

expenses |

$ |

13,419 |

$ |

823 |

| Due

to related party |

|

794,757 |

|

651,999 |

| Long-term

loan payable, current portion |

|

9,628 |

|

10,197 |

| |

|

|

|

|

| TOTAL

CURRENT LIABILITIES |

|

817,804 |

|

663,019 |

| |

|

|

|

|

| NON-CURRENT

LIABILITIES |

|

|

|

|

| Long-term

loan payable, non-current portion |

|

6,419 |

|

16,994 |

| |

|

|

|

|

| TOTAL

LIABILITIES |

|

824,223 |

|

680,013 |

| |

|

|

|

|

| STOCKHOLDERS’

DEFICIT |

|

|

|

|

| Preferred

stock ($0.0001 par value, 20,000,000 shares authorized; 0 issued and outstanding as of November 30, 2023 and November 30, 2022) |

|

- |

|

-

|

| Common

stock ($0.0001 par value, 500,000,000 shares authorized; 8,000,000 shares issued and outstanding as of November 30, 2023 and November

30, 2022) |

|

800 |

|

800 |

| Additional

paid in capital |

|

50,030 |

|

50,030 |

| Accumulated

deficit |

|

(938,784) |

|

(674,947) |

| Accumulated

other comprehensive income |

|

220,144 |

|

74,089 |

| |

|

|

|

|

| TOTAL

STOCKHOLDERS’ DEFICIT |

|

(667,810) |

|

(550,028) |

| |

|

|

|

|

| TOTAL

LIABILITIES & STOCKHOLDERS’ DEFICIT |

$ |

156,413 |

$ |

129,985 |

The accompanying notes are an integral part of these

consolidated financial statements.

- F4 -

Table of Contents

PHOTOZOU HOLDINGS, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS AND

COMPREHENSIVE LOSS

| |

|

Year Ended |

|

Year Ended |

| |

|

November 30, 2023 |

|

November 30, 2022 |

| |

|

|

|

|

| REVENUES |

|

|

|

|

| Revenue from cameras sold |

$ |

57,436 |

$ |

139,974 |

| Service revenue |

|

16,465 |

|

46,017 |

| |

|

|

|

|

| TOTAL REVENUES |

|

73,901 |

|

185,991 |

| |

|

|

|

|

| COST OF REVENUES |

|

|

|

|

| Cost of revenue from cameras sold |

|

41,992 |

|

109,301 |

| Cost of service revenue |

|

37,354 |

|

41,337 |

| |

|

| TOTAL COST OF REVENUES |

|

79,346 |

|

150,638 |

| |

|

|

|

|

| GROSS (LOSS) PROFIT |

|

(5,445) |

|

35,353 |

| |

|

|

|

|

| OPERATING EXPENSES |

|

|

|

|

| General and administrative expenses |

$ |

259,504 |

$ |

199,022 |

| |

|

|

|

|

| TOTAL OPERATING EXPENSES |

$ |

259,504 |

$ |

199,022 |

| |

|

|

|

|

| OTHER INCOME |

$ |

1,454 |

$ |

8,544 |

| |

|

|

|

|

| OTHER EXPENSES |

|

342 |

|

161 |

| |

|

|

|

|

| NET LOSS BEFORE TAXES |

$ |

(263,837) |

$ |

(155,286) |

| |

|

|

|

|

| NET LOSS |

$ |

(263,837) |

$ |

(155,286) |

| |

|

|

|

|

| OTHER COMPREHENSIVE INCOME |

|

|

|

|

| Foreign currency translation adjustment |

$ |

146,055 |

$ |

61,514 |

| |

|

|

|

|

| TOTAL COMPREHENSIVE LOSS |

$ |

(117,782) |

$ |

(93,772) |

| |

|

|

|

|

| BASIC AND DILUTED NET LOSS PER COMMON STOCK |

$ |

(0.03) |

$ |

(0.02) |

| |

|

|

|

|

| WEIGHTED AVERAGE NUMBER OF COMMON STOCK OUTSTANDING, BASIC AND DILUTED |

|

8,000,000 |

|

8,000,000 |

| |

|

|

|

|

| The accompanying notes are an integral part of these consolidated financial statements. |

-

F5 -

Table of Contents

PHOTOZOU

HOLDINGS, INC.

CONSOLIDATED

STATEMENTS OF CHANGES IN STOCKHOLDERS’ DEFICIT

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

ADDITIONAL |

|

OTHER |

|

|

|

|

| |

COMMON

STOCK |

|

PAID

IN |

|

COMPREHENSIVE |

|

ACCUMULATED |

|

|

| |

NUMBER |

|

AMOUNT |

|

CAPITAL |

|

(LOSS)

INCOME |

|

DEFICIT |

|

TOTALS |

| |

|

|

|

|

|

|

|

|

|

|

|

| Balance

November 30, 2021 |

8,000,000 |

$ |

800 |

$ |

50,030 |

|

12,575 |

|

(519,661) |

|

(456,256) |

| Net

loss |

- |

|

- |

|

- |

|

- |

|

(155,286) |

|

(155,286) |

| Foreign

currency translation |

- |

|

- |

|

- |

|

61,514 |

|

- |

|

61,514 |

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Balance

November 30, 2022 |

8,000,000 |

|

800 |

|

50,030 |

|

74,089 |

|

(674,947) |

|

(550,028) |

| Net

loss |

- |

|

- |

|

- |

|

- |

|

(263,837) |

|

(263,837) |

| Foreign

currency translation |

- |

|

- |

|

- |

|

146,055 |

|

- |

|

146,055 |

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Balance

November 30, 2023 |

8,000,000 |

|

800 |

|

50,030 |

|

220,144 |

|

(938,784) |

|

(667,810) |

The

accompanying notes are an integral part of these consolidated financial statements.

-

F6 -

Table

of Contents

PHOTOZOU HOLDINGS, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

| |

|

|

|

|

| |

|

Year Ended |

|

Year Ended |

| |

|

November 30, 2023 |

|

November 30, 2022 |

| |

|

|

|

|

| CASH FLOWS FROM OPERATING ACTIVITIES |

|

|

|

|

| Net loss |

$ |

(263,837) |

$ |

(155,286) |

| Adjustments to reconcile net loss to net cash: |

|

|

|

|

| Amortization expenses |

|

9,397 |

|

1,542 |

| Allowance for inventory obsolescence |

|

- |

|

11,900 |

| Impairment loss on advance payments |

|

24,904 |

|

- |

| Changes in operating assets and liabilities: |

|

|

|

|

| Accounts receivable |

|

3,093 |

|

7,886 |

| Inventories, net |

|

(13,628) |

|

11,861 |

| Prepaid and other current assets |

|

862 |

|

(1,168) |

| Sales tax recoverable |

|

(4,631) |

|

10,825 |

| Accrued expenses |

|

101,674 |

|

110,967 |

| Due to related party |

|

167 |

|

- |

| Deferred revenue |

|

- |

|

(1,850) |

| Net cash used in operating activities |

|

(141,999) |

|

(3,323) |

| |

|

|

|

|

| CASH FLOWS FROM FINANCING ACTIVITIES |

|

|

|

|

| Proceeds from due to related party |

$ |

151,205 |

$ |

23,129 |

| Repayments of due to related party |

|

(7,410) |

|

(50,112) |

| Repayments of long-term loan |

|

(10,426) |

|

(10,917) |

| Net

cash provided by (used in) by financing activities |

|

133,369 |

|

(37,900) |

| |

|

|

|

|

| Net effect of exchange rate changes on cash |

$ |

1,088 |

$ |

(7,985) |

| |

|

|

|

|

| Net Change in Cash and Cash equivalents |

$ |

(7,542) |

$ |

(49,208) |

| Cash and cash equivalents - beginning of year |

|

19,104 |

|

68,312 |

| Cash and cash equivalents - end of year |

|

11,562 |

|

19,104 |

| |

|

|

|

|

| NON-CASH TRANSACTIONS |

|

|

|

|

| Expense paid by related party on behalf of the Company |

$ |

101,340 |

$ |

138,465 |

| Software

acquired with accounts payable |

$ |

11,439 |

$ |

- |

| Deemed

contribution related to website transferred from related party under common control |

|

48,902 |

|

- |

| |

|

|

|

|

| SUPPLEMENTAL DISCLOSURES OF CASH FLOW INFORMATION |

|

|

|

|

| Interest paid |

$ |

175 |

$ |

161 |

| Income taxes paid |

$ |

- |

$ |

- |

The accompanying notes are an integral part of these consolidated financial statements.

- F7 -

Table of Contents

PHOTOZOU HOLDINGS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

NOVEMBER

30, 2023 AND 2022

NOTE 1

- ORGANIZATION, DESCRIPTION OF BUSINESS

Photozou Holdings, Inc. (the “Company”)

was incorporated under the laws of the State of Delaware on September 29, 2014.

On May 8, 2018, the Company

conducted a stock cancellation of the above 3,037,300 shares and the total funds of $75,933 were returned to investors. The cancellation

of the shares and return of funds was due to the fact that we did not make an acquisition in the allotted time granted by Rule 419.

On May 31, 2018, the Company

entered into and consummated a Stock Purchase Agreement (the “Stock Purchase Agreement”) with Koichi Ishizuka, our President,

CEO, and Director. At the closing of the Stock Purchase Agreement, Koichi Ishizuka transferred to the Company, 10,000 shares of common

stock of Photozou Koukoku Co., Ltd., a Japan corporation (“Photozou Koukoku”), which represented all of its issued and outstanding

shares, in consideration of 1,000,000 JPY ($9,190 USD as of the exchange rate May 31, 2018). The Company has since gained a 100% interest

in the issued and outstanding shares of Photozou Koukoku’s common stock and Photozou Koukoku is now a wholly owned subsidiary of

the Company. The Company and Photozou Koukoku were under common control at the time of the acquisition.

Photozou Koukoku was incorporated under the laws of

Japan on March 14, 2017. Currently, Photozou Koukoku is headquartered in Tokyo, Japan. The Company offers advertising services and photo

session services, and sells used cameras.

On June 5, 2018, Photozou Co., Ltd., our controlling

shareholder, entered into stock purchase agreements with 69 Japanese shareholders. Pursuant to these agreements, Photozou Co., Ltd. sold

3,028,900 shares of Photozou Holdings common stock in total to these individuals and received $75,723 as aggregate consideration. Each

shareholder paid .025 USD per share.

On July 17, 2018, Photozou Co., Ltd., our controlling

shareholder, entered into a stock purchase agreement with 1 Japanese shareholder. Pursuant to the agreement, Photozou Co., Ltd. sold a

total of 7,000 shares of common stock to this individual and received $175 as aggregate consideration. Each shareholder paid $0.025 USD

per share.

On September 21, 2020, Photozou Co., Ltd., our principal controlling shareholder,

entered into a Stock Purchase Agreement with Koichi Ishizuka, our Sole Officer and Director. Pursuant to the closing of the Agreement

on September 21, 2020, Photozou Co., Ltd. transferred to Koichi Ishizuka 4,553,200 shares of our common stock, which represents approximately

56.9% of our issued and outstanding common stock, in consideration of JPY 6,657,917 (approximately $60,500). Following the closing of

the share purchase transaction, Koichi Ishizuka owns approximately 66.7% interest in the issued and outstanding shares of our common stock.

Photozou Co., Ltd. was and remains owned and controlled entirely by Koichi Ishizuka, we do not believe that this transaction is deemed

to be a change in control of the Company.

Our principal executive offices are located at 4-30-4F,

Yotsuya, Shinjuku-ku, Tokyo, 160-0004, Japan.

The Company has elected November 30th as its fiscal

year end.

NOTE 2 - SIGNIFICANT ACCOUNTING POLICIES

PRINCIPLES OF CONSOLIDATION

The consolidated financial statements include the accounts of the Company and of its wholly-owned subsidiary, Photozou Koukoku. Intercompany

transactions are eliminated.

USE OF ESTIMATES

The presentation of financial statements in conformity with generally accepted accounting principles requires management to make estimates

and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities as of

the date of the financial statements and the reported amounts of revenue and expenses during the reporting periods. The most significant

estimates and assumptions made by management include going concern, allowance for doubtful accounts, valuation allowance on deferred income

tax, inventory obsolescence and sales allowance. Actual results in the future could vary from the amounts derived from management's estimates

and assumptions.

RELATED PARTY TRANSACTION

The Company accounts for related party transactions

in accordance with ASC 850 ("Related Party Disclosures"). A related party is generally defined as (i) any person that holds

10% or more of the Company's securities and their immediate families, (ii) the Company's management, (iii) someone that directly or indirectly

controls, is controlled by or is under common control with the Company, or (iv) anyone who can significantly influence the financial and

operating decisions of the Company. A transaction is considered to be a related party transaction when there is a transfer of resources

or obligations between related parties. The Company conducts business with its related parties in the ordinary course of business.

Transactions involving related parties cannot be presumed

to be carried out on an arm's-length basis, as the requisite conditions of competitive, free market dealings may not exist. Representations

about transactions with related parties, if made, shall not imply that the related party transactions were consummated on terms equivalent

to those that prevail in arm's-length transactions unless such representations can be substantiated.

CASH EQUIVALENTS

The Company considers all highly liquid investments with maturities of three months or less at the time of purchase to be cash equivalents.

ACCOUNTS RECEIVABLE AND CREDIT POLICIES

Accounts receivable are recognized and carried at the original invoice amount less allowance for any uncollectible amounts. An estimate

for doubtful accounts is made when collection of the full amount is no longer probable. Bad debts are written off as incurred. If there

is a claim for a defect of product after within four days after arrival of goods, the Company shall accept a goods return. Uncollectible

accounts are written off against the allowance after appropriate collection efforts have been exhausted and when it is deemed that a balance

is uncollectible. As of November 30, 2023, the Company expects to collect these balances completely and therefore has not created any

allowance for it.

As of November 30, 2023 and 2022, the Company had

account receivable in the amount of $4,594 and $7,981, respectively.

SALES TAX RECOVERABLE

As of November 30, 2023 and 2022, the Company had

sales tax recoverable in the amount of $14,771 and $10,978, respectively. The sales tax recoverable was related to sales tax paid by Photozou

Koukoku for inventories and expenses incurred during the period which was recoverable from the government.

INVENTORY

Inventories, consisting of used cameras, are primarily

accounted for using the specific identification method, and are valued at the lower of cost or net realizable value. This valuation requires

the Company to make judgments, based on currently-available information, about the likely method of disposition, such as through sales

to individual customers, returns to product vendors, or liquidations, and expected recoverable values of each disposition category. The

Company routinely evaluates its inventories for their salability and for indications of obsolescence to determine if inventories should

be written down to market value. The write down for obsolescence is charged to cost of revenue from cameras sold in the consolidated statements

of operations and comprehensive loss. At the point of the loss recognition, a new, lower cost basis for that inventory is established,

and subsequent changes in facts and circumstances do not result in the restoration or increase in that newly established cost basis.

As of November 30, 2023 and 2022, the Company held inventory

comprised solely of used cameras in the amount of $68,466 and $58,780, respectively. The aforementioned amounts were presented net

of allowance for inventory obsolescence as of November 30, 2023 and 2022 totaling $7,089 and

$11,900, respectively.

SOFTWARE

The Company capitalizes certain costs related to obtaining or developing computer software for internal use. Costs incurred during the

application development stage internally or externally are capitalized and amortized on a straight-line basis over the expected useful

life of two to five years since the computer software is ready for its intended use. The application development stage includes design

of chosen path, software configuration and integration, coding, hardware installation and testing. Costs incurred during the preliminary

project stage and post implementation-operation stage are expensed as incurred.

IMPAIRMENT OF LONG-LIVED ASSETS

In accordance with ASC Topic 360, the Company reviews long-lived assets for impairment whenever events or changes in circumstances indicate

that the carrying amount of the assets may not be fully recoverable, or at least annually. The Company recognizes an impairment loss when

the sum of expected undiscounted future cash flows is less than the carrying amount of the asset. The amount of impairment is measured

as the difference between the asset’s estimated fair value and its book value. For the years ended November 30, 2023 and 2022, the

Company did not record any impairment charges on long-lived assets.

FOREIGN CURRENCY TRANSLATION

The Company maintains its books and record in its

local currency, Japanese YEN (“JPY”), which is a functional currency as being the primary currency of the economic environment

in which its operation is conducted. Transactions denominated in currencies other than the functional currency are translated into the

functional currency at the exchange rates prevailing at the dates of the transaction. Monetary assets and liabilities denominated in currencies

other than the functional currency are translated into the functional currency using the applicable exchange rates at the balance sheet

dates. The resulting exchange differences are recorded in the statements of operations.

The reporting currency of the Company is the United

States Dollars (“US$”) and the accompanying consolidated financial statements have been expressed in US$. In accordance with

ASC Topic 830-30, “Translation of Financial Statement”, assets and liabilities of the Company whose functional currency is

not US$ are translated into US$, using the exchange rate on the balance sheet date. Revenues and expenses are translated at average rates

prevailing during the period. The gains and losses resulting from translation of financial statements are recorded as a separate component

of accumulated other comprehensive loss within the statements of shareholders’ equity.

Translation of amounts from the local currency of

the Company into US$1 has been made at the following exchange rates:

| |

November 30, 2023 |

|

November 30, 2022 |

| Current JPY: US$1 exchange rate |

147.07 |

|

138.87 |

| Average JPY: US$1 exchange rate |

139.88 |

|

129.71 |

- F8 -

Table of Contents

COMPREHENSIVE INCOME OR LOSS

ASC Topic 220, “Comprehensive Income”, establishes standards for reporting and display of comprehensive income or loss, its

components and accumulated balances. Comprehensive income or loss as defined includes all changes in equity during a period from non-owner

sources. Accumulated comprehensive loss, as presented in the accompanying consolidated statements of changes in shareholders’ deficit

consists of changes in unrealized gains and losses on foreign currency translation.

REVENUE RECOGNITION AND

DEFERRED REVENUE

The Company recognizes its revenue in accordance with

ASC 606 - Revenue from contracts with Customers. To determine revenue recognition for agreements within the scope of ASC 606, the Company

performs the following five steps: (1) identify the contract with a customer; (2) identify the performance obligations in the contract;

(3) determine the transaction price; (4) allocate the transaction price to each performance obligation in the contract; and (5) recognize

revenue when each performance obligation is satisfied.

Revenue from cameras sold is recognized at a point

in time when the cameras are delivered to the customer. There are two types of service revenue. Revenue for advertising service is recognized

over time when the service is provided to the customers. Revenue for photo session service is recognized at a point of time when service

is provided to the customers at the photo session.

Deferred revenue is recorded when consideration is

received from a customer prior to the goods or services were delivered. There was no deferred revenue as of November 30, 2023 or November

30, 2022.

Disaggregated revenue by nature of the Company is

as follows:

| |

|

For the year |

Percentage of |

For the year |

Percentage of |

| |

|

ended |

total revenues |

ended |

total revenues |

| |

|

November 30, 2023 |

|

November 30, 2022 |

|

| Revenue from cameras sold |

$ |

57,436 |

77.72% |

139,974 |

75.26% |

| Service revenue |

|

16,465 |

22.28% |

46,017 |

24.74% |

| Total |

|

73,901 |

100% |

185,991 |

100% |

Disaggregated revenue by geographic of the Company

is as follows:

| |

|

For the year |

Percentage of |

For the year |

Percentage of |

| |

|

ended |

total revenues |

ended |

total revenues |

| |

|

November 30, 2023 |

|

November 30, 2022 |

|

| Revenue from US |

$ |

52,888 |

71.57% |

139,974 |

75.26% |

| Revenue from Japan |

|

21,013 |

28.43% |

46,017 |

24.74% |

| Total |

|

73,901 |

100% |

185,991 |

100% |

NET LOSS

PER COMMON SHARE

Net income per common share is computed pursuant to section 260-10-45 of the FASB Accounting Standards Codification. Basic net loss per

share is computed by dividing net loss by the weighted average number of shares of common stock outstanding during the period. Diluted

net loss per share is computed by dividing net loss by the weighted average number of shares of common stock and potentially outstanding

shares of common stock during each period. There were no potentially dilutive shares outstanding as of November 30, 2023 and 2022.

INCOME TAX

The Company follows Section 740-10-30 of the FASB Accounting Standards Codification, which requires recognition of deferred tax assets

and liabilities for the expected future tax consequences of events that have been included in the financial statements or tax returns.

Under this method, deferred tax assets and liabilities are based on the differences between the financial statement and tax bases of assets

and liabilities using enacted tax rates in effect for the year in which the differences are expected to reverse. Deferred tax assets are

reduced by a valuation allowance to the extent management concludes it is more likely than not that the assets will not be realized. Deferred

tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary

differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized

in the Statements of operations in the period that includes the enactment date. The Company adopted section 740-10-25 of the FASB Accounting

Standards Codification ("Section 740-10-25"). Section 740-10-25 addresses the determination of whether tax benefits claimed or expected

to be claimed on a tax return should be recorded in the financial statements. Under Section 740-10-25, the Company may recognize the tax

benefit from an uncertain tax position only if it is more likely than not that the tax position will be sustained on examination by the

taxing authorities, based on the technical merits of the position. The tax benefits recognized in the financial statements from such a

position should be measured based on the largest benefit that has a greater than fifty percent (50%) likelihood of being realized upon

ultimate settlement.

CONCENTRATION OF CREDIT RISKS

Financial instruments that potentially expose the Company to concentrations of credit risk consist primarily of cash and cash equivalents

and accounts receivable. The Company places its cash and cash equivalents with financial institutions. The Company does not require collateral

or other security to support financial instruments subject to credit risks. With respect to trade receivables, the Company routinely assesses

the financial strength of its customers and, as a consequence, believes that the receivable credit risk exposure is limited.

RECENT

ACCOUNTING PRONOUNCEMENTS

In June 2016, the FASB issued ASU 2016-13 "Financial Instruments - Credit Losses (Topic 326) Measurement of Credit Losses on Financial

Instruments." ASU 2016-13 requires an entity to utilize a new impairment model known as the current expected credit loss ("CECL") model

to estimate its lifetime "expected credit loss" and record an allowance that, when deducted from the amortized cost basis of the financial

asset, presents the net amount expected to be collected on the financial asset. The CECL model is expected to result in more timely recognition

of credit losses. ASU 2016-13 also requires new disclosures for financial assets measured at amortized cost, loans and available-for-sale

debt securities. ASU 2016-13 is effective for smaller reporting companies for annual periods beginning after December 15, 2022, including

interim periods within those fiscal years. Entities will apply the standard's provisions as a cumulative-effect adjustment to retained

earnings as of the beginning of the first reporting period in which the guidance is adopted. The Company is in the process of evaluating

the impact of the adoption of ASU 2016-13 on the Company's financial statements and disclosures.

The Company has implemented all new accounting pronouncements that are in effect and that may impact its financial statements and does

not believe that there are any other new pronouncements that have been issued that might have a material impact on its financial position

or results of operations.

NOTE 3

- GOING CONCERN

The accompanying consolidated financial statements are prepared on a basis of accounting assuming that the Company is a going concern

that contemplates realization of assets and satisfaction of liabilities in the normal course of business. The Company is in the early

stage of operations and has reoccurring net losses and working capital deficit. These factors raise substantial doubt about the Company’s

ability to continue as a going concern. The Company will offer noncash consideration and seek equity lines as a means of financing its

operations. If the Company is unable to obtain revenue-producing contracts or financing or if the revenue or financing it does obtain

is insufficient to cover any operating losses it may incur, it may substantially curtail or terminate its operations or seek other business

opportunities through strategic alliances, acquisitions or other arrangements that may dilute the interests of existing stockholders.

However, management cannot provide any assurances that the Company will be successful in accomplishing any of its plans. The accompanying

financial statements do not include any adjustments that might result from the outcome of this uncertainty.

NOTE 4

- RELATED-PARTY TRANSACTIONS

For the year ended November 30, 2023, Photozou

Co., Ltd., a company controlled by Koichi Ishizuka, our CEO, advanced to the Company $4,647

and paid expenses on behalf of the Company in the amount of $101,340.

For the year ended November 30, 2023, the Company repaid $7,410

to Photozou Co., Ltd. During the year ended November 30, 2023, Photozou Co., Ltd. transferred accounts receivable and, a website, in

the amount of $97 and nil (JPY 1), respectively, to the Company. The total due to related party as of November 30, 2023 was $726,603

and are unsecured, due on demand and non-interest bearing.

For the year ended November 30, 2023, the Company

borrowed $71,492 from White Knight Co., Ltd a company controlled by Koichi Ishizuka, CEO, all of which was cash borrowing received by

the Company directly through its bank account from the related party. For the year ended November 30, 2023, the Company had $167 accrued

interest payable due to the related party. The total due to White Knight Co. as of November 30, 2023 and November 30, 2022 were $68,154

and $0, respectively. The payable due to White Knight Co., Ltd. is unsecured, bears an annual interest rate of 0.8%, and is due on July

31, 2024.

For the year ended November 30, 2022, Photozou Co.,

Ltd., a company controlled by Koichi Ishizuka, our CEO, advanced to the Company $23,129

and paid expenses on behalf of the Company in the amount of $138,465.

For the year ended November 30, 2022, the Company repaid $50,112

to Photozou Co., Ltd. The total due to related party as of November 30, 2022 was $651,999

and is unsecured, due on demand and non-interest bearing.

For the years ended November 30, 2023, and 2022, the Company utilized

office space and storage space of the Company’s sole officer, Koichi Ishizuka, free of charge.

NOTE

5 - SHAREHOLDER EQUITY

Preferred Stock

The authorized preferred stock of the Company consists

of 20,000,000 shares with a par value of $0.0001. The Company has not issued any shares during November 30, 2023, and 2022.

Common Stock

The authorized common stock of the Company consists

of 500,000,000 shares with a par value of $0.0001. There were 8,000,000 shares of common stock issued and outstanding as of November 30,

2023 and 2022.

Pertinent Rights and Privileges

Holders of shares of common stock are entitled to

one vote for each share held to be used at all stockholders’ meetings and for all purposes including the election of directors.

Common stock does not have cumulative voting rights. Nor does it have preemptive or preferential rights to acquire or subscribe for any

unissued shares of any class of stock.

NOTE

6 - INCOME TAXES

The Company conducts its major businesses in Japan

and is subject to tax in this jurisdiction. As a result of its business activities, the Company files tax returns that are subject to

examination by the local tax authority.

National income tax in Japan is charged at 15% of

the Company’s assessable profit based on its current capital base. The Company’s subsidiary, Photozou Koukoku, was incorporated

in Japan and is subject to Japanese national income tax and city income tax at the applicable tax rates on the taxable income as reported

in their Japanese statutory accounts in accordance with the relevant enterprises income tax laws applicable to foreign enterprises.

Photozou Koukoku’s operation during the year

ended November 30, 2023 has resulted a net taxable loss, as such Photozou Koukoku was not subject to income tax for the year ended November

30, 2023. The effective income tax rate of Photozou Koukoku is 0%.

Photozou Holdings, Inc., which acts as a holding company