0001603793

false

Q1

--02-28

2024

http://fasb.org/us-gaap/2023#RelatedPartyMember

http://fasb.org/us-gaap/2023#RelatedPartyMember

0001603793

2023-03-01

2023-05-31

0001603793

2023-07-10

0001603793

2023-05-31

0001603793

2023-02-28

0001603793

NRIS:SeriesAConvertiblePreferredStockMember

2023-05-31

0001603793

NRIS:SeriesAConvertiblePreferredStockMember

2023-02-28

0001603793

2022-03-01

2022-05-31

0001603793

us-gaap:OilAndGasMember

2023-03-01

2023-05-31

0001603793

us-gaap:OilAndGasMember

2022-03-01

2022-05-31

0001603793

us-gaap:PreferredStockMember

NRIS:SeriesAConvertiblePreferredStockMember

2023-02-28

0001603793

us-gaap:CommonStockMember

2023-02-28

0001603793

us-gaap:AdditionalPaidInCapitalMember

2023-02-28

0001603793

us-gaap:RetainedEarningsMember

2023-02-28

0001603793

us-gaap:PreferredStockMember

NRIS:SeriesAConvertiblePreferredStockMember

2023-03-01

2023-05-31

0001603793

us-gaap:CommonStockMember

2023-03-01

2023-05-31

0001603793

us-gaap:AdditionalPaidInCapitalMember

2023-03-01

2023-05-31

0001603793

us-gaap:RetainedEarningsMember

2023-03-01

2023-05-31

0001603793

us-gaap:PreferredStockMember

NRIS:SeriesAConvertiblePreferredStockMember

2023-05-31

0001603793

us-gaap:CommonStockMember

2023-05-31

0001603793

us-gaap:AdditionalPaidInCapitalMember

2023-05-31

0001603793

us-gaap:RetainedEarningsMember

2023-05-31

0001603793

2022-02-28

0001603793

2022-05-31

0001603793

2022-03-01

2023-02-28

0001603793

NRIS:SeriesAConvertiblePreferredStockMember

2023-03-01

2023-05-31

0001603793

NRIS:SeriesAConvertiblePreferredStockMember

2022-03-01

2022-05-31

0001603793

us-gaap:ConvertibleDebtMember

2023-03-01

2023-05-31

0001603793

us-gaap:ConvertibleDebtMember

2022-03-01

2022-05-31

0001603793

srt:OilReservesMember

2023-03-01

2023-05-31

0001603793

srt:OilReservesMember

2022-03-01

2022-05-31

0001603793

srt:NaturalGasReservesMember

2023-03-01

2023-05-31

0001603793

srt:NaturalGasReservesMember

2022-03-01

2022-05-31

0001603793

NRIS:DispositionsMember

2023-05-31

0001603793

NRIS:PromissoryNoteMember

NRIS:JBBPartnersIncMember

2017-12-27

2017-12-28

0001603793

NRIS:PromissoryNoteMember

NRIS:JBBPartnersIncMember

2017-12-28

0001603793

NRIS:PromissoryNoteMember

NRIS:JBBPartnersIncMember

NRIS:ModificationOfExistingLoanMember

2018-06-26

0001603793

NRIS:PromissoryNoteMember

NRIS:JBBPartnersIncMember

NRIS:ModificationOfExistingLoanMember

2018-06-25

2018-06-26

0001603793

NRIS:LoanNoteMember

NRIS:JBBPartnersIncMember

2019-05-20

2019-05-21

0001603793

NRIS:LoanNoteMember

NRIS:JBBPartnersIncMember

us-gaap:ExtendedMaturityMember

2019-05-20

2019-05-21

0001603793

NRIS:SecuredPromissoryNoteMember

NRIS:OdysseyEnterprisesLLCMember

2019-06-12

2019-06-13

0001603793

NRIS:SecuredPromissoryNoteMember

NRIS:OdysseyEnterprisesLLCMember

2019-06-13

0001603793

NRIS:JBBPartnersIncMember

2019-09-30

2019-10-01

0001603793

NRIS:JBBPartnersIncMember

2019-10-01

0001603793

NRIS:LoanNoteMember

NRIS:JBBPartnersIncMember

2020-05-27

2020-05-29

0001603793

NRIS:LoanNoteMember

NRIS:JBBPartnersIncMember

us-gaap:ExtendedMaturityMember

2020-05-27

2020-05-29

0001603793

NRIS:LoanNoteMember

NRIS:JBBPartnersIncMember

2020-12-21

2020-12-22

0001603793

NRIS:LoanNoteMember

NRIS:JBBPartnersIncMember

us-gaap:ExtendedMaturityMember

2020-12-21

2020-12-22

0001603793

NRIS:JBBPartnersIncMember

2021-05-01

2021-05-01

0001603793

NRIS:JBBPartnersIncMember

2021-05-01

0001603793

NRIS:JBBPartnersIncMember

2021-04-29

2021-05-01

0001603793

NRIS:LoanNoteMember

NRIS:JBBPartnersIncMember

2023-05-04

2023-05-05

0001603793

NRIS:LoanNoteMember

NRIS:JBBPartnersIncMember

us-gaap:ExtendedMaturityMember

2023-05-04

2023-05-05

0001603793

NRIS:JBBPartnersIncMember

2023-03-01

2023-05-31

0001603793

NRIS:JBBPartnersIncMember

2023-05-31

0001603793

2018-09-01

2018-09-01

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

utr:acre

utr:MBbls

utr:Mcf

utr:bbl

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-Q

(Mark

One)

☒ QUARTERLY

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the quarterly period ended May 31, 2023.

or

☐ TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the transition period from __________ to __________

Commission

File Number: 000-55695

Norris

Industries, Inc.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

46-5034746 |

(State

or other jurisdiction of

incorporation or organization) |

|

(I.R.S. Employer

Identification No.) |

102

Palo Pinto St, Suite B

Weatherford,

Texas |

|

76086 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

(855)

809-6900

(Registrant’s

telephone number, including area code)

N/A

(Former

name, former address and former fiscal year, if changed since last report)

Securities

registered pursuant to Section 12(b) of the Act:

| |

Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| |

N/A

|

|

N/A |

|

N/A |

Securities

registered pursuant to Section 12(g) of the Act:

| |

Title

of each class |

|

Trading

Symbol(s) |

|

Name

of eah exchange on which registered |

| |

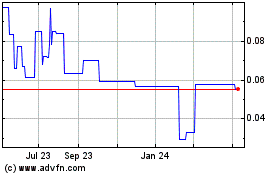

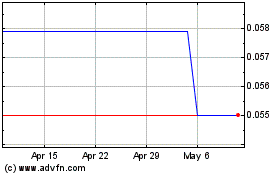

Common

Stock, $.01 Par Value |

|

NRIS |

|

OTCMKTS |

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit such files). Yes ☒ No ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting

company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company”

in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer ☐ |

Accelerated

filer ☐ |

| |

|

| Non-accelerated

filer ☒ |

Smaller

reporting company ☒ |

| |

|

| |

Emerging

growth company ☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13 (a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No

☒

As

of July 10, 2023, the registrant had 90,883,013 shares of common stock issued and outstanding.

NORRIS

INDUSTRIES, INC.

TABLE

OF CONTENTS

FORM

10-Q REPORT

May

31, 2023

NORRIS

INDUSTRIES, INC.

CONSOLIDATED

BALANCE SHEETS

MAY

31, 2023 AND FEBRUARY 28, 2023

(UNAUDITED)

| | |

May 31, 2023 | | |

February 28, 2023 | |

| ASSETS | |

| | | |

| | |

| Current Assets | |

| | | |

| | |

| Cash | |

$ | 43,673 | | |

$ | 151,731 | |

| Account receivable - oil & gas | |

| 32,328 | | |

| 24,151 | |

| Total Current Assets | |

| 76,001 | | |

| 175,882 | |

| | |

| | | |

| | |

| Oil and Gas Property - Full Cost Method | |

| | | |

| | |

| Properties subject to amortization | |

| 3,003,042 | | |

| 3,006,271 | |

| Less: accumulated depletion and impairment | |

| (2,853,631 | ) | |

| (2,844,022 | ) |

| Total Oil and Gas Property, net | |

| 149,411 | | |

| 162,249 | |

| Total Assets | |

$ | 225,412 | | |

$ | 338,131 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS’ DEFICIT | |

| | | |

| | |

| | |

| | | |

| | |

| Current Liabilities | |

| | | |

| | |

| Accounts payable and accrued expenses | |

$ | 166,518 | | |

$ | 125,647 | |

| Total Current Liabilities | |

| 166,518 | | |

| 125,647 | |

| | |

| | | |

| | |

| Convertible note payable - related party | |

| 3,900,000 | | |

| 3,900,000 | |

| Accounts payable and accrued expenses - related parties | |

| 487,630 | | |

| 456,879 | |

| Asset retirement obligations | |

| 143,242 | | |

| 146,245 | |

| | |

| | | |

| | |

| Total Liabilities | |

| 4,697,390 | | |

| 4,628,771 | |

| | |

| | | |

| | |

| Commitments and Contingencies | |

| - | | |

| - | |

| | |

| | | |

| | |

| Stockholders’ Deficit | |

| | | |

| | |

| Preferred stock, $0.001 par value per share 20,000,000 shares authorized | |

| - | | |

| - | |

| Series A Convertible Preferred stock, $0.001 par value per share 1,000,000 shares authorized; 1,000,000 shares issued and outstanding; liquidation preference of $2,250,000 | |

| 1,000 | | |

| 1,000 | |

| Common stock, $0.001 par value per share, 150,000,000 shares authorized; 90,883,013 shares issued and outstanding | |

| 90,883 | | |

| 90,883 | |

| Additional paid-in capital | |

| 6,286,399 | | |

| 6,286,399 | |

| Accumulated deficit | |

| (10,850,260 | ) | |

| (10,668,922 | ) |

| Total Stockholder’s Deficit | |

| (4,471,978 | ) | |

| (4,290,640 | ) |

| | |

| | | |

| | |

| Total Liabilities and Stockholders’ Deficit | |

$ | 225,412 | | |

$ | 338,131 | |

The

accompanying notes are an integral part of these interim unaudited consolidated financial statements.

NORRIS

INDUSTRIES, INC.

CONSOLIDATED

STATEMENTS OF OPERATIONS

FOR

THE THREE MONTHS ENDED MAY 31, 2023 AND 2022

(UNAUDITED)

| | |

2023 | | |

2022 | |

| | |

| | |

| |

| Revenues | |

| | | |

| | |

| Oil and gas sales | |

$ | 81,352 | | |

| 152,641 | |

| Total Revenues | |

| 81,352 | | |

| 152,641 | |

| | |

| | | |

| | |

| Operating Expenses | |

| | | |

| | |

| Lease operating expenses | |

| 138,972 | | |

| 164,450 | |

| General and administrative expenses | |

| 83,132 | | |

| 84,134 | |

| Depletion, depreciation and accretion | |

| 9,835 | | |

| 16,297 | |

| | |

| | | |

| | |

| Total Operating Expenses | |

| 231,939 | | |

| 264,881 | |

| | |

| | | |

| | |

| Loss from Operations | |

| (150,587 | ) | |

| (112,240 | ) |

| | |

| | | |

| | |

| Other Expenses | |

| | | |

| | |

| Interest expense | |

| 30,751 | | |

| 28,482 | |

| Total Other Expense | |

| 30,751 | | |

| 28,482 | |

| | |

| | | |

| | |

| Net Loss | |

$ | (181,338 | ) | |

| (140,722 | ) |

| | |

| | | |

| | |

| Net loss per common share - basic and diluted | |

$ | (0.02 | ) | |

| (0.00 | ) |

| | |

| | | |

| | |

| Weighted average number of common shares outstanding - basic and diluted | |

| 90,883,013 | | |

| 90,883,013 | |

The

accompanying notes are an integral part of these interim unaudited consolidated financial statements.

NORRIS

INDUSTRIES, INC.

CONSOLIDATED

STATEMENT OF CHANGES IN STOCKHOLDERS’ DEFICIT

FOR

THE THREE MONTHS ENDED MAY 31, 2023

(UNAUDITED)

| | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Capital | | |

Deficit | | |

Deficit | |

| | |

Series

A

Convertible

Preferred

Stock | | |

Common

Stock | | |

Additional

Paid-in | | |

Accumulated

| | |

Total

Stockholders’ | |

| | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Capital | | |

Deficit | | |

Deficit | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Balance, February 28, 2023 | |

| 1,000,000 | | |

$ | 1,000 | | |

| 90,883,013 | | |

$ | 90,883 | | |

$ | 6,286,399 | | |

$ | (10,668,922 | ) | |

$ | (4,290,640 | ) |

| Balance, value | |

| 1,000,000 | | |

$ | 1,000 | | |

| 90,883,013 | | |

$ | 90,883 | | |

$ | 6,286,399 | | |

$ | (10,668,922 | ) | |

$ | (4,290,640 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (181,338 | ) | |

| (181,338 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance, May 31, 2023 | |

| 1,000,000 | | |

$ | 1,000 | | |

| 90,883,013 | | |

$ | 90,883 | | |

$ | 6,286,399 | | |

$ | (10,850,260 | ) | |

$ | (4,471,978 | ) |

| Balance, value | |

| 1,000,000 | | |

$ | 1,000 | | |

| 90,883,013 | | |

$ | 90,883 | | |

$ | 6,286,399 | | |

$ | (10,850,260 | ) | |

$ | (4,471,978 | ) |

The

accompanying notes are an integral part of these interim unaudited consolidated financial statements.

NORRIS

INDUSTRIES, INC.

CONSOLIDATED

STATEMENTS OF CASH FLOWS

FOR

THE THREE MONTHS ENDED MAY 31, 2023 AND 2022

(UNAUDITED)

| | |

2023 | | |

2022 | |

| Cash Flow from Operating Activities | |

| | | |

| | |

| Net loss | |

$ | (181,338 | ) | |

$ | (140,722 | ) |

| Adjustments to reconcile net loss to net cash from operating activities: | |

| | | |

| | |

| Depletion, depreciation and accretion | |

| 9,835 | | |

| 16,297 | |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| Accounts receivable - oil & gas | |

| (8,177 | ) | |

| 11,461 | |

| Accounts payable and accrued expenses | |

| 40,871 | | |

| (372 | ) |

| Accounts payable and accrued expenses - related parties | |

| 30,751 | | |

| 28,482 | |

| Net Cash Used in Operating Activities | |

| (108,058 | ) | |

| (84,854 | ) |

| | |

| | | |

| | |

| Net Decrease in Cash | |

| (108,058 | ) | |

| (84,854 | ) |

| Cash – beginning of period | |

| 151,731 | | |

| 139,569 | |

| | |

| | | |

| | |

| Cash – end of period | |

$ | 43,673 | | |

$ | 54,715 | |

| | |

| | | |

| | |

| Noncash Investing and Financing Activities | |

| | | |

| | |

| Change in estimate of asset retirement obligations | |

$ | 3,229 | | |

$ | 9,424 | |

The

accompanying notes are an integral part of these interim unaudited consolidated financial statements.

NORRIS

INDUSTRIES, INC.

NOTES

TO CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

Note

1 – Organization, Nature of Operations and Summary of Significant Accounting Policies

Norris

Industries, Inc. (“NRIS” or the “Company”), was incorporated on February 19, 2014, as a Nevada corporation. The

Company was formed to conduct operations in the oil and gas industry. The Company’s principal operating properties are in the Ellenberger

formation in Coleman County, and in Jack County and Palo-Pinto County. Texas. The Company’s production operations are all located

in the State of Texas.

On

April 25, 2018, the Company incorporated a Texas registered subsidiary, Norris Petroleum, Inc., as an operating entity.

Basis

of Presentation

The

accompanying financial statements of the Company have been prepared in accordance with accounting principles generally accepted in the

United States of America (“GAAP”) and the rules of the Securities and Exchange Commission (“SEC”) and should

be read in conjunction with the audited financial statements and notes thereto contained in the Company’s annual report filed with

the SEC on Form 10-K for the year ended February 28, 2023. In the opinion of management, all adjustments, consisting of normal recurring

adjustments, necessary for a fair presentation of financial position and the results of operations for the interim periods presented

have been reflected herein. The results of operations for interim periods are not necessarily indicative of the results to be expected

for the full year. The Company’s consolidated financial statements include the accounts of the Company, its wholly-owned subsidiaries

and entities in which the Company has a controlling financial interest. All significant inter-company accounts and transactions have

been eliminated in consolidation.

Liquidity

and Capital Considerations

The

accompanying consolidated financial statements have been prepared assuming that the Company will continue as a going concern, which contemplates

the realization of assets and the satisfaction of liabilities in the normal course of business for the twelve-month period following

the issuance date of these consolidated financial statements.

The

timeline and potential magnitude of Ukraine-Russia war and its impact on the Company’s future operations is currently unknown.

The Company has incurred continuing losses since 2016, including a loss of $504,980 and $181,338 for the fiscal year ended February 28,

2023, and the three-month ended May 31, 2023, respectively. During the three months ended May 31, 2023, the Company incurred cash losses

of approximately $108,000 from its operating activities. As of May 31, 2023, the Company had a cash balance of approximately $44,000

and negative working capital of approximately $91,000.

The

Company’s principal capital and exploration expenditures during next fiscal year are expected to relate to selected well workovers

on its Jack and Palo Pinto County acreages. The Company believes that it has sufficient cash on hand and available funds from its credit

line to fund its costs for such expenditures as well as other operating costs, for the 12-month period subsequent to issuance of these

financial statements.

In

the event that the Company requires additional capital to fund higher operational losses or oil and gas property lease purchases for

fiscal year ending February 28, 2024, the Company expects to seek additional capital from one or more sources via restricted private

placement sales of equity and debt securities. If the Company requires additional financing beyond what is available under its existing

credit line, it expects to secure additional borrowing capacity from JBB.

Use

of Estimates

The

preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires

management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent

assets and liabilities as of the date of the financial statements and the reported amounts of revenues and expense during the period.

Actual results could differ from those estimates.

Risks

and Uncertainties

The

Company’s operations are subject to significant risks and uncertainties, including financial, operational, technological, and other

risks associated with operating an emerging business, including the potential risk of business failure.

Cash

and Cash Equivalents

The

Company considers all highly liquid investments purchased with an original maturity of the year or less to be cash equivalents. The Company

has not experienced any losses on its deposits of cash and cash equivalents.

Oil

and Gas Properties, Full Cost Method

The

Company follows the full cost method of accounting for its oil gas properties, whereby all costs incurred in connection with the acquisition,

exploration for and development of petroleum and natural gas reserves are capitalized. Such costs include lease acquisition, geological

and geophysical activities, rentals on non-producing leases, drilling, completing and equipping of oil wells and administrative costs

directly attributable to those activities and asset retirement costs. Disposition of oil properties are accounted for as a reduction

of capitalized costs, with no gain or loss recognized unless such adjustment would significantly alter the relationship between capital

costs and proved reserves of oil and gas, in which case the gain or loss is recognized in the statement of operations.

Depletion

and depreciation of proved oil properties are calculated on the units-of-production method based upon estimates of proved reserves. Such

calculations include the estimated future costs to develop proved reserves. Costs of unproved properties are not included in the costs

subject to depletion. These costs are assessed periodically for impairment.

At

the end of each quarter, the unamortized cost of oil and gas properties, net of related deferred income taxes, is limited to the sum

of the estimated future after-tax net revenues from proved properties, after giving effect to cash flow hedge positions, discounted at

10%, and the lower of cost or fair value of unproved properties, adjusted for related income tax effects. Costs in excess of the present

value of estimated future net revenues are charged to impairment expense. This limitation is known as the “ceiling test,”

and is based on SEC rules for the full cost oil and gas accounting method.

Income

Taxes

Income

taxes are accounted for in accordance with the provisions of ASC Topic No. 740. Deferred tax assets and liabilities are recognized for

the future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities

and their respective tax bases. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable

income in the years in which those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and

liabilities of a change in tax rates is recognized in income in the period that includes the enactment date. Valuation allowances are

established, when necessary, to reduce deferred tax assets to the amounts expected to be realized.

Uncertain

Tax Positions

The

Company evaluates uncertain tax positions to recognize a tax benefit from an uncertain tax position only if it is more likely than not

that the tax position will be sustained on examination by the taxing authorities based on the technical merits of the position. Those

tax positions failing to qualify for initial recognition are recognized in the first interim period in which they meet the more likely

than not standard or are resolved through negotiation or litigation with the taxing authority, or upon expiration of the statute of limitations.

De-recognition of a tax position that was previously recognized occurs when an entity subsequently determines that a tax position no

longer meets the more likely than not threshold of being sustained.

Revenue

Recognition

The

Company’s revenue is comprised entirely of revenue from exploration and production activities. The Company’s oil is sold

primarily to wholesalers and others that sell product to end use customers. Natural gas is sold primarily to interstate and intrastate

natural-gas pipelines, various end-users, local distribution companies, and natural-gas marketers. NGLs are sold primarily to various

end-users. Payment is generally received from the customer in the month following delivery.

Contracts

with customers have varying terms, including spot sales or month-to-month contracts, or contracts with a finite term, where the production

from a well or group of wells is sold to one or more customers. The Company recognizes sales revenues for oil, natural gas, and NGLs

based on the amount of each product sold to a customer when control transfers to the customer. Generally, control transfers at the time

of delivery to the customer at a pipeline interconnect, the tailgate of a processing facility, or as a tanker lifting is completed. Revenue

is measured based on the contract price, which may be index-based or fixed, and may include adjustments for market differentials and

downstream costs incurred by the customer, including gathering, transportation, and fuel costs.

Revenues

are recognized for the sale of the Company’s net share of production volumes. Sales on behalf of other working interest owners

and royalty interest owners are not recognized as revenues. The Company does not hedge nor forward sell any of its current production

via derivative financial contracts.

Net

Loss per Common Share

Basic

net loss per common share amounts are computed by dividing the net loss available to Norris Industries, Inc. shareholders by the weighted

average number of common shares outstanding over the reporting period. In periods in which the Company reports a net loss, dilutive securities

are excluded from the calculation of diluted earnings per share as the effect would be anti-dilutive. The following table summarizes

the common stock equivalents excluded from the calculation of diluted net loss per common share as the inclusion of these shares would

be anti-dilutive for the three months ended May 31, 2023, and 2022:

Schedule

of Antidilitive Securities Excluded from Computation of Earning Per Shares

| | |

2023 | | |

2022 | |

| Series A Convertible Preferred Stock | |

| 66,666,667 | | |

| 66,666,667 | |

| Convertible debt | |

| 24,750,000 | | |

| 21,000,000 | |

| Total common shares to be issued | |

| 91,416,667 | | |

| 87,666,667 | |

Concentrations

of Credit Risk

Financial

instruments which potentially subject the Company to concentrations of credit risk include cash deposits placed with financial institutions.

The Company maintains its cash in bank accounts which, at times, may exceed federally insured limits as guaranteed by the Federal Deposit

Insurance Corporation (“FDIC”). At May 31, 2023, $0 of the Company’s cash balances was uninsured. The Company has not

experienced any losses on such accounts.

Recent

Issued Accounting Pronouncements

In

June 2016, the FASB issued ASU No. 2016-13, Financial Instruments – Credit Losses (Topic 326), Measurement of Credit Losses

on Financial Instruments. The standard replaces the incurred loss impairment methodology in current U.S. GAAP with a methodology

that reflects expected credit losses on instruments within its scope, including trade receivables. This update is intended to provide

financial statement users with more decision-useful information about the expected credit losses. The Company adopted the ASU No. 2016-13

in this quarter; and the adoption has no impacts to the accompanying consolidated financial statements.

Note

2 – Revenues from Contracts with Customers

Disaggregation

of Revenues from Contracts with Customers

The

following table disaggregates revenue by significant product types for the three months ended May 31, 2023 and 2022:

Schedule of Disaggregation of Revenue

| | |

2023 | | |

2022 | |

| Oil sales | |

$ | 109,547 | | |

$ | 53,269 | |

| Natural gas sales | |

| 43,094 | | |

| 28,083 | |

| Total | |

$ | 152,641 | | |

$ | 81,352 | |

There

were no significant contract liabilities or transaction price allocations to any remaining performance obligations as of May 31, 2023

and February 28, 2023.

Note

3 – Oil and Gas Properties

The

following table summarizes the Company’s oil and gas activities by classification for the three months ended May 31, 2023:

Summary of Oil and Gas Activities

| | |

February 28, 2023 | | |

Additions | | |

Change in Estimates | | |

May 31, 2023 | |

| | |

| | |

| | |

| | |

| |

| Oil and gas properties, subject to depletion | |

$ | 2,930,237 | | |

$ | - | | |

$ | - | | |

$ | 2,930,237 | |

| Asset retirement costs | |

| 76,034 | | |

| - | | |

| (3,229 | ) | |

| 72,805 | |

| Accumulated depletion and depreciation | |

| (2,844,022 | ) | |

| (9,609 | ) | |

| - | | |

| (2,853,631 | ) |

| Total oil and gas assets | |

$ | 162,249 | | |

| (9,609 | ) | |

$ | (3,229 | ) | |

$ | 149,411 | |

The

depletion and depreciation recorded for production on proved properties for the three months ended May 31, 2023 and 2022, amounted to

$9,609 and $7,338, respectively. During the three months ended May 31, 2023 and 2022, there were no ceiling test write-downs of the Company’s

oil and gas properties.

Note

4 – Asset Retirement Obligations

The

following table summarizes the change in the Company’s asset retirement obligations during the three months ended May 31, 2023:

Schedule of Asset Retirement Obligations

| Asset

retirement obligations as of February 28, 2023 |

|

$ |

146,245 |

|

| Additions |

|

|

226 |

|

| Current

year revision of previous estimates |

|

|

(3,229) |

|

| Accretion

adjustment during the three months ended May 31, 2023 |

|

|

- |

|

| Asset

retirement obligations as of May 31, 2023 |

|

$ |

143,242 |

|

During

the three months ended May 31, 2023 and 2022, the Company recognized accretion expense of $226 and $8,959, respectively.

Note

5 – Related Party Transactions

Promissory

Note to JBB

On

December 28, 2017, the Company borrowed $1,550,000 from JBB to complete the purchases of a series of oil and gas leases (the “Loan

Note”). The loan has an interest rate of 3% per annum, a maturity date of December 28, 2018 and is secured by all assets of the

Company. The loan is convertible to the Company’s common stock at the conversion rate of $0.20 per share.

On

June 26, 2018, the Company and JBB entered into a modification of the existing Loan Note, to add provisions to permit the Company to

obtain additional advances under the Loan Note up to a maximum of $1,000,000. The Company may request an advance in increments of $100,000

no more frequently than every 30 days, provided that (i) it provides a description of the use of proceeds for the advance reasonably

acceptable to JBB, and (ii) the Company is not otherwise in default of the Loan Note. The original loan amount and the advances are secured

by all the assets of the Company and are convertible into common stock of the Company at the rate of $0.20 per common share, subject

to adjustment for any reverse and forward stock splits. The Loan Note may be repaid at any time, without penalty, however, any advance

that is repaid before maturity may not be re-borrowed as a further advance.

On

May 21, 2019, the Company entered into an extension agreement with JBB to extend the maturity of its outstanding Loan Note to September

30, 2020.

On

June 13, 2019, JBB lent the Company $250,000 under a secured promissory note. The funds were used to acquire the remaining working interest

in the Marshall Walden oil and gas property from Odyssey Enterprises LLC. The loan has an interest rate of 5% per annum, a maturity date

of June 30, 2022, and is secured by all assets of the Company. The loan is convertible into the Company’s common stock at a conversion

rate of $0.20 per common share.

On

October 1, 2019, the Company entered into another amendment of its Loan Note with JBB to increase the line of credit by an additional

$500,000, for a total of $1,500,000, and extend the maturity date for the original note and line of credit to December 31, 2020.

On

May 29, 2020, the Company entered into an extension agreement with JBB to extend the maturity of its outstanding Loan Note to September

30, 2021.

On

December 22, 2020, the Company entered into an extension agreement with JBB to extend the maturity of all its outstanding indebtedness

under credit line and Loan Note to May 31, 2022.

On

May 1, 2021, the Company entered into a new funding agreement with a maturity date of May 31, 2022 and an interest rate of five percent

annual percentage rate (5% APR) with JBB for a further $1 million drawable in $100,000 increments at the discretion of JBB to cover the

Company’s current and projected working capital requirements in near-term. The loan is convertible into common stock of the Company

at the rate of $0.08 per share, subject to adjustment for any reverse and forward stock splits.

On

May 5, 2023, the Company entered into an extension agreement with JBB to extend the maturity of its outstanding Loan Note to September

30, 2024.

During

the three months ended May 31, 2023, there were no additional funds advanced to the Company under the Loan Note. As of May 31, 2023,

the Company had availability of $300,000 on its existing credit line with JBB.

The

Company recognized interest expense of $30,751 and $28,482 for the three months ended May 31, 2023 and 2022, respectively. Accrued interest

as of February 28, 2023 and May 31, 2023 was $456,879 and $487,630, respectively, and is due at maturity of the Loan Note Outstanding

borrowings under notes payable to JBB totaled $3,900,000 as of February 28, 2023 and May 31, 2023.

Note

6 – Commitments and Contingencies

Office

Lease

In

September 2018, the Company moved to the offices of International Western Oil (“IWO”) in Weatherford, TX that is being rented

on a month-to-month sublease basis at rate of $950 per month from IWO. During the three months ended May 31, 2023, the Company incurred

$2,850 of rent expense under this lease that is included in lease operating expenses on the statement of operations.

Leasehold

Drilling Commitments

The Company’s oil and gas leasehold acreage is subject to expiration of leases if the Company does not drill and hold such acreage

by production or otherwise exercises options to extend such leases, if available, in exchange for payment of additional cash consideration.

In the King County, Texas lease acreage, 640 acres were due to expire in June 2021; and the Company chose not to extend this lease.

Note

7 - Subsequent Event

In

preparing these consolidated financial statements, the Company has evaluated events and transactions for potential recognition or disclosure

through the date these consolidated financial statements were issued.

Item

2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Cautionary

Notice Regarding Forward Looking Statements

The

information contained in this report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933,

as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Actual results may materially differ from those indicated

in the forward-looking statements as a result of certain risks and uncertainties set forth in this report. Although the Company’s

management believes that the assumptions made and expectations reflected in the forward-looking statements are reasonable, there is no

assurance that the underlying assumptions will, in fact, prove to be correct or that actual results will not be different from expectations

expressed in this report.

This

filing contains a number of forward-looking statements which reflect management’s current views and expectations with respect to

our business, strategies, products, future results and events, and financial performance. All statements made in this filing other than

statements of historical fact, including statements addressing operating performance, events or developments which management expects

or anticipates will or may occur in the future, and non-historical information are forward looking statements. In particular, the words

“believe,” “expect,” “intend,” “anticipate,” “estimate,” “may,”

and variations of those words and similar expressions identify forward-looking statements. The foregoing are not the exclusive means

of identifying forward looking statements, and their absence does not mean that a statement is not forward-looking. These forward-looking

statements are subject to certain risks and uncertainties. Our actual results, performance or achievements could differ materially from

historical results as well as those expressed in, anticipated, or implied by these forward-looking statements.

Readers

should not place undue reliance on these forward-looking statements, which are based on management’s current expectations and projections

about future events, are not guarantees of future performance, are subject to risks, uncertainties and assumptions (including those described

below), and apply only as of the date of this filing. Factors which could cause or contribute to such differences include, but are not

limited to, the risks discussed in our Annual Report on Form 10-K and in the press releases and other communications to shareholders

issued by us from time to time which attempt to advise interested parties of the risks and factors which may affect our business. We

undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events,

or otherwise.

Overview

Norris

Industries, Inc. (the “Company”, “we”, or “us”) is an oil and natural gas company that focuses on

the acquisition, development, and exploration of crude oil and natural gas properties in Texas. As of March 1, 2023 the SEC Non-Escalated

Analysis of Estimated Proved Reserve of our various leases in Jack County and Palo-Pinto County, the Ratliff leases, the Marshall-Walden,

and the Bend Arch Lion 1A and Bend Arch Lion 1B leaseholds, is a total of 29 Mbbl in oil net reserves, plus 150 MMcf in natural gas net

reserves being out of total of BOE equivalent of 54 Mbbl in gross reserves, which is down from prior year by 322 Mbbl due to reduction

of expected production as result of well workover issues.

For

near- to medium-term cash flow enhancement, the Company will plan to focus on existing fields and to selectively consider larger-reserve

oil and gas properties with low production to acquire at reasonable cost and then implement effective Enhanced Oil Recovery (“EOR”)

methods to improve its current revenues and assets. For long-term cash flow enhancement, the Company plans to identify other oil-field

related, and niche enterprises to consider for bolt on, or diversified acquisition targets to grow Company revenues. This may be with

use of capital partners to buyout via the Company’s strategic joint venture partnerships, and to raise outside capital to fund

any potential future acquisition.

The

Company’s long-term objective is to increase shareholder value by growing reserves, production, and cash flow. As a result, we

may seek to identify and consider acquisition opportunities of oilfield services companies and other non-oilfield companies that align

with our operational plan to implement a diversified growth strategy.

Notwithstanding the above

stated objectives, the ramification of the pandemic containment measures and consequent disruptions to the United States and world economies

do to COVID-19 viral outbreaks had an adverse impact on the overall business of the Company and the industry in which it operates. The

demand for oil and gas has impacted all producers as commodity prices of oil and gas has increased substantially but so has inflation

resulting in higher costs for materials, equipment, personnel and service providers. In addition, in early 2022 the industry faced added

complications as a result of the Russian Federation invasion of Ukraine. As a result, energy prices have risen; however, we are unable

to predict exact supply and demand balances that will cause energy prices to be highly volatile and thus affect our revenues in the near

future. Therefore, we anticipate that we may not be able to cover operating costs and will have to take cost cutting measures and seek

continued operational financing.

Our

Business Strategy

We

are a small Exploration and Production (“E&P”) oil and natural gas company that focuses on the acquisition, development,

and exploration of crude oil and natural gas properties in Texas. The Company is currently managed by business and oil and gas exploration

veterans who specialize in the oil and gas acquisition and exploration markets of the Central West Texas region. The Company’s

goal is to tap into the high potential leases of the Central West Texas region of the United States, aiming to unlock its potential,

specifically in the prolific Bend Arch-Fort Worth region. This area is approximately 120 miles long and 40 miles wide running from Archer

County, Texas in the north to Brown County, Texas in the south. The Company is also looking at other acquisition opportunities in the

Permian Basin, West Texas, East Texas and South Texas region.

Management

believes that focusing on the development of existing small producing fields is one of the key differentiators of the Company. Oil and

natural gas reserve development is a technologically oriented industry. Management believes that the use of current generally available

technology has greatly increased the success rate of finding commercial oil or natural gas deposits. In this context, success means the

ability to make an oil/gas well that produces a commercialized quantity of hydrocarbons.

We

plan to execute the following business strategies:

Develop

and Grow Our Hydrocarbon Resource Acreage Positions Using Outside Development Expertise. We plan to continue to seek and acquire

niche assets in hydrocarbon-rich resource plays to improve our asset quality and expand our drilling inventory. We plan to leverage our

management team’s expertise and apply the latest available EOR technologies to economically develop our existing property portfolio

in Central West and East Texas in addition to any assets in other regions we may acquire. We operate the majority of our acreage, thus

giving us certain control over the planning of capital expenditures, execution and cost reduction. Our operational plan allows us to

adjust our capital spending based on drilling results and the economic environment. As a small producer, we regionally evaluate industry

drilling results to implement simple yet effective operating practices which may increase our initial production rates, ultimate recovery

factors and rate of return on invested capital.

The

Company’s long-term objective is to increase shareholder value by growing reserves, production, and cash flow. As result we may

seek to identify and consider acquisition opportunities of oilfield services companies and other non-oilfield companies to implement

a diversified growth strategy.

Our

management’s time in the petroleum markets and our ability to contract experienced geology expertise, allows us to identify and

secure acreage with potential reserves. Management believes that the Company’s near prospects as a public company could become

attractive as a potential merger candidate for acquisition of a private enterprise.

Our

Competitive Strengths

Management

believes that we have a number of competitive strengths that will allow us to successfully execute our business strategies:

Simple

Capital Structure. We have a simple capital structure and de-risked inventory of quality locations with what we believe is upside

potential to take advantage of the current recovery of oil prices to acquire potential production at reasonable cost. Management believes

there are opportunities for profits to be made now that oil prices appear to have stabilized and if they continue to gradually rise higher.

Moderate

Risk Exploration Practice. Unlike many major oil companies that often drill very deep wells with a high degree of risk, we focus

on shallow well exploration (sub 5,000 feet) that is less expensive and has lower risk factors. The basis for management’s belief

that the wells that can be drilled in the prospective leases will have the capacity to produce a reasonable amount of hydrocarbon and

due to our recent studies of the general areas where we are prospecting the projects. That is our most important exploration practice.

Under

The Radar Asset Base. Management believes our local West Texas E&P team has a special talent in acquiring local “prime

time” hydrocarbon land leases with sub-300 barrels of oil per day (“bopd”) wells that have large hydrocarbon reserves.

Management believes that these “under the radar” prospective leases have multi-year drilling inventory and reasonable production

history with high upside potential and not readily accessible to the public for auctions, thus adding to our competitive advantage on

these “under the radar” opportunities. It is because management also believes that these highly valuable leases are not economically

justifiable for the major oil and gas companies in the region because such companies need the wells they drill to produce at least 300

barrels (“Bbls”) of oil per day per well.

Technologies

Oil

and natural gas reserve development is a technologically oriented industry; many techniques developed by the industry are now used in

other industries, including the space program. Management believes that technological innovations have made it possible for the oil and

natural gas industry to furnish the fuels that power the world economy. Management also believes that technology has greatly increased

the success rate of finding commercial oil or natural gas deposits. In this context, success rate means the ability to make an oil/gas

well that can produce a commercialized quantity of hydrocarbon.

At

NRIS, we focus on core basic field EOR management practices and contract outside experts to provide us the understanding of complex mineralogy

in shale reservoirs to better determine zones prone to fracture stimulation. This technology can suggest where to frack by providing

us with available data to deliver us a greater chance of success. Our field engineers, geologists and petrophysicists work together for

better drilling decisions.

Sales

Strategy

Our

sales strategy in relation to spot pricing will be to produce less when the sales price is lower and produce more when the sales price

is higher. To maintain the lowest production cost, we will aim to have our inventory be as low as possible, in some instances virtually

zero. Our E&P core team has business relationships with BML, Transport Oil, and Lion Oil Trading & Transportation, for oil sales

and WTG Jameson for gas sales. The Company entered into production agreements with BML, Lion Oil and WTG Jameson so that, as our tier

1 buyer, they can handle pick-up and sales of our crude oil stock to refineries and gas via local gas pipelines.

As

such, crude oil will be picked up from our leases as needed during the calendar month. At the end of the month the crude total sales

will be tallied by lease and the 30-day average of the daily closing of oil will be tabulated. On or about the 25th of the following

month the proceeds checks’ will be issued to the financial parties of record.

Operational

Plans

Overall,

we seek to acquire on a selective basis, oil and gas reserve concessions with existing production. To maintain our operations and complete

any acquisitions we intend to raise capital via equity or debt, be this from our control owner, or other third-party financing sources,

including the capital markets. The Company is still in the process of assessing the wells it holds, or recently acquired and is reviewing

its options.

As

result of market and financial condition the Company will likely take a pause on any near-term drilling activity. If the Company

does review any acquisitions, it will follow model which is based on a concept that has been proven in the past to be an effective

and successful path of development for many other well- known E&P players:

| a) |

The

financed acquisition of mature smaller oil fields that have potential for instituting EOR incremental production processes; and |

| |

|

| b) |

Develop

strategic partnerships with existing operators to share production increases garnered through the implementation of this EOR plan. |

The

Company has plans to limit its operating budget for current wells to basic maintenance and has not determined whether to spend for any

new drill programs in the near future.

Results

of Operations

Comparison

of the Three Months Ended May 31, 2023 with the Three Months Ended May 31, 2022

Revenues

The

Company generated revenues of $81,352 from oil and gas sales for the three months ended May 31, 2023, compared to $152,641 for the three

months ended May 31, 2022. The decrease in revenues came from a decrease in the market price, and decrease in the production volume of

the Company’s oil and gas assets.

Operating

Expenses

Operating

expenses for the three months ended May 31, 2023 and 2022 were $231,939 and $264,881, respectively. Our lease operating expenses decreased

to $138,972 for the three-month period ended May 31, 2023, compared to $164,450 for the three-month period ended May 31, 2022, that was

primarily related to lower variable operating expenses as a result of the lower production during the current period. Our general

and administrative expense decreased slightly to $83,132 for the three-month period ended May 31, 2023, compared to $84,134 for the three-month

period ended May 31, 2022, primarily because of implemented cost cutting measures. Our depletion, depreciation and accretion expense

decreased by $6,462, primarily related to a decrease in accretion expenses recognized during the three-month ended May 31, 2023 than

the same period in 2022, resulting from lower estimates asset retirement obligations.

Other

Income (Expense)

For

the three months ended May 31, 2023 and 2022, the Company recorded interest expense of $30,751 and $28,482 related to outstanding debts.

The increase in interest expense was the result of additional draws from the line of credit.

Net

Loss

We

had a net loss in the amount of $181,338 for the three months ended May 31, 2023, compared to a net loss of $140,722 for the three months

ended May 31, 2022. The increase in losses was primarily related to the decrease in the market price of the Company’s oil and gas,

which resulting lower revenue recognized in this quarter.

Liquidity

and Capital Resources

As

of May 31, 2023, the Company had cash on-hand of $43,673.

Net

cash used by operating activities during the three months ended May 31, 2023 was $108,058, compared to cash used in operating activities

of $84,854 for the same period in 2022.

Net

cash provided by financing and investing activities for three months ended May 31, 2023 and 2022 was $0.

The

Company will require additional financing to support its operations and to pursue its acquisition program. As of May 31, 2023, the Company

had availability of $300,000 on its existing credit line with JBB. If the Company requires additional financing beyond what is available

under its existing credit line, it expects to secure additional borrowing capacity from JBB.

To

date, the funding during the past three fiscal years to support operations and facilitate some acquisitions has been provided by the

largest shareholder of the Company. This individual does not have any legal obligation to continue to provide funding to the Company.

Yet the majority owner has indicated a willingness, and provided some assurances, to selectively review and determine added funding for

certain low risk initiatives on those oil and gas wells in which the Company has either a 100% or a majority working interest in order

to increase its existing production. Our majority shareholder expects, but is not legally obligated, to provide funding for the Company’s

capital expenditure program for fiscal year 2024. Such funding may be provided in the form of loans, issuance of equity or other means.

The

consolidated financial statements of the Company have been prepared on a going concern basis. The Company will either have to increase

its operating revenues to a point to be able to cover its operating expenses or obtain funding from other investors or lenders. There

is no assurance that the Company will be able to increase its revenues or obtain funding. The Company believes that it will experience

revenue disruption and declines as a result of the COVID-19 pandemic and the government response thereto as well as the war and general

political instability in Europe due to Russian Federation invasion of Ukraine. If it is not able to do so, it will have to adjust operations

or cease operations. There is no assurance that the Company will be able to continue its operations. In such instances, investors will

suffer a loss in the value of their investment in the Company.

On

May 2, 2023, the Company entered into an extension agreement with JBB to extend the maturity of its outstanding Loan Note and promissory

note agreement to September 30, 2024.

Off-Balance

Sheet Arrangements

As

of May 31, 2023, we did not have any off-balance sheet arrangements as defined in Item 303 (a)(4)(ii) of Regulation S-K promulgated under

the Securities Act of 1934.

Item

3. Quantitative and Qualitative Disclosures About Market Risk.

We

are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 and are not required to provide the information

under this item.

Item

4. Controls and Procedures.

Evaluation

of Disclosure Controls and Procedures

Disclosure

controls and procedures are designed to ensure that information required to be disclosed in the reports filed or submitted under the

Securities and Exchange Act of 1934, as amended (“Exchange Act”) is recorded, processed, summarized and reported, within

the time period specified in the SEC’s rules and forms. Disclosure controls and procedures include, without limitation, controls

and procedures designed to ensure that information required to be disclosed in the reports filed under the Exchange Act is accumulated

and communicated to management, including the Chief Executive Officer and Chief Financial Officer, which in our case is the same individual.

We carried out an evaluation, under the supervision and with the participation of our management, including our Chief Executive Officer

and Chief Financial Officer, of the effectiveness of the design and operation of our disclosure controls and procedures as of May 31,

2023 (the “Evaluation Date”). Based upon the evaluation of our disclosure controls and procedures as of the Evaluation Date,

the Chief Executive Officer and Chief Financial Officer concluded that our disclosure controls and procedures were not effective because

of the identification of material weaknesses in our internal control over financial reporting that were disclosed in Item 9A. Controls

and Procedures in our 2022 annual report on Form 10-K in Internal Control over Financial Reporting

There

were no changes in our internal control over financial reporting during the three months ended May 31, 2023, that have materially affected,

or are reasonably likely to materially affect, our internal control over financial reporting.

PART

II - OTHER INFORMATION

Item

1. Legal Proceedings.

We

are not currently involved in any litigation that we believe could have a material adverse effect on our financial condition or results

of operations. There is no action, suit, proceeding, inquiry or investigation before or by any court, public board, government agency,

self-regulatory organization or body pending or, to the knowledge of the executive officers of our company or any of our subsidiaries,

threatened against or affecting our company, our common stock, any of our subsidiaries or of our companies or our subsidiaries’

officers or directors in their capacities as such, in which an adverse decision could have a material adverse effect.

Item

1A. Risk Factors.

You

should carefully consider the risk factors in our Annual Report on Form 10-K filed with the Securities and Exchange Commission on June

15, 2023 (the “2022 10-K”), together with all of the other information included in this report, before investing in our common

stock. Those risks and uncertainties encompass many of the risks that could affect our business and the value of our stock. Not all risks

and uncertainties are described. Risks that we do not know about could occur and issues we now view as minor could become more important.

If any of these risks actually occur, our business, financial condition or results of operations could be materially and adversely affected.

In that case, the trading price of our common stock could decline, and you may lose all or part of your investment.

Item

2. Unregistered Sales of Equity Securities

None

Item

3. Defaults Upon Senior Securities.

None.

Item

4. Mine Safety Disclosures.

Not

applicable.

Item

5. Other Information.

None.

Item

6. Exhibits.

*

Filed herewith.

+

In accordance with SEC Release 33-8238, Exhibit 32.1 and 32.2 are being furnished and not filed.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| |

Norris

Industries, Inc. |

| |

|

|

| Date:

July 14, 2023 |

By: |

/s/

Patrick L. Norris |

| |

|

Patrick

L. Norris |

| |

|

Chief

Executive Officer, Chief Financial Officer (Principal Executive Office, Principal Financial and Principal Accounting Officer) and

Chairman of Board |

| |

|

|

| Date:

July 14, 2023 |

By: |

/s/

Ross Henry Ramsey |

| |

|

Ross

Henry Ramsey |

| |

|

President

of the Oil and Gas Division and Director |

Exhibit 31.1

CERTIFICATION OF PRINCIPAL EXECUTIVE

OFFICER

PURSUANT TO SECTION 302 OF THE

SARBANES-OXLEY ACT OF 2002

I, Patrick L. Norris, certify that:

1. I have reviewed this quarterly

report on Form 10-Q of Norris Industries, Inc.;

2. Based on my knowledge, this

quarterly report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements

made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this quarterly

report;

3. Based on my knowledge, the

financial statements, and other financial information included in this quarterly report, fairly present in all material respects the financial

condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this quarterly report;

4. I am responsible for establishing

and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal controls over

financial reporting (as defined in Exchange Act Rules 13a-15(f) and 15d-15(f)) for the registrant and have:

| |

a) |

designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to us by others within those entities, particularly for the period in which this quarterly report is being prepared; |

| |

|

|

| |

b) |

designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles; |

| |

|

|

| |

c) |

evaluated the effectiveness of the registrant’s disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation; |

| |

|

|

| |

d) |

disclosed in this report any change in the registrant’s internal control over financial reporting that occurred during the registrant’s most recent fiscal quarter that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting; |

5. I have disclosed, based on

my most recent evaluation, to the registrant’s auditors and the audit committee of the registrant’s board of directors (or

persons performing the equivalent function):

| |

a) |

all significant deficiencies in the design or operation of internal controls which could adversely affect the registrant’s ability to record, process, summarize and report financial data and have identified for the registrant’s auditors any material weaknesses in internal controls; and |

| |

|

|

| |

b) |

any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant’s internal controls over financial reporting. |

| |

Norris Industries, Inc. |

| |

|

|

| Date: July 14, 2023 |

By: |

/s/ Patrick L. Norris |

| |

|

Chief Executive Officer, Chief Financial Officer (Principal Executive Office, Principal Financial and Principal Accounting Officer) and Chairman of Board |

Exhibit 31.2

CERTIFICATION OF PRINCIPAL FINANCIAL OFFICER

PURSUANT TO SECTION 302 OF THE

SARBANES-OXLEY ACT OF 2002

I, Patrick L. Norris, certify that:

1. I have reviewed this quarterly

report on Form 10-Q of Norris Industries, Inc.;

2. Based on my knowledge, this

quarterly report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements

made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this quarterly

report;

3. Based on my knowledge, the

financial statements, and other financial information included in this quarterly report, fairly present in all material respects the financial

condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this quarterly report;

4. I am responsible for establishing

and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal controls over

financial reporting (as defined in Exchange Act Rules 13a-15(f) and 15d-15(f)) for the registrant and have:

| |

a) |

designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to us by others within those entities, particularly for the period in which this quarterly report is being prepared; |

| |

|

|

| |

b) |

designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles; |

| |

|

|

| |

c) |

evaluated the effectiveness of the registrant’s disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation; |

| |

|

|

| |

d) |

disclosed in this report any change in the registrant’s internal control over financial reporting that occurred during the registrant’s most recent fiscal quarter that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting; |

5. I have disclosed, based on

my most recent evaluation, to the registrant’s auditors and the audit committee of the registrant’s board of directors (or

persons performing the equivalent function):

| |

a) |

all significant deficiencies in the design or operation of internal controls which could adversely affect the registrant’s ability to record, process, summarize and report financial data and have identified for the registrant’s auditors any material weaknesses in internal controls; and |

| |

|

|

| |

b) |

any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant’s internal controls over financial reporting. |

| |

Norris Industries, Inc. |

| |

|

|

| Date: July 14, 2023 |

By: |

/s/ Patrick L. Norris |

| |

|

Patrick L. Norris |

| |

|

Chief Executive Officer, Chief Financial Officer (Principal Executive Office, Principal Financial and Principal Accounting Officer) and Chairman of Board |

EXHIBIT 32.1

CERTIFICATION PURSUANT TO

18 U.S.C. SECTION 1350,

AS ADOPTED PURSUANT TO SECTION 906 OF

THE SARBANES-OXLEY ACT OF 2002

In connection with this Quarterly Report of Norris

Industries, Inc. (the “Company”), on Form 10-Q for the period ended May 31, 2023, as filed with the U.S. Securities and Exchange

Commission on the date hereof, I, Patrick L. Norris, Principal Executive Officer of the Company, certify to the best of my knowledge,

pursuant to 18 U.S.C. Sec. 1350, as adopted pursuant to Sec. 906 of the Sarbanes-Oxley Act of 2002, that:

| |

(1) |

Such Quarterly Report on Form 10-Q for the period ended May 31, 2023, fully complies with the requirements of section 13(a) or 15(d) of the Securities Exchange Act of 1934: and |

| |

|

|

| |

(2) |

The information contained in such Quarterly Report on Form 10-Q for the period ended May 31, 2023, fairly presents, in all material respects, the financial condition and results of operations of the Company. |

| Date: July 14, 2023 |

By: |

/s/ Patrick L. Norris |

| |

|

Patrick L. Norris |

| |

|

Chief Executive Officer, Chief Financial Officer (Principal Executive Office, Principal Financial and Principal Accounting Officer) and Chairman of Board |

This certification accompanies the Report pursuant

to Section 906 of the Sarbanes-Oxley Act of 2002 and shall not, except to the extent required by the Sarbanes-Oxley Act of 2002, be deemed

filed by the Company for purposes of Section 18 of the Securities Exchange Act of 1934, as amended.

A signed original of this written statement required

by Section 906 of the Sarbanes-Oxley Act of 2002 has been provided to the Company and will be retained by the Company and furnished to

the Securities and Exchange Commission or its staff upon request.

EXHIBIT 32.2

CERTIFICATION PURSUANT TO

18 U.S.C. SECTION 1350,

AS ADOPTED PURSUANT TO SECTION 906 OF

THE SARBANES-OXLEY ACT OF 2002

In connection with this Quarterly Report of Norris

Industries, Inc. (the “Company”), on Form 10-Q for the period ended May 31, 2023, as filed with the U.S. Securities and Exchange

Commission on the date hereof, I, Patrick L. Norris, Principal Financial Officer of the Company, certify to the best of my knowledge,

pursuant to 18 U.S.C. Sec. 1350, as adopted pursuant to Sec. 906 of the Sarbanes-Oxley Act of 2002, that:

| |

(1) |

Such Quarterly Report on Form 10-Q for the period ended May 31, 2023, fully complies with the requirements of section 13(a) or 15(d) of the Securities Exchange Act of 1934: and |

| |

|

|

| |

(2) |

The information contained in such Quarterly Report on Form 10-Q for the period ended May 31, 2023, fairly presents, in all material respects, the financial condition and results of operations of the Company. |

| Date: July 14, 2023 |

By: |

/s/ Patrick L. Norris |

| |

|

Patrick L. Norris |

| |

|

Chief Executive Officer, Chief Financial Officer (Principal Executive Office, Principal Financial and Principal Accounting Officer) and Chairman of Board |

This certification accompanies the Report pursuant

to Section 906 of the Sarbanes-Oxley Act of 2002 and shall not, except to the extent required by the Sarbanes-Oxley Act of 2002, be deemed

filed by the Company for purposes of Section 18 of the Securities Exchange Act of 1934, as amended.

A signed original of this written statement required

by Section 906 of the Sarbanes-Oxley Act of 2002 has been provided to the Company and will be retained by the Company and furnished to

the Securities and Exchange Commission or its staff upon request.

v3.23.2

Cover - shares

|

3 Months Ended |

|

May 31, 2023 |

Jul. 10, 2023 |

| Cover [Abstract] |

|

|

| Document Type |

10-Q

|

|

| Amendment Flag |

false

|

|

| Document Quarterly Report |

true

|

|

| Document Transition Report |

false

|

|

| Document Period End Date |

May 31, 2023

|

|

| Document Fiscal Period Focus |

Q1

|

|

| Document Fiscal Year Focus |

2024

|

|

| Current Fiscal Year End Date |

--02-28

|

|

| Entity File Number |

000-55695

|

|

| Entity Registrant Name |

Norris

Industries, Inc.

|

|

| Entity Central Index Key |

0001603793

|

|

| Entity Tax Identification Number |

46-5034746

|

|

| Entity Incorporation, State or Country Code |

NV

|

|

| Entity Address, Address Line One |

102

Palo Pinto St

|

|

| Entity Address, Address Line Two |

Suite B

|

|

| Entity Address, City or Town |

Weatherford

|

|

| Entity Address, State or Province |

TX

|

|

| Entity Address, Postal Zip Code |

76086

|

|

| City Area Code |

(855)

|

|

| Local Phone Number |

809-6900

|

|

| Trading Symbol |

NRIS

|

|

| Title of 12(g) Security |

Common

Stock, $.01 Par Value

|

|

| Entity Current Reporting Status |

Yes

|

|

| Entity Interactive Data Current |

Yes

|

|

| Entity Filer Category |

Non-accelerated Filer

|

|

| Entity Small Business |

true

|

|

| Entity Emerging Growth Company |

false

|

|

| Entity Shell Company |

false

|

|

| Entity Common Stock, Shares Outstanding |

|

90,883,013

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFiscal period values are FY, Q1, Q2, and Q3. 1st, 2nd and 3rd quarter 10-Q or 10-QT statements have value Q1, Q2, and Q3 respectively, with 10-K, 10-KT or other fiscal year statements having FY.

| Name: |

dei_DocumentFiscalPeriodFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fiscalPeriodItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThis is focus fiscal year of the document report in YYYY format. For a 2006 annual report, which may also provide financial information from prior periods, fiscal 2006 should be given as the fiscal year focus. Example: 2006.

| Name: |

dei_DocumentFiscalYearFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gYearItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |