Current Report Filing (8-k)

August 02 2022 - 4:30PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 27, 2022

MITESCO, INC.

(Exact Name of Registrant as Specified in Charter)

| Delaware | | 000-53601 | | 87-0496850 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| 1600 Highway 100 South, Suite 432 St. Louis Park, MN 55416 |

| (Address of principal executive offices) (Zip Code) |

(844) 383-8689

(Registrant's telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: None

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| N/A | N/A | N/A |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 1.01.

|

Entry into a Material Definitive Agreement.

|

Issuance of Promissory Note

Mitesco, Inc. (the “Company”) issued a 10% Promissory Note due as described below (the “Note”), dated July 27, 2022, to James H Caplan, (the “Lender”) and in respect of which the Company received proceeds of $50,000.

The Note carries a 10% interest rate per annum, accrued monthly and payable at maturity. The Note has a maturity date that is the earlier of (i) January 21, 2023, or (ii) five business days after the date on which the Company successfully lists its shares of common stock on Nasdaq or NYSE.

The aggregate amount payable at maturity will be $58,823 plus 10% of that amount plus any accrued and unpaid interest. Following an event of default, as defined in the Note, the principal amount shall bear interest for each day until paid, at a rate per annum equal to the lesser of the maximum interest permitted by applicable law and 18%. The Note contains a “most favored nations” clause that provides that, so long as the Note is outstanding, if the Company issues any new security, which the Lender reasonably believes contains a term that is more favorable than those in the Note, the Company shall notify the Lender of such term, and such term, at the option of the Lender, shall become a part of the Note. In addition, the Lender will be issued in the aggregate (1) 24,117 five-year warrants (the “Warrants”) and (2) 24,117 shares of Common Stock as commitment shares (“Commitment Shares”). The Commitment Shares are priced at $0.25. The Warrants have an initial exercise price of $0.50 per share. The Warrants are not exercisable for six months following their issuance. The Lender may exercise the Warrants on a cashless basis if after the six-month anniversary of date of issuance, the shares of Common Stock underlying the Warrants are not then registered pursuant to an effective registration statement. The Note has an optional conversion provision whereby on the maturity date of the Note, the Company can either pay in cash or convert into restricted common stock of the Company pursuant to a conversion ratio.

This summary is not a complete description of all of the terms of the Note and the Warrants and is qualified in its entirety by reference to the full text of the form Note and the form Warrants filed as Exhibits 4.1 and 4.2, respectively hereto, which is incorporated by reference into this Item 1.01.

|

Item 2.03.

|

Creation of a Direct Financial Obligation or an Obligation Under an Off-Balance Sheet Arrangement of a Registrant.

|

To the extent required by this Item 2.03, the information contained in Item 1.01 is incorporated herein by reference.

|

Item 3.02.

|

Unregistered Sales of Equity Securities.

|

To the extent required by this Item 3.02, the information contained in Item 1.01 is incorporated herein by reference.

|

Item 3.03.

|

Material Modification to Rights of Security Holders.

|

To the extent required by this Item 3.03, the information contained in Item 1.01 is incorporated herein by reference.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

(d) Exhibits

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Dated: August 2, 2022

|

MITESCO, INC.

|

| |

|

|

| |

By:

|

/s/ Lawrence Diamond

|

|

| |

Name:

|

Lawrence Diamond

|

| |

Title:

|

Chief Executive Officer

|

NONE

false

0000802257

0000802257

2022-07-27

2022-07-27

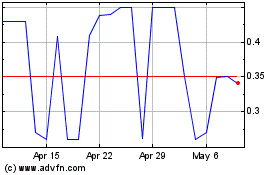

Mitesco (PK) (USOTC:MITI)

Historical Stock Chart

From Jun 2024 to Jul 2024

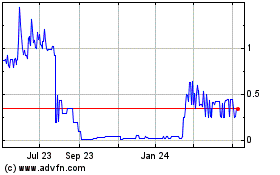

Mitesco (PK) (USOTC:MITI)

Historical Stock Chart

From Jul 2023 to Jul 2024