Current Report Filing (8-k)

July 07 2016 - 4:49PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

July 5, 2016

(Date of earliest event reported)

Legend Oil and Gas, Ltd.

(Exact Name of Registrant as Specified in

Charter)

|

Colorado

|

000-49752

|

84-1570556

|

|

(State

or Other Jurisdiction of Incorporation)

|

(Commission

File Number)

|

(IRS

Employer Identification No.)

|

|

|

|

|

|

555

Northpoint Center East, Suite 400 Alpharetta, GA

|

30022

|

|

(Address

of Principal Executive Offices)

|

Zip

Code

|

(678)

366-4587

(Registrant’s

telephone number, including area code)

______________________________________________

(Former

Address, if Changed Since Last Report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

Item 1.01

|

Entry into a Material Definitive Agreement

|

The

disclosure below under Item 3.02 is incorporated by reference into this Item 1.01.

|

Item 2.03

|

Creation of a Direct Financial Obligation or an Obligation

under an Off-Balance Sheet Arrangement of the Registrant.

|

The

information provided in Item 1.01 of this Current Report on Form 8-K with respect to the issuance and the terms of the Debenture

is incorporated by reference into this Item 2.03.

|

Item

3.02

|

Unregistered Sale of Equity

Securities

|

On

July 5, 2016,

the Company entered into a Securities

Purchase Agreement with Hillair Capital Investments, L.P. (“

Purchaser

”) pursuant to which it issued an Original

Issue Discount Senior Convertible Debenture (the “

Debenture

”) to the Purchaser in the aggregate amount of $330,000,

payable in full on March 1, 2018. The Debenture is convertible into up to 11,000,000 shares of Common Stock at a conversion price

of $.03 per share. The repayment of the Debenture is unsecured.

After

taking into account the original issue discount, the net proceeds received by the Company was $300,000.

These

transactions are exempt from registration subject to Section 4(2) of the Securities Act of 1933, as amended (the “

Securities

Act

”).

|

Item

9.01

|

Financial

Statements and Exhibits

|

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned thereunto duly authorized.

|

|

Legend

Oil and Gas, Ltd.

|

|

|

|

|

|

|

|

|

|

Date:

July 7, 2016

|

By:

|

/s/ Warren S. Binderman

|

|

|

|

Warren

S. Binderman

|

|

|

President

and Chief Financial Officer

|

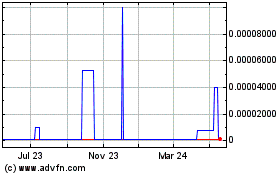

Legend Oil and Gas (CE) (USOTC:LOGL)

Historical Stock Chart

From Dec 2024 to Jan 2025

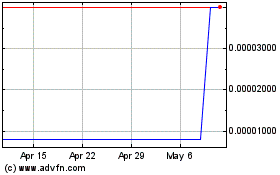

Legend Oil and Gas (CE) (USOTC:LOGL)

Historical Stock Chart

From Jan 2024 to Jan 2025