ICOA, Inc. to Reduce Outstanding Shares by 4.5 Billion

October 07 2010 - 9:00AM

Marketwired

ICOA, Inc. (PINKSHEETS: ICOA) (www.icoacorp.com) today announced

the Company's Board of Directors has agreed to reduce the issued

and outstanding shares by 4.5 billion shares held by related

parties.

The reduction will be executed in three phases: Phase I: 1.5

billion shares will be cancelled as soon as practical in the month

of October 2010. Phase II: 1.5 billion shares will be cancelled

during the month of November 2010. Phase III: 1.5 billion shares

will be cancelled in the month of December 2010.

While these shares were restricted for three years, the Company

believes this strategic action will provide a long term benefit to

existing stakeholders and potentially inspire confidence to future

shareholders.

The Company intends to expedite the necessary documentation and

conclude the reduction of the issued and outstanding shares,

earlier than originally planned.

Regarding the transaction with American Marketing Complex (AMC)

announced on October 4th 2010, the Company wishes to clarify that

this transaction will record equity of $10 million in ICOA's

Balance Sheet. The numbers of shares (20,000,000) are issued at a

price that is $0.50 Cash Equivalent Credits per share (Media etc

credits). In the Company's opinion this is a strong indication of

the direction AMC believes the Company is headed. This transaction

will strengthen our balance sheet significantly and management

believes it was executed in the best interest of its shareholders.

These shares are restricted and cannot be traded in the market

until released from restriction in accordance with SEC rules:

twelve months for non-reporting or six months for reporting

companies.

About ICOA ICOA, Inc. (PINKSHEETS: ICOA)

is a national provider of wireless and wired broadband Internet

networks in high-traffic public locations. ICOA provides design,

installation, operation, maintenance and management of WI-FI

hot-spot and hot-zone Internet access. Based in Warwick, Rhode

Island, ICOA owns or operates broadband access installations in

high-traffic locations across 40 states, located in airports,

quick-service restaurants, hotels and motels, travel plazas,

marinas etc. ICOA networks are compatible with widely-used 802.11x

technology and with virtually all Internet service providers.

Further information is at www.icoacorp.com.

Safe Harbor: This press release includes forward-looking

statements related to theglobe.com, inc. that involve risks and

uncertainties, including, but not limited to, risks and

uncertainties relating to integration of newly acquired businesses

and assets, product delivery, product launch dates, risks relating

to the Internet, development and protection of technology, the

availability of financing or other capital to fund its plans and

operations, the management of growth, market acceptance of our

products, our ability to compete successfully against established

competitors with greater resources, the uncertainty of future

governmental regulation (particularly as it pertains to the

Internet), pending litigation and other risks. These

forward-looking statements are made in reliance on the "Safe

Harbor'' provisions of the Private Securities Litigation Reform Act

of 1995. For further information about these and other factors that

could affect ICOA's future results and business plans, please see

the Company's filings with the Securities and Exchange Commission,

including in particular our Annual Report on Form 10-K for the year

ended December 31, 2005, and our Quarterly Report on Form 10-Q for

the quarter ended September 30, 2006. Copies of these filings are

available online at http://www.sec.gov. Prospective investors are

cautioned that forward-looking statements are not guarantees of

performance. Actual results may differ materially and adversely

from management expectations.

Contact: ICOA, Inc. investor@icoamail.com www.icoacorp.com

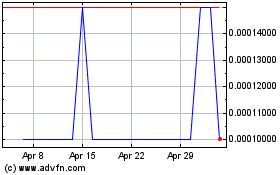

Icoa (CE) (USOTC:ICOA)

Historical Stock Chart

From Dec 2024 to Jan 2025

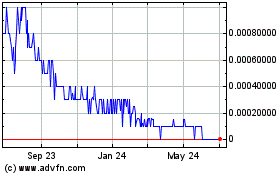

Icoa (CE) (USOTC:ICOA)

Historical Stock Chart

From Jan 2024 to Jan 2025