Pacific WebWorks Reports Q2 2009 Financials

August 14 2009 - 8:00AM

Business Wire

Pacific WebWorks, Inc. (OTCBB: PWEB) reported that revenues

increased to $8,697,551 for the second quarter of 2009, up from

$2,450,681 for the second quarter 2008, an increase of 255%. For

the first six months of the year revenues were $11,935,470 compared

to $5,576,715 in 2008, an increase of 112%.

Unrestricted cash amounted to $907,566 at June 30, 2009, an

increase of nearly $530,000 from year end December 31, 2008, with

all the growth coming from operations. Total assets increased 49.0%

from $4,482,215 at December 31, 2008, to $6,677,342 at June 30,

2009.

The company’s net income from continuing operations was $13,108,

compared to a net gain of $240,437 during the 2008 second quarter.

This decrease relates primarily to a significant increase in

marketing costs directly associated with new customer acquisitions

as well as one-time infrastructure expenses required to support

growth. Profits for the first six months of 2009 were $322,803, or

$.01 per share, compared to $278,031, or $.01 per share, over the

same period last year.

2009 second quarter accomplishments:

- Installed a new IT based phone

system.

- Upgraded and automated

accounting system to better handle billing and reporting.

- Programmed integration with

several key banks.

- Automated and staffed a larger

customer service department.

- Solidified additional merchant

account relationships.

CEO Ken Bell stated, “Our overall financial condition and

liquidity continues to be strong. During the second quarter we

dramatically increased our customer count. Since there is typically

about a 30-45-day lag between the acquisition of a new customer and

the profitability of that customer, we expect a large part of the

revenue growth of the second quarter to reflect as profit growth in

the third quarter and beyond. Our business model is similar to

other subscriber based models, where the majority of costs

associated with new customers are upfront and the recurring monthly

revenues from these customers drive profits.”

Bell continued, “Our revenues have already exceeded 2008 full

year revenues. These are exciting times for the company, and it is

very likely we may exceed our previous revenue forecast of $23 to

$24 million. Demand for our product remains strong, and our online

marketing channels have been highly effective in reaching our

potential customers. We now have the systems in place to allow us

to reach our goal of becoming a $100 million per year organization.

We believe we are now prepared to handle the multitude of

transactions and customer service requirements that will accompany

our growth and are prepared to continue our focus on product sales

and marketing. Additionally, the company also has no ongoing legal

or regulatory issues surrounding its business practices as has been

purported by some.”

Please visit the company’s filings for more information

concerning the financials.

About Pacific WebWorks, IntelliPay and TradeWorks

Marketing

Pacific WebWorks provides a comprehensive suite of affordable,

easy-to-use software programs for small businesses that want to

create, manage, and maintain an effective Web strategy including

full e-commerce capabilities. Pacific WebWorks operates a number of

wholly owned subsidiaries including IntelliPay, TradeWorks

Marketing and others.

Forward-Looking Statements

All statements other than statements of historical fact included

in this press release are forward-looking statements. Words such as

“anticipate,” “believe,” “estimate,” “expect,” “intend” and other

similar expressions as they relate to the Company or its

management, identify forward-looking statements. Such

forward-looking statements are based on the beliefs of the

Company’s management as well as assumptions made by and information

currently available to the Company’s management. These statements

are not a guarantee of future performance. Actual results could

differ materially from those contemplated by the forward-looking

statements as a result of certain factors, including the Company’s

ability to maintain sufficient credit card processing capabilities

to service the demands of their hosting portfolio and other risk

factors discussed under the caption “Risk Factors” in our Annual

Report on Form 10-K for the year ended December 31, 2008 as filed

with the Securities and Exchange Commission. Such statements

reflect the current view of the Company’s management with respect

to future events and are subject to these and other risks,

uncertainties and assumptions related to the operations, result of

operations, growth strategy and liquidity of the Company. All

subsequent written and oral forward-looking statements attributable

to the Company or persons acting on its behalf are expressly

qualified in their entirety by this paragraph. The Company has no

intention, and disclaims any obligation to update or revise any

forward-looking statements, whether as a result of new information,

future results or otherwise.

Heyu Biological Technology (PK) (USOTC:HYBT)

Historical Stock Chart

From Jun 2024 to Jul 2024

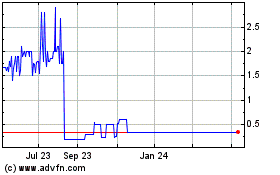

Heyu Biological Technology (PK) (USOTC:HYBT)

Historical Stock Chart

From Jul 2023 to Jul 2024