Hong Kong's Hang Seng Index Gets a Facelift

March 01 2021 - 7:56AM

Dow Jones News

By Joanne Chiu

Hong Kong's flagship stock index is getting a major overhaul

that will expand the number of companies it covers and give more

sway to fast-growing technology stocks.

The changes to the Hang Seng Index, a key gauge of Hong Kong's

$6 trillion-plus stock market, amount to one of the biggest revamps

since it was launched in 1969. They also follow a period of

underperformance: despite a recent rally, the index has gained only

around 12% in the 12 months ended February, lagging U.S. benchmarks

and the Shanghai Composite.

On Monday, Hang Seng Indexes Co. said that it would eventually

broaden the index to up to 100 companies from the 55 that will be

in the index as of mid-March, and that it would ensure the

benchmark has a better mix of industries, reducing the outsize

impact of financial companies. The move follows a consultation

launched in December.

"Adding more stocks into the benchmark is always a good thing.

It's going to offer a much more diversified benchmark, which is

always important" to investors, said Ken Wong, a client portfolio

manager at Eastspring Investments.

However, Mr. Wong noted that the Hang Seng was less widely

tracked than indexes compiled by global peers like MSCI Inc. and

FTSE Russell.

In another change, some companies will be allowed to join the

index just three months after going public -- effectively

fast-tracking inclusion for newly listed startups, which currently

have to wait up to two years, depending on their size.

The index compiler will also cap any single stock at 8% of the

index, down from 10% now. At the same time, it will increase the

ceiling from 5% for companies with secondary listings in Hong Kong,

like Chinese tech giant Alibaba Group Holding Ltd., and those with

super-voting shares.

Gabriel Chan, head of investment services for Hong Kong at BNP

Paribas Wealth Management, said the overhaul was an overdue

improvement for investors, while the shorter waiting time would

make it more appealing for companies to list in Hong Kong.

The growing popularity of new-economy companies and those

catering to China's consumers has made the benchmark, which is

heavily influenced by the stocks of banks, insurers and real-estate

developers, less compelling to investors. Its biggest constituents

by weight are Tencent Holdings Ltd., insurer AIA Group Ltd. and

HSBC Holdings Plc.

The changes by the index compiler, a unit of HSBC Holdings

Ltd.'s Hang Seng Bank Ltd., echo moves by Hong Kong Exchanges and

Clearing Ltd., which in recent years has revamped its rules to

allow Chinese tech companies with supervoting shares and

unprofitable biotechnology companies to trade in Hong Kong.

Strategists at CCB International said adding more high-growth

tech stocks could boost the index's overall valuation. Cliff Zhao,

the bank's head of strategy, said the scope of the expansion had

exceeded his expectations.

Hang Seng Indexes Co. last year launched a separate 30-stock

tech index, creating a dedicated benchmark to reflect interest in

Hong Kong-listed Chinese tech stocks such as Alibaba and

Tencent.

The changes will start to take effect with an index rebalancing

in June. The Hang Seng will have 80 constituents by mid-2022 and

will ultimately expand to 100 stocks.

The compiler plans to keep no more than a quarter of Hong Kong

companies as constituents in its flagship index, which is dominated

by mainland Chinese businesses.

Write to Joanne Chiu at joanne.chiu@wsj.com

(END) Dow Jones Newswires

March 01, 2021 07:41 ET (12:41 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

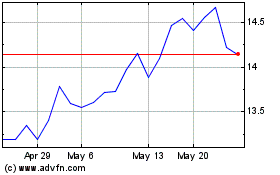

Hang Seng Bank (PK) (USOTC:HSNGY)

Historical Stock Chart

From Jan 2025 to Feb 2025

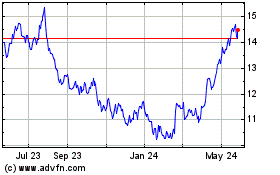

Hang Seng Bank (PK) (USOTC:HSNGY)

Historical Stock Chart

From Feb 2024 to Feb 2025