Form 8-K - Current report

February 14 2024 - 8:00AM

Edgar (US Regulatory)

false

0000930775

0000930775

2024-02-14

2024-02-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 OR 15(d)

of

The Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): February

14, 2024

ENCISION, INC.

(Exact

name of registrant as specified in its charter)

| Colorado |

001-11789 |

84-1162056 |

| (State or other jurisdiction of incorporation) |

(Commission File

Number) |

(I.R.S. Employer Identification

No.) |

| |

|

|

| 6797

Winchester Circle, Boulder, Colorado |

80301 |

| (Address

of principal executive offices) |

(Zip Code)

|

| (303)

444-2600 |

| (Registrant’s

telephone number, including area code) |

| |

(Former name or former address, if changed since last report.)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

| ☐

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

| ☐

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

| ☐

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

| ☐

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

Securities registered

pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange

on

which registered |

| Common

Stock, no par value |

|

ECIA |

|

OTC

Bulletin Board |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02

Results of Operations and Financial Condition.

On February 14, 2024, Encision,

Inc. issued a press release announcing its third quarter financial results for the quarter ended December 31, 2023. The full text

of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

ENCISION, INC. |

| |

(Registrant) |

| |

|

| Date: February

14, 2024 |

|

| |

/s/ Mala M Ray |

| |

Mala M Ray |

| |

Controller |

| |

Principal Accounting Officer |

Exhibit 99.1

February 14, 2024

Encision Reports Third Quarter Fiscal Year

2024 Results

Boulder, Colorado, February 14, 2024 -- Encision Inc.

(PK:ECIA), a medical device company owning patented Active Electrode Monitoring (AEM®) Technology that prevents dangerous radiant

energy burns in minimally invasive surgery, today announced financial results for its fiscal 2024 third quarter that ended December 31,

2023.

The Company posted quarterly product net revenue of

$1.56 million and service net revenue of $20 thousand, or total net revenue of $1.58 million for a quarterly net loss of $207 thousand,

or $(0.02) per diluted share. These results compare to product net revenue of $1.68 million and no service net revenue, or total net revenue

of $1.68 million for a quarterly net loss of $216 thousand, or $(0.02) per diluted share, in the year-ago quarter. Gross margin on product

net revenue was 46% in the fiscal 2024 third quarter and 53% in the fiscal 2023 third quarter.

The Company posted nine months

product net revenue of $4.93 million and service net revenue of $134 thousand, or total net revenue of $5.06 million for a nine months

net loss of $355 thousand, or $(0.03) per diluted share. These results compare to product net revenue of $5.08 million and service net

revenue of $459 thousand, or total net revenue of $5.54 million for a nine months net loss of $231 thousand, or ($0.02) per diluted share,

in the year-ago nine months. Gross margin on product net revenue was 48% in the fiscal 2024 nine months and 50% in the fiscal 2023 nine

months.

“The fiscal 2024 third quarter

presented significant challenges for Encision and for the medical device market in general,” said Gregory Trudel, President and

CEO of Encision Inc. “The demand for surgical procedures was diminished during the pandemic period and its rebound has been a slow

process. The market has seen a number of positive indicators for an increase in demand and Encision continues to drive toward them. The

service revenue that we were able to drive in the previous year was very helpful and we are starting to gain traction in recreating that

revenue stream with a few new partners and opportunities to collaborate on our foundational technologies.”

Encision Inc. designs and markets a portfolio

of high-performance surgical instrumentation that delivers advances in patient safety with AEM technology, surgical performance, and value

to hospitals across a broad range of minimally invasive surgical procedures. Based in Boulder, Colorado, the company pioneered the development

and deployment of Active Electrode Monitoring, AEM technology, to eliminate dangerous stray energy burns during minimally invasive procedures.

For additional information about all our products, please visit www.encision.com.

In accordance with the safe harbor provisions

of the Private Securities Litigation Reform Act of 1995, the Company notes that statements in this press release and elsewhere that look

forward in time, which include everything other than historical information, involve risks and uncertainties that may cause actual results

to differ materially from those indicated by the forward-looking statements. Factors that could cause the Company’s actual results

to differ materially include, among others, its ability to develop new or enhanced products and have such products accepted in the market,

its ability to increase net sales through the Company’s distribution channels, its ability to compete successfully against other

manufacturers of surgical instruments, insufficient quantity of new account conversions, insufficient cash to fund operations, delay

in developing new products and receiving FDA approval for such new products and other factors discussed in the Company’s filings

with the Securities and Exchange Commission. Readers are encouraged to review the risk factors and other disclosures appearing in the

Company’s Annual Report on Form 10-K for the year ended March 31, 2023 and subsequent filings with the Securities and Exchange

Commission. We do not undertake any obligation to update publicly any forward-looking statements, whether as a result of the receipt

of new information, future events, or otherwise.

CONTACT: Mala Ray, Encision Inc., 303-444-2600,

mray@encision.com

Encision Inc.

Unaudited Condensed Statements of Operations

(in thousands, except per share information)

| | |

Three Months Ended | | |

Nine Months Ended | |

| | |

December 31, 2023 | | |

December 31, 2022 | | |

December 31, 2023 | | |

December 31, 2022 | |

| Product revenue | |

$ | 1,561 | | |

$ | 1,684 | | |

$ | 4,927 | | |

$ | 5,084 | |

| Service revenue | |

| 20 | | |

| — | | |

| 134 | | |

| 459 | |

| Total revenue | |

| 1,581 | | |

| 1,684 | | |

| 5,061 | | |

| 5,543 | |

| | |

| | | |

| | | |

| | | |

| | |

| Product cost of revenue | |

| 843 | | |

| 786 | | |

| 2,539 | | |

| 2,528 | |

| Service cost of revenue | |

| 11 | | |

| — | | |

| 69 | | |

| — | |

| Total cost of revenue | |

| 854 | | |

| 786 | | |

| 2,608 | | |

| 2,528 | |

| | |

| | | |

| | | |

| | | |

| | |

| Gross profit | |

| 727 | | |

| 898 | | |

| 2,453 | | |

| 3,015 | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| Sales and marketing | |

| 414 | | |

| 502 | | |

| 1,237 | | |

| 1,494 | |

| General and administrative | |

| 352 | | |

| 360 | | |

| 1,107 | | |

| 1,103 | |

| Research and development | |

| 151 | | |

| 247 | | |

| 420 | | |

| 641 | |

| Total operating expenses | |

| 917 | | |

| 1,109 | | |

| 2,764 | | |

| 3,238 | |

| Operating income (loss) | |

| (190 | ) | |

| (211 | ) | |

| (311 | ) | |

| (223 | ) |

| Interest expense and other income, net | |

| (17 | ) | |

| (5 | ) | |

| (44 | ) | |

| (8 | ) |

| (Loss) before provision for income taxes | |

| (207 | ) | |

| (216 | ) | |

| (355 | ) | |

| (231 | ) |

| Provision for income taxes | |

| — | | |

| — | | |

| — | | |

| — | |

| Net (loss) | |

$ | (207 | ) | |

$ | (216 | ) | |

$ | (355 | ) | |

$ | (231 | ) |

| Net (loss) per share—basic and diluted | |

$ | (0.02 | ) | |

$ | (0.02 | ) | |

$ | (0.03 | ) | |

$ | (0.02 | ) |

| Weighted average shares—basic and diluted | |

| 11,770 | | |

| 11,763 | | |

| 11,770 | | |

| 11,761 | |

Encision Inc.

Unaudited Condensed Balance Sheets

(in thousands)

| | |

December 31,

2023 | | |

March 31,

2023 | |

| ASSETS | |

| | | |

| | |

| Cash | |

$ | 99 | | |

$ | 189 | |

| Accounts receivable | |

| 923 | | |

| 921 | |

| Inventories, net | |

| 1,554 | | |

| 1,899 | |

| Prepaid expenses | |

| 129 | | |

| 116 | |

| Total current assets | |

| 2,705 | | |

| 3,125 | |

| Equipment, net | |

| 269 | | |

| 303 | |

| Right of use asset | |

| 1,083 | | |

| 496 | |

| Patents, net | |

| 166 | | |

| 163 | |

| Other assets | |

| 64 | | |

| 47 | |

| Total assets | |

$ | 4,287 | | |

$ | 4,134 | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | |

| | | |

| | |

| Accounts payable | |

$ | 302 | | |

$ | 253 | |

| Secured notes | |

| 45 | | |

| 44 | |

| Line of credit | |

| — | | |

| 177 | |

| Accrued compensation | |

| 233 | | |

| 218 | |

| Other accrued liabilities | |

| 130 | | |

| 85 | |

| Accrued lease liability | |

| 351 | | |

| 354 | |

| Total current liabilities | |

| 1,061 | | |

| 1,131 | |

| Secured notes | |

| 233 | | |

| 268 | |

| Accrued lease liability | |

| 800 | | |

| 240 | |

| Total liabilities | |

| 2,094 | | |

| 1,639 | |

| Common stock and additional paid-in capital | |

| 24,401 | | |

| 24,348 | |

| Accumulated (deficit) | |

| (22,208 | ) | |

| (21,853 | ) |

| Total shareholders’ equity | |

| 2,193 | | |

| 2,495 | |

| Total liabilities and shareholders’ equity | |

$ | 4,287 | | |

$ | 4,134 | |

Encision Inc.

Unaudited Condensed Statements of Cash

Flows

(in thousands)

| | |

Nine Months Ended | |

| | |

December

31,

2023 | | |

December 31,

2022 | |

| Operating activities: | |

| | | |

| | |

| Net (loss) | |

$ | (355 | ) | |

$ | (231 | ) |

Adjustments to reconcile net (loss) to cash generated by

(used in) operating activities: | |

| | | |

| | |

| Depreciation and amortization | |

| 64 | | |

| 64 | |

| Share-based compensation expense | |

| 53 | | |

| 39 | |

| Provision for inventory obsolescence, net | |

| 63 | | |

| 53 | |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| Right of use asset, net | |

| (30 | ) | |

| (31 | ) |

| Accounts receivable | |

| (2 | ) | |

| 118 | |

| Inventories | |

| 282 | | |

| (375 | ) |

| Prepaid expenses and other assets | |

| (30 | ) | |

| (28 | ) |

| Accounts payable | |

| 49 | | |

| (274 | ) |

| Accrued compensation and other accrued liabilities | |

| 60 | | |

| (73 | ) |

| Net cash generated by (used in) operating activities | |

| 154 | | |

| (738 | ) |

| | |

| | | |

| | |

| Investing activities: | |

| | | |

| | |

| Acquisition of property and equipment | |

| (12 | ) | |

| (173 | ) |

| Patent costs | |

| (20 | ) | |

| (10 | ) |

| Net cash (used in) investing activities | |

| (32 | ) | |

| (183 | ) |

| | |

| | | |

| | |

| Financing activities: | |

| | | |

| | |

| Net proceeds from options exercised | |

| — | | |

| 21 | |

| Borrowings from secured notes | |

| (212 | ) | |

| 70 | |

| Net cash (used in) provided by financing activities | |

| (212 | ) | |

| 91 | |

| | |

| | | |

| | |

| Net (decrease) in cash | |

| (90 | ) | |

| (830 | ) |

| Cash, beginning of period | |

| 189 | | |

| 950 | |

| Cash, end of period | |

$ | 99 | | |

$ | 120 | |

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

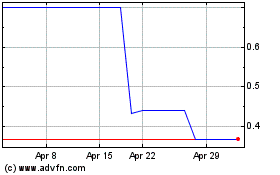

Encision (PK) (USOTC:ECIA)

Historical Stock Chart

From Sep 2024 to Oct 2024

Encision (PK) (USOTC:ECIA)

Historical Stock Chart

From Oct 2023 to Oct 2024