SCHEDULE 14C INFORMATION

Information Statement Pursuant to Section 14(c)

of the Securities Exchange Act of 1934 (Amendment No. 1)

|

Check the appropriate box:

|

|

|

|

|

[ X ]

|

Preliminary Information Statement

|

|

|

|

|

[ ]

|

Confidential, for use of the Commission only (as permitted by Rule 14c-5(d)(21))

|

|

|

|

|

[ ]

|

Definitive Information Statement

|

AXIM International, Inc.

_____________________________________

(Name of Registrant as Specified In Its Charter)

Payment of Filing Fee (Check the appropriate box):

|

[ X ]

|

No fee required

|

|

|

|

|

[ ]

|

Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11.

|

|

1)

|

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

2)

|

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

3)

|

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing is calculated and state how it was determined.):

|

|

|

|

|

|

4)

|

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

5)

|

|

Total Fee Paid:

|

|

[ ]

|

Fee paid previously with preliminary materials.

|

|

|

|

|

[ ]

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

1)

|

|

Amount Previously Paid:

|

|

|

|

|

|

2)

|

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

3)

|

|

Filing Party:

|

|

|

|

|

|

4)

|

|

Dated Filed:

|

AXIM INTERNATIONAL, INC.

18 EAST 50

TH

STREET, 5

TH

FLOOR

NEW YORK, NY 10022

NOTICE OF SHAREHOLDER ACTION BY WRITTEN CONSENT

____________________

April 30, 2014

On April 21, 2014, the board of directors of AXIM International, Inc. (the “Company”) adopted a resolution approving a certificate of amendment to the Company’s Articles of Incorporation to: (i) change the name of the Company to “Canchew Biotechnologies, Inc.;” (the “Name Change”) and (ii) increase in the number of authorized shares of capital stock of the Company from one hundred ninety five million (195,000,000) shares of common stock, par value $0.0001per share, to three hundred million (300,000,000) shares of capital stock, par value $0.0001 per share (the “ Authorized Capital Increase ”).

The Company obtained the written consent of stockholders representing 91% of the Company’s outstanding common stock as of April 21, 2014 (the “ Majority Stockholders ”) approving an amendment to the Company’s Articles of Incorporation to effect the above-mentioned Name Change and Authorized Capital Increase. Pursuant to Rule 14c-2 under the Securities Exchange Act of 1934, as amended, the actions will not be effective, and a Certificate of Amendment to our Articles of Incorporation effectuating the Name Change and Authorized Capital Increase will not be filed with the Secretary of State for the State of Nevada, until twenty (20) days after the date this Information Statement is filed with the Securities and Exchange Commission and a copy thereof is mailed to each of the Company’s stockholders.

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

THIS IS NOT A NOTICE OF A SPECIAL MEETING OF STOCKHOLDERS AND NO

STOCKHOLDER MEETING WILL BE HELD TO CONSIDER ANY MATTER DESCRIBED

HEREIN. WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED

NOT TO SEND US A PROXY

No action is required by you. The accompanying information statement is furnished only to inform our stockholders of the actions described above before they take place in accordance with the requirements of United States federal securities laws. This Information Statement is being mailed on or about April 30, 2014, to all of the Company's stockholders of record as of the close of business on April 21, 2014.

/s/

Dr. George E. Anastassov

Dr. George E. Anastassov

Chief Executive Officer

AXIM INTERNATIONAL, INC.

INFORMATION STATEMENT

____________________

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY

This Information Statement is furnished by the Board of Directors of AXIM International, Inc., a Nevada (the “Company,” “we” or “us”) to the holders of record at the close of business on April 21, 2014 (the “ Record Date ”) of the Company’s outstanding common stock, par value $0.0001 per share, pursuant to Rule 14c-2 of the Securities Exchange Act of 1934, as amended (the “ Exchange Act” ), and pursuant Section 78.390 of the Nevada Revised Statutes.

The cost of furnishing this Information Statement will be borne by us. We will mail this Information Statement to registered stockholders and certain beneficial stockholders where requested by brokerage houses, nominees, custodians, fiduciaries and other like parties.

This Information Statement informs stockholders of the action taken and approved on April 21, 2014, by the Company’s Board of Directors and by the Company’s stockholders holding 91% of the Company’s common stock issued and outstanding on April 21, 2014 (the “Majority Stockholders”). The Company’s Board of Directors and the Majority Stockholders approved an amendment of the Company’s Articles of Incorporation to: (i) change the name of the Company to “Canchew Biotechnologies, Inc.;” (the “Name Change”) and (ii) increase in the number of authorized shares of capital stock of the Company from one hundred ninety five million (195,000,000) shares of common stock, par value $0.0001per share, to three hundred million (300,000,000) shares of capital stock, par value $0.0001 per share (the “Authorized Capital Increase”).

Accordingly, all necessary corporate approvals in connection with the amendment to the Company’s Articles of Incorporation to affect the Name Change and the Authorized Capital Increase have been obtained. This Information Statement is furnished solely for the purpose of informing the Company’s stockholders, in the manner required under the Exchange Act of these corporate actions. Pursuant to Rule 14c-2 under the Exchange Act, the actions will not be effective and a Certificate of Amendment to our Articles of Incorporation effectuating the Authorized Capital Increase will not be filed with the Secretary of State for the State of Nevada, until twenty (20) days after the date this Information Statement is filed with the Securities and Exchange Commission and a copy thereof is mailed to each of the Company’s stockholders. Therefore, this Information Statement is being sent to you for informational purposes only.

THIS IS NOT A NOTICE OF A SPECIAL MEETING OF STOCKHOLDERS AND NO

STOCKHOLDER MEETING WILL BE HELD TO CONSIDER ANY MATTER DESCRIBED

HEREIN. WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED

NOT TO SEND US A PROXY

The Company’s stockholders as of the Record Date are being furnished copies of this Information Statement. This Information Statement is first being mailed or furnished to our stockholders on or about April 30, 2014.

NO DISSENTERS’ RIGHTS

Pursuant to the Section 78.297, 78.3793 and 78.390 of the Nevada Revised Statutes, none of the corporate actions described in this Information Statement will afford stockholders the opportunity to dissent from the actions described herein and to receive an agreed or judicially appraised value for their shares.

NOTICE OF ACTIONS TO BE TAKEN PURSUANT TO THE WRITTEN CONSENT OF STOCKHOLDERS HOLDING A MAJORITY OF THE OUTSTANDING SHARES OF COMMON STOCK OF THE COMPANY IN LIEU OF A SPECIAL MEETING OF THE STOCKHOLDERS, DATED April 21, 2014.

TO OUR STOCKHOLDERS:

NOTICE IS HEREBY GIVEN that, on April 21, 2014, AXIM International, Inc. a Nevada corporation (the “Company”) obtained the unanimous written consent of its board of directors (“ Board of Directors ”) and the written consent of stockholders (the “ Majority Stockholders ”) holding 29,887,300 shares of common stock of the Company or 91% of the voting power of the issued and outstanding shares of the Company’s common stock approving an amendment of the Company’s Articles of Incorporation (the “Articles of Incorporation”) to: (i) change the name of the Company to “Canchew Biotechnologies, Inc.;” (the “Name Change”) and (ii) increase in the number of authorized shares of capital stock of the Company from one hundred ninety five million (195,000,000) shares of common stock, par value $0.0001per share, to three hundred million (300,000,000) shares of capital stock, par value $0.0001 per share (the “Authorized Capital Increase ”).

OUTSTANDING SHARES AND VOTING RIGHTS

As of April 21, 2014 (the “Record Date”), the Company's authorized capitalization consisted of 195,000,000 shares of common stock, of which 33,000,000 shares were issued and outstanding.

Each share of common stock of the Company entitles its holder to one vote on each matter submitted to the Company’s stockholders. However, because the Majority Stockholders have consented to the foregoing actions by resolution dated April 21, 2014, in lieu of a special meeting in accordance with 78.320 of the Nevada Revised Statutes and because the Majority Stockholders have sufficient voting power to approve such actions through their ownership of common stock, no other stockholder vote will be solicited in connection with this Information Statement.

AMENDMENT TO THE COMPANY’S ARTICLES OF INCORPORATION

The Board of Directors and Majority Stockholders have approved an amendment to the Company’s Articles of Incorporation to affect the Name Change and Authorized Capital Increase.

We intend to file a Certificate of Amendment (“Amendment”) to our Articles of Incorporation with the Secretary of State for the State of Nevada effectuating the above action. Pursuant to Rule 14c-2 under the Exchange Act, the actions will not be effective, and the Amendment will not be filed, until twenty (20) days after the date this Information Statement is filed with the Securities and Exchange Commission (the “Commission”) and a copy thereof is mailed to each of the Company’s stockholders. It is presently contemplated that such filing will be made on or about May 20, 2014.

The Name Change

On April 21, 2014, our Board of Directors approved, subject to receiving the approval of the holder of a majority of our outstanding capital stock, an amendment of our Articles of Incorporation to change our name to (i) change the name of the Company to “Canchew Biotechnologies, Inc.” to more accurately reflect our anticipated future operations. The majority stockholders approved the Amendment pursuant to a written consent dated as of April 21, 2014. The proposed Amendment is attached hereto as

Appendix A.

The Amendment effecting the name change will become effective following the 20th day after the mailing of this Information Statement to our stockholders as of the Record Date.

The Amendment has been adopted based on the anticipated change of business of the Company. Going forward, the Company will become an

innovative biotechnology company working on t

he treatment of pain, spasticity, anxiety and other medical disorders with the application of cannabinoids based products as well as focusing on

research, development and production of pharmaceutical, nutriceutical and cosmetic products.

Therefore, our Board of Directors has determined that the change of our name to “Canchew Biotechnologies, Inc.” is in the best interest of our stockholders and will more accurately reflect, and allow us to engage in, our new business operations.

The Authorized Capital Increase

The purpose of the Authorized Capital Increase is to increase the number of shares of the Company’s capital stock available for issuance to investors who agree to provide the Company with the funding it requires to continue its operations, and/or to persons in connection with potential acquisition transactions, warrant or option exercises and other transactions under which the Company’s Board of Directors may determine is in the best interest of the Company and its stockholder to issue shares of common stock. As of the date of this Information Statement, the Company has not identified any investors, entered into any agreements relating to any potential investment in the Company; or entered into any agreements relating to an acquisition of another specified company, pursuant to which the Company will issue shares of its common stock.

The Authorized Capital Increase will not have any immediate effect on the rights of existing stockholders, but may have a dilutive effect on the Company’s existing stockholders if additional shares are issued.

We are not increasing our authorized common stock to construct or enable any anti-takeover defense or mechanism on behalf of the Company. While it is possible that management could use the additional shares to resist or frustrate a third-party transaction providing an above-market premium that is favored by a majority of the independent stockholders, the Company has no intent or plan to employ the additional unissued authorized shares as an anti-takeover device.

EFFECTIVE DATE OF THE AMENDMENT

Pursuant to Rule 14c-2 under the Exchange Act, the Authorized Capital Increase and the Name Change will not be effective, until at least twenty (20) days after the date on which this Information Statement is filed with the Commission and a copy hereof has been mailed to each of the Company’s stockholders. The Company anticipates that this Information Statement will be mailed to our stockholders as of the Record Date on or about April 30, 2014. Therefore, the Company anticipates that the Name Change and Authorized Capital Increase will be effective, and the Amendment to our Articles of Incorporation will be filed with the Secretary of State for the State of Nevada, on or about May 20, 2014.

The Company has asked brokers and other custodians, nominees and fiduciaries to forward this Information Statement to the beneficial owners of the Company’s common stock and will reimburse such persons for out-of-pocket expenses incurred in forwarding such material.

INFORMATION ON CONSENTING STOCKHOLDERS

Pursuant to the Company’s Bylaws and the NRS, a vote by the holders of at least a majority of the voting shares are required to effect the action described herein. As of the Record Date, the Company had 33,000,000 voting common shares issued and outstanding and entitled to vote, which for voting purposes are entitled to one vote per share. The consenting stockholders are the record and beneficial owners of a total of 29,887,300 shares of Common Stock which represent approximately 91% of the total number of voting shares. The consenting stockholders voted in favor of the actions described herein in a written consent, dated April 21, 2014. No consideration was paid for the consent. The consenting stockholder’s name, affiliations with the Company and beneficial holdings are as follows:

|

Voting Shareholders

|

Affiliation

|

Number of

Voting Shares

|

Percentage of

Voting Shares

|

|

|

|

|

|

|

Sanammad Foundation

|

Shareholder. Sanammad Foundation is controlled by Messrs. Anastassov, Van Damme and Changoer who are our directors and officers

|

14,943,650

|

45.5%

|

|

|

|

|

|

|

Medical Marijuana, Inc.

|

Shareholder

|

14,943,650

|

45.5%

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information regarding the beneficial ownership of our common stock as of the Record Date held by (a) each stockholder who we know to own beneficially 5% or more of our outstanding common stock; (b) all directors; (c) our executive officers; and (d) all executive officers and directors as a group.

Except as otherwise indicated, all persons listed below have (i) sole voting power and investment power with respect to their common stock, except to the extent that authority is shared by spouses under applicable law, and (ii) record and beneficial ownership with respect to their common stock. The percentage of beneficial ownership is based upon 33,000,000 shares of common stock issued and outstanding as of April 21, 2014.

(1)

|

Name and Address

|

Position

|

Amount and

Nature of

Beneficial

Ownership

|

Percentage

Owned

(1)

|

|

|

|

|

|

|

Dr. George E. Anastassov

|

Chief Executive Officer

President

Chief Financial Officer

Secretary

Director

|

(2)

|

(2)

|

|

Dr. Philip A. Van Damme

|

Chief Scientific Officer

Director

|

(2)

|

(2)

|

|

Lekhram Changoer:

|

Chief Technology Officer

Director

|

(2)

|

(2)

|

|

Sanammad Foundation

(3)

|

|

14,943,650

(3)

|

45.5%

|

|

Medical Marijuana, Inc

.(4)

|

|

14,943,650

(4)

|

45.5%

|

|

|

|

|

|

|

All officers and directors

as a group (3 persons)

|

|

14,943,650

|

45.5%

|

(1) Applicable percentage ownership is based on 33,000,000 shares of common stock outstanding as of April 21, 2014. Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission and generally includes voting or investment power with respect to securities. Shares of common stock that are currently exercisable or exercisable within 60 days of April 21, 2014, are deemed to be beneficially owned by the person holding such securities for the purpose of computing the percentage of ownership of such person, but are not treated as outstanding for the purpose of computing the percentage ownership of any other person.

(2) Messrs. Anastassov, Van Damme and Changoer are the founders and control persons of Sanammad Foundation which holds 14,943,650 shares of our common stock. In addition, Sanammad Foundation holds 500,000 shares of our Preferred Stock. Each share of our Preferred Stock has 100 votes per share on all matters voted on by the shareholders.

(3) Sanammad Foundation hold holds 14,943,650 shares of our common stock and 500,000 shares of our Preferred Stock.

(4) Medical Marijuana, Inc. hold holds 14,943,650 shares of our common stock and 500,000 shares of our Preferred Stock.

SEC Rule 13d-3 generally provides that beneficial owners of securities include any person who, directly or indirectly, has or shares voting power and/or investment power with respect to such securities, and any person who has the right to acquire beneficial ownership of such security within 60 days. Any securities not outstanding which are subject to such options, warrants or conversion privileges exercisable within 60 days are treated as outstanding for the purpose of computing the percentage of outstanding securities owned by that person. Such securities are not treated as outstanding for the purpose of computing the percentage of the class owned by any other person.

VOTING SECURITIES AND PRINCIPAL HOLDERS THEREOF

As of April 21, 2014, there were 33,000,000 shares of the Company’s common stock issued and outstanding and 1,000,000 share of the Company’s preferred stock outstanding. Each holder of common stock is entitled to one vote per share. Each holder of preferred stock is entitled to 100 votes per share.

The Majority Stockholders, as stockholders holding in the aggregate 29,887,300 shares of common stock of the Company or 91% of the voting power of our outstanding shares of common stock, have approved the Name Change and Authorized Capital Increase by written consent dated April 21, 2014.

VOTING PROCEDURES

Pursuant to the Nevada Revised Statutes and our Articles of Incorporation, the affirmative vote of the holders of a majority of our outstanding common stock is sufficient to amend our Articles of Incorporation, which vote was obtained by the written consent of the Majority Stockholder as described herein. As a result, the amendment to our Articles of Incorporation has been approved and no further votes will be needed.

INTEREST OF CERTAIN PERSONS IN MATTERS TO BE ACTED UPON

Our current officers and directors, Messrs. Anastassov, Van Damme and Changoer are also the founders and control persons of Sanammad Foundation. Sanammad Foundation is a 50/50 joint venture partner with Medical Marijuana, Inc. in Canchew Bio-technologies, LLC, a Nevada limited liability company. Canchew Bio-technologies, LLC is an early-stage biotechnology company which has a proprietary nutriceutical product called “CanChew Gum” which is based upon industrial hemp oil which is readily available in all 50 states and internationally.

NO DISSENTER'S RIGHT OF APPRAISAL

Under Nevada law, stockholders are not entitled to dissenter's rights of appraisal with respect to the Name Change or Authorized Capital Increase.

CHANGE OF CONTROL AND CHANGES TO OUR BUSINESS

On March 17, 2014, our former majority stockholder and former director the Company, entered into a stock purchase agreement with Sanammad Foundation and Medical Marijuana, Inc. our current majority stockholders. Pursuant to the agreements, both Sanammad Foundation and Medical Marijuana, Inc. acquired 14,943,650 shares of common stock each representing approximately 91% of our voting common stock. In addition, pursuant to the agreements, both Sanammad Foundation and Medical Marijuana, Inc. acquired 500,000 shares of preferred stock each. Each share of preferred stock has 100 votes.

The signing of the stock purchase agreements and the transactions contemplated thereby resulted in a change of control of the Company.

Going forward, the Company will become an

innovative biotechnology company working on t

he treatment of pain, spasticity, anxiety and other medical disorders with the application of cannabinoids based products as well as focusing on

research, development and production of pharmaceutical, nutriceutical and cosmetic products.

WHERE YOU CAN OBTAIN ADDITIONAL INFORMATION

The Company is subject to the informational requirements of the Exchange Act, and in accordance therewith files reports, proxy statements and other information including annual and quarterly reports on Form 10-K and 10-Q with the Commission. Reports and other information filed by the Company can be inspected and copied at the public reference facilities maintained at the Commission at 100 F Street NW, Washington, D.C. 20549. Copies of such material can be obtained upon written request addressed to the Commission, Public Reference Section, 100 F Street NW, Washington D.C. 20549, at prescribed rates. The Commission maintains a website on the Internet (http://www.sec.gov) that contains the filings of issuers that file electronically with the Commission through the EDGAR system. Copies of such filings may also be obtained by writing to the Company at AXIM International, Inc., 18 East 50

th

Street, 5

th

Floor, New York, NY 10022.

STOCKHOLDERS SHARING AN ADDRESS

Unless we have received contrary instructions from a stockholder, we are delivering only one Information Statement to multiple stockholders sharing an address. We will, upon request, promptly deliver a separate copy of this Information Statement to a stockholder who shares an address with another stockholder. A stockholder who wishes to receive a separate copy of the Information Statement may make such a request in writing to the Company at AXIM International, Inc., 18 East 50

th

Street, 5

th

Floor, New York, NY 10022.

|

|

On behalf of the Board of Directors,

|

|

|

|

|

|

/s/

Dr. George E. Anastassov

|

|

|

By: Dr. George E. Anastassov

|

|

|

Its: Chief Executive Officer

|

|

|

April 30, 2014

|

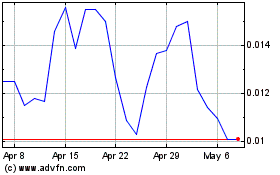

Axim Biotechnologies (QB) (USOTC:AXIM)

Historical Stock Chart

From Oct 2024 to Nov 2024

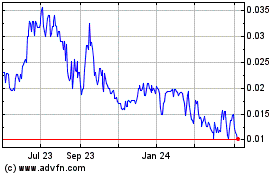

Axim Biotechnologies (QB) (USOTC:AXIM)

Historical Stock Chart

From Nov 2023 to Nov 2024