AMERICAN BUSINESS BANK (Bank) (OTCBB: AMBZ) today reported net

income of $8,701,000 for the year ended December 31, 2010, a 20%

increase over the $7,225,000 earned in 2009. Earnings per share

(EPS) for 2010 increased to $2.19 versus $1.82 in 2009. Shares

outstanding at the end of the year totaled 3,979,156.

“The Bank had an excellent year in terms of growth and

profitability. Not only were we able to post outstanding earnings,

but we were also able to add to the Bank’s reserves,” said Wes

Schaefer, Vice Chairman of the Bank.

“As we have said throughout this year, the Bank has been and

continues to be built one customer at a time,” said Don Johnson,

President and CEO of the Bank. “We have stayed the course and

worked through a very difficult economy, not stepping out by

pursuing the latest fad or taking risks beyond those that are part

of our core business: banking middle market companies.”

Robert Schack, Chairman, added, “2010 was a tumultuous year,

with the passage of the largest banking bill since the Depression,

the closure of a significant number of banks and many headwinds for

the economy. Despite this, our bank was able to post record

earnings and add new middle market clients to our customer base,

increasing assets nearly twelve percent from the previous

year.”

Assets and Liabilities

Total assets increased over 11% or $107 million to $1,007

million at December 31, 2010 as compared to $900 million at

December 31, 2009. Loans increased 11% or by $41 million from $360

million to $401 million, while investments increased $70 million.

Funding the asset growth was a 12% or $93 million increase in core

deposits.

Interest Income

During 2010, Net Interest Income increased $3,601,000 or 13%

over the previous year.

Non-interest Income

Non-interest Income for the year rose 15% to $3,462,000 in 2010

from $2,989,000 in 2009.

Credit Quality

Asset quality at year-end remains excellent, with nominal past

dues and no OREO loans. At year-end, the allowance for loan losses

stood at $7,050,000 or 1.73% of loans.

AMERICAN BUSINESS BANK, headquartered in downtown Los Angeles,

offers a wide range of financial services to the business

marketplace. Clients include wholesalers, manufacturers, service

businesses, professionals and non-profits. The Bank has opened four

Loan Production Offices in strategic areas including our Orange

County Office in Irvine, our South Bay Office in Torrance, our San

Fernando Valley Office in the Warner Center and our Inland Empire

Office in Ontario.

AMERICAN BUSINESS BANK

BALANCE SHEET

(Unaudited-000’s omitted)

December

2010

2009

Assets

Investment Securities $ 562,022 $ 491,483 Federal

Funds Sold - - Loans and Leases (net) 401,554 360,028

Cash, Checks in process of collection, Due

From Banks

9,750 13,599 Premises, Equipment and Other Assets 34,247

35,795

Total Assets

$

1,007,573

$

900,905

Liabilities and Shareholders’

Equity

Demand Deposits 346,992 288,341 Money Market and Now Deposits

446,557 404,909 Savings and Time Deposits 85,359

91,935

Total Deposits

878,908 785,185 Federal Funds Purchased -0- 5,000 FHLB

Advances/FRB Borrowings 56,400 47,335 Other Liabilities 6,216 8,178

Shareholders’ Equity 66,049 55,207

Total Liabilities and Shareholders’

Equity

$

1,007,573

$

900,905

AMERICAN BUSINESS BANK

INCOME STATEMENT

(Unaudited-000’s omitted)

Twelve months ended December

2010

2009

Interest Income

Loans and Leases $ 21,319 $ 19,788 Investment Securities 14,559

13,646 Fed Funds Sold 21 38 Total Interest

Income 35,899 33,472

Interest Expense

Money Market and NOW Accounts

3,085 3,387 Savings and Time Deposits 1,004 1,360

Repurchase Agreements/Other Borrowings

490 1,006 Total Interest Expense 4,579 5,753

Net Interest Income 31,320 27,719 Provision for Loan Losses

(1,839 ) (1,268 )

Net Interest Income after Provision for

Loan Losses

29,481 26,451

Other Income

3,462 2,989

Other Expense

21,964 20,750

Operating Income

10,979 8,690

Income Taxes

(2,278 ) (1,465 )

Net Earnings

$

8,701

$

7,225

Selected Preliminary Ratios:

Earnings per share-basic $ 2.19 $ 1.82 Tier 1 Capital Ratio 6.93 %

6.84 %

Net Interest Margin (Prior to tax

effects)

3.22 % 3.59 % Return on Beginning Equity 14.25 % 13.87 % Return on

Average Assets 0.82 % 0.87 % Efficiency Ratio 59.0 % 70.8 %

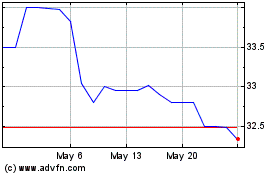

American Business Bank (QX) (USOTC:AMBZ)

Historical Stock Chart

From Dec 2024 to Jan 2025

American Business Bank (QX) (USOTC:AMBZ)

Historical Stock Chart

From Jan 2024 to Jan 2025