Omni-Lite Industries reports results for the first quarter of 2012

May 29 2012 - 12:25PM

PR Newswire (Canada)

OMNI-LITE INDUSTRIES CANADA INC. OML-TSX VENTURE CERRITOS, CA, May

31, 2012 /CNW/ - For the three months ended March 31, 2012

Omni-Lite Industries Canada Inc. is pleased to report revenue of

$1,367,644 US ($1,363,582 CAD) and Cash Flow from Operations((1))

of $323,527 US ($322,566 CDN). Net income was $63,543 US

($63,354 CDN). Earnings per share in Q1 2012 were $0.01 US

($0.01 CDN), based on the weighted average number of shares

outstanding of 13,012,134. Omni-Lite Industries is also pleased to

announce that it has received several new orders that include

several divisions of the Company. The total value of these new

orders is approximately $342,000. Of these new orders,

approximately 52% per cent are in the specialty automotive

division, 28% are in the sports and recreation division and 20% are

in the aerospace division. "The Company continues to invest heavily

in equipment and technology to meet current and anticipated future

demands from our U.S. Military customers," stated Allen W. Maxin,

President. "The Company invested approximately $450,000 US in

a new highly modified cold forging system that will be delivered in

July of 2012. This system incorporates the latest version of a

sophisticated forging adaptation called the OD PLUS and is the

first machine to be modified to this specification, which may be

essential to current and future U.S. Military orders. Given the

success of this modification in Japan, the Company has returned

three additional systems for similar modifications. These machines

are expected to be returned to Omni-Lite in September 2012 and will

most likely be utilized in the production of military

products. It will cost approximately $250,000 US to modify

these three machines. To protect the intellectual property

developed by the Company, the OD PLUS system is the subject of a

pending patent submission. The Company has already negotiated the

worldwide rights on this technology from the Japanese

manufacturer." Through the private placement financing completed in

February 2011 and cash flow from operations, the Company's balance

sheet remains very strong, allowing the continued development of

critical technology and the purchase of new highly modified

equipment. Without the financing of 2011, the Company may not have

been in a position to aggressively pursue these long term programs.

At March 31, 2012, the Company had cash reserves of $4,723,081.

SUMMARY OF THREE MONTH FINANCIAL HIGHLIGHTS (US $)

_____________________________________________________________________

|Basic Weighted Average| | | | |Shares Issued And | For the period

| For the period | % | |Outstanding: | ended March | endedMarch |

Increase | |13,012,124 | 31, 2012 | 31, 2011 | (Decrease) |

|______________________|________________|________________|____________|

|Revenue | $1,367,644 | $1,482,314 | (8%) |

|______________________|________________|________________|____________|

|Cash flow from | | | | |operations(1) | 323,527 | 637,813 | (49%)

|

|______________________|________________|________________|____________|

|Net Income | 63,543 | 307,899 | (79%) |

|______________________|________________|________________|____________|

|EPS (US) | 0.01 | 0.03 | (66%) |

|______________________|________________|________________|____________|

|EPS (CAD) | 0.01 | 0.03 | (66%) |

|______________________|________________|________________|____________|

(Note: at 03/31/12, $1US = $0.99703 CAD; 03/31/11, $1US = $0.9722

CAD) Quarterly Information The following table summarizes the

Company's financial performance over the last eight quarters. ALL

FIGURES IN US DOLLARS UNLESS NOTED

__________________________________________________________________________________________________________

| | Mar | Dec | Sep | Jun | Mar | Dec | Sep | Jun | | | 31/2012 |

31/2011 | 30/2011 | 30/2011 | 31/2011 | 31/2010 | 30/2010 | 30/2010

|

|__________|___________|___________|___________|___________|___________|___________|___________|___________|

|Revenue | 1,367,644 | 1,098,466 | 1,793,959 | 2,139,344 |

1,482,314 | 1,126,037 | 1,720,995 | 2,439,705 |

|__________|___________|___________|___________|___________|___________|___________|___________|___________|

|Cash Flow | | | | | | | | | |from | 323,527 | 110,268 | 414,176 |

763,456 | 637,813 | 523,347 | 881,838 | 1,005,306 | |Operations| |

| | | | | | | |(1) | | | | | | | | |

|__________|___________|___________|___________|___________|___________|___________|___________|___________|

|Net Income| 63,543 | 996,036 | 143,761 | 510,960 | 307,899 |

231,268 | 427,806 | 687,889 |

|__________|___________|___________|___________|___________|___________|___________|___________|___________|

|EPS - | .005 | .076 | .011 | .039 | .026 | .017 | .048 | .066 |

|basic (US)| | | | | | | | |

|__________|___________|___________|___________|___________|___________|___________|___________|___________|

|EPS - | | | | | | | | | |basic | .005 | .081 | .011 | .038 | .025

| .017 | .048 | .067 | |(CAD) | | | | | | | | |

|__________|___________|___________|___________|___________|___________|___________|___________|___________|

|EPS - | | | | | | | | | |diluted | .005 | .074 | .011 | .038 |

.026 | .016 | .047 | .066 | |(US) | | | | | | | | |

|__________|___________|___________|___________|___________|___________|___________|___________|___________|

|EPS - | | | | | | | | | |diluted | .005 | .079 | .011 | .037 |

.025 | .016 | .047 | .067 | |(CAD) | | | | | | | | |

|__________|___________|___________|___________|___________|___________|___________|___________|___________|

((1) )Cash flow from operations is a non-GAAP term requested

by the oil and gas investment community that represents net

earnings adjusted for non-cash items including depreciation,

depletion and amortization, future income taxes, asset write-downs

and gains (losses) on sale of assets, if any. Please see

www.sedar.com or contact the Company for complete results.

Omni-Lite is a rapidly growing high technology company that

develops and manufactures precision components utilized by several

Fortune 500 Companies including Boeing, Airbus, Alcoa, Ford,

Caterpillar, Borg Warner, Chrysler, the U.S. Military, Nike, and

adidas. Except for historical information contained herein this

document contains forward-looking statements. These statements

contain known and unknown risks and uncertainties that may cause

the company's actual results or outcomes to be materially different

from those anticipated and discussed herein. THE TSX-VENTURE

EXCHANGE NEITHER APPROVES NOR DISAPPROVES OF THE INFORMATION

CONTAINED HEREIN. Omni-Lite Industries Canada Inc. CONTACT:

Mr. Tim Wang, CFOTel. No. (562) 404-8510 or (800) 577-6664 (Canada

and USA)Fax. No. (562) 926-6913, email: info@omni-lite.comWebsite:

www.omni-lite.com

Copyright

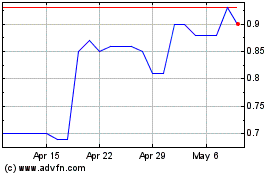

Omni Lite Industries Can... (TSXV:OML)

Historical Stock Chart

From Jun 2024 to Jul 2024

Omni Lite Industries Can... (TSXV:OML)

Historical Stock Chart

From Jul 2023 to Jul 2024