OMNI-LITE INDUSTRIES REPORTS FIRST QUARTER 2011 RESULTS

July 04 2011 - 2:13PM

PR Newswire (Canada)

CERRITOS, CA, July 4, 2011 /CNW/ -- OML-TSX VENTURE CERRITOS, CA,

July 4, 2011 /CNW/ - For the period ended March 31, 2011, Omni-Lite

Industries Canada Inc. is pleased to announce that revenue was

$1,482,314 US. Cash flow was $637,813 US. Net income was $307,899.

Earnings per share were $0.03 US per share. "This is a very

productive time at Omni-Lite with key brake, battery, and military

programs all going ahead simultaneously. These future revenue

streams should have a very positive effect on the growth of the

Company," stated David F. Grant, CEO. "As an example, the

revenue in the second quarter was $2,131,000 US, a 44% increase

from Q1 2011." Highlighting the quarter were the following events:

1) For the first time in the Company's recent history, gross

margins were affected by large orders of a product that provides

one of the lowest margins in the Company's inventory of products.

Sales of these products approached 150 percent of typical first

quarter sales and drove the contribution of that division from 11

percent of revenue in 2010 to 22 percent of revenue in 2011. These

sales portend a strong year in this division overall. While these

sales have continued at record pace in the second quarter of 2011,

the Company's financial model indicates that margins should return

to historical levels in the near future as the product mix changes

in subsequent quarters. 2) The transition to International

Financial Reporting Standards (IFRS). While Omni-Lite was not

severely affected by this change, the planning and preparation for

this event took significant Company resources. In addition,

Omni-Lite has had its Q1 balance sheet reviewed to IFRS and as a

result does not foresee additional resources devoted to the IFRS

transition. Because of the balance sheet audit, Omni-Lite has

delayed releasing the first quarter results by approximately 30

days, a delay which was approved by the TSX Venture Exchange to

assist all issuers in the transition to IFRS. 3) The earnings per

share numbers were affected by the financing completed in February

2011. The weighted average number of shares increased by about 11

percent in Q1 2011 over Q1 2010. 4) The Company's revenue was

partially affected by the reduction in orders for one military

program pending the replacement product currently in the final

approval stage. The Company expects to be in production with the

new component in third quarter of 2011. Financial Highlights

Revenue: For the period ended March 31, 2011, Omni-Lite reported

revenue of $1,482,314 ($1,441,150 CDN), a decrease of 19 percent

from the prior period in 2010. The Automotive division represented

the largest portion of sales with 27 percent of revenue. Sales in

this division were higher by 47 percent when compared to the period

ended March 31, 2010. The Military division contributed 26

percent of revenue, a 65 percent decrease from 2010. The

Aerospace division contributed 24 percent of revenue, an increase

of 8 percent from the same period in 2010. The Sports and

Recreation division contributed 22 percent of revenue, a 150

percent increase from 2010. The Commercial divisions provided

1 percent of the revenue. Sales by division and by geographic

location are summarized below: Division/ Sport & Segments

Military Aerospace Recreation Automotive Commercial Q1 2011 26% 24%

22% 27% 1% Q1 2010 59% 18% 7% 15% 1% Net Income: Net income was

$307,899 ($299,349 CDN) versus $484,087 in 2010, a decrease of 36

percent. A decrease in military revenue was largely

responsible for the reduction in revenue and income in the first

quarter of 2011 as compared with 2010. Earnings per share: Basic

earnings per share were $0.03 ($0.03 CDN) compared to $0.05 ($0.05

CDN) in 2010 based on the weighted average number of shares

outstanding of 11,769,089. The actual number of shares outstanding

was 13,419,166. The weighted average number of shares

increased approximately 11 percent over the first quarter of the

prior year. Under the Normal Course Issuer Bid, 34,700 shares

were repurchased for cancellation. SUMMARY OF FINANCIAL HIGHLIGHTS

(US $) All figures in US dollars unless noted.

____________________________________________________________________

|Basic Weighted Average |For the period|For the period | % |

|Shares Issued And | ended | ended |Increase | |Outstanding:

11,769,089 |March 31, 2011|March 31, 2010 |(Decrease)|

|__________________________|______________|_______________|__________|

|Revenue | $1,482,314 | $1,834,076 | (19%) |

|__________________________|______________|_______________|__________|

|Cash flow from operations(| | | | |(2)) | 637,813 | 768,309 |

(17%) |

|__________________________|______________|_______________|__________|

|Net Income | 307,899 | 484,087 | (38%) |

|__________________________|______________|_______________|__________|

|EPS (US) | 0.03 | 0.05 | (44%) |

|__________________________|______________|_______________|__________|

|EPS (CDN) | 0.03 | 0.05 | (47%) |

|__________________________|______________|_______________|__________|

(Note: at 3/31/11, $1US = $0.9722 CDN; 3/31/10, $1US = $1.0192 CDN)

((2) ) Cash flow from operations is a non-GAAP term requested by

the oil and gas investment community that represents net earnings

adjusted for non-cash items including depreciation, depletion and

amortization, future income taxes, asset write-downs and gains

(losses) on sale of assets, if any. Quarterly Information The

following table summarizes the Company's financial performance over

the last eight quarters. All figures in US dollars unless noted.

ALL FIGURES IN US DOLLARS UNLESS NOTED

__________________________________________________________________________________________

| | Mar | Dec | Sep | Jun | Mar | Dec | Sept | Jun | | | 31/2011 |

31/2010 | 30/2010 | 30/2010 | 31/2010 | 31/2009 | 30/2009 | 30/2009

|

|__________|_________|_________|_________|_________|_________|_________|_________|_________|

|Revenue

|1,482,314|1,126,037|1,720,995|2,439,705|1,834,076|1,175,516|1,084,771|1,151,296|

|__________|_________|_________|_________|_________|_________|_________|_________|_________|

|Cash Flow | | | | | | | | | |from | | | | | | | | | |Operations| |

| | | | | | | |((2)) | 637,813 | 523,347 | 881,838 |1,005,306|

768,309 | 429,416 | 314,077 | 395,702 |

|__________|_________|_________|_________|_________|_________|_________|_________|_________|

|Net Income| 307,899 | 220,290 | 427,806 | 687,889 | 484,087 |

83,011 | 95,078 | 170,322 |

|__________|_________|_________|_________|_________|_________|_________|_________|_________|

|EPS - | .026 | .017 | .048 | .066 | .045 | .008 | .009 | .016 |

|basic (US)| | | | | | | | |

|__________|_________|_________|_________|_________|_________|_________|_________|_________|

|EPS - | .025 | .017 | .048 | .067 | .045 | .008 | .009 | .016 |

|basic | | | | | | | | | |(CDN) | | | | | | | | |

|__________|_________|_________|_________|_________|_________|_________|_________|_________|

|EPS - | .026 | .016 | .047 | .066 | .045 | .008 | .009 | .016 |

|diluted | | | | | | | | | |(US) | | | | | | | | |

|__________|_________|_________|_________|_________|_________|_________|_________|_________|

|EPS - | .025 | .016 | .047 | .067 | .045 | .008 | .009 | .016 |

|diluted | | | | | | | | | |(CDN) | | | | | | | | |

|__________|_________|_________|_________|_________|_________|_________|_________|_________|

((2) ) Cash flow from operations is a non-GAAP term requested by

the oil and gas investment community that represents net earnings

adjusted for non-cash items including depreciation, depletion and

amortization, future income taxes, asset write-downs and gains

(losses) on sale of assets, if any. For complete results, please

visit www.sedar.com or request a copy from the Company. Omni-Lite

is a rapidly growing high technology company that develops and

manufactures precision components utilized by several Fortune 500

companies including Boeing, Airbus, Alcoa, Ford, Caterpillar, Borg

Warner, Chrysler, the U.S. Military, Nike, and adidas. Except for

historical information contained herein this document contains

forward-looking statements. These statements contain known and

unknown risks and uncertainties that may cause the Company's actual

results or outcomes to be materially different from those

anticipated and discussed herein. THE TSX-VENTURE EXCHANGE NEITHER

APPROVES NOR DISAPPROVES OF THE INFORMATION CONTAINED HEREIN.

To view this news release in HTML formatting, please use the

following URL:

http://www.newswire.ca/en/releases/archive/July2011/04/c3078.html p

align="justify" Mr. Tim Wang, CFObr/ Tel. No. (562) 404-8510

or (800) 577-6664 (Canada and USA)br/ Fax. No. (562) 926-6913,

email: a cr="true"

href="mailto:info@omni-lite.com"info@omni-lite.com/a /p p

align="justify" Website: a

href="http://www.omni-lite.com"www.omni-lite.com/a /p

Copyright

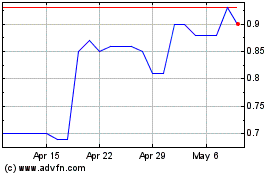

Omni Lite Industries Can... (TSXV:OML)

Historical Stock Chart

From Jun 2024 to Jul 2024

Omni Lite Industries Can... (TSXV:OML)

Historical Stock Chart

From Jul 2023 to Jul 2024