Lomiko Metals Inc. (TSX-V: LMR) (“Lomiko” or the

“Company”) is pleased to announce grants for management, IR and

board compensation. As part of the annual short and long-term

incentive program as determined by the Board, Lomiko is announcing

the grant of stock options to management and an investor relations

advisor, Restricted Share Units (“RSUs”) to management and RSUs and

Deferred Share Units (“DSUs”) to the Board in accordance with the

Company’s approved 2024 Omnibus Equity Incentive Plan.

On the recommendation of the Compensation, Corporate Governance,

and Nominating Committee (“CCGNC”), the Board has approved the

grant of an aggregate of 644,446 RSUs and 844,403 DSUs to the

Company's directors. Management including the Executive Chair has

been granted an aggregate of 370,370 RSUs and 375,000 stock options

have been issued. The Company is pleased to announce that it has

retained A. Paul Gill to provide investor relations services in

accordance with TSX Venture Exchange policies. The Agreement is for

a six month term, subject to renewability. Mr. Gill has been

granted an option to purchase up to 110,000 common shares,

exerciseable for three years at $0.135, subject to vesting

provisions and in accordance with the Company’s Omnibus Equity

Share Plan.

Mr. Gill reports that he currently holds an aggregate of 596,000

common shares and 325,000 warrants/options of Lomiko Metals Inc.,

directly and indirectly. The above mentioned transaction is subject

to the approval of the regulatory authorities. This is an

arm’s-length transaction.

The 2024 Omnibus Equity Incentive Plan’s objective is to create

an incentive compensation program that is aligned with the

Company’s long-term objectives. Stock options, DSUs, RSUs and PSUs

are granted in accordance with Policy 4.4 – Security Based

Compensation of the TSX Venture Exchange (the “Exchange”), the

terms and conditions of the 2024 Omnibus Equity Incentive Plan and

the terms of the award agreement evidencing such equity

compensation security.

RSUs: Each vested RSU can be redeemed for one fully paid and

non-assessable common share of Lomiko issued from treasury. RSUs

are vested by January 24, 2026. The number of RSUs granted was

calculated based on the compensation to be paid to the director, as

recommended by CCGNC and approved by the Board, and was calculated

using a price of $0.135 per common share.

DSUs: Each vested DSU can be redeemed for one fully paid and

non-assessable common share of Lomiko issued from treasury. For

directors, the DSUs granted vest January 24, 2026, and are settled

on a director’s retirement from the board. The number of DSUs

granted was calculated based on the compensation to be paid to the

director, as recommended by CCGNC and approved by the Board, and

was calculated using a price of $0.135 per common share.

Stock options: Stock options for management have a 5 year term

from the grant date. The vesting Schedule is as follows: equal

instalments of one-third (1/3) on grant date, in year 1, the first

anniversary of the grant date and in year 3, the third anniversary

of the grant date. The exercise is $0.135 per option.

About Lomiko Metals Inc.

The Company holds mineral interests in its La Loutre graphite

development in southern Quebec. The La Loutre project site is

within the Kitigan Zibi Anishinabeg (KZA) First Nation’s territory.

The KZA First Nation is part of the Algonquin Nation, and the KZA

traditional territory is situated within the Outaouais and

Laurentides regions. Located 180 kilometers northwest of Montreal,

the property consists of one large, continuous block with 76

mineral claims totalling 4,528 hectares (45.3 km2).

The La Loutre Property is underlain by rocks from the Grenville

Province of the Precambrian Canadian Shield. The Grenville was

formed under conditions that were very favorable for the

development of coarse-grained, flake-type graphite mineralization

from organic-rich material during high-temperature

metamorphism.

Lomiko published an updated Mineral Resource Estimate (“MRE”) in

a NI 43-101 Technical Report and Mineral Resource Estimate Update

for the La Loutre Project, Quebec, Canada, prepared by InnovExplo

on May 11th, 2023, which estimated 64.7 million tonnes of Indicated

Mineral Resources averaging 4.59% Cg per tonne for 3.0 million

tonnes of graphite, a tonnage increase of 184%. Indicated Mineral

Resources increased by 41.5 million tonnes as a result of the 2022

drilling campaign, from 17.5 million tonnes in 2021 MRE with

additional Mineral resources reported down-dip and within marble

units resulted in the addition of 17.5 million tonnes of Inferred

Mineral Resources averaging 3.51% Cg per tonne for 0.65 million

tonnes of contained graphite; and the additional 13,107 metres of

infill drilling in 79 holes completed in 2022 combined with the

refinement of the deposit and structural models contributed to the

addition of most of the Inferred Mineral Resources to the Indicated

Mineral Resource category, relative to the 2021 Mineral Resource

Estimate. The MRE assumes a US$1,098.07 per tonne graphite price

and a cut-off grade of 1.50% Cg (graphitic carbon).

In addition to La Loutre, Lomiko has earned-in its 49% stake in

the Bourier Project from Critical Elements Lithium Corporation as

per the option agreement announced on April 27th, 2021. The Bourier

project site is located near Nemaska Lithium and Critical Elements

south-east of the Eeyou Istchee James Bay territory in Quebec,

which consists of 203 claims for a total ground position of

10,252.20 hectares (102.52 km2), in Canada’s lithium triangle near

the James Bay region of Quebec that has historically housed lithium

deposits and mineralization trends.

The company also holds interest in seven early stage projects in

southern Quebec including Ruisseau, Tremblant, Meloche, Boyd,

Dieppe, North Low and Carmin covering 328 claims in total on 7

early-stage projects covering 18,622 hectares in the Laurentian

region of Quebec and within KZA territory.

On behalf of the Board, Gordana Slepcev CEO & President and

Director, Lomiko Metals Inc.

For more information on Lomiko Metals, review the website at

www.lomiko.com.

Contact us at 1-833-4-LOMIKO or e-mail: info@lomiko.com

Cautionary Note Regarding Forward-Looking Information

This news release contains “forward-looking information” within

the meaning of the applicable Canadian securities legislation that

is based on expectations, estimates, projections and

interpretations as at the date of this news release. The

information in this news release about the Company; and any other

information herein that is not a historical fact may be

“forward-looking information” (“FLI”). All statements, other than

statements of historical fact, are FLI and can be identified by the

use of statements that include words such as “anticipates”,

“plans”, “continues”, “estimates”, “expects”, “may”, “will”,

“projects”, “predicts”, “proposes”, “potential”, “target”,

“implement”, “scheduled”, “intends”, “could”, “might”, “should”,

“believe” and similar words or expressions. FLI in this new release

includes, but is not limited to: expected timing of completion of

the closing conditions in connection with the acquisition and

closing of the acquisition, expected costs of exploration and

timing to achieve certain milestones, timing for completion of

exploration programs; the Company’s ability to successfully fund,

or remain fully funded for the implementation of its business

strategy and for exploration of any of its projects (including from

the capital markets). FLI involves known and unknown risks,

assumptions and other factors that may cause actual results or

performance to differ materially. This FLI reflects the Company’s

current views about future events, and while considered reasonable

by the Company at this time, are inherently subject to significant

uncertainties and contingencies. Accordingly, there can be no

certainty that they will accurately reflect actual results.

Assumptions upon which such FLI is based include, without

limitation: the ability of the Company to meet the closing

conditions of the acquisition, including regulatory approval, and

complete the transaction within the anticipated timing; ability to

implement its business strategy and to fund, explore, advance and

develop each of its projects, including results therefrom and

timing thereof; uncertainties related to receiving and maintaining

exploration, environmental and other permits or approvals in

Quebec; impact of increasing competition in the mineral exploration

business, including the Company’s competitive position in the

industry; general economic conditions, including in relation to

currency controls and interest rate fluctuations.

The FLI contained in this news release are expressly qualified

in their entirety by this cautionary statement, the

“Forward-Looking Statements” section contained in the Company’s

most recent management’s discussion and analysis (MD&A), which

is available on SEDAR+ at www.sedarplus.ca, and on the investor

presentation on its website. All FLI in this news release are made

as of the date of this news release. There can be no assurance that

such statements will prove to be accurate, as actual results and

future events could differ materially from those anticipated in

such statements. Accordingly, readers should not place undue

reliance on forward-looking information. The Company does not

undertake to update or revise any such forward-looking statements

or forward-looking information contained herein to reflect new

events or circumstances, except as may be required by applicable

securities laws.

Neither the TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in the policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this news release. No stock exchange, securities

commission or other regulatory authority has approved or

disapproved the information contained herein.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250124322502/en/

Contact us at 1-833-4-LOMIKO or e-mail: info@lomiko.com

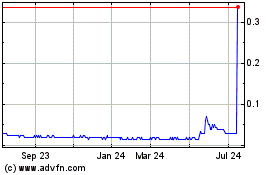

Lomiko Metals (TSXV:LMR)

Historical Stock Chart

From Dec 2024 to Jan 2025

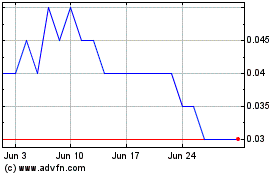

Lomiko Metals (TSXV:LMR)

Historical Stock Chart

From Jan 2024 to Jan 2025