Digihost Provides January 2025 Production Update

February 03 2025 - 7:31AM

Digihost Technology Inc. (“

Digihost” or the

“

Company”) (Nasdaq / TSXV: DGHI), an innovative

energy infrastructure company that develops cutting-edge data

centers, is pleased to provide unaudited comparative Bitcoin

(“

BTC”) production results for the month ended

January 31, 2025, combined with an operations update. All monetary

references are expressed in USD unless otherwise indicated.

Monthly

Production Highlights for

January 2025

- On a year over year basis, the

Company’s cash, BTC and cash deposits of approximately $12.3

million as of January 31, 2025, as compared to $3.7 million on

January 31, 2024 (based on a BTC price of $102,405 as of January

31, 2025 and $42,758 as of January 31, 2024, per CoinMarketCap),

represents a 232% increase in its total holdings position

balance.

- The Company held cash, BTC and cash

deposits of approximately $12.3 million as of January 31, 2025, as

compared to $10.0 million on December 31, 2024 (based on a BTC

price of $102,405 as of January 31, 2025 and $93,429 as of December

31, 2024, per CoinMarketCap), representing a 23% increase in its

total holdings position balance.

- Miners at the Company’s facilities

produced approximately 30 BTC during the month between self-mining

and hosting agreements, representing a decrease in 17% versus

December 2024. This decrease is due to Digihost’s decision to

actively participate in load curtailment for approximately seven

days due to the high energy costs associated with the weather

conditions at the Company’s locations in the month of January. By

contributing and performing in these load reduction programs, the

Company has seen a reduction in its BTC mining costs, in addition

to being able to provide crucial grid reliability to surrounding

electric consumers.

- The Company invested approximately

$1.2 million in January on capital expenditures, mining

infrastructure support equipment, and deposits. This continued

significant investment underscores Digihost’s commitment to

long-term growth while maintaining a disciplined approach to

capital allocation, prioritizing self-funding to minimize equity

dilution for shareholders when possible, and still retaining a

clean balance sheet with zero debt to bolster the Company’s

flexible capital deployment strategies.

Operations Update

Digihost currently operates with approximately

100MW of available power across its three sites and is working

towards expansion to 200MW and beyond. The Company plans to fuel

this growth using its existing asset portfolio, combined with

strategic inorganic expansion through targeted power

acquisitions.

As part of its long-term strategy, Digihost

remains committed to its three core business pillars:

- Acquiring Power Assets – The

Company continues to expand its power infrastructure, ensuring a

reliable and scalable energy foundation for its operations.

- Providing a Competitive Platform

for Colocation and Self-Mining – By leveraging its infrastructure,

Digihost offers cost-effective power solutions for digital asset

miners while optimizing internal mining capacity.

- Maximizing the Highest and Best Use

of Energy – With a strong focus on high-margin High-Performance

Computing (“HPC”) applications, the Company is

positioning itself at the forefront of next-generation computing

and data processing.

Tier III HPC Data Center

Update

The Company is also pleased to provide an update

on its Tier III data center conversion in Columbiana, AL. Digihost

is currently working with multiple contractors to finalize the

existing site plans and is actively collaborating with local

municipalities to ensure a smooth permit approval process. The

Company remains on track with its development timeline, with an

anticipated ~$175m Phase I (22MW), expected to be operational in

2026, and an anticipated ~$265m Phase II (55MW) to be completed in

early 2027.

Collaboration with Nano Nuclear

Energy

Digihost continues to advance its commitment to

sustainability and innovation in energy solutions. In December

2024, the Company formalized a strategic Memorandum of

Understanding (“MOU”) with NANO Nuclear Energy to

integrate advanced nuclear energy technologies at its 60MW New York

power facility. Digihost is committed to achieving net-zero carbon

emissions, and its partnership with NANO Nuclear Energy is a key

step toward this goal. Through this collaboration, Digihost aims to

integrate advanced nuclear energy solutions across its operations,

securing a long-term, zero-emission power supply. Beyond the

initial MOU, both companies are actively exploring additional

opportunities to expand nuclear energy integration, reinforcing

Digihost’s desire to be a leader in sustainable digital asset

mining.

About

Digihost

Digihost is an innovative energy infrastructure

company that develops cutting-edge data centers to drive the

expansion of sustainable energy assets.

For further information, please contact:

Michel Amar, Chief Executive OfficerDigihost

Technology Inc.www.digihostpower.comDigihost Investor RelationsT:

888-474-9222Email: IR@digihostpower.com

Cautionary

StatementTrading in the securities of the Company

should be considered highly speculative. No stock exchange,

securities commission or other regulatory authority has approved or

disapproved the information contained herein. Neither the TSX

Venture Exchange nor its Regulation Services Provider (as that term

is defined in the policies of the TSX Venture Exchange) accepts

responsibility for the adequacy or accuracy of this release.

Forward-Looking

Statements

Except for the statements of historical fact,

this news release contains “forward-looking information” and

“forward-looking statements” (collectively, “forward-looking

information”) that are based on expectations, estimates and

projections as at the date of this news release and are covered by

safe harbors under Canadian and United States securities laws.

Forward-looking information in this news release includes

information about potential further improvements to profitability

and efficiency across mining operations, including, as a result of

the Company’s expansion efforts, potential for the Company’s

long-term growth and clean energy strategy, and the business goals

and objectives of the Company. Factors that could cause actual

results to differ materially from those described in such

forward-looking information include, but are not limited to: future

capital needs and uncertainty of additional financing; share

dilution resulting from equity issuances; risks relating to the

strategy of maintaining and increasing Bitcoin holdings and the

impact of depreciating Bitcoin prices on working capital; effects

on Bitcoin prices as a result of the most recent Bitcoin halving;

development of additional facilities and installation of

infrastructure to expand operations may not be completed on the

timelines anticipated by the Company, or at all; ability to access

additional power from the local power grid and realize the

potential of the clean energy strategy on terms which are economic

or at all; a decrease in cryptocurrency pricing, volume of

transaction activity or generally, the profitability of

cryptocurrency mining; further improvements to profitability and

efficiency may not be realized; development of additional

facilities to expand operations may not be completed on the

timelines anticipated by the Company; ability to access additional

power from the local power grid; an increase in natural gas prices

may negatively affect the profitability of the Company’s power

plant; the digital currency market; the Company’s ability to

successfully mine digital currency on the cloud; the Company may

not be able to profitably liquidate its current digital currency

inventory, or at all; a decline in digital currency prices may have

a significant negative impact on the Company’s operations; the

volatility of digital currency prices; and other related risks as

more fully set out in the Annual Information Form of the Company

and other documents disclosed under the Company’s filings at

www.sedarplus.ca and www.SEC.gov/EDGAR. The forward-looking

information in this news release reflects the current expectations,

assumptions and/or beliefs of the Company based on information

currently available to the Company. In connection with the

forward-looking information contained in this news release, the

Company has made assumptions about: the current profitability in

mining cryptocurrency (including pricing and volume of current

transaction activity); profitable use of the Company’s assets going

forward; the Company’s ability to profitably liquidate its digital

currency inventory as required; historical prices of digital

currencies and the ability of the Company to mine digital

currencies on the cloud will be consistent with historical prices;

the ability to maintain reliable and economical sources of power to

run its cryptocurrency mining assets; the negative impact of

regulatory changes in the energy regimes in the jurisdictions in

which the Company operates; and there will be no regulation or law

that will prevent the Company from operating its business. The

Company has also assumed that no significant events occur outside

of the Company's normal course of business. Although the Company

believes that the assumptions inherent in the forward-looking

information are reasonable, forward-looking information is not a

guarantee of future performance and accordingly undue reliance

should not be put on such information due to the inherent

uncertainties therein. The Company undertakes no obligation to

revise or update any forward-looking information other than as

required by law.

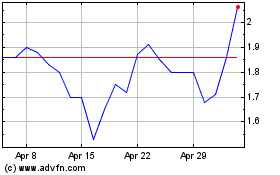

Digihost Technology (TSXV:DGHI)

Historical Stock Chart

From Jan 2025 to Feb 2025

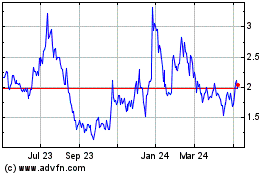

Digihost Technology (TSXV:DGHI)

Historical Stock Chart

From Feb 2024 to Feb 2025