Crowflight Secures $55 Million Debt Facility to Complete Bucko Lake Nickel Mine Development

January 10 2008 - 8:12AM

Marketwired Canada

CROWFLIGHT MINERALS INC. (Crowflight, the Company) (TSX VENTURE:CML) is pleased

to announce that it has obtained an offer for up to Cdn$55 million in debt

finance from RMB Resources Inc. (RMB) of Lakewood, Colorado. RMB is arranging

the finance as Agent for FirstRand Ireland Plc, the Lender and underwriter of

the debt finance package.

The proposed $55 million facility will be used to finance the remaining

construction and start-up of the Bucko Lake Nickel Mine near Wabowden, Manitoba.

The proposed loan is subject to final approval by the FirstRand Underwriting

Committee among other conditions typical of a facility of this nature. RMB is a

well-known arranger and provider of mining project finance. FirstRand is one of

South Africa's most prominent financial institutions. Auramet Trading, LLC of

Fort Lee, New Jersey is advising Crowflight on this transaction.

Mike Hoffman, Crowflight's President and CEO commented: "Securing this debt

facility is a critical step in bringing the Bucko Lake Nickel Mine to fruition.

By financing the remainder of this project by a debt facility, rather than

equity, we are utilizing the most capital efficient means of financing that

offers the least amount of dilution. These funds will enable us to complete

construction at Bucko and commence production as planned by mid-2008."

The debt facility will be divided into three tranches. The first tranche of $10

million is a secured loan with attaching warrants. The term of the warrants is

36 months and the exercise price is to be determined in the context of the

market at the time of satisfaction of certain condition precedents. The proceeds

of the warrant conversion are to be used to pay off the Tranche 1 debt facility.

The second bridge tranche is a $15 million short term secured loan, which is to

be repaid by drawing upon funds from the final tranche, a senior, secured $45

million debt facility. The senior tranche of $45 million may be drawn once

permits for Bucko are in place. In total, this gives Crowflight access to $55

million to fund the Bucko Lake Nickel Mine.

In addition, a total of one million warrants will also be issued with an

exercise price to be determined in the context of the market at the time of

satisfaction of certain condition precedents. The term of the warrants is 24

months.

Crowflight Minerals - Canada's Next Nickel Producer

Crowflight Minerals Inc. (TSX VENTURE:CML) is a Canadian junior mining

exploration and development company focused on nickel, copper and Platinum Group

Mineral ("PGM") projects in the Thompson Nickel Belt and Sudbury Basin. The

Company currently owns and/or has under option approximately 800 square

kilometres of exploration and development properties in Manitoba and Ontario.

Crowflight's priority is to bring the Bucko Nickel deposit located near

Wabowden, Manitoba into production by mid-2008.

Cautionary Note on Forward-Looking Information

Except for statements of historical fact contained herein, the information in

this press release constitutes "forward-looking information" within the meaning

of Canadian securities law. Such forward-looking information may be identified

by words such as "plans", "proposes", "estimates", "intends", "expects",

"believes", "may", "will" and include without limitation, statements regarding

approval and finalization of the debt facility, the benefits of the facility,

availability of financing, construction and permitting timelines and costs of

timing of production. There can be no assurance that such statements will prove

to be accurate; actual results and future events could differ materially from

such statements. Factors that could cause actual results to differ materially

include, among others, metal prices, competition, risks inherent in the mining

industry, and regulatory risks. Most of these factors are outside the control of

the Company. Investors are cautioned not to put undue reliance on

forward-looking information. Except as otherwise required by applicable

securities statutes or regulation, the Company expressly disclaims any intent or

obligation to update publicly forward-looking information, whether as a result

of new information, future events or otherwise.

Total Shares Outstanding: 249.7MM

Fully Diluted: 286.5MM

52-Week Trading Range: C$0.35 - $1.35

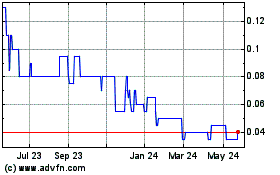

Canickel Mining (TSXV:CML)

Historical Stock Chart

From Jun 2024 to Jul 2024

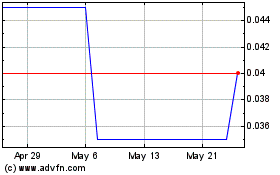

Canickel Mining (TSXV:CML)

Historical Stock Chart

From Jul 2023 to Jul 2024