CALGARY, March 8, 2012 /CNW/ - Western Energy Services Corp.

("Western" or the "Company") is pleased to release its fourth

quarter and year end 2011 financial and operating results prepared

under International Financial Reporting Standards ("IFRS").

Effective January 1, 2011, Western began reporting its financial

results under IFRS. Prior year comparative amounts have been

changed to reflect results as if Western had always prepared its

financial results using IFRS. Additional information relating

to the Company, including the Company's financial statements and

management's discussion and analysis as at and for the years ended

December 31, 2011 and 2010 will be available on SEDAR at

www.sedar.com. All amounts are denominated in Canadian

dollars ($CDN) unless otherwise identified. Highlights: -- Revenue

in the fourth quarter of 2011 totalled $101.3 million, a $74.7

million increase (or 281%) over the prior year. For the year ended

December 31, 2011, revenue increased by $206.5 million (or 369%) to

$262.5 million as compared to $56.0 million in the prior year; --

EBITDA totalled $41.5 million (41% of revenue) in the fourth

quarter of 2011, a $32.1 million increase (or 343%) over the prior

year. For the year ended December 31, 2011, EBITDA totalled $99.3

million (38% of revenue) an increase of 502% over the prior year.

The increase reflects the growth in the contract drilling segment

which exited 2011 with 43 rigs as compared to 22 rigs in 2010; --

Net income from continuing operations, before considering gains on

business acquisitions, totalled $24.9 million ($0.43 per share) in

the fourth quarter of 2011, an increase of 751%, and $53.9 million

($1.04 per share) for the year ended December 31, 2011, an increase

of 1,362% as compared to the same periods in the prior year; --

During the fourth quarter, utilization in the contract drilling

segment averaged 79% in Canada as compared to the CAODC industry

average of 61%. For the year, utilization in Canada averaged 70% as

compared to the CAODC industry average of 52%. In the United

States, utilization averaged 79% in the fourth quarter and 70% for

the year; -- For the three and twelve months ended December 31,

2011 capital expenditures totalled $34.3 million and $88.9 million,

respectively. The majority of Western's capital spending related to

its drilling rig build program, which incurred $16.7 million in the

fourth quarter and $43.0 million in the year. Additionally, Western

spent $2.6 million and $5.2 million, respectively during the three

and twelve months ended December 31, 2011 on the construction of

five next generation well servicing rigs, the first of which began

operations in the first quarter of 2012. The remaining capital

spending related to ancillary drilling equipment; -- Subsequent to

year end, on January 30, 2012 Western completed a private offering

of $175.0 million aggregate principle amount of 7⅞% senior

unsecured notes due January 30, 2019. Selected Financial

Information (stated in thousands, except share and per share

amounts) Financial Threemonths Three Yearended Year ended

Highlights ended months Dec 31, Dec Dec 31, ended 2011 31,2010 2011

Dec 31, 2010 Revenue 101,300 26,582 262,519 56,009 EBITDA(1) 41,473

9,359 99,324 16,504 EBITDA as a 41% 35% 38% 29% percentage of

revenue Cash flow 25,337 3,716 59,368 10,953 from operating

activities Capital 34,336 13,826 88,869 21,282 expenditures Net

income 24,923 2,766 53,882 23,339 (2) from continuing operations

-basic 0.43 0.10 1.04 1.03 net income per share -diluted 0.41 0.09

1.00 0.96 net income per share Net income 24,314 5,739 64,746 (3)

26,590 (2) -basic 0.42 0.20 1.25 1.17 net income per share -diluted

0.40 0.19 1.21 1.09 net income per share Weighted average number of

shares -basic 58,533,287 28,220,418 51,595,078 22,724,270 -diluted

60,549,515 29,769,783 53,640,617 24,385,704 Outstanding 58,533,287

37,680,944 58,533,287 37,680,944 common shares as at period end (1)

See financial measures reconciliations. (2) Includes a $19.7

million non-recurring gain on acquisitions. (3) Includes a $10.1

million non-recurring gain on the sale of StimSol Canada Inc.

Operating Three Three months Year ended Year ended Highlights

months ended Dec 31, 2011 Dec 31, ended Dec 31, 2010 2010 Dec 31,

2011 Contract Drilling Canadian Operations Contract drilling rig

fleet: -Average 37 16 32 13 (1) -End of 38 22 38 22 period Drilling

33,199 27,487 29,885 25,349 revenue per operating day (CDN$)

Drilling rig operating days(2) 2,706 967 8,074 2,210 Drilling rig

(1) utilization rate(2) 79% 65% 70% 58% CAODC (1) industry average

utilization rate(2) 61% 50% 52% 37% United States Operations

Contract drilling rig fleet: -Average 5 - 4 (3) - -End of 5 - 5 -

period Drilling 30,705 - 33,038 - revenue per operating day (US$)

Drilling rig operating days(2) 365 - 640 - Drilling rig (3) -

utilization rate(2) 79% - 70% Financial Position at Dec 31, Dec

31,2010 Jan 1, 2010 (stated in thousands) 2011 Working 39,874

13,156 809 capital Property and 473,930 188,355 - equipment Total

assets 619,645 264,108 12,269 Long term 108,039 46,054 - debt (1)

Calculated from the date of acquisition of the Contract Drilling

segment (March 18, 2010). (2) Utilization rate calculated on a spud

to rig release basis. (3) Calculated from the date of acquisition

of the United States operations (June 10, 2011). Outlook Western

currently has a drilling rig fleet of 44 rigs, with an additional 3

rigs under construction. Western is the sixth largest

drilling contractor in Canada with a fleet of 39 drilling

rigs. As a result of the acquisition of Stoneham on June 10,

2011, Western has entered the United States market with the

intention of building a strong presence, initially in the Williston

basin of North Dakota. Currently, Western has five drilling

rigs deployed in the United States. Subsequent to year-end,

the Company has established a corporate presence in Denver,

Colorado. Additionally, during 2012 Western commenced

operations of four next generation well servicing rigs in the

Lloydminster, Alberta area with the fifth expected to be delivered

by the end of the first quarter. This moves Western towards

its stated objective of entering the well servicing industry in

Canada. Western's drilling rig fleet is specifically suited for the

current market which is focused on drilling wells of increased

complexity. In total, approximately 95% of Western's fleet

are Efficient Long Reach ("ELR") rigs with depth ratings greater

than 3,000 meters and all of Western's rigs are capable of drilling

horizontal wells. Approximately 66% of Western's fleet is

under long term take-or-pay contracts, which provide a base level

of revenue. These contracts typically generate 250

utilization days per year in Canada, as the annual spring breakup

restricts activity during the second quarter, while in the United

States these contracts typically generate approximately 300

utilization days per year. Western has increased its 2012 capital

budget to include the construction of 3 additional ELR telescopic

double drilling rigs for approximately $32.0 million, all of which

are expected to be contracted prior to going into service.

Additionally, the Board of Directors approved the construction of 5

additional next generation well servicing rigs for approximately

$10.0 million. As such, our revised capital expenditures are

expected to be approximately $125 million for 2012, which includes

approximately $75 million in expansion capital and approximately

$50 million in maintenance capital. Expansion capital in the

contract drilling segment aggregates to approximately $65 million

and mainly relates to Western's drilling rig build program which

includes the completion of seven drilling rigs in 2012, one of

which has already been commissioned. Of the remaining

drilling rigs currently under construction, one is expected to be

completed in each of the first, second and third quarters of

2012. The three new builds discussed above are anticipated to

be completed in the latter part of the fourth quarter of 2012 or

early in the first quarter of 2013. Expansion capital in the

well servicing segment relates to the five service rig builds

discussed above, which are anticipated to be completed in the

latter part of the fourth quarter of 2012 or early in the first

quarter of 2013. Maintenance capital relates to various items

such as rotational equipment, drill pipe, replacement parts and

infrastructure upgrades. Western believes that with continued

strong pricing environments for oil and natural gas liquids,

additional rig build opportunities will be available. Drilling

activity in Canada and the United States was substantially higher

in 2011 as compared to the last number of years. Furthermore,

Western's utilization rates have consistently been above industry

average due to the Company's modern rig fleet, strong customer base

and solid reputation. Western believes that customers

targeting oil and liquids-rich natural gas wells will continue to

drive demand in 2012 and lead to levels of utilization consistent

with 2011. Currently the largest challenges facing the

drilling industry are the growth of the industry's drilling rig

fleet, as contract drillers continue to expand their fleet,

depressed natural gas prices, and the challenge to attract and

retain skilled labour. Despite the weakness in natural gas

prices, which have recently hit 10 year lows, the price for oil and

natural gas liquids remains strong, which to this point has driven

the strong activity levels in 2011 and the first quarter of

2012. Currently Western's fleet is fully crewed with

qualified personnel and three crews on every rig. The Company

believes Western's modern fleet and corporate culture will provide

a distinct advantage in attracting qualified individuals.

Western has a proven track record for delivering high quality

equipment and well trained, highly skilled crews to its customers

who rely on the Company to drill increasingly complex long reach

horizontal wells. As such, Western is well positioned for

future growth. Financial Measures Reconciliations Western uses

certain measures in this press release which do not have any

standardized meaning as prescribed by IFRS. These measures

may not be comparable to similar measures presented by other

reporting issuers. These measures have been described and

presented in this press release in order to provide shareholders

and potential investors with additional information regarding the

Company. EBITDA Management believes that in addition to net income

from continuing operations, earnings from continuing operations

before interest and finance costs, taxes, depreciation, other

non-cash items and one-time gains and losses ("EBITDA") as derived

from information reported in the consolidated statements of

operations and comprehensive income is a useful supplemental

measure as it provides an indication of the results generated by

Western's principal business activities prior to consideration of

how those activities are financed, the impact of foreign exchange,

how the results are taxed, how funds are invested, and how non-cash

charges and one-time gains or losses affect results. Operating

Earnings Management believes that in addition to net income from

continuing operations, operating earnings is a useful supplemental

measure as it provides an indication of the results generated by

the Company's principal operating segments similar to EBITDA but

also factors in the depreciation expense charged in the period. The

following table provides a reconciliation of net income from

continuing operations under IFRS as disclosed in the consolidated

statements of operations and comprehensive income to EBITDA and

Operating Earnings. (stated in thousands Threemonths Threemonths

Year ended Year ended of Canadian dollars) ended ended Dec 31,2011

Dec 31, 2010 Dec 31, 2011 Dec 31, 2010 EBITDA 41,473 9,359 99,324

16,504 Less: Depreciation - 9,012 3,021 24,541 6,942 operating

Depreciation - 165 47 446 124 administrative Operating earnings

32,296 6,291 74,337 9,438 Less: Stock based 125 31 307 81

compensation - operating Stock based 398 125 1,028 375 compensation

- administrative Finance costs 1,246 358 3,650 883 Other items

(1,472) 1,376 677 1,600 Gain on business - 161 - (19,653)

acquisitions Income taxes 7,076 1,474 14,793 2,813 Net income from

24,923 2,766 53,882 23,339 continuing operations 2011 Fourth

Quarter and Year End Results Conference Call and Webcast Western

has scheduled a conference call and webcast to begin promptly at

12:00 p.m. MST (2:00 p.m. EST) on March 8, 2012. The conference

call dial-in number is 1-888-231-8192. A live webcast of the

conference call will be accessible on Western's website at

www.wesc.ca by selecting "Investor Relations", then

"Webcasts". Shortly after the live webcast, an archived

version will be available for approximately 14 days. An archived

recording of the conference call will also be available

approximately one hour after the completion of the call until March

22, 2012 by dialing 1-855-859-2056 or 1-416-849-0833, passcode

56136739. Forward-Looking Statements and Information: This press

release contains forward-looking statements and forward-looking

information within the meaning of applicable securities laws.

All statements other than statements of historical fact contained

in this press release may be forward-looking statements and

forward-looking information. In particular, forward-looking

information and statements in this press release include, but are

not limited to, "capital expenditures are expected to be

approximately $125 million for 2012, which includes approximately

$75 million in expansion capital and approximately $50 million in

maintenance capital. Expansion capital in the contract

drilling segment aggregates to approximately $65 million and mainly

relates to Western's drilling rig build program which includes the

completion of seven drilling rigs in 2012, one of which has already

been commissioned. Of the remaining drilling rigs currently

under construction, one is expected to be completed in each of the

first, second and third quarters of 2012. The three new

builds discussed above are anticipated to be completed in the

latter part of the fourth quarter of 2012 or early in the first

quarter of 2013. Expansion capital in the well servicing

segment relates to the five service rig builds discussed above,

which are anticipated to be completed in the latter part of the

fourth quarter of 2012 or early in the first quarter of 2013." and

"Western believes that customers targeting oil and liquids-rich

natural gas wells will continue to drive demand in 2012 and lead to

levels of utilization consistent with 2011". These

forward-looking statements and information are based on certain key

expectations and assumptions made by Western, including the

assumption that the demand for Western's drilling rigs will remain

strong through 2012 and that such demand and financial performance

will not affect expansion capital. Although Western believes

that the expectations and assumptions on which such forward-looking

statements and information are based are reasonable, undue reliance

should not be placed on the forward-looking statements and

information as Western cannot give any assurance that they will

prove to be correct. Since forward-looking statements and

information address future events and conditions, by their very

nature they involve inherent risks and uncertainties. Actual

results could differ materially from those currently anticipated

due to a number of factors and risks. These include, but are

not limited to, general economic, market and business

conditions. Readers are cautioned that the foregoing list of

risks and uncertainties is not exhaustive. Additional

information on these and other risk factors that could affect

Western's operations and financial results are included in

Western's annual information form and the other disclosure

documents filed by Western with securities regulatory authorities

which may be accessed through the SEDAR website at

www.sedar.com. The forward-looking statements and information

contained in this press release are made as of the date hereof and

Western does not undertake any obligation to update publicly or

revise and forward-looking statements and information, whether as a

result of new information, future events or otherwise, unless so

required by applicable securities laws. Western Energy

Services Corp. CONTACT: Dale E. Tremblay Chief Executive

Officer403.984.5929dtremblay@wesc.ca Alex MacAusland President and

COO403.984.5932amacausland@wesc.ca Jeffrey K. BowersVP Finance and

CFO403.984.5933jbowers@wesc.ca

Copyright

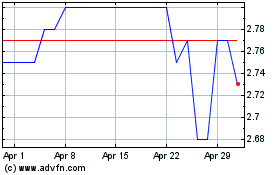

Western Energy Services (TSX:WRG)

Historical Stock Chart

From Jun 2024 to Jul 2024

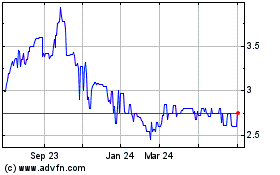

Western Energy Services (TSX:WRG)

Historical Stock Chart

From Jul 2023 to Jul 2024