VitalHub Achieves Record Revenues in Q3 2021 with ARR over $21.5 million

November 15 2021 - 11:59AM

VitalHub Corp. (the “Company” or “VitalHub”) (TSX: VHI) announced

today it has filed its Interim Condensed Consolidated Financial

Statements and Management's Discussion and Analysis report for the

three and nine months ended September 30, 2021 with the Canadian

securities authorities. These documents may be viewed under the

Company's profile at www.sedar.com.

When asked to comment on the results, VitalHub

CEO Dan Matlow said,

“Although Q3 is traditionally a slower quarter

due to the summer months, we have continued to experience strong

organic growth and improved earnings year-over-year and

quarter-over-quarter. Despite experiencing some extraordinary costs

pertaining to our uplisting to the TSX and bank financing

transaction, we have continued to see operational and financial

improvement from the previous quarter. While the valuations of

digital health providers have experienced multiple compression in

recent months, we believe our status as a near pure SaaS-based

software company differentiates us significantly, and is

continually substantiated by improvements in key performance

indicators and our reported financials.”

The Company will be holding a conference call

via Zoom on November 16th, 2021, at 9:00am EST hosted by CEO Dan

Matlow and CFO Brian Goffenberg with a Q&A session to follow.

To register for the conference call please visit: VitalHub Q3 2021

Conference Call or https://bit.ly/VitalHub-Q3-2021.

Third Quarter 2021

Highlights

- Revenue of $6,619,047, an increase

of $3,426,881 or 107% from the comparative period in the prior

year.

- Gross profit as a percentage of

revenue for Q3 2021 was 82% compared to 81% in Q3 2020 and 77%

compared to Q2 2021.

- ARR (1, 2) grew by $1,811,726 to

$21,569,032, achieving 9% growth in Q3 2021 versus Q2 2021.

- ARR (1) consists of $513,488 or

2.60% organic growth and $1,298,238 or 6.57% acquisition growth in

Q3 2021 versus Q2 2021.

- Net (loss) of ($575,792) compared

to a net loss of ($1,065,505) from the comparative period in the

prior year.

- EBITDA (2) of $189,088 compared to

($419,362) from the comparative period in the prior year.

- Adjusted EBITDA (Non-IFRS measure)

of $1,277,573, or 19% of revenue, compared to $502,595 or 16% of

revenue from the comparative period in the prior year.

- Cash on hand at September 30, 2021

was $15,704,130 compared to $23,391,946 as at December 31,

2020.

- Cashflows from operations before

changes in working capital was $1,394,927 for the period as

compared to $352,464 for the same period last year.

- During the quarter the Company

arranged a $10,000,000 acquisition debt facility from the

technology and Innovation banking division of The Bank of Nova

Scotia.

- On September 23, 2021 the Company

commenced trading on the Toronto Stock Exchange (“TSX”). The common

shares were previously listed on the TSX Venture Exchange (“TSXV”)

since December 2, 2016.

Q3 2021 and 2020 Results

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended |

Nine months ended |

|

|

September 30, 2021 |

% Revenue |

September 30, 2020 |

% Revenue |

Change |

September 30, 2021 |

% Revenue |

September 30, 2020 |

% Revenue |

Change |

|

|

$ |

|

$ |

|

% |

$ |

|

$ |

|

% |

|

Revenue |

6,619,047 |

|

100 |

% |

3,192,166 |

|

100 |

% |

107 |

% |

17,734,300 |

|

100 |

% |

8,711,060 |

|

100 |

% |

104 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of sales |

1,174,244 |

|

18 |

% |

618,482 |

|

19 |

% |

90 |

% |

3,773,770 |

|

21 |

% |

2,264,839 |

|

26 |

% |

67 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross Profit |

5,444,803 |

|

82 |

% |

2,573,684 |

|

81 |

% |

112 |

% |

13,960,530 |

|

79 |

% |

6,446,221 |

|

74 |

% |

117 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Expenses |

|

|

|

|

|

|

|

|

|

|

|

General and administrative |

1,361,762 |

|

21 |

% |

680,030 |

|

21 |

% |

100 |

% |

3,638,214 |

|

21 |

% |

2,019,506 |

|

23 |

% |

80 |

% |

|

Sales and marketing |

974,506 |

|

15 |

% |

433,933 |

|

14 |

% |

125 |

% |

2,646,543 |

|

15 |

% |

896,725 |

|

10 |

% |

195 |

% |

|

Research and development |

1,875,775 |

|

28 |

% |

859,192 |

|

27 |

% |

118 |

% |

4,328,219 |

|

24 |

% |

1,992,248 |

|

23 |

% |

117 |

% |

|

Depreciation |

42,625 |

|

1 |

% |

29,598 |

|

1 |

% |

44 |

% |

117,314 |

|

1 |

% |

82,961 |

|

1 |

% |

41 |

% |

|

Depreciation of right-of-use assets |

71,006 |

|

1 |

% |

55,495 |

|

2 |

% |

28 |

% |

201,769 |

|

1 |

% |

162,341 |

|

2 |

% |

24 |

% |

|

Stock based compensation |

484,226 |

|

7 |

% |

101,720 |

|

3 |

% |

376 |

% |

1,088,306 |

|

6 |

% |

189,493 |

|

2 |

% |

474 |

% |

|

Foreign currency loss (gain) |

(44,469 |

) |

(1 |

%) |

97,934 |

|

3 |

% |

(145 |

%) |

148,311 |

|

1 |

% |

(1,394 |

) |

(0 |

%) |

(10736 |

%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Other Income and Expenses |

|

|

|

|

|

|

|

|

|

|

|

Amortization of intangible assets |

637,685 |

|

10 |

% |

541,129 |

|

17 |

% |

18 |

% |

1,618,502 |

|

9 |

% |

1,427,604 |

|

16 |

% |

13 |

% |

|

Business acquisition, restructuring and integration

costs |

604,259 |

|

9 |

% |

820,237 |

|

26 |

% |

(26 |

%) |

1,463,345 |

|

8 |

% |

1,075,803 |

|

12 |

% |

36 |

% |

|

Interest expense and accretion (net of interest

income) |

(7,292 |

) |

(0 |

%) |

(59 |

) |

(0 |

%) |

12177 |

% |

(25,584 |

) |

(0 |

%) |

9,210 |

|

0 |

% |

(378 |

%) |

|

Interest income from sublease |

0 |

|

0 |

% |

(404 |

) |

(0 |

%) |

(100 |

%) |

0 |

|

0 |

% |

(1,703 |

) |

(0 |

%) |

(100 |

%) |

|

Interest expense from lease liabilities |

20,856 |

|

0 |

% |

18,509 |

|

1 |

% |

13 |

% |

64,236 |

|

0 |

% |

58,790 |

|

1 |

% |

9 |

% |

|

Loss on disposal of property and equipment |

(344 |

) |

(0 |

%) |

0 |

|

0 |

% |

0 |

% |

2,153 |

|

0 |

% |

0 |

|

0 |

% |

100 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Current income taxes |

0 |

|

0 |

% |

1,875 |

|

0 |

% |

100 |

% |

10,071 |

|

0 |

% |

(14,859 |

) |

(0 |

%) |

(168 |

%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net (loss) income |

(575,792 |

) |

(9 |

%) |

(1,065,505 |

) |

(33 |

%) |

(46 |

%) |

(1,340,869 |

) |

(8 |

%) |

(1,450,504 |

) |

(17 |

%) |

(8 |

%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

EBITDA (Non-IFRS measure) |

189,088 |

|

3 |

% |

(419,362 |

) |

(13 |

%) |

(145 |

%) |

645,439 |

|

4 |

% |

273,840 |

|

3 |

% |

136 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA (Non-IFRS

measure) |

1,277,573 |

|

19 |

% |

502,595 |

|

16 |

% |

154 |

% |

3,197,090 |

|

18 |

% |

1,539,136 |

|

18 |

% |

108 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Annualized Recurring Revenue (Non-IFRS

measure) |

21,569,032 |

|

|

7,491,841 |

|

|

188 |

% |

21,569,032 |

|

|

7,491,841 |

|

|

188 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Recurring revenue (Non-IFRS

Measure) |

5,462,774 |

|

83 |

% |

2,479,513 |

|

78 |

% |

120 |

% |

13,960,056 |

|

79 |

% |

6,125,295 |

|

70 |

% |

128 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

ABOUT VITALHUB:

Software for Health and Human Services providers

designed to simplify the user experience & optimize

outcomes.

VitalHub provides technology to Health and Human

Services providers including; Hospitals, Regional Health

Authorities, Mental Health, Long Term Care, Home Health, Community

and Social Services. VitalHub solutions span the categories of

Electronic Health Record (EHR), Case Management, Care Coordination,

Patient Flow & Operational Visibility, and DOCit Mobile

Apps.

The Company has a robust two-pronged growth

strategy, targeting organic growth opportunities within its product

suite, and pursuing an aggressive M&A plan. Currently, VitalHub

serves 275+ clients across Canada, USA, UK, Australia, Qatar, and

Latvia. VitalHub is based in Toronto, Canada, with an offshore

development hub in Sri Lanka. The Company is publicly traded on the

TSX Venture Exchange under the symbol “VHI”.

CAUTIONARY STATEMENT:

This press release includes forward-looking

statements regarding the Corporation and its business, which may

include, but is not limited to, statements with respect to the

appointment of a new directors. Often, but not always,

forward-looking statements can be identified by the use of words

such as "plans", "is expected", "expects", "scheduled", "intends",

"contemplates", "anticipates", "believes", "proposes" or variations

(including negative variations) of such words and phrases, or state

that certain actions, events or results "may", "could", "would",

"might" or "will" be taken, occur or be achieved. Such statements

are based on the current expectations of the management of each

entity and are based on assumptions and subject to risks and

uncertainties. Although the management of each entity believes that

the assumptions underlying these statements are reasonable, they

may prove to be incorrect. The forward-looking events and

circumstances discussed in this release, may not occur by certain

specified dates or at all and could differ materially as a result

of known and unknown risk factors and uncertainties affecting the

companies, including risks regarding the technology industry,

failure to obtain regulatory or shareholder approvals, market

conditions, economic factors, the equity markets generally and

risks associated with growth and competition. Although the

Corporation has attempted to identify important factors that could

cause actual actions, events or results to differ materially from

those described in forward-looking statements, there may be other

factors that cause actions, events or results to differ from those

anticipated, estimated or intended. No forward-looking statement

can be guaranteed. Except as required by applicable securities

laws, forward-looking statements speak only as of the date on which

they are made and the Corporation undertakes no obligation to

publicly update or revise any forward-looking statement, whether as

a result of new information, future events, or otherwise.

CONTACT INFORMATION

Dan MatlowChief Executive Officer, Director(416)

727-9061dan.matlow@vitalhub.com

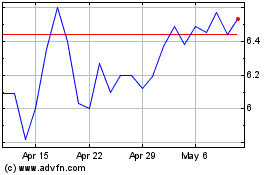

Vitalhub (TSX:VHI)

Historical Stock Chart

From Jun 2024 to Jul 2024

Vitalhub (TSX:VHI)

Historical Stock Chart

From Jul 2023 to Jul 2024