TC Energy announces South Bow’s closing of $7.9 billion Notes Offering for Liquids Pipelines spinoff

August 28 2024 - 5:00PM

News Release — TC Energy Corporation (TSX, NYSE: TRP) (TC Energy)

announced today that South Bow Corporation (South Bow) has closed a

notes offering of approximately $7.9 billion Canadian-dollar

equivalent in aggregate principal amount (the Notes Offering)

related to the spinoff of TC Energy's Liquids Pipelines business

(the spinoff Transaction). Establishing the independent,

investment-grade debt capital structure was met with strong market

interest and is one of the final milestones required to consummate

the spinoff Transaction, which remains on track to close early in

the fourth quarter of 2024. The Notes Offering is comprised of:

- US$700 million in aggregate principal amount of 4.911 per cent

senior unsecured notes that will mature on Sept. 1, 2027 (the 2027

Notes); US$1,000 million in aggregate principal amount of 5.026 per

cent senior unsecured notes that will mature on Oct. 1, 2029 (the

2029 Notes); US$1,250 million in aggregate principal amount of

5.584 per cent senior unsecured notes that will mature on Oct. 1,

2034 (the 2034 Notes); and US$700 million in aggregate principal

amount of 6.176 per cent senior unsecured notes that will mature on

Oct. 1, 2054 (the 2054 Notes).

- C$450 million in aggregate principal amount of 4.323 per cent

senior unsecured notes that will mature on Feb. 1, 2030 (the 2030

Notes); C$500 million in aggregate principal amount of 4.616 per

cent senior unsecured notes that will mature on Feb. 1, 2032 (the

2032 Notes); and C$500 million in aggregate principal amount of

4.933 per cent senior unsecured notes that will mature on Feb. 1,

2035 (the 2035 Notes).

- US$450 million in aggregate principal amount of 7.625 per cent

junior subordinated notes that will mature on March 1, 2055 (the

Series 1 Notes) and US$650 million in aggregate principal amount of

7.500 per cent junior subordinated notes that will mature on March

1, 2055 (the Series 2 Notes and, together with the 2027 Notes, the

2029 Notes, the 2030 Notes, the 2032 Notes, the 2034 Notes, the

2035 Notes, the 2054 Notes, and the Series 1 Notes, the

Notes).

The Notes were issued by South Bow Canadian Infrastructure

Holdings Ltd. and 6297782 LLC, which will, upon completion of the

spinoff Transaction, be wholly owned subsidiaries of South Bow.

The net proceeds of the Notes Offering were placed into escrow

pending the completion of the spinoff Transaction. Upon completion

of the spinoff Transaction, the escrowed funds will be released to

South Bow and used to repay indebtedness owed by South Bow and its

subsidiaries to TC Energy and its subsidiaries. Separately, South

Bow established a C$2.0 billion four-year senior unsecured

revolving credit facility (the Facility) in the third quarter of

2024, which will become available upon completion of the spinoff

Transaction. The Facility will be used for committed capital

expenditures and other general corporate purposes and will provide

significant liquidity for South Bow.

The Notes will be subject to a special mandatory redemption or

repurchase, as applicable, if (i) the spinoff Transaction is not

consummated on or prior to March 31, 2025, or (ii) South Bow

delivers notice to the escrow agent and the trustee for the Notes

prior to such date advising that it is no longer pursuing the

consummation of the spinoff Transaction, as further described in

the terms of the Notes.

The Notes and the related guarantees have not been registered

under the Securities Act of 1933, as amended (the Securities Act)

or any state securities laws and were offered in reliance upon

exemptions from, or in transactions not subject to, the

registration requirements of the Securities Act and applicable

state securities laws. The Notes and the guarantees thereof were

offered and sold in the United States only to persons reasonably

believed to be qualified institutional buyers pursuant to Rule 144A

under the Securities Act and to certain non-US persons outside the

United States in reliance on Regulation S under the Securities Act.

The Notes were offered and sold in Canada on a private placement

basis to "accredited investors" pursuant to exemptions from the

prospectus requirements of applicable Canadian securities laws. The

Notes have not been and will not be qualified for distribution to

the public under applicable Canadian securities laws.

This news release does not constitute an offer to sell, or the

solicitation of an offer to buy, the Notes, nor shall there be any

sale of the Notes in any jurisdiction in which such offer,

solicitation, or sale would be unlawful.

South Bow Virtual Corporate Update

South Bow will host a corporate update via live broadcast on

Monday, Sept. 9, 2024, beginning at 8 a.m. (MDT) / 10 a.m. (EDT),

where members of South Bow's management team and intended board of

directors will provide an overview of South Bow's business and

strategic priorities.

The presentation can be accessed directly at

https://my.400.lumiconnect.com/r/participant/live-meeting/400-357-322-809,

or on South Bow's website at www.southbow.com/investors. The

presentation will be archived and accessible for replay following

the live event.

About South Bow

South Bow, which is expected to be a standalone company early in

the fourth quarter of 2024, safely operates 4,900 kilometres (3,045

miles) of crude oil pipeline infrastructure. TC Energy shareholders

approved the spinoff Transaction in June 2024. The spinoff

Transaction is expected to unlock South Bow's unrivalled market

position, connecting Alberta crude oil supplies to US refining

markets in Illinois, Oklahoma, and the US Gulf Coast. We take pride

in what we do – providing safe and reliable transportation to North

America's highest demand markets. To learn more, visit us at

www.SouthBow.com.

About TC Energy

We're a team of 7,000+ energy problem solvers working to move,

generate and store the energy North America relies on. Today, we're

delivering solutions to the world's toughest energy challenges –

from innovating to deliver the natural gas that feeds LNG to global

markets, to working to reduce emissions from our assets, to

partnering with our neighbours, customers and governments to build

the energy system of the future. It's all part of how we continue

to deliver sustainable returns for our investors and create value

for communities.

TC Energy's common shares trade on the Toronto (TSX) and New

York (NYSE) stock exchanges under the symbol TRP. To learn more,

visit us at www.TCEnergy.com.

Forward-looking Information

This release contains certain information that is

forward-looking and is subject to important risks and uncertainties

and is based on certain key assumptions. Forward-looking statements

are usually accompanied by words such as "anticipate", "expect",

"believe", "may", "will", "should", "estimate", or other similar

words. Forward-looking statements in this document may include, but

are not limited to, statements on expectations with respect to: the

Notes Offering, including the use of the net proceeds therefrom;

the Facility, including the uses and benefits thereof; the spinoff

Transaction, including the timing thereof; and TC Energy and South

Bow following the completion of the spinoff Transaction.

Forward-looking statements in this document are intended to provide

TC Energy security holders and potential investors with information

regarding TC Energy, South Bow and their respective subsidiaries,

including management's assessment of TC Energy's, South Bow's and

their respective subsidiaries' future plans and financial outlook.

All forward-looking statements reflect TC Energy's beliefs and

assumptions based on information available at the time the

statements were made and as such are not guarantees of future

performance. As actual results could vary significantly from the

forward-looking information, readers should not put undue reliance

on forward-looking information. TC Energy does not update its

forward-looking information due to new information or future

events, unless required to by law. For additional information on

the assumptions made, and the risks and uncertainties which could

cause actual results to differ from the anticipated results, refer

to the most recent Quarterly Report to Shareholders and the 2023

Annual Report filed under TC Energy's profile on SEDAR+ at

www.sedarplus.ca and with the US Securities and Exchange

Commission at www.sec.gov.

-30-

Media Inquiries:Media

Relationsmedia@tcenergy.com 403-920-7859 or 800-608-7859

Investor & Analyst Inquiries:Gavin Wylie /

Hunter Mauinvestor_relations@tcenergy.com403-920-7911 or

800-361-6522

PDF

available: http://ml.globenewswire.com/Resource/Download/259f4dc9-7f7b-4bfc-a9bd-499f4b6b2f23

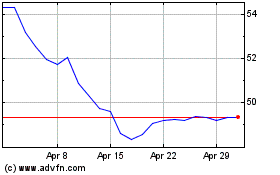

TC Energy (TSX:TRP)

Historical Stock Chart

From Nov 2024 to Dec 2024

TC Energy (TSX:TRP)

Historical Stock Chart

From Dec 2023 to Dec 2024