Imperial Oil Limited (TSX:IMO):

- Net income of $1,212 million, including a $662 million benefit

from the Alberta corporate tax rate change

- Highest second quarter production in over 25 years, including

record second quarter production at Kearl

- Cash generated from operations of $1 billion; $2 billion in the

first six months, the highest since 2014

- Returned $515 million to shareholders; renewed share purchase

program for another year

Second quarter

Six months

millions of Canadian dollars, unless

noted

2019

2018

∆

2019

2018

∆

Net income (loss) (U.S. GAAP)

1,212

196

+1,016

1,505

712

+793

Net income (loss) per common share,

assuming dilution (dollars)

1.57

0.24

+1.33

1.94

0.86

+1.08

Capital and exploration expenditures

429

284

+145

958

558

+400

Estimated net income in the second quarter of 2019 was $1,212

million, up from net income of $196 million in the same period of

2018. Second quarter 2019 results include a favourable impact,

largely non-cash, of $662 million associated with the recently

enacted Alberta corporate income tax rate decrease.

Overall upstream gross oil-equivalent production averaged

400,000 barrels per day, up from 336,000 barrels per day in the

second quarter of 2018, due to strong Kearl production and the

absence of Syncrude turnaround activity. Gross production at Kearl

averaged 207,000 barrels per day in the second quarter, and 193,000

barrels per day in the first six months of 2019, representing both

a record second quarter and a record first half.

“In a quarter when the upstream completed significant turnaround

activities, the company still achieved its highest second quarter

production in over 25 years,” said Rich Kruger, chairman, president

and chief executive officer. “The ongoing focus on improving

reliability at Kearl is working, with the operation recording four

of its ten best-ever production days following completion of the

turnaround in June.”

Refinery throughput averaged 344,000 barrels per day, compared

to 363,000 barrels per day in the second quarter of 2018. Petroleum

product sales averaged 477,000 barrels per day in the second

quarter, compared to 510,000 barrels per day in the same period of

2018. Downstream results were impacted by the planned Sarnia

refinery turnaround and a fractionation tower incident, which

occurred during preparations for the turnaround.

On June 21, Imperial announced the renewal of its share purchase

program, allowing the company to buy approximately 38 million

shares over a 12-month period ending June 26, 2020. The company

fully utilized the prior program, returning $1.6 billion to

shareholders through the purchase of over 40 million shares.

Imperial remains committed to returning cash to shareholders

through paying a reliable and growing dividend and returning

surplus cash to shareholders through share buybacks.

“Given overall financial and operational performance in the

first half, and with several of the year’s planned upstream and

downstream turnarounds completed, Imperial remains on track to

deliver on our commitments for 2019,” added Kruger.

Second quarter highlights

- Net income of $1,212 million or $1.57 per share on a diluted

basis, up from net income of $196 million or $0.24 per share in

the second quarter of 2018. Second quarter 2019 results include a

favourable impact, largely non-cash, of $662 million associated

with the recently enacted Alberta corporate income tax rate

decrease.

- Cash generated from operating activities was $1,026

million, up from $859 million in the second quarter of

2018.

- Capital and exploration expenditures totalled $429

million, compared with $284 million in the second quarter of

2018.

- Dividends paid and share purchases totalled $515 million in

the second quarter of 2019, including the purchase of about 9.8

million shares for $368 million. Under the 12-month program that

ended on June 26, 2019, the company purchased 40.4 million shares

for $1.6 billion, the maximum allowable.

- Share purchase program renewed for another 12 months. In

June, Imperial received Toronto Stock Exchange approval to renew

its program enabling the purchase of up to five percent of its

common shares outstanding, approximately 38 million shares, during

the 12-month period ending June 26, 2020. The company remains

committed to returning surplus cash to shareholders.

- Production averaged 400,000 gross oil-equivalent barrels per

day, up from 336,000 barrels per day in the same period of

2018. Strong post-turnaround production at Kearl and the absence of

turnaround activities at Syncrude contributed to this result.

- Gross production of Kearl bitumen averaged 207,000 barrels

per day (147,000 barrels Imperial’s share), up from 180,000

barrels per day (128,000 barrels Imperial’s share) in the second

quarter of 2018. Production was impacted by an estimated 46,000

barrels per day (33,000 barrels Imperial’s share) associated with

the largest planned turnaround in the asset’s history.

- Gross production of Cold Lake bitumen averaged 135,000

barrels per day, up from 133,000 barrels per day in the same

period of 2018. A 32-day turnaround at the Mahkeses facility was

completed in the quarter and impacted production by an estimated

12,000 barrels per day.

- The company’s share of gross production from Syncrude

averaged 80,000 barrels per day, up from 50,000 barrels per day

in the same period of 2018. The increase was primarily due to the

absence of turnaround activities and production impacts resulting

from the 2018 power disruption.

- Crude-by-rail shipments averaged 64,000 barrels per day in

the second quarter, up from 36,000 barrels per day in the first

quarter of 2019. Future rail movements will continue to be driven

by economics.

- Refinery throughput averaged 344,000 barrels per day,

compared to 363,000 barrels per day in the second quarter of 2018.

Capacity utilization was 81 percent, compared to 86 percent in the

second quarter of 2018. The results reflect the impact of a planned

turnaround at the Sarnia facility and an incident with a

fractionation tower during preparations for the turnaround.

Turnaround activities were completed in the quarter and work

continues to replace the tower.

- Petroleum product sales were 477,000 barrels per day,

compared to 510,000 barrels per day in the second quarter of 2018.

Lower volumes were mainly due to reduced throughput at Sarnia.

- Speedpass+™mobile payment app enhanced.

Imperial’s Speedpass+ app now allows customers to link their PC

Financial Mastercard, earn PC Optimum points, and use the app at

participating Mobil stations. Until September 30, customers can

earn five times the Esso Extra points or 50 PC Optimum points per

litre when using the app at participating Esso and Mobil stations

nationwide.

Second quarter 2019 vs. second quarter 2018

The company’s net income for the second quarter of 2019 was

$1,212 million or $1.57 per share on a diluted basis, up from net

income of $196 million or $0.24 per share in the same period of

2018. Second quarter 2019 results include a favourable impact,

largely non-cash, of $662 million associated with the Alberta

corporate income tax rate decrease. On June 28, 2019, the Alberta

government enacted a 4 percent decrease in the provincial tax rate,

from 12 percent to 8 percent by 2022.

Upstream net income was $985 million in the second quarter,

reflecting the favourable impact associated with the decreased

Alberta corporate income tax rate of $689 million. Excluding this

impact, second quarter 2019 net income was $296 million, an

increase of $302 million compared to a net loss of $6 million in

the same period of 2018. Improved results reflect higher volumes of

about $310 million, primarily at Syncrude, Kearl and Norman Wells,

as well as the impact of higher Canadian crude oil realizations of

about $80 million. Results were negatively impacted by higher

operating expenses of about $60 million and higher royalties of

about $50 million.

West Texas Intermediate (WTI) averaged US$59.91 per barrel in

the second quarter of 2019, down from US$67.91 per barrel in the

same quarter of 2018. Western Canada Select (WCS) averaged US$49.31

per barrel and US$48.81 per barrel for the same periods. The WTI /

WCS differential narrowed during the second quarter of 2019 to

average approximately US$11 per barrel for the quarter, compared to

around US$19 per barrel in the same period of 2018.

The Canadian dollar averaged US$0.75 in the second quarter of

2019, a decrease of US$0.03 from the second quarter of 2018.

Imperial’s average Canadian dollar realizations for bitumen

increased in the quarter, supported primarily by lower diluent

costs. Bitumen realizations averaged $57.19 per barrel in the

second quarter of 2019, up from $48.90 per barrel in the second

quarter of 2018. The company’s average Canadian dollar realizations

for synthetic crude declined generally in line with WTI in the

quarter, adjusted for changes in exchange rates and transportation

costs. Synthetic crude realizations averaged $79.96 per barrel in

the second quarter of 2019, compared to $86.31 per barrel in the

same period of 2018.

Gross production of Cold Lake bitumen averaged 135,000 barrels

per day in the second quarter, up from 133,000 barrels per day in

the same period of 2018.

Gross production of Kearl bitumen averaged 207,000 barrels per

day in the second quarter (147,000 barrels Imperial’s share), up

from 180,000 barrels per day (128,000 barrels Imperial’s share) in

the second quarter of 2018. Higher production was mainly due to

improved reliability.

The company's share of gross production from Syncrude averaged

80,000 barrels per day, up from 50,000 barrels per day in the

second quarter of 2018. Higher production was mainly due to the

absence of turnaround activities and impacts from the 2018 power

disruption.

Downstream net income was $258 million in the second quarter, up

from $201 million in the second quarter of 2018. Earnings increased

primarily due to lower net turnaround impacts of about $150 million

partially offset by reliability events of about $70 million,

including the Sarnia tower incident.

Refinery throughput averaged 344,000 barrels per day, compared

to 363,000 barrels per day in the second quarter of 2018. Capacity

utilization was 81 percent, compared to 86 percent in the second

quarter of 2018. Reduced throughput was mainly due to the impact of

a planned turnaround and the tower incident at Sarnia, partially

offset by the absence of the 2018 planned turnaround at

Strathcona.

Petroleum product sales were 477,000 barrels per day, compared

to 510,000 barrels per day in the second quarter of 2018. Lower

petroleum product sales were mainly due to lower refinery

throughput.

Chemical net income was $38 million in the second quarter,

compared to $78 million from the same quarter of 2018, primarily

reflecting lower margins.

Corporate and other expenses were $69 million in the second

quarter, compared to $77 million in the same period of 2018.

Cash flow generated from operating activities was $1,026 million

in the second quarter, up from $859 million in the corresponding

period in 2018, reflecting higher earnings partially offset by

working capital effects.

Investing activities used net cash of $429 million in the second

quarter, compared with $379 million used in the same period of

2018.

Cash used in financing activities was $521 million in the second

quarter, compared with $1,032 million used in the second quarter of

2018. Dividends paid in the second quarter of 2019 were $147

million. The per share dividend paid in the second quarter was

$0.19, up from $0.16 in the same period of 2018. During the second

quarter, the company, under its share purchase program, purchased

about 9.8 million shares for $368 million, including shares

purchased from Exxon Mobil Corporation. In the second quarter of

2018, the company purchased about 21.4 million shares for $893

million following the increase of its share purchase program.

The company’s cash balance was $1,087 million at June 30, 2019,

versus $873 million at the end of second quarter 2018.

On June 21, 2019, the company announced by news release that it

had received final approval from the Toronto Stock Exchange for a

new normal course issuer bid and will continue its existing share

purchase program. The program enables the company to purchase up to

a maximum of 38,211,086 common shares during the period June 27,

2019 to June 26, 2020. This maximum includes shares purchased under

the normal course issuer bid and from Exxon Mobil Corporation

concurrent with, but outside of the normal course issuer bid. As in

the past, Exxon Mobil Corporation has advised the company that it

intends to participate to maintain its ownership percentage at

approximately 69.6 percent. The program will end should the company

purchase the maximum allowable number of shares, or on June 26,

2020. The company currently anticipates exercising its share

purchases uniformly over the duration of the program. Purchase

plans may be modified at any time without prior notice.

Six months highlights

- Net income of $1,505 million, up from net income of $712

million in 2018.

- Net income per share on a diluted basis was $1.94, up from net

income per share of $0.86 in 2018.

- Cash flow generated from operating activities was $2,029

million, up from $1,844 million in 2018.

- Gross oil-equivalent production averaged 394,000 barrels per

day, up from 353,000 barrels per day in 2018.

- Refinery throughput averaged 364,000 barrels per day, compared

to 386,000 barrels per day in 2018.

- Petroleum product sales were 477,000 barrels per day, compared

to 494,000 barrels per day in 2018.

- Per share dividends declared during the year totalled $0.41, up

from $0.35 per share in 2018.

- Returned over $1 billion to shareholders through share

purchases and dividends.

Six months 2019 vs. six months 2018

Net income in the first six months of 2019 was $1,505 million,

or $1.94 per share on a diluted basis, up from net income of $712

million or $0.86 per share in the first six months of 2018. 2019

results include a favourable impact, largely non-cash, of $662

million associated with the Alberta corporate income tax rate

decrease. On June 28, 2019, the Alberta government enacted a 4

percent decrease in the provincial tax rate, from 12 percent to 8

percent by 2022.

Upstream net income was $1,043 million for the first six months

of the year, reflecting the favourable impact associated with the

decreased Alberta corporate income tax rate of $689 million.

Excluding this impact, 2019 net income was $354 million, an

increase of $404 million compared to a net loss of $50 million in

the same period of 2018. Improved results reflect higher volumes of

about $330 million, primarily at Syncrude, Kearl and Norman Wells,

as well as the impact of higher Canadian crude oil realizations of

about $260 million and favourable foreign exchange impacts of about

$60 million. Results were negatively impacted by higher operating

expenses of about $180 million and higher royalties of about $80

million.

West Texas Intermediate averaged US$57.45 per barrel in the

first six months of 2019, down from US$65.44 per barrel in the same

period of 2018. Western Canada Select averaged US$45.88 per barrel

and US$43.74 per barrel for the same periods. The WTI / WCS

differential narrowed to average approximately US$12 per barrel in

the first six months of 2019, from around US$22 per barrel in the

same period of 2018.

The Canadian dollar averaged US$0.75 in the first six months of

2019, a decrease of $0.03 from the same period in 2018.

Imperial's average Canadian dollar realizations for bitumen

increased in the first six months of 2019, supported primarily by

lower diluent costs and an increase in WCS. Bitumen realizations

averaged $53.20 per barrel, up from $41.84 per barrel from the same

period in 2018. The company's average Canadian dollar realizations

for synthetic crude declined generally in line with WTI, adjusted

for changes in exchange rates and transportation costs. Synthetic

crude realizations averaged $74.77 per barrel, compared to $81.24

per barrel from the same period in 2018.

Gross production of Cold Lake bitumen averaged 140,000 barrels

per day in the first six months of 2019, compared to 143,000

barrels per day in the same period of 2018.

Gross production of Kearl bitumen averaged 193,000 barrels per

day in the first six months of 2019 (137,000 barrels Imperial's

share) up from 181,000 barrels per day (128,000 barrels Imperial's

share) in the same period of 2018. Higher production was mainly due

to improved reliability.

During the first six months of 2019, the company's share of

gross production from Syncrude averaged 79,000 barrels per day, up

from 57,000 barrels per day in the same period of 2018. Higher

production was mainly due to the absence of turnaround activities

and impacts from the 2018 power disruption.

Downstream net income was $515 million for the first six months

of 2019, compared to $722 million for the same period of 2018.

Earnings were negatively impacted by lower margins of about $210

million, reliability events of about $130 million, including the

Sarnia tower incident, and lower sales volumes of about $70

million. These factors were partially offset by lower net

turnaround impacts of about $150 million and favourable foreign

exchange effects of about $70 million.

Refinery throughput averaged 364,000 barrels per day in the

first six months of 2019, compared to 386,000 barrels per day in

the same period of 2018. Capacity utilization was 86 percent,

compared to 91 percent in the same period of 2018. Reduced

throughput was mainly due to the impact of a planned turnaround and

the tower incident at Sarnia, partially offset by the absence of

the 2018 planned turnaround at Strathcona.

Petroleum product sales were 477,000 barrels per day in the

first six months of 2019, compared to 494,000 barrels per day in

the same period of 2018. Lower petroleum product sales were mainly

due to lower refinery throughput.

Chemical net income was $72 million in the first six months of

2019, compared to $151 million in the same period of 2018,

primarily reflecting lower margins.

Corporate and other expenses were $125 million in the first six

months of 2019, compared to $111 million in the same period of

2018.

Cash flow generated from operating activities was $2,029 million

in the first six months of 2019, up from $1,844 million in the same

period of 2018, primarily reflecting higher earnings.

Investing activities used net cash of $892 million in the first

six months of 2019, compared with $744 million used in 2018,

primarily reflecting higher additions to property, plant and

equipment.

Cash used in financing activities was $1,038 million in the

first six months of 2019, compared with $1,422 million used in the

same period of 2018. Dividends paid in the first six months of 2019

were $296 million. The per share dividend paid in the first six

months of 2019 was $0.38, up from $0.32 in the same period of 2018.

During the first six months of 2019, the company, under its share

purchase program, purchased about 19.8 million shares for $729

million, including shares purchased from Exxon Mobil Corporation.

In the first six months of 2018, the company purchased about 28.6

million shares for $1,143 million following the increase of its

share purchase program.

Key financial and operating data follow.

Forward-looking statements

Statements of future events or conditions in this release,

including projections, targets, expectations, estimates, and

business plans are forward-looking statements. Forward-looking

statements can be identified by words such as believe, anticipate,

propose, plan, goal, target, estimate, expect, future, continue,

likely, may, should, will and similar references to future periods.

Disclosure related to continued Kearl performance improvements;

ability to deliver on performance commitments for 2019; commitment

to dividends and the share purchase program, and anticipated

purchases under the share purchase program; and future crude by

rail movements constitute forward-looking statements.

Forward-looking statements are based on the company's current

expectations, estimates, projections and assumptions at the time

the statements are made. Actual future financial and operating

results, including expectations and assumptions concerning demand

growth and energy source, supply and mix; commodity prices and

foreign exchange rates; production rates, growth and mix; project

plans, dates, costs, capacities and execution; production life and

resource recoveries; cost savings; applicable laws and government

policies; and capital and environmental expenditures could differ

materially depending on a number of factors. These factors include

changes in the supply of and demand for crude oil, natural gas, and

petroleum and petrochemical products and resulting price and margin

impacts; transportation for accessing markets; political or

regulatory events, including changes in law or government policy,

applicable royalty rates and tax laws; third party opposition to

operations and projects; environmental risks inherent in oil and

gas exploration and production activities; environmental

regulation, including climate change and greenhouse gas regulation

and changes to such regulation; currency exchange rates;

availability and allocation of capital; availability and

performance of third party service providers; unanticipated

operational disruptions; management effectiveness; project

management and schedules; response to technological developments;

operational hazards and risks; cybersecurity incidents; disaster

response preparedness; the ability to develop or acquire additional

reserves; and other factors discussed in Item 1A risk factors and

Item 7 management’s discussion and analysis of financial condition

and results of operations of Imperial Oil Limited’s most recent

annual report on Form 10-K.

Forward-looking statements are not guarantees of future

performance and involve a number of risks and uncertainties, some

that are similar to other oil and gas companies and some that are

unique to Imperial. Imperial’s actual results may differ materially

from those expressed or implied by its forward-looking statements

and readers are cautioned not to place undue reliance on them.

Imperial undertakes no obligation to update any forward-looking

statements contained herein, except as required by applicable

law.

In this release all dollar amounts are expressed in Canadian

dollars unless otherwise stated. This release should be read in

conjunction with Imperial’s most recent Form 10-K. Note that

numbers may not add due to rounding.

The term “project” as used in this release can refer to a

variety of different activities and does not necessarily have the

same meaning as in any government payment transparency reports.

Attachment I

Second Quarter

Six Months

millions of Canadian dollars, unless

noted

2019

2018

2019

2018

Net Income (loss) (U.S. GAAP)

Total revenues and other income

9,261

9,543

17,243

17,477

Total expenses

8,532

9,279

16,116

16,516

Income (loss) before income taxes

729

264

1,127

961

Income taxes

(483)

68

(378)

249

Net income (loss)

1,212

196

1,505

712

Net income (loss) per common share

(dollars)

1.58

0.24

1.95

0.86

Net income (loss) per common share -

assuming dilution (dollars)

1.57

0.24

1.94

0.86

Other Financial Data

Gain (loss) on asset sales, after tax

10

8

6

15

Total assets at June 30

41,929

41,390

Total debt at June 30

5,168

5,194

Shareholders' equity at June 30

25,022

23,765

Capital employed at June 30

30,215

28,978

Dividends declared on common stock

Total

169

155

316

287

Per common share (dollars)

0.22

0.19

0.41

0.35

Millions of common shares outstanding

At June 30

762.8

802.7

Average - assuming dilution

769.9

818.8

774.9

825.2

Attachment II

Second Quarter

Six Months

millions of Canadian dollars

2019

2018

2019

2018

Total cash and cash equivalents at

period end

1,087

873

1,087

873

Net income (loss)

1,212

196

1,505

712

Adjustments for non-cash items:

Depreciation and depletion

392

358

782

735

(Gain) loss on asset sales

(11)

(9)

(6)

(19)

Deferred income taxes and other

(471)

24

(475)

209

Changes in operating assets and

liabilities

(96)

290

223

207

Cash flows from (used in) operating

activities

1,026

859

2,029

1,844

Cash flows from (used in) investing

activities

(429)

(379)

(892)

(744)

Proceeds associated with asset sales

14

9

36

21

Cash flows from (used in) financing

activities

(521)

(1,032)

(1,038)

(1,422)

Attachment III

Second Quarter

Six Months

millions of Canadian dollars

2019

2018

2019

2018

Net income (loss) (U.S. GAAP)

Upstream

985

(6)

1,043

(50)

Downstream

258

201

515

722

Chemical

38

78

72

151

Corporate and other

(69)

(77)

(125)

(111)

Net income (loss)

1,212

196

1,505

712

Revenues and other income

Upstream

3,707

2,971

6,895

5,618

Downstream

6,881

7,221

12,813

13,212

Chemical

314

402

637

779

Eliminations / Corporate and other

(1,641)

(1,051)

(3,102)

(2,132)

Revenues and other income

9,261

9,543

17,243

17,477

Purchases of crude oil and

products

Upstream

1,802

1,573

3,388

2,947

Downstream

5,338

5,803

9,920

10,097

Chemical

171

216

364

418

Eliminations

(1,649)

(1,055)

(3,115)

(2,145)

Purchases of crude oil and products

5,662

6,537

10,557

11,317

Production and manufacturing

expenses

Upstream

1,171

1,106

2,327

2,118

Downstream

474

488

855

856

Chemical

70

52

128

103

Eliminations

-

-

-

-

Production and manufacturing expenses

1,715

1,646

3,310

3,077

Capital and exploration

expenditures

Upstream

301

183

673

389

Downstream

111

88

240

145

Chemical

6

7

23

11

Corporate and other

11

6

22

13

Capital and exploration expenditures

429

284

958

558

Exploration expenses charged to income

included above

5

1

38

9

Attachment IV

Operating statistics

Second Quarter

Six Months

2019

2018

2019

2018

Gross crude oil and natural gas liquids

(NGL) production

(thousands of barrels per day)

Cold Lake

135

133

140

143

Kearl

147

128

137

128

Syncrude

80

50

79

57

Conventional

13

3

13

4

Total crude oil production

375

314

369

332

NGLs available for sale

2

1

1

1

Total crude oil and NGL production

377

315

370

333

Gross natural gas production

(millions of cubic feet per day)

138

128

142

123

Gross oil-equivalent production

(a)

400

336

394

353

(thousands of oil-equivalent barrels per

day)

Net crude oil and NGL production

(thousands of barrels per day)

Cold Lake

108

104

115

116

Kearl

140

122

132

123

Syncrude

69

46

69

53

Conventional

13

3

12

4

Total crude oil production

330

275

328

296

NGLs available for sale

1

1

2

1

Total crude oil and NGL production

331

276

330

297

Net natural gas production

(millions of cubic feet per day)

139

122

140

119

Net oil-equivalent production

(a)

354

296

353

317

(thousands of oil-equivalent barrels per

day)

Cold Lake blend sales (thousands of

barrels per day)

188

182

189

200

Kearl blend sales (thousands of

barrels per day)

198

171

187

182

NGL sales (thousands of barrels per

day)

5

4

6

5

Average realizations (Canadian

dollars)

Bitumen (per barrel)

57.19

48.90

53.20

41.84

Synthetic oil (per barrel)

79.96

86.31

74.77

81.24

Conventional crude oil (per barrel)

58.20

74.55

55.29

69.00

NGL (per barrel)

16.78

35.30

27.20

40.08

Natural gas (per thousand cubic feet)

1.94

2.01

2.40

2.46

Refinery throughput (thousands of

barrels per day)

344

363

364

386

Refinery capacity utilization

(percent)

81

86

86

91

Petroleum product sales (thousands

of barrels per day)

Gasolines

250

259

245

249

Heating, diesel and jet fuels

162

178

172

182

Heavy fuel oils

28

31

23

24

Lube oils and other products

37

42

37

39

Net petroleum products sales

477

510

477

494

Petrochemical sales (thousands of

tonnes)

190

217

385

418

- Gas converted to oil-equivalent at six million cubic feet per

one thousand barrels.

Attachment V

Net income (loss) per

Net income (loss) (U.S. GAAP)

common share - diluted (a)

millions of Canadian dollars

Canadian dollars

2015

First Quarter

421

0.50

Second Quarter

120

0.14

Third Quarter

479

0.56

Fourth Quarter

102

0.12

Year

1,122

1.32

2016

First Quarter

(101)

(0.12)

Second Quarter

(181)

(0.21)

Third Quarter

1,003

1.18

Fourth Quarter

1,444

1.70

Year

2,165

2.55

2017

First Quarter

333

0.39

Second Quarter

(77)

(0.09)

Third Quarter

371

0.44

Fourth Quarter

(137)

(0.16)

Year

490

0.58

2018

First Quarter

516

0.62

Second Quarter

196

0.24

Third Quarter

749

0.94

Fourth Quarter

853

1.08

Year

2,314

2.86

2019

First Quarter

293

0.38

Second Quarter

1,212

1.57

Year

1,505

1.94

(a)

Computed using the average number of

shares outstanding during each period. The sum of the quarters

presented may not add to the year total.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190802005079/en/

Investor relations (587) 476-4743

Media relations (587) 476-7010

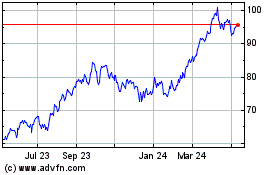

Imperial Oil (TSX:IMO)

Historical Stock Chart

From Jan 2025 to Feb 2025

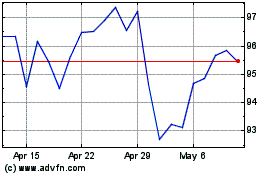

Imperial Oil (TSX:IMO)

Historical Stock Chart

From Feb 2024 to Feb 2025