Golden Minerals Company Produces 14,449 oz Gold During 2021, Exceeding Guidance

January 12 2022 - 6:45AM

Business Wire

Golden Minerals Company (“Golden Minerals”, “Golden” or the

“Company”) (NYSE American: AUMN and TSX: AUMN) has today reported

production data from its Rodeo gold-silver mine (Durango State,

Mexico) for the fourth quarter and full year (“FY”) 2021.

Rodeo’s operation came online in mid-January 2021 and reached a

steady state of throughput in April 2021. Summary production

figures are as follows:

- Payable gold production: 4,831 oz Au in Q4 and 14,449 oz Au in

FY 2021 Au, beating annual production guidance of 12,000 - 14,000

oz Au

- Payable silver production: 15,250 oz in Q4 and 51,058 oz in FY

2021, beating annual guidance of 25,000 - 30,000 oz Ag

- Payable gold equivalent production: 5,028 AuEq oz in Q4 and

15,156 AuEq oz in FY 2021

- High average gold grades: 4.6 g/t Au in Q4 and 4.1 g/t in FY

2021, vs. Preliminary Economic Assessment [link] life of mine

average grade of 3.3.g/t

- Throughput (tonnes per day (“tpd”) processed): 466 tpd in Q4

and 409 tpd in FY 2021

- Gold recovery: 76.5% in Q4 and 74.9% for FY 2021

- Realized gold/silver prices (before selling and refining

costs): $1,784/oz Au in Q4 and $1,793/oz for FY 2021; $23.08/oz Ag

in Q4 and $24.83/oz Ag in FY 2021

Warren Rehn, Golden’s President and Chief Executive Officer,

commented, “2021 was an exciting and successful year for Golden

Minerals, as it marked our progression to junior gold-silver

producer from exploration company based on our Rodeo Mine start-up

and excellent production record. Exceeding our production guidance

for the year is a testament to the success of our very capable

mining team through the planning and execution stages of the mine

start-up and into full production. We are well positioned to

continue our growth strategy in 2022 based on our forecasted

continued production from Rodeo and from the possible re-start of

our Velardeña mining operation.”

Full production data for 2021 is shown in the table below.

Three Months Ended Dec. 31,

2021

Twelve Months Ended Dec. 31,

2021

Total tonnes mined (1)

145,205

661,102

Total tonnes in stockpiles awaiting processing (2)

14,068

14,068

Total tonnes in low grade stockpiles (3)

69,567

69,567

Tonnes processed

42,827

149,411

Tonnes per day processed

466

409

Gold grade processed (grams per tonne)

4.6

4.1

Silver grade processed (grams per tonne)

13.8

12.2

Plant recovery - gold (%)

76.5

74.9

Plant recovery - silver (%)

82.6

89.9

Payable gold produced in dore (ounces)

4,831

14,449

Payable silver produced in dore (ounces)

15,250

51,058

Payable gold equivalent produced in dore (ounces) (4)

5,028

15,156

Gold sold in dore (ounces)

5,164

13,772

Silver sold in dore (ounces)

15,552

48,970

Gold equivalent sold in dore (ounces) (4)

5,366

14,454

Realized price, before refining and selling costs Gold

(dollars per ounce)

1,784

1,793

Silver (dollars per ounce)

23.08

24.83

(1)

Includes all mined material

transported to the plant, stockpiled or designated as waste

(2)

Includes mined material

stockpiled at the mine or transported to the plant awaiting

processing in the plant

(3)

Material grading between 2 g/t

(current cut off grade) and 1 g/t Au held for possible future

processing

(4)

Gold equivalents based on

realized $ Au and $ Ag price

About Golden Minerals

Golden Minerals is a growing gold and silver producer based in

Golden, Colorado. The Company is primarily focused on producing

gold and silver from its Rodeo Mine and advancing its Velardeña

Properties in Mexico and, through partner funded exploration, its

El Quevar silver property in Argentina, as well as acquiring and

advancing selected mining properties in Mexico, Nevada and

Argentina.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended and Section 21E of the Securities Exchange Act of 1934, as

amended, and applicable Canadian securities legislation, including

statements regarding the Company’s growth strategy for 2022 and

projections related to production at the Rodeo and the potential

re-start of the Velardeña mining operation. These statements are

subject to risks and uncertainties, including the overall impact of

the COVID-19 pandemic and the possible future re-suspension of

non-essential activities in Mexico, including mining; higher than

anticipated costs at the Rodeo mine or at Velardeña; declines in

general economic conditions; changes in political conditions, in

tax, royalty, environmental and other laws in the United States,

Mexico or Argentina and other market conditions; and fluctuations

in silver and gold prices. Golden Minerals assumes no obligation to

update this information. Additional risks relating to Golden

Minerals may be found in the periodic and current reports filed

with the SEC by Golden Minerals, including the Company’s Annual

Report on Form 10-K for the year ended December 31, 2020.

Follow us at

www.linkedin.com/company/golden-minerals-company/ and

https://twitter.com/Golden_Minerals

For additional information please visit

http://www.goldenminerals.com/

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220112005233/en/

Golden Minerals Company Karen Winkler, Director of Investor

Relations (303) 839-5060

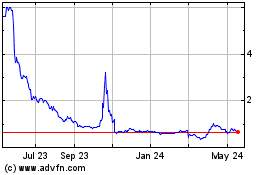

Golden Minerals (TSX:AUMN)

Historical Stock Chart

From Jan 2025 to Feb 2025

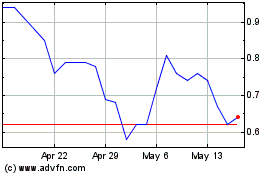

Golden Minerals (TSX:AUMN)

Historical Stock Chart

From Feb 2024 to Feb 2025