Accord Announces Second Quarter and First Half Earnings, Declares Regular Quarterly Dividend and Resolves to Renew Normal Cou...

July 26 2011 - 12:46PM

PR Newswire (Canada)

TORONTO, July 26, 2011 /CNW/ -- TORONTO, July 26, 2011 /CNW/ -

Accord Financial Corp. (TSX: ACD), a leading North American

provider of factoring and other asset-based financial services to

businesses, today released its interim unaudited consolidated

financial results for the three and six months ended June 30,

2011. The financial results presented in this release are

reported in Canadian dollars and have been prepared in accordance

with International Financial Reporting Standards. SUMMARY OF

FINANCIAL RESULTS Three Months Ended June Six Months Ended June 30

30 2011 2010 2011 2010 Factoring $ $ $ volume 455 500 $ 1,005

(millions) 937 Revenue $ 6,828,201 $ 8,069,232 $ $ 15,048,156

13,695,478 Net earnings $ 1,393,639 $ $ $ 3,915,688 2,306,864

2,992,107 Basic and $ $ diluted earnings 0.16 $ $ 0.42 0.25 0.33

per common share Basic and 8,975,460 9,408,833 diluted 8,948,580

9,408,695 weighted average number of shares Net earnings for the

second quarter of 2011 declined 40% to $1,393,639 compared to

$2,306,864 last year. Earnings declined mainly due to lower revenue

and an impairment charge of $462,026 taken against assets held for

sale. Earnings per share decreased to 16 cents compared to 25

cents last year. Factoring volume declined 9% to $455 million

compared to $500 million last year largely due to lower

non-recourse volume. Revenue decreased 15% to $6,828,201

compared to $8,069,232 last year mainly due to lower volume and

miscellaneous fee income. Net earnings for the first six months of

2011 declined 24% to $2,992,107 compared with $3,915,688 in 2010

mainly due to the above noted reasons. Earnings per share declined

to 33 cents compared to 42 cents last year. Factoring volume for

the first half of 2011 declined 7% to $937 million largely as a

result of lower non-recourse volume. Revenue decreased 9% to

$13,695,478 compared to $15,048,156 last year for reasons noted

above. Commenting on the second quarter and first half 2011

results, Mr. Tom Henderson, the Company's President and CEO stated:

"After developing an imaginative and very successful program to

cover risky credits, our non-recourse factoring business saw the

departure of a number of clients when some of the risky accounts

improved to credit-worthy status. The credit insurers, who were

unable to compete with Accord when the going appeared risky,

entered the fray with aggressive rates when the risk dissipated.

Needless to say, this depressed our earnings in the current quarter

and first half of 2011. In addition, our recourse factoring

business took in lower miscellaneous fee income, and incurred an

asset impairment charge. However, we exited the first half with

record funds employed and, accordingly, the second half of 2011

holds the promise of more robust revenue growth." The Company's

Board of Directors today declared a regular quarterly dividend of

$0.075 per share, payable September 1, 2011 to shareholders of

record August 15, 2011. The Board also resolved, subject to

regulatory approval, to renew its normal course issuer bid which

recently terminated when it completed its purchase of 470,373

shares under the bid. To view this news release in HTML formatting,

please use the following URL:

http://www.newswire.ca/en/releases/archive/July2011/26/c7572.html p

Stuart Adairbr/ Vice President, Chief Financial Officerbr/ Accord

Financial Corp.br/ 77 Bloor Street West, 18supth/sup floorbr/

Toronto, ON M5S 1M2br/ (416) 961-0304 Ext.

207br/ a

href="mailto:sadair@accordfinancial.com"sadair@accordfinancial.com/a

/p

Copyright

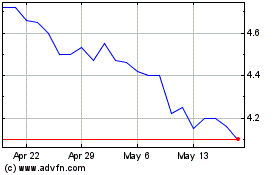

Accord Financial (TSX:ACD)

Historical Stock Chart

From Jun 2024 to Jul 2024

Accord Financial (TSX:ACD)

Historical Stock Chart

From Jul 2023 to Jul 2024