Aberdeen Appoints Seasoned Mining Executive Dev Shetty as Executive Chairman and New CEO and Other Corporate Updates

December 05 2024 - 7:00AM

ABERDEEN INTERNATIONAL INC. (“Aberdeen” or the

“Company”) (TSX: AAB F:A8H, OTC:AABVF) is pleased

to announce the appointment of Dev Shetty as Chief Executive

Officer of the Company and as Executive Chairman of the Company's

board of directors (the “

Board”), effective

immediately. Mr. Shetty's appointment follows Mr. Fred Leigh's

resignation as Chief Executive Officer of the Company, though Mr.

Leigh will remain on the Board.

The appointment of Mr. Shetty is part of the

Board’s strategy to revamp the Company's investment strategy and to

establish a new investment platform focused on identifying and

acquiring assets in energy transition metals, precious metals, base

metals, and gemstones. As part of this new strategy, Mr. Shetty

intends to onboard an executive team with extensive experience

acquiring and managing mining assets.

Mr. Shetty is a chartered accountant and has

extensive experience in private equity, mining, and corporate

turnarounds. His expertise includes direct hands-on management of

all phases of diverse mining projects and he has a particular

expertise in acquiring, and transforming and monetizing mining

projects into valuable assets.

In private equity, Mr. Shetty has successfully

acquired and revitalized key mining assets, including a manganese

and platinum mine in South Africa and an iron ore mine in

Australia. As founder and former CEO of Fura Gems Inc. (previously

listed on the TSXV Venture Exchange), (“Fura

Gems”) he transformed the Fura Gems into the only company

with all three major colour gemstones in its portfolio and turned

mines in Colombia, Mozambique, and Australia into

revenue-generating operations. He is credited with the turnaround

of Gemfields Group Limited, where he was instrumental in developing

the world's largest emerald mine in Zambia and the world’s largest

ruby deposit in Mozambique. Mr. Shetty joined the Board of Prospect

Resources Ltd (“Prospect”) in 2020 and

collaborated with the management and board to create a new strategy

for the company. In 2022, Prospect announced the sale of its

Arcadia Lithium in Zimbabwe at a total valuation of AUD528 million

and a 1,500% share price appreciation over 6 years for Prospect

shareholders.

Mr. Shetty commented on his appointment: "I am

excited about this appointment, and with my team of mining talent,

we look forward to building Aberdeen into a significant force in

the mining sector. We are currently evaluating some exciting

opportunities where attractive valuations are available, given

where the resource sector is positioned. With the talent pool we

are building, we will support portfolio companies with the

operating talents required to create value for the Company. I want

to thank the Board of Aberdeen and Mr. Leigh for this

appointment."

Shares for Debt Settlement

The Company is also pleased to announce that the

Company has entered into shares for debt settlement agreements with

a service provider of the Company to settle an aggregate amount of

approximately C$678,000 of accrued debt obligations and accrued

fees owing to such service provider of the Company (the

"Debt") by issuing common shares of the Company

(the "Debt Shares") at a price of C$0.05 per Debt

Share for a total of 13,560,000 Debt Shares (the "Debt

Settlement").

The Company believes that the Debt Settlement

will strengthen its balance sheet by reducing its liabilities as

well as further align the interests of its creditors with the

shareholders of the Company. The Debt Settlement is subject to the

acceptance of the Toronto Stock Exchange.

ABOUT ABERDEEN INTERNATIONAL INC.

Aberdeen is a global resource investment company

and merchant bank focused on small capitalization companies in the

rare metals and renewable energy sectors.

For additional information, please visit our

website at www.aberdeen.green

For further information, please contact:

Dev ShettyExecutive Chairman and Chief Executive

Officer Aberdeen International Inc. Dev.Shetty@aberdeen.green

This press release contains "forward-looking

information" within the meaning of applicable Canadian securities

legislation. Forward-looking information includes, without

limitation, statements regarding the investment portfolio of the

Company; the appointment of directors and officers; the Debt

Settlement and the Company’s future plans. Forward-looking

information is subject to known and unknown risks, uncertainties

and other factors that may cause the actual results, level of

activity, performance or achievements of the Company to be

materially different from those expressed or implied by such

forward-looking information, including risks inherent in the mining

industry and risks described in the public disclosure of the

Company which is available under the profile of the Company on

SEDAR+ at www.sedarplus.ca and on the Company's website at

www.aberdeen.green. Although the Company has attempted to identify

important factors that could cause actual results to differ

materially from those contained in forward-looking information,

there may be other factors that cause results not to be as

anticipated, estimated or intended. There can be no assurance that

such information will prove to be accurate, as actual results and

future events could differ materially from those anticipated in

such statements. Accordingly, readers should not place undue

reliance on forward-looking information. The Company does not

undertake to update any forward-looking information, except in

accordance with applicable securities laws.

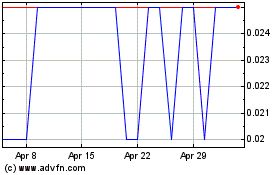

Aberdeen (TSX:AAB)

Historical Stock Chart

From Jan 2025 to Feb 2025

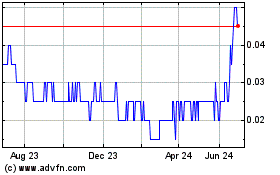

Aberdeen (TSX:AAB)

Historical Stock Chart

From Feb 2024 to Feb 2025