adidas Group Full Year 2007 Results

March 05 2008 - 1:33AM

Business Wire

Fourth quarter adidas Group (FWB:ADS) currency-neutral sales grow

14% Fourth quarter Group revenues grew 14% on a currency-neutral

basis. This development was driven by strong sales increases at

both adidas and TaylorMade-adidas Golf. Reebok sales, however,

declined. On a regional basis, sales grew by double-digit rates in

all regions except North America, where sales increased at a

low-single-digit rate. Currency movements negatively impacted

revenues in euro terms. Group sales in euro terms increased 8% to �

2.419 billion in the fourth quarter of 2007 (2006:

��2.248�billion). Fourth quarter net income attributable to

shareholders up 63% Fourth quarter gross margin increased 3.2

percentage points to 46.6% (2006: 43.4%) as a result of underlying

improvements in all segments. Cost synergies resulting from the

combination of adidas and Reebok sourcing activities and, to a

lesser extent, the non-recurrence of negative impacts from purchase

price allocation in the Reebok segment also positively impacted

gross margin development. Group gross profit increased 15% to

��1.127�billion (2006: � 976 million). Operating expenses as a

percentage of sales increased mainly due to higher marketing

expenses in the adidas segment. As a result of the strong gross

margin increase, which more than offset the increase in operating

expenses, the Group�s operating margin increased 0.2 percentage

points to 2.5% in the fourth quarter of 2007 versus 2.3% in the

prior year. Operating profit grew 18% to � 61 million versus

��52�million in 2006. The Group�s net income attributable to

shareholders increased 63% to � 21 million (2006: ��13�million) due

to higher operating profit and lower net financial expenses. Net

financial expenses decreased following the strong reduction of net

borrowings. These positive effects more than offset a higher tax

rate. adidas Group currency-neutral sales grow 7% in 2007 In 2007,

Group revenues increased 7% on a currency-neutral basis, mainly

as�a result of sales growth in the adidas segment. Currency

movements negatively impacted Group sales in euro terms. Group

revenues grew 2% to ��10.299 billion in 2007 from � 10.084 billion

in 2006. �Our Group made big strides in 2007,� commented adidas AG

Chairman and CEO Herbert Hainer. �Our focus on performance and

executional excellence was a big contributor to our success. I am

extremely proud that all our hard work has helped the Group achieve

new record sales and net income levels - and all this despite

conditions that got tougher in some important markets as the year

went on.� adidas segment drives top-line growth The adidas segment

set the pace for the Group�s sales growth in 2007. Currency-neutral

adidas segment revenues increased 12% during the period,

representing the brand�s third consecutive year of double-digit

growth. Currency-neutral sales in the Reebok segment were stable as

a result of the consolidation of twelve months of Reebok�s revenues

in 2007 versus only eleven months in the prior year. On a

like-for-like basis1, Reebok segment sales declined by 5% in 2007.

At TaylorMade-adidas Golf, currency-neutral revenues increased 1%,

negatively impacted by the divestiture of the Greg Norman

Collection wholesale business. On a like-for-like basis,

TaylorMade-adidas Golf sales increased 9%. Sales in the

HQ/Consolidation segment decreased by 60% on a currency-neutral

basis, mainly due to the expiration of the Salomon footwear

sourcing cooperation agreement. Currency translation effects

negatively impacted sales in all segments in euro terms. adidas

sales increased 7% to � 7.113 billion in 2007 from � 6.626 billion

in 2006. Sales at Reebok decreased 6% to � 2.333 billion versus �

2.473 billion in the prior year. TaylorMade-adidas Golf sales

declined 6% to � 804 million in 2007 from � 856 million in 2006.

HQ/Consolidation sales decreased 62% to � 48 million from � 129

million in the prior year. 1 This like-for-like comparison of

Reebok segment revenues reflects sales for the full twelve-month

periods of both years. It also includes GNC retail sales which were

transferred from the TaylorMade-adidas Golf segment to the Reebok

segment, effective January 1, 2007. However, it excludes sales

related to the NBA and Liverpool licensed businesses. These were

transferred to brand adidas in the first half of 2006. Sales

increase in nearly all regions adidas Group sales grew in all

regions except North America in 2007. Group sales in Europe grew 7%

on a currency-neutral basis as a result of strong growth in the

region�s emerging markets. In North America, Group sales declined

2% on a currency-neutral basis due to lower Reebok sales in the

USA. Sales for the adidas Group in Asia increased 18% on a

currency-neutral basis, driven in particular by strong growth in

China. In Latin America, sales grew 38% on a currency-neutral

basis, with increases coming from all of the region�s major

markets. Currency translation effects negatively impacted sales in

euro terms in all regions. In euro terms, sales in Europe increased

5% to � 4.369 billion in 2007 from � 4.162 billion in 2006. Sales

in North America decreased 9% to � 2.929 billion in 2007 from �

3.234 billion in the prior year. Revenues in Asia grew 12% to �

2.254 billion in 2007 from ��2.020�billion in 2006. Sales in Latin

America grew 32% to � 657 million in 2007 from � 499 million in the

prior year. Gross margin increases by 2.8 percentage points The

gross margin of the adidas Group increased by 2.8 percentage points

to 47.4% in 2007 (2006: 44.6%). The non-recurrence of negative

impacts from purchase price allocation in the Reebok segment, which

in 2006 amounted to � 76 million, positively impacted gross margin

development. Cost synergies resulting from the combination of

adidas and Reebok sourcing activities as well as underlying

improvements in all segments also contributed to this development.

As a result, gross profit for the adidas Group rose 9% in 2007

to�reach � 4.882 billion versus ��4.495�billion in the prior year.

Operating margin reaches 9.2% The operating margin of the adidas

Group increased 0.5 percentage points to 9.2% in 2007 (2006: 8.7%).

The operating margin increase was a result of the Group�s gross

margin improvement, which more than offset higher operating

expenses as a percentage of sales. Operating expenses as a

percentage of sales grew 2.5 percentage points to 39.2% in 2007

from 36.7% in 2006. This increase primarily reflects one-time costs

related to the integration of Reebok into the adidas Group as well

as higher expenses in the Reebok segment for marketing, product

development and initiatives to grow the brand in emerging markets.

Group operating profit increased 8% in 2007 to reach � 949 million

versus � 881 million in 2006. Income before taxes increases by 13%

Income before taxes increased 13% to � 815 million in 2007 from

��723�million in 2006. Operational improvements and lower financial

expenses contributed to this development. Net financial expenses

decreased 15% to � 134 million in 2007 from � 158 million in the

prior year mainly as a result of the strong reduction of net

borrowings. Net income attributable to shareholders grows 14% The

Group�s net income attributable to shareholders increased 14% to

��551�million in 2007 from � 483 million in 2006, representing the

seventh consecutive year of double-digit earnings growth. The

Group�s higher operating profit, lower net financial expenses and

lower minority interests each contributed to this development.

These effects more than offset a slightly higher tax rate. Basic

and diluted earnings per share both increase 14% In line with the

increase of the Group�s net income attributable to shareholders,

basic earnings per share increased 14% to � 2.71 in 2007 versus �

2.37 in 2006. Diluted earnings per share in 2007 also increased 14%

to � 2.57 from � 2.25 in the prior year. Continued working capital

progress Group inventories increased 1% to � 1.629 billion at the

end of 2007 versus ��1.607 billion in 2006. On a currency-neutral

basis, inventories grew 7%. The�increase was driven by higher

inventory levels in emerging markets, reflecting the Group�s high

sales growth expectations for these countries in particular. Group

receivables increased 3% to � 1.459 billion (2006:

��1.415�billion). On a currency-neutral basis, receivables grew 8%.

This is well below sales growth in the fourth quarter of 2007. Net

borrowings reduced by nearly � 500 million Net borrowings at

December 31, 2007 amounted to � 1.766 billion, which represents a

reduction of � 465 million, or 21%, versus � 2.231 billion in the

prior year. This improvement was significantly better than the

Group�s original target of below � 2 billion as communicated at the

beginning of 2007. The Group�s strong profitability improvement and

continued tight working capital management were the primary drivers

of this decline. Consequently, the Group�s financial leverage also

improved significantly to 58.4% at the end of 2007 versus 78.9% in

the prior year. adidas backlogs at highest level in almost 10 years

Backlogs for the adidas brand at the end of 2007 increased 17%

versus the prior year on a currency-neutral basis. This improvement

represents the highest growth rate in almost ten years. It was

supported by adidas� strength in all major categories. Order

backlogs in Europe were positively impacted by orders for UEFA EURO

2008� related products. In euro terms, adidas backlogs grew 12%.

Footwear backlogs increased 13% in currency-neutral terms (+8% in

euros). Double-digit growth in both Asia and Europe more than

offset a small decline in North America. Apparel backlogs grew 20%

on a currency-neutral basis (+15% in euros), driven by strong

double-digit increases in Asia and Europe. Reebok backlogs decline

Currency-neutral Reebok backlogs at the end of 2007 were down 8%

versus the prior year on a currency-neutral basis. In euro terms,

this represents a decline of 14%. Footwear backlogs decreased 12%

in currency-neutral terms (�18% in euros). This is the result of

lower orders from mall-based retailers in North America scheduled

for delivery in the first half of 2008. Apparel backlogs grew by 3%

on a currency-neutral basis (�3% in euros). Group sales to increase

at a high-single-digit rate In 2008, adidas Group sales are

expected to increase at a high-single-digit rate on a

currency-neutral basis, driven by growth at all brands. The adidas

segment is projected to achieve high-single-digit currency-neutral

sales growth in 2008. Revenues in the Reebok segment are expected

to grow at a low- to mid-single-digit rate on a currency-neutral

basis. Currency-neutral TaylorMade-adidas Golf sales are forecasted

to grow at a mid-single-digit rate. Gross and operating margins to

improve further in 2008 The adidas Group gross margin is expected

to increase modestly to a range of 47.5 to 48%. Operating expenses

as a percentage of sales are expected to be higher mainly as a

result of increases in the marketing working budget as a percentage

of sales at both adidas and Reebok to support the brands� presence

at this year�s major sporting events. The operating margin for the

adidas Group is forecasted to increase to at least 9.5% as a result

of operating margin improvements in all segments. 2008 net income

to grow at least 15% Net income attributable to shareholders is

projected to grow by at least 15% in 2008 versus the 2007 level of

� 551 million. This represents the eighth consecutive year of

double-digit net income growth. Top-line improvement and an

increased operating margin will be the primary drivers of this

positive development. 19% dividend increase to be proposed At the

Group�s Annual General Meeting on May 8, 2008, the adidas AG

Executive and Supervisory Boards intend to propose a dividend of �

0.50 per share for the 2007 financial year (2006: � 0.42). Based on

the number of shares outstanding at the end of 2007, the dividend

payout will increase 19% to � 102 million (2006: � 85 million)1,

outpacing the earnings growth of 14% in 2007. This represents a

payout ratio of 19% (2006: 18%) and demonstrates Management�s

confidence in the Group�s future business performance. 1 Actual

payout may be lower due to current share buyback program. Excess

cash largely to be used for adidas share buyback On January 29,

2008, adidas AG announced the launch of a share buyback program of

up to � 420 million. As at March 4, 2008, adidas AG had bought back

2.1 million shares with an average purchase price of � 42.84.

adidas AG intends to cancel the repurchased shares, thus reducing

its stock capital. As a�result, the Group�s equity ratio will

decrease and earnings per share will increase. The Group�s excess

cash will be largely invested in the buyback. Net�borrowings will

consequently be at or slightly below the prior year level. Herbert

Hainer: �We have positioned our Group for continued growth in 2008

and beyond. Our strong positions at the European

Football�Championships and the Olympic Games in Beijing as well as

our focus on executing our brand strategies globally will propel us

to new heights. We will continue to grow both our top and bottom

line in 2008, achieving new record results.� Please visit our

corporate website: www.adidas-Group.com

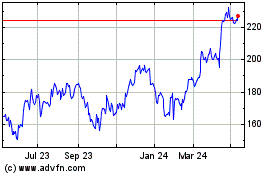

Adidas (TG:ADS)

Historical Stock Chart

From Feb 2025 to Mar 2025

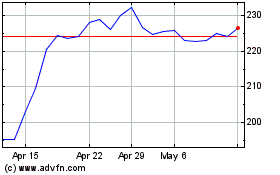

Adidas (TG:ADS)

Historical Stock Chart

From Mar 2024 to Mar 2025