LFL growth of 0.5% in Q3. Continued progress

against our strategic objectives with important client wins and

retentions. Full year guidance reiterated

WPP (NYSE: WPP) today reported its 2024 Third Quarter Trading

Update.

Third quarter

£m

+/(-) % reported1

+/(-) %

LFL2

Revenue

3,558

1.4

4.1

Revenue less pass-through costs

2,765

(2.6)

0.5

Year to date

Revenue

10,784

0.5

3.1

Revenue less pass-through costs

8,364

(3.3)

(0.5)

Q3 highlights

- Q3 reported revenue +1.4%, LFL revenue +4.1%

- Q3 LFL revenue less pass-through costs +0.5%, with North

America +1.7%, Western Continental Europe +2.2% and UK flat,

partially offset by a 2.2% decline in Rest of World, reflecting a

continued decline in China (-21.3%)

- Global Integrated Agencies Q3 LFL revenue less pass-through

costs grew 0.5% (Q3 2023: +0.1%). GroupM growth improved

sequentially to 4.8% (Q3 2023: +1.6%), offset by a 3.1% decline at

integrated creative agencies (Q3 2023: -1.1%)

- Top ten clients3 grew 7.0% in Q3. CPG, automotive, travel &

leisure and financial services client sectors grew well in the

quarter. Technology client sector stabilising, with growth of 1.3%

in Q3 vs -5.1% in H1 2024. Healthcare and retail sectors continued

to be impacted by 2023 client losses

- Strong progress on strategic initiatives with new products,

capabilities and solutions launched within WPP Open, our AI-powered

marketing operating system. Burson, GroupM and VML on track to

deliver targeted savings and build simpler, stronger

businesses

- Q3 net new billings4 $1.5bn (Q3 2023: $1.4bn). Year-to-date

$3.2bn (YTD 2023: $3.4bn). Encouraging success in recent pitches

built around WPP Open

- Client wins in Q3 included Amazon (media ex Americas), Unilever

(media, retail media and activation, and creative) and Henkel

(media). Strong start to Q4 with Starbucks (US creative) and Honor

(global media including China)

- Adjusted net debt as at 30 September 2024 £3.6bn, down £0.3bn

year-on-year

- Agreement to sell WPP’s majority stake in FGS Global on track

to close in Q4, generating net cash proceeds to WPP of c.£604m

after tax (link). Proceeds will be used to reduce leverage

- 2024 guidance unchanged: 2024 LFL revenue less pass-through

costs of -1% to 0%, with Q4 facing a tougher comparative than Q3

and macro uncertainty. Improvement in FY24 headline operating

profit margin of 20-40bps (excluding the impact of FX)

Mark Read, Chief Executive Officer of WPP, said:

“Our third quarter delivered like-for-like growth in net sales5,

with a strong performance from GroupM in particular. We saw growth

in North America, Western Continental Europe and India, though

trading in China remains difficult.

“Most importantly, we returned to form in new business, winning

Amazon’s media account outside the Americas and securing our media

relationship with Unilever, including taking back the retail media

and activation business in the United States. Our success with two

of the world’s top ten advertisers demonstrates the renewed

competitiveness of our offer. We are also proud to be supporting

the new Starbucks leadership team with our recent creative win in

the United States.

“Our people are increasingly embedding AI in the way that we

work and deliver creative and media campaigns to clients, with

usage of WPP Open up 107%6 since the beginning of the year.

Supporting this, the creation of VML and Burson, and the

simplification of GroupM, are delivering a stronger business and

structural cost savings.

“We are encouraged by progress during the quarter, but with

recent new business wins primarily impacting 2025 and continuing

macroeconomic pressures our expectations for the full year remain

unchanged.”

Strategic progress

We have continued to make strong progress against each of our

four strategic pillars.

Lead through AI, data and technology

At our Capital Markets Day, we laid out our plans to embrace AI

and invest in the technology and data that is required. WPP Open,

our intelligent marketing operating system powered by AI, is a

critical component of our strategy, enabling us to use AI in how we

work.

We have continued to invest in WPP Open as part of our annual

investment of £250m in AI-driven technology. We have developed new

functionality and integrated new AI models and, as a result, have

seen growing adoption and usage across WPP and by our clients.

Since the start of the year, we are seeing monthly active users

up 107%, LLM usage up 300% and image generation up 349% as we work

to drive increased adoption across WPP. We are also seeing growing

adoption by clients, with key clients using the platform including

Google, IBM, L'Oréal, LVMH, Nestlé and The Coca-Cola Company. In

particular, clients are seeing significant value in using WPP Open

to streamline how they work with WPP, using the workflow elements

of the platform to standardise processes.

Functionality and Model Integration

WPP Open is a single marketing operating system that powers all

of WPP’s businesses. The core Studios – Creative, Production,

Media, Experience, Commerce and PR – are designed to support key

functional areas with AI-powered applications in a way that allows

for integrated ways of working across the company.

During the quarter, we launched a new iOS and Android companion

app for WPP Open, providing mobile access to key functionality

within Open across WPP. This includes capabilities which enable our

new business, client management, and strategy teams to deliver more

effective and efficient work. Within Creative Studio we have

launched Canvas, a new natural language user interface, which

provides an intuitive platform for a variety of use cases, linking

AI-powered ideation to creative workflow.

WPP Open’s Media Studio continued its rollout to clients and was

central to our successful pitch at Amazon. Media Studio provides an

end-to-end workflow solution accessing GroupM’s scale and

Choreograph data and technology. It enables the automation of

complex media decisions, choosing from thousands of AI-powered

strategies and leveraging 2.3 trillion AI-evaluated impressions to

build unique audiences and activate and measure campaigns across a

full range of channels.

Media Studio provides access to Choreograph’s global data graph

that enables intelligent activation across more than 73 markets and

5 billion consumer profiles, creating the most connectivity between

owned, partner and client datasets in the media marketplace.

Combining owned data; data that we generate from planning,

optimisation and campaigns across GroupM; partner and third-party

data; and client owned data, we can discover insights, plan

communications, optimise campaigns and measure effectiveness, all

within Media Studio’s sophisticated web-based user interface.

Our Work with Clients

Not only is AI enabling us to innovate in how we work with

clients and to produce work in new ways, it is also allowing us to

develop new ground-breaking consumer experiences for our clients.

We continue to lead the way in demonstrating the power of the

technology to build more relevant and personalised experiences for

our clients.

Some examples include:

- ‘Adscan by Makro’ uses AI-powered recognition of product

images to harness brands’ outdoor advertising, directing them to

Makro’s e-commerce platform to buy those products at a

discount.

- Mondelēz’s ‘Cadbury Give a Cheer to a Volunteer’ uses AI

to allow Cadbury consumers to create customised short animated

videos to celebrate the generosity of sporting volunteers.

- Mars Wrigley’s Mars Bar ‘For You Who Did That Thing You

Did’ leverages AI to reward Australians for their everyday

achievements with a campaign through Amazon.com.au.

Partnerships

In August, in partnership with Pacvue, we launched an Integrated

Commerce Management solution to enhance our retail media capability

by unifying bespoke insights, media management, and retail

operations exclusively for GroupM clients.

In October, we announced a global technology partnership with

Roblox, a leading immersive gaming and creation platform, building

on several years of collaboration on interactive 3D brand content

and advertising. The alliance will help scale expertise among

agency teams and brands in leveraging Roblox as a new media

channel.

Accelerate growth through the power of creative

transformation

Creativity is what sets WPP apart, and when combined with AI,

technology, data and the largest global media platform, we have an

unparalleled integrated offer to clients.

That offer is resonating well, as reflected in growth across our

largest clients, driving expansion in scope for many top clients,

with wins including both creative and media assignments for

Unilever during the quarter and in new assignments such as

Starbucks.

During the quarter we acquired New Commercial Arts (‘NCA’), a

fast-growing independent creative agency employing around 90

people, with clients including Sainsbury’s, MoneySuperMarket,

Vodafone, Nando’s and Paramount+. NCA was founded in 2020 by a team

including industry leaders James Murphy and David Golding.

Build world-class, market-leading brands

We have made excellent progress towards building stronger,

world-class brands.

VML launched in January 2024 and played a key role in client

assignment wins during the year to date, including AstraZeneca,

Colgate-Palmolive, Perrigo, Starbucks and Telefonica. VML’s

industry-leading capabilities in commerce were also a factor in

media assignment wins at Amazon and Unilever.

As announced in August, Brian Lesser joined in September as

Global CEO of GroupM. The GroupM simplification initiative is

progressing well, with related cost actions on track to be

completed by the end of 2024. Media Studio, a key component of WPP

Open, is now our go-to-market platform for GroupM, bringing

together our global media tools and capability.

Burson, which launched in June, continued to strengthen and

broaden its PR offer and delivered new client assignment wins at

Google, Honor and ViiV Healthcare.

Execute efficiently to drive financial returns through margin

and cash

As well as the structural cost savings relating to the

initiatives above, we are making good progress in our back-office

efficiency programme across enterprise IT, finance, procurement and

real estate.

In real estate, our ongoing campus programme and consolidation

of leases continues to deliver benefits. Four new campuses opened

during the quarter, including WPP’s third London campus at One

Southwark Bridge, now the location for all staff from London-based

GroupM agencies.

Purpose and ESG

WPP’s purpose is to use the power of creativity to build better

futures for our people, planet, clients and communities. Read more

on the ways WPP is working to deliver against its purpose in our

2023 Sustainability Report.

Third quarter overview

Revenue was £3.6bn, up 1.4% from £3.5bn in Q3 2023, and up 4.1%

like-for-like. Revenue less pass-through costs was £2.8bn, down

2.6% from Q3 2023, and up 0.5% like-for-like.

Q3 2024

£m

%

reported

%

M&A

%

FX

%

LFL

Revenue

3,558

1.4

0.2

(2.9)

4.1

Revenue less pass-through

costs

2,765

(2.6)

(0.2)

(2.9)

0.5

YTD 2024

£m

%

reported

%

M&A

%

FX

%

LFL

Revenue

10,784

0.5

0.4

(3.0)

3.1

Revenue less pass-through

costs

8,364

(3.3)

0.1

(2.9)

(0.5)

Segmental review

Business segments - revenue less pass-through costs

% LFL +/(-)

Global

Integrated

Agencies

Public Relations

Specialist Agencies

Q3 2024

0.5

0.2

0.8

YTD 2024

(0.3)

(0.5)

(2.9)

Global Integrated Agencies: GroupM, our media planning

and buying business, grew 4.8% in Q3 (Q2: +1.4%), offset by a 3.1%

decline at other Global Integrated Agencies (Q2: -2.4%).

GroupM saw broad-based growth in all major markets, including

the US, UK and Germany, partially offset by weakness in China.

GroupM saw good growth from existing and new clients and a benefit

from an easier comparison against the prior year (Q3 2023:

+1.6%).

Our integrated creative agencies declined 3.1%. Hogarth

continued to grow well, benefiting from new business wins and

growing demand for its technology and AI-driven capabilities, as

clients seek to produce more personalised and addressable content.

Ogilvy grew well in the US, benefiting from recent client

assignment wins, but this was offset by weakness in China. VML

continued to be impacted by the loss of Pfizer creative

assignments, partially offset by growth in spending by automotive

and technology clients. AKQA saw continued pressure on

project-related work with macroeconomic uncertainty resulting in

more cautious client spend.

Public Relations: Burson, created in June from the merger

of BCW and Hill & Knowlton, made good progress with its

integration and launched additional AI-powered tools including

Decipher Health. During the quarter, Burson declined mid-single

digits as the business continued to be impacted by the loss of

Pfizer assignments and the impact of macroeconomic uncertainty on

some areas of client spending. This was offset by continued strong

growth at FGS Global. The planned sale of FGS Global to KKR is

expected to close in Q4 2024.

Specialist Agencies: CMI Media Group, our specialist

healthcare media planning and buying agency, grew well. Landor and

Design Bridge and Partners declined due to continued pressure on

project-based spending, partially offset by stabilisation in some

smaller agencies against easier comparisons.

Regional segments - revenue less pass-through costs

% LFL +/(-)

North America

United Kingdom

Western Continental

Europe

Rest of World

Q3 2024

1.7

0.0

2.2

(2.2)

YTD 2024

(0.5)

(1.8)

1.9

(1.7)

North America grew by 1.7% in Q3 2024, reflecting good growth in

automotive and financial services client spending, offset by lower

revenues in healthcare, due to a 2023 client loss.

United Kingdom net sales were unchanged on the prior year on a

LFL basis with good year-on-year growth at GroupM, benefiting from

an easier comparison, offset by weakness in project-based spend at

smaller agencies. By client sector, CPG delivered good growth, but

this was offset by weaker spending from healthcare, retail and

automotive clients.

Western Continental Europe grew 2.2%, reflecting growth in

Germany, against an easier comparison, and in France and Spain. CPG

and automotive were the strongest client sectors.

The Rest of World declined by 2.2% in Q3 2024 as growth in most

regions was offset by a decline of 21.3% in China on client

assignment losses and persistent macroeconomic pressures impacting

both our media and creative businesses.

The new management team in China continues to bring together the

best of our talent and capabilities in the region and build on our

market-leading position. Our new business momentum has begun to

stabilise, with several key client retentions, including the

retention of a global assignment with expanded scope for Honor.

While we expect performance to continue to be challenging in the

rest of 2024 and into 2025, we are confident these actions will

strengthen our business in an important strategic market for

WPP.

Top five markets - revenue less pass-through costs

% LFL +/(-)

USA

UK

Germany

China

India

Q3 2024

1.9

0.0

1.4

(21.3)

2.3

YTD 2024

(0.3)

(1.8)

(2.8)

(20.6)

6.2

Client sector review - revenue less pass-through

costs

Q3 2024

YTD 2024

YTD 2024

% LFL +/(-)

% LFL +/(-)

% share, revenue

less pass-through

costs7

CPG

7.6

7.3

28.1

Tech & Digital Services

1.3

(3.1)

17.2

Healthcare & Pharma

(7.7)

(8.6)

11.2

Automotive

5.8

2.9

10.5

Retail

(5.9)

(8.6)

8.9

Telecom, Media & Entertainment

(2.3)

3.3

6.8

Financial Services

5.3

2.2

6.3

Other

(15.4)

(15.3)

4.7

Travel & Leisure

10.8

5.6

3.7

Government, Public Sector &

Non-profit

4.1

(2.9)

2.6

Balance sheet highlights

As at 30 September 2024, adjusted net debt was £3.6bn, £0.3bn

lower compared to £3.9bn as at 30 September 2023. Average adjusted

net debt in the twelve months to 30 September 2024 was £3.6bn,

£0.1bn higher compared to £3.5bn for the twelve months to 30

September 2023.

The agreement, announced in August, to sell WPP’s majority stake

in FGS Global to KKR at an enterprise valuation of $1.7bn, is

expected to close in Q4, generating net cash proceeds to WPP of

c.£604m after tax. Proceeds will be used to reduce leverage.

Outlook

Our guidance for 2024 is as follows:

Like-for-like revenue less

pass-through costs growth of -1% to 0%;

Headline operating margin

improvement of 20-40bps (excluding the impact of FX)

Other 2024 financial indications:

- Mergers and acquisitions will have a slightly negative impact

to revenue less pass-through costs growth, primarily due to the

expected disposal of FGS Global and limited M&A activity in FY

2024 (previously <0.5%)

- FX impact: current rates (at 16 October 2024) imply a c.3.2%

drag on FY 2024 revenue less pass-through costs, with a 0.2pt drag

expected on FY 2024 headline operating margin

- Headline income from associates8 and non-controlling interests

at similar levels to 2023

- Headline net finance costs of around £295m

- Headline effective tax rate9 of around 28%

- Capex of around £260m

- Cash restructuring costs of around £285m

- Working capital expected to be broadly flat year-on-year

Medium-term targets

In January 2024 we presented an updated medium-term financial

framework including the following three targets:

- 3%+ LFL growth in revenue less pass-through costs

- 16-17% headline operating profit margin

- Adjusted operating cash flow conversion of 85%+10

Business sector and regional analysis

Business sector11

Revenue analysis

Q3

YTD

£m

+/(-) %

reported

+/(-) % LFL

£m

+/(-) %

reported

+/(-) % LFL

Global Int. Agencies

3,011

2.1

4.8

9,127

1.1

3.7

Public Relations

292

(3.3)

0.0

893

(2.9)

(0.6)

Specialist Agencies

255

(1.2)

1.4

764

(1.9)

0.1

Total Group

3,558

1.4

4.1

10,784

0.5

3.1

Revenue less pass-through costs analysis

Q3

YTD

£m

+/(-) %

reported

+/(-) % LFL

£m

+/(-) %

reported

+/(-) % LFL

Global Int. Agencies

2,268

(2.5)

0.5

6,863

(3.2)

(0.3)

Public Relations

274

(3.0)

0.2

842

(2.8)

(0.5)

Specialist Agencies

223

(2.3)

0.8

659

(5.1)

(2.9)

Total Group

2,765

(2.6)

0.5

8,364

(3.3)

(0.5)

Regional

Revenue analysis

Q3

YTD

£m

+/(-) %

reported

+/(-) %

LFL

£m

+/(-) %

reported

+/(-) %

LFL

N. America

1,376

3.0

5.9

4,157

1.9

3.6

United Kingdom

550

7.7

7.3

1,608

2.1

1.6

W Cont. Europe

693

(0.2)

2.3

2,151

(0.9)

2.0

Rest of World12

939

(2.9)

1.3

2,868

(1.2)

4.0

Total Group

3,558

1.4

4.1

10,784

0.5

3.1

Revenue less pass-through costs analysis

Q3

YTD

£m

+/(-) %

reported

+/(-) %

LFL

£m

+/(-) %

reported

+/(-) %

LFL

N. America

1,092

(1.2)

1.7

3,299

(2.7)

(0.5)

United Kingdom

390

0.3

0.0

1,169

(1.3)

(1.8)

W Cont. Europe

554

0.0

2.2

1,718

(0.8)

1.9

Rest of World

729

(7.7)

(2.2)

2,178

(7.0)

(1.7)

Total Group

2,765

(2.6)

0.5

8,364

(3.3)

(0.5)

Cautionary statement regarding forward-looking

statements

This document contains statements that are, or may be deemed to

be, “forward-looking statements”. Forward-looking statements give

the Company’s current expectations or forecasts of future

events.

These forward-looking statements may include, among other

things, plans, objectives, beliefs, intentions, strategies,

projections and anticipated future economic performance based on

assumptions and the like that are subject to risks and

uncertainties. These statements can be identified by the fact that

they do not relate strictly to historical or current facts. They

use words such as ‘aim’, ‘anticipate’, ‘believe’, ‘estimate’,

‘expect’, ‘forecast’, ‘guidance’, ‘intend’, ‘may’, ‘will’,

‘should’, ‘potential’, ‘possible’, ‘predict’, ‘project’, ‘plan’,

‘target’, and other words and similar references to future periods

but are not the exclusive means of identifying such statements. As

such, all forward-looking statements involve risk and uncertainty

because they relate to future events and circumstances that are

beyond the control of the Company. Actual results or outcomes may

differ materially from those discussed or implied in the

forward-looking statements. Therefore, you should not rely on such

forward-looking statements, which speak only as of the date they

are made, as a prediction of actual results or otherwise. Important

factors which may cause actual results to differ include but are

not limited to: the impact of epidemics or pandemics including

restrictions on businesses, social activities and travel; the

unanticipated loss of a material client or key personnel; delays or

reductions in client advertising budgets; shifts in industry rates

of compensation; regulatory compliance costs or litigation; changes

in competitive factors in the industries in which we operate and

demand for our products and services; changes in client

advertising, marketing and corporate communications requirements;

our inability to realise the future anticipated benefits of

acquisitions; failure to realise our assumptions regarding goodwill

and indefinite lived intangible assets; natural disasters or acts

of terrorism; the Company’s ability to attract new clients; the

economic and geopolitical impact of the conflicts in Ukraine and

Gaza; the risk of global economic downturn; slower growth,

increasing interest rates and high and sustained inflation; supply

chain issues affecting the distribution of our clients’ products;

technological changes and risks to the security of IT and

operational infrastructure, systems, data and information resulting

from increased threat of cyber and other attacks; effectively

managing the risks, challenges and efficiencies presented by using

Artificial Intelligence (AI) and Generative AI technologies and

partnerships in our business; risks related to our environmental,

social and governance goals and initiatives, including impacts from

regulators and other stakeholders, and the impact of factors

outside of our control on such goals and initiatives; the Company’s

exposure to changes in the values of other major currencies

(because a substantial portion of its revenues are derived and

costs incurred outside of the UK); and the overall level of

economic activity in the Company’s major markets (which varies

depending on, among other things, regional, national and

international political and economic conditions and government

regulations in the world’s advertising markets). In addition, you

should consider the risks described in Item 3D, captioned ‘Risk

Factors’ in the Group’s Annual Report on Form 20-F for 2023, which

could also cause actual results to differ from forward-looking

information. Neither the Company, nor any of its directors,

officers or employees, provides any representation, assurance or

guarantee that the occurrence of any events anticipated, expressed

or implied in any forward-looking statements will actually occur.

Accordingly, no assurance can be given that any particular

expectation will be met and investors are cautioned not to place

undue reliance on the forward-looking statements.

Other than in accordance with its legal or regulatory

obligations (including under the Market Abuse Regulation, the UK

Listing Rules and the Disclosure and Transparency Rules of the

Financial Conduct Authority), The Company undertakes no obligation

to update or revise any such forward-looking statements, whether as

a result of new information, future events or otherwise.

Any forward looking statements made by or on behalf of the Group

speak only as of the date they are made and are based upon the

knowledge and information available to the Directors at the

time.

______________________________

1.

Percentage change in reported

sterling.

2.

Like-for-like. LFL comparisons

are calculated as follows: current year, constant currency actual

results (which include acquisitions from the relevant date of

completion) are compared with prior year, constant currency actual

results from continuing operations, adjusted to include the results

of acquisitions and disposals for the commensurate period in the

prior year.

3.

Growth in Q3 2024 for the top 10

clients by revenue less pass-through costs in YTD 2023. Growth rate

includes the adverse impact of a client loss in the healthcare

sector.

4.

As defined in the glossary on

page 43 of WPP’s 2024 Interim Results. Note Q3 net new billings

include expanded scope won alongside retentions at Unilever, Honor

and Henkel.

5.

“Net sales” refers to revenue

less pass-through costs.

6.

Increase in monthly active users

January to September 2024.

7.

Proportion of WPP revenue less

pass-through costs in YTD 2024; table made up of clients

representing 79% of WPP total revenue less pass-through costs.

8.

In accordance with IAS 28:

Investments in Associates and Joint Ventures once an investment in

an associate reaches zero carrying value, the Group does not

recognise any further losses, nor income, until the cumulative

share of income returns the carrying value to above zero.

9.

Measured as headline tax as a %

of headline profit before tax.

10.

Adjusted operating cash flow

divided by headline operating profit.

11.

Prior year figures have been

re-presented to reflect the reallocation of a number of businesses

between Global Integrated Agencies and Specialist Agencies. The

impact of the re-presentation is not material.

12.

RoW includes - Asia Pacific,

Latin America, Africa & Middle East and Central & Eastern

Europe.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241022456069/en/

Media Chris Wade +44 20 7282 4600 Richard Oldworth, +44

7710 130 634 Burson Buchanan +44 20 7466 5000

press@wpp.com

Investors and analysts Tom Waldron +44 7788 695864

Anthony Hamilton +44 7464 532903 Caitlin Holt +44 7392 280178

irteam@wpp.com wpp.com/investors

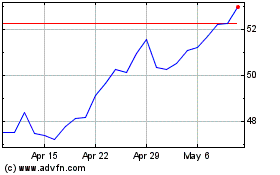

WPP (NYSE:WPP)

Historical Stock Chart

From Jan 2025 to Feb 2025

WPP (NYSE:WPP)

Historical Stock Chart

From Feb 2024 to Feb 2025