false

0000880631

0000880631

2025-01-28

2025-01-28

0000880631

WT:CommonStock0.01ParValueMember

2025-01-28

2025-01-28

0000880631

WT:PreferredStockPurchaseRightsMember

2025-01-28

2025-01-28

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________

Form 8-K

________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

January 28, 2025

__________________

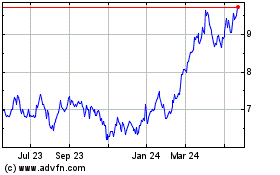

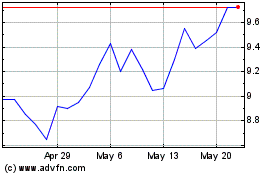

WisdomTree, Inc.

(Exact name of registrant as specified in its charter)

_____________________

| Delaware |

001-10932 |

13-3487784 |

|

(State or other jurisdiction

of incorporation) |

Commission

File Number: |

(IRS Employer

Identification No.) |

250 West 34th Street

3rd Floor

New York, NY 10119

(Address of principal executive offices, including zip code)

(212) 801-2080

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last

report)

_______________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Exchange Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

| Common Stock, $0.01 par value |

|

WT |

|

The New York Stock Exchange |

| Preferred Stock Purchase Rights |

|

WT |

|

The New York Stock Exchange |

Indicate by check mark whether the registrant is an

emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has

elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ¨

| Item 2.02. | Results of Operations and Financial Condition |

On January 31, 2025, WisdomTree, Inc. (the “Company”)

issued a press release announcing its financial results for the three months and year ended December 31, 2024. A copy of the press release

containing this information is being furnished as Exhibit 99.1 to this Report on Form 8-K and is incorporated herein by reference.

The information furnished pursuant to this Item 2.02,

including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934,

as amended, or otherwise subject to the liabilities under that Section and shall not be deemed incorporated by reference into any filing

of the Company under the Securities Act of 1933, as amended.

On January 28, 2025, the Company’s Board of

Directors declared a quarterly cash dividend of $0.03 per share of common stock, payable on February 26, 2025 to stockholders of record

as of the close of business on February 12, 2025. A copy of the press release issued in connection with the dividend is attached as Exhibit 99.1

to this Report on Form 8-K and is incorporated herein by reference.

| Item 9.01. | Financial Statements and Exhibits |

(d) Exhibits:

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

WisdomTree, Inc. |

| |

|

|

|

| Date: January 31, 2025 |

|

By: |

/s/ Bryan Edmiston

|

| |

|

|

Bryan Edmiston |

| |

|

|

Chief Financial Officer |

Exhibit 99.1

WisdomTree Announces Fourth Quarter 2024 Results

Diluted Earnings Per Share of $0.18 ($0.17,

as Adjusted)

700 bps of Annual Operating Margin Expansion

vs. the Prior Year

New York, NY – (Business Wire) – January 31, 2025 – WisdomTree,

Inc. (NYSE: WT), a global financial innovator, today reported financial results for the fourth quarter of 2024.

$27.3 million of net income ($25.3(1) million of net income,

as adjusted). See “Non-GAAP Financial Measurements” for additional information.

$109.8 billion of ending AUM, a decrease of 2.5% from the prior

quarter arising from market depreciation and net outflows.

($0.3) billion of net outflows, primarily driven by outflows from

our emerging markets, commodity and fixed income products, partly offset by inflows into our U.S. equity and cryptocurrency products.

0.36% average advisory fee, a 1 basis point decrease from the prior

quarter.

0.39% adjusted revenue yield(2), unchanged from the prior

quarter.

$110.7 million of operating revenues, a decrease of 2.2% from the

prior quarter due to lower other revenues. The prior quarter included $3.7 million of other revenues related to legal and other expenses

expected to be covered by insurance that were incurred in connection with a settlement with the U.S. Securities and Exchange Commission

(the “SEC”) regarding certain statements about the ESG screening process for three ETFs advised by WisdomTree Asset Management,

Inc. (the “SEC ESG Settlement”).

79.3% gross margin(1), a 1.5 point decrease from the

prior quarter due to higher non-recurring costs associated with the migration of custody, fund accounting, fund administration, ETF services

and securities lending to Bank of New York Mellon (“BNY”) during the quarter (the “BNY Custody Migration”).

31.7% operating income margin, a 4.3 point decrease (5.6 point decrease,

as adjusted(1)) compared to our operating margin of 36.0% (37.3%, as adjusted(1)) in the prior quarter primarily

due to higher expenses, including those associated with the BNY Custody Migration and seasonally higher discretionary spending. We also

recognized approximately $1.0 million of costs remaining under one of our WisdomTree Prime-related contracts as we transition away from

this service provider while continuing to expand our internal capabilities to further enhance the platform.

$0.03 quarterly dividend declared, payable on February

26, 2025 to stockholders of record as of the close of business on February 12, 2025.

Update from Jonathan Steinberg, WisdomTree

CEO

| “In 2024, we focused on disciplined execution, delivering a 73% increase in adjusted EPS fueled by higher AUM, an expansion in our revenue yield, margin expansion, and stock repurchases. Looking ahead to 2025, I am confident WisdomTree will continue leveraging increased client engagement and the growing traction of our models business to drive top-line growth. At the same time, we will remain disciplined in executing margin expansion, proactive in accretive capital deployment, and focused on driving strategic innovation to position the company for accelerated growth.” |

Update from Jarrett Lilien, WisdomTree

COO and President

| “The formula for sustainable long-term growth includes expanding WisdomTree’s client base and deepening engagement. We executed well on both initiatives, growing both the number of clients using WisdomTree products by 5% while also increasing the number of WisdomTree products held by each client by 4%. We will continue that momentum into 2025, leveraging our broad product lineup, our robust solutions offerings and our expertise to further expand our client relationships and grow AUM.” |

OPERATING AND FINANCIAL HIGHLIGHTS

| | |

| |

| | |

Dec. 31,

2024 | | |

Sept. 30,

2024 | | |

June 30,

2024 | | |

Mar. 31,

2024 | | |

Dec. 31,

2023 | |

| Consolidated

Operating Highlights ($ in billions): | |

| | | |

| | | |

| | | |

| | | |

| | |

| AUM—end of period | |

$ | 109.8 | | |

$ | 112.6 | | |

$ | 109.7 | | |

$ | 107.2 | | |

$ | 100.1 | |

| Net (outflows)/inflows | |

$ | (0.3 | ) | |

$ | (2.4 | ) | |

$ | 0.3 | | |

$ | 2.0 | | |

$ | (0.3 | ) |

| Average AUM | |

$ | 112.3 | | |

$ | 110.4 | | |

$ | 108.5 | | |

$ | 102.5 | | |

$ | 96.6 | |

| Average advisory fee | |

| 0.36% | | |

| 0.37% | | |

| 0.37% | | |

| 0.36% | | |

| 0.36% | |

| Adjusted revenue yield(2) | |

| 0.39% | | |

| 0.39% | | |

| 0.40% | | |

| 0.38% | | |

| 0.37% | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

Consolidated

Financial Highlights ($ in millions, except per

share amounts): | |

| | | |

| | | |

| | | |

| | | |

| | |

| Operating revenues | |

$ | 110.7 | | |

$ | 113.2 | | |

$ | 107.0 | | |

$ | 96.8 | | |

$ | 90.8 | |

| Net income/(loss) | |

$ | 27.3 | | |

$ | (4.5 | ) | |

$ | 21.8 | | |

$ | 22.1 | | |

$ | 19.1 | |

| Diluted earnings/(loss) per share | |

$ | 0.18 | | |

$ | (0.13 | ) | |

$ | 0.13 | | |

$ | 0.13 | | |

$ | 0.16 | |

| Operating income margin | |

| 31.7% | | |

| 36.0% | | |

| 31.3% | | |

| 28.9% | | |

| 28.7% | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| As

Adjusted (Non-GAAP(1)): | |

| | | |

| | | |

| | | |

| | | |

| | |

| Operating revenues, as adjusted | |

$ | 110.5 | | |

$ | 109.5 | | |

$ | 107.0 | | |

$ | 96.4 | | |

$ | 90.8 | |

| Gross margin | |

| 79.3% | | |

| 80.8% | | |

| 81.2% | | |

| 79.3% | | |

| 79.7% | |

| Net income, as adjusted | |

$ | 25.3 | | |

$ | 28.8 | | |

$ | 27.1 | | |

$ | 20.3 | | |

$ | 18.6 | |

| Diluted earnings per share, as adjusted | |

$ | 0.17 | | |

$ | 0.18 | | |

$ | 0.16 | | |

$ | 0.12 | | |

$ | 0.11 | |

| Operating income margin, as adjusted | |

| 31.7% | | |

| 37.3% | | |

| 35.3% | | |

| 29.7% | | |

| 28.7% | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

RECENT BUSINESS DEVELOPMENTS

Company News

| · | In January 2025, Smita Conjeevaram was appointed as Chair of the Board of Directors of WisdomTree, Inc., succeeding Win Neuger, who

will continue to serve on the Board. |

| · | In December 2024, WisdomTree was named a 2024 “Best Places to Work in Money Management” by Pensions & Investments for

the fifth consecutive year and the eighth year since the award was created. WisdomTree was ranked second within the large employer category

for managers with 100-499 employees, the third consecutive year earning a ranking among the top five employers. |

| · | In Europe, we concluded 2024 as the leading provider of Crypto ETP flows, recording $520 million in net new flows. The WisdomTree

Crypto ETP range exceeded $1.5 billion in assets under management (AUM), driven primarily by WisdomTree Physical Bitcoin (BTCW). BTCW

surpassed $1 billion in AUM, led the European market for bitcoin ETP flows with $232 million in net new flows, and marked its 5-year anniversary

in December 2024. |

Product News

| · | In November 2024, we launched the WisdomTree Global Efficient Core UCITS ETF (NTSG) on Deutsche Börse Xetra, the London Stock

Exchange and Borsa Italiana, and the WisdomTree Physical XRP ETP (XRPW) on the Deutsche Börse Xetra, the Swiss Stock Exchange SIX

and Euronext exchanges in Paris and Amsterdam. |

| · | In January 2025, we launched the WisdomTree Strategic Metals UCITS ETF (WENU) on Deutsche Börse Xetra, the London Stock Exchange

and Borsa Italiana alongside Euro-currency hedged and GBP-currency hedged share classes. |

| · | In addition, in January 2025, the Siegel-WisdomTree Moderate, Longevity and Global Equity Model Portfolios became available on the

UBS Financial Services Inc. separately managed account platform, providing over 85,000 advisors access to WisdomTree’s custom models. |

WISDOMTREE, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except per share amounts)

(Unaudited)

| | |

Three

Months Ended | | |

Years

Ended | |

| | |

Dec.

31,

2024 | | |

Sept.

30,

2024 | | |

June

30,

2024 | | |

Mar.

31,

2024 | | |

Dec.

31,

2023 | | |

Dec.

31,

2024 | | |

Dec.

31,

2023 | |

| Operating Revenues: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Advisory

fees | |

$ | 102,264 | | |

$ | 101,659 | | |

$ | 98,938 | | |

$ | 92,501 | | |

$ | 86,988 | | |

$ | 395,362 | | |

$ | 333,227 | |

| Other

revenues | |

| 8,433 | | |

| 11,509 | | |

| 8,096 | | |

| 4,337 | | |

| 3,856 | | |

| 32,375 | | |

| 15,808 | |

| Total

revenues | |

| 110,697 | | |

| 113,168 | | |

| 107,034 | | |

| 96,838 | | |

| 90,844 | | |

| 427,737 | | |

| 349,035 | |

| Operating

Expenses: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Compensation

and benefits | |

| 30,032 | | |

| 29,405 | | |

| 30,790 | | |

| 31,054 | | |

| 27,860 | | |

| 121,281 | | |

| 109,532 | |

| Fund management

and administration | |

| 22,858 | | |

| 21,004 | | |

| 20,139 | | |

| 19,962 | | |

| 18,445 | | |

| 83,963 | | |

| 71,348 | |

| Marketing

and advertising | |

| 6,117 | | |

| 4,897 | | |

| 5,110 | | |

| 4,408 | | |

| 4,951 | | |

| 20,532 | | |

| 17,256 | |

| Sales and

business development | |

| 4,101 | | |

| 3,465 | | |

| 3,640 | | |

| 3,611 | | |

| 3,881 | | |

| 14,817 | | |

| 13,584 | |

| Contractual

gold payments | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 6,069 | |

| Professional

fees | |

| 4,559 | | |

| 6,315 | | |

| 6,594 | | |

| 3,630 | | |

| 3,201 | | |

| 21,098 | | |

| 18,969 | |

| Occupancy,

communications and equipment | |

| 1,423 | | |

| 1,397 | | |

| 1,314 | | |

| 1,210 | | |

| 1,208 | | |

| 5,344 | | |

| 4,684 | |

| Depreciation

and amortization | |

| 504 | | |

| 447 | | |

| 418 | | |

| 383 | | |

| 335 | | |

| 1,752 | | |

| 872 | |

| Third-party

distribution fees | |

| 3,161 | | |

| 2,983 | | |

| 2,687 | | |

| 2,307 | | |

| 2,549 | | |

| 11,138 | | |

| 9,377 | |

| Other | |

| 2,902 | | |

| 2,463 | | |

| 2,831 | | |

| 2,323 | | |

| 2,379 | | |

| 10,519 | | |

| 9,852 | |

| Total

operating expenses | |

| 75,657 | | |

| 72,376 | | |

| 73,523 | | |

| 68,888 | | |

| 64,809 | | |

| 290,444 | | |

| 261,543 | |

| Operating income | |

| 35,040 | | |

| 40,792 | | |

| 33,511 | | |

| 27,950 | | |

| 26,035 | | |

| 137,293 | | |

| 87,492 | |

| Other

Income/(Expenses): | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Interest

expense | |

| (5,616 | ) | |

| (5,027 | ) | |

| (4,140 | ) | |

| (4,128 | ) | |

| (3,758 | ) | |

| (18,911 | ) | |

| (15,242 | ) |

| Gain on

revaluation/termination of deferred consideration—gold payments | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 61,953 | |

| Interest

income | |

| 2,147 | | |

| 1,795 | | |

| 1,438 | | |

| 1,398 | | |

| 1,225 | | |

| 6,778 | | |

| 4,099 | |

| Impairments | |

| — | | |

| — | | |

| — | | |

| — | | |

| (339 | ) | |

| — | | |

| (7,942 | ) |

| Loss on

extinguishment of convertible notes | |

| — | | |

| (30,632 | ) | |

| — | | |

| — | | |

| — | | |

| (30,632 | ) | |

| (9,721 | ) |

| Other

gains and losses, net | |

| 2,627 | | |

| (3,062 | ) | |

| (1,283 | ) | |

| 2,592 | | |

| 1,602 | | |

| 874 | | |

| (1,631 | ) |

| Income before

income taxes | |

| 34,198 | | |

| 3,866 | | |

| 29,526 | | |

| 27,812 | | |

| 24,765 | | |

| 95,402 | | |

| 119,008 | |

| Income

tax expense | |

| 6,890 | | |

| 8,351 | | |

| 7,767 | | |

| 5,701 | | |

| 5,688 | | |

| 28,709 | | |

| 16,462 | |

| Net

income/(loss) | |

$ | 27,308 | | |

$ | (4,485 | ) | |

$ | 21,759 | | |

$ | 22,111 | | |

$ | 19,077 | | |

$ | 66,693 | | |

$ | 102,546 | |

| Earnings/(loss) per share—basic | |

$ | 0.19 | | |

$ | (0.13) | (3) | |

$ | 0.13 | (3) | |

$ | 0.14 | (3) | |

$ | 0.16 | (3) | |

$ | 0.34 | (3) | |

$ | 0.66 | (3) |

| Earnings/(loss) per share—diluted | |

$ | 0.18 | | |

$ | (0.13) | (3) | |

$ | 0.13 | | |

$ | 0.13 | | |

$ | 0.16 | (3) | |

$ | 0.33 | (3) | |

$ | 0.64 | (3) |

| Weighted average common shares—basic | |

| 141,275 | | |

| 143,929 | | |

| 146,896 | | |

| 146,464 | | |

| 145,310 | | |

| 144,630 | | |

| 144,707 | |

| Weighted average common shares—diluted | |

| 147,612 | | |

| 143,929 | | |

| 166,359 | | |

| 165,268 | | |

| 171,703 | | |

| 158,844 | | |

| 170,413 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| As

Adjusted (Non-GAAP(1)) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total

revenues | |

$ | 110,505 | | |

$ | 109,507 | | |

$ | 107,034 | | |

$ | 96,385 | | |

$ | 90,844 | | |

| | | |

| | |

| Total

operating expenses | |

$ | 75,465 | | |

$ | 68,715 | | |

$ | 69,252 | | |

$ | 67,740 | | |

$ | 64,809 | | |

| | | |

| | |

| Operating

income | |

$ | 35,040 | | |

$ | 40,792 | | |

$ | 37,782 | | |

$ | 28,645 | | |

$ | 26,035 | | |

| | | |

| | |

| Income

before income taxes | |

$ | 33,033 | | |

$ | 37,187 | | |

$ | 36,083 | | |

$ | 26,987 | | |

$ | 23,908 | | |

| | | |

| | |

| Income

tax expense | |

$ | 7,753 | | |

$ | 9,049 | | |

$ | 9,008 | | |

$ | 6,731 | | |

$ | 5,342 | | |

| | | |

| | |

| Net

income | |

$ | 25,280 | | |

$ | 28,768 | | |

$ | 27,075 | | |

$ | 20,256 | | |

$ | 18,566 | | |

| | | |

| | |

| Earnings

per share—diluted | |

$ | 0.17 | | |

$ | 0.18 | | |

$ | 0.16 | | |

$ | 0.12 | | |

$ | 0.11 | | |

| | | |

| | |

| Weighted

average common shares—diluted | |

| 147,612 | | |

| 156,745 | | |

| 166,359 | | |

| 165,268 | | |

| 171,703 | | |

| | | |

| | |

QUARTERLY HIGHLIGHTS

Operating Revenues

| · | Operating revenues decreased 2.2% from the third quarter of 2024 due to lower other revenues as the

prior quarter included $3.7 million of other revenues related to legal and other expenses incurred in connection with the SEC ESG Settlement

that are expected to be covered by insurance. Operating revenues increased 21.9% from the fourth quarter of 2023 due to higher average

AUM and higher other revenues attributable to our European listed exchange-traded products (“ETPs”). |

| · | Our average advisory fee was 0.36%, 0.37% and 0.36% during the fourth quarter of 2024, the third quarter

of 2024 and the fourth quarter of 2023, respectively. |

Operating Expenses

| · | Operating expenses increased 4.5% from the third quarter of 2024 primarily due to seasonally higher

discretionary spending, including marketing and sales-related expenses. In addition, higher fund management expenses arose from non-recurring

costs related to the BNY Custody Migration and we recognized approximately $1.0 million of costs remaining under one of our WisdomTree

Prime-related contracts as we transition away from this service provider while continuing to expand our internal capabilities to further

enhance the platform. These increases were partly offset by lower professional fees incurred in the fourth quarter related to the SEC

ESG Settlement. |

| · | Operating expenses increased 16.7% from the fourth quarter of 2023 primarily due to higher fund management

and administration costs, compensation, professional fees and marketing expenses. |

Other Income/(Expenses)

| · | Interest expense increased 11.7% and 49.4% from the third quarter of 2024 and fourth quarter of 2023,

respectively, due to a higher level of debt outstanding, partly offset by a lower average interest rate. The increase from the fourth

quarter of 2023 also is due to the recognition of a full quarter of imputed interest on our obligation payable to Gold Bullion Holdings

(Jersey) Limited (“GBH”), a subsidiary of the World Gold Council, in connection with our repurchase in November 2023 of our

Series C Non-Voting Convertible Preferred Stock. |

| · | Interest income increased 19.6% and 75.3% from the third quarter of 2024 and the fourth quarter of 2023,

respectively, due to a higher level of interest-earning assets. |

| · | Other gains and losses, net was a gain of $2.6 million for the fourth quarter of 2024. This included

net gains of $2.3 million on our financial instruments owned and net losses of $0.5 million on our investments. Gains and losses also

generally arise from the sale of gold and crypto earned from management fees paid by our physically-backed gold and crypto ETPs, foreign

exchange fluctuations and other miscellaneous items. |

Income Taxes

| · | Our effective income tax rate for the fourth quarter of 2024 was 20.1%, resulting in income tax expense

of $6.8 million. The effective tax rate differs from the federal statutory rate of 21.0% primarily due to a favorable tax adjustment to

the non-deductible loss on extinguishment of convertible notes and a lower tax rate on foreign earnings. |

| · | Our adjusted effective income tax rate for the fourth quarter of 2024 was 23.5%(1). |

ANNUAL HIGHLIGHTS

| · | Operating revenues increased 22.5% as compared to 2023 due to higher average AUM and higher other revenues

attributable to our European listed ETPs. In addition, operating revenues include $4.3 million of other revenues related to legal and

other related expenses incurred in connection with the SEC ESG Settlement that are expected to be covered by insurance. |

| · | Operating expenses increased 11.1% as compared to 2023 primarily due to higher incentive and stock-based

compensation expense and increased headcount, fund management and administration costs, marketing expenses, sales and business development

expenses, third-party distribution fees, as well as higher depreciation and amortization. Operating expenses during the year ended December

31, 2024 also include $4.3 million of legal and other related expenses expected to be covered by insurance that were incurred in connection

with the SEC ESG Settlement. These increases were partly offset by lower contractual gold payments. |

| · | Significant items reported in other income/(expense) in 2024 include: a loss on extinguishment of convertible

notes of $30.6 million arising from the repurchase of $104.2 million aggregate principal amount of our 5.75% convertible senior notes

due 2028; a civil money penalty of $4.0 million in connection with the SEC ESG Settlement; an increase in interest expense of 24.1% due

to imputed interest on our obligation payable to GBH and higher level of debt outstanding, partly offset by a lower average interest rate;

an increase in interest income of 65.4% due to an increase in our interest-earning assets; net gains on our financial instruments owned

of $4.9 million; and losses on our investments of $1.1 million. Gains and losses also generally arise from the sale of gold earned on

management fees paid by our physically-backed gold ETPs, foreign exchange fluctuations and other miscellaneous items. |

| · | Our effective income tax rate for 2024 was 30.1%, resulting in an income tax expense of $28.7 million.

Our tax rate differs from the federal statutory rate of 21.0% primarily due to a non-deductible loss on extinguishment of convertible

notes, a non-deductible civil money penalty of $4.0 million in connection with the SEC ESG Settlement and non-deductible executive compensation.

These items were partly offset by a lower tax rate on foreign earnings. |

CONFERENCE CALL DIAL-IN AND WEBCAST DETAILS

WisdomTree will discuss its results and operational highlights during a

live webcast on Friday, January 31, 2025 at 11:00 a.m. ET, which can be accessed using the following link: https://event.choruscall.com/mediaframe/webcast.html?webcastid=VyP1taaA.

Participants also can dial in using the following numbers: (877)

407-9210 or (201) 689-8049. Click here to access the participant international toll-free access numbers. To avoid delays, we encourage

participants to log in or dial into the conference call 10 minutes ahead of the scheduled start time. All earnings materials and the webcast

can be accessed through WisdomTree’s investor relations website at https://ir.wisdomtree.com. A replay of the webcast will also

be available shortly after the call.

About WisdomTree

WisdomTree is a global financial innovator, offering a well-diversified

suite of exchange-traded products (ETPs), models, solutions and products leveraging blockchain technology. We empower investors and consumers

to shape their future and support financial professionals to better serve their clients and grow their businesses. WisdomTree is leveraging

the latest financial infrastructure to create products that provide access, transparency and an enhanced user experience. Building on

our heritage of innovation, we are also developing and have launched next-generation digital products, services and structures, including

digital or blockchain-enabled mutual funds and tokenized assets, as well as our blockchain-native digital wallet, WisdomTree Prime®

and institutional platform, WisdomTree Connect™.*

* The WisdomTree Prime digital wallet and digital asset services

and WisdomTree Connect institutional platform are made available through WisdomTree Digital Movement, Inc., a federally registered money

services business, state-licensed money transmitter and financial technology company (NMLS ID: 2372500) or WisdomTree Digital Trust Company,

LLC, in select U.S. jurisdictions and may be limited where prohibited by law. WisdomTree Digital Trust Company, LLC is chartered as a

limited purpose trust company by the New York State Department of Financial Services to engage in virtual currency business. Visit https://www.wisdomtreeprime.com,

the WisdomTree Prime mobile app or https://wisdomtreeconnect.com for more information.

WisdomTree currently has approximately $113.5 billion in assets under

management globally.

For more information about WisdomTree, WisdomTree Connect and WisdomTree

Prime, visit: https://www.wisdomtree.com.

Please visit us on X at @WisdomTreeNews.

WisdomTree® is the marketing name for WisdomTree,

Inc. and its subsidiaries worldwide.

PRODUCTS AND SERVICES AVAILABLE VIA WISDOMTREE PRIME:

NOT FDIC INSURED | NO BANK GUARANTEE | NOT A BANK DEPOSIT | MAY

LOSE VALUE | NOT SIPC PROTECTED | NOT INSURED BY ANY GOVERNMENT AGENCY

The products and services available through the WisdomTree Prime

app and WisdomTree Connect are not endorsed, indemnified or guaranteed by any regulatory agency.

| (1) | See “Non-GAAP Financial Measurements.” |

| (2) | Adjusted revenue yield is computed by dividing our annualized adjusted operating revenues as reported

in the GAAP to Non-GAAP Reconciliation herein by our average AUM during the period. |

| (3) | Earnings per share (“EPS”) is calculated pursuant to the two-class method as it results

in a lower EPS amount as compared to the treasury stock method. In addition, the three months ended September 30, 2024 and year ended

December 31, 2024 include a loss of $11,375 recognized upon the repurchase of our Series A Non-Voting Convertible Preferred Stock convertible

into approximately 14.75 million shares of common stock from ETFS Capital Limited and $1,868 of stock repurchase excise taxes. The three

months ended December 31, 2023 includes a gain of $7,966 recognized upon the repurchase of our Series C Non-Voting Convertible Preferred

Stock convertible into approximately 13.1 million shares of common stock from GBH. These items are excluded from net income, but are required

to be added to net income to arrive at income available to common stockholders in the calculation of EPS. These items are excluded from

our EPS when computed on a non-GAAP basis. |

Contact Information:

| Investor Relations |

Media Relations |

| Jeremy Campbell |

Natasha Ramsammy |

| +1.917.267.3859 |

+1.917.267.3798 |

| jeremy.campbell@wisdomtree.com |

nramsammy@wisdomtree.com / wisdomtree@fullyvested.com |

WISDOMTREE, INC. AND SUBSIDIARIES

KEY OPERATING STATISTICS

(Unaudited)

| | |

| |

| | |

Three

Months Ended | |

| | |

Dec.

31, 2024 | | |

Sept.

30, 2024 | | |

June

30, 2024 | | |

Mar.

31, 2024 | | |

Dec.

31, 2023 | |

| GLOBAL

ETPs ($ in millions) | |

| | |

| | |

| | |

| | |

| |

| | |

| | |

| | |

| | |

| | |

| |

| Beginning of period assets | |

$ | 112,577 | | |

$ | 109,686 | | |

$ | 107,230 | | |

$ | 100,124 | | |

$ | 93,735 | |

| (Outflows)/inflows | |

| (281 | ) | |

| (2,395 | ) | |

| 340 | | |

| 1,988 | | |

| (255 | ) |

| Market (depreciation)/appreciation | |

| (2,517 | ) | |

| 5,286 | | |

| 2,116 | | |

| 5,118 | | |

| 6,644 | |

| End of period assets | |

$ | 109,779 | | |

$ | 112,577 | | |

$ | 109,686 | | |

$ | 107,230 | | |

$ | 100,124 | |

| Average assets during the period | |

$ | 112,349 | | |

$ | 110,369 | | |

$ | 108,479 | | |

$ | 102,461 | | |

$ | 96,641 | |

| Average advisory fee during the period | |

| 0.36% | | |

| 0.37% | | |

| 0.37% | | |

| 0.36% | | |

| 0.36% | |

| Revenue days | |

| 92 | | |

| 92 | | |

| 91 | | |

| 91 | | |

| 92 | |

| Number of ETPs—end of the period | |

| 353 | | |

| 352 | | |

| 350 | | |

| 338 | | |

| 337 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| U.S. LISTED ETFs ($ in millions) | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Beginning of period assets | |

$ | 81,267 | | |

$ | 79,722 | | |

$ | 78,087 | | |

$ | 72,486 | | |

$ | 68,018 | |

| (Outflows)/inflows | |

| (40 | ) | |

| (1,650 | ) | |

| 1,106 | | |

| 1,983 | | |

| (67 | ) |

| Market (depreciation)/appreciation | |

| (2,132 | ) | |

| 3,195 | | |

| 529 | | |

| 3,618 | | |

| 4,535 | |

| End of period assets | |

$ | 79,095 | | |

$ | 81,267 | | |

$ | 79,722 | | |

$ | 78,087 | | |

$ | 72,486 | |

| Average assets during the period | |

$ | 80,661 | | |

$ | 80,335 | | |

$ | 78,523 | | |

$ | 74,831 | | |

$ | 69,801 | |

| Number of ETFs—end of the period | |

| 78 | | |

| 78 | | |

| 78 | | |

| 77 | | |

| 76 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| EUROPEAN LISTED ETPs ($ in millions) | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Beginning of period assets | |

$ | 31,310 | | |

$ | 29,964 | | |

$ | 29,143 | | |

$ | 27,638 | | |

$ | 25,717 | |

| (Outflows)/inflows | |

| (241 | ) | |

| (745 | ) | |

| (766 | ) | |

| 5 | | |

| (188 | ) |

| Market (depreciation)/appreciation | |

| (385 | ) | |

| 2,091 | | |

| 1,587 | | |

| 1,500 | | |

| 2,109 | |

| End of period assets | |

$ | 30,684 | | |

$ | 31,310 | | |

$ | 29,964 | | |

$ | 29,143 | | |

$ | 27,638 | |

| Average assets during the period | |

$ | 31,688 | | |

$ | 30,034 | | |

$ | 29,956 | | |

$ | 27,630 | | |

$ | 26,840 | |

| Number of ETPs—end of the period | |

| 275 | | |

| 274 | | |

| 272 | | |

| 261 | | |

| 261 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| PRODUCT CATEGORIES ($ in millions) | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| U.S. Equity | |

| | | |

| | | |

| | | |

| | | |

| | |

| Beginning of period assets | |

$ | 34,643 | | |

$ | 31,834 | | |

$ | 31,670 | | |

$ | 29,156 | | |

$ | 25,643 | |

| Inflows | |

| 1,099 | | |

| 328 | | |

| 221 | | |

| 536 | | |

| 487 | |

| Market (depreciation)/appreciation | |

| (328 | ) | |

| 2,481 | | |

| (57 | ) | |

| 1,978 | | |

| 3,026 | |

| End of period assets | |

$ | 35,414 | | |

$ | 34,643 | | |

$ | 31,834 | | |

$ | 31,670 | | |

$ | 29,156 | |

| Average assets during the period | |

$ | 35,714 | | |

$ | 33,175 | | |

$ | 31,339 | | |

$ | 30,154 | | |

$ | 26,928 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Commodity & Currency | |

| | | |

| | | |

| | | |

| | | |

| | |

| Beginning of period assets | |

$ | 23,034 | | |

$ | 21,987 | | |

$ | 21,944 | | |

$ | 21,336 | | |

$ | 20,466 | |

| Outflows | |

| (440 | ) | |

| (741 | ) | |

| (1,499 | ) | |

| (460 | ) | |

| (449 | ) |

| Market (depreciation)/appreciation | |

| (688 | ) | |

| 1,788 | | |

| 1,542 | | |

| 1,068 | | |

| 1,319 | |

| End of period assets | |

$ | 21,906 | | |

$ | 23,034 | | |

$ | 21,987 | | |

$ | 21,944 | | |

$ | 21,336 | |

| Average assets during the period | |

$ | 22,989 | | |

$ | 22,016 | | |

$ | 22,437 | | |

$ | 20,837 | | |

$ | 21,254 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Fixed Income | |

| | | |

| | | |

| | | |

| | | |

| | |

| Beginning of period assets | |

$ | 20,767 | | |

$ | 21,430 | | |

$ | 21,218 | | |

$ | 21,197 | | |

$ | 21,797 | |

| (Outflows)/inflows | |

| (387 | ) | |

| (897 | ) | |

| 236 | | |

| (14 | ) | |

| (715 | ) |

| Market (depreciation)/appreciation | |

| (337 | ) | |

| 234 | | |

| (24 | ) | |

| 35 | | |

| 115 | |

| End of period assets | |

$ | 20,043 | | |

$ | 20,767 | | |

$ | 21,430 | | |

$ | 21,218 | | |

$ | 21,197 | |

| Average assets during the period | |

$ | 20,398 | | |

$ | 21,135 | | |

$ | 21,277 | | |

$ | 21,082 | | |

$ | 21,889 | |

| | |

Three

Months Ended | |

| | |

Dec.

31, 2024 | | |

Sept.

30, 2024 | | |

June

30, 2024 | | |

Mar.

31, 2024 | | |

Dec.

31, 2023 | |

| International Developed Market Equity | |

| | | |

| | | |

| | | |

| | | |

| | |

| Beginning of period assets | |

$ | 18,075 | | |

$ | 19,385 | | |

$ | 18,103 | | |

$ | 15,103 | | |

$ | 13,902 | |

| Inflows/(outflows) | |

| 63 | | |

| (1,391 | ) | |

| 1,253 | | |

| 1,597 | | |

| 9 | |

| Market (depreciation)/appreciation | |

| (536 | ) | |

| 81 | | |

| 29 | | |

| 1,403 | | |

| 1,192 | |

| End of period assets | |

$ | 17,602 | | |

$ | 18,075 | | |

$ | 19,385 | | |

$ | 18,103 | | |

$ | 15,103 | |

| Average assets during the period | |

$ | 17,716 | | |

$ | 18,636 | | |

$ | 18,809 | | |

$ | 16,691 | | |

$ | 14,267 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Emerging Market Equity | |

| | | |

| | | |

| | | |

| | | |

| | |

| Beginning of period assets | |

$ | 12,452 | | |

$ | 11,875 | | |

$ | 11,189 | | |

$ | 10,726 | | |

$ | 9,569 | |

| (Outflows)/inflows | |

| (908 | ) | |

| (20 | ) | |

| 57 | | |

| 217 | | |

| 412 | |

| Market (depreciation)/appreciation | |

| (1,076 | ) | |

| 597 | | |

| 629 | | |

| 246 | | |

| 745 | |

| End of period assets | |

$ | 10,468 | | |

$ | 12,452 | | |

$ | 11,875 | | |

$ | 11,189 | | |

$ | 10,726 | |

| Average assets during the period | |

$ | 11,407 | | |

$ | 12,083 | | |

$ | 11,448 | | |

$ | 10,900 | | |

$ | 9,833 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Leveraged & Inverse | |

| | | |

| | | |

| | | |

| | | |

| | |

| Beginning of period assets | |

$ | 2,082 | | |

$ | 1,922 | | |

$ | 1,828 | | |

$ | 1,815 | | |

$ | 1,781 | |

| (Outflows)/inflows | |

| (69 | ) | |

| 71 | | |

| (18 | ) | |

| (50 | ) | |

| (59 | ) |

| Market (depreciation)/appreciation | |

| (89 | ) | |

| 89 | | |

| 112 | | |

| 63 | | |

| 93 | |

| End of period assets | |

$ | 1,924 | | |

$ | 2,082 | | |

$ | 1,922 | | |

$ | 1,828 | | |

$ | 1,815 | |

| Average assets during the period | |

$ | 2,032 | | |

$ | 1,962 | | |

$ | 1,905 | | |

$ | 1,792 | | |

$ | 1,803 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Cryptocurrency | |

| | | |

| | | |

| | | |

| | | |

| | |

| Beginning of period assets | |

$ | 1,054 | | |

$ | 838 | | |

$ | 874 | | |

$ | 414 | | |

$ | 243 | |

| Inflows | |

| 315 | | |

| 201 | | |

| 75 | | |

| 158 | | |

| 28 | |

| Market appreciation /(depreciation) | |

| 543 | | |

| 15 | | |

| (111 | ) | |

| 302 | | |

| 143 | |

| End of period assets | |

$ | 1,912 | | |

$ | 1,054 | | |

$ | 838 | | |

$ | 874 | | |

$ | 414 | |

| Average assets during the period | |

$ | 1,599 | | |

$ | 917 | | |

$ | 856 | | |

$ | 614 | | |

$ | 325 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Alternatives | |

| | | |

| | | |

| | | |

| | | |

| | |

| Beginning of period assets | |

$ | 470 | | |

$ | 415 | | |

$ | 404 | | |

$ | 377 | | |

$ | 334 | |

| Inflows | |

| 46 | | |

| 54 | | |

| 15 | | |

| 4 | | |

| 32 | |

| Market (depreciation)/appreciation | |

| (6 | ) | |

| 1 | | |

| (4 | ) | |

| 23 | | |

| 11 | |

| End of period assets | |

$ | 510 | | |

$ | 470 | | |

$ | 415 | | |

$ | 404 | | |

$ | 377 | |

| Average assets during the period | |

$ | 494 | | |

$ | 445 | | |

$ | 408 | | |

$ | 391 | | |

$ | 342 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Headcount | |

| 313 | | |

| 314 | | |

| 304 | | |

| 300 | | |

| 303 | |

Note: Previously issued statistics may be restated due to fund closures

and trade adjustments.

Source: WisdomTree

WISDOMTREE, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(in thousands, except per share amounts)

| | |

Dec.

31,

2024 | | |

Dec.

31,

2023

| |

| | |

(Unaudited) | | |

| |

| ASSETS | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash,

cash equivalents and restricted cash | |

$ | 181,191 | | |

$ | 129,305 | |

| Financial

instruments owned, at fair value | |

| 85,439 | | |

| 58,722 | |

| Accounts receivable | |

| 44,866 | | |

| 35,473 | |

| Prepaid expenses | |

| 5,340 | | |

| 5,258 | |

| Other

current assets | |

| 1,542 | | |

| 1,036 | |

| Total current

assets | |

| 318,378 | | |

| 229,794 | |

| Fixed assets,

net | |

| 336 | | |

| 427 | |

| Securities

held-to-maturity | |

| 206 | | |

| 230 | |

| Deferred tax

assets, net | |

| 11,656 | | |

| 11,057 | |

| Investments | |

| 8,922 | | |

| 9,684 | |

| Right of use

assets—operating leases | |

| 880 | | |

| 563 | |

| Goodwill | |

| 86,841 | | |

| 86,841 | |

| Intangible

assets, net | |

| 605,896 | | |

| 605,082 | |

| Other

noncurrent assets | |

| 425 | | |

| 459 | |

| Total

assets | |

$ | 1,033,540 | | |

$ | 944,137 | |

| LIABILITIES

AND STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| LIABILITIES | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Fund management

and administration payable | |

$ | 31,135 | | |

$ | 30,085 | |

| Compensation

and benefits payable | |

| 39,701 | | |

| 38,111 | |

| Payable to

Gold Bullion Holdings (Jersey) Limited (“GBH”) | |

| 14,804 | | |

| 14,804 | |

| Income taxes

payable | |

| 724 | | |

| 3,866 | |

| Operating

lease liabilities | |

| 709 | | |

| 578 | |

| Accounts

payable and other liabilities | |

| 22,124 | | |

| 15,772 | |

| Total current

liabilities | |

| 109,197 | | |

| 103,216 | |

| Convertible

notes—long term | |

| 512,033 | | |

| 274,888 | |

| Payable to

GBH | |

| 12,159 | | |

| 24,328 | |

| Operating

lease liabilities—long term | |

| 171 | | |

| — | |

| Total liabilities | |

| 633,560 | | |

| 402,432 | |

| Preferred stock: | |

| | | |

| | |

| Series

A Non-Voting Convertible, par value $0.01; Zero and 14.750 shares authorized, issued and outstanding at December 31, 2024 and December

31, 2023, respectively | |

| — | | |

| 132,569 | |

| STOCKHOLDERS’

EQUITY | |

| | | |

| | |

| Common stock, par value $0.01;

400,000 shares authorized: | |

| | | |

| | |

| Issued and

outstanding: 146,102 and 150,330 at December 31, 2024 and December 31, 2023, respectively | |

| 1,461 | | |

| 1,503 | |

| Additional

paid-in capital | |

| 270,303 | | |

| 312,440 | |

| Accumulated

other comprehensive loss | |

| (1,607 | ) | |

| (548 | ) |

| Retained earnings | |

| 129,823 | | |

| 95,741 | |

| Total

stockholders’ equity | |

| 399,980 | | |

| 409,136 | |

| Total

liabilities and stockholders’ equity | |

$ | 1,033,540 | | |

$ | 944,137 | |

WISDOMTREE, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

(Unaudited)

| | |

Years

Ended

December 31,

|

| | |

2024

| |

2023

|

| Cash

flows from operating activities: | |

| | | |

| | |

| Net

income | |

$ | 66,693 | | |

$ | 102,546 | |

| Adjustments to reconcile net income

to net cash provided by operating activities: | |

| | | |

| | |

| Advisory and license

fees paid in gold, other precious metals and cryptocurrency | |

| (53,452 | ) | |

| (49,400 | ) |

| Loss on extinguishment

of convertible notes | |

| 30,632 | | |

| 9,721 | |

| Stock-based compensation | |

| 20,691 | | |

| 16,190 | |

| (Gains)/losses

on financial instruments owned, at fair value | |

| (4,851 | ) | |

| 517 | |

| Imputed interest

on payable to GBH | |

| 2,635 | | |

| 297 | |

| Amortization of

issuance costs—convertible notes | |

| 1,893 | | |

| 1,817 | |

| Depreciation and

amortization | |

| 1,752 | | |

| 872 | |

| Amortization of

right of use asset | |

| 1,304 | | |

| 1,285 | |

| Losses on investments | |

| 1,135 | | |

| 242 | |

| Deferred income

taxes | |

| (398 | ) | |

| (481 | ) |

| Gain on revaluation/termination

of deferred consideration—gold payments | |

| — | | |

| (61,953 | ) |

| Impairments | |

| — | | |

| 7,942 | |

| Contractual gold

payments | |

| — | | |

| 6,069 | |

| Other | |

| — | | |

| — | |

| Changes in operating

assets and liabilities: | |

| | | |

| | |

| Accounts receivable | |

| (9,036 | ) | |

| (6,212 | ) |

| Prepaid expenses | |

| (107 | ) | |

| (518 | ) |

| Gold and other precious

metals | |

| 52,640 | | |

| 42,150 | |

| Other assets | |

| (247 | ) | |

| 281 | |

| Fund management and

administration payable | |

| 1,290 | | |

| 5,837 | |

| Compensation and

benefits payable | |

| 1,937 | | |

| 1,209 | |

| Income taxes payable | |

| (3,126 | ) | |

| 2,260 | |

| Operating lease liabilities | |

| (1,320 | ) | |

| (1,284 | ) |

| Accounts

payable and other liabilities | |

| 3,396 | | |

| 6,213 | |

| Net

cash provided by operating activities | |

| 113,461 | | |

| 85,600 | |

| Cash

flows from investing activities: | |

| | | |

| | |

| Purchase of financial

instruments owned, at fair value | |

| (69,439 | ) | |

| (57,364 | ) |

| Cash paid—software

development | |

| (2,336 | ) | |

| (2,149 | ) |

| Purchase of investments | |

| (674 | ) | |

| (11,228 | ) |

| Purchase of fixed

assets | |

| (141 | ) | |

| (113 | ) |

| Cash paid—acquisition

of Securrency Transfers, Inc. (net of cash acquired) | |

| — | | |

| (985 | ) |

| Proceeds from

the sale of financial instruments owned, at fair value | |

| 48,126 | | |

| 123,564 | |

| Proceeds from

the exit of investments | |

| 565 | | |

| 28,818 | |

| Proceeds from

held-to-maturity securities maturing or called prior to maturity | |

| 24 | | |

| 29 | |

| Receipt

of contingent consideration—Sale of Canadian ETF business | |

| — | | |

| 1,477 | |

| Net

cash (used in)/provided by investing activities | |

| (23,875 | ) | |

| 82,049 | |

| Cash

flows from financing activities: | |

| | | |

| | |

| Repurchase of

Series A Non-Voting Convertible Preferred Stock | |

| (143,812 | ) | |

| — | |

| Repurchase and

maturity of convertible notes | |

| (132,713 | ) | |

| (184,272 | ) |

| Common stock repurchased | |

| (62,870 | ) | |

| (3,570 | ) |

| Dividends paid | |

| (19,002 | ) | |

| (20,144 | ) |

| Cash paid to GBH | |

| (14,804 | ) | |

| — | |

| Issuance costs—convertible

notes | |

| (7,667 | ) | |

| (3,548 | ) |

| Repurchase costs—Series

A Non-Voting Convertible Preferred Stock | |

| (132 | ) | |

| — | |

| Proceeds from

the issuance of convertible notes | |

| 345,000 | | |

| 130,000 | |

| Repurchase of

Series C Non-Voting Convertible Preferred Stock | |

| — | | |

| (40,000 | ) |

| Termination of

deferred consideration—gold payments | |

| — | | |

| (50,005 | ) |

| Issuance

costs—Series C Non-Voting Convertible Preferred Stock | |

| — | | |

| (97 | ) |

| Net

cash used in financing activities | |

| (36,000 | ) | |

| (171,636 | ) |

| Decrease/(increase)

in cash flow due to changes in foreign exchange rate | |

| (1,700 | ) | |

| 1,191 | |

| Net increase/(decrease)

in cash, cash equivalents and restricted cash | |

| 51,886 | | |

| (2,796 | ) |

| Cash,

cash equivalents and restricted cash—beginning of year | |

| 129,305 | | |

| 132,101 | |

| Cash,

cash equivalents and restricted cash—end of period | |

$ | 181,191 | | |

$ | 129,305 | |

| Supplemental

disclosure of cash flow information: | |

| | | |

| | |

| Cash

paid for income taxes | |

$ | 32,218 | | |

$ | 16,156 | |

| Cash

paid for interest | |

$ | 12,350 | | |

$ | 10,709 | |

NON-GAAP FINANCIAL MEASUREMENTS

In an effort to provide additional information

regarding our results as determined by GAAP, we also disclose certain non-GAAP information which we believe provides useful and meaningful

information. Our management reviews these non-GAAP financial measurements when evaluating our financial performance and results of operations;

therefore, we believe it is useful to provide information with respect to these non-GAAP measurements so as to share this perspective

of management. Non-GAAP measurements do not have any standardized meaning, do not replace nor are they superior to GAAP financial measurements

and are unlikely to be comparable to similar measures presented by other companies. These non-GAAP financial measurements should be considered

in the context with our GAAP results. The non-GAAP financial measurements contained in this press release include:

Adjusted Revenues, Operating Income, Operating Expenses, Income

Before Income Taxes, Income Tax Expense, Net Income and Diluted Earnings per Share

We disclose adjusted revenues, operating income,

operating expenses, income before income taxes, income tax expense, net income and diluted earnings per share as non-GAAP financial measurements

in order to report our results exclusive of items that are non-recurring or not core to our operating business. We believe presenting

these non-GAAP financial measurements provides investors with a consistent way to analyze our performance. These non-GAAP financial measurements

exclude the following:

Legal and other related expenses expected

to be covered by insurance: We have incurred $4.3 million of legal and other related expenses in connection with the SEC ESG Settlement

that are expected to be covered by insurance. GAAP requires that such covered expenses be reported gross in the income statement such

that revenues are recorded to offset expenses incurred. We offset the revenues and related expenses when calculating our non-GAAP financial

measurements as the gross presentation serves to overstate our revenues and expenses recognized in the ordinary course of business.

Gains or losses on financial instruments

owned: We account for our financial instruments owned as trading securities, which requires these instruments to be measured at

fair value with gains and losses reported in net income. We exclude these items when calculating our non-GAAP financial measurements as

the gains and losses introduce volatility in earnings and are not core to our operating business.

Tax windfalls and shortfalls upon vesting

of stock-based compensation awards: GAAP requires the recognition of tax windfalls and shortfalls within income tax expense. These

items arise upon the vesting of stock-based compensation awards and the magnitude is directly correlated to the number of awards vesting/exercised

as well as the difference between the price of our stock on the date the award was granted and the date the award vested or was exercised.

We exclude these items when calculating our non-GAAP financial measurements as they introduce volatility in earnings and are not core

to our operating business.

Imputed interest on our payable to the Gold

Bullion Holdings (Jersey) Limited (“GBH”): During the fourth quarter of 2023, we repurchased our Series C Non-Voting

Convertible Preferred Stock, which was convertible into approximately 13.1 million shares of WisdomTree common stock, from GBH, a subsidiary

of the World Gold Council, for aggregate cash consideration of approximately $84.4 million. Under the terms of the transaction, we paid

GBH $40.0 million on the closing date, with the remainder of the purchase price payable in equal annual installments on the first, second

and third anniversaries of the closing date, with no requirement to pay interest. Under US GAAP, the obligation is recorded at its present

value utilizing a market rate of interest on the closing date of 7.0% and the corresponding discount is amortized as interest expense

pursuant to the effective interest method of accounting over the life of the obligation. We exclude this item when calculating our non-GAAP

financial measurements as recognition of interest expense is non-cash and contrary to the stated terms of our obligation.

Other items: Losses on extinguishment

of convertible notes, a civil money penalty in connection with the SEC ESG Settlement, gains and losses recognized on our investments,

changes in deferred tax asset valuation allowance, expenses incurred in response to an activist campaign and impairments are excluded

when calculating our non-GAAP financial measurements.

Adjusted Effective Income Tax Rate

We disclose our adjusted effective income tax

rate as a non-GAAP financial measurement in order to report our effective income tax rate exclusive of items that are non-recurring or

not core to our operating business. We believe reporting our adjusted effective income tax rate provides investors with a consistent way

to analyze our income taxes. Our adjusted effective income tax rate is calculated by dividing adjusted income tax expense by adjusted

income before income taxes. See above for information regarding the items that are excluded.

Gross Margin and Gross Margin Percentage

We disclose our gross margin and gross margin

percentage as non-GAAP financial measurements because we believe they provide investors with a consistent way to analyze the amount we

retain after paying third-party service providers to operate our ETPs. These measures also assist us in analyzing the profitability of

our products. We define gross margin as total adjusted operating revenues less fund management and administration expenses. Gross margin

percentage is calculated as gross margin divided by total adjusted operating revenues.

GAAP to NON-GAAP RECONCILIATION (CONSOLIDATED)

(in thousands)

(Unaudited)

| | |

Three Months Ended |

Adjusted

Net Income and Diluted Earnings per Share: | |

Dec. 31,

2024

| |

Sept. 30,

2024

| |

June 30,

2024

| |

Mar. 31,

2024

| |

Dec. 31,

2023

|

| | |

| | |

| | |

| | |

| | |

| |

| Net income/(loss), as reported | |

$ | 27,308 | | |

$ | (4,485 | ) | |

$ | 21,759 | | |

$ | 22,111 | | |

$ | 19,077 | |

| (Deduct)/add back: (Gains)/losses

on financial instruments owned, net of income taxes | |

| (1,722 | ) | |

| (607 | ) | |

| 220 | | |

| (1,562 | ) | |

| (370 | ) |

| Add back: Loss on extinguishment

of convertible notes, net of income taxes | |

| (718 | ) | |

| 30,128 | | |

| — | | |

| — | | |

| — | |

| Add back: Imputed interest

on payable to GBH, net of income taxes | |

| 451 | | |

| 528 | | |

| 513 | | |

| 504 | | |

| 224 | |

| (Deduct)/add back: (Decrease)/increase

in deferred tax asset valuation allowance on financial instruments owned and investments | |

| (428 | ) | |

| (335 | ) | |

| 391 | | |

| (531 | ) | |

| (280 | ) |

| Add back/(deduct): Losses/(gains)

recognized on investments, net of income taxes | |

| 389 | | |

| (436 | ) | |

| 998 | | |

| (93 | ) | |

| (336 | ) |

| Add back: Civil money penalty

in connection with SEC ESG Settlement | |

| — | | |

| 4,000 | | |

| — | | |

| — | | |

| — | |

| (Deduct)/add back: Tax (windfalls)/shortfalls

upon vesting of stock-based compensation awards | |

| — | | |

| (25 | ) | |

| (40 | ) | |

| (699 | ) | |

| (6 | ) |

| Add back: Expenses incurred

in response to an activist campaign, net of income taxes | |

| — | | |

| — | | |

| 3,234 | | |

| 526 | | |

| — | |

| Add back:

Impairments, net of income taxes | |

| — | | |

| — | | |

| — | | |

| — | | |

| 257 | |

| Adjusted net income | |

$ | 25,280 | | |

$ | 28,768 | | |

$ | 27,075 | | |

$ | 20,256 | | |

$ | 18,566 | |

| Weighted average common shares—diluted | |

| 147,612 | | |

| 156,745 | | |

| 166,359 | | |

| 165,268 | | |

| 171,703 | |

| Adjusted earnings per share—diluted | |

$ | 0.17 | | |

$ | 0.18 | | |

$ | 0.16 | | |

$ | 0.12 | | |

$ | 0.11 | |

| | |

Three Months Ended |

Gross

Margin and Gross Margin Percentage: | |

Dec. 31,

2024

| |

Sept. 30,

2024

| |

June 30,

2024

| |

Mar. 31,

2024

| |

Dec. 31,

2023

|

| | |

| | |

| | |

| | |

| | |

| |

| Operating revenues | |

$ | 110,697 | | |

$ | 113,168 | | |

$ | 107,034 | | |

$ | 96,838 | | |

$ | 90,844 | |

| Less:

Legal and other related expenses expected to be covered by insurance | |

| (192 | ) | |

| (3,661 | ) | |

| — | | |

| (453 | ) | |

| — | |

| Operating revenues, as adjusted | |

$ | 110,505 | | |

$ | 109,507 | | |

$ | 107,034 | | |

$ | 96,385 | | |

$ | 90,844 | |

| Less:

Fund management and administration | |

| (22,858 | ) | |

| (21,004 | ) | |

| (20,139 | ) | |

| (19,962 | ) | |

| (18,445 | ) |

| Gross margin | |

$ | 87,647 | | |

$ | 88,503 | | |

$ | 86,895 | | |

$ | 76,423 | | |

$ | 72,399 | |

| Gross margin percentage | |

| 79.3% | | |

| 80.8% | | |

| 81.2% | | |

| 79.3% | | |

| 79.7% | |

| | |

Three Months Ended |

| Adjusted Operating Revenues, Operating Income and Adjusted Operating

Income Margin: | |

Dec. 31,

2024

| |

Sept. 30,

2024

| |

June 30,

2024

| |

Mar. 31,

2024

| |

Dec. 31,

2023

|

| | |

| | |

| | |

| | |

| | |

| |

| Operating revenues | |

$ | 110,697 | | |

$ | 113,168 | | |

$ | 107,034 | | |

$ | 96,838 | | |

$ | 90,844 | |

| Deduct:

Legal and other related expenses expected to be covered by insurance | |

| (192 | ) | |

| (3,661 | ) | |

| — | | |

| (453 | ) | |

| — | |

| Operating revenues, as adjusted | |

$ | 110,505 | | |

$ | 109,507 | | |

$ | 107,034 | | |

$ | 96,385 | | |

$ | 90,844 | |

| Operating income | |

$ | 35,040 | | |

$ | 40,792 | | |

$ | 33,511 | | |

$ | 27,950 | | |

$ | 26,035 | |

| Add back:

Expenses incurred in response to an activist campaign | |

| — | | |

| — | | |

| 4,271 | | |

| 695 | | |

| — | |

| Adjusted operating income | |

$ | 35,040 | | |

$ | 40,792 | | |

$ | 37,782 | | |

$ | 28,645 | | |

$ | 26,035 | |

| Adjusted operating income margin | |

| 31.7% | | |

| 37.3% | | |

| 35.3% | | |

| 29.7% | | |

| 28.7% | |

| | |

Three Months Ended |

Adjusted

Total Operating Expenses: | |

Dec. 31,

2024

| |

Sept. 30,

2024

| |

June 30,

2024

| |

Mar. 31,

2024

| |

Dec. 31,

2023

|

| | |

| | |

| | |

| | |

| | |

| |

| Total operating expenses | |

$ | 75,657 | | |

$ | 72,376 | | |

$ | 73,523 | | |

$ | 68,888 | | |

$ | 64,809 | |

| Deduct: Legal and other related

expenses expected to be covered by insurance | |

| (192 | ) | |

| (3,661 | ) | |

| — | | |

| (453 | ) | |

| — | |

| Deduct:

Expenses incurred in response to an activist campaign | |

| — | | |

| — | | |

| (4,271 | ) | |

| (695 | ) | |

| — | |

| Adjusted total operating expenses | |

$ | 75,465 | | |

$ | 68,715 | | |

$ | 69,252 | | |

$ | 67,740 | | |

$ | 64,809 | |

| | |

Three Months Ended |

Adjusted

Income Before Income Taxes: | |

Dec. 31,

2024

| |

Sept. 30,

2024

| |

June 30,

2024

| |

Mar. 31,

2024

| |

Dec. 31,

2023

|

| | |

| | |

| | |

| | |

| | |

| |

| Income before income taxes | |

$ | 34,198 | | |

$ | 3,866 | | |

$ | 29,526 | | |

$ | 27,812 | | |

$ | 24,765 | |

| (Deduct)/add back: (Gains)/losses on financial

instruments owned | |

| (2,275 | ) | |

| (802 | ) | |

| 291 | | |

| (2,063 | ) | |

| (489 | ) |

| Add back: Imputed interest on payable to GBH | |

| 596 | | |

| 697 | | |

| 677 | | |

| 666 | | |

| 296 | |

| Add back/(deduct): Losses/(gains) recognized on

investments | |

| 514 | | |

| (576 | ) | |

| 1,318 | | |

| (123 | ) | |

| (1,003 | ) |

| Add back: Loss on extinguishment of convertible

notes | |

| — | | |

| 30,632 | | |

| — | | |

| — | | |

| — | |

| Add back: Civil money penalty in connection with

SEC ESG Settlement | |

| — | | |

| 4,000 | | |

| — | | |

| — | | |

| — | |

| Add back: Expenses incurred in response to an

activist campaign | |

| — | | |

| — | | |

| 4,271 | | |

| 695 | | |

| — | |

| Add back:

Impairments | |

| — | | |

| — | | |

| — | | |

| — | | |

| 339 | |

| Adjusted income before income taxes | |

$ | 33,033 | | |

$ | 37,817 | | |

$ | 36,083 | | |

$ | 26,987 | | |

$ | 23,908 | |

| | |

Three Months Ended |

| Adjusted Income Tax Expense and Adjusted Effective Income Tax Rate: | |

Dec. 31,

2024

| |

Sept. 30,

2024

| |

June 30,

2024

| |

Mar. 31,

2024

| |

Dec. 31,

2023

|

| | |

| | |

| | |

| | |

| | |

| |

| Adjusted income before income taxes

(above) | |

$ | 33,033 | | |

$ | 37,817 | | |

$ | 36,083 | | |

$ | 26,987 | | |

$ | 23,908 | |

| Income tax expense | |

$ | 6,890 | | |

$ | 8,351 | | |

$ | 7,767 | | |

$ | 5,701 | | |

$ | 5,688 | |

| Add back: Tax benefit arising

from extinguishment of convertible notes | |

| 718 | | |

| 504 | | |

| — | | |

| — | | |

| — | |

| (Deduct)/add back: Tax (expense)/benefit

arising from (gains)losses on financial instruments owned | |

| (553 | ) | |

| (195 | ) | |

| 71 | | |

| (501 | ) | |

| (119 | ) |

| Add back/(deduct): Decrease/(increase)

in deferred tax asset valuation allowance on financial instruments owned and investments | |

| 428 | | |

| 335 | | |

| (391 | ) | |

| 531 | | |

| 280 | |

| Add back: Tax benefit on imputed

interest | |

| 145 | | |

| 169 | | |

| 164 | | |

| 162 | | |

| 72 | |

| Add back/(deduct): Tax benefit/(expense)

on losses/(gains) on investments | |

| 125 | | |

| (140 | ) | |

| 320 | | |

| (30 | ) | |

| (667 | ) |

| Add back/(deduct): Tax windfalls/(shortfalls)

upon vesting of stock-based compensation awards | |

| — | | |

| 25 | | |

| 40 | | |

| 699 | | |

| 6 | |

| Add back: Tax benefit arising

from expenses incurred in response to an activist campaign | |

| — | | |

| — | | |

| 1,037 | | |

| 169 | | |

| — | |

| Add back:

Tax benefit arising from impairments | |

| — | | |

| — | | |

| — | | |

| — | | |

| 82 | |

| Adjusted income tax expense | |

$ | 7,753 | | |

$ | 9,049 | | |

$ | 9,008 | | |

$ | 6,731 | | |

$ | 5,342 | |

| Adjusted effective income tax rate | |

| 23.5% | | |

| 23.9% | | |

| 25.0% | | |

| 24.9% | | |

| 22.3% | |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING

STATEMENTS

This press release contains forward-looking statements

that are based on our management’s beliefs and assumptions and on information currently available to our management. Although we

believe that the expectations reflected in these forward-looking statements are reasonable, these statements relate to future events or

our future financial performance, and involve known and unknown risks, uncertainties and other factors that may cause our actual results,

levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or

achievements expressed or implied by these forward-looking statements. In some cases, you can identify forward-looking statements by terminology

such as “may,” “will,” “should,” “expects,” “intends,” “plans,”

“anticipates,” “believes,” “estimates,” “predicts,” “potential,” “continue”

or the negative of these terms or other comparable terminology. These statements are only predictions. You should not place undue reliance

on forward-looking statements because they involve known and unknown risks, uncertainties and other factors, which are, in some cases,

beyond our control and could materially affect results. Factors that may cause actual results to differ materially from current expectations

include, among other things, the risks described below. If one or more of these or other risks or uncertainties occur, or if our underlying

assumptions prove to be incorrect, actual events or results may vary significantly from those implied or projected by the forward-looking

statements. No forward-looking statement is a guarantee of future performance. You should read this press release completely and with

the understanding that our actual future results may be materially different from any future results expressed or implied by these forward-looking

statements.

In particular, forward-looking statements in this

press release may include statements about:

| · | anticipated trends, conditions and investor sentiment in the global markets and ETPs; |

| · | anticipated levels of inflows into and outflows out of our ETPs; |

| · | our ability to deliver favorable rates of return to investors; |

| · | competition in our business; |

| · | whether we will experience future growth; |

| · | our ability to develop new products and services and their potential for success; |

| · | our ability to maintain current vendors or find new vendors to provide services to us at favorable costs; |

| · | our ability to successfully implement our strategy relating to digital assets and blockchain-enabled financial services, including

WisdomTree Prime® and WisdomTree Connect™, and achieve its objectives; |

| · | our ability to successfully operate and expand our business in non-U.S. markets; |

| · | the effect of laws and regulations that apply to our business; and |

| · | actions of activist stockholders. |

Our business is subject to many risks and uncertainties,

including without limitation:

| · | declining prices of securities, gold and other precious metals and other commodities and changes in interest rates and general market

conditions can adversely affect our business by reducing the market value of the assets we manage or causing WisdomTree ETP investors

to sell their fund shares and trigger redemptions; |

| · | fluctuations in the amount and mix of our AUM, whether caused by disruptions in the financial markets or otherwise, including but

not limited to events such as a pandemic or war, geopolitical conflicts, political events, acts of terrorism and other matters beyond

our control, may negatively impact revenues and operating margins, and may impede our ability to refinance our debt upon maturity or increase

the cost of borrowing upon a refinancing; |

| · | competitive pressures could reduce revenues and profit margins; |

| · | we derive a substantial portion of our revenues from a limited number of products, and, as a result, our operating results are particularly

exposed to investor sentiment toward investing in the products’ strategies and our ability to maintain the AUM of these products,

as well as the performance of these products and market-specific and political and economic risk; |

| · | a significant portion of our AUM is held in products with exposure to U.S. and international developed markets, and we therefore have

exposure to domestic and foreign market conditions and are subject to currency exchange rate risks; |

| · | withdrawals or broad changes in investments in our ETPs by investors with significant positions may negatively impact revenues and

operating margins; |

| · | we face increased operational, regulatory, financial and other risks as a result of conducting our business internationally, and as

we expand our digital assets product offerings and services beyond our existing ETP business; |

| · | many of our ETPs have a limited track record, and poor investment performance could cause our revenues to decline; |

| · | we depend on third parties to provide many critical services to operate our business and our ETPs. The failure of key vendors to adequately

provide such services could materially affect our operating business and harm WisdomTree ETP investors; and |

| · | actions of activist stockholders against us, which have been costly and may be disruptive and cause uncertainty about the strategic

direction of our business. |

Other factors, such as general economic conditions,

including currency exchange rate fluctuations, also may have an effect on the results of our operations. For a more complete description

of the risks noted above and other risks that could cause our actual results to differ from our current expectations, see “Risk

Factors” in our Annual Report on Form 10-K for the year ended December 31, 2023, and in subsequent reports filed with or furnished

to the SEC.

The forward-looking statements in this press release

represent our views as of the date of this press release. We anticipate that subsequent events and developments may cause our views

to change. However, while we may elect to update these forward-looking statements at some point in the future, we have no current intention

of doing so except to the extent required by applicable law. Therefore, these forward-looking statements do not represent our views

as of any date other than the date of this press release.

Category: Business Update

15

v3.24.4

Cover

|

Jan. 28, 2025 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jan. 28, 2025

|

| Entity File Number |

001-10932

|

| Entity Registrant Name |

WisdomTree, Inc.

|

| Entity Central Index Key |

0000880631

|

| Entity Tax Identification Number |

13-3487784

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

250 West 34th Street

|

| Entity Address, Address Line Two |

3rd Floor

|

| Entity Address, City or Town |

New York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10119

|

| City Area Code |

(212)

|

| Local Phone Number |

801-2080

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock, $0.01 par value |

|

| Title of 12(b) Security |

Common Stock, $0.01 par value

|

| Trading Symbol |

WT

|

| Security Exchange Name |

NYSE

|

| Preferred Stock Purchase Rights |

|

| Title of 12(b) Security |