Q2 revenue increased 8% year-over-year to a

second quarter record $673 million, driven by 13% growth in the

Benefits segment and acceleration in Mobility segment growth

rate

Q2 GAAP net income was $1.83 per diluted share;

Q2 adjusted net income was $3.91 per diluted share

Q2 GAAP operating income margin of 25.0% and

adjusted operating income margin of 40.7%

Share repurchases of approximately $100 million

during Q2, an additional $70 million in July 2024, and expect to

enter into a $300 million accelerated share repurchase agreement in

the near future

WEX (NYSE: WEX), the global commerce platform that simplifies

the business of running a business, today reported financial

results for the three months ended June 30, 2024.

“WEX achieved another quarter of record revenue and delivered

adjusted earnings per share above the top end of our guidance

range, showcasing our ability to deliver consistently strong

financial results even in challenging economic conditions,” said

Melissa Smith, WEX’s Chair, Chief Executive Officer, and

President.

“During the quarter, we exceeded our goal of achieving $100

million of run rate savings six months earlier than expected. We

also made meaningful progress advancing our strategic initiatives

to expand our product capabilities on our commerce platform in each

of our segments. Further, we continued to invest in our EV

offerings to support the transition to mixed fleets and embraced

digital transformation by harnessing cutting-edge technologies and

leveraging AI capabilities. We remain committed to creating value

for our shareholders and expect to enter into an accelerated share

repurchase agreement in the near future to repurchase $300 million

of WEX common stock, reflecting our confidence in WEX’s intrinsic

value and long-term growth potential.”

Second Quarter 2024 Financial Results

Total revenue for the second quarter of 2024 increased 8% to

$673.5 million from $621.3 million for the second quarter of 2023.

The revenue increase in the quarter includes a $5.4 million

unfavorable impact from fuel prices and spreads and a $0.8 million

unfavorable impact from foreign exchange rates.

Net income on a GAAP basis decreased by $18.3 million to a net

income of $77.0 million, or $1.83 per diluted share, for the second

quarter of 2024, compared with net income of $95.3 million, or

$2.20 per diluted share, for the second quarter of 2023. The

Company's adjusted net income, which is a non-GAAP measure, was

$164.0 million for the second quarter of 2024, or $3.91 per diluted

share, up 8% per diluted share from $159.3 million, or $3.63 per

diluted share, for the same period last year. GAAP operating income

margin for the second quarter of 2024 was 25.0% compared to 25.7%

last year. Adjusted operating income margin was 40.7% in the second

quarter of 2024 compared to 40.3% for the prior year comparable

period. See Exhibit 1 for a full explanation and reconciliation of

adjusted net income, adjusted net income per diluted share, and

adjusted operating income to the most directly comparable GAAP

financial measures. See Exhibit 5 for information on the

calculation of adjusted operating income margin.

Second Quarter 2024 Performance Metrics

- Total volume across all segments was $60.1 billion, an increase

of 9% from the second quarter of 2023.

- Mobility payment processing transactions in the second quarter

of 2024 increased 2% to 144.9 million compared with the prior year

at 142.4 million.

- Average number of vehicles serviced was approximately 19.4

million, an increase of 3% from the second quarter of 2023.

- Benefits’ average number of Software-as-a-Service (SaaS)

accounts grew 3% to 20.0 million compared with the second quarter

of 2023.

- Average HSA custodial cash assets in the second quarter of 2024

were $4.2 billion, which is 9% higher than $3.9 billion a year

ago.

- Corporate Payments’ purchase volume grew 12% to $25.8 billion

from $22.9 billion in the second quarter of 2023.

- The Company repurchased 0.5 million shares of its stock for a

total cost of approximately $100 million.

- Cash flows used in operating activities in the second quarter

of this year were $7.0 million. Adjusted free cash flow, which is a

non-GAAP measure, was $161.1 million for the same period. Please

see Exhibit 1 for a reconciliation of operating cash flow to this

non-GAAP measure.

“We delivered solid financial performance in the second quarter,

underpinned by our solid balance sheet, strong cash generation, and

low leverage ratio that allow us to invest in the business and

return capital to our shareholders,” said Jagtar Narula, WEX’s

Chief Financial Officer. “Our Mobility segment revenue growth

accelerated in Q2 as expected, however, as a result of recent

trends in the travel environment, we are modestly revising our

outlook for the second half of 2024. We are taking actions to drive

further operational efficiency, and remain confident in WEX’s

strong market position, strategic growth initiatives, and culture

of innovation that empowers us to drive sustainable long-term

success.”

Financial Guidance and Assumptions

The Company provides revenue guidance on a GAAP basis and

earnings guidance on a non-GAAP basis, due to the uncertainty and

the indeterminate amount of certain elements that are included in

reported GAAP earnings.

- For the third quarter of 2024, the Company expects revenue in

the range of $688 million to $698 million and adjusted net income

in the range of $4.42 to $4.52 per diluted share.

- For the full year 2024, the Company now expects revenue in the

range of $2.68 billion to $2.72 billion. Adjusted net income is now

expected to be in the range of $15.98 to $16.38 per diluted

share.

Third quarter and full year 2024 guidance is based on assumed

average U.S. retail fuel prices of $3.65 and $3.61 per gallon,

respectively, and a 25.0% adjusted net income effective tax rate.

The fuel prices referenced above are based on the applicable NYMEX

futures price from the week of July 15, 2024. Our guidance assumes

approximately 40.8 million and 41.4 million fully diluted shares

outstanding for the third quarter and the full year, respectively.

The share count assumptions include the effect of approximately $70

million of shares purchased during the month of July and the

expected effect of entering into a $300 million accelerated share

repurchase transaction that we expect to do in the near future.

The Company's adjusted net income guidance, which is a non-GAAP

measure, excludes unrealized gains and losses on financial

instruments, net foreign currency gains and losses,

acquisition-related intangible amortization, other acquisition and

divestiture related items, stock-based compensation, other costs,

debt restructuring costs and debt issuance cost amortization, tax

related items and certain other non-operating items and

non-recurring or non-cash operating charges that are not core to

our operations, as applicable depending on the period presented. We

are unable to reconcile our adjusted net income guidance to the

comparable GAAP measure without unreasonable effort because of the

difficulty in predicting the amounts to be adjusted, including, but

not limited to, foreign currency exchange rates, unrealized gains

and losses on financial instruments, and acquisition and

divestiture related items, which may have a significant impact on

our financial results.

Additional Information

Management uses the non-GAAP measures presented within this

earnings release to evaluate the Company’s performance on a

comparable basis. Management believes that investors may find these

measures useful for the same purposes, but cautions that they

should not be considered a substitute for, or superior to,

disclosure in accordance with GAAP.

To provide investors with additional insight into its

operational performance, WEX has included in this earnings release:

in Exhibit 1, reconciliations of non-GAAP measures referenced in

this earnings release; in Exhibit 2, tables illustrating the impact

of foreign currency rates and fuel prices for each of our

reportable segments for the three months ended June 30, 2024; and

in Exhibit 3, a table of selected other metrics for the quarter

ended June 30, 2024 and the four preceding quarters. See segment

revenue for the three months ended June 30, 2024 and 2023 in

Exhibit 4 and information regarding segment adjusted operating

income margin and adjusted operating income margin in Exhibit

5.

Conference Call Details

In conjunction with this announcement, WEX will host a

conference call today, July 25, 2024, at 10:00 a.m. (ET). As

previously announced, the conference call will be webcast live on

the Internet, and can be accessed along with the accompanying

slides at the Investor Relations section of the WEX website,

www.wexinc.com. The live conference call also can be accessed by

dialing (888) 596-4144 or (646) 968-2525. The Conference ID number

is 2902800. A replay of the webcast and the accompanying slides

will be available on the Company's website for at least 30

days.

About WEX

WEX (NYSE: WEX) is the global commerce platform that simplifies

the business of running a business. WEX has created a powerful

ecosystem that offers seamlessly embedded, personalized solutions

for its customers around the world. Through its rich data and

specialized expertise in simplifying benefits, reimagining

mobility, and paying and getting paid, WEX aims to make it easy for

companies to overcome complexity and reach their full potential.

For more information, please visit www.wexinc.com.

Forward-Looking Statements

This earnings release includes forward-looking statements

including, but not limited to, statements about management’s plans,

goals, expectations, and guidance and assumptions with respect to

future financial performance of the Company as well as our ability

to enter into and execute an expected accelerated share repurchase

agreement. Any statements in this earnings release that are not

statements of historical facts are forward-looking statements. When

used in this earnings release, the words “anticipate,” “believe,”

“continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,”

“project,” “will,” “positions,” “confidence,” and similar

expressions are intended to identify forward-looking statements,

although not all forward-looking statements contain such words.

Forward-looking statements relate to our future plans, objectives,

expectations, and intentions and are not historical facts and

accordingly involve known and unknown risks and uncertainties and

other factors that may cause the actual results or performance to

be materially different from future results or performance

expressed or implied by these forward-looking statements. The

following factors, among others, could cause actual results to

differ materially from those contained in forward-looking

statements made in this earnings release and in oral statements

made by our authorized officers:

- the impact of fluctuations in demand for fuel and the

volatility and prices of fuel, including fuel spreads in the

Company’s international markets, and the resulting impact on the

Company’s margins, revenues, and net income;

- the effects of general economic conditions, including a decline

in demand for fuel, corporate payment services, travel related

services, or healthcare related products and services;

- the failure to comply with the applicable requirements of

Mastercard or Visa contracts and rules;

- the extent to which unpredictable events in the locations in

which the Company or the Company’s customers operate or elsewhere

may adversely affect the Company’s employees, ability to conduct

business, results of operations and financial condition;

- the impact and size of credit losses, including fraud losses,

and other adverse effects if the Company fails to adequately assess

and monitor credit risk or fraudulent use of our payment cards or

systems;

- the impact of changes to the Company’s credit standards;

- limitations on, or compression of, interchange fees;

- the effect of adverse financial conditions affecting the

banking system;

- the impact of increasing scrutiny with respect to our

environmental, social and governance practices;

- failure to implement new technologies and products;

- the failure to realize or sustain the expected benefits from

our cost and organizational operational efficiencies

initiatives;

- the failure to compete effectively in order to maintain or

renew key customer and partner agreements and relationships, or to

maintain volumes under such agreements;

- the ability to attract and retain employees;

- the ability to execute the Company’s business expansion and

acquisition efforts and realize the benefits of acquisitions we

have completed;

- the failure to achieve commercial and financial benefits as a

result of our strategic minority equity investments;

- the impact of foreign currency exchange rates on the Company’s

operations, revenue and income and other risks associated with our

operations outside the United States;

- the failure to adequately safeguard custodial HSA assets;

- the incurrence of impairment charges if the Company’s

assessment of the fair value of certain of its reporting units

changes;

- the uncertainties of investigations and litigation;

- the ability of the Company to protect its intellectual property

and other proprietary rights;

- the impact of regulatory capital requirements and other

regulatory requirements on the operations of WEX Bank or its

ability to make payments to WEX Inc.;

- the impact of the Company’s debt instruments on the Company’s

operations;

- the impact of leverage on the Company’s operations, results or

borrowing capacity generally;

- changes in interest rates, including those which we must pay

for our deposits, and the rate of inflation;

- the ability to refinance certain indebtedness or obtain

additional financing;

- the actions of regulatory bodies, including tax, banking and

securities regulators, or possible changes in tax, banking or

financial regulations impacting the Company’s industrial bank, the

Company as the corporate parent or other subsidiaries or

affiliates;

- the failure to comply with the Treasury Regulations applicable

to non-bank custodians;

- the impact from breaches of, or other issues with, the

Company’s technology systems or those of its third-party service

providers and any resulting negative impact on the Company’s

reputation, liabilities or relationships with customers or

merchants;

- the impact of regulatory developments with respect to privacy

and data protection;

- the impact of any disruption to the technology and electronic

communications networks we rely on;

- the ability to incorporate artificial intelligence in our

business successfully and ethically;

- the ability to maintain effective systems of internal

controls;

- the impact of provisions in our charter documents, Delaware law

and applicable banking laws that may delay or prevent our

acquisition by a third party; as well as

- other risks and uncertainties identified in Item 1A of our

Annual Report on Form 10-K for the year ended December 31, 2023,

filed with the Securities and Exchange Commission on February 23,

2024, and subsequent filings with the Securities and Exchange

Commission.

The forward-looking statements speak only as of the date of the

initial filing of this earnings release and undue reliance should

not be placed on these statements. The Company disclaims any

obligation to update any forward-looking statements as a result of

new information, future events or otherwise.

WEX INC.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(in millions, except per share

data)

(unaudited)

Three months ended June

30,

Six months ended June

30,

2024

2023

2024

2023

Revenues

Payment processing revenue

$

318.4

$

300.5

$

620.4

$

588.6

Account servicing revenue

168.6

152.9

341.9

313.6

Finance fee revenue

77.8

76.4

148.1

157.1

Other revenue

108.7

91.5

215.8

174.0

Total revenues

673.5

621.3

1,326.1

1,233.3

Cost of services

Processing costs

163.8

149.7

332.9

295.3

Service fees

20.8

17.9

41.8

36.2

Provision for credit losses

20.6

22.7

43.0

68.1

Operating interest

25.7

19.5

49.2

32.3

Depreciation and amortization

32.8

25.2

64.0

50.4

Total cost of services

263.8

235.0

530.9

482.3

General and administrative

101.0

106.2

189.5

195.1

Sales and marketing

93.7

78.9

179.0

158.8

Depreciation and amortization

46.9

41.8

94.0

83.4

Operating income

168.1

159.4

332.6

313.7

Financing interest expense, net of

financial instruments

(59.9

)

(40.2

)

(120.2

)

(93.1

)

Change in fair value of contingent

consideration

(1.7

)

(1.2

)

(3.4

)

(3.0

)

Net foreign currency loss

(0.4

)

(0.2

)

(13.0

)

(1.6

)

Income before income taxes

106.1

117.8

196.1

216.0

Income tax expense

29.1

22.5

53.4

52.7

Net income

$

77.0

$

95.3

$

142.7

$

163.3

Net income per share:

Basic

$

1.85

$

2.22

$

3.42

$

3.80

Diluted

$

1.83

$

2.20

$

3.38

$

3.76

Weighted average common shares

outstanding:

Basic

41.7

42.9

41.8

43.0

Diluted

42.0

43.4

42.2

43.5

WEX INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(in millions)

(unaudited)

June 30, 2024

December 31, 2023

Assets

Cash and cash equivalents

$

682.6

$

975.8

Restricted cash

1,095.7

1,254.2

Accounts receivable, net

3,966.4

3,428.5

Investment securities

3,322.5

3,022.1

Securitized accounts receivable,

restricted

138.7

129.4

Prepaid expenses and other current

assets

177.2

125.3

Total current assets

9,383.1

8,935.3

Property, equipment and capitalized

software

256.9

242.9

Goodwill and other intangible assets

4,368.2

4,474.4

Investment securities

65.7

66.8

Deferred income taxes, net

14.6

13.7

Other assets

158.4

149.0

Total assets

$

14,246.9

$

13,882.1

Liabilities and Stockholders’

Equity

Accounts payable

$

1,734.1

$

1,479.1

Accrued expenses and other current

liabilities

702.9

802.7

Restricted cash payable

1,095.1

1,253.5

Short-term deposits

4,288.8

3,942.8

Short-term debt, net

1,248.6

1,041.1

Total current liabilities

9,069.6

8,519.2

Long-term debt, net

2,959.6

2,827.5

Long-term deposits

—

129.8

Deferred income taxes, net

132.6

129.5

Other liabilities

301.6

455.5

Total liabilities

12,463.3

12,061.5

Total stockholders’ equity

1,783.5

1,820.6

Total liabilities and stockholders’

equity

$

14,246.9

$

13,882.1

WEX INC.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(in millions)

(unaudited)

Six Months Ended June

30,

2024

2023

Cash flows from operating

activities

$

(160.3

)

$

99.5

Cash flows from investing

activities

Purchases of property, equipment and

capitalized software

(73.6

)

(65.3

)

Purchase of other investments

(14.5

)

(5.0

)

Purchases of available-for-sale debt

securities

(512.2

)

(1,362.0

)

Sales and maturities of available-for-sale

debt securities

203.5

114.4

Acquisition of intangible assets

(5.1

)

(4.5

)

Other investing activities

(0.9

)

—

Net cash used for investing activities

(402.7

)

(1,322.4

)

Cash flows from financing

activities

Purchase of treasury shares

(173.6

)

(104.0

)

Net change in deposits

216.9

842.8

Net change in restricted cash payable

(133.2

)

271.5

Payments of deferred and contingent

consideration

(86.6

)

(27.2

)

Other financing activities

(20.9

)

(7.9

)

Net debt activity 1

344.1

493.3

Net cash provided by financing

activities

146.7

1,468.5

Effect of exchange rates on cash, cash

equivalents and restricted cash

(35.3

)

13.6

Net change in cash, cash equivalents and

restricted cash

(451.7

)

259.2

Cash, cash equivalents and restricted

cash, beginning of period

2,230.0

1,859.8

Cash, cash equivalents and restricted

cash, end of period

$

1,778.3

$

2,119.0

1 Net activity on debt includes: borrowings and repayments on

revolving credit facility; borrowings and repayments on term loans;

borrowings and repayments on Bank Term Funding Program (BTFP);

borrowings on Federal Home Loan Bank (FHLB); net change in borrowed

federal funds; and net borrowings on or repayments of other debt.

Exhibit 1

Reconciliation of Non-GAAP

Measures

(in millions, except per share

data)

(unaudited)

Reconciliation of GAAP Net Income to

Non-GAAP Adjusted Net Income

Three Months Ended June

30,

2024

2023

per diluted share

per diluted share

Net income

$

77.0

$

1.83

$

95.3

$

2.20

Unrealized loss (gain) on financial

instruments

0.2

—

(2.2

)

(0.05

)

Net foreign currency loss

0.4

0.01

0.2

—

Change in fair value of contingent

consideration

1.7

0.04

1.2

0.03

Acquisition-related intangible

amortization

50.5

1.20

44.3

1.02

Other acquisition and divestiture related

items

3.8

0.09

1.4

0.03

Stock-based compensation

33.3

0.79

36.5

0.84

Other costs

19.4

0.46

9.0

0.21

Debt restructuring and debt issuance cost

amortization

3.2

0.08

4.8

0.11

Tax related items

(25.5

)

(0.61

)

(31.2

)

(0.72

)

Dilutive impact of convertible debt1

—

—

—

(0.04

)

Adjusted net income

$

164.0

$

3.91

$

159.3

$

3.63

Six Months Ended June

30,

2024

2023

per diluted share

per diluted share

Net income

$

142.7

$

3.38

$

163.3

$

3.76

Unrealized loss on financial

instruments

0.4

0.01

12.3

0.28

Net foreign currency loss

13.0

0.31

1.6

0.04

Change in fair value of contingent

consideration

3.4

0.08

3.0

0.07

Acquisition-related intangible

amortization

101.5

2.41

88.4

2.03

Other acquisition and divestiture related

items

7.0

0.17

2.5

0.06

Stock-based compensation

60.0

1.42

62.6

1.44

Other costs

25.2

0.60

13.5

0.31

Debt restructuring and debt issuance cost

amortization

7.7

0.18

9.5

0.22

Tax related items

(50.2

)

(1.19

)

(51.6

)

(1.19

)

Dilutive impact of convertible debt1

—

—

—

(0.08

)

Adjusted net income

$

310.7

$

7.37

$

305.1

$

6.94

1 The dilutive impact of the Convertible Notes was calculated under

the ‘if-converted’ method for the periods through which they were

outstanding. Under the ‘if-converted’ method, interest expense, net

of tax, associated with the Convertible Notes of $3.8 million and

$7.7 million was added back to adjusted net income for the three

and six months ended June 30, 2023, respectively. For the three and

six months ended June 30, 2023, 1.6 million shares of the Company’s

common stock associated with the assumed conversion of the

Convertible Notes (prior to repurchase and cancellation) were

included in the calculation of adjusted net income per diluted

share, as the effect of including such adjustments was dilutive.

The total number of shares used in calculating adjusted net income

per diluted share for the three and six months ended June 30, 2024

was 42.0 million and 42.2 million, respectively. The total number

of shares used in calculating adjusted net income per diluted share

for the three and six months ended June 30, 2023 was 44.9 million

and 45.0 million, respectively.

Reconciliation of GAAP Operating Income

to Non-GAAP Total Segment Adjusted Operating Income and Adjusted

Operating Income

Three Months Ended June

30,

Six Months Ended June

30,

2024

(margin)1

2023

(margin)1

2024

(margin)1

2023

(margin)1

Operating income

$

168.1

25.0

%

$

159.4

25.7

%

$

332.6

25.1

%

$

313.7

25.4

%

Unallocated corporate expenses

26.1

25.3

49.7

47.7

Acquisition-related intangible

amortization

50.5

44.3

101.5

88.4

Other acquisition and divestiture related

items

1.4

1.4

3.8

2.5

Stock-based compensation

33.3

36.5

60.0

62.6

Other costs

20.6

9.0

27.3

13.5

Total segment adjusted operating

income

$

299.9

44.5

%

$

275.9

44.4

%

$

574.9

43.4

%

$

528.4

42.8

%

Unallocated corporate expenses

(26.1

)

(25.3

)

(49.7

)

(47.7

)

Adjusted operating income

$

273.9

40.7

%

$

250.6

40.3

%

$

525.2

39.6

%

$

480.7

39.0

%

1 Margins are derived by dividing the applicable measures by total

net revenue for the Company.

The Company's non-GAAP adjusted net income excludes unrealized

gains and losses on financial instruments, net foreign currency

gains and losses, acquisition-related intangible amortization,

other acquisition and divestiture related items, stock-based

compensation, other costs, debt restructuring costs and debt

issuance cost amortization, tax related items and certain other

non-operating items and non-recurring or non-cash operating charges

that are not core to our operations, as applicable depending on the

period presented.

The Company's non-GAAP adjusted operating income excludes

acquisition-related intangible amortization, other acquisition and

divestiture related items, debt restructuring costs, stock-based

compensation, other costs and certain non-recurring or non-cash

operating charges that are not core to our operations, as

applicable depending on the period presented. Total segment

adjusted operating income incorporates these same adjustments and

further excludes unallocated corporate expenses.

Although adjusted net income, adjusted operating income, and

total segment adjusted operating income are not calculated in

accordance with GAAP, our management team believes these non-GAAP

measures are integral to our reporting and planning processes and

uses them to assess operating performance because they generally

exclude financial results that are outside the normal course of our

business operations or management’s control. These measures are

also used to allocate resources among our operating segments and

for internal budgeting and forecasting purposes for both short- and

long-term operating plans.

For the periods presented herein, the following items have been

excluded in determining one or more non-GAAP measures for the

following reasons:

- Exclusion of the non-cash, mark-to-market adjustments on

financial instruments, including interest rate swap agreements and

investment securities, helps management identify and assess trends

in the Company’s underlying business that might otherwise be

obscured due to quarterly non-cash earnings fluctuations associated

with these financial instruments. Additionally, the non-cash,

mark-to-market adjustments on financial instruments are difficult

to forecast accurately, making comparisons across historical and

future periods difficult to evaluate;

- Net foreign currency gains and losses primarily result from the

remeasurement to functional currency of cash, accounts receivable

and accounts payable balances, certain intercompany notes

denominated in foreign currencies and any gain or loss on foreign

currency economic hedges relating to these items. The exclusion of

these items helps management compare changes in operating results

between periods that might otherwise be obscured due to currency

fluctuations;

- The change in fair value of contingent consideration, which is

related to the acquisition of certain contractual rights to serve

as custodian or sub-custodian to HSAs, is dependent upon changes in

future interest rate assumptions and has no significant impact on

the ongoing operations of the Company. Additionally, the non-cash,

mark-to-market adjustments on financial instruments are difficult

to forecast accurately, making comparisons across historical and

future periods difficult to evaluate;

- The Company considers certain acquisition-related costs,

including certain financing costs, investment banking fees,

warranty and indemnity insurance, certain integration-related

expenses and amortization of acquired intangibles, as well as gains

and losses from divestitures to be unpredictable, dependent on

factors that may be outside of our control and unrelated to the

continuing operations of the acquired or divested business or the

Company. In addition, the size and complexity of an acquisition,

which often drives the magnitude of acquisition-related costs, may

not be indicative of such future costs. The Company believes that

excluding acquisition-related costs and gains or losses on

divestitures facilitates the comparison of our financial results to

the Company’s historical operating results and to other companies

in our industry;

- Stock-based compensation is different from other forms of

compensation as it is a non-cash expense. For example, a cash

salary generally has a fixed and unvarying cash cost. In contrast,

the expense associated with an equity-based award is generally

unrelated to the amount of cash ultimately received by the

employee, and the cost to the Company is based on a stock-based

compensation valuation methodology and underlying assumptions that

may vary over time;

- Other costs are not consistently occurring and do not reflect

expected future operating expense, nor do they provide insight into

the fundamentals of current or past operations of our business.

This also includes non-recurring professional service costs, costs

related to certain identified initiatives, including restructuring

and technology initiatives, to further streamline the business,

improve the Company’s efficiency, create synergies and globalize

the Company’s operations, all with an objective to improve scale

and efficiency and increase profitability going forward.

- Impairment charges represent non-cash asset write-offs, which

do not reflect recurring costs that would be relevant to the

Company’s continuing operations. The Company believes that

excluding these nonrecurring expenses facilitates the comparison of

our financial results to the Company’s historical operating results

and to other companies in its industry;

- Debt restructuring and debt issuance cost amortization are

unrelated to the continuing operations of the Company. Debt

restructuring costs are not consistently occurring and do not

reflect expected future operating expense, nor do they provide

insight into the fundamentals of current or past operations of our

business. In addition, since debt issuance cost amortization is

dependent upon the financing method, which can vary widely company

to company, we believe that excluding these costs helps to

facilitate comparison to historical results as well as to other

companies within our industry;

- The tax related items are the difference between the Company’s

GAAP tax provision and a non-GAAP tax provision. Beginning in

fiscal year 2024, the Company utilizes a fixed annual projected

long-term non-GAAP tax rate in order to provide better consistency

across reporting periods. To determine this long-term projected tax

rate, the Company performs a pro forma tax provision based upon the

Company’s projected adjusted net income before taxes. The fixed

annual projected long-term non-GAAP tax rate could be subject to

change in future periods for a variety of reasons, including the

rapidly evolving global tax environment, significant changes in our

geographic earnings mix including due to acquisition activity, or

other changes to our strategy or business operations; and

- The Company does not allocate certain corporate expenses to our

operating segments, as these items are centrally controlled and are

not directly attributable to any reportable segment.

WEX believes that adjusted net income, adjusted operating

income, and total segment adjusted operating income may also be

useful to investors when evaluating the Company’s performance.

However, because adjusted net income, adjusted operating income,

and total segment adjusted operating income are non-GAAP measures,

they should not be considered as a substitute for, or superior to,

net income, operating income, or cash flows from operating

activities as determined in accordance with GAAP. In addition,

adjusted net income, adjusted operating income, and total segment

adjusted operating income as used by WEX may not be comparable to

similarly titled measures employed by other companies.

Reconciliation of GAAP Operating Cash Flow to Non-GAAP

Adjusted Free Cash Flow

The Company’s non-GAAP adjusted free cash flow is calculated as

cash flows from operating activities, adjusted for net purchases of

current investment securities, capital expenditures, net funding

activity including the change in net deposits, net advances from

the FHLB, and changes in borrowings under the BTFP and borrowed

federal funds, and certain other adjustments which, for the six

months ended June 30, 2024 and 2023, reflects an adjustment for

contingent and deferred consideration paid to sellers in excess of

acquisition-date fair value. Although non-GAAP adjusted free cash

flow is not calculated in accordance with GAAP, WEX believes that

adjusted free cash flow is a useful measure for investors to

further evaluate our results of operations because (i) adjusted

free cash flow indicates the level of cash generated by the

operations of the business, which excludes consideration paid on

acquisitions, after appropriate reinvestment for recurring

investments in property, equipment and capitalized software that

are required to operate the business; (ii) net funding activity

includes fluctuations in deposits and other borrowings primarily

used as part of our accounts receivable funding strategy; and (iii)

purchases of current investment securities are made as a result of

deposits gathered operationally. However, because adjusted free

cash flow is a non-GAAP measure, it should not be considered as a

substitute for, or superior to, operating cash flow as determined

in accordance with GAAP. In addition, adjusted free cash flow as

used by WEX may not be comparable to similarly titled measures

employed by other companies.

The following table reconciles GAAP operating cash flow to

adjusted free cash flow:

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Operating cash flow, as

reported

$

(7.0

)

$

72.4

$

(160.3

)

$

99.5

Adjustments to operating cash flow:

Other

—

—

67.1

1.5

Adjusted for certain investing and

financing activities:

Net funding activity

233.3

375.4

431.9

1,342.8

Less: Purchases of current investment

securities, net of sales and maturities

(25.6

)

(220.8

)

(308.5

)

(1,247.6

)

Less: Capital expenditures

(39.6

)

(34.7

)

(73.6

)

(65.3

)

Adjusted free cash flow

$

161.1

$

192.3

$

(43.4

)

$

130.9

Exhibit 2

Impact of Certain Macro

Factors on Reported Revenue and Adjusted Net Income

(in millions, except per share

data)

(unaudited)

The tables below show the impact of certain macro factors on

reported revenue:

Segment Revenue

Results

Mobility

Corporate Payments

Benefits

Total WEX Inc.

Three months ended June

30,

2024

2023

2024

2023

2024

2023

2024

2023

Reported revenue

$

359.6

$

340.2

$

134.1

$

121.9

$

179.8

$

159.2

$

673.5

$

621.3

FX impact (favorable) / unfavorable

$

0.4

$

0.5

$

—

$

0.8

PPG impact (favorable) / unfavorable

$

5.4

$

—

$

—

$

5.4

Six months ended June

30,

2024

2023

2024

2023

2024

2023

2024

2023

Reported revenue

$

698.5

$

682.5

$

256.6

$

226.7

$

371.0

$

324.1

$

1,326.1

$

1,233.3

FX impact (favorable) / unfavorable

$

0.5

$

(0.4

)

$

—

$

0.1

PPG impact (favorable) / unfavorable

$

25.9

$

—

$

—

$

25.9

To determine the impact of foreign exchange translation (“FX”)

on revenue, revenue from entities whose functional currency is not

denominated in U.S. dollars, as well as revenue from purchase

volume transacted in non-U.S. denominated currencies, were

translated using the weighted average exchange rates for the same

period in the prior year, exclusive of revenue derived from

acquisitions for one year following the acquisition dates.

To determine the impact of price per gallon of fuel (“PPG”) on

revenue, revenue subject to changes in fuel prices was calculated

based on the average retail price of fuel for the same period in

the prior year for the portion of our business that earns revenue

based on a percentage of fuel spend, exclusive of revenue derived

from acquisitions for one year following the acquisition dates. For

the portions of our business that earn revenue based on margin

spreads, revenue was calculated utilizing the comparable margin

from the prior year.

The table below shows the impact of certain macro factors on

adjusted net income by segment:

Segment Estimated Adjusted Net

Income Impact

Mobility

Corporate Payments

Benefits

Three months ended June

30,

2024

2023

2024

2023

2024

2023

FX impact (favorable) / unfavorable

$

(0.2

)

$

—

$

0.2

$

—

$

—

$

—

PPG impact (favorable) / unfavorable

$

3.8

$

—

$

—

$

—

$

—

$

—

Six months ended June

30,

2024

2023

2024

2023

2024

2023

FX impact (favorable) / unfavorable

$

0.4

$

—

$

(0.5

)

$

—

$

—

$

—

PPG impact (favorable) / unfavorable

$

17.9

$

—

$

—

$

—

$

—

$

—

To determine the estimated adjusted net income impact of FX on

revenue and expenses from entities whose functional currency is not

denominated in U.S. dollars, as well as revenue and variable

expenses from purchase volume transacted in non-U.S. denominated

currencies, amounts were translated using the weighted average

exchange rates for the same period in the prior year, net of tax,

exclusive of revenue and expenses derived from acquisitions for one

year following the acquisition dates.

To determine the estimated adjusted net income impact of PPG,

revenue and certain variable expenses impacted by changes in fuel

prices were adjusted based on the average retail price of fuel for

the same period in the prior year for the portion of our business

that earns revenue based on a percentage of fuel spend, net of

applicable taxes, exclusive of revenue and expenses derived from

acquisitions for one year following the acquisition dates. For the

portions of our business that earn revenue based on margin spreads,

revenue was adjusted to the comparable margin from the prior year,

net of applicable taxes.

Exhibit 3

Selected Other Metrics

(in millions, except rate

statistics)

(unaudited)

Q2 2024

Q1 2024

Q4 2023

Q3 2023

Q2 2023

Mobility:

Payment processing transactions (1)

144.9

136.9

138.1

144.6

142.4

Payment processing gallons of fuel (2)

3,694.4

3,567.7

3,578.6

3,687.2

3,664.5

Average US fuel price (US$ / gallon)

$

3.62

$

3.56

$

3.76

$

3.97

$

3.68

Payment processing $ of fuel (3)

$

13,729.1

$

13,061.0

$

13,814.3

$

14,945.1

$

13,779.8

Net payment processing rate (4)

1.29

%

1.31

%

1.26

%

1.18

%

1.25

%

Payment processing revenue

$

177.2

$

170.7

$

174.4

$

176.9

$

172.1

Net late fee rate (5)

0.49

%

0.46

%

0.50

%

0.44

%

0.48

%

Late fee revenue (6)

$

67.3

$

60.4

$

69.0

$

66.4

$

66.3

Corporate Payments:

Purchase volume (7)

$

25,756.2

$

23,947.9

$

22,800.8

$

27,860.1

$

22,901.3

Net interchange rate (8)

0.45

%

0.43

%

0.52

%

0.42

%

0.46

%

Payment solutions processing revenue

$

116.2

$

103.2

$

117.4

$

115.7

$

104.8

Benefits:

Purchase volume (9)

$

1,865.1

$

2,114.7

$

1,510.0

$

1,501.3

$

1,715.9

Average number of SaaS accounts (10)

20.0

20.3

19.9

19.9

19.5

Definitions and explanations:

(1) Payment processing transactions represents the total number of

purchases made by fleets that have a payment processing

relationship with WEX where the Company maintains the receivable

for the total purchase. (2) Payment processing gallons of fuel

represents the total number of gallons of fuel purchased by fleets

that have a payment processing relationship with WEX. (3) Payment

processing $ of fuel represents the total dollar value of the fuel

purchased by fleets that have a payment processing relationship

with WEX. (4) Net payment processing rate represents the percentage

of each payment processing dollar of fuel transaction that WEX

records as revenue from merchants, less certain discounts given to

customers and network fees. (5) Net late fee rate represents late

fee revenue as a percentage of fuel purchased by fleets that have a

payment processing relationship with WEX. (6) Late fee revenue

represents fees charged for payments not made within the terms of

the customer agreement based upon the outstanding customer

receivable balance. (7) Purchase volume represents the total dollar

value of all WEX-issued transactions that use WEX corporate card

products and virtual card products. (8) Net interchange rate

represents the percentage of the dollar value of each payment

processing transaction that WEX records as revenue from merchants,

less certain discounts given to customers and network fees. (9)

Purchase volume represents the total dollar value of all

transactions where interchange is earned by WEX. (10) Average

number of SaaS accounts represents the number of active

consumer-directed health, COBRA, and billing accounts on our SaaS

platforms.

Exhibit 4

Segment Revenue

Information

(in millions)

(unaudited)

Three months ended June

30,

Increase (decrease)

Six months ended June

30,

Increase (decrease)

Mobility

2024

2023

Amount

Percent

2024

2023

Amount

Percent

Revenues

Payment processing revenue

$

177.2

$

172.2

$

5.0

3

%

$

347.9

$

343.7

$

4.2

1

%

Account servicing revenue

$

49.8

40.8

9.0

22

%

96.2

81.1

15.1

19

%

Finance fee revenue

$

77.7

76.3

1.4

2

%

147.7

156.7

(9.0

)

(6

)%

Other revenue

$

54.8

50.9

3.9

8

%

106.7

101.0

5.7

6

%

Total revenues

$

359.6

$

340.2

$

19.4

6

%

$

698.5

$

682.5

$

16.0

2

%

Three months ended June

30,

Increase (decrease)

Six months ended June

30,

Increase (decrease)

Corporate Payments

2024

2023

Amount

Percent

2024

2023

Amount

Percent

Revenues

Payment processing revenue

$

116.2

$

104.7

$

11.5

11

%

$

219.4

$

194.8

$

24.6

13

%

Account servicing revenue

10.3

10.6

(0.3

)

(2

)%

20.3

21.2

(0.9

)

(4

)%

Finance fee revenue

(0.1

)

0.1

(0.2

)

NM

0.2

0.3

(0.1

)

NM

Other revenue

7.6

6.5

1.1

16

%

16.7

10.4

6.3

61

%

Total revenues

$

134.1

$

121.9

$

12.2

10

%

$

256.6

$

226.7

$

29.9

13

%

Three months ended June

30,

Increase (decrease)

Six months ended June

30,

Increase (decrease)

Benefits

2024

2023

Amount

Percent

2024

2023

Amount

Percent

Revenues

Payment processing revenue

$

24.9

$

23.6

$

1.3

6

%

$

53.1

$

50.1

$

3.0

6

%

Account servicing revenue

108.4

101.5

6.9

7

%

225.4

211.3

14.1

7

%

Finance fee revenue

0.1

—

0.1

NM

0.2

0.1

0.1

NM

Other revenue

46.3

34.1

12.2

36

%

92.3

62.6

29.7

48

%

Total revenues

$

179.8

$

159.2

$

20.6

13

%

$

371.0

$

324.1

$

46.9

14

%

NM - Not meaningful

Exhibit 5

Segment Adjusted Operating

Income and Adjusted Operating Income Margin Information

(in millions)

(unaudited)

Segment Adjusted Operating

Income

Segment Adjusted Operating

Income Margin(1)

Three Months Ended June

30,

Three Months Ended June

30,

2024

2023

2024

2023

Mobility

$

154.3

$

150.3

42.9

%

44.2

%

Corporate Payments

74.4

66.3

55.5

%

54.4

%

Benefits

71.1

59.3

39.6

%

37.2

%

Total segment adjusted operating

income

$

299.9

$

275.9

44.5

%

44.4

%

Segment Adjusted Operating

Income

Segment Adjusted Operating

Income Margin(1)

Six Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Mobility

$

285.4

$

289.1

40.9

%

42.4

%

Corporate Payments

139.0

115.5

54.2

%

50.9

%

Benefits

150.5

123.8

40.6

%

38.2

%

Total segment adjusted operating

income

$

574.9

$

528.4

43.4

%

42.8

%

(1) Segment adjusted operating income margin is derived by dividing

segment adjusted operating income by the revenue of the

corresponding segment (or the entire Company in the case of total

segment adjusted operating income). See Exhibit 1 for a

reconciliation of GAAP operating income and related margin to total

segment adjusted operating income and related margin.

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Adjusted operating income

$

273.9

$

250.6

$

525.2

$

480.7

Adjusted operating income margin (1)

40.7

%

40.3

%

39.6

%

39.0

%

(1) Adjusted operating income margin is derived by dividing

adjusted operating income by total revenues of the entire Company

as shown on the Condensed Consolidated Statement of Operations. See

Exhibit 1 for a reconciliation of GAAP operating income and related

margin to adjusted operating income and related margin.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240724707432/en/

News media contact: WEX Julie Lydon, 415-816-9397

Julie.Lydon@wexinc.com or Investor contact: WEX Steve Elder,

207-523-7769 Steve.Elder@wexinc.com

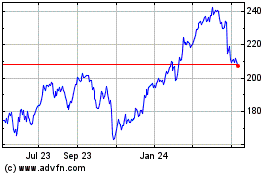

WEX (NYSE:WEX)

Historical Stock Chart

From Nov 2024 to Dec 2024

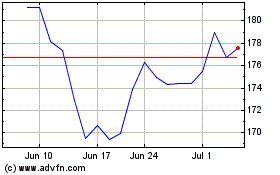

WEX (NYSE:WEX)

Historical Stock Chart

From Dec 2023 to Dec 2024