As filed with the Securities

and Exchange Commission on November 5, 2021.

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C.

20549

Form S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT

OF 1933

WEC ENERGY GROUP, INC.

(Exact name of registrant

as specified in its charter)

WISCONSIN

(State or other jurisdiction

of incorporation or organization)

39-1391525

(I.R.S. Employer

Identification Number)

231 West Michigan

Street

P.O. Box 1331

Milwaukee, Wisconsin

53201

(414) 221-2345

(Address, including zip

code, and telephone number, including area code, of registrant’s principal executive offices)

Anthony L. Reese

Vice President and Treasurer

231 West Michigan Street

P.O. Box 1331

Milwaukee, Wisconsin 53201

(414) 221-2345

(Name, address, including

zip code, and telephone number, including area code, of agent for service)

Copies to:

|

|

|

|

Joshua M. Erickson

WEC Energy Group, Inc.

231 West Michigan Street, P.O. Box 1331

Milwaukee, Wisconsin 53201

(414) 221-2345

|

|

Eric A. Koontz

Troutman Pepper Hamilton Sanders LLP

600 Peachtree Street, N.E., Suite 3000

Atlanta, Georgia 30308

(404) 885-3309

|

Approximate date of

commencement of proposed sale to the public: From time to time after this Registration Statement becomes effective as the

registrant shall determine in light of market conditions and other factors.

If the only securities being registered on this

Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ¨

If any of the securities being registered on this

Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities

offered only in connection with dividend or interest reinvestment plans, check the following box. x

If this Form is filed to register additional

securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities

Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment

filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement

number of the earlier effective registration statement for the same offering. ¨

If this Form is

a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon

filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. x

If this Form is

a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities

or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ¨

Indicate by check mark

whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an

emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller

reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer x

|

|

Accelerated filer ¨

|

|

Non-accelerated filer ¨

|

|

Smaller reporting company ¨

Emerging growth company ¨

|

|

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ¨

|

CALCULATION OF REGISTRATION

FEE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amount to be

Registered

|

|

|

Proposed Maximum

Offering Price

per Unit

|

|

|

Proposed Maximum

Aggregate Offering

Price

|

|

|

Amount of

Registration Fee

|

|

|

|

|

|

|

|

|

|

|

|

Title of Each Class of Securities to be Registered

|

|

|

|

|

|

|

|

|

|

Debt Securities

|

|

|

|

(1)

|

|

|

|

(1

|

)

|

|

|

(1

|

)

|

|

|

(2

|

)

|

|

|

(1)

|

There is being registered hereunder an indeterminate number or amount of Debt Securities of WEC Energy

Group, Inc. as may from time to time be offered at indeterminate prices.

|

|

|

(2)

|

In accordance with Rules 456(b) and 457(r) under the Securities Act of 1933, as amended,

the registrant is deferring payment of all of the registration fee.

|

PROSPECTUS

WEC ENERGY GROUP, INC.

Debt Securities

WEC Energy Group, Inc.

may issue and sell debt securities to the public from time to time in one or more offerings. We urge you to read this prospectus and the

applicable prospectus supplement carefully before you make your investment decision.

This prospectus describes

some of the general terms that may apply to these debt securities. The specific terms of any debt securities to be offered, and any other

information relating to a specific offering, will be set forth in a prospectus supplement that will describe the interest rates, payment

dates, ranking, maturity and other terms of any debt securities that we issue or sell.

We may offer and sell

these debt securities to or through one or more underwriters, dealers and agents, or directly to purchasers, on a continuous or delayed

basis. The supplements to this prospectus will provide the specific terms of the plan of distribution. This prospectus may not be used

to offer and sell securities unless accompanied by a prospectus supplement.

Our common stock is quoted

on the New York Stock Exchange under the symbol “WEC.”

See “Risk Factors”

on page 1 of this prospectus and “Risk Factors” contained in any applicable prospectus supplement and documents incorporated

by reference for information on certain risks related to the purchase of the debt securities.

Neither the Securities

and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus

is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus

is November 5, 2021.

TABLE OF CONTENTS

|

About this Prospectus

|

1

|

|

Risk Factors

|

1

|

|

Forward-Looking Statements and Cautionary Factors

|

1

|

|

WEC Energy Group, Inc.

|

2

|

|

Use of Proceeds

|

3

|

|

Description of Debt Securities

|

3

|

|

Plan of Distribution

|

10

|

|

Legal Matters

|

11

|

|

Experts

|

11

|

|

Where You Can Find More Information

|

11

|

ABOUT THIS PROSPECTUS

In

this prospectus, “we,” “us,” “our” and “WEC Energy Group” refer to WEC Energy Group, Inc.

This

prospectus is part of a registration statement that we filed with the Securities and Exchange Commission (“SEC”) utilizing

a “shelf” registration process. Under this shelf process, we may issue and sell to the public the debt securities described

in this prospectus in one or more offerings.

This

prospectus provides you with only a general description of the debt securities we may issue and sell. Each time we offer debt securities,

we will provide a prospectus supplement to this prospectus that will contain specific information about the particular debt securities

and terms of that offering. In the prospectus supplement, we will describe the interest rate, payment dates, ranking, maturity and other

terms of any debt securities that we issue and sell.

The

prospectus supplement will also describe the proceeds and uses of proceeds from the debt securities, together with the names and compensation

of the underwriters, if any, through which the debt securities are being issued and sold, and other important considerations for investors.

The prospectus supplement may also add to, update or change information contained in this prospectus.

If

there is any inconsistency between the information in this prospectus and any prospectus supplement, you should rely on the information

in the prospectus supplement. Please carefully read this prospectus and the applicable prospectus supplement, in addition to the information

contained in the documents we refer you to under the heading “WHERE YOU CAN FIND MORE INFORMATION.”

RISK FACTORS

Investing

in the securities of WEC Energy Group involves risk. Please see the “Risk Factors” described in Item 1A of our Annual

Report on Form 10-K for the year ended December 31, 2020, which is incorporated by reference in this prospectus. Before making

an investment decision, you should carefully consider these risks as well as other information contained or incorporated by reference

in this prospectus.

FORWARD-LOOKING STATEMENTS

AND CAUTIONARY FACTORS

We

have included or may include statements in this prospectus or in any prospectus supplement (including documents incorporated by reference)

that constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended

(the “Securities Act of 1933”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange

Act of 1934”). Any statements that express, or involve discussions as to, expectations, beliefs, plans, objectives, goals, strategies,

assumptions or future events or performance may be forward-looking statements. Also, forward-looking statements may be identified by reference

to a future period or periods or by the use of forward-looking terminology such as “anticipates,” “believes,”

“could,” “estimates,” “expects,” “forecasts,” “goals,” “guidance,”

“intends,” “may,” “objectives,” “plans,” “possible,” “potential,”

“projects,” “seeks,” “should,” “targets,” “will,” or similar terms or variations

of these terms.

We

caution you that any forward-looking statements are not guarantees of future performance and involve known and unknown risks, uncertainties

and other factors that may cause our actual results, performance or achievements to differ materially from the future results, performance

or achievements we have anticipated in the forward-looking statements.

In

addition to the assumptions and other factors referred to specifically in connection with those statements, factors that could cause our

actual results, performance or achievements to differ materially from those contemplated in the forward-looking statements include factors

we have described under the captions “Cautionary Statement Regarding Forward-Looking Information” and “Risk Factors”

in our Annual Report on Form 10-K for the year ended December 31, 2020, and under the caption “Factors Affecting Results,

Liquidity, and Capital Resources” in the “Management’s Discussion and Analysis of Financial Condition and Results of

Operations” section of our Annual Report on Form 10-K for the year ended December 31, 2020, or under similar captions

in the other documents we have incorporated by reference. Any forward-looking statement speaks only as of the date on which that statement

is made, and, except as required by applicable law, we do not undertake any obligation to update any forward-looking statement to reflect

events or circumstances, including unanticipated events, after the date on which that statement is made.

WEC ENERGY GROUP, INC.

WEC

Energy Group, Inc. was incorporated in the State of Wisconsin in 1981 and became a diversified holding company in 1986. On June 29,

2015, we acquired 100% of the outstanding common shares of Integrys Energy Group, Inc. and changed our name to WEC Energy Group, Inc.

Our

wholly owned subsidiaries are primarily engaged in the business of providing regulated electricity service in Wisconsin and Michigan and

regulated natural gas service in Wisconsin, Illinois, Michigan and Minnesota. As of September 30, 2021, our regulated utility

subsidiaries served approximately 1.6 million electric customers and approximately 2.9 million natural gas customers. In addition, we

have an approximately 60% equity interest in American Transmission Company LLC (“ATC”), a regulated electric transmission

company. Through subsidiaries, we also own majority interests in a number of wind generating facilities as part of our non-utility energy

infrastructure business. At December 31, 2020, we conducted our operations in the six reportable segments discussed below.

Wisconsin

Segment: The Wisconsin segment includes the electric and natural gas operations of Wisconsin Electric Power Company (“WE”),

Wisconsin Gas LLC (“WG”), Wisconsin Public Service Corporation (“WPS”), and Upper Michigan Energy Resources Corporation

(“UMERC”). This segment also includes steam service to WE steam customers in metropolitan Milwaukee, Wisconsin.

Illinois

Segment: The Illinois segment includes the natural gas operations of The Peoples Gas Light and Coke Company (“PGL”)

and North Shore Gas Company, which provide natural gas service to customers located in Chicago and the northern suburbs of Chicago. PGL

also owns and operates a 38.8 billion cubic feet natural gas storage field in central Illinois.

Other

States Segment: The other states segment includes the natural gas operations of Minnesota Energy Resources Corporation, which

serves customers in various cities and communities throughout Minnesota, and Michigan Gas Utilities Corporation (“MGU”), which

serves customers in southern and western Michigan.

Electric

Transmission Segment: The electric transmission segment includes our approximately 60% ownership interest in ATC, which owns,

maintains, monitors, and operates electric transmission systems primarily in Wisconsin, Michigan, Illinois, and Minnesota, and our

approximately 75% ownership interest in ATC Holdco, LLC, a separate entity formed to invest in transmission-related projects outside of

ATC’s traditional footprint.

Non-Utility

Energy Infrastructure Segment: The non-utility energy infrastructure segment includes the operations of W.E. Power, LLC (“We

Power”), which owns and leases electric power generating facilities to WE; Bluewater Natural Gas Holding, LLC (“Bluewater”),

which owns underground natural gas storage facilities in southeastern Michigan; and WEC Infrastructure LLC (“WECI”). As of

September 30, 2021, WECI has acquired or agreed to acquire majority interests in eight wind parks, capable of providing more than

1,500 megawatts of renewable energy. These wind parks represent more than $2.3 billion of committed investments and have long-term agreements

with unaffiliated third parties. WECI’s investment in all of these wind parks either qualifies, or is expected to qualify, for production

tax credits.

Corporate

and Other Segment: The corporate and other segment includes the operations of the WEC Energy Group holding company, the Integrys

Holding, Inc. (“Integrys Holding”) holding company, the Peoples Energy, LLC holding company, Wispark LLC, WEC Business

Services LLC, and WPS Power Development, LLC (prior to the sale of its remaining solar facilities in November 2020). This segment

also includes Wisvest LLC and Wisconsin Energy Capital Corporation, which no longer have significant operations.

WEC

Business Services LLC is a wholly owned centralized service company that provides administrative and general support services to our regulated

utilities, as well as certain services to our nonregulated entities. Wispark LLC develops and invests in real estate and had $28.8 million

in real estate holdings at December 31, 2020.

Our

principal executive offices are located at 231 West Michigan Street, P.O. Box 1331, Milwaukee, Wisconsin 53201. Our telephone

number is (414) 221-2345.

USE OF PROCEEDS

Except

as otherwise described in the applicable prospectus supplement, we intend to use the net proceeds from the sale of our debt securities

(a) to fund, or to repay short-term debt incurred to fund, investments (including equity contributions and loans to affiliates),

(b) to repay and/or refinance debt, and/or (c) for other general corporate purposes. Pending disposition, we may temporarily

invest any proceeds of the offering not required immediately for the intended purposes in U.S. governmental securities and other

high quality U.S. securities. We expect to borrow money or sell securities from time to time, but we cannot predict the precise amounts

or timing of doing so. For current information, please refer to our current filings with the SEC. See “WHERE YOU CAN FIND MORE INFORMATION.”

DESCRIPTION OF DEBT

SECURITIES

The

debt securities will be our direct unsecured general obligations. The debt securities will consist of one or more senior debt securities,

subordinated debt securities and junior subordinated debt securities. The debt securities will be issued in one or more series under the

indenture described below between us and The Bank of New York Mellon Trust Company, N.A. (as successor to The First National Bank of Chicago),

as trustee, dated as of March 15, 1999, and under a securities resolution (which may be in the form of a resolution or a supplemental

indenture) authorizing the particular series.

We

have summarized selected provisions of the indenture and the debt securities that we may offer hereby. This summary is not complete and

may not contain all of the information important to you. Copies of the indenture and a form of securities resolution are filed or incorporated

by reference as exhibits to the registration statement of which this prospectus is a part. The securities resolution for each series of

debt securities issued and outstanding also has been or will be filed or incorporated by reference as an exhibit to the registration statement.

You should read the indenture and the applicable securities resolution for other provisions that may be important to you. In the summary

below, where applicable, we have included references to section numbers in the indenture so that you can easily find those provisions.

The particular terms of any debt securities we offer will be described in the related prospectus supplement, along with any applicable

modifications of or additions to the general terms of the debt securities described below and in the indenture. For a description of the

terms of any series of debt securities, you should also review both the prospectus supplement relating to that series and the description

of the debt securities set forth in this prospectus before making an investment decision.

General

The

indenture does not significantly limit our operations. In particular, it does not:

|

|

·

|

limit the amount of debt securities that we can issue under the indenture;

|

|

|

·

|

limit the number of series of debt securities that we can issue from time to time;

|

|

|

·

|

restrict the total amount of debt that we or our subsidiaries may incur; or

|

|

|

·

|

contain any covenant or other provision that is specifically intended to afford any holder of the debt

securities protection in the event of highly leveraged transactions or any decline in our ratings or credit quality.

|

The

ranking of a series of debt securities with respect to all of our indebtedness will be established by the securities resolution creating

the series.

Although

the indenture permits the issuance of debt securities in other forms or currencies, the debt securities covered by this prospectus will

only be denominated in U.S. dollars in registered form without coupons, unless otherwise indicated in the applicable prospectus supplement.

Unless

we say otherwise in the applicable prospectus supplement, we may redeem the debt securities for cash.

Terms

A

prospectus supplement and a securities resolution relating to the offering of any new series of debt securities will include specific

terms relating to the offering. The terms will include some or all of the following:

|

|

·

|

the designation, aggregate principal amount, currency or composite currency and denominations of the debt

securities;

|

|

|

·

|

the price at which the debt securities will be issued and, if an index, formula or other method is used,

the method for determining amounts of principal or interest;

|

|

|

·

|

the maturity date and other dates, if any, on which the principal of the debt securities will be payable;

|

|

|

·

|

the interest rate or rates, if any, or method of calculating the interest rate or rates, which the debt

securities will bear;

|

|

|

·

|

the date or dates from which interest will accrue and on which interest will be payable and the record

dates for the payment of interest;

|

|

|

·

|

the manner of paying principal and interest on the debt securities;

|

|

|

·

|

the place or places where principal and interest will be payable;

|

|

|

·

|

the terms of any mandatory or optional redemption of the debt securities by us, including any sinking

fund;

|

|

|

·

|

the terms of any conversion or exchange right;

|

|

|

·

|

the terms of any redemption of debt securities at the option of holders;

|

|

|

·

|

any tax indemnity provisions;

|

|

|

·

|

if payments of principal or interest may be made in a currency other than U.S. dollars, the manner for

determining those payments;

|

|

|

·

|

the portion of principal payable upon acceleration of any discounted debt security (as described below);

|

|

|

·

|

whether and upon what terms debt securities may be defeased (which means that we would be discharged from

our obligations by depositing sufficient cash or government securities to pay the principal, interest, any premiums and other sums due

to the stated maturity date or a redemption date of the debt securities of the series);

|

|

|

·

|

whether any events of default or covenants in addition to or instead of those set forth in the indenture

apply;

|

|

|

·

|

provisions for electronic issuance of debt securities or for debt securities in uncertificated form;

|

|

|

·

|

the ranking of the debt securities, including the relative degree, if any, to which the debt securities

of a series are subordinated to one or more other series of debt securities in right of payment, whether outstanding or not;

|

|

|

·

|

any provisions relating to extending or shortening the date on which the principal and premium, if any,

of the debt securities of the series is payable;

|

|

|

·

|

any provisions relating to the deferral of any interest; and

|

|

|

·

|

any other terms not inconsistent with the provisions of the indenture, including any covenants or other

terms that may be required or advisable under United States or other applicable laws or regulations or advisable in connection with the

marketing of the debt securities. (Section 2.01)

|

We

may issue debt securities of any series as registered debt securities, bearer debt securities or uncertificated debt securities. (Section 2.01)

We may issue the debt securities of any series in whole or in part in the form of one or more global securities that will be deposited

with, or on behalf of, a depositary identified in the prospectus supplement relating to the series. We may issue global securities in

registered, bearer or uncertificated form and in either temporary or permanent form. Unless and until it is exchanged in whole or in part

for securities in definitive form, a global security may not be transferred except as a whole by the depositary to a nominee or a successor

depositary. (Section 2.12) We will describe in the prospectus supplement relating to any series the specific terms of the depositary

arrangement with respect to that series.

Unless

otherwise indicated in a prospectus supplement, we will issue registered debt securities in denominations of $1,000 and whole multiples

of $1,000 and bearer debt securities in denominations of $5,000 and whole multiples of $5,000. We will issue one or more global securities

in a denomination or aggregate denominations equal to the aggregate principal amount of outstanding debt securities of the series to be

represented by that global security or securities. (Section 2.12)

In

connection with its original issuance, no bearer debt security will be offered, sold or delivered to any location in the United States.

We may deliver a bearer debt security in definitive form in connection with its original issuance only if a certificate in a form we specify

to comply with United States laws and regulations is presented to us. (Section 2.04)

A

holder of registered debt securities may request registration of a transfer upon surrender of the debt security being transferred at any

agency we maintain for that purpose and upon fulfillment of all other requirements of the agent. (Sections 2.03 and 2.07)

We

may issue debt securities under the indenture as discounted debt securities to be offered and sold at a substantial discount from the

principal amount of those debt securities. Special U.S. federal income tax and other considerations applicable to discounted debt

securities, if material, will be described in the related prospectus supplement. A discounted debt security is a debt security where the

amount of principal due upon acceleration is less than the stated principal amount. (Sections 1.01 and 2.10)

Conversion and Exchange

The

terms, if any, on which debt securities of any series will be convertible into or exchangeable for our common stock or other equity or

debt securities, property, cash or obligations, or a combination of any of the foregoing, will be summarized in the prospectus supplement

relating to the series. The terms may include provisions for conversion or exchange on a mandatory basis, at the option of the holder

or at our option. (Sections 2.01 and 9.01)

Certain Covenants

Any

restrictive covenants which may apply to a particular series of debt securities will be described in the related prospectus supplement.

Ranking of Debt Securities

Unless

stated otherwise in a prospectus supplement, the debt securities issued under the indenture will rank equally and ratably with our other

unsecured and unsubordinated debt. The debt securities will not be secured by any properties or assets and will represent our unsecured

debt.

Because

we are a holding company and conduct all of our operations through subsidiaries, holders of debt securities will generally have a position

that is effectively junior to claims of creditors of our subsidiaries, including trade creditors, debt holders, secured creditors, taxing

authorities, guarantee holders and any preferred stockholders. Various financing arrangements and regulatory requirements impose restrictions

on the ability of our utility subsidiaries to transfer funds to us in the form of cash dividends, loans or advances. All of our utility

subsidiaries, with the exception of UMERC and MGU, are prohibited from loaning funds to us, either directly or indirectly. The indenture

does not limit us or our subsidiaries if we decide to issue additional debt.

As

of September 30, 2021, our direct obligations included $2.9 billion of outstanding senior notes and $500 million of junior subordinated

notes, all issued under the indenture. We have a $1.5 billion multi-year bank back-up credit facility to support our commercial paper

program and had $968.0 million of commercial paper outstanding at September 30, 2021. At September 30, 2021, our subsidiaries

had approximately $9.8 billion of long-term debt outstanding, $540.5 million of commercial paper outstanding and $30.4 million of preferred

stock outstanding.

Successor Obligor

The

indenture provides that, unless otherwise specified in the securities resolution establishing a series of debt securities, we will not

consolidate with or merge into another company in a transaction in which we are not the surviving company, or transfer all or substantially

all of our assets to another company, unless:

|

|

·

|

that company is organized under the laws of the United States or a state thereof or is organized under

the laws of a foreign jurisdiction and consents to the jurisdiction of the courts of the United States or a state thereof;

|

|

|

·

|

that company assumes by supplemental indenture all of our obligations under the indenture, the debt securities

and any coupons;

|

|

|

·

|

all required approvals of any regulatory body having jurisdiction over the transaction have been obtained;

and

|

|

|

·

|

immediately after the transaction no default exists under the indenture.

|

The

successor will be substituted for us as if it had been an original party to the indenture, securities resolutions and debt securities.

Thereafter, the successor may exercise our rights and powers under the indenture, the debt securities and any coupons, and all of our

obligations under those documents will terminate. (Section 5.01)

Exchange of Debt Securities

Registered

debt securities may be exchanged for an equal principal amount of registered debt securities of the same series and date of maturity in

authorized denominations requested by the holders upon surrender of the registered debt securities at an agency we maintain for that purpose

and upon fulfillment of all other requirements of the agent. (Section 2.07)

To

the extent permitted by the terms of a series of debt securities authorized to be issued in registered form and bearer form, bearer debt

securities may be exchanged for an equal aggregate principal amount of registered or bearer debt securities of the same series and date

of maturity in authorized denominations upon surrender of the bearer debt securities with all unpaid interest coupons, except as may otherwise

be provided in the debt securities, at our agency maintained for that purpose and upon fulfillment of all other requirements of the agent.

(Section 2.07) As of the date of this prospectus, we do not expect that the terms of any series of debt securities will permit registered

debt securities to be exchanged for bearer debt securities.

Defaults and Remedies

Unless

the securities resolution establishing the series provides for different events of default, in which event the prospectus supplement will

describe any differences, an event of default with respect to a series of debt securities will occur if:

|

|

·

|

we default in any payment of interest on any debt securities of that series when the payment becomes due

and payable and the default continues for a period of 60 days;

|

|

|

·

|

we default in the payment of the principal and premium, if any, of any debt securities of that series

when those payments become due and payable at maturity or upon redemption, acceleration or otherwise;

|

|

|

·

|

we default in the payment or satisfaction of any sinking fund obligation with respect to any debt securities

of that series as required by the securities resolution establishing that series and the default continues for a period of 60 days;

|

|

|

·

|

we default in the performance of any of our other agreements applicable to that series and the default

continues for 90 days after the notice specified below;

|

|

|

·

|

pursuant to or within the meaning of any Bankruptcy Law, we:

|

|

|

-

|

commence a voluntary case,

|

|

|

-

|

consent to the entry of an order for relief against us in an involuntary case,

|

|

|

-

|

consent to the appointment of a custodian for us or for all or substantially all of our property, or

|

|

|

-

|

make a general assignment for the benefit of our creditors;

|

|

|

·

|

a court of competent jurisdiction enters an order or decree under any Bankruptcy Law that remains unstayed

and in effect for 60 days and that:

|

|

|

-

|

is for relief against us in an involuntary case,

|

|

|

-

|

appoints a custodian for us or for all or substantially all of our property, or

|

|

|

-

|

orders us to liquidate; or

|

|

|

·

|

there occurs any other event of default provided for in that series. (Section 6.01)

|

The

term “Bankruptcy Law” means Title 11, U.S. Code or any similar federal or state law for the relief of debtors. The

term “custodian” means any receiver, trustee, assignee, liquidator or a similar official under any Bankruptcy Law. (Section 6.01)

A

default under the indenture means any event which is, or after notice or passage of time would be, an event of default under the indenture.

(Section 1.01) A default under the fourth bullet point above is not an event of default until the trustee or the holders of at least

25% in principal amount of the series notify us of the default and we do not cure the default within the time specified after receipt

of the notice. (Section 6.01)

If

an event of default occurs under the indenture and is continuing on a series, the trustee by notice to us, or the holders of at least

25% in principal amount of the series by notice both to us and to the trustee, may declare the principal of and accrued interest on all

the debt securities of the series to be due and payable immediately. Discounted debt securities may provide that the amount of principal

due upon acceleration is less than the stated principal amount. (Section 6.02)

The

holders of a majority in principal amount of a series of debt securities, by notice to the trustee, may rescind an acceleration and its

consequences if the rescission would not conflict with any judgment or decree and if all existing events of default on the series have

been cured or waived except nonpayment of principal or interest that has become due solely because of the acceleration. (Section 6.02)

If

an event of default occurs and is continuing on a series, the trustee may pursue any available remedy to collect principal or interest

then due on the series, to enforce the performance of any provision applicable to the series or otherwise to protect the rights of the

trustee and holders of the series. (Section 6.03)

The

trustee may require indemnity satisfactory to it before it performs any duty or exercises any right or power under the indenture or the

debt securities which it reasonably believes may expose it to any loss, liability or expense. (Section 7.01) With some limitations,

holders of a majority in principal amount of the debt securities of a series may direct the trustee in its exercise of any trust or power

with respect to that series. (Section 6.05) Except in the case of default in payment on a series, the trustee may withhold notice

of any continuing default if it in good faith determines that withholding the notice is in the interest of holders of the series. (Section 7.04)

We are required to furnish to the trustee annually a brief certificate as to our compliance with all conditions and covenants under the

indenture. (Section 4.04)

The

failure to redeem any debt securities subject to a conditional redemption is not an event of default if any event on which the redemption

is conditioned does not occur and is not waived before the scheduled redemption date. (Section 6.01) Debt securities are subject

to a conditional redemption if the notice of redemption relating to the debt securities provides that it is subject to the occurrence

of any event before the date fixed for the redemption in the notice. (Section 3.04)

The

indenture does not have a cross-default provision. Thus, a default by us on any other debt, including a default on another series of debt

securities issued under the indenture, would not automatically constitute an event of default under the indenture. A securities resolution

may provide for a cross-default provision. In that case, the prospectus supplement will describe the terms of that provision.

Amendments and Waivers

The

indenture and the debt securities, or any coupons, of any series may be amended, and any default may be waived. Unless the securities

resolution provides otherwise, in which event the prospectus supplement will describe the revised provision, we and the trustee may amend

the indenture, the debt securities and any coupons with the written consent of the holders of a majority in principal amount of the debt

securities of all series affected voting as one class. (Section 10.02)

Without

the consent of each debt security holder affected, no amendment or waiver may:

|

|

·

|

reduce the principal amount of debt securities whose holders must consent to an amendment or waiver;

|

|

|

·

|

reduce the interest on or change the time for payment of interest on any debt security (subject to any

right to defer one or more payments of interest we may have retained in the securities resolution and described in the prospectus supplement);

|

|

|

·

|

change the fixed maturity of any debt security (subject to any right we may have retained in the securities

resolution and described in the prospectus supplement);

|

|

|

·

|

reduce the principal of any non-discounted debt security or reduce the amount of principal of any discounted

debt security that would be due on its acceleration;

|

|

|

·

|

change the currency in which the principal or interest on a debt security is payable;

|

|

|

·

|

make any change that materially adversely affects the right to convert or exchange any debt security;

|

|

|

·

|

waive any default in payment of interest on or principal of a debt security or any default in respect

of a provision that pursuant to the indenture cannot be amended without the consent of each debt security holder affected; or

|

|

|

·

|

make any change in the section of the indenture concerning waiver of past defaults or the section of the

indenture concerning amendments requiring the consent of debt security holders, except to increase the amount of debt securities whose

holders must consent to an amendment or waiver or to provide that other provisions of the indenture cannot be amended or waived without

the consent of each holder of debt securities affected by the amendment or waiver. (Sections 6.04 and 10.02)

|

Without

the consent of any debt security holder, we may amend the indenture or the debt securities:

|

|

·

|

to cure any ambiguity, omission, defect, or inconsistency;

|

|

|

·

|

to provide for the assumption of our obligations to debt security holders by the surviving company in

the event of a merger, consolidation or transfer of all or substantially all of our assets requiring such assumption;

|

|

|

·

|

to provide that specific provisions of the indenture will not apply to a series of debt securities not

previously issued;

|

|

|

·

|

to create a series of debt securities and establish its terms;

|

|

|

·

|

to provide for a separate trustee for one or more series of debt securities; or

|

|

|

·

|

to make any change that does not materially adversely affect the rights of any debt security holder. (Section 10.01)

|

Legal Defeasance and

Covenant Defeasance

Debt

securities of a series may be defeased at any time in accordance with their terms and as set forth in the indenture and described briefly

below, unless the securities resolution establishing the terms of the series otherwise provides. Any defeasance may terminate all of our

obligations (with limited exceptions) with respect to a series of debt securities and the indenture (“legal defeasance”),

or it may terminate only our obligations under any restrictive covenants which may be applicable to a particular series (“covenant

defeasance”). (Section 8.01)

We

may exercise our legal defeasance option even though we have also exercised our covenant defeasance option. If we exercise our legal defeasance

option, that series of debt securities may not be accelerated because of an event of default. If we exercise our covenant defeasance option,

that series of debt securities may not be accelerated by reference to any restrictive covenants which may be applicable to that particular

series. (Section 8.01)

To

exercise either defeasance option as to a series of debt securities, we must:

|

|

·

|

irrevocably deposit in trust with the trustee or another trustee money or U.S. government obligations;

|

|

|

·

|

deliver to the trustee a certificate from a nationally recognized firm of independent accountants expressing

their opinion that the payments of principal and interest when due on the deposited U.S. government obligations, without reinvestment,

plus any deposited money without investment, will provide cash at the times and in the amounts necessary to pay the principal and interest

when due on all debt securities of the series to maturity or redemption, as the case may be; and

|

|

|

·

|

comply with certain other conditions. In particular, we must obtain an opinion of tax counsel that the

defeasance will not result in recognition of any income, gain or loss to holders for federal income tax purposes. (Section 8.02)

|

U.S. government

obligations are direct obligations of (a) the United States or (b) an agency or instrumentality of the United States, the payment

of which is unconditionally guaranteed by the United States, which, in either case (a) or (b), have the full faith and credit of

the United States pledged for payment and which are not callable at the issuer’s option. This term also includes certificates representing

an ownership interest in such obligations. (Section 8.02)

Regarding the Trustee

Unless

otherwise indicated in a prospectus supplement, The Bank of New York Mellon Trust Company, N.A. (as successor to JPMorgan Trust Company,

National Association) (successor to Bank One Trust Company, N.A.) (successor to The First National Bank of Chicago) will act as trustee

and registrar for debt securities issued under the indenture, and the trustee will also act as transfer agent and paying agent with respect

to the debt securities. (Section 2.03) We may remove the trustee with or without cause if we notify the trustee three months in advance

and if no default occurs during the three-month period. If the trustee resigns or is removed, or if a vacancy exists in the office of

trustee for any reason, the indenture provides that we must promptly appoint a successor trustee. (Section 7.07) The trustee, in

its individual or any other capacity, may make loans to, accept deposits from, and perform services for us or our affiliates, and may

otherwise deal with us or our affiliates, as if it were not the trustee. (Section 7.02) In addition, the trustee serves as collateral

agent for notes issued by non-utility subsidiaries of We Power.

Governing Law

The

indenture and the debt securities will be governed by and construed in accordance with the laws of the State of Wisconsin, except to the

extent that the Trust Indenture Act of 1939 is applicable.

PLAN OF DISTRIBUTION

We

may sell the debt securities covered by this prospectus in any one or more of the following ways from time to time: (a) to or through

underwriters or dealers; (b) directly to one or more purchasers; (c) through agents; (d) through competitive bidding; or

(e) any combination of the above. The prospectus supplement will set forth the terms of the offering of the debt securities being

offered thereby, including the name or names of any underwriters, the purchase price of those debt securities and the proceeds to us from

such sale, any underwriting discounts and other items constituting underwriters’ compensation, any initial public offering price,

any discounts or concessions allowed or reallowed or paid to dealers, and any securities exchange on which those debt securities may be

listed. Only underwriters so named in the applicable prospectus supplement are deemed to be underwriters in connection with the debt securities

offered thereby.

If

underwriters are used in the sale, the debt securities will be acquired by the underwriters for their own account and may be resold from

time to time in one or more transactions, including negotiated transactions, at a fixed public offering price or at varying prices determined

at the time of sale. Unless otherwise described in the applicable prospectus supplement, the obligations of the underwriters to purchase

those debt securities will be subject to certain conditions precedent, and the underwriters will be obligated to purchase all the debt

securities of the series offered by us and described in the applicable prospectus supplement if any of those debt securities are purchased.

Any initial public offering price and any discounts or concessions allowed or reallowed or paid to dealers may be changed from time to

time.

Debt

securities may also be offered and sold, if so indicated in the prospectus supplement, in connection with a remarketing upon their purchase,

in accordance with a redemption or repayment pursuant to their terms, by one or more firms (“remarketing firms”) acting as

principals for their own accounts or as agents for us. Any remarketing firm will be identified and the terms of its agreement, if any,

with us and its compensation will be described in the prospectus supplement. Remarketing firms may be deemed to be underwriters in connection

with the debt securities remarketed thereby.

Debt

securities may also be sold directly by us or through agents designated by us from time to time. Any agent involved in the offering and

sale of the debt securities in respect of which this prospectus is delivered will be named, and any commissions payable by us to such

agent will be set forth, in the prospectus supplement. Unless otherwise indicated in the prospectus supplement, any such agent will be

acting on a best efforts basis for the period of its appointment.

If

so indicated in the prospectus supplement, we will authorize agents, underwriters or dealers to solicit offers by certain institutional

investors to purchase debt securities providing for payment and delivery on a future date specified in the prospectus supplement. There

may be limitations on the minimum amount which may be purchased by any such institutional investor or on the portion of the aggregate

principal amount of the particular debt securities which may be sold pursuant to such arrangements. Institutional investors to which such

offers may be made, when authorized, include commercial and savings banks, insurance companies, pension funds, investment companies, educational

and charitable institutions and such other institutions as may be approved by us. The obligations of any such purchasers pursuant to such

delayed delivery and payment arrangements will not be subject to any conditions except (a) the purchase by an institution of the

particular debt securities must not at the time of delivery be prohibited under the laws of any jurisdiction in the United States

to which such institution is subject, and (b) if the particular debt securities are being sold to underwriters, we must have sold

to such underwriters all of those debt securities other than the debt securities covered by such arrangements. Underwriters will not have

any responsibility in respect of the validity of such arrangements or the performance by us or such institutional investors thereunder.

If

any underwriter or any selling group member intends to engage in stabilizing transactions, syndicate short covering transactions, penalty

bids or any other transaction in connection with the offering of debt securities that may stabilize, maintain, or otherwise affect the

price of those debt securities, such intention and a description of such transactions will be described in the prospectus supplement.

Agents

and underwriters may be entitled under agreements entered into with us to indemnification by us against certain civil liabilities, including

liabilities under the Securities Act of 1933, or to contribution with respect to payments which the agents or underwriters may be required

to make in respect thereof. Agents and underwriters may engage in transactions with, or perform services for, us and our subsidiaries

in the ordinary course of business.

LEGAL MATTERS

Unless

otherwise indicated in the applicable prospectus supplement, various legal matters in connection with the debt securities will be passed

upon (a) for us by Troutman Pepper Hamilton Sanders LLP, Atlanta, Georgia, and (b) for any underwriters by Hunton Andrews Kurth

LLP, New York, New York. Unless otherwise indicated in the applicable prospectus supplement,

Joshua M. Erickson, Vice President and Deputy General Counsel of WEC Business Services LLC, will pass upon the validity of the debt securities,

as well as certain other legal matters, on our behalf. Mr. Erickson is the beneficial owner of less than 0.01% of our common stock.

EXPERTS

The

consolidated financial statements, and the related financial statement schedules, as of December 31, 2020 and 2019, and for each

of the three years in the period ended December 31, 2020, incorporated in this prospectus by reference from our Annual Report on

Form 10-K for the year ended December 31, 2020, and the effectiveness of our internal control over financial reporting have

been audited by Deloitte & Touche LLP, an independent registered public accounting firm, as stated in their reports. Such consolidated

financial statements and related financial statement schedules are incorporated by reference in reliance upon the reports of such firm

given their authority as experts in accounting and auditing.

WHERE YOU CAN FIND

MORE INFORMATION

We

file annual, quarterly and current reports, as well as registration and proxy statements and other information, with the SEC under File

No. 001-09057. Our SEC filings are available to the public over the Internet at the SEC’s web site at http://www.sec.gov and

through our own web site at www.wecenergygroup.com. Except for the documents filed with the SEC and incorporated by reference into this

prospectus, the other information on, or accessible from, our web site is not a part of, and is not incorporated by reference in, this

prospectus.

The

SEC allows us to “incorporate by reference” into this prospectus the information we file with it. This means that we can disclose

important information to you by referring you to those documents. The information we incorporate by reference is considered a part of

this prospectus, and later information we file with the SEC will automatically update and supersede this information. We incorporate by

reference the documents listed below and any future filings we make with the SEC under Sections 13(a), 13(c), 14 or 15(d) of

the Securities Exchange Act of 1934 until this offering is completed:

|

|

·

|

Current Reports on Form 8-K filed March 12, 2021, March 19, 2021, March 30, 2021, May 11, 2021, August 12, 2021, October 21, 2021 and October 25, 2021.

|

No

information furnished under Items 2.02 or 7.01 of any Current Report on Form 8-K will be incorporated by reference in this prospectus

unless specifically stated otherwise. You may request a copy of these documents at no cost by calling or writing to us at the following

address:

WEC

Energy Group, Inc.

231 West

Michigan Street

P.

O. Box 1331

Milwaukee,

Wisconsin 53201

Attn:

Corporate Secretary

Telephone:

(414) 221-2345

You

should rely only on the information provided in or incorporated by reference (and not later changed) in this prospectus or any prospectus

supplement. We have not authorized anyone else to provide you with additional or different information. We are not making an offer of

any securities in any state where the offer is not permitted. You should not assume that the information in this prospectus or any prospectus

supplement is accurate as of any date other than the date on the front of those documents.

PART II

INFORMATION NOT REQUIRED

IN PROSPECTUS

ITEM 14. OTHER EXPENSES

OF ISSUANCE AND DISTRIBUTION

The

following table sets forth the estimated costs and expenses, other than underwriting discounts, payable by the registrant in connection

with the offering of the securities being registered.

|

SEC registration fee (actual)

|

|

$

|

*

|

|

|

Trustee’s fees and expenses

|

|

|

**

|

|

|

Printing fees and expenses

|

|

|

**

|

|

|

Legal fees and expenses

|

|

|

**

|

|

|

Accountants’ fees and expenses

|

|

|

**

|

|

|

Rating agencies’ fees and expenses

|

|

|

**

|

|

|

Miscellaneous expenses

|

|

|

**

|

|

|

Total

|

|

$

|

***

|

|

|

*

|

|

Under Rules 456(b) and 457(r) under the Securities Act of 1933, the SEC registration fee will be paid at the time of any particular offering of securities under this Registration Statement and is therefore not currently determinable.

|

|

|

|

|

|

**

|

|

Because an indeterminate amount of securities is covered by this Registration Statement, the expenses in connection with the issuance and distribution of the securities are not currently determinable.

|

|

|

|

|

|

***

|

|

Each prospectus supplement will reflect estimated expenses based upon the amount of the related offering.

|

ITEM 15. INDEMNIFICATION OF DIRECTORS AND OFFICERS

WEC

Energy Group, Inc. (“WEC Energy Group”) is incorporated under the Wisconsin Business Corporation Law (the “WBCL”).

Under

Section 180.0851(1) of the WBCL, WEC Energy Group is required to indemnify a director or officer, to the extent such person

is successful on the merits or otherwise in the defense of a proceeding, for all reasonable expenses incurred in the proceeding if such

person was a party because he or she was a director or officer of WEC Energy Group. In all other cases, WEC Energy Group is required by

Section 180.0851(2) to indemnify a director or officer against liability incurred in a proceeding to which such person was a

party because he or she was a director or officer of WEC Energy Group, unless it is determined that he or she breached or failed to perform

a duty owed to WEC Energy Group and the breach or failure to perform constitutes: (i) a willful failure to deal fairly with WEC Energy

Group or its shareholders in connection with a matter in which the director or officer has a material conflict of interest; (ii) a

violation of criminal law, unless the director or officer had reasonable cause to believe his or her conduct was lawful or no reasonable

cause to believe his or her conduct was unlawful; (iii) a transaction from which the director or officer derived an improper personal

profit; or (iv) willful misconduct.

Section 180.0858(1) of

the WBCL provides that, subject to certain limitations, the mandatory indemnification provisions do not preclude any additional right

to indemnification or allowance of expenses that a director or officer may have under WEC Energy Group’s Restated Articles of Incorporation

or Bylaws, any written agreement or a resolution of the Board of Directors or shareholders.

Section 180.0859

of the WBCL provides that it is the public policy of the State of Wisconsin to require or permit indemnification, allowance of expenses

and insurance to the extent required or permitted under Sections 180.0850 to 180.0858 of the WBCL, for any liability incurred in connection

with a proceeding involving a federal or state statute, rule or regulation regulating the offer, sale or purchase of securities.

Section 180.0828

of the WBCL provides that, with certain exceptions, a director is not liable to a corporation, its shareholders, or any person asserting

rights on behalf of the corporation or its shareholders, for damages, settlements, fees, fines, penalties or other monetary liabilities

arising from a breach of, or failure to perform, any duty resulting solely from his or her status as a director, unless the person asserting

liability proves that the breach or failure to perform constitutes any of the four exceptions to mandatory indemnification under Section 180.0851(2) referred

to above.

Under

Section 180.0833 of the WBCL, directors of WEC Energy Group against whom claims are asserted with respect to the declaration of improper

dividends or distributions to shareholders or certain other improper acts which they approved are entitled to contribution from other

directors who approved such actions and from shareholders who knowingly accepted an improper dividend or distribution, as provided therein.

Articles V

and VI of WEC Energy Group’s Bylaws provide that WEC Energy Group will indemnify to the fullest extent permitted by law any person

who is or was a party or threatened to be made a party to any legal proceeding by reason of the fact that such person is or was a director

or officer of WEC Energy Group, or is or was serving at the request of WEC Energy Group as a director or officer of another enterprise,

against expenses (including attorney fees), judgments, fines and amounts paid in settlement actually and reasonably incurred by the person

in connection with such legal proceeding. WEC Energy Group’s Restated Articles of Incorporation and Bylaws do not limit the indemnification

to which directors and officers are entitled under the WBCL.

Underwriting

or purchase agreements entered into by WEC Energy Group in connection with the securities being registered may provide for indemnification

of directors, officers and controlling persons of WEC Energy Group against certain liabilities, including liabilities under the Securities

Act of 1933.

Officers

and directors of WEC Energy Group are covered by insurance policies purchased by WEC Energy Group under which they are insured (subject

to exceptions and limitations specified in the policies) against expenses and liabilities arising out of actions, suits or proceedings

to which they are parties by reason of being or having been such directors or officers.

ITEM 16. EXHIBITS

|

Exhibit No.

|

|

Description of Document

|

|

1.1

|

|

Form of Underwriting Agreement for Debt Securities (to be filed by amendment or as an exhibit to a Current Report on Form 8-K).

|

|

|

|

|

|

4.1

|

|

Indenture for Debt Securities, dated as of March 15, 1999, including, as exhibits, forms of Registered Security and Bearer Security thereunder (the “Indenture”) (Incorporated by reference to Exhibit 4.46 to WEC Energy Group’s Current Report on Form 8-K, dated March 25, 1999) (File No. 001-09057).

|

|

|

|

|

|

4.2

|

|

Securities Resolution No. 4 of WEC Energy Group under the Indenture, effective as of March 17, 2003 (Incorporated by reference to Exhibit 4.12 to Post-Effective Amendment No. 1 to WEC Energy Group’s Registration Statement on Form S-3, filed March 20, 2003) (File No. 333-69592).

|

|

|

|

|

|

4.3

|

|

Securities Resolution No. 5 of WEC Energy Group under the Indenture, effective as of May 8, 2007 (Incorporated by reference to Exhibit 4.1 to WEC Energy Group’s Current Report on Form 8-K, dated May 8, 2007) (File No. 001-09057).

|

|

|

|

|

|

4.4

|

|

Securities Resolution No. 6 of WEC Energy Group under the Indenture, effective as of June 4, 2015 (Incorporated by reference to Exhibit 4.1 to WEC Energy Group's Current Report on Form 8-K, dated June 4, 2015) (File No. 001-09057).

|

|

|

|

|

|

4.5

|

|

Securities Resolution No. 9 of WEC Energy Group under the Indenture, effective as of September 14, 2020 (Incorporated by reference to Exhibit 4.1 to WEC Energy Group’s Current Report on Form 8-K, dated September 14, 2020 (File No. 333-69592).

|

|

|

|

|

|

4.6

|

|

Securities Resolution No. 10 of WEC Energy Group under the Indenture, effective as of October 5, 2020 (Incorporated by reference to Exhibit 4.1 to WEC Energy Group’s Current Report on Form 8-K, dated October 5, 2020) (File No. 001-09057).

|

|

|

|

|

|

4.7

|

|

Securities Resolution No. 11 of WEC Energy Group under the Indenture, effective as of March 16, 2021 (Incorporated by reference to Exhibit 4.1 to WEC Energy Group’s Current Report on Form 8-K, dated March 16, 2021) (File No. 001-09057).

|

|

|

|

|

|

4.8

|

|

Form of Securities Resolution for Debt Securities (to be filed by amendment or as an exhibit to a Current Report on Form 8-K).

|

|

|

|

|

|

5.1

|

|

Opinion of Joshua M. Erickson.

|

|

|

|

|

|

23.1

|

|

Consent of Deloitte & Touche LLP.

|

|

|

|

|

|

23.2

|

|

Consent of Joshua M. Erickson (included in Exhibit 5.1).

|

|

|

|

|

|

24.1

|

|

Power of Attorney.

|

|

|

|

|

|

25.1

|

|

Form T-1, Statement of Eligibility under the Trust Indenture Act of 1939 of The Bank of New York Mellon Trust Company, N.A., as Trustee under the Indenture.

|

ITEM 17. UNDERTAKINGS

(a) The

undersigned registrant hereby undertakes:

(1) To

file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(i) To

include any prospectus required by Section 10(a)(3) of the Securities Act of 1933;

(ii) To

reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective

amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration

statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities

offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range

may be reflected in the form of prospectus filed with the SEC pursuant to Rule 424(b), if, in the aggregate, the changes in volume

and price represent no more than 20 percent change in the maximum aggregate offering price set forth in the “Calculation of Registration

Fee” table in the effective registration statement.

(iii) To

include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any

material change to such information in the registration statement;

Provided,

however, that paragraphs (a)(1)(i), (a)(1)(ii) and (a)(1)(iii) of this section do not apply if the information required

to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the SEC by the registrant

pursuant to section 13 or section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in the registration

statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

(2) That,

for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be

a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed

to be the initial bona fide offering thereof.

(3) To

remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination

of the offering.

(4) That,

for the purpose of determining liability under the Securities Act of 1933 to any purchaser:

(i) Each

prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of

the date the filed prospectus was deemed part of and included in the registration statement; and

(ii) Each

prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in reliance

on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii), or (x) for the purpose of providing the

information required by section 10(a) of the Securities Act of 1933 shall be deemed to be part of and included in the registration

statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of

sale of securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and

any person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating

to the securities in the registration statement to which that prospectus relates, and the offering of such securities at that time shall

be deemed to be the initial bona fide offering thereof. Provided, however, that no statement made in a registration statement

or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into

the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of

sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was

part of the registration statement or made in any such document immediately prior to such effective date.

(5) That,

for the purpose of determining liability of the registrant under the Securities Act of 1933 to any purchaser in the initial distribution

of the securities:

The

undersigned registrant undertakes that in a primary offering of securities of the undersigned registrant pursuant to this registration

statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to

such purchaser by means of any of the following communications, the undersigned registrant will be a seller to the purchaser and will

be considered to offer or sell such securities to such purchaser:

(i) Any

preliminary prospectus or prospectus of the undersigned registrant relating to the offering required to be filed pursuant to Rule 424;

(ii) Any

free writing prospectus relating to the offering prepared by or on behalf of the undersigned registrant or used or referred to by the

undersigned registrant;

(iii) The

portion of any other free writing prospectus relating to the offering containing material information about the undersigned registrant

or its securities provided by or on behalf of the undersigned registrant; and

(iv) Any

other communication that is an offer in the offering made by the undersigned registrant to the purchaser.

(b) The

undersigned registrant hereby undertakes that, for purposes of determining any liability under the Securities Act of 1933 each filing

of the registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Securities Exchange Act

of 1934 (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the

Securities Exchange Act of 1934) that is incorporated by reference in this registration statement shall be deemed to be a new registration

statement relating to the securities offered herein, and the offering of such securities at that time shall be deemed to be the initial

bona fide offering thereof.

(c) Insofar

as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons

of the registrant pursuant to the provisions described under Item 15 above, or otherwise, the registrant has been advised that in the

opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Act and is, therefore,

unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses

incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding)

is asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless

in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the

question whether such indemnification by it is against public policy as expressed in the Act and will be governed by the final adjudication

of such issue.

SIGNATURES

Pursuant to the requirements of the Securities

Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all the requirements for filing on Form S-3

and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City

of Milwaukee, Wisconsin, on November 5, 2021.

|

|

|

WEC ENERGY GROUP, INC.

|

|

|

|

|

|

|

|

By:

|

/s/ J. Kevin Fletcher

|

|

|

|

|

Name:

|

J. Kevin Fletcher

|

|

|

|

|

Title:

|

President and Chief Executive Officer

|

Pursuant to the requirements of the Securities

Act of 1933, this Registration Statement has been signed by the following persons in the capacities and on the dates indicated.

|

/s/ J. Kevin Fletcher

J. Kevin Fletcher

|

|

President and Chief Executive Officer and Director (principal executive officer)

|

|

November 5, 2021

|

|

*

Xia Liu

|

|

Executive Vice President and Chief Financial Officer (principal financial officer)

|

|

November 5, 2021

|

|

*

William J. Guc

|

|

Vice President and Controller (principal accounting officer)

|

|

November 5, 2021

|

|

*

Curt S. Culver

|

|

Director

|

|

November 5, 2021

|

|

*

Danny L. Cunningham

|

|

Director

|

|

November 5, 2021

|

|

*

William M. Farrow III

|

|

Director

|

|

November 5, 2021

|

|

*

Cristina A. Garcia-Thomas

|

|

Director

|

|

November 5, 2021

|

|

*

Maria C. Green

|

|

Director

|

|

November 5, 2021

|

|

*

Gale E. Klappa

|

|

Director

|

|

November 5, 2021

|

|

*

Thomas K. Lane

|

|

Director

|

|

November 5, 2021

|

|

*

Ulice Payne, Jr.

|

|

Director

|

|

November 5, 2021

|

|

*

Mary Ellen Stanek

|

|

Director

|

|

November 5, 2021

|

|

* By:

|

/s/ Anthony L. Reese

|

|

November 5, 2021

|

|

|

Anthony L. Reese

|

|

|

|

|

As Attorney-in-Fact

|

|

|

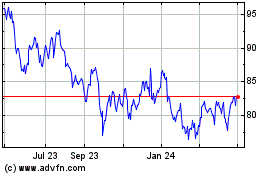

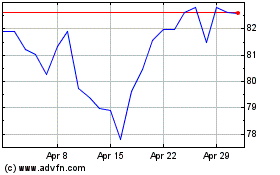

x

WEC Energy (NYSE:WEC)

Historical Stock Chart

From Aug 2024 to Sep 2024

WEC Energy (NYSE:WEC)

Historical Stock Chart

From Sep 2023 to Sep 2024