false

0000823768

WASTE MANAGEMENT INC

0000823768

2024-09-10

2024-09-10

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

SECURITIES AND

EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13

or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

September 10, 2024

Waste

Management, Inc.

(Exact Name of Registrant as Specified in Charter)

| Delaware |

|

1-12154 |

|

73-1309529 |

(State

or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification No.) |

| 800

Capitol Street, Suite

3000, Houston,

Texas |

|

77002 |

| (Address

of Principal Executive Offices) |

|

(Zip

Code) |

Registrant’s Telephone number, including

area code: (713) 512-6200

(Former Name or Former Address, if Changed Since

Last Report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of

the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common

Stock, $0.01 par value |

|

WM |

|

New

York Stock Exchange |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

As previously announced, on

June 3, 2024, Waste Management, Inc. (the “Company”), Stag Merger Sub Inc., an indirect wholly-owned subsidiary

of the Company (“Merger Sub”), and Stericycle, Inc. (“Stericycle”) entered into an Agreement and Plan of

Merger (the “Merger Agreement”) pursuant to which, upon the terms and subject to the conditions set forth in the Merger Agreement,

Merger Sub will merge with and into Stericycle, and Stericycle will continue as the surviving company and an indirect, wholly-owned subsidiary

of the Company (the “Merger”).

On September 10, 2024,

the Company announced that, in connection with the pending Merger, the Company is commencing a private exchange offer (the “Exchange

Offer”) and related consent solicitation (the “Consent Solicitation”) with respect to the outstanding 3.875% Senior

Notes due 2029 (the “SRCL Notes”) issued by Stericycle. The Exchange Offer and the Consent Solicitation are being made upon

the terms and conditions set forth in an exchange offer memorandum and consent solicitation statement dated September 10, 2024 (the

“Offering Memorandum”), copies of which will be made available to holders of the SRCL Notes eligible to participate in the

Exchange Offer (“Eligible Holders”).

Pursuant to the Exchange Offer,

the Company is offering to issue new notes in exchange for any and all of the $500 million aggregate principal amount of the SRCL Notes

held by Eligible Holders. In addition, pursuant to the Consent Solicitation, the Company is soliciting consents on behalf of Stericycle

from the Eligible Holders to amend the SRCL Notes and the related indenture under which they were issued to eliminate substantially all

of the restrictive covenants, restrictive provisions and events of default, other than payment-related, guarantee-related and bankruptcy-related

events of default.

The

Exchange Offer and Consent Solicitation are being made solely pursuant to the conditions set forth in the Offering Memorandum in a private

offering exempt from, or not subject to, registration under the Securities Act of 1933, as amended, and are conditioned upon, among other

things, receipt of the requisite consents in connection with the Consent Solicitation and the consummation of the Merger.

This announcement does not

constitute an offer to sell or purchase, or a solicitation of an offer to sell or purchase, or the solicitation of tenders or consents

with respect to, any security. No offer, solicitation, purchase or sale will be made in any jurisdiction in which such an offer, solicitation,

or sale would be unlawful. The Exchange Offer and Consent Solicitation are being made solely pursuant to the Offering Memorandum and only

to such persons and in such jurisdictions as is permitted under applicable law.

A copy of the press release

issued by the Company is attached as Exhibit 99.1 hereto and is incorporated by reference herein.

Cautionary Note Regarding Forward-Looking Statements

This filing contains “forward-looking

statements” within the meaning of the U.S. federal securities laws about the Company, Stericycle, the Exchange Offer, the Consent

Solicitation, and the Merger, including but not limited to all statements about the timing and consummation of the Exchange Offer, the

Consent Solicitation, and the Merger which are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform

Act of 1995. You should view these statements with caution and should not place undue reliance on such statements. They are based on the

facts and circumstances known to the Company as of the date the statements are made. These forward-looking statements are subject to risks

and uncertainties that could cause actual results to be materially different from those set forth in such forward-looking statements,

including but not limited to, general economic and capital markets conditions; inability to obtain required regulatory or government approvals

for the Merger or to obtain such approvals on satisfactory conditions; inability to satisfy closing conditions; the occurrence of any

event, change or other circumstance that could give rise to the termination of the Exchange Offer, the Consent Solicitation or the Merger

Agreement; the effects that any termination of the Merger Agreement may have on Stericycle or its business; legal proceedings that may

be instituted related to the Merger or otherwise; unexpected costs, charges or expenses; and other risks and uncertainties described in

the Company’s and Stericycle’s filings with the U.S. Securities and Exchange Commission (the “SEC”), including

Part I, Item 1A of each company’s most recently filed Annual Report on Form 10-K and subsequent reports on Form 10-Q,

which are incorporated herein by reference, and in other documents that the Company or Stericycle file or furnish with the SEC. Except

to the extent required by law, neither the Company nor Stericycle assume any obligation to update any forward-looking statement, including

financial estimates and forecasts, whether as a result of future events, circumstances or developments or otherwise.

| Item 9.01 | Financial Statements and Exhibits. |

Exhibit Index

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto

duly authorized.

| | WASTE

MANAGEMENT, INC. |

| | |

|

| Date: September 10,

2024 | By: |

/s/

Charles C. Boettcher |

| | |

Charles C. Boettcher |

| | |

Executive Vice President &

Chief Legal Officer |

Exhibit 99.1

For Immediate Release

WM Announces Private

Exchange Offer and Consent Solicitation for any and all of Stericycle, Inc.’s $500 million Outstanding 3.875% Senior Notes Due

2029

HOUSTON – September 10, 2024

– Waste Management, Inc., a Delaware corporation (NYSE: WM) (“WM”), announced today that it has commenced a private

offer to exchange (the “Exchange Offer”) any and all of the $500 million aggregate principal amount outstanding of the

3.875% Senior Notes due 2029 (the “SRCL Notes”) issued by Stericycle, Inc., a Delaware corporation (“SRCL”),

held by eligible holders, for a series of new notes to be issued by WM (the “WM Notes”). Eligible holders of SRCL Notes

tendered by the Early Tender Deadline (as defined below) and not validly withdrawn before the Withdrawal Deadline (as defined below),

will also receive the Cash Consideration (as defined below). The WM Notes will have the same interest payment dates, maturity date

and interest rate as the SRCL Notes, but will differ in certain respects from the SRCL Notes, including the redemption provisions, as

described in the Offering Memorandum.

Concurrently with the Exchange Offer, WM is soliciting

consents (the “Consent Solicitation”) from eligible holders of SRCL Notes, on behalf of SRCL, to amend the SRCL Notes and

the indenture governing the SRCL Notes (the “SRCL Indenture”) to eliminate substantially all of the restrictive covenants,

restrictive provisions and events of default from the SRCL Indenture and the SRCL Notes, other than payment-related, guarantee-related

and bankruptcy-related events of default. Consents of the holders of not less than a majority in aggregate principal amount of the SRCL

Notes must be obtained for the amendments to the SRCL Notes and the SRCL Indenture to be effective. Holders validly tendering their SRCL

Notes will be deemed to have delivered consents to the proposed amendments with respect to such tendered SRCL Notes. Holders will not

be permitted to tender their SRCL Notes without delivering consents or to deliver consents without tendering their SRCL Notes.

The Exchange Offer and Consent Solicitation are

being made upon the terms and conditions set forth in an exchange offer memorandum and consent solicitation statement, dated September 10,

2024 (the “Offering Memorandum”), copies of which will be made available to holders of the SRCL Notes eligible to participate

in the Exchange Offer. The following table sets forth the Total Exchange Consideration (as defined below) and the Exchange Consideration

(as defined below) being offered for the SRCL Notes:

FOR MORE INFORMATION

Waste Management

Analysts

Ed Egl

713.265.1656

eegl@wm.com

Media

Toni Werner

media@wm.com

| | |

| |

| | | |

| |

| Total Exchange

Consideration for

SRCL Notes Validly

Tendered by the

Early Tender

Deadline and Not

Validly Withdrawn by

the Withdrawal

Deadline | | |

| Exchange

Consideration

for SRCL Notes

Validly

Tendered After

the Early

Tender

Deadline | |

Title of

Series of

SRCL

Notes | |

CUSIP No.

and ISIN of

SRCL Notes | |

| Aggregate

Principal

Amount of

SRCL Notes

Outstanding | | |

WM Notes

to be

Issued in

Exchange

for SRCL

Notes | |

| Principal

Amount

of WM

Notes (1) | | |

| Cash

Consideration

(2) | | |

| Principal

Amount of

WM Notes

(3) | |

| 3.875% Senior Notes due 2029 | |

858912AG3;

US858912AG34 (144A)

/ U85881AC1;

USU85881AC12 (Reg S) | |

$ | 500,000,000 | | |

3.875%

Senior Notes due 2029 | |

$ | 1,000 | | |

| $2.50

to $5.00 | | |

$ | 970 | |

| (1) | Principal

amount of WM Notes issued in exchange for each $1,000 principal amount of SRCL Notes validly

tendered and accepted for exchange. |

| (2) | Per

$1,000 principal amount of SRCL Notes validly tendered by the Early Tender Deadline and not

validly withdrawn by the Withdrawal Deadline and accepted for exchange, the Cash Consideration

will be an amount equal to the product of $2.50 multiplied by a fraction, the numerator of

which is the aggregate principal amount of SRCL Notes outstanding as of the Early Tender

Deadline and the denominator of which is the aggregate principal amount of SRCL Notes validly

tendered by the Early Tender Deadline and not validly withdrawn by the Withdrawal Deadline.

As a result, the Cash Consideration for the SRCL Notes will range from $2.50 per $1,000 principal

amount (if all eligible holders of SRCL Notes tender) to approximately $5.00 per $1,000 principal

amount (if eligible holders of a simple majority of the aggregate principal amount of the

SRCL Notes tender). |

| (3) | Exchange

Consideration does not include, and eligible holders tendering after the Early Tender Deadline

will not be eligible to receive, any Cash Consideration. In addition, Exchange Consideration

involves the issuance of $970 principal amount of WM Notes, as opposed to $1,000 principal

amount of WM Notes, for each $1,000 principal amount of SRCL Notes validly tendered after

the Early Tender Deadline and accepted for exchange. |

Indicative Timetable for the Exchange Offer and

Consent Solicitation

| Commencement Date |

September 10,

2024 |

| |

|

| Withdrawal Deadline |

5:00 p.m.,

New York City time, on September 23, 2024, unless extended or earlier terminated by WM. |

| |

|

| Early Tender Deadline |

5:00 p.m.,

New York City time, on September 23, 2024, unless extended or earlier terminated by WM. |

| |

|

| Expiration Date |

5:00 p.m.,

New York City time, on October 8, 2024, unless extended or earlier terminated by WM. |

| |

|

| Settlement Date |

Promptly after the Expiration Date, subject to the satisfaction or waiver of certain conditions as

described herein. Expected to occur on or about the third business day after the Expiration Date, but subject to

change. |

The Exchange Offer and Consent Solicitation will

expire at 5:00 p.m., New York City time, on October 8, 2024, unless such date is extended or earlier terminated (such date and time,

as they may be extended, the “Expiration Date”). Tenders of SRCL Notes may be validly withdrawn and consents revoked at any

time prior to 5:00 p.m., New York City time, on September 23, 2024 (such date and time, as they may be extended, the “Withdrawal

Deadline”), but tenders not so validly withdrawn will be irrevocable after the Withdrawal Deadline, except in certain limited circumstances

where additional withdrawal rights are required by law. WM reserves the right to terminate, withdraw, amend or extend the Exchange Offer

and Consent Solicitation in its sole discretion, subject to the terms and conditions set forth in the Offering Memorandum.

Subject to the terms and conditions set forth

in the Offering Memorandum, for each $1,000 principal amount of SRCL Notes validly tendered in the Exchange Offer by 5:00 p.m., New York

City time, on September 23, 2024 (such date and time, as they may be extended, the “Early Tender Deadline”), and not

validly withdrawn by the Withdrawal Deadline, each eligible holder of SRCL Notes will be eligible to receive WM Notes in an equal principal

amount as the tendered SRCL Notes accepted for exchange and the cash consideration of an amount equal to the product of $2.50 multiplied

by a fraction, the numerator of which is the aggregate principal amount of SRCL Notes outstanding as of the Early Tender Deadline and

the denominator of which is the aggregate principal amount of SRCL Notes validly tendered by the Early Tender Deadline and not validly

withdrawn by the Withdrawal Deadline (the “Cash Consideration” and, together with such amount of WM Notes, the “Total

Exchange Consideration”). As a result, the Cash Consideration for the SRCL Notes will range from $2.50 per $1,000 principal amount

(if all eligible holders tender) to approximately $5.00 per $1,000 principal amount (if eligible holders of a simple majority of the aggregate

principal amount of the SRCL Notes tender) of the SRCL Notes validly tendered and accepted for exchange.

Eligible holders who validly tender their SRCL

Notes after the Early Tender Deadline but on or prior to the Expiration Date will be eligible to receive $970 principal amount of the

WM Notes per $1,000 principal amount of SRCL Notes validly tendered but no Cash Consideration (the “Exchange Consideration”).

Settlement of the Exchange Offer is expected

to occur on or about the third business day following the Expiration Date, unless WM extends or terminates the

Exchange Offer (such date and time, as the same may be extended, the “Settlement Date”). Interest on the WM Notes will

accrue from (and including) the last interest payment date on which interest was paid on the SRCL Notes, and, accordingly, no

accrued interest will be paid on the Settlement Date in respect of SRCL Notes accepted for exchange, except with respect to cash

paid in lieu of WM Notes not delivered, as described below.

The WM Notes will be issued in minimum denominations

of $2,000 and integral multiples of $1,000 in excess thereof. No tender of SRCL Notes will be accepted if it would result in the issuance

of less than $2,000 principal amount of the WM Notes. If the principal amount of WM Notes validly tendered after the Early Tender Deadline

that would otherwise be required to be delivered in exchange for a tender of SRCL Notes would not equal $2,000 or an integral multiple

of $1,000 in excess thereof, then the principal amount of such WM Notes will be rounded down to $2,000 or the nearest integral multiple

of $1,000 in excess thereof, and WM will pay cash (in lieu of such WM Notes not delivered) equal to the remaining portion of the Exchange

Consideration for such SRCL Notes plus accrued and unpaid interest with respect to that portion to, but not including, the Settlement

Date.

WM’s obligation to accept and exchange the

SRCL Notes validly tendered pursuant to the Exchange Offer is subject to certain conditions as set forth in the Offering Memorandum. The

Exchange Offer and Consent Solicitation are not conditioned upon any minimum aggregate principal amount of SRCL Notes being validly tendered

for exchange, but are conditioned upon, among others, the receipt of the requisite consents to adopt the proposed amendments and the consummation

of the previously announced merger transaction contemplated by that certain Agreement and Plan of Merger, dated as of June 3, 2024,

by and among WM, Stag Merger Sub Inc., a Delaware corporation and an indirect wholly owned subsidiary of WM, and SRCL. Other than the

consummation of the merger transaction contemplated by the Merger Agreement (without which the Exchange Offer will not be consummated,

neither the Exchange Consideration nor the Total Exchange Consideration will be paid, nor will the amendments contemplated by the

Consent Solicitation become effective), WM may generally waive any condition with respect to the Exchange Offer and Consent Solicitation,

in its sole discretion, at any time.

The Exchange Offer is being made only to holders

of SRCL Notes who satisfy the eligibility conditions described under “Disclaimer” below. Holders of SRCL Notes who desire

a copy of the eligibility letter should contact Global Bondholder Services Corporation, the information agent and exchange agent for the

Exchange Offer and Consent Solicitation, at (855) 654-2015. Banks and brokers should call (212) 430-3774. The eligibility letter may also

be found here: https://gbsc-usa.com/eligibility/wm. Global Bondholder Services Corporation will also provide copies of the Offering Memorandum

to eligible holders of SRCL Notes.

Holders of SRCL Notes are advised to check with

any bank, securities broker or other intermediary through which they hold SRCL Notes as to when such intermediary needs to receive instructions

from a holder in order for that holder to be able to participate in, or (in the circumstances in which revocation is permitted) revoke

their instruction to participate in, the Exchange Offer and Consent Solicitation before the deadlines specified herein and in the Offering

Memorandum. The deadlines set by each clearing system for the submission and withdrawal of exchange instructions will also be earlier

than the relevant deadlines specified herein and in the Offering Memorandum.

Disclaimer

This press release is issued pursuant to Rule 135c

under the Securities Act of 1933, as amended (the “Securities Act”). This press release is neither an offer to sell nor the

solicitation of an offer to buy the WM Notes or any other securities and shall not constitute an offer, solicitation or sale in any jurisdiction

in which, or to any person to whom, such an offer, solicitation or sale is unlawful. The Exchange Offer has not been and will not be registered

under the Securities Act, or the securities laws of any other jurisdiction, and, accordingly, the WM Notes will be subject to transfer

restrictions unless and until the WM Notes are registered or exchanged for registered notes. The WM Notes will be issued in reliance upon

exemptions from, or in transactions not subject to, registration under the Securities Act. The Exchange Offer is being made only to, and

the WM Notes will be offered for exchange only to, holders of SRCL Notes who are (i) reasonably believed to be “qualified institutional

buyers” (as defined in Rule 144A under the Securities Act) in reliance on the exemption from registration provided by Section 4(a)(2) of

the Securities Act, and (ii) outside the United States, persons who are not, and who are not acting for the account or benefit of,

“U.S. persons” (as defined in Rule 902 under the Securities Act) in compliance with Regulation S under the Securities

Act. The WM Notes will not be offered or sold in the United States or to U.S. persons (as defined in Rule 902 under the Securities

Act) unless the transaction is registered under the Securities Act, an exemption from the registration requirements of the Securities

Act is available or the transaction is not subject to registration under the Securities Act.

The Exchange Offer and Consent Solicitation are

being made only pursuant to the Offering Memorandum. The Offering Memorandum and other documents relating to the Exchange Offer

and Consent Solicitation will be distributed only to holders of SRCL Notes who confirm that they are within the categories of eligible

participants in the Exchange Offer. None of WM, its directors or officers, the dealer managers and solicitation agents, the exchange

agent, the information agent, the trustees for the WM Notes or the SRCL Notes, their respective affiliates, or any other person is making

any recommendation as to whether holders should tender their SRCL Notes in the Exchange Offer or consent to the proposed amendments in

the Consent Solicitation.

This press release, the Offering Memorandum and

any other offering material relating to the Exchange Offer are not being made, and have not been approved, by an authorized person for

the purposes of Section 21 of the Financial Services and Markets Act 2000. Accordingly, this press release, the Offering Memorandum

and any other offering material relating to the Exchange Offer are only being distributed to and are only directed at: (i) persons

who are outside the United Kingdom, (ii) persons in the United Kingdom who have professional experience in matters relating to investments

who fall within the definition of investment professionals as defined within Article 19(5) of the Financial Services and Markets

Act 2000 (Financial Promotion) Order 2005 (as amended, the “Order”) or (iii) high net worth entities and other persons

who fall within Article 49(2)(a) to (d) of the Order (all such persons together being referred to for purposes of this

paragraph as “relevant persons”). The WM Notes will only be available to, and any invitation, offer or agreement to

subscribe, purchase or otherwise acquire such notes will be engaged in only with, relevant persons. Any person who is not a relevant

person should not act or rely on the Offering Memorandum or any of its contents and may not participate in the Exchange Offer.

The complete terms and conditions of the Exchange

Offer and Consent Solicitation are set forth in the Offering Memorandum. The Exchange Offer is only being made pursuant to the Offering

Memorandum. The Exchange Offer is not being made to holders of SRCL Notes in any jurisdiction in which the making or acceptance

thereof would not be in compliance with the securities, blue sky or other laws of such jurisdiction. Neither the Securities and

Exchange Commission nor any other regulatory body has registered, recommended or approved of the WM Notes or passed upon the accuracy

or adequacy of the Offering Memorandum.

ABOUT WM

WM is North America’s leading provider of

comprehensive environmental solutions. Previously known as Waste Management and based in Houston, Texas, WM is driven by commitments to

put people first and achieve success with integrity. WM, through its subsidiaries, provides collection, recycling and disposal services

to millions of residential, commercial, industrial and municipal customers throughout the U.S. and Canada. With innovative infrastructure

and capabilities in recycling, organics and renewable energy, WM provides environmental solutions to and collaborates with its customers

in helping them achieve their sustainability goals. WM has the largest disposal network and collection fleet in North America, is the

largest recycler of post-consumer materials and is the leader in beneficial use of landfill gas, with a growing network of renewable natural

gas plants and the most landfill gas-to-electricity plants in North America. WM’s fleet includes more than 12,000 natural gas trucks

– the largest heavy-duty natural gas truck fleet of its kind in North America.

FORWARD-LOOKING STATEMENTS

This press release

contains forward-looking statements that involve risks and uncertainties. Factors that could cause actual results to differ materially

from those expressed or implied by the forward-looking statements in this press release are discussed in WM’s most recent Annual

Report on Form 10-K and subsequent reports on Form 10-Q.

# # #

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

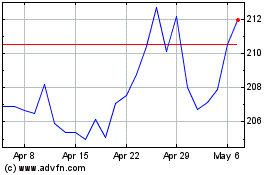

Waste Management (NYSE:WM)

Historical Stock Chart

From Nov 2024 to Dec 2024

Waste Management (NYSE:WM)

Historical Stock Chart

From Dec 2023 to Dec 2024