VICI Properties Inc. Completes Acquisition of 38 Bowling Entertainment Centers in Sale-Leaseback Transaction With Bowlero Corp.

October 19 2023 - 4:15PM

Business Wire

- Represents VICI’s Inaugural Sale-Leaseback

Transaction in Family Entertainment Sector with a Publicly Traded

Operator Redefining the Bowling Category -

- Further Diversifies VICI’s Tenant Base and

Geographic Reach to Drive Future Potential Growth and Value

Creation -

- Enhances VICI’s Embedded Growth Pipeline

-

- Transaction Expected to be Immediately

Accretive to AFFO per Share -

VICI Properties Inc. (NYSE: VICI) (“VICI Properties,” “VICI” or

the “Company”), an experiential real estate investment trust, today

announced that it has acquired the real estate assets of 38 bowling

entertainment centers (the “Bowlero Portfolio”) from Bowlero Corp.

(NYSE: BOWL) (“Bowlero”) in a sale-leaseback transaction for an

aggregate purchase price of $432.9 million. Bowlero is a global

leader in bowling entertainment, media, and events and is the

largest operator of bowling centers in North America.

Simultaneous with the closing of the transaction, VICI

Properties entered into a triple-net master lease agreement with

Bowlero (the “Lease”). The Lease will have an initial total annual

rent of $31.6 million, representing an acquisition cap rate of

7.3%, and an initial term of 25 years, with six 5-year tenant

renewal options. Rent under the Lease will escalate at the greater

of 2.0% or CPI (subject to a 2.5% ceiling). The obligations of the

tenants under the Lease are guaranteed by Bowlero Corp.

The transaction further enhances VICI’s embedded growth pipeline

with a right of first offer for a term of eight years to acquire

the real estate of current or future Bowlero properties should

Bowlero elect to enter into a sale-leaseback transaction.

Strategic Merits

- Inaugural family entertainment experiential real estate

acquisition: The Bowlero business model meets each of VICI’s

investment criteria – lower than average cyclicality, low secular

threat, proven durability, and favorable supply/demand dynamics. As

a market innovator, Bowlero has redefined the programming and

economics of the bowling experience, thus aligning with VICI’s

focus on partnering with best-in-class, growth-minded experiential

operators with a demonstrated track record of enduring growth.

- New partnership with market-leading company and management

team: The Lease is bolstered by a parent guarantee from a

publicly traded company (NYSE: BOWL) and by Bowlero’s market

leadership as the largest bowling operator in North America with

350 operating centers, a footprint more than 6x greater than its

next largest competitor, and a differentiated strategy that

attracts nearly 30 million guests each year.

- Diversifies tenant base and geographic reach: The

acquisition of the Bowlero Portfolio expands VICI’s portfolio with

38 bowling entertainment centers across 17 states, representing 11

new states for VICI – seven of which do not currently have

commercial casino gaming operations. Based on annualized rent as of

October 1, 2023, Bowlero will represent 1% of VICI’s rent roll.

Bowlero is VICI’s 12th tenant.

- Enhances embedded growth pipeline: VICI has a right of

first offer for a term of eight years for future sale-leasebacks as

Bowlero continues revamping the bowling landscape by executing its

consolidation and conversion growth strategy, unlocking opportunity

for potential future VICI acquisitions.

- Immediately accretive to AFFO per share: The transaction

is expected to provide immediate accretion to AFFO per share.

Key Comments

- Sector Initiation – John

Payne, President & COO of VICI Properties: “We are excited to

announce our entry into the family entertainment sector, a $15+

billion experiential category, with a best-in-class, growth-minded

operator. At VICI, we seek to invest in non-commodity real estate

centered on experiences benefiting from long-term secular

tailwinds, and Bowlero’s track record of growth and innovation in a

resilient experiential sector aligns well with our investment

framework. We are proud to be a key real estate and capital partner

for the Bowlero team.”

- Innovative Operating

Partner – David Kieske, EVP & CFO of VICI

Properties: “Bowlero’s success represents a standout roll-up story

in a compelling space with ample room for consolidation, margin

expansion, and economic densification. We are thrilled to add

another strong, publicly traded operator to our tenant roster, and

VICI looks forward to supporting our tenant and expanding our

partnership along the way.”

- Foundational Real Estate

Partnership - Thomas Shannon, Chairman, Founder, and CEO

of Bowlero: “This transaction marks the beginning of a long-term,

valuable partnership with VICI. John, David and team have been

fantastic partners, and the support of VICI’s capital gives us the

firepower to continue advancing our strategic directives. We look

forward to growing the relationship over the coming years.”

The transaction was funded through cash on hand, partial

settlement of outstanding forward equity sale agreements, and a

combination of units in a newly formed VICI subsidiary issued to

Bowlero. After funding this transaction, VICI maintains ample

liquidity, including $431 million in cash and cash equivalents,

$248 million of estimated net equity proceeds available upon

settlement of outstanding forward sale agreements, and $2.3 billion

of availability under the revolving credit facility.

J.P. Morgan acted as exclusive financial advisor and Hogan

Lovells US LLP and Kramer Levin Naftalis & Frankel LLP served

as legal advisors to VICI Properties on the transaction.

In addition to this release, the Company has furnished a

Transaction Overview presentation and video. Both are available on

VICI’s website in the “Investors” section, under the menu heading

“Events & Presentations.” For the presentation, please visit

https://investors.viciproperties.com/events-and-presentations/

presentations. For the video, please visit

https://investors.viciproperties.com/events-and-presentations/

event-archive.

About VICI Properties

VICI Properties Inc. is an S&P 500® experiential real estate

investment trust that owns one of the largest portfolios of

market-leading gaming, hospitality and entertainment destinations,

including Caesars Palace Las Vegas, MGM Grand and the Venetian

Resort Las Vegas, three of the most iconic entertainment facilities

on the Las Vegas Strip. VICI Properties owns 92 experiential assets

across a geographically diverse portfolio consisting of 54 gaming

properties and 38 non-gaming experiential properties across the

United States and Canada. The portfolio is comprised of

approximately 125 million square feet, features approximately

60,300 hotel rooms and approximately 500 restaurants, bars,

nightclubs and sportsbooks. Its properties are occupied by industry

leading gaming, leisure and hospitality operators under long-term,

triple-net lease agreements. VICI Properties has a growing array of

real estate and financing partnerships with leading non-gaming

experiential operators, including Bowlero, Great Wolf Resorts,

Cabot, Canyon Ranch and Chelsea Piers. VICI Properties also owns

four championship golf courses and 33 acres of undeveloped and

underdeveloped land adjacent to the Las Vegas Strip. VICI

Properties’ goal is to create the highest quality and most

productive experiential real estate portfolio through a strategy of

partnering with the highest quality experiential place makers and

operators. For additional information, please visit

www.viciproperties.com.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the federal securities laws. You can identify these

statements by our use of the words “assumes,” “believes,”

“estimates,” “expects,” “guidance,” “intends,” “plans,” “projects,”

“will,” and similar expressions that do not relate to historical

matters. All statements other than statements of historical fact

are forward-looking statements. You should exercise caution in

interpreting and relying on forward-looking statements because they

involve known and unknown risks, uncertainties, and other factors

which are, in some cases, beyond VICI’s control and could

materially affect actual results, performance, or achievements.

Among those risks, uncertainties and other factors are risks that

VICI may not achieve the benefits contemplated by the acquisition

of thirty-eight bowling entertainment centers from Bowlero Corp.

(“Bowlero“), including any expected accretion or the amount of any

future rent payments (including the anticipated rent escalations),

entry into any future sale lease-back or other transactions between

VICI and Bowlero, including pursuant to VICI’s right of first

offer, or the anticipated benefits thereof. Additional important

risk factors that may affect VICI’s business, results of operations

and financial position are detailed from time to time in VICI’s

filings with the Securities and Exchange Commission. VICI does not

undertake any obligation to update or revise any forward-looking

statement, whether as a result of new information, future events,

or otherwise, except as may be required by applicable law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231019022395/en/

Investors: Investors@viciproperties.com (646) 949-4631 Or David

Kieske EVP, Chief Financial Officer DKieske@viciproperties.com

Moira McCloskey SVP, Capital Markets

MMcCloskey@viciproperties.com

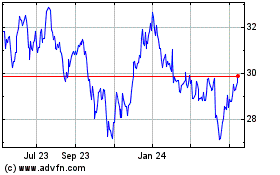

Vici Properties (NYSE:VICI)

Historical Stock Chart

From Oct 2024 to Nov 2024

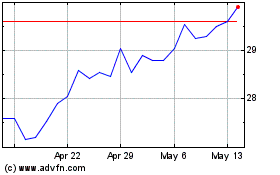

Vici Properties (NYSE:VICI)

Historical Stock Chart

From Nov 2023 to Nov 2024