Current Report Filing (8-k)

February 17 2021 - 6:04AM

Edgar (US Regulatory)

false

0000884219

true

0000884219

2021-02-16

2021-02-16

0000884219

us-gaap:CommonStockMember

2021-02-16

2021-02-16

0000884219

us-gaap:PreferredStockMember

2021-02-16

2021-02-16

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 16, 2021

Viad Corp

(Exact name of registrant as specified in its charter)

|

Delaware

|

001-11015

|

36-1169950

|

|

(State or other jurisdiction

of incorporation)

|

(Commission File Number)

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

1850 North Central Avenue, Suite 1900,

Phoenix, Arizona

|

|

85004-4565

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (602) 207-1000

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, $1.50 Par Value

|

|

VVI

|

|

New York Stock Exchange

|

|

Preferred Stock Purchase Rights

|

|

__

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02. Departure of Directors or Principal Officers; Election of Directors; Appointment of Principal Officers; Compensatory Arrangements of Certain Officers.

On February 16, 2021, the Human Resources Committee (the “Committee”) of the Board of Directors of Viad Corp (the “Company”) approved certain changes to the compensation program for Steven Moster, the Company’s President and Chief Executive Officer, and Ellen Ingersoll, the Company’s Chief Financial Officer, each of whom we refer to below as an executive.

The Committee approved a one-time grant of 80,357 and 21,428 performance-based restricted stock units (“PRSUs”) to each of Mr. Moster and Ms. Ingersoll, respectively (the “PRSU Awards”). The PRSU Awards were granted under the 2017 Viad Corp Omnibus Incentive Plan (the “Plan”) and pursuant to a new form of Restricted Stock Units Agreement.

The PRSU Awards will become earned based on the achievement of stock price goals (measured as an average closing price over 20 days), as set forth in the following table, at any time between the grant date and December 31, 2024, which we refer to as the performance period:

|

|

|

|

Price Per Share Goal

|

Number of Earned PRSUs

|

|

$46.11

|

50%

|

|

$56.00

|

50%

|

Any PRSUs that become earned PRSUs will vest on December 31, 2024, subject to the executive’s continued employment.

In the event the Company incurs a change in control during the performance period, then any previously-earned PRSUs will vest and any remaining PRSUs will vest based on the price per share received by or payable with respect to the Company’s common stockholders in connection with the transaction. Additionally, upon a termination of the executive’s employment during the performance period by us without cause or by the executive for good reason, or due to the executive’s death or disability, then any previously earned PRSUs will vest; if such termination is by us without cause or by the executive for good reason, then any remaining PRSUs will remain outstanding and eligible to vest upon a change in control of the Company that occurs within 30 days following the termination date. The foregoing treatment upon a termination of employment is subject to the executive’s timely execution and non-revocation of a release of claims against the Company.

Any PRSUs that become vested will be settled in shares of Company common stock upon the executive’s separation from service from the Company.

In addition, Mr. Moster and Ms. Ingersoll no longer will be participants in the Company’s Executive Severance Plan (Tier I) (which we refer to in our filings as the “grandfathered plan”), but instead will become participants in the Company’s Executive Severance Plan (Tier I - 2013). As a result, Mr. Moster and Ms. Ingersoll’s severance payments upon a termination of employment without cause or for good reason within 36 months after a change in control no longer will include:

|

|

•

|

An amount equal to the greater of (i) the executive’s largest cash payment under our Management Incentive Plan during the last four employment years and (ii) the executive’s target bonus for the fiscal year in which the change in control occurs.

|

|

|

•

|

An amount equal to the greatest of (i) the executive’s largest cash bonus under the Performance Unit Plan during the last four employment years, (ii) the aggregate value of shares when earned during a performance period under any performance-related restricted stock award, and (iii) the aggregate value, at the time of grant, of target shares awarded under the performance-related restricted stock programs for the fiscal year in which the change in control occurs.

|

The foregoing summary is qualified in its entirely by reference to the full text of the form PRSU Agreement, which is filed as Exhibit 10.1 to this Form 8-K, and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

1

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

Viad Corp

|

|

|

|

(Registrant)

|

|

|

|

|

|

|

February 16, 2021

|

|

By:

|

/s/ Derek P. Linde

|

|

|

|

Name:

|

Derek P. Linde

|

|

|

|

Title:

|

General Counsel & Corporate Secretary

|

2

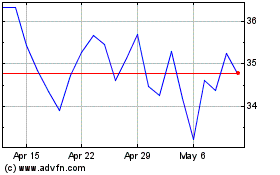

Viad (NYSE:VVI)

Historical Stock Chart

From Jun 2024 to Jul 2024

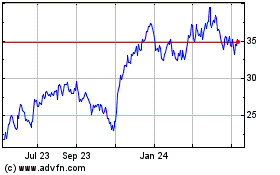

Viad (NYSE:VVI)

Historical Stock Chart

From Jul 2023 to Jul 2024