Form 8-K - Current report

December 04 2023 - 6:03AM

Edgar (US Regulatory)

0001674101FALSE00016741012023-12-042023-12-04

| | | | | | | | | | | | | | |

| | | | |

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| | | | |

| | | | |

FORM 8-K |

| | | | |

| | | | |

| CURRENT REPORT |

| PURSUANT TO SECTION 13 OR 15(d) OF THE |

| SECURITIES EXCHANGE ACT OF 1934 |

| | | | |

Date of Report (Date of earliest event reported): December 4, 2023 |

| | | | |

| | | | |

| VERTIV HOLDINGS CO |

| Exact name of registrant as specified in its charter |

| | | | |

| | | | |

| | | | |

| Delaware | | 001-38518 | | 81-2376902 |

| (State or other Jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification Number) |

| | | | |

505 N. Cleveland Ave., Westerville, Ohio 43082 |

| (Address of principal executive offices, including zip code) |

| | | | |

Registrant's telephone number, including area code: 614-888-0246 |

| | | | |

| | | | |

| | | | |

| Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: |

| | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | | | | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Class A common stock, $0.0001 par value per share | | VRT | | New York Stock Exchange |

| | | | |

| Indicate by check mark whether the Registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). |

| | | | Emerging growth company | ☐ |

| | | | | |

If an emerging growth company, indicate by check mark if the Registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐ |

| | | | |

Item 8.01 Other Events

On December 4, 2023, Vertiv Holdings Co., a Delaware corporation (the “Company”) issued a press release announcing that its indirect, wholly owned subsidiaries, entered into an agreement to acquire (i) the shares in CoolTera Ltd, a private company limited by shares incorporated in England and (ii) certain assets, including certain contracts, patent and trademark assets and intellectual property, from an affiliate of CoolTera Ltd. (the “Acquisition”).

The closing of the Acquisition is subject to customary closing conditions. The Acquisition is expected to close in the fourth quarter of 2023.

The press release describing the transaction is furnished as Exhibit 99.1 to this Form 8-K.

Item 9.01 (d) Financial Statements and Exhibits

| | | | | | | | |

| Exhibit No. | | Exhibit Description |

| 99.1 | | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

Date: December 4, 2023 | Vertiv Holdings Co |

| /s/ David Fallon |

| Name: David Fallon |

| Title: Chief Financial Officer |

Vertiv Acquisition of CoolTera Ltd. Boosts Liquid Cooling Portfolio

Deal to strengthen Vertiv’s capabilities to support deployment of AI at scale

Columbus, Ohio December 4, 2023 – Vertiv (NYSE: VRT), a global provider of critical digital infrastructure and continuity solutions, today announced that subsidiaries of the company have entered into a definitive agreement to acquire all of the shares of CoolTera Ltd. (CoolTera), a provider of coolant distribution infrastructure for data center liquid cooling technology and certain assets, including certain contracts, patents, trademarks, and intellectual property from an affiliate of CoolTera.

Founded in 2016 and based in the UK, CoolTera provides liquid cooling infrastructure solutions, and designs and manufactures coolant distribution units (CDU), secondary fluid networks (SFN), and manifolds for data center liquid cooling solutions. CoolTera and Vertiv have been technology partners for three years with multiple global deployments to data centers and super compute systems. The acquisition of CoolTera brings advanced cooling technology, deep domain expertise, controls and systems, and manufacturing and testing for high density compute cooling requirements to Vertiv’s already robust thermal management portfolio, as well as key industry partnerships already in place across the ecosystem for such applications. CoolTera has a proven track record of engineering excellence and strong customer service supported by a team of highly qualified, proven liquid cooling engineers.

“This bolt-on technology acquisition is consistent with our long-term strategic vision for value creation, and further strengthens our expertise in high-density cooling solutions,” said Giordano Albertazzi, Chief Executive Officer, Vertiv. “And while the purchase price is not material to Vertiv, the acquisition is essential to further reinforce our liquid cooling portfolio, enhancing our ability to serve the needs of our global data center customers and strengthening our position and capabilities to support the needs of AI at scale.”

“It was a logical decision to join the Vertiv family,” said Mark Luxford, CoolTera’s Managing Director. “We are excited to join the leader in data center thermal management. Vertiv has demonstrated the ability to scale technologies at a pace that is needed for AI deployment. We look forward to working as a team to deliver next generation liquid cooling technologies at the scale the industry requires. Vertiv is well-positioned to support the industry growth.”

The acquisition is expected to close in the fourth quarter of 2023, subject to customary closing conditions.

About Vertiv

Vertiv (NYSE: VRT) brings together hardware, software, analytics and ongoing services to enable its customers’ vital applications to run continuously, perform optimally and grow with their business needs. Vertiv solves the most important challenges facing today’s data centers, communication networks and commercial and industrial facilities with a portfolio of power, cooling and IT infrastructure solutions and services that extends from the cloud to the edge of the network. Headquartered in Westerville, Ohio, USA, Vertiv does business in more than 130 countries. For more information, and for the latest news and content from Vertiv, visit Vertiv.com.

Forward-Looking Statements

This release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27 of the Securities Act, and Section 21E of the Securities Exchange Act. These statements are only a prediction. Actual events or results may differ materially from those in the forward-looking statements set forth herein. Readers are referred to Vertiv’s filings with the Securities and Exchange Commission, including its most recent Annual Report on Form 10-K and any subsequent Quarterly Reports on Form 10-Q for a discussion of these and other important risk factors concerning Vertiv and its operations. Vertiv is under no obligation to, and expressly disclaims any obligation to, update or alter its forward-looking statements, whether as a result of new information, future events or otherwise.

Category: Financial News

For investor inquiries, please contact:

Lynne Maxeiner

Vice President, Global Treasury & Investor Relations

Vertiv

T +1 614-841-6776

E: lynne.maxeiner@vertiv.com

For media inquiries, please contact:

Sara Steindorf

FleishmanHillard for Vertiv

E: sara.steindorf@fleishman.com

Source: Vertiv Holdings Co

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

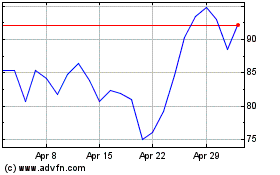

Vertiv (NYSE:VRT)

Historical Stock Chart

From Apr 2024 to May 2024

Vertiv (NYSE:VRT)

Historical Stock Chart

From May 2023 to May 2024