Board of Arbitration Rules in Favor of U. S. Steel, Affirming Transaction with Nippon Steel

September 25 2024 - 11:19AM

Business Wire

U. S. Steel has satisfied the successorship

obligations in the Basic Labor Agreement (BLA) with the United

Steelworkers (USW)

All BLA issues between U. S. Steel and USW are

now resolved

No further action is necessary under the BLA

for Nippon Steel to acquire U. S. Steel and assume all USW

agreements in line with its commitments

United States Steel Corporation (NYSE: X) (“U. S. Steel” or the

“Company”) today announced the Board of Arbitration, which is

jointly selected by U. S. Steel and the United Steelworkers (“USW”)

to decide disputes between them, ruled that U. S. Steel has

satisfied each of the conditions of the successorship clause of its

Basic Labor Agreement (“BLA”) with the USW and that no further

action under the BLA is required to proceed to closing the pending

transaction between U. S. Steel and Nippon Steel (the

“Transaction”).

On January 12, 2024, USW leadership filed a series of grievances

alleging that the successorship clause in the BLA had not been

satisfied. On August 15, 2024, the Board of Arbitration heard

evidence and arguments from both U. S. Steel and the USW on the

matter. Today, the Board of Arbitration determined that the

successorship clause has been satisfied and that, as required by

the BLA, Nippon Steel has:

- recognized the USW as the bargaining representative for

USW-represented employees at U. S. Steel;

- provided reasonable assurances that it has both the willingness

and financial wherewithal to honor the commitments in the

agreements between U. S. Steel and the USW applicable to

USW-represented employees; and

- assumed all USW agreements that are applicable to

USW-represented employees at U. S. Steel.

In making this decision, the Board of Arbitration recognized the

repeated written commitments Nippon Steel made to fulfill the

requirements of the successorship clause and that no further

actions by Nippon Steel were required. Moreover, the Board of

Arbitration cited Nippon Steel’s written commitments—including its

commitment to invest no less than $1.4 billion in USW-represented

facilities, not to conduct layoffs or plant closings during the

term of the BLA, and to protect the best interests of U. S. Steel

in trade matters—in support of its decision.

With the completion of this arbitration proceeding, all

outstanding issues related to the BLA have now been resolved with

respect to the Transaction.

Following the ruling, Karl Kocsis, Vice President and Chief

Labor Relations Officer for U. S. Steel, commented, “We commend the

Board of Arbitration for its thorough review of the USW’s

allegations and are pleased with its decision that U. S. Steel and

Nippon Steel have fully complied with the BLA. U. S. Steel always

has and always will continue to have the utmost regard for our

union-represented employees and the role of the USW.”

David Burritt, President and Chief Executive Officer of U. S.

Steel remarked, “With the arbitration process now behind us, we

look forward to moving ahead with our pending transaction with

Nippon Steel. With the significant investments and contractual

commitments from Nippon Steel, we will protect and grow U. S. Steel

for the benefit of our employees, communities and customers. We

look forward to collaborative discussions with the USW and all our

stakeholders.”

U. S. Steel and Nippon Steel continue to progress through U.S.

regulatory reviews of the pending transaction and work toward

closing the transaction by the end of this year.

About U. S. Steel

Founded in 1901, United States Steel Corporation is a leading

steel producer. With an unwavering focus on safety, the Company’s

customer-centric Best for All® strategy is advancing a more secure,

sustainable future for U. S. Steel and its stakeholders. With a

renewed emphasis on innovation, U. S. Steel serves the automotive,

construction, appliance, energy, containers, and packaging

industries with high value-added steel products such as U. S.

Steel’s proprietary XG3® advanced high-strength steel. The Company

also maintains competitively advantaged iron ore production and has

an annual raw steelmaking capability of 22.4 million net tons. U.

S. Steel is headquartered in Pittsburgh, Pennsylvania, with

world-class operations across the United States and in Central

Europe. For more information, please visit www.ussteel.com.

FORWARD-LOOKING STATEMENTS

This press release contains information regarding the Company

that may constitute “forward-looking statements,” as that term is

defined under the Private Securities Litigation Reform Act of 1995

and other securities laws, that are subject to risks and

uncertainties. We intend the forward-looking statements to be

covered by the safe harbor provisions for forward-looking

statements in those sections. Generally, we have identified such

forward-looking statements by using the words “believe,” “expect,”

“intend,” “estimate,” “anticipate,” “project,” “target,”

“forecast,” “aim,” “should,” “plan,” “goal,” “future,” “will,”

“may” and similar expressions or by using future dates in

connection with any discussion of, among other things, statements

expressing general views about future operating or financial

results, operating or financial performance, trends, events or

developments that we expect or anticipate will occur in the future,

anticipated cost savings, potential capital and operational cash

improvements and changes in the global economic environment,

anticipated capital expenditures, the construction or operation of

new or existing facilities or capabilities and the costs associated

with such matters, statements regarding our greenhouse gas

emissions reduction goals, as well as statements regarding the

proposed transaction between the Company and Nippon Steel

Corporation. However, the absence of these words or similar

expressions does not mean that a statement is not forward-looking.

Forward-looking statements include all statements that are not

historical facts, but instead represent only the Company’s beliefs

regarding future goals, plans and expectations about our prospects

for the future and other events, many of which, by their nature,

are inherently uncertain and outside of the Company’s control. It

is possible that the Company’s actual results and financial

condition may differ, possibly materially, from the anticipated

results and financial condition indicated in these forward-looking

statements. Management of the Company believes that these

forward-looking statements are reasonable as of the time made.

However, caution should be taken not to place undue reliance on any

such forward-looking statements because such statements speak only

as of the date when made. In addition, forward looking statements

are subject to certain risks and uncertainties that could cause

actual results to differ materially from the Company’s historical

experience and our present expectations or projections. Risks and

uncertainties include without limitation: the ability of the

parties to consummate the proposed transaction between the Company

and Nippon Steel Corporation, on a timely basis or at all; the

timing, receipt and terms and conditions of any required

governmental and regulatory approvals of the proposed transaction;

the occurrence of any event, change or other circumstances that

could give rise to the termination of the definitive agreement and

plan of merger relating to the proposed transaction (the “Merger

Agreement”); the risk that the parties to the Merger Agreement may

not be able to satisfy the conditions to the proposed transaction

in a timely manner or at all; risks related to disruption of

management time from ongoing business operations due to the

proposed transaction; certain restrictions during the pendency of

the proposed transaction that may impact the Company’s ability to

pursue certain business opportunities or strategic transactions;

the risk that any announcements relating to the proposed

transaction could have adverse effects on the market price of the

Company’s common stock; the risk of any unexpected costs or

expenses resulting from the proposed transaction; the risk of any

litigation relating to the proposed transaction; the risk that the

proposed transaction and its announcement could have an adverse

effect on the ability of the Company to retain customers and retain

and hire key personnel and maintain relationships with customers,

suppliers, employees, stockholders and other business relationships

and on its operating results and business generally; and the risk

the pending proposed transaction could distract management of the

Company. The Company directs readers to its Form 10-K for the year

ended December 31, 2023 and Quarterly Report on Form 10-Q for the

quarter ended June 30, 2024, and the other documents it files with

the SEC for other risks associated with the Company’s future

performance. These documents contain and identify important factors

that could cause actual results to differ materially from those

contained in the forward-looking statements. All information in

this press release is as of the date above. The Company does not

undertake any duty to update any forward-looking statement to

conform the statement to actual results or changes in the Company’s

expectations whether as a result of new information, future events

or otherwise, except as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240925280434/en/

U. S. Steel Media Relations T - (412) 433-1300 E -

media@uss.com

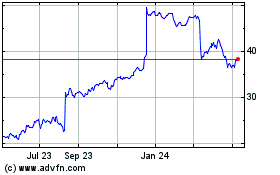

US Steel (NYSE:X)

Historical Stock Chart

From Nov 2024 to Dec 2024

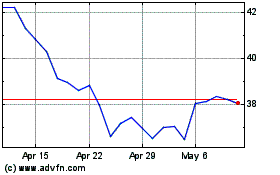

US Steel (NYSE:X)

Historical Stock Chart

From Dec 2023 to Dec 2024