Delivered Net Sales of $9.1 Billion,

Up 2.1%

Increased Gross Profit 6% to $1.5 Billion

and Net Income to $95 Million

Grew Adjusted EBITDA 15% to $402 Million and

Expanded Adjusted EBITDA Margin by ~50 bps

Reduced Net Leverage to 2.9x, Prepaid $60

Million of Debt and Repurchased $29 Million of Shares

Raises Adjusted EBITDA Guidance for Fiscal

Year 2023 to $1.54 Billion - $1.56 Billion

US Foods Holding Corp. (NYSE: USFD), one of the largest

foodservice distributors in the United States, today announced

results for the third quarter fiscal year 2023.

Third Quarter Fiscal 2023

Highlights

- Net sales increased 2.1% to $9.1 billion

- Total case volume increased 4.0%; independent restaurant case

volume increased 5.8%

- Gross profit increased 5.6% to $1.5 billion

- Net income available to common shareholders was $95

million

- Adjusted EBITDA increased 14.5% to $402 million

- Diluted EPS decreased 11.6% to $0.38; Adjusted Diluted EPS

increased 16.7% to $0.70

Nine Month Fiscal 2023

Highlights

- Net sales increased 4.4% to $26.7 billion

- Total case volume increased 4.0%; independent restaurant case

volume increased 6.1%

- Gross profit increased 12.9% to $4.6 billion

- Net income available to common shareholders was $352

million

- Adjusted EBITDA increased 22.0% to $1.2 billion

- Diluted EPS increased 123.4% to $1.43; Adjusted Diluted EPS

increased 25.2% to $1.99

“Our strong third quarter and year-to-date earnings are a result

of continued growth and market share gains in our target customer

types, the operational efficiencies we have achieved over the last

few quarters, and the dedication of our 29,000 associates, who

relentlessly focus on delivering best-in-class service to our

customers and executing our strategic long-range plan initiatives,”

said Dave Flitman, CEO. “We drove strong case volume growth in our

target customer types again this quarter, with volume increasing

nearly 6% for independent restaurants, 8% for healthcare and 6% for

hospitality. Building on our differentiated team-based selling

model, industry-leading technology suite and strong momentum, our

team delivered the tenth consecutive quarter of market share gains

with independent restaurants. Importantly, we accelerated our

market share gains in the third quarter with independent

restaurants despite a slowing macro environment.”

Flitman continued, “Finally, we are excited to announce that we

have signed a definitive agreement to acquire Saladino's

Foodservice, our second tuck-in acquisition this year and look

forward to welcoming the Saladino's team to US Foods, adding

improved scale as we continue to enhance our position with new and

existing customers in central California. As we move toward 2024,

we are laser focused on delivering our strategy to grow market

share and margins, while we effectively deploy capital to deliver

compounded shareholder value over the long term.”

“The execution of our strategy is driving sustainable operating

leverage gains as we delivered strong Adjusted EBITDA growth again

this quarter,” added Dirk Locascio, CFO. “Adjusted EBITDA grew 15%

and we expanded Adjusted EBITDA margin by 50 basis points.

Additionally, we remain disciplined in prudently deploying our

strong and growing free cash flow during the quarter, prepaying

additional debt, executing opportunistic share repurchases and

further reducing net leverage to 2.9x, in-line with our target

leverage range. Following strong financial results and continued

effective execution of our strategy, we are raising our Adjusted

EBITDA guidance for fiscal 2023 to a range of $1.54 billion to

$1.56 billion.”

Third Quarter Fiscal 2023

Results Net sales were $9.1 billion for the quarter, an

increase of 2.1% from the prior year, driven by case volume growth,

partially offset by food cost deflation of 1.3%. Total case volume

increased 4.0% from the prior year driven by a 5.8% increase in

independent restaurant case volume, a 7.7% increase in healthcare

volume and a 5.8% increase in hospitality volume, offset by a 3.6%

decrease in chain volume. Independent restaurant case growth was

negatively impacted by 0.8% from slower growth in CHEF’STORE.

Gross profit was $1.5 billion, an increase of 5.6% from the

prior year, primarily as a result of an increase in total case

volume and cost of goods sold optimization, partially offset by an

unfavorable year-over-year LIFO adjustment. Gross profit as a

percentage of net sales was 16.9%. Adjusted Gross profit was $1.6

billion, a 7.7% increase from the prior year. Adjusted Gross profit

as a percentage of net sales was 17.3% and adjusted Gross profit

per case continued at strong levels.

Operating expenses of $1.3 billion increased by $66 million, or

5.3% from the prior year. Operating expenses increased primarily

due to increased total case volume and higher seller compensation

costs, partially offset by lower distribution cost per case from

cost savings initiatives including routing improvements and focused

efforts positively impacting labor turnover and productivity as

well as lower fuel costs. Operating expenses as a percentage of Net

sales were 14.4%. Adjusted Operating expenses for the quarter were

$1.2 billion, an increase of $58 million or 5.2% from the prior

year due to the aforementioned factors. Adjusted Operating expenses

as a percent of net sales were 12.9%.

Net income available to common shareholders was $95 million, a

decrease of $5 million compared to the prior year, driven by an

increase in operating income that was more than offset by a loss on

extinguishment of debt and an increase in interest expense.

Adjusted EBITDA was $402 million, an increase of $51 million or

14.5%, compared to the prior year. Adjusted EBITDA margin was 4.4%,

an increase of 48 basis points compared to the prior year. Diluted

EPS was $0.38; Adjusted Diluted EPS was $0.70.

Nine Month Fiscal 2023

Results Net sales were $26.7 billion for the first nine

months of 2023, an increase of 4.4% from the prior year, driven by

case volume growth and food cost inflation of 0.6%. Total case

volume increased 4.0% from the prior year driven by a 6.1% increase

in independent restaurant volume, a 6.8% increase in healthcare

volume and a 9.9% increase in hospitality volume, partially offset

by a 2.7% decrease in chain volume. Independent restaurant case

growth was negatively impacted by 0.8% from slower growth in

CHEF’STORE.

Gross profit was $4.6 billion, an increase of 12.9% from the

prior year primarily as a result of an increase in total case

volume, cost of goods sold optimization, increased freight income

from improved inbound logistics, optimized pricing and a favorable

year-over-year LIFO adjustment. Gross profit as a percentage of Net

sales was 17.1%. Adjusted Gross profit was $4.6 billion, a 10.0%

increase from the prior year. Adjusted Gross profit as a percentage

of Net sales was 17.3%.

Operating expenses of $3.8 billion increased $179 million, or

4.9% from the prior year. Operating expenses increased primarily

due to increased total case volume and higher seller compensation

costs, partially offset by lower distribution cost per case from

cost savings initiatives including routing improvements and focused

efforts positively impacting labor turnover and productivity as

well as lower fuel costs. Operating expenses as a percentage of Net

sales were 14.3%. Adjusted Operating expenses for the first nine

months of 2023 were $3.4 billion, an increase of $196 million or

6.1% from the prior year due to the aforementioned factors.

Adjusted Operating expenses as a percent of Net sales were

12.9%.

Net income available to common shareholders was $352 million, an

increase of $207 million compared to the prior year, driven by an

increase in operating income that was partially offset by an

increase in interest expense and a loss on extinguishment of debt.

Adjusted EBITDA was $1.2 billion, an increase of $211 million or

22.0%, compared to the prior year. Adjusted EBITDA margin was 4.4%,

an increase of 63 basis points compared to the prior year. Diluted

EPS was $1.43; Adjusted Diluted EPS was $1.99.

Cash Flow and Debt Cash flow

provided by operating activities for the first nine months of

fiscal 2023 was $935 million, an increase of $322 million from the

prior year due to earnings growth and strong working capital

management. Cash capital expenditures for the nine months of fiscal

2023 totaled $167 million, a decrease of $34 million from the prior

year period, and related to investments in information technology,

property and equipment for fleet replacement and maintenance of

distribution facilities.

During the third quarter of fiscal 2023, the Company used

cash-on-hand to make a $60 million voluntary prepayment on the 2019

Incremental Term Loan Facility. Additionally, the Company repaid

all of the then outstanding borrowings under its Secured Senior

Notes due 2025, using proceeds from the issuance of Unsecured

Senior Notes due 2028 and Unsecured Senior Notes due 2032, along

with cash on hand. Furthermore, the Company amended its loan

agreement on the 2021 Incremental Term Loan Facility to lower the

interest rate margins by 25 basis points.

Net Debt at the end of the third quarter of fiscal 2023 was $4.3

billion. The ratio of Net Debt to Adjusted EBITDA was 2.9x at the

end of the third quarter of fiscal 2023, compared to 3.5x at the

end of fiscal 2022 and 3.7x at the end of the third quarter of

fiscal 2022.

During the third quarter of fiscal 2023, the Company repurchased

0.7 million shares of common stock at an aggregate purchase price

of $29 million. The Company has approximately $257 million in

remaining funds authorized under its $500 million share repurchase

program.

M&A Update Subsequent to

quarter-end, the Company has signed a definitive agreement to

acquire Saladino's Foodservice, an independently owned broadline

distributor based in central California, with approximately $600

million in annual revenue and more than 4,000 customers.

During the third quarter of fiscal 2023, the Company acquired

Renzi Foodservice, a broadline distributor in New York for a

purchase price of $142 million. The acquisition, which was funded

with cash from operations, will allow the Company to further expand

its reach into central upstate New York.

Outlook for Fiscal Year

20231 The Company is updating its previously announced

fiscal year 2023 guidance to:

- Adjusted EBITDA of $1.54-$1.56 billion, compared to previous

guidance of $1.51-$1.54 billion

- Adjusted Diluted EPS of $2.60-$2.70, compared to previous

guidance of $2.55-$2.65

- Interest expense of $320-$325 million

- Total capital expenditures of $410-$430 million, consisting of

$290-$310 million of cash capital expenditures and ~$120 million of

fleet capital leases

- Net Debt to Adjusted EBITDA leverage below 3.0x by end of

fiscal year 2023

Conference Call and Webcast

Information US Foods will host a live webcast to discuss

third quarter fiscal 2023 results on Thursday, November 9, 2023, at

8 a.m. CST. The call can also be accessed live over the phone by

dialing (877) 344-2001; the conference passcode is 2528845. The

presentation slides reviewed during the webcast will be available

shortly before the webcast begins. The webcast, slides and a copy

of this press release can be found in the Investor Relations

section of our website at https://ir.usfoods.com.

About US Foods With a

promise to help its customers Make It, US Foods is one of America’s

great food companies and a leading foodservice distributor,

partnering with approximately 250,000 restaurants and foodservice

operators to help their businesses succeed. With 70 broadline

locations and more than 85 cash and carry stores, US Foods and its

29,000 associates provides its customers with a broad and

innovative food offering and a comprehensive suite of e-commerce,

technology and business solutions. US Foods is headquartered in

Rosemont, Ill. Visit www.usfoods.com to learn more.

_________________________________________

1

The Company is not providing a

reconciliation of certain forward-looking non-GAAP financial

measures, including Adjusted EBITDA and Adjusted Diluted EPS,

because the Company is unable to predict with reasonable certainty

the financial impact of certain significant items, including

restructuring costs and asset impairment charges, share-based

compensation expenses, non-cash impacts of LIFO reserve

adjustments, losses on extinguishments of debt, business

transformation costs, other gains and losses, business acquisition

and integration related costs and diluted earnings per share. These

items are uncertain, depend on various factors, and could have a

material impact on GAAP reported results for the guidance periods.

For the same reasons, the Company is unable to address the

significance of the unavailable information, which could be

material to future results.

Forward-Looking Statements

Statements in this press release which are not historical in

nature, including those under the heading “Outlook for Fiscal Year

2023,” are “forward-looking statements” within the meaning of the

federal securities laws. These statements often include words such

as “believe,” “expect,” “project,” “anticipate,” “intend,” “plan,”

“outlook,” “estimate,” “target,” “seek,” “will,” “may,” “would,”

“should,” “could,” “forecast,” “mission,” “strive,” “more,” “goal,”

or similar expressions (although not all forward-looking statements

may contain such words) and are based upon various assumptions and

our experience in the industry, as well as historical trends,

current conditions, and expected future developments. However, you

should understand that these statements are not guarantees of

performance or results and there are a number of risks,

uncertainties and other important factors, many of which are beyond

our control, that could cause our actual results to differ

materially from those expressed in the forward-looking statements,

including, among others: economic factors affecting consumer

confidence and discretionary spending and reducing the consumption

of food prepared away from home; cost inflation/deflation and

commodity volatility; competition; reliance on third party

suppliers and interruption of product supply or increases in

product costs; changes in our relationships with customers and

group purchasing organizations; our ability to increase or maintain

the highest margin portions of our business; achievement of

expected benefits from cost savings initiatives; increases in fuel

costs; changes in consumer eating habits; cost and pricing

structures; the impact of climate change or related legal,

regulatory or market measures; impairment charges for goodwill,

indefinite-lived intangible assets or other long-lived assets; the

impact of governmental regulations; product recalls and product

liability claims; our reputation in the industry; labor relations

and increased labor costs and continued access to qualified and

diverse labor; indebtedness and restrictions under agreements

governing our indebtedness; interest rate increases; the

replacement of LIBOR with an alternative reference rate; disruption

of existing technologies and implementation of new technologies;

cybersecurity incidents and other technology disruptions; risks

associated with intellectual property, including potential

infringement; effective consummation of pending acquisitions and

effective integration of acquired businesses; potential costs

associated with shareholder activism; changes in tax laws and

regulations and resolution of tax disputes; certain provisions in

our governing documents; health and safety risks to our associates

and related losses; adverse judgments or settlements resulting from

litigation; extreme weather conditions, natural disasters and other

catastrophic events; and management of retirement benefits and

pension obligations.

For a detailed discussion of these risks, uncertainties and

other factors that could cause our actual results to differ

materially from those anticipated or expressed in any

forward-looking statements, see the section entitled “Risk Factors”

in our Annual Report on Form 10-K for the fiscal year ended

December 31, 2022 filed with the Securities and Exchange Commission

(“SEC”). Additional risks and uncertainties are discussed from time

to time in current, quarterly and annual reports filed by the

Company with the SEC, which are available on the SEC’s website at

www.sec.gov. Additionally, we operate in a highly competitive and

rapidly changing environment; new risks and uncertainties may

emerge from time to time, and it is not possible to predict all

risks nor identify all uncertainties. The forward-looking

statements contained in this press release speak only as of the

date of this press release and are based on information and

estimates available to us at this time. We undertake no obligation

to update or revise any forward-looking statements, except as may

be required by law.

Non-GAAP Financial Measures

We report our financial results in accordance with U.S. generally

accepted accounting principles (“GAAP”). However, Adjusted Gross

profit, Adjusted Operating expenses, EBITDA, Adjusted EBITDA,

Adjusted EBITDA margin, Net Debt, Adjusted Net income and Adjusted

Diluted EPS are non-GAAP financial measures regarding our

operational performance and liquidity. These non-GAAP financial

measures exclude the impact of certain items and, therefore, have

not been calculated in accordance with GAAP.

We use Adjusted Gross profit and Adjusted Operating expenses as

supplemental measures to GAAP measures to focus on

period-over-period changes in our business and believe this

information is helpful to investors. Adjusted Gross profit is Gross

profit adjusted to remove the impact of the LIFO inventory reserve

adjustments. Adjusted Operating expenses are Operating expenses

adjusted to exclude amounts that we do not consider part of our

core operating results when assessing our performance.

We believe EBITDA, Adjusted EBITDA and Adjusted EBITDA margin

provide meaningful supplemental information about our operating

performance because they exclude amounts that we do not consider

part of our core operating results when assessing our performance.

EBITDA is Net income (loss), plus Interest expense-net, Income tax

provision (benefit), and Depreciation and amortization. Adjusted

EBITDA is EBITDA adjusted for (1) Restructuring costs and asset

impairment charges; (2) Share-based compensation expense; (3) the

non-cash impact of LIFO reserve adjustments; (4) loss on

extinguishment of debt; (5) Business transformation costs; and (6)

other gains, losses or costs as specified in the agreements

governing our indebtedness. Adjusted EBITDA margin is Adjusted

EBITDA divided by total net sales.

We use Net Debt as a supplemental measure to GAAP measures to

review the liquidity of our operations. Net Debt is defined as

total debt net of total Cash, cash equivalents and restricted cash

remaining on the balance sheet as of the end of the most recent

fiscal quarter. We believe that Net Debt is a useful financial

metric to assess our ability to pursue business opportunities and

investments. Net Debt is not a measure of our liquidity under GAAP

and should not be considered as an alternative to Cash Flows

Provided by Operations or Cash Flows Used in Financing

Activities.

We believe that Adjusted Net income is a useful measure of

operating performance for both management and investors because it

excludes items that are not reflective of our core operating

performance and provides an additional view of our operating

performance including depreciation, interest expense, and Income

taxes on a consistent basis from period to period. Adjusted Net

income is Net income (loss) excluding such items as restructuring

costs and asset impairment charges, Share-based compensation

expense, the non-cash impacts of LIFO reserve adjustments,

amortization expense, loss on extinguishment of debt, Business

transformation costs and other items, and adjusted for the tax

effect of the exclusions and discrete tax items. We believe that

Adjusted Net income may be used by investors, analysts, and other

interested parties to facilitate period-over-period comparisons and

provides additional clarity as to how factors and trends impact our

operating performance.

We use Adjusted Diluted Earnings per Share, which is calculated

by adjusting the most directly comparable GAAP financial measure,

Diluted Earnings per Share, by excluding the same items excluded in

our calculation of Adjusted EBITDA to the extent that each such

item was included in the applicable GAAP financial measure. We

believe the presentation of Adjusted Diluted Earnings per Share is

useful to investors because the measurement excludes amounts that

we do not consider part of our core operating results when

assessing our performance. We also believe that the presentation of

Adjusted EBITDA, Adjusted EBITDA margin and Adjusted Diluted

Earnings per Share is useful to investors because these metrics may

be used by securities analysts, investors and other interested

parties in their evaluation of the operating performance of

companies in our industry.

Management uses these non-GAAP financial measures (a) to

evaluate our historical and prospective financial performance as

well as our performance relative to our competitors as they assist

in highlighting trends, (b) to set internal sales targets and

spending budgets, (c) to measure operational profitability and the

accuracy of forecasting, (d) to assess financial discipline over

operational expenditures, and (e) as an important factor in

determining variable compensation for management and employees.

EBITDA and Adjusted EBITDA are also used in connection with certain

covenants and restricted activities under the agreements governing

our indebtedness. We also believe these and similar non-GAAP

financial measures are frequently used by securities analysts,

investors, and other interested parties to evaluate companies in

our industry.

We caution readers that our definitions of Adjusted Gross

profit, Adjusted Operating expenses, EBITDA, Adjusted EBITDA,

Adjusted EBITDA margin, Net Debt, Adjusted Net income and Adjusted

Diluted EPS may not be calculated in the same manner as similar

measures used by other companies. Definitions and reconciliations

of the non-GAAP financial measures to their most comparable GAAP

financial measures are included in the schedules attached to this

press release.

US FOODS HOLDING CORP.

Consolidated Balance Sheets (Unaudited)

($ in millions)

September 30,

2023

December 31,

2022

ASSETS

Current assets:

Cash and cash equivalents

$

346

$

211

Accounts receivable, less allowances of

$19 and $30

1,926

1,705

Vendor receivables, less allowances of $7

and $8

206

143

Inventories—net

1,582

1,616

Prepaid expenses

138

124

Assets held for sale

—

2

Other current assets

11

19

Total current assets

4,209

3,820

Property and equipment—net

2,187

2,171

Goodwill

5,685

5,625

Other intangibles—net

808

785

Other assets

382

372

Total assets

$

13,272

$

12,773

LIABILITIES, MEZZANINE EQUITY AND

SHAREHOLDERS’ EQUITY

Current liabilities:

Cash overdraft liability

$

214

$

175

Accounts payable

2,249

1,855

Accrued expenses and other current

liabilities

677

650

Current portion of long-term debt

112

116

Total current liabilities

3,252

2,796

Long-term debt

4,574

4,738

Deferred tax liabilities

304

298

Other long-term liabilities

450

446

Total liabilities

8,580

8,278

Mezzanine equity:

Series A convertible preferred stock

—

534

Shareholders’ equity:

Common stock

3

2

Additional paid-in capital

3,642

3,036

Retained earnings

1,362

1,010

Accumulated other comprehensive loss

(70

)

(73

)

Treasury Stock

(245

)

(14

)

Total shareholders’ equity

4,692

3,961

Total liabilities, mezzanine equity and

shareholders’ equity

$

13,272

$

12,773

US FOODS HOLDING CORP.

Consolidated Statements of Operations (Unaudited)

13 Weeks Ended

39 Weeks Ended

($ in millions, except share and per

share data)

September 30,

2023

October 1,

2022

September 30,

2023

October 1,

2022

Net sales

$

9,106

$

8,917

$

26,661

$

25,542

Cost of goods sold

7,564

7,457

22,103

21,504

Gross profit

1,542

1,460

4,558

4,038

Operating expenses:

Distribution, selling and administrative

costs

1,312

1,246

3,819

3,640

Total operating expenses

1,312

1,246

3,819

3,640

Operating income

230

214

739

398

Other income—net

(1

)

(5

)

(4

)

(16

)

Interest expense—net

81

65

244

180

Loss on extinguishment of debt

21

—

21

—

Income before income taxes

129

154

478

234

Income tax provision

34

45

119

62

Net income

$

95

$

109

$

359

$

172

Other comprehensive income—net of tax:

Changes in retirement benefit

obligations

$

1

$

—

$

1

—

Unrecognized gain on interest rate

caps

—

—

1

—

Comprehensive income

$

96

$

109

$

361

$

172

Net income

$

95

$

109

$

359

$

172

Series A convertible preferred stock

dividends

—

(9

)

(7

)

(27

)

Net income available to common

shareholders

$

95

$

100

$

352

$

145

Net income per share

Basic

$

0.38

$

0.44

$

1.49

$

0.65

Diluted

$

0.38

$

0.43

$

1.43

$

0.64

Weighted-average common shares

outstanding

Basic

246,796,649

224,584,298

237,117,546

223,840,992

Diluted

248,954,716

251,174,198

250,577,973

226,300,639

US FOODS HOLDING CORP.

Consolidated Statements of Cash Flows (Unaudited)

39 Weeks Ended

($ in millions)

September 30,

2023

October 1,

2022

Cash flows from operating activities:

Net income

$

359

$

172

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization

290

273

Gain on disposal of property and

equipment—net

(5

)

(2

)

Loss on extinguishment of debt

21

—

Amortization of deferred financing

costs

14

10

Deferred tax provision

5

(1

)

Share-based compensation expense

43

34

Provision for doubtful accounts

20

3

Changes in operating assets and

liabilities:

Increase in receivables

(291

)

(435

)

Decrease (increase) in inventories—net

45

(74

)

(Increase) decrease in prepaid expenses

and other assets

(14

)

2

Increase in accounts payable and cash

overdraft liability

434

574

(Decrease) increase in accrued expenses

and other liabilities

14

57

Net cash provided by operating

activities

935

613

Cash flows from investing activities:

Proceeds from sales of property and

equipment

8

4

Purchases of property and equipment

(167

)

(201

)

Acquisition of broadline operations

(142

)

—

Net cash used in investing activities

(301

)

(197

)

Cash flows from financing activities:

Principal payments on debt and financing

leases

(535

)

(1,215

)

Paydown of Senior Note Debt

(1,000

)

—

Issuance of Senior Note Debt

1,000

—

Repricing of Term Loan Debt

(43

)

—

Issuance of new Term Loan Debt

43

—

Proceeds from debt borrowings

255

1,031

Dividends paid on Series A convertible

preferred stock

(7

)

(27

)

Repurchase of common stock

(229

)

—

Debt financing costs and fees

(10

)

—

Proceeds from employee stock purchase

plan

19

17

Proceeds from exercise of stock

options

23

12

Purchase of interest rate caps

(3

)

—

Tax withholding payments for net

share-settled equity awards

(12

)

(16

)

Net cash used in financing activities

(499

)

(198

)

Net increase in cash, and cash equivalents

and restricted cash

135

218

Cash, cash equivalents and restricted

cash—beginning of period

211

148

Cash, cash equivalents and restricted

cash—end of period

$

346

$

366

Supplemental disclosures of cash flow

information:

Conversion of Series A Convertible

Preferred Stock

$

534

$

—

Interest paid—net of amounts

capitalized

239

162

Income taxes paid—net

126

45

Property and equipment purchases included

in accounts payable

25

25

Leased assets obtained in exchange for

financing lease liabilities

108

98

Leased assets obtained in exchange for

operating lease liabilities

27

35

Cashless exercise of stock options

1

1

US FOODS HOLDING CORP.

Non-GAAP Reconciliation (Unaudited)

13 Weeks Ended

($ in millions, except share and per

share data)

September 30,

2023

October 1,

2022

Change

%

Net income available to common

shareholders

$

95

$

100

$

(5

)

(5.0

)%

Series A Preferred Stock Dividends

—

(9

)

9

(100.0

)%

Net income (GAAP)

95

109

(14

)

(12.8

)%

Interest expense—net

81

65

16

24.6

%

Income tax provision (benefit)

34

45

(11

)

(24.4

)%

Depreciation expense

85

81

4

4.9

%

Amortization expense

12

11

1

9.1

%

EBITDA (Non-GAAP)

307

311

(4

)

(1.3

)%

Adjustments:

Restructuring costs and asset impairment

charges (1)

2

—

2

—

%

Share-based compensation expense (2)

15

13

2

15.4

%

LIFO reserve adjustment (3)

37

6

31

NM

Loss on extinguishment of debt (4)

21

—

21

—

%

Business transformation costs (5)

9

12

(3

)

(25.0

)%

Business acquisition and integration

related costs and other (6)

11

9

2

22.2

%

Adjusted EBITDA (Non-GAAP)

402

351

51

14.5

%

Depreciation expense

(85

)

(81

)

(4

)

4.9

%

Interest expense—net

(81

)

(65

)

(16

)

24.6

%

Income tax provision, as adjusted (7)

(62

)

(54

)

(8

)

14.8

%

Adjusted Net Income (Non-GAAP)

$

174

$

151

$

23

15.2

%

Diluted EPS (GAAP)

$

0.38

$

0.43

$

(0.05

)

(11.6

)%

Restructuring costs and asset impairment

charges (1)

0.01

—

0.01

—

%

Share-based compensation expense (2)

0.06

0.05

0.01

20.0

%

LIFO reserve adjustment (3)

0.15

0.02

0.13

NM

Loss on extinguishment of debt (4)

0.08

—

0.08

—

%

Business transformation costs (5)

0.04

0.05

(0.01

)

(20.0

)%

Business acquisition and integration

related costs and other (6)

0.04

0.04

—

—

%

Income tax provision, as adjusted (7)

(0.06

)

0.01

(0.07

)

NM

Adjusted Diluted EPS (Non-GAAP)

(8)

$

0.70

$

0.60

$

0.10

16.7

%

Weighted-average diluted shares

outstanding (Non-GAAP) (9)

248,954,716

251,174,198

Gross profit (GAAP)

$

1,542

$

1,460

$

82

5.6

%

LIFO reserve adjustment (3)

37

6

31

NM

Adjusted Gross profit

(Non-GAAP)

$

1,579

$

1,466

$

113

7.7

%

Operating expenses (GAAP)

$

1,312

$

1,246

$

66

5.3

%

Depreciation expense

(85

)

(81

)

(4

)

4.9

%

Amortization expense

(12

)

(11

)

(1

)

9.1

%

Restructuring costs and asset impairment

charges (1)

(2

)

—

(2

)

—

%

Share-based compensation expense (2)

(15

)

(13

)

(2

)

15.4

%

Business transformation costs (5)

(9

)

(12

)

3

(25.0

)%

Business acquisition and integration

related costs and other (6)

(11

)

(9

)

(2

)

22.2

%

Adjusted Operating expenses

(Non-GAAP)

$

1,178

$

1,120

$

58

5.2

%

NM - Not Meaningful

(1)

Consists primarily of severance and

related costs, organization realignment costs and asset impairment

charges.

(2)

Share-based compensation expense for

expected vesting of stock awards and employee stock purchase

plan.

(3)

Represents the impact of LIFO reserve

adjustments.

(4)

Includes early redemption premium and the

write-off of certain pre-existing debt issuance costs.

(5)

Transformational costs represent

non-recurring expenses prior to formal launch of strategic projects

with anticipated long-term benefits to the Company. These costs

generally relate to third party consulting and non-capitalizable

construction or technology. For the 13 weeks ended September 30,

2023, business transformation costs related to projects associated

with information technology infrastructure initiatives. For the 13

weeks ended October 1, 2022, business transformation costs consist

of new facility openings, supply chain strategy improvements, and

information technology infrastructure initiatives.

(6)

Includes: (i) aggregate acquisition and

integration related costs of $10 million and $6 million for the 13

weeks ended September 30, 2023 and October 1, 2022, respectively;

and (ii) other gains, losses or costs that we are permitted to

addback for purposes of calculating Adjusted EBITDA under certain

agreements governing our indebtedness.

(7)

Represents our income tax provision

adjusted for the tax effect of pre-tax items excluded from Adjusted

net income and the removal of applicable discrete tax items.

Applicable discrete tax items include changes in tax laws or rates,

changes related to prior year unrecognized tax benefits, discrete

changes in valuation allowances, and excess tax benefits associated

with share-based compensation. The tax effect of pre-tax items

excluded from Adjusted net income is computed using a statutory tax

rate after taking into account the impact of permanent differences

and valuation allowances.

(8)

Adjusted Diluted EPS is calculated as

Adjusted net income divided by weighted average diluted shares

outstanding (Non-GAAP).

(9)

For purposes of the Adjusted Diluted EPS

calculation (Non-GAAP), when the Company has net income (GAAP),

weighted average diluted shares outstanding (Non-GAAP) is used and

assumes conversion of the Series A convertible preferred stock,

and, when the Company has net loss (GAAP) and assumed conversion of

the Series A convertible preferred stock would be antidilutive,

weighted-average diluted shares outstanding (GAAP) is

used.

US FOODS HOLDING CORP.

Non-GAAP Reconciliation (Unaudited)

39 Weeks Ended

($ in millions, except share and per

share data)

September 30,

2023

October 1,

2022

Change

%

Net income available to common

shareholders

$

352

$

145

$

207

142.8

%

Series A convertible preferred stock

dividends

(7

)

(27

)

20

(74.1

)%

Net income (GAAP)

359

172

187

108.7

%

Interest expense—net

244

180

64

35.6

%

Income tax provision (benefit)

119

62

57

91.9

%

Depreciation expense

256

240

16

6.7

%

Amortization expense

34

33

1

3.0

%

EBITDA (Non-GAAP)

1012

687

325

47.3

%

Adjustments:

Restructuring costs and asset impairment

costs (1)

2

—

2

—

%

Share-based compensation expense (2)

43

34

9

26.5

%

LIFO reserve adjustment(3)

42

143

(101

)

(70.6

)%

Loss on extinguishment of debt (4)

21

—

21

—

%

Business transformation costs (5)

16

41

(25

)

(61.0

)%

Business acquisition and integration

related costs and other (6)

35

53

(18

)

(34.0

)%

COVID-19 other related expenses (7)

—

2

(2

)

(100.0

)%

Adjusted EBITDA (Non-GAAP)

1171

960

211

22.0

%

Depreciation expense

(256

)

(240

)

(16

)

6.7

%

Interest expense—net

(244

)

(180

)

(64

)

35.6

%

Income tax provision, as adjusted (8)

(173

)

(140

)

(33

)

23.6

%

Adjusted net income (Non-GAAP)

$

498

$

400

$

98

24.5

%

Diluted EPS (GAAP)

$

1.43

$

0.64

$

0.79

123.4

%

Restructuring costs and asset impairment

costs (1)

0.01

—

0.01

—

%

Share-based compensation expense (2)

0.17

0.14

0.03

21.4

%

LIFO reserve adjustment (3)

0.17

0.57

(0.40

)

(70.2

)%

Loss on extinguishment of debt (4)

0.08

—

0.08

—

%

Business transformation costs (5)

0.06

0.16

(0.10

)

(62.5

)%

Business acquisition and integration

related costs and other (6)

0.14

0.21

(0.07

)

(33.3

)%

COVID-19 other related expenses (7)

—

0.01

(0.01

)

(100.0

)%

Income tax impact of adjustments (8)

(0.07

)

(0.14

)

0.07

(50.0

)%

Adjusted Diluted EPS (Non-GAAP)

(9)

$

1.99

$

1.59

$

0.40

25.2

%

Weighted-average diluted shares

outstanding (Non-GAAP) (10)

250,577,973

251,057,880

Gross profit (GAAP)

$

4,558

$

4,038

$

520

12.9

%

LIFO reserve adjustment (3)

42

143

(101

)

(70.6

)%

Adjusted Gross profit

(Non-GAAP)

$

4,600

$

4,181

$

419

10.0

%

Operating expenses (GAAP)

$

3,819

$

3,640

$

179

4.9

%

Depreciation expense

(256

)

(240

)

(16

)

6.7

%

Amortization expense

(34

)

(33

)

(1

)

3.0

%

Restructuring costs and asset impairment

costs (1)

(2

)

—

(2

)

—

%

Share-based compensation expense (2)

(43

)

(34

)

(9

)

26.5

%

Business transformation costs (5)

(16

)

(41

)

25

(61.0

)%

Business acquisition and integration

related costs and other (6)

(35

)

(53

)

18

(34.0

)%

COVID-19 other related expenses (7)

—

(2

)

2

(100.0

)%

Adjusted Operating expenses

(Non-GAAP)

$

3,433

$

3,237

$

196

6.1

%

(1)

Consists primarily of severance and

related costs, organizational realignment costs and other asset

impairment charges.

(2)

Share-based compensation expense for

expected vesting of stock awards and employee stock purchase

plan.

(3)

Represents the impact of LIFO reserve

adjustments.

(4)

Includes early redemption premium and the

write-off of certain pre-existing debt issuance costs.

(5)

Transformational costs represent

non-recurring expenses prior to formal launch of strategic projects

with anticipated long-term benefits to the Company. These costs

generally relate to third party consulting and non-capitalizable

construction or technology. For the 39 weeks ended September 30,

2023, business transformation costs related to projects associated

with information technology infrastructure initiatives. For the 39

weeks ended October 1, 2022, business transformation costs consist

of new facility openings, supply chain strategy improvements, and

information technology infrastructure initiatives.

(6)

Includes: (i) aggregate acquisition and

integration related costs of $31 million and $18 million for the 39

weeks ended September 30, 2023 and October 1, 2022, respectively;

(ii) CEO sign on bonus of $3 million for the 39 weeks ended

September 30, 2023 (iii) contested proxy and related legal and

consulting costs of $21 million for the 39 weeks ended October 1,

2022 and (iv) CEO severance for $5 million for the 39 weeks ended

October 1, 2022 and (v) other gains, losses or costs that we are

permitted to addback for purposes of calculating Adjusted EBITDA

under certain agreements governing our indebtedness.

(7)

Includes COVID-19 related costs that we

are permitted to addback for purposes of calculating Adjusted

EBITDA under certain agreements governing our indebtedness.

(8)

Represents our income tax provision

adjusted for the tax effect of pre-tax items excluded from Adjusted

net income and the removal of applicable discrete tax items.

Applicable discrete tax items include changes in tax laws or rates,

changes related to prior year unrecognized tax benefits, discrete

changes in valuation allowances, and excess tax benefits associated

with share-based compensation. The tax effect of pre-tax items

excluded from Adjusted net income is computed using a statutory tax

rate after taking into account the impact of permanent differences

and valuation allowances.

(9)

Adjusted Diluted EPS is calculated as

Adjusted net income divided by weighted average diluted shares

outstanding (Non-GAAP).

(10)

For purposes of the Adjusted Diluted EPS

calculation (Non-GAAP), when the Company has net income (GAAP),

weighted average diluted shares outstanding (Non-GAAP) is used and

assumes conversion of the Series A convertible preferred stock,

and, when the Company has net loss (GAAP) and assumed conversion of

the Series A convertible preferred stock would be antidilutive,

weighted-average diluted shares outstanding (GAAP) is

used.

US FOODS HOLDING CORP.

Non-GAAP Reconciliation Net Debt and Net Leverage

Ratios

($ in millions, except ratios)

September 30,

2023

December 31,

2022

October 1,

2022

Total Debt (GAAP)

$

4,686

$

4,854

$

4,937

Cash, cash equivalents and restricted

cash

(346

)

(211

)

(366

)

Net Debt (Non-GAAP)

$

4,340

$

4,643

$

4,571

Adjusted EBITDA (1)

$

1,521

$

1,310

$

1,222

Net Leverage Ratio (2)

2.9

3.5

3.7

(1)

Trailing Twelve Months (TTM) Adjusted

EBITDA

(2)

Net Debt/TTM Adjusted EBITDA

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231108087181/en/

INVESTOR CONTACT: Mike Neese (847) 232-5894

Michael.Neese@usfoods.com

MEDIA CONTACT: Sara Matheu (847) 720-2392

Sara.Matheu@usfoods.com

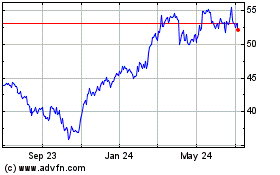

US Foods (NYSE:USFD)

Historical Stock Chart

From Jan 2025 to Feb 2025

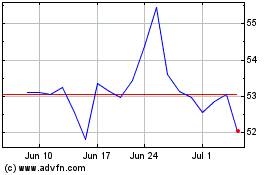

US Foods (NYSE:USFD)

Historical Stock Chart

From Feb 2024 to Feb 2025