Current Report Filing (8-k)

March 26 2020 - 4:18PM

Edgar (US Regulatory)

FALSE000133691700013369172020-03-202020-03-200001336917us-gaap:CommonClassAMember2020-03-202020-03-200001336917us-gaap:CommonClassCMember2020-03-202020-03-2000013369172020-02-052020-02-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________________________________________________________________

FORM 8-K

______________________________________________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 20, 2020

________________________________________________________________________________

UNDER ARMOUR, INC.

________________________________________________________________________________

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Maryland

|

|

001-33202

|

|

52-1990078

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

|

|

|

1020 Hull Street, Baltimore, Maryland

|

|

|

|

21230

|

|

(Address of principal executive offices)

|

|

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (410) 454-6428

(Former name or former address, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

Class A Common Stock

|

UAA

|

New York Stock Exchange

|

Class C Common Stock

|

UA

|

New York Stock Exchange

|

(Title of each class)

|

(Trading Symbols)

|

(Name of each exchange on which registered)

|

________________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

|

|

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

|

|

|

|

|

|

|

|

Emerging growth company

|

☐

|

|

|

|

|

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

|

☐

|

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

As previously disclosed, Under Armour, Inc. (the “Company”) is party to an Amended and Restated Credit Agreement that provides for a revolving credit facility commitment of $1.25 billion (the “Credit Facility”).

Between March 13 and March 20, 2020, the Company borrowed $700 million under the Credit Facility as a precautionary measure in order to increase its cash position and preserve liquidity given the uncertainty in global markets resulting from the COVID-19 outbreak. The Company considers the aggregate of the borrowings to represent a material increase in its borrowing, requiring disclosure under this Form 8-K.

The Company is currently holding these borrowings on its balance sheet. The Company may from time to time re-pay or re-borrow certain of the amounts based on a number of factors, including market conditions, business needs, general liquidity and the Company’s leverage ratio. As of December 31, 2019 and immediately prior to this borrowing, no amounts were outstanding under the Credit Facility. Borrowings under the Credit Facility bear interest at a rate per annum equal to, at the Company’s option, either (a) an alternate base rate, or (b) a rate based on the rates applicable for deposits in the interbank market for U.S. Dollars or the applicable currency in which the loans are made, plus in each case an applicable margin.

CAUTIONARY LANGUAGE CONCERNING FORWARD-LOOKING STATEMENTS

This disclosure contains forward-looking statements within the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. All statements other than those that are purely historical are forward-looking statements, and include statements regarding the potential impact of the COVID-19 outbreak. These forward-looking statements are subject to risks, uncertainties, assumptions and changes in circumstances that may cause results to differ materially from the forward-looking statements. Additional information regarding factors that could cause the Company’s results to differ can be found in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2019. The forward-looking statements contained in this disclosure reflects the Company’s views and assumptions only as of the date of this Current Report on Form 8-K. The Company undertakes no obligation to update any forward-looking statement to reflect events or circumstances after the date on which this disclosure is made or to reflect the occurrence of unanticipated events.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

UNDER ARMOUR, INC.

|

|

|

|

|

|

|

|

|

|

Date: March 26, 2020

|

|

By:

|

|

/s/ David E. Bergman

|

|

|

|

|

|

David E. Bergman

|

|

|

|

|

|

Chief Financial Officer

|

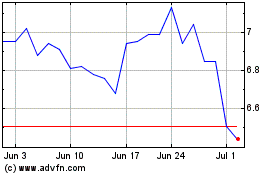

Under Armour (NYSE:UAA)

Historical Stock Chart

From Aug 2024 to Sep 2024

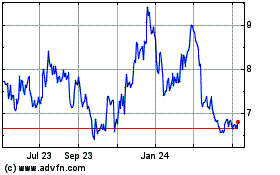

Under Armour (NYSE:UAA)

Historical Stock Chart

From Sep 2023 to Sep 2024