2755 Sand Hill RoadSuite 150Menlo ParkCaliforniaFALSE000158034511/1/202300015803452023-11-012023-11-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 1, 2023

TriplePoint Venture Growth BDC Corp.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Maryland | | 814-01044 | | 46-3082016 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

| | | | | | | | |

TriplePoint Venture Growth BDC Corp. 2755 Sand Hill Road, Suite 150 Menlo Park, California | | 94025 |

| (Address of principal executive offices) | | (Zip Code) |

(650) 854-2090

(Registrant’s telephone number, including area code)

n/a

(Former name or former address, if changed since last report)

Securities registered pursuant to Section 12(b) of the Exchange Act:

| | | | | | | | | | | | | | |

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, par value $0.01 per share | | TPVG | | New York Stock Exchange |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 2.02 Results of Operations and Financial Condition.

On November 1, 2023, TriplePoint Venture Growth BDC Corp. (the “Company”) issued a press release announcing its financial results for the fiscal quarter ended September 30, 2023. A copy of the press release is being furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information in this Item 2.02, including Exhibit 99.1, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, and is not incorporated by reference into any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, unless it is specifically incorporated by reference therein.

Item 7.01 Regulation FD Disclosure.

Additionally, on November 1, 2023, the Company made available on its website, www.tpvg.com, a supplemental investor presentation with respect to the third quarter 2023 earnings release. The information furnished in this Item 7.01 shall not be deemed to be “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that section, and is not incorporated by reference into any filing under the Securities Act or the Exchange Act.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | | |

| 104 | | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| TriplePoint Venture Growth BDC Corp. |

| |

| By: | /s/ James P. Labe |

| Name: | James P. Labe |

| Title: | Chief Executive Officer |

Date: November 1, 2023

Exhibit 99.1

TriplePoint Venture Growth BDC Corp. Announces

Third Quarter 2023 Financial Results

Net Investment Income of $0.54 Per Share for the Third Quarter

DECLARES FOURTH QUARTER 2023 DISTRIBUTION OF $0.40 PER SHARE

Menlo Park, Calif., November 1, 2023 - TriplePoint Venture Growth BDC Corp. (NYSE: TPVG) (the “Company,” “TPVG,” “we,” “us,” or “our”), the leading financing provider to venture growth stage companies backed by a select group of venture capital firms in technology and other high growth industries, today announced its financial results for the third quarter ended September 30, 2023 and the declaration by its Board of Directors of its fourth quarter 2023 distribution of $0.40 per share.

Third Quarter 2023 Highlights

▪Signed $58.1 million of term sheets with venture growth stage companies at TriplePoint Capital LLC (“TPC”) and TPVG closed $5.6 million of new debt commitments to venture growth stage companies;

▪Funded $12.7 million in debt investments to five portfolio companies with a 14.2% weighted average annualized yield at origination;

▪Received $37.3 million of loan principal prepayments;

▪Achieved a 15.1% weighted average annualized portfolio yield on total debt investments for the quarter;

▪Earned net investment income of $19.1 million, or $0.54 per share;

▪Generated total investment income of $35.7 million;

▪Realized a record 20.0% return on average equity, based on net investment income during the quarter;

▪Three debt portfolio companies raised an aggregate $46.8 million of capital in private financings during the quarter;

▪Held debt investments in 54 portfolio companies, warrants in 106 portfolio companies and equity investments in 48 portfolio companies as of September 30, 2023;

▪Debt investment portfolio weighted average investment ranking of 2.10 as of quarter’s end;

▪Raised $6.2 million of net proceeds under the at-the-market equity offering program (“ATM Program”) from the issuance of 563,565 shares of common stock;

▪Net asset value of $374.1 million, or $10.37 per share, as of September 30, 2023;

▪Total liquidity of $262.5 million and total unfunded commitments of $141.9 million;

▪Ended the quarter with a 1.62x gross leverage ratio; and

▪Declared a fourth quarter distribution of $0.40 per share, payable on December 29, 2023; bringing total declared distributions to $14.65 per share since the Company’s initial public offering.

Year to Date 2023 Highlights

▪Earned net investment income of $56.5 million, or $1.59 per share;

▪Generated total investment income of $104.5 million;

▪Paid distributions of $1.20 per share;

▪Signed $370.9 million of term sheets with venture growth stage companies at TPC and TPVG closed $27.3 million of new debt commitments to venture growth stage companies;

▪Funded $100.9 million in debt investments to 19 portfolio companies with a 14.7%1 weighted average annualized portfolio yield at origination and funded $0.2 million in direct equity investments in private rounds of financing to three portfolio companies;

▪16 debt portfolio companies raised an aggregate $436.9 million of capital in private financings;

▪Achieved a 14.8% weighted average annualized portfolio yield on total debt investments;

▪In April 2023, DBRS, Inc. reaffirmed TPVG’s investment grade rating, BBB Long-Term Issuer rating, with a negative trend outlook; and

▪Estimated undistributed taxable earnings from net investment income (or “spillover income”) of $37.3 million, or $1.03 per share, as of September 30, 2023.

1 This yield excludes the impact of $2.0 million in short-term loans that were funded and repaid during the three months ended March 31, 2023, which carried a higher interest rate than our normal course investments, and the impact thereof on our weighted average adjusted annualized yield at origination for the period presented.

“We continue to navigate the challenging venture capital markets,” said Jim Labe, chairman and chief executive officer of TPVG. “Our focus remains on managing the portfolio, maintaining our earnings power, and generating NII that exceeds our distribution.”

“During the third quarter, we strengthened our liquidity position and continued to enhance our investment capacity,” said Sajal Srivastava, president and chief investment officer of the Company. “We expect to increase our investment activity as market conditions improve.”

PORTFOLIO AND INVESTMENT ACTIVITY

During the three months ended September 30, 2023, the Company entered into $5.6 million of new debt commitments with three portfolio companies, funded debt investments totaling $12.7 million to five portfolio companies and acquired warrants valued at $1.3 million in three portfolio companies. Debt investments funded during the quarter carried a weighted average annualized portfolio yield of 14.2% at origination. During the quarter, the Company received $37.3 million of principal prepayments, $15.0 million of early repayments and $20.0 million of scheduled principal amortization. The weighted average annualized portfolio yield on total debt investments for the third quarter was 15.1%. The Company calculates weighted average portfolio yield as the annualized rate of the interest income recognized during the period divided by the average amortized cost of debt investments in the portfolio during the period. The return on average equity for the third quarter was 20.0%. The Company calculates return on average equity as the annualized rate of net investment income recognized during the period divided by the Company’s average net asset value during the period.

As of September 30, 2023, the Company held debt investments in 54 portfolio companies, warrants in 106 portfolio companies and equity investments in 48 portfolio companies. The total cost and fair value of these investments were $924.1 million and $870.2 million, respectively.

Total portfolio investment activity for the three and nine months ended September 30, 2023 and 2022 was as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | For the Three Months Ended

September 30, | | For the Nine Months Ended

September 30, |

| (in thousands) | | 2023 | | 2022 | | 2023 | | 2022 |

| Beginning portfolio at fair value | | $ | 941,955 | | | $ | 876,718 | | | $ | 949,276 | | | $ | 865,340 | |

New debt investments, net(a) | | 12,428 | | | 99,208 | | | 98,967 | | | 315,058 | |

| Scheduled principal amortization | | (20,031) | | | (3,282) | | | (38,288) | | | (19,446) | |

| Principal prepayments and early repayments | | (52,250) | | | (723) | | | (89,400) | | | (171,295) | |

| Net amortization and accretion of premiums and discounts and end-of-term payments | | 38 | | | 4,873 | | | 9,528 | | | 10,414 | |

| Payment-in-kind coupon | | 3,265 | | | 1,659 | | | 7,946 | | | 4,593 | |

| New warrant investments | | 1,334 | | | 1,873 | | | 1,502 | | | 4,833 | |

| New equity investments | | 384 | | | 2,951 | | | 1,320 | | | 6,747 | |

| Proceeds from dispositions of investments | | — | | | (4,616) | | | (3,173) | | | (4,862) | |

| Net realized gains (losses) on investments | | (25,545) | | | (12,990) | | | (23,682) | | | (14,653) | |

| Net change in unrealized gains (losses) on investments | | 8,600 | | | (3,241) | | | (43,818) | | | (34,299) | |

| Ending portfolio at fair value | | $ | 870,178 | | | $ | 962,430 | | | $ | 870,178 | | | $ | 962,430 | |

_____________

(a)Debt balance is net of fees and discounts applied to the loan at origination.

SIGNED TERM SHEETS

During the three months ended September 30, 2023, TPC entered into $58.1 million of non-binding term sheets to venture growth stage companies. These opportunities are subject to underwriting conditions including, but not limited to, the completion of due diligence, negotiation of definitive documentation and investment committee approval, as well as compliance with the allocation policy. Accordingly, there is no assurance that any or all of these transactions will be completed or assigned to the Company.

UNFUNDED COMMITMENTS

As of September 30, 2023, the Company’s unfunded commitments totaled $141.9 million, of which $38.2 million was dependent upon portfolio companies reaching certain milestones. Of the $141.9 million of unfunded commitments, $45.7 million will expire during 2023, $73.3 million will expire during 2024 and $22.9 million will expire during 2025, if not drawn prior to expiration. Since these commitments may expire without being drawn, unfunded commitments do not necessarily represent future cash requirements or future earning assets for the Company.

RESULTS OF OPERATIONS

Total investment and other income was $35.7 million for the third quarter of 2023, representing a weighted average annualized portfolio yield of 15.1% on total debt investments, as compared to $29.7 million and 13.8% for the third quarter of 2022. The increase in total investment and other income was primarily due to a greater weighted average principal amount outstanding on our income-bearing debt investment portfolio and higher investment yields. For the nine months ended September 30, 2023, the Company’s total investment and other income was $104.5 million, as compared to $84.5 million for the nine months ended September 30, 2022, representing a weighted average annualized portfolio yield on total debt investments of 14.8% and 14.5%, respectively.

Operating expenses for the third quarter of 2023 were $16.6 million as compared to $12.8 million for the third quarter of 2022. Operating expenses for the third quarter of 2023 consisted of $9.3 million of interest expense and amortization of fees, $4.6 million of base management fees, $0.6 million of administration agreement expenses and $2.2 million of general and administrative expenses. Due to the total return requirement under the income component of our incentive fee structure, our income incentive fees were reduced by $3.8 million during the three months ended September 30, 2023. Operating expenses for the third quarter of 2022 consisted of $7.2 million of interest expense and amortization of fees, $3.9 million of base management fees, $0.1 million of income incentive fees, $0.6 million of administration agreement expenses and $1.1 million of general and administrative expenses. The Company’s total operating expenses were $48.0 million and $41.4 million for the nine months ended September 30, 2023 and 2022, respectively.

For the third quarter of 2023, the Company recorded net investment income of $19.1 million, or $0.54 per share, as compared to $16.9 million, or $0.51 per share, for the third quarter of 2022. The increase in net investment income between periods was driven primarily by greater investment and other income. Net investment income for the nine months ended September 30, 2023 was $56.5 million, or $1.59 per share, compared to $43.1 million, or $1.35 per share, for the nine months ended September 30, 2022.

During the third quarter of 2023, the Company recognized net realized losses on investments of $25.6 million, resulting primarily from the write-off of Hi.Q, Inc., which was rated Red (5) on our watch list, and its removal from our investment portfolio. During the third quarter of 2022, the Company recognized net realized losses on investments of $13.2 million.

Net change in unrealized gains on investments for the third quarter of 2023 was $8.6 million, consisting of $17.6 million of net unrealized gains from the reversal of previously recorded unrealized losses from investments realized during the period, offset by $6.2 million of net unrealized losses on the existing debt investment portfolio and $2.8 million of net unrealized losses on the warrant and equity portfolio resulting from fair value adjustments. Net change in unrealized losses on investments for the third quarter of 2022 was $3.2 million. The Company’s net realized and unrealized losses were $67.5 million for the nine months ended September 30, 2023, compared to net realized and unrealized losses of $51.3 million for the nine months ended September 30, 2022.

The Company’s net increase in net assets resulting from operations for the third quarter of 2023 was $2.1 million, or $0.06 per share, as compared to a net increase in net assets resulting from operations of $0.4 million, or $0.01 per share, for the third quarter of 2022. For the nine months ended September 30, 2023, the Company’s net decrease in net assets resulting from operations was $11.0 million, or $0.31 per share, as compared to a net decrease in net assets resulting from operations of $8.3 million, or $0.26 per share, for the nine months ended September 30, 2022.

CREDIT QUALITY

The Company maintains a credit watch list with portfolio companies placed into one of five credit categories, with Clear, or 1, being the highest rating and Red, or 5, being the lowest. Generally, all new loans receive an initial grade of White, or 2, unless the portfolio company’s credit quality meets the characteristics of another credit category.

As of September 30, 2023, the weighted average investment ranking of the Company’s debt investment portfolio was 2.10, as compared to 2.07 at the end of the prior quarter. During the quarter ended September 30, 2023, portfolio company credit category changes, excluding fundings and repayments, consisted of the following: one portfolio company with a principal balance of $27.7 million was upgraded from White (2) to Clear (1), three portfolio companies with an aggregate principal balance of $19.4 million were downgraded from White (2) to Yellow (3), two portfolio companies with an aggregate principal balance of $9.0 million were downgraded from Yellow (3) to Orange (4), and one portfolio company with a principal balance of $10.6 million was downgraded from Orange (4) to Red (5).

The following table shows the credit categories for the Company’s debt investments at fair value as of September 30, 2023 and December 31, 2022:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | September 30, 2023 | | December 31, 2022 |

Credit Category

(dollars in thousands) | | Fair Value | | Percentage of Total Debt Investments | | Number of Portfolio Companies | | Fair Value | | Percentage of Total Debt Investments | | Number of Portfolio Companies |

| Clear (1) | | $ | 91,262 | | | 11.7 | % | | 6 | | $ | 55,921 | | | 6.6 | % | | 3 |

| White (2) | | 584,279 | | | 74.6 | | | 35 | | 699,008 | | | 81.9 | | | 48 |

| Yellow (3) | | 68,669 | | | 8.8 | | | 6 | | 88,912 | | | 10.4 | | | 5 |

| Orange (4) | | 17,446 | | | 2.2 | | | 3 | | 9,110 | | | 1.1 | | | 1 |

| Red (5) | | 21,197 | | | 2.7 | | | 4 | | — | | | — | | | — |

| | $ | 782,853 | | | 100.0 | % | | 54 | | $ | 852,951 | | | 100.0 | % | | 57 |

NET ASSET VALUE

As of September 30, 2023, the Company’s net assets were $374.1 million, or $10.37 per share, as compared to $419.9 million, or $11.88 per share, as of December 31, 2022.

LIQUIDITY AND CAPITAL RESOURCES

As of September 30, 2023, the Company had total liquidity of $262.5 million, consisting of cash, cash equivalents and restricted cash of $122.5 million and available capacity under its Revolving Credit Facility of $140.0 million (which excludes an additional $50.0 million available under the Revolving Credit Facility’s accordion feature), subject to existing advance rates, terms and covenants. As of September 30, 2023, the Company held $1.4 million of stock and warrant positions in publicly traded companies. The Company ended the quarter with a 1.62x gross leverage ratio and an asset coverage ratio of 162%.

The Company maintains an ATM Program with UBS Securities LLC, providing for the issuance from time to time of up to an aggregate of $50.0 million in shares of its common stock. As of September 30, 2023, $43.7 million in shares remain available for sale.

DISTRIBUTION

On October 26, 2023, the Company’s board of directors declared a regular quarterly distribution of $0.40 per share for the fourth quarter, payable on December 29, 2023 to stockholders of record as of December 15, 2023. As of September 30, 2023, the Company had estimated spillover income of $37.3 million, or $1.03 per share.

RECENT DEVELOPMENTS

Since September 30, 2023 and through October 31, 2023:

▪TPC’s direct originations platform entered into $17.5 million of additional non-binding signed term sheets with venture growth stage companies;

▪The Company closed $3.0 million of additional debt commitments; and

▪The Company funded $10.0 million in new investments.

CONFERENCE CALL

The Company will host a conference call at 5:00 p.m. Eastern Time, today, November 1, 2023, to discuss its financial results for the quarter ended September 30, 2023. To listen to the call, investors and analysts should dial (844) 826-3038 (domestic) or +1 (412) 317-5184 (international) and ask to join the TriplePoint Venture Growth BDC Corp. call. Please dial in at least five minutes before the scheduled start time. A replay of the call will be available through December 1, 2023, by dialing (877) 344-7529 (domestic) or +1 (412) 317-0088 (international) and entering conference ID 1131961. The conference call also will be available via a live audio webcast in the investor relations section of the Company’s website, https://www.tpvg.com. An online archive of the webcast will be available on the Company’s website for one year after the call.

ABOUT TRIPLEPOINT VENTURE GROWTH BDC CORP.

TriplePoint Venture Growth BDC Corp. is an externally-managed business development company focused on providing customized debt financing with warrants and direct equity investments to venture growth stage companies in technology and other high growth industries backed by a select group of venture capital firms. The Company’s sponsor, TriplePoint Capital, is a Sand Hill Road-based global investment platform which provides customized debt financing, leasing, direct equity investments and other complementary solutions to venture capital-backed companies in technology and other high growth industries at every stage of their development with unparalleled levels of creativity, flexibility and service. For more information about TriplePoint Venture Growth BDC Corp., visit https://www.tpvg.com. For more information about TriplePoint Capital, visit https://www.triplepointcapital.com.

FORWARD-LOOKING STATEMENTS

Certain statements contained in this press release constitute forward-looking statements. Forward-looking statements are not guarantees of future performance, investment activity, financial condition or results of operations and involve a number of substantial risks and uncertainties, many of which are difficult to predict and are generally beyond the Company’s control. Words such as “anticipates,” “expects,” “intends,” “plans,” “will,” “may,” “continue,” “believes,” “seeks,” “estimates,” “would,” “could,” “should,” “targets,” “projects,” and variations of these words and similar expressions are intended to identify forward-looking statements. Actual events, investment activity, performance, condition or results may differ materially from those in the forward-looking statements as a result of a number of factors, including as a result of changes in economic, market or other conditions, and the impact of such changes on the Company’s and its portfolio companies’ results of operations and financial condition, and those factors described from time to time in the Company’s filings with the Securities and Exchange Commission. More information on these risks and other potential factors that could affect actual events and the Company’s performance and financial results, including important factors that could cause actual results to differ materially from plans, estimates or expectations included herein or discussed on the webcast/conference call, is or will be included in the Company’s filings with the Securities and Exchange Commission, including in the “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of the Company’s Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. Readers are cautioned not to place undue reliance on these forward-looking statements, which reflect management’s opinions only as of the date hereof. The Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by law.

INVESTOR RELATIONS AND MEDIA CONTACT

The IGB Group

Leon Berman

212-477-8438

lberman@igbir.com

TriplePoint Venture Growth BDC Corp.

Consolidated Statements of Assets and Liabilities

(in thousands, except per share data)

| | | | | | | | | | | |

| September 30, 2023 | | December 31, 2022 |

| (unaudited) | | |

| Assets | | | |

| Investments at fair value (amortized cost of $924,127 and $959,407, respectively) | $ | 870,178 | | | $ | 949,276 | |

| Cash and cash equivalents | 105,003 | | | 51,489 | |

| Restricted cash | 17,461 | | | 7,771 | |

| Deferred credit facility costs | 3,068 | | | 4,128 | |

| Prepaid expenses and other assets | 2,770 | | | 1,869 | |

| Total assets | $ | 998,480 | | | $ | 1,014,533 | |

| | | |

| Liabilities | | | |

| Revolving Credit Facility | $ | 210,000 | | | $ | 175,000 | |

| 2025 Notes, net | 69,685 | | | 69,543 | |

| 2026 Notes, net | 198,930 | | | 198,598 | |

| 2027 Notes, net | 124,048 | | | 123,839 | |

| Other accrued expenses and liabilities | 21,717 | | | 27,613 | |

| Total liabilities | $ | 624,380 | | | $ | 594,593 | |

| | | |

| Net assets | | | |

| Preferred stock, par value $0.01 per share (50,000 shares authorized; no shares issued and outstanding, respectively) | $ | — | | | $ | — | |

| Common stock, par value $0.01 per share | 361 | | | 353 | |

| Paid-in capital in excess of par value | 478,445 | | | 470,572 | |

| Total distributable earnings (loss) | (104,706) | | | (50,985) | |

| Total net assets | $ | 374,100 | | | $ | 419,940 | |

| Total liabilities and net assets | $ | 998,480 | | | $ | 1,014,533 | |

| | | |

| Shares of common stock outstanding (par value $0.01 per share and 450,000 authorized) | 36,086 | | | 35,348 | |

| Net asset value per share | $ | 10.37 | | | $ | 11.88 | |

TriplePoint Venture Growth BDC Corp.

Consolidated Statements of Operations

(in thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| For the Three Months Ended

September 30, | | For the Nine Months Ended September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| (unaudited) | | (unaudited) | | (unaudited) | | (unaudited) |

| Investment income | | | | | | | |

| Interest income from investments | $ | 34,070 | | | $ | 29,214 | | | $ | 100,825 | | | $ | 82,142 | |

| Other income | 1,668 | | | 484 | | | 3,693 | | | 2,333 | |

| Total investment and other income | $ | 35,738 | | | $ | 29,698 | | | $ | 104,518 | | | $ | 84,475 | |

| | | | | | | |

| Operating expenses | | | | | | | |

| Base management fee | $ | 4,596 | | | $ | 3,932 | | | $ | 13,403 | | | $ | 11,550 | |

| Income incentive fee | — | | | 101 | | | — | | | 6,651 | |

| Interest expense and amortization of fees | 9,297 | | | 7,153 | | | 28,486 | | | 18,378 | |

| Administration agreement expenses | 579 | | | 593 | | | 1,720 | | | 1,673 | |

| General and administrative expenses | 2,162 | | | 1,059 | | | 4,389 | | | 3,162 | |

| Total operating expenses | $ | 16,634 | | | $ | 12,838 | | | $ | 47,998 | | | $ | 41,414 | |

| | | | | | | |

| Net investment income | $ | 19,104 | | | $ | 16,860 | | | $ | 56,520 | | | $ | 43,061 | |

| | | | | | | |

| Net realized and unrealized gains/(losses) | | | | | | | |

| Net realized gains (losses) on investments | $ | (25,556) | | | $ | (13,187) | | | $ | (23,730) | | | $ | (17,038) | |

| Net change in unrealized gains (losses) on investments | 8,600 | | | (3,241) | | | (43,818) | | | (34,299) | |

| Net realized and unrealized gains/(losses) | $ | (16,956) | | | $ | (16,428) | | | $ | (67,548) | | | $ | (51,337) | |

| | | | | | | |

| Net increase (decrease) in net assets resulting from operations | $ | 2,148 | | | $ | 432 | | | $ | (11,028) | | | $ | (8,276) | |

| | | | | | | |

| Per share information (basic and diluted) | | | | | | | |

| Net investment income per share | $ | 0.54 | | | $ | 0.51 | | | $ | 1.59 | | | $ | 1.35 | |

| Net increase (decrease) in net assets per share | $ | 0.06 | | | $ | 0.01 | | | $ | (0.31) | | | $ | (0.26) | |

| Weighted average shares of common stock outstanding | 35,609 | | | 33,373 | | | 35,453 | | | 31,816 | |

| Total distributions declared per share | $ | 0.40 | | | $ | 0.36 | | | $ | 1.20 | | | $ | 1.08 | |

Weighted Average Portfolio Yield

on Total Debt Investments

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Ratios (Percentages, on an annualized basis)(1) | | For the Three Months Ended

September 30, | | For the Nine Months Ended

September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

Weighted average portfolio yield on total debt investments(2) | | 15.1 | % | | 13.8 | % | | 14.8 | % | | 14.5 | % |

| Coupon income | | 11.6 | % | | 11.3 | % | | 11.7 | % | | 10.6 | % |

| Accretion of discount | | 0.9 | % | | 0.8 | % | | 0.9 | % | | 0.8 | % |

| Accretion of end-of-term payments | | 1.6 | % | | 1.7 | % | | 1.7 | % | | 1.7 | % |

| Impact of prepayments during the period | | 1.0 | % | | — | % | | 0.5 | % | | 1.4 | % |

_____________

(1)Weighted average portfolio yields on total debt investments for periods shown are the annualized rates of interest income recognized during the period divided by the average amortized cost of debt investments in the portfolio during the period.

(2)The weighted average portfolio yields on total debt investments reflected above do not represent actual investment returns to the Company’s stockholders.

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

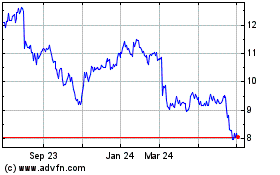

TriplePoint Venture Grow... (NYSE:TPVG)

Historical Stock Chart

From Apr 2024 to May 2024

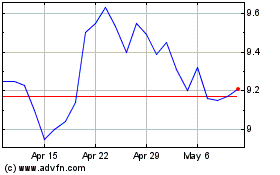

TriplePoint Venture Grow... (NYSE:TPVG)

Historical Stock Chart

From May 2023 to May 2024