TotalEnergies: Strategy & Outlook Presentation 2024

October 02 2024 - 8:58AM

Business Wire

“More energy, less emissions, more free

cash-flow”

TotalEnergies advances its balanced and

profitable multi-energy strategy

2024-2030: energy production growth of 4%

per year +$10 billion underlying free cash flow

growth

Buy-backs of $8 billion in 2024 and

$2 billion per quarter in 20251

Regulatory News:

TotalEnergies (Paris:TTE) (LSE:TTE) (NYSE:TTE):

Patrick Pouyanné, Chairman and CEO, and the members of the

Executive Committee will present TotalEnergies’ Strategy &

Outlook in New York today. The webcast of the presentation in

English is available on totalenergies.com.

TotalEnergies advances its balanced and profitable transition

strategy anchored on two pillars: Oil & Gas, notably LNG, and

electricity, growing its global energy production (oil, gas,

electricity, bioenergy) by 4% per year through 2030 while

drastically lowering the emissions from its operations (-40% on

Scope 1+2 net in 2030 vs 2015 and - 80% on methane in 2030 vs

2020). As a result of this transition strategy, the average carbon

content of TotalEnergies energy sales will be 25% lower in 2030 vs

2015.

Since its last outlook in September 2023, TotalEnergies has

de-risked its growth and profitability perspectives in several

ways:

- Oil & Gas production average growth

of ~3% per year to 2030, led by LNG, thanks to the launch of

six major projects in 2024 (two in Brazil, Suriname, Angola, Oman,

Nigeria) that de-risk, high-grade and extend guidance from 2028 to

2030. Over the next two years 2025 and 2026, growth will exceed

3% per year due to the start-up of several high margin

projects (US GoM, Brazil, Iraq, Uganda, Argentina, Malaysia,

Qatar) which are accretive in net income per barrel and cash-flow

per barrel. In 2024, the Company has also de-risked its LNG

exposure to spot gas prices by signing long-term LNG sales

contracts mainly indexed on Brent and by developing its upstream

gas production in the US through two low-cost acquisitions.

Natural gas is indeed at the core of

TotalEnergies’ transition strategy through an outstanding LNG

growth (+50% over 2024-2030) and a gas-to-power integration

supporting its profitable Integrated Power strategy to complement

the intermittent renewables.

- Growing electricity generation, reaching

more than 100 TWh in 2030, of which 70% will be renewable and

30% flexible-based. It will represent nearly 20% of global energy

production of the Company. By actively completing in 2024 its

integrated model in key targeted deregulated markets, Integrated

Power is making progress on its main levers to achieve at least

12% ROACE by 2028-2030 and will be net cash positive by

2028.

TotalEnergies confirms net investments between $16-18 billion

per year during 2025-2030, of which around $5 billion will be

dedicated to low-carbon energies. The Company retains flexibility

to reduce its net investments by $2 billion in case of a sharp drop

in prices.

Thanks to this clear and disciplined investment policy and the

perspective for +$10 billion of free cash flow growth by

2030 (versus 2024 at same price deck), the Board of Directors

has confirmed a shareholder return2 of over 40% of cash flow

through cycles and has made the following decisions:

- In 2024, execute $8 billion in share

buybacks3, corresponding to approximately 5% of the Company's

capital. Anticipated shareholder return2 is above 45% of 2024

cash flow.

- In 2025, continue share buybacks3 of $2

billion per quarter assuming reasonable market conditions, and

increase the dividend per share by at least 5% based on the

2024 share buybacks.

* * *

About TotalEnergies TotalEnergies is a global

multi-energy company that produces and markets energies: oil and

biofuels, natural gas and green gases, renewables and electricity.

Our more than 100,000 employees are committed to energy that is

ever more affordable, cleaner, more reliable and accessible to as

many people as possible. Active in about 120 countries,

TotalEnergies puts sustainable development in all its dimensions at

the heart of its projects and operations to contribute to the

well-being of people.

@TotalEnergies TotalEnergies TotalEnergies

TotalEnergies

Cautionary Note The terms “TotalEnergies”, “TotalEnergies

company” or “Company” in this document are used to designate

TotalEnergies SE and the consolidated entities that are directly or

indirectly controlled by TotalEnergies SE. Likewise, the words

“we”, “us” and “our” may also be used to refer to these entities or

to their employees. The entities in which TotalEnergies SE directly

or indirectly owns a shareholding are separate legal entities. This

document may contain forward-looking information and statements

that are based on a number of economic data and assumptions made in

a given economic, competitive and regulatory environment. They may

prove to be inaccurate in the future and are subject to a number of

risk factors. Neither TotalEnergies SE nor any of its subsidiaries

assumes any obligation to update publicly any forward-looking

information or statement, objectives or trends contained in this

document whether as a result of new information, future events or

otherwise. Information concerning risk factors, that may affect

TotalEnergies’ financial results or activities is provided in the

most recent Universal Registration Document, the French-language

version of which is filed by TotalEnergies SE with the French

securities regulator Autorité des Marchés Financiers (AMF), and in

the Form 20-F filed with the United States Securities and Exchange

Commission (SEC).

1 Assuming reasonable market conditions 2 Payout = (dividends +

share buybacks for cancellation) / CFFO 3 Including coverage of

employees share grant plans

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241002646138/en/

TotalEnergies Media Relations: +33 (0)1 47 44 46 99 l

presse@totalenergies.com l @TotalEnergiesPR Investor Relations: +33

(0)1 47 44 46 46 l ir@totalenergies.com

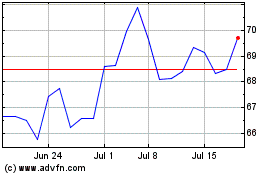

TotalEnergies (NYSE:TTE)

Historical Stock Chart

From Nov 2024 to Dec 2024

TotalEnergies (NYSE:TTE)

Historical Stock Chart

From Dec 2023 to Dec 2024