Baldwin Technology Company, Inc. (NYSE Amex: BLD), a global

leader in process automation technology for the printing industry,

today reported its financial results for the Company’s fiscal

second quarter ended December 31, 2009.

Highlights

- Sequential increase in revenues

of 7% to $38.8 million

- Sequential improvement in gross

margin percentage from 28.8% to 30.1%

- EBITDA of $0.8 million

- Cash flow from operations of

$10.8 million (includes $9.6 million patent settlement)

- Reduced net debt from $16

million to less than $6 million

- Leveraging Baldwin’s brand

equity in emerging countries [Cobra Spray Dampening]

Second Quarter Fiscal 2010 Financial Results

The Company reported net sales of $38.8 million for the second

quarter, a 7% improvement over net sales of $36.2 million in the

first quarter of fiscal 2010, and a decrease of $7.5 million from

net sales of $46.3 million for the second quarter of the prior

fiscal year. Currency effects increased sales by $2.9 million, or

6% from the same quarter of the prior year.

Net loss for the second quarter was $(0.4) million or $(0.03)

per diluted share, compared to net income of $0.5 million or $0.03

per diluted share for the comparable quarter in the prior year.

Cash flow from operations in the quarter was $10.8 million

compared to $2.1 million in the second quarter of the prior year,

primarily as a result of the receipt of $9.6 million in settlement

of the patent infringement lawsuit mentioned below.

Orders for the quarter were approximately $34.3 million,

compared to $39.3 million in the second quarter of the prior year,

a decrease of 13%. Backlog as of December 31, 2009 was $33.4

million compared to $37.8 million at September 30, 2009.

Please refer to the schedule following the reported GAAP results

which shows a reconciliation of GAAP results to adjusted results,

and the notes below explaining management’s reasons for using

certain non-GAAP financial measures.

Settled Patent Infringement Case

The Company received €6.5 million ($9.6 million) during the

second quarter in full settlement of a long-standing dispute with a

German competitor concerning patent infringement, patent validity

and the alleged amount of damages.

Improved Balance Sheet

Primarily as a result of the settlement discussed above, the

Company’s equity increased to $52.5 million at December 31, 2009

from $47.6 million at June 30, 2009. The proceeds from the

settlement, net of taxes and expenses, were applied to the

Company’s term loan in Germany. Additional operating cash flow

reduced net debt from $16.2 million on September 30 to $5.7 million

on December 31.

Introduced New Process Automation Systems and Alliances at

Trade Shows

In October, the Company showed a range of new process automation

systems for the Asian marketplace at the Japanese Graphic Arts Show

(JGAS) in Japan. Also in October, at IFRA Expo 09 in Austria, the

Company announced its latest alliances with other leading

manufacturers and continued the roll-out of its Just Ask! global

marketing campaign, introduced at Print 09 in Chicago in

September.

Significant Announcements

- Baldwin New Press Equipment

Orders (October 26, 2009)

- Baldwin and PRISCO Extend

Marketing Distribution Alliance (November 19, 2009)

- Baldwin Secures $1.2 million

Order for Newspaper Press Equipment (December 8, 2009)

Additional details, copies of these releases and other news are

available at www.baldwintech.com.

Comments

President and CEO Karl S. Puehringer said, “We have adjusted our

cost structure to the current market demand and as such have been

able to achieve a positive operating performance during the second

quarter despite significantly lower volumes compared to a year ago.

We are now diligently focused on leveraging Baldwin’s brand equity

through identified growth opportunities in emerging markets, as

well as promotion of alliance partner products. I am especially

pleased with the recent progress we made in India in China. During

the second quarter, we received our first orders for Baldwin’s

newly introduced Cobra Spray Dampening System in both of those

countries.

“Baldwin has also improved gross margins over the previous

quarter. The sequential improvement in gross margins in a difficult

marketplace resulted from the success of our supply chain

initiatives. During the second quarter, we had a successful start

up of our dry cloth conversion activities in China supplying local

customers as well as the United States and Europe. Our centralized

sourcing initiatives are also producing early results in spite of

lower revenues. Due to a combination of efforts in diligent cost

improvement and working capital management, we were able to produce

positive operating income and cash flow during the second quarter.

These efforts have also solidified our market position as a global

leader in process automation technology and related

consumables.”

Vice President and CFO John P. Jordan said, “Cash flow from

operations during the quarter was $10.8 million, primarily

resulting from the proceeds of settlement of the long-standing

patent dispute with a German competitor. Excluding the effect of

the settlement in the face of a very challenging market, the

Company’s disciplined management of working capital generated

operating cash flow of $1.2 million. Absolute values of accounts

receivable and inventory, as well as DSO and DOI made healthy

improvements from the September, 2009 levels.

“Net debt also decreased by more than $10 million from $16.2

million at September 30, 2009 to $5.7 million at December 31, 2009,

as a result of the application of the settlement proceeds and

internally-generated cash. Operating expenses (excluding

restructuring charges in prior years) for the quarter of $11.6

million were $1.5 million (12%) lower than Q2 Fiscal 2009 OPEX,

which in turn were lower than Q2 Fiscal 2008 OPEX by $2.5 million,

or 16%, reflecting the benefits from the Company’s restructurings

and other cost reduction initiatives.

“The dedication and perseverance of the Baldwin team in these

challenging times has enabled the Company to maintain compliance

with its debt covenants and produce positive cash flow. When the

world’s economies recover from the recent economic contraction, the

Company will be positioned to leverage its lower cost structure for

enhanced profitability and cash flow.” Jordan concluded.

Non-GAAP Financial Measures

This release contains non-GAAP financial measures. For purposes

of Regulation G, a non-GAAP financial measure is a numerical

measure of a company’s historical or future financial performance,

financial position or cash flows that excludes amounts, or is

subject to adjustments that have the effect of excluding amounts,

that are included in the most directly comparable measure

calculated and presented in accordance with GAAP in the statements

of income, balance sheets, or statements of cash flows of the

Company; or includes amounts, or is subject to adjustments that

have the effect of including amounts, that are excluded from the

most directly comparable measure so calculated and presented.

Pursuant to the requirements of Regulation G, the Company has

provided reconciliations of each of the non-GAAP financial measures

contained herein to the most directly comparable GAAP financial

measures. These non-GAAP measures are provided because management

of the Company uses these financials measures as an indicator of

business performance in maintaining and evaluating the Company’s

on-going financial results and trends. The Company believes that

both management and investors benefit from referring to these

non-GAAP measures in assessing the performance of the Company’s

ongoing operations and liquidity and when planning and forecasting

future periods. These non-GAAP measures also facilitate

management’s internal comparisons to the Company’s historical

operating results and liquidity.

Conference Call and Webcast

The Company will host a conference call to discuss the financial

results and business outlook today at 11:00 AM Eastern Time. Call

in information is below:

Conference Call Access:

Domestic: 800-619-4043 International: 415-228-5043 Passcode:

Baldwin Q2

Rebroadcast Access:

Domestic: 800-945-7436 International: 402-220-3567

An archived webcast of the conference call will also be

available on the Company’s web site http://www.baldwintech.com or

http://www.investorcalendar.com/IC/CEPage.asp?ID=151978.

Leading the call will be Baldwin President and CEO Karl S.

Puehringer and Vice President and CFO John P. Jordan.

About Baldwin

Baldwin Technology Company, Inc. is a leading international

supplier of process automation equipment and related consumables

for the printing and publishing industries. Baldwin offers its

customers a broad range of market-leading technologies, products

and systems that enhance the quality of printed products and

improve the economic and environmental efficiency of the printing

process. Headquartered in Shelton, Connecticut, the Company has

operations strategically located in the major print markets and

distributes its products via a global sales and service

infrastructure. Baldwin’s technology and products include cleaning

systems, fluid management and ink control systems, web press

protection systems and drying systems and related consumables. For

more information, visit http://www.baldwintech.com

A profile for investors can be accessed at

www.hawkassociates.com/profile/bld.cfm. An online investor kit

including press releases, current price quotes, stock charts and

other valuable information for investors is available at

http://www.hawkassociates.com.

To receive free e-mail notification of future releases for

Baldwin, sign up at www.hawkassociates.com/about/alert/.

Cautionary Statement

Certain statements contained in this News Release constitute

"forward-looking statements" within the meaning of the Private

Securities Litigation Reform Act of 1995, including statements

regarding expected revenue, gross margins, operating income (loss),

EBITDA, asset impairments, expectations concerning the reductions

of costs, the level of customer demand and the ability of the

Company to achieve its stated objectives. Such forward-looking

statements involve a number of known and unknown risks,

uncertainties and other factors which may cause the actual results,

performance or achievements of the Company to be materially

different from any future results, performance or achievements

expressed or implied by such forward- looking statements. Such

factors include, but are not limited to: the severity and length of

the current economic downturn, the impact of the economic downturn

on the availability of credit for the Company's customers, the

ability of the Company to maintain ongoing compliance with the

terms of its amended credit agreement, market acceptance of and

demand for the Company's products and resulting revenue, the

ability of the Company to successfully expand into new territories,

the ability of the Company to meet its stated financial and

operational objectives, the Company's dependence on its partners

(both manufacturing and distribution), and other risks and

uncertainties detailed in the Company's periodic filings with the

Securities and Exchange Commission. The words "looking forward,"

"looking ahead, " "believe(s)," "should," "may," "expect(s),"

"anticipate(s)," "project(s)," " likely," "opportunity," and

similar expressions, among others, identify forward-looking

statements. Readers are cautioned not to place undue reliance on

these forward-looking statements, which speak only as of the date

the statement was made. The Company undertakes no obligation to

update any forward-looking statements contained in this news

release.

Baldwin Technology Company,

Inc.

Condensed Consolidated Statements

of Operations

(Unaudited, in thousands, except

per share data)

Quarter ended December 31,

2009 2008 Net

sales $ 38,751 $ 46,259 Cost of goods sold

27,093 31,886 Gross

profit 11,658 14,373 Operating expenses 11,551 13,053 Restructuring

-- 681

Operating income 107 639 Interest expense, net 485 545 Other

expense (income), net

26

(846 ) Income (loss) before income taxes

(404 ) 940 Provision for income taxes

12

477 Net income (loss)

(416 ) 463 Net

income (loss) per share – basic and diluted

$

(0.03 ) $ 0.03

Weighted average shares outstanding – basic

15,461 15,332

Weighted average shares outstanding – diluted

15,461 15,408

Six Months ended December 31, 2009

2008 Net sales $ 74,925 $ 102,196

Cost of goods sold

52,847

70,488 Gross profit 22,078 31,708 Operating

expenses 23,581 27,897 Restructuring -- 681 Legal settlement

(income), net of expenses

(9,266 )

-- Operating income 7,763 3,130 Interest

expense, net 2,200 1,232 Other expense (income), net

202 (1,249 )

Income before income taxes 5,361 3,147 Provision for income taxes

1,879 1,474

Net income

3,482

1,673 Net income per share – basic and diluted

$ 0.23 $

0.11 Weighted average shares outstanding –

basic

15,421 15,307

Weighted average shares outstanding – diluted

15,472 15,435

Baldwin Technology Company,

Inc.

Condensed Consolidated Balance

Sheets

(Unaudited, in thousands)

December 31, June 30, Assets

2009

2009

Cash and equivalents $ 14,321 $ 13,806 Trade receivables 27,128

29,654 Inventory 21,735 22,765 Prepaid expenses and other

8,683 9,445 Total current assets

71,867 75,670 Property, plant and equipment 5,301 5,592 Intangible

assets 31,679 31,918 Other assets

14,609

14,825 Total assets

123,456

128,005 Liabilities Loans payable $ 4,297 $

4,153 Current portion of long-term debt 1,467 3,534 Other current

liabilities

39,193 40,601

Total current liabilities 44,957 48,288 Long-term debt 14,247

20,300 Other long-term liabilities

11,778

11,782 Total liabilities

70,982

80,370 Shareholders’ equity

52,474 47,635 Total liabilities

and shareholders’ equity

$ 123,456

$ 128,005

Baldwin Technology Company,

Inc.

Consolidated Statements of Cash

Flows

(Unaudited, in thousands)

For

the six months ended December 31,

2009

2008

CASH FLOWS FROM OPERATING ACTIVITIES: Net income 3,482 1,673

Adjustments to reconcile net

income to net cash provided by operating activities:

Depreciation and amortization 1,331 1,447 Gain on legal settlement

(9,266 ) -- Proceeds from legal settlement 9,560 -- Restructuring

charge -- 681 Deferred financing charge 1,183 -- Stock based

compensation expense 448 626 Other non cash items 186 37 Changes in

assets and liabilities Accounts and notes receivable 2,918 4,719

Inventories 1,666 2,429 Customer deposits 1,764 2,045 Accrued

compensation (858 ) (2,859 ) Payment of restructuring charges

(1,621 ) (789 ) Accounts and notes payable, trade (3,585 ) (8,177 )

Other

2,326 (1,813 )

Net cash provided by operating activities

9,534

19 CASH FLOWS FROM INVESTING ACTIVITIES:

Additions of property, plant and equipment (227 ) (548 ) Additions

of patents and trademarks

(93 )

(629 ) Net cash used by investing

activities

(320 ) (1,177

) CASH FLOWS FROM FINANCING ACTIVITIES: Debt

borrowings (repayments), net (8,483 ) 5,933 Payment of debt

financing costs (685 ) -- Other financing

(10

) (215 ) Net cash (used)

provided by financing activities

(9,178 )

5,718 Effect of exchange rate changes

479 141 Net increase in

cash and cash equivalents 515 4,701 Cash and cash equivalents at

beginning of period

13,806 9,333

Cash and cash equivalents at end of period

14,321 14,034

Baldwin Technology Company,

Inc.

Reconciliation of GAAP Results to

Adjusted Results

(Unaudited, in thousands, except

per share data)

Quarter ended December 31,

2009

As

Reported

Adjustments

As

Adjusted

Net sales

$

38,751

$ -- $ 38,751 Cost of goods sold

27,093

-- 27,093 Gross

profit 11,658 -- 11,658 Operating expenses

11,551 --

11,551 Operating income 107 -- 107 Interest

expense, net 485 -- 485 Other (income) expense, net

26 --

26 Loss before income taxes (404 ) -- (404 )

Provision for income taxes

12

-- 12 Net loss

(416 ) --

(416 ) Net income (loss)

per share: $ (0.03 ) $ -- $ (0.03 ) Basic and Diluted

Weighted average shares outstanding: Basic 15,461 15,461 15,461

Diluted 15,461 15,461 15,461

EBITDA Calculation (1)

As

Reported

Adjustments

As

Adjusted

Net income (loss) $

(416

)

$ -- $ (416 ) Add back: Provision (benefit) for income taxes 12 --

12 Interest, net 485 -- 485 Depreciation and amortization

672 --

672 EBITDA

753

-- 753

Quarter ended December 31,

2008

As

Reported

Adjustments

As

Adjusted

Net sales

$

46,259

$ -- $ 46,259 Cost of goods sold

31,886

-- 31,886

Gross profit 14,373 -- 14,373 Operating expenses 13,053 -- 13,053

Restructuring

681

681

--

(1)

Operating income 639 (681 )

1,320

(1)

Interest expense, net 545 -- 545 Other (income) expense, net

(846 ) --

(846

) Income before income taxes 940 (681 )

1,621

(1)

Provision for income taxes

477

(191 )

668

(1)

Net income

463

(490 )

953

(1)

Net income per share: Basic and Diluted

$

0.03 $ (0.03

) $

0.06

(1)

Weighted average shares outstanding: Basic 15,332 15,332

15,332 Diluted 15,408 15,408 15,408

EBITDA

Calculation(1)

As

Reported

Adjustments

As

Adjusted

Net income

463

$ -- 463 Add back: Provision for income taxes 477 -- 477 Interest,

net 545 -- 545 Depreciation and amortization

775

-- 775 EBITDA

2,260

-- 2,260

Six months ended December 31,

2009

As

Reported

Adjustments

As

Adjusted

Net sales

$

74,925

-- $ 74,925 Cost of goods sold

52,847

-- 52,847 Gross

profit 22,078 -- 22,078 Operating expenses 23,581

911

(a)

22,670

(1)

Legal settlement (income), net of expense

(9,266 ) (9,266

)

(b)

--

(1)

Operating income (loss) 7,763 8,355 (592

)

(1)

Interest expense, net 2,200

1,183

(c)

1,017

(1)

Other (income) expense, net

202

-- 202 Income (loss) before

income taxes 5,361 7,172 (1,811

)

(1)

Provision (benefit) for income taxes

1,879

1,883 (4

)

(1)

Net income (loss)

3,482

5,289 (1,807

)

(1)

Net income (loss) per share: $ 0.23 $ 0.34 $ (0.12

)

(1)

Basic and Diluted Weighted average shares outstanding: Basic

15,421 15,421 15,421 Diluted 15,472 15,472 15,472

(a) Adjustment represents non-routine charges for special

investigation costs.

(b) Adjustment represents non-routine income associated with a

legal settlement, net of expenses.

(c) Adjustment represents non-routine charges for debt financing

costs.

EBITDA Calculation

(1)

As

Reported

Adjustments

As

Adjusted

Net income (loss)

3,482

5,289 (1,807 ) Add back: Provision for income taxes 1,879 1,883 (4

) Interest, net 2,200 1,183 1,017 Depreciation and amortization

1,331

1,331 EBITDA

8,892

8,355 537

Six months ended December 31,

2008

As

Reported

Adjustments

As

Adjusted

Net sales

102,196

-- 102,196 Cost of goods sold

70,488

-- 70,488

Gross profit 31,708 -- 31,708 Operating expenses 27,897 -- 27,897

Restructuring 681 681

--

(1)

Legal settlement gain

--

-- --

Operating income 3,130 (681 )

3,811

(1)

Interest expense, net 1,232 -- 1,232 Other (income) expense, net

(1,249 ) --

(1,249 ) Income before

income taxes 3,147 (681 )

3,828

(1)

Provision for income taxes

1,474

(191 )

1,665

(1)

Net income

1,673

(490 )

2,163

(1)

Net income per share: $ 0.11 $ (0.03 ) $ 0.14

(1)

Basic and Diluted Weighted average shares outstanding: Basic

15,307 15,307 15,307 Diluted 15,435 15,435 15,435

EBITDA Calculation

(1)

As

Reported

Adjustments

As

Adjusted

Net income

1,673

-- 1,673 Add back: Provision for income taxes 1,474 -- 1,474

Interest, net 1,232 -- 1,232 Depreciation and amortization

1,447

1,447 EBITDA

5,826 --

5,826

Net Debt Calculation

(1)

Dec

31, 2009

Sept 30, 2009

Loans payable

4,297

4,456 Current portion of long-term debt 1,467 9,927 Long-term debt

14,247 13,563 Total Debt 20,011 27,946

Cash

14,321 11,733 Net debt

5,690 16,213

(1) Restructuring, Operating income, Income before income taxes,

Provision for income taxes, Net income and net income per share, as

adjusted, as well as EBITDA (earnings before interest, taxes,

depreciation and amortization) and Net Debt are not measures of

performance under accounting principles generally accepted in the

United States of America ("GAAP") and should not be considered

alternatives for, or in isolation from, the financial information

prepared and presented in accordance with GAAP. Baldwin’s

management believes that EBITDA, Net Debt and the other non-GAAP

measures listed above provide meaningful supplemental information

regarding Baldwin’s current financial performance and prospects for

the future. Baldwin believes that both management and investors

benefit from referring to these non-GAAP measures in assessing the

performance of Baldwin’s ongoing operations and liquidity, and when

planning and forecasting future periods. These non-GAAP measures

also facilitate management's internal comparisons to Baldwin’s

historical operating results and liquidity. Our presentations of

these measures, however, may not be comparable to similarly titled

measures used by other companies. Refer also to the section

entitled “Non-GAAP Financial Measures” above.

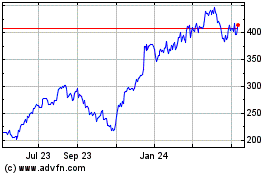

TopBuild (NYSE:BLD)

Historical Stock Chart

From Nov 2024 to Dec 2024

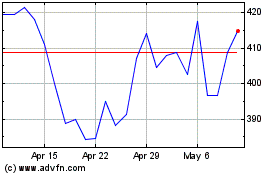

TopBuild (NYSE:BLD)

Historical Stock Chart

From Dec 2023 to Dec 2024