Targa Resources Corp. Prices $1.0 Billion Offering of Senior Notes

August 06 2024 - 3:59PM

Targa Resources Corp. (“Targa” or the “Company”) (NYSE: TRGP),

announced today the pricing of an underwritten public offering (the

“Offering”) of $1.0 billion aggregate principal amount of its

5.500% Senior Notes due 2035 at a price to the public of 99.943% of

their face value. The Offering is expected to close on August 9,

2024, subject to the satisfaction of customary closing conditions.

The Company expects to use the net proceeds from

the Offering for general corporate purposes, including to repay

borrowings under its commercial paper note program, a portion of

which were incurred to repay the remaining $500.0 million

outstanding under its prior $1.5 billion unsecured term loan

facility due July 2025, which was terminated in May 2024. Other

general corporate purposes may include repayment of other

indebtedness, capital expenditures, additions to working capital

and investments in its subsidiaries.

This Offering is being made pursuant to an effective shelf

registration statement and prospectus filed by the Company with the

U.S. Securities and Exchange Commission (the “SEC”) and may be made

only by means of a prospectus and prospectus supplement related to

such Offering meeting the requirements of Section 10 of the

Securities Act of 1933, as amended (the “Securities Act”). This

announcement shall not constitute an offer to sell or a

solicitation of an offer to buy any of these securities, except as

required by law.

About Targa Resources Corp.

Targa Resources Corp. (NYSE: TRGP) is a leading provider of

midstream services and is one of the largest independent midstream

infrastructure companies in North America. The Company owns,

operates, acquires, and develops a diversified portfolio of

complementary domestic midstream infrastructure assets and its

operations are critical to the efficient, safe and reliable

delivery of energy across the United States and increasingly to the

world. The Company’s assets connect natural gas and natural gas

liquids (“NGL(s)”) to domestic and international markets with

growing demand for cleaner fuels and feedstocks. The Company is

primarily engaged in the business of: gathering, compressing,

treating, processing, transporting, and purchasing and selling

natural gas; transporting, storing, fractionating, treating, and

purchasing and selling NGLs and NGL products, including services to

liquified petroleum gas exporters; and gathering, storing,

terminaling, and purchasing and selling crude oil.

The principal executive offices of Targa

Resources Corp. are located at 811 Louisiana, Suite 2100, Houston,

TX 77002 and their telephone number is 713-584-1000.

Forward-Looking Statements

Certain statements in this release are “forward-looking

statements” within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended. All statements, other than statements of

historical facts, included in this release that address activities,

events or developments that the Company expects, believes or

anticipates will or may occur in the future, are forward-looking

statements, including the expected closing date and use of proceeds

from the offering. These forward-looking statements rely on a

number of assumptions concerning future events and are subject to a

number of uncertainties, factors and risks, many of which are

outside the Company’s control, which could cause results to differ

materially from those expected by management of the Company. Such

risks and uncertainties include, but are not limited to those

described more fully in the Company’s filings with the SEC,

including its Annual Report on Form 10-K, Quarterly Reports on Form

10-Q and Current Reports on Form 8-K. The Company does not

undertake an obligation to update or revise any forward-looking

statement, whether as a result of new information, future events or

otherwise.

Contact the Company's investor relations department by email at

InvestorRelations@targaresources.com or by phone at (713)

584-1133.

Sanjay LadVice President, Finance & Investor Relations

William ByersChief Financial Officer

Jennifer KnealePresident – Finance and Administration

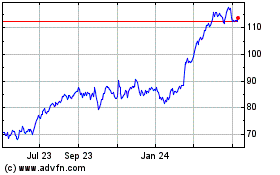

Targa Resources (NYSE:TRGP)

Historical Stock Chart

From Oct 2024 to Nov 2024

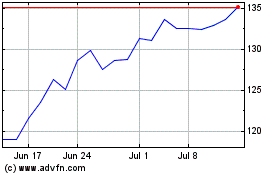

Targa Resources (NYSE:TRGP)

Historical Stock Chart

From Nov 2023 to Nov 2024