SCHEDULE 13D/A

DATE OF EVENT WHICH REQUIRES FILING OF THIS STATEMENT

7/13/2022

1. NAME OF REPORTING PERSON

Bulldog Investors, LLP

2. CHECK THE BOX IF MEMBER OF A GROUP a[]

b[]

3. SEC USE ONLY

4. SOURCE OF FUNDS

WC

5. CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED

PURSUANT TO ITEMS 2(d) AND 2(e) []

6. CITIZENSHIP OR PLACE OF ORGANIZATION

DE

7. SOLE VOTING POWER

3,315

8. SHARED VOTING POWER

324,662

9. SOLE DISPOSITIVE POWER

3,315

10. SHARED DISPOSITIVE POWER

324,662

11. AGGREGATE AMOUNT OWNED BY EACH REPORTING PERSON

327,977 (Footnote 1)

12. CHECK IF THE AGGREGATE AMOUNT EXCLUDES CERTAIN SHARES

[]

13. PERCENT OF CLASS REPRESENTED BY ROW 11

4.39%

14. TYPE OF REPORTING PERSON

IA

1. NAME OF REPORTING PERSON

Phillip Goldstein

2. CHECK THE BOX IF MEMBER OF A GROUP a[]

b[]

3. SEC USE ONLY

4. SOURCE OF FUNDS

WC

5. CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED

PURSUANT TO ITEMS 2(d) AND 2(e) []

6. CITIZENSHIP OR PLACE OF ORGANIZATION

USA

7. SOLE VOTING POWER

3,315

8. SHARED VOTING POWER

324,662

9. SOLE DISPOSITIVE POWER

3,315

10. SHARED DISPOSITIVE POWER

324,662

11. AGGREGATE AMOUNT OWNED BY EACH REPORTING PERSON

327,977 (Footnote 1)

12. CHECK IF THE AGGREGATE AMOUNT EXCLUDES CERTAIN SHARES

[]

13. PERCENT OF CLASS REPRESENTED BY ROW 11

4.39%

14. TYPE OF REPORTING PERSON

IN

1. NAME OF REPORTING PERSON

Andrew Dakos

2. CHECK THE BOX IF MEMBER OF A GROUP a[]

b[]

3. SEC USE ONLY

4. SOURCE OF FUNDS

WC

5. CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED

PURSUANT TO ITEMS 2(d) AND 2(e) []

6. CITIZENSHIP OR PLACE OF ORGANIZATION

USA

7. SOLE VOTING POWER

3,315

8. SHARED VOTING POWER

324,662

9. SOLE DISPOSITIVE POWER

3,315

10. SHARED DISPOSITIVE POWER

324,662

11. AGGREGATE AMOUNT OWNED BY EACH REPORTING PERSON

327,977 (Footnote 1)

12. CHECK IF THE AGGREGATE AMOUNT EXCLUDES CERTAIN SHARES

[]

13. PERCENT OF CLASS REPRESENTED BY ROW 11

4.39%

14. TYPE OF REPORTING PERSON

IN

Item 1. SECURITY AND ISSUER

This statement constitutes Amendment #1 to the schedule 13d

filed July 6, 2022. Except as specifically set forth

herein, the Schedule 13d remains unmodified.

ITEM 4. PURPOSE OF TRANSACTION

See exhibit A. Letter to the Board of Directors.

ITEM 5. INTEREST IN SECURITIES OF THE ISSUER

c) Since the last filing on July 6, 2022 no shares of TWN were traded.

ITEM 6. CONTRACTS,ARRANGEMENTS,UNDERSTANDINGS OR RELATIONSHIPS

WITH RESPECT TO SECURITIES OF THE ISSUER.

N/A

ITEM 7. MATERIAL TO BE FILED AS EXHIBITS

Exhibit A

After reasonable inquiry and to the best of my knowledge

and belief, I certify that the information set forth in this

statement is true, complete and correct.

Dated: 7/13/2022

By: /S/ Phillip Goldstein

Name: Phillip Goldstein

By: /S/ Andrew Dakos

Name: Andrew Dakos

Bulldog Investors, LLP

By: /s/ Andrew Dakos

Andrew Dakos, Partner

Footnote 1: The reporting persons disclaim beneficial ownership except

to the extent of any pecuniary interest therein.

|

Exhibit A:

Bulldog Investors, LLP , 250 Pehle Avenue, Suite 708,

Saddle Brook, NJ 07663

(201) 881-7111 // Fax: (201) 556-0097 //

pgoldstein@bulldoginvestors.com

July 13, 2022

The Board of Directors

The Taiwan Fund, Inc.

c/o State Street Bank & Trust Company

One Lincoln Street

P.O. Box 5049

Boston, MA 02110.

Dear Board Members:

Our clients own about 325,000 shares of The Taiwan Fund.

According to a press release issued on July 8, 2022, "The Board expects

to announce the replacement adviser selected by the Board by the end of

July 2022 and to seek stockholder approval of the new adviser at a

special meeting of stockholders to be held early in September 2022."

The Fund's shares currently trade at a discount of about 16%. We believe

that it connection with a change of advisers, the Board should consider

affording stockholders an opportunity to monetize a portion of their

shares at a price close to net asset value via a self-tender offer.

We would like to have a discussion with a representative of the Board as

to how to strike a balance between the desire of those shareholders that

would like to sell some of their shares at a price higher than the

market price and those that want the Fund to continue as a viable

long-term vehicle for investing in Taiwan. If the proper balance can be

achieved, it should be relatively easy and inexpensive to get

stockholder approval for a new advisory agreement. Please let us know

if such a discussion can be arranged. Thank you.

Sincerely yours,

/S/ Phillip Goldstein

Phillip Goldstein

Managing Partner

|

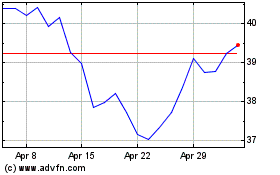

Taiwan (NYSE:TWN)

Historical Stock Chart

From Aug 2024 to Sep 2024

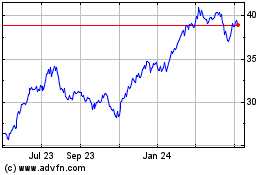

Taiwan (NYSE:TWN)

Historical Stock Chart

From Sep 2023 to Sep 2024